-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: BOJ Tankan To Show Slipping Sentiment

MNI: PBOC Net Drains CNY288.1 Bln via OMO Friday

MNI EUROPEAN MARKETS ANALYSIS: Yen Misses Broader USD Sell-Off As BoJ Stays Accommodative

- The main focus today was the BoJ meeting, which maintained the status quo in terms of major policy parameters. There is likely to be focus on the Ueda's press conference in a short while to gauge risks around a YCC shift in July.

- The BoJ's accommodative stance leaves the yen lagging weaker USD trends elsewhere. The FinMin giving some fresh verbal jawboning today on FX markets prior to the BoJ outcome. JGB futures have also outperformed a weaker US futures tone today.

- Elsewhere, China assets continue to reflate, with onshore and HK equities higher amid on-going stimulus hopes. USD/CNH has rebounded today, but gains above 7.1400 weren't sustained.

- The final print of Eurozone CPI provides the highlight in Europe today. Further out we have UofMich Consumer Sentiment, as well as Fedspeak from St Louis Fed President Bullard, Gov Waller and Richmond Fed President Barkin.

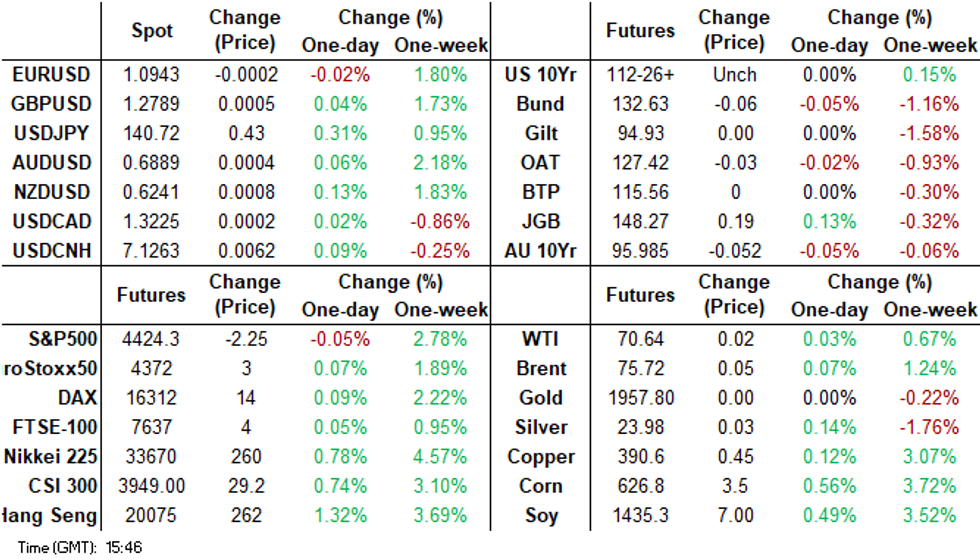

MARKETS

US TSYS: Marginally Cheaper In Asia

TYU3 deals at 113-11+, -0-03, a 0-08 range has been observed on volume of ~80k.

- Cash tsys sit 1-3bps cheaper across the major benchmarks, the curve has bear flattened.

- Tsys cheapened in early dealing as local participants faded yesterday's richening perhaps using the opportunity to enter fresh shorts/close out long positions.

- Pressure marginally extended as e-minis fell and the USD firmed. However there was little follow through on the move and tsys ticked away from session lows dealing in narrow ranges for the remainder of the session.

- The space looked through the latest BOJ monetary policy decision, the bank held policy steady as expected.

- The final print of Eurozone CPI provides the highlight in Europe today. Further out we have UofMich Consumer Sentiment, as well as Fedspeak from St Louis Fed President Bullard, Gov Waller and Richmond Fed President Barkin.

JGBS: Futures Off Post BoJ Highs

Futures are around mid range in terms of post lunch break moves. We last sat at 148.27, +19, after a range of 148.18/39 post the break, The positive bias is consistent with an unchanged BoJ stance (which hit the wires during the break), but we haven't breached earlier highs from Wednesday this week (148.39).

- JGB futures are outperforming US Tsy futures, with TYU3 last sitting a touch heavier at 113-12, -02.

- In the cash JGB space, we remain well within recent ranges. Post BoJ extremes have been faded in yield terms. The 10yr currently sits close to 0.415%, while the 40yr is back near 1.39%, we got sub 1.36% earlier.

- For swaps, yields are still lower across the benchmark, the 10yr back under 0.58%.

- Looking ahead, the focus will be on Ueda's press conference at 07:30BST.

AUSSIE BONDS: Little Changed On Friday

ACGB's sit little changed from Thursdays closing levels across the major benchmarks after ticking away from early session highs, coming alongside a moderate cheapening in US Tsys.

- Cash ACGB's have opened dealing 2-4bps richer across the major benchmarks, however spillover from US Tsys saw gains pared through the session.

- Futures have also ticked away from session highs, XM is flat and YM sits +0.010.

- RBA dated OIS remain stable, a terminal rate of 4.56% is seen in December.

- Looking ahead the data calendar is thin next week with the RBA minutes of the June policy meeting on Tuesday and Judo Bank PMIs on Friday the only data of note.

NZGB's: Richer On Friday

NZGB's have finished 3-4bps richer across the major benchmarks on Friday, the curve has bull flattened.

- NZGB's ticked away from best levels seen early dealing as much a 6bps richer across the curve before marginally paring gains.

- RBNZ dated OIS have remained stable through the session, a terminal rate of 5.61% is seen in October.

- On the wires early this morning May BusinessNZ Mfg PMI printed at 48.9, the prior read was revised lower to 48.8 from 49.1.

- Looking ahead; May PSI crosses on Monday, May Trade Balance is due on Thursday and the latest ANZ Heavy Truckometer crosses on Friday.

FOREX: USD Marginally Firmer, USD/JPY Higher As BoJ Holds Steady

The BBDXY saw support in the first part of trade on moves towards the 1220 level. We got above 1222, but last tracked near 1221.70, only +0.10% on NY closing levels from Thursday. Some support has emerged from the firmer US yield backdrop (+1.4-3.4bps higher), but outside of yen, moves have been marginal.

- USD/JPY has seen the greatest degree of volatility, dipping to 139.85 pre BoJ, but ultimately rebounding as the central bank left policy settings unchanged. We currently track close to session highs in the 140.60/65 region, +0.25%.

- The BOJ stated FX markets will need to be monitored, which may be a topic of Ueda's press conference later, as FinMin Suzuki also gave some verbal jawboning this morning.

- Ranges have been relatively tight elsewhere, albeit with modest USD support. EUR/USD sits back at 1.0940.

- AUD/USD is at 0.6875/80, slightly down from Thursday session highs, while NZD tracks around the 0.6230 level.

- Looking ahead, the European morning's focus will be the final, detailed Eurozone readings of CPI, along with several ECB speakers including Holzmann, Rehn, Muller, Centeno, and Villeroy. For the US side, we have Fed speakers, Bullard speaking early, then Waller and Barkin, later on. U. of Mich Sentiment also prints.

EQUITIES: Japan Stocks Recover As BoJ Stays On Hold, CSI 300 Nears 200-day MA Upside Test

Most Asia Pac equity indices are tracking higher for the Friday session. Japan equities have recovered from lows pre the lunchtime break, as the BoJ held steady in terms of policy settings. China and Hong Kong equities are also firmer, but trends in SEA are more mixed. US futures are weaker, but away from session lows (Eminis last near 4466.50, -0.10%).

- The Nikkei saw support prior to the lunch break near 33200, but post the break haves't been able to rebound beyond 33600. This leaves us below highs from earlier in the week near 33800. The BoJ left policy settings unchanged, but there will be focus on Ueda's press conference later.

- The HSI is up 0.73% to the break, while the CSI 300 is up 0.44% at the stage. In index terms we just below 3943, which is multi-week highs. The simple 200-day MA, around 3952, is not too far away. We may see a China State Council meeting later today to discuss further stimulus options.

- The Kospi has rebounded 0.55% so far today, but the Taiex is down 0.25%, in line with a weaker SOX trend from US Thursday trade.

- In SEA markets, Malaysia stocks are weaker -0.50%, maintaining a recent underperformance trend. Indonesia stocks are also down, -0.45%.

OIL: Largely Holding Onto Thursday's Bounce

Brent crude has largely tracked sideways through the first part of the Friday session. We were last near $75.50/bbl, not far off yesterday's session highs close to $76/bbl. This leaves us only 0.25% lower for the session so far, after a 3.37% gain for Thursday. WTI was last around

$70.40-50/bbl, tracing a similar trajectory.

- The Thursday rally was largely on the back of China stimulus hopes. A State Council meeting may take place today, the market will be looking for additional signs that China will improve domestic demand outside of the recent rate cuts announced.

- Earlier headlines crossed from China's NDRC, stating the authorities will ensure coal/gas supply to meet summer demand. This could be seen as a positive at the margin for broader commodities, and comes after China's oil import quota bump earlier in the week.

- Still, elevated Russian supply and US inventory builds are working against upside price momentum. The prompt spread continues to fall.

- For Brent, support is still evident on moves sub $71.50/bbl, while on the topside the 50-day MA is near $77.75/bbl.

GOLD: Drifting Down From Thursday Session Highs

Gold is tracking a touch below NY closing levels, last near $1956.30/50 (range of $1955.23-$1962.07 so far today). Current levels area below closing levels from the end of last week, but only just. At this stage, gold is largely holding onto gains from the Thursday session, which owed mostly to weaker USD indices.

- The simple 100-day MA around $1942, has been an important support point in recent weeks. We did break sharply sub this support level earlier in the week, but it wasn't sustained. On the topside, the 50-day MA sits near $1985.

- The downtrend in gold ETF holdings persists from late May highs.

ASIA FX: USD/INR Testing Simple 200-day MA Support, USD/CNH Above Thursday Lows

USD/Asia pairs have been mixed today. USD/CNH has rebounded somewhat, following a sharp move lower on Thursday on stimulus hopes and broader USD weakness. Spot USD/KRW has seen support again under the 1270 level, which was also evident earlier this week. Other currencies are firmer though, PHP and INR rallying. Spot USD/INR is currently tracking sub the simple 200-day MA for the first time since early 2022.

- USD/CNH has recovered some ground from Thursday session lows sub 7.1200. We got back to a high of 7.1445 (with weaker yen levels post the on hold BoJ weighing at the margin), but now sit around 100pips lower at 7.1330/40. The tone to onshore and HK equities is positive, amid on-going stimulus hopes. There has been some chatter this week a State Council meeting could take place today.

- Spot USD/KRW gapped lower at the open but there appears to be some support under 1270 at this stage. Spot hit a low of 1268.90, but we now sit back at 1275/76, still +0.40% firmer in won terms for the session. 1 month USD/KRW is back to 1273/74, up from NY Thurs lows sub 1270. Onshore equities have rebounded somewhat, the Kospi +0.50%. Offshore equity inflows have only been modest though.

- The Rupee is firmer in early dealing on Friday, USD/INR is down ~0.3% and dealing a touch below the 82 handle. Broader USD trends are weighing on the pair and USD/INR sits at its lowest level since early May. Inflows into Indian stocks from Foreign Investors is aiding the Rupee. In the week to Wednesday the inflows total $421mn. On the wires yesterday May Trade Balance printed at $22.12bn widening from April's $15.24bn deficit. Q1 Current Account Balance is due sometime below today and June 30.

- The Ringgit briefly firmed in early dealing, USD/MYR fell below 4.60 handle however the move did not follow through and the Ringgit now sits a touch weaker on the day. USD/MYR prints at 4.6170/4.6200, the pair is ~0.2% firmer than opening levels and well within recent ranges. Looking ahead the data calendar is empty until Tuesday when May Trade Balance crosses. However next week is highlighted by the May CPI print on Friday.

- Finance Secretary Diokno has stated that the BSP is likely to leave rates on hold at next week's policy meeting. Rate cuts will be considered if there is a significant drop in inflation, with Diokno highlighting the Q1 2024 period as a potential window. Th Secretary also said Q2 growth was likely to be similar to Q1's. In the FX space, USD/PHP is tracking lower, last at 55.85, slightly up from session lows near 55.76. The pair largely remains range bound with moves above the simple 200-day (56.13), drawing selling interest in recent months. Peso bulls will look to target a break sub the 50-day MA near 55.70.

- The SGD NEER (per Goldman Sachs estimates) is a touch softer in early dealing, the measure however remains well within recent ranges. We now sit ~0.6% below the upper end of the band. USD/SGD has fallen to its lowest level since May 17, broader USD flows are dominating, the pair sits at $1.3365/75. The pair is down ~1.2% month to date. To recap from earlier in the session, May export data came in weaker than expected. The m/m printing at -14.6%, versus -1.9% forecast. This is the steepest m/m fall going back to 2012, but the m/m readings can be volatile and we have had positive outcomes in the past two months. The y/y print fell to -14.7% , also well below consensus estimates (-7.7%). Looking ahead, next Friday's May CPI print is the only data of note next week. Headline CPI is expected to fall to 5.4% Y/Y from 5.7%, and Core CPI is also expected to tick lower to 4.7% Y/Y from 5.0%.

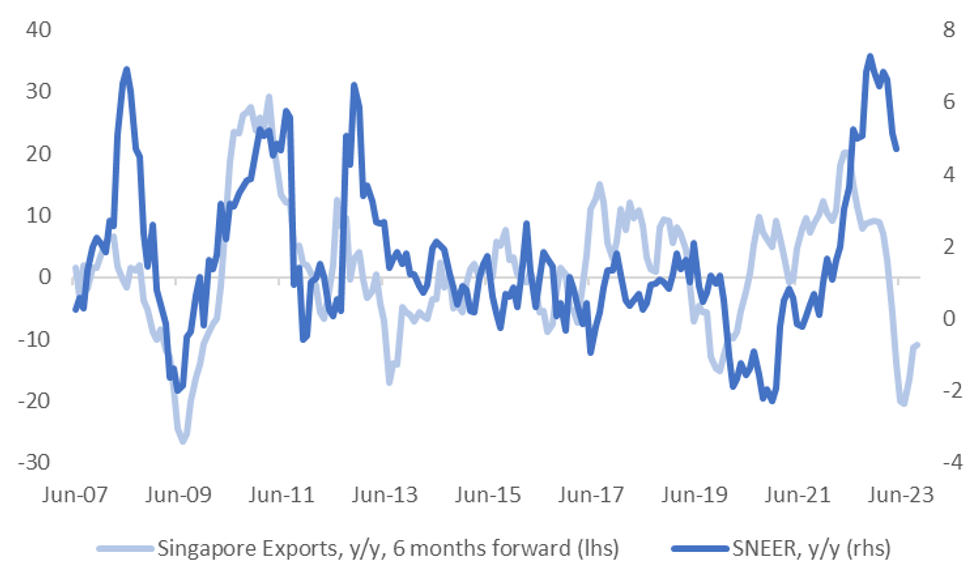

SINGAPORE DATA: Steep Fall In May Exports, But Y/Y Momentum Showing Signs Of Basing

May export data came in weaker than expected. The m/m printing at -14.6%, versus -1.9% forecast. This is the steepest m/m fall going back to 2012, but the m/m readings can be volatile and we have had positive outcomes in the past two months. The y/y print fell to -14.7% , also well below consensus estimates (-7.7%). Electronic exports also remain weak in y/y terms, down -27.2%, versus -23.3% prior.

- in terms of the detail, weakness was evident in pharmaceuticals and petrochemicals in y/y terms. By country, exports to China and the US were positive in y/y terms but negative elsewhere, particularly in parts of Asia, which are tech sensitive. This fits with the ongoing tech export headwinds in these economies.

- Despite the weaker export headline result, y/y momentum smoothed (by a 3 month average) is above its recent trough point, see the chart below, overlaid with y/y SGD NEER changes.

- Still, with global headwinds still present, it may be a stretch to expect a sharp turn higher in the next few months.

Fig 1: Singapore Exports (3mth moving average) & SGD NEER Y/Y

Source: MNI - Market News/Bloomberg

SOUTH KOREA: Highlights From Local News Wires

Below is a collection of news wires reports from English versions of South Korean Newspapers and some other major news outlets from the past day or so.

ECONOMY: Economic slowdown continues on weak exports, inflation weakens: government (link)

ECONOMY: S. Korea's H2 economy strategy to focus on rebound, livelihood stability (link)

FISCAL: S. Korea's fiscal deficit expands on-year in April (link)

TRADE: Auto exports jump 50% in May on strong eco-friendly car sales (link)

SHIPPING: Container freight rates for US, EU up in May: data (link)

MARKETS: Retail investors show weaker presence in Kosdaq market amid large-cap rally (link)

FX: Korean currency on course to settle at 1,200 won level over Fed's rate freeze (link)

TECH: Samsung, SK hynix benefit from soaring demand for high-performing memory chips amid AI boom (link)

TECH: DRAM prices may go up on high demand for high-performance memory chips (link)

TECH: Korea unfazed by new EU battery law (link)

GEOPOLITICS: US, S. Korea and Japan condemn N. Korea's latest missile provocation (link)

GEOPOLITICS: S. Korea salvages NK 'satellite' launch debris in West Sea (link)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/06/2023 | 0700/0300 |  | US | St. Louis Fed's James Bullard | |

| 16/06/2023 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 16/06/2023 | 0830/0930 | ** |  | UK | Bank of England/Ipsos Inflation Attitudes Survey |

| 16/06/2023 | 0900/1100 | *** |  | EU | HICP (f) |

| 16/06/2023 | 1145/0745 |  | US | Fed Governor Christopher Waller | |

| 16/06/2023 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 16/06/2023 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 16/06/2023 | 1230/0830 | * |  | CA | International Canadian Transaction in Securities |

| 16/06/2023 | 1300/0900 |  | US | Richmond Fed's Tom Barkin | |

| 16/06/2023 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.