-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Yen & JGB Yields Lower Post Uchida Speech

- JGB futures are sitting with an uptick, +2 compared to the settlement levels, after a volatile session. JBH4 was sharply lower in morning trade before spiking higher following BoJ Deputy Governor Shinichi Uchida's speech to local business leaders in Nara. Yen is the weakest performer in the G10 space. Most other pairs are steady against the USD.

- China inflation was below expectations, likely to fuel further easing expectations. China equity sentiment has been mixed, capping a volatile week before the LNY break kicks off tomorrow.

- The RBA revised down its growth and inflation outlooks for 2024 in its February Statement on Monetary Policy. This impacts the inflation gap, difference between headline and the target mid-point (2.5%), and output gap variables in our policy reaction function. As a result, the estimated peak in rates is around 50bp lower than in November but the inflation gap needs to close for estimates of easing, see below for more details.

- Looking ahead, later the Fed’s Barkin speaks, and BoE’s Mann, ECB’s Lane & Elderson appear. There is little on the data front.

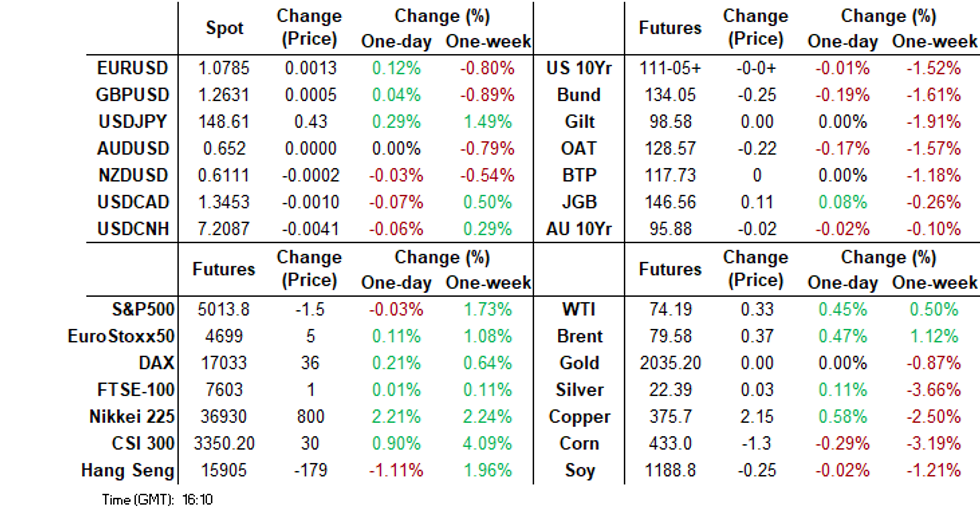

MARKETS

US TSYS: Yields Grind Lower, Yellen To Testify

TYH4 is currently trading at 110-05, - 00+ from New York closing levels.

An uneventful session today, with the only thing of note being BoJ Deputy Governor Uchida's comments on financial conditions and interest rates. It, however, hasn't shed too much light on when the end of NIRP will come.

- Treasuries futures have been trading in a very small range of 111-03 lows/ 111-07+ highs, Key support lies at 110-22+, the February 5th lows, with resistance at 111-20, the 20-day EMA.

- Cash yields opened 1bp lower and have drifted just a touch to be 1.5-2bps lower for the day, the 2Y yield -1.5bp at 4.414%, the 10Y yield trade -1.7bp at 4.104% while the 2y10y, is -1.7 at -31.80.

- US Secretary Treasury Janet Yellen will testify on the 2023 Financial Stability Oversight Council annual report, at 9am ET Thursday.

- Thursday Data Calendar: Weekly Claims, Fed Speak, 30Y Bond Sale.

JGBS: BoJ Dep. Gov. Uchida's Comments Move The Market, 5Y Supply Tomorrow

JGB futures are sitting with an uptick, +2 compared to the settlement levels, after a volatile session. JBH4 was sharply lower in morning trade before spiking higher following BoJ Deputy Governor Shinichi Uchida's speech to local business leaders in Nara.

- (MNI) BoJ Deputy Governor Shinichi Uchida's comments on Thursday have somewhat weakened the chance of a March policy change, despite noting the probability of the Japanese economy achieving the 2% price target had increased. A press conference is due at 1430 JT. (See link)

- This morning's data drop of weekly International Investment Flows, BoP Current Account Balance and Bank Lending data failed to be market-moving, as expected. Also, Tokyo Avg Office Vacancies declined to 5.83% in January from 6.03% in December.

- Cash JGBs are dealing flat to 2bps richer after cheapening 1-2bps in pre-Uchida dealings. The benchmark 10-year yield is 1.0bp lower at 0.708% after dealing as high as 0.734% in morning trade.

- Swaps rates are flat to 1bp lower. Swap spreads are generally tighter out to the 5-year and slightly wider beyond.

- Tomorrow, the local calendar is light, with M2 & M3 Money Stock data as the highlights. The MoF plans to sell Y2.5tn of 5-year JGBs.

AUSSIE BONDS: Little Changed, Light Calendar, RBA Gov. Bullock In Parliament Tomorrow

ACGBs (YM flat & XM flat) are weaker after trading in narrow ranges during the Sydney. With the domestic calendar empty, local participants have likely been monitoring US tsys watch after yesterday’s moderate rise in yields. Cash US tsys are currently dealing 1-2bps richer in today’s Asia-Pac session.

- Cash ACGBs are unchanged, with the AU-US 10-year yield differential 1bp tighter at flat.

- Swap rates are 1bp lower, with EFPs slightly tighter.

- The bills strip is slightly cheaper, with pricing flat to -1.

- RBA-dated OIS pricing is flat to 4bps softer across meetings. A cumulative 47bps of easing is priced by year-end.

- (AFR) Central banks around the world are at pains to push back on the wave of rate cut optimism that is driving sharemarkets higher, yet bond traders still believe an easing cycle is imminent, including in Australia. (See link)

- TCorp has issued A$500mn of its existing 3.00% Feb-30 (A$272mn) and 2.00% Mar-31 (A$228mn) benchmark bonds, with cover ratios of 3.60x and 8.00x respectively.

- Tomorrow, the local calendar will see RBA Governor Bullock appear before the House of Reps Economics Committee at 0930 AEDT.

RBA: Inflation Gap Needs To Close For Rate Model To Imply Easing

The RBA revised down its growth and inflation outlooks for 2024 in its February Statement on Monetary Policy. This impacts the inflation gap, difference between headline and the target mid-point (2.5%), and output gap variables in our policy reaction function. As a result, the estimated peak in rates is around 50bp lower than in November but the inflation gap needs to close for estimates of easing.

- The inflation gap remains positive throughout the RBA’s forecast horizon while we estimate that the output gap should close around mid-2024 and be slightly negative through next year. This drives the model to estimate one more hike in 2024 based on these economic fundamentals with rates levelling off after that.

- The equation has a forward looking component with the inflation gap leading by two quarters. The reaction function only begins to imply rate cuts once this gap closes, which is not yet in the RBA’s forecasts with Q2 2026 at 2.6%. Governor Bullock said the further out the projections the greater the uncertainty though. The Q4 2024 gap improved 30bp with the RBA’s February revision.

- We also have an equation that includes CoreLogic house prices and since they began rising again in Q1 last year, it has been estimating the cash rate at a higher level than without house prices.

Source: MNI - Market News/Refinitiv/Bloomberg/RBA

NZGBS: Cheaper, Closed Mid-Range, Year-End Easing Expectations Under 70bps

NZGBs closed 1-2bps cheaper and in the middle of the local session’s ranges. In the absence of domestic data, local participants were likely on headlines and US tsys watch.

- US tsys are dealing 1-2bps richer in today’s Asia-Pac session, reversing yesterday’s modest cheapening.

- Nevertheless, it has been an uneventful session so far, with the only thing of note being BoJ Deputy Governor Uchida’s remarks on financial conditions and interest rates. It, however, didn’t shed too much light on when the end of NIRP will come.

- Today’s weekly supply saw a respectable range (2.0x to 2.83x) for the auction cover ratios.

- Swap rates closed 2bps higher.

- RBNZ dated OIS pricing closed 2-6bps firmer for meetings beyond May. A cumulative 67bps of easing is priced by year-end compared to 96bps last Friday.

- (BBG) NZ construction spending is projected to slow in coming years as fewer homes are built, according to a government report. The value of total construction is projected to drop to NZ$54.6bn in 2027 from NZ$61bn in 2023. (See link)

- Tomorrow, the local calendar is empty.

FOREX: Yen Underperforms Post Deputy BoJ Governor's Speech

The USD is marginally lower in the first part of Thursday dealing, the BBDXY off modestly and holding above 1240 at this stage. The yen has underperformed though, as the BoJ Deputy Governor didn't suggest a policy shift at the March meeting was likely and noted when rate hikes do commence they will be modest.

- USD/JPY sits around session highs in recent dealings above 148.45, down close to 0.20% for the session. Focus is on the 148.80/90 region, which has marked recent highs. Softer US yields, down 1-2bps across the benchmarks haven't aided the yen much.

- AUD and NZD are marginally higher, but have maintained tight ranges overall.

- For AUD/USD we sit near 0.6525. Less positive impetus from the China/HK space has been evident today, but it has been a 14pip range at this stage.

- For NZD/USD we last track at 0.6610/15, with equally tight ranges. It was reported earlier that a quarter of all NZ apartments sales are now being made at a loss, while 10% of all residential property sales in Auckland and made at a loss, according to CoreLogic. While ASB has raised is milk price forecast to $8.00/kg from $7.85/kg.

- Looking ahead, later the Fed’s Barkin speaks, and BoE’s Mann, ECB’s Lane & Elderson appear. There is little on the data front.

CHINA EQUITIES: Mixed Ahead of Lunar New Year, CPI Declines Fastest Since Sept 09

Final day of trading ahead of the Lunar New Year holiday, after a very eventful week with multiple headlines out supporting Chinese and Hong Kong Equities markets, equities indices have seen some wild swings particularly in the small cap space.

China data was released before with CPI -0.8% YoY vs -0.5% est, Dec -0.3% (Fastest decline since Sept 2009) while PPI -2.5% YoY vs. -2.6% est, Dec -2.5%

- Hong Kong indices were somewhat volatile today largely on the back of CPI and PPI data, HSI opened down 0.60% to recover back to flat, only to then reverse that move to trade 1% lower going into lunch, Alibaba led the move lower down 6.80%, meanwhile HSTech is 0.35% lower, after being up as much as 1%, while the Mainland property index is higher up 2.00%, this outperformance could be attributed to the announcement that Shenzhen has lowered the threshold for non-local homebuyers, by easing the requirement of tax and social insurance payments to three from five years.

- China Mainland equities are outperforming Hong Kong indices, led by small caps with the CSI 1000 higher by 4.8%, CS1 300 is up 0.30% for the day.

ASIA PAC EQUITIES: Asia Equities Continue Higher On Strong Earnings

Regional Asia Equities are higher today, all moving higher in unison as the US market hit record highs. It has been a slow data and news headline day in Asia, as well as China heading into Lunar New Year holiday break tomorrow. The Japanese BoJ Deputy Governor Uchida has been speaking this morning on financial conditions and interest rates, however hasn't shed too much light on when the end of NIRP will come.

- Japan equities are the top performer in Asia higher today, as the yen weakened during Uchida's speech. Tech names are trading well as market expectations of strong corporate profits, while strong performance during the US session for chipmakers is lending supporting to trading here in Asia. The Topix is higher 0.70% higher led by Toyota again up 3.00%, while the tech heavy Nikkei is higher by 2.20%.

- Australian equities are higher today, after solid earnings from the likes of AGL, Mirvac and Cochlear. the ASX 200 is higher 0.30% led by Utilities.

- South Korea equities are up today, led by semiconductor names, after TSMC posted a rise in monthly sales of 7.9%YoY, while US names also climbed. Headlines out earlier from SK President Yoon, saying the "Korea Discount" in equity markets must be reduced, the KOSPI is 0.20% higher, off it's highs from earlier though as inflows into SK equities taper off, with just $75m today

- Elsewhere in SEA, many regions markets are closed. Philippines is 1.50% higher, while India is lower by 0.60% after the RBI kept rates on hold.

OIL: Crude Finding Support From Geopolitics & Risk Sentiment

Oil prices are moderately higher during APAC trading today after rising around a percent on Wednesday as the situation in the Middle East deteriorated with the US killing an Iranian-backed militant leader in Baghdad and Israel rejecting Hamas’ ceasefire terms. Crude has also been supported by better risk sentiment. The USD index is down slightly.

- WTI has traded above $74 for much of today and is currently up 0.4% to $74.14/bbl just off the intraday high of $74.27. Brent is also 0.4% higher at $79.52 down from the $79.65 high.

- Brent’s prompt spread is in a bullish structure, whereas WTI’s is bearish, according to Bloomberg.

- Data today showing an increase in deflationary pressures in China in January didn’t worry crude. Jet fuel and gasoline usage will be monitored to gauge the strength of travel over the upcoming Lunar New Year holiday. China is the world’s largest oil importer.

- Later the Fed’s Barkin speaks, and BoE’s Mann, ECB’s Lane & Elderson appear. There is little on the data front.

GEOPOLITICS: Tensions Escalate As US Kills Militant & Israel Rejects Ceasefire

There was no reprieve in tensions in the Middle East on Wednesday. US strikes continued and Israel turned down Hamas’ demands for ceasefire. This supported oil prices with crude rising around a percent and shipping costs sharply higher with contracts coming up for renewal next month.

- The US, Qatar and Egypt have been working on a ceasefire deal between Israel and Hamas. After considering it Hamas presented its terms, which Israel rejected with PM Netanyahu calling them “bizarre”. He said that “there is no other solution but a complete and final victory”, but despite this talks are scheduled to continue today in Cairo. The US will want a deal given growing pressure at home.

- Far from a ceasefire, Netanyahu said that forces are preparing to move into Rafah in southern Gaza.

- The BBC is reporting that the US struck a vehicle in Baghdad killing a leader of Kataib Hezbollah who is believed to be responsible for the attacks on US troops which killed three soldiers. The organisation has said that it will suspend attacks on the US to avoid “embarrassment” to the Iraqi government. The US has about 2500 troops in Iraq.

- The US has said it will continue to strike rebel groups and Houthi militants but wants to avoid its wider involvement in the region and an escalation of an already tense situation.

- Houthis targeted two more ships in the southern Red Sea on Wednesday. More and more shipping is avoiding the area resulting in a 156% increase in container rates this year.

GOLD: Struggling For Direction Amid Fed Policy Outlook Uncertainty

Gold is little changed in the Asia-Pac session, after closing unchanged at $2035.36 on Wednesday.

- The precious metal spiked shortly after the cash US equity open on Wednesday, which was closely linked to further concerns over New York Community Bancorp. It rose to a session high of $2044.60, however, the subsequent stabilisation for broader sentiment halted the rally. The price moderated back to unchanged.

- More generally, bullion has been struggling for direction amid a lack of clarity regarding when the Fed is likely to start easing monetary policy.

- On Wednesday, there was a continued focus on Fed speakers: Fed Kashkari popped up in morning trade positing that 2-3x 25bp cuts this year "seems appropriate". Fed Kugler said she could not close the door to policy action at any upcoming meetings, including March, “Every meeting is live". Fed Collins said waiting until 12-month inflation hits 2% for the central bank to begin cutting interest rates would be waiting too long.

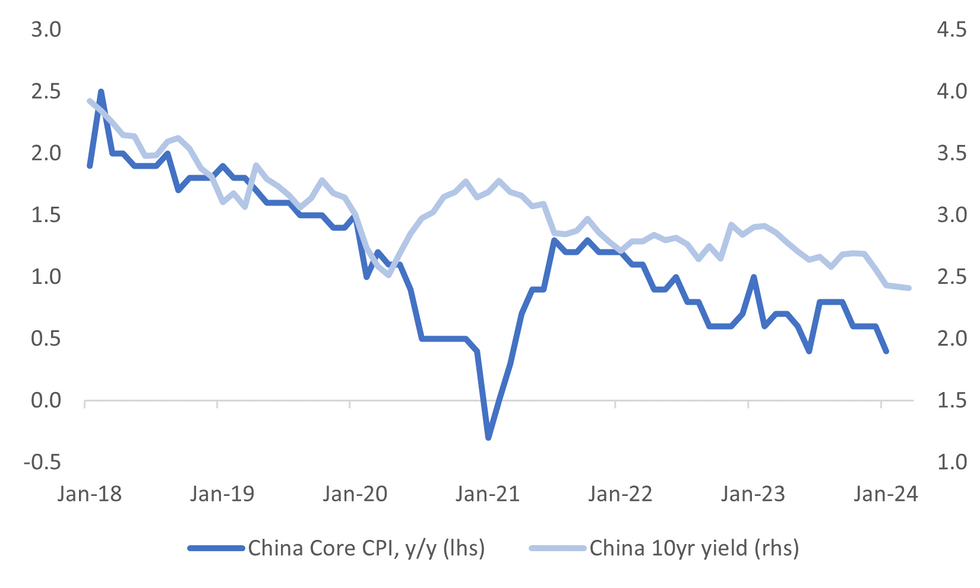

CHINA DATA: CPI Headline Weakest Y/Y Pace Since 2009, PPI Steady But Still In Negative Territory

Jan inflation was noticeably weaker than expected from a headline CPI standpoint. We came in at -0.8% y/y, versus -0.5% forecast and -0.3% prior. The PPI was close to expected at -2.5% y/y, versus -2.6% forecast and -2.7% prior.

- On CPI, the y/y headline drop was the weakest pace since 2009. The +2.1%y/y rise in Jan last year is obviously a headwind from a base effect standpoint. In m/m terms, prices were +0.3%, versus a 0.1% gain in Dec.

- Still core inflation eased to 0.4% y/y after 3 straight months of 0.6% outcomes. Consumer goods fell -1.7% y/y, services inflation to 0.5%y/y from 1.0% in Dec.

- By product we saw big drags from food -3.6% y/y (prior -2.0%) and -2.4%y/y from transport. Positives were clothing, +1.36% y/y and household items, at least relative to Dec outcomes.

- The core trend is consistent with a lower yield backdrop, see the chart below.

Fig 1: China Core CPI Y/Y Versus 10yr CGB Yield

Source: MNI - Market News/Bloomberg

- On the PPI side, the trend has only improved modestly in the past 6 months and we remain wedged in negative y/y territory. In terms of the detail, Mining and raw materials PPI showed some sequential y/y improvement but there were similar trends elsewhere.

- Manufacturing PPI came in at -3.1% y/y (versus -3.2% prior), while consumer durables were -2.3% y/y (versus -2.2% prior).

ASIA: Further Moderation In Inflation Likely Across Asia

Today China’s January CPI printed below expectations falling to -0.8% y/y from -0.3%, the worst since 2009, but there were negative base effects. But core moderated to 0.4% y/y from 0.6% with lower consumer goods prices and services inflation. Food prices were down 3.6% y/y. Global food prices fell for the sixth consecutive month in January and are now down 10.4% y/y with weakness across categories except sugar.

- Even without China’s deflationary influence, headline and core inflation across Asia have eased. Our non-Japan Asian ex China aggregate eased to 3.9% from 4% in January assuming unchanged rates for those countries who haven’t released the data yet, but given regional trends, the aggregate could be lower when they do. Core moderated by more falling to 2.1% from 2.4%, the lowest since December 2021.

- Lower food and fuel prices helped to bring inflation down across the region and look likely to continue to do so. Global oil prices jumped 2% in January due to geopolitical tensions in the Middle East but have stabilised since then. It is also worth noting that Brent is down almost 15% since September. Rice prices rose sharply in H2 2023 but have started this year on a softer note with the February average of processed rice prices down 7.5% from December. Global cereal prices fell 2.2% m/m in January.

Source: MNI - Market News/Refinitiv/IMF

ASIA FX: USD/Asia Pairs Mixed Ahead Of LNY Break, THB Softer On Dovish BoT Hold

USD/Asia pairs have been mixed in the first part of Thursday trade. USD/CNH has steadied, up from earlier lows, last near 7.2100. CPI data was weaker than expected. Local equities are also mixed. THB is the other notable underperformer following yesterday's dovish BoT hold. PHP has seen marginal gains, while steady trends are evident elsewhere. Tomorrow many parts of the region are out as the LNY holiday period commences.

- USD/CNH has remained within recent ranges. The pair last near 7.2100. The CPI y/y print fell back to 2009 lows, which is likely to see continued calls for easier policy settings. Local equities are mixed but volatility continues with recent policy changes and changing of the head of the securities regulator. China markets are closed tomorrow and all of next week for the LNY.

- 1 month USD/KRW has maintained recent ranges, last in the 1325/26 region. Local equities are off earlier highs, but focus is on the policy response to remove the Korea-discount. Tensions with North Korea continue to push higher, albeit not impacting market sentiment at this stage.

- Political uncertainty weighed on the rupiah with USD/IDR rising almost 2% from mid-January to its high on January 26. BI intervention has helped to bring it down and it has fallen in recent days and is now 1.3% below that late January peak. Cabinet stability despite rumours the finance minister might resign has helped the currency marginally. Indonesians go to the polls in less than a week to choose a new President, House of Representatives, the Senate and local legislative councils. Until recently it looked like there would be a runoff in June as no one looked likely to win 50% but all of the last three opinion polls show defence minister Prabowo with over 50% support. It is now looking a lot closer that he will be the next President without a runoff vote.

- USD/THB is tracking higher in the first part of Thursday trade, albeit without breaking out of recent ranges. The pair was last 35.77, around 0.50% weaker in baht terms versus end Wednesday levels (we closed at 35.59 yesterday). Upside targets will focus on recent highs in the 35.80/90 region. A break above these levels could see 36.15 targeted (highs from Nov last year. Earlier Feb lows rest at 35.24. Baht weakness is bucking with the modestly softer USD trend in terms of broader USD indices. Carry over from yesterday's dovish BoT hold (5-2 voted in favor of steady rates, with the previous 8 meetings all being unanimous).

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/02/2024 | 1330/0830 | *** |  | US | Jobless Claims |

| 08/02/2024 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 08/02/2024 | 1500/1000 | ** |  | US | Wholesale Trade |

| 08/02/2024 | 1500/1500 |  | UK | BoE's Mann Speaks At OMFIF | |

| 08/02/2024 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 08/02/2024 | 1530/1630 |  | EU | ECB's Lane at Brookings Institution | |

| 08/02/2024 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 08/02/2024 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 08/02/2024 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 08/02/2024 | 1705/1205 |  | US | Richmond Fed's Tom Barkin | |

| 08/02/2024 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.