-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI European Morning FI Analysis: Core FI Bid To Start The Week

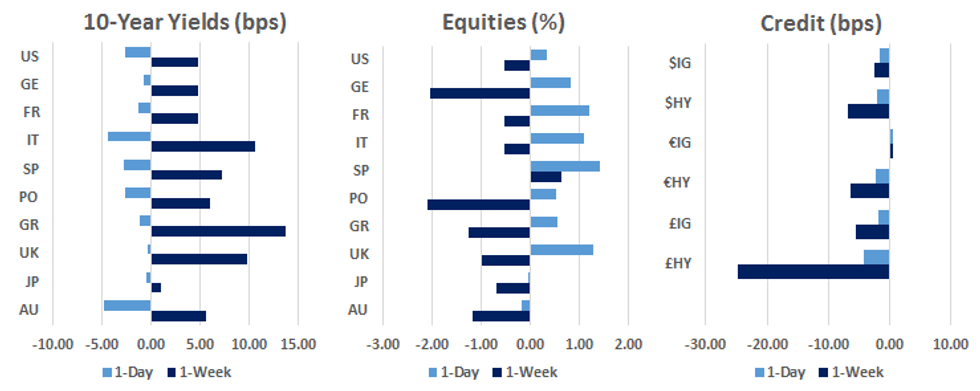

US TSYS: Friday's Flattening Extends

The trifecta of broader COVID mitigation measures in Europe, a lack of fiscal impulse coming from the Hill and the recent re-pricing of a "Blue Wave" U.S. election scenario (although the odds of this actually ticked up on Sunday, after the recent pullback) weighed on risk at the start of the new week, providing a bid for U.S. Tsys, extending on the flattening witnessed on Friday. T-Notes last +0-05+ at 138-17 on healthy volume of ~125K, with cash Tsys running 0.4-3.5bp richer across the curve, bull flattening. On the European COVID front, while it is true that the latest round of infections has not been subjected to the mortality rate witnessed during the first major round of European cases, governments are still willing to impose lockdown/mitigation measures, which will have an economic impact.

- As a reminder, the Tsy curve flattened on Friday, with the market switching focus to a realisation that any fiscal pact in DC will likely have to wait until after the November election, despite some quarters on the Hill remaining upbeat re: the prospect of a deal (At least externally).

- Eurodollar futures sit unchanged to +0.5 through the reds, with flattening flows evident in EDU2/U4 in Asia-Pac hours.

- Regional Fed activity data headlines locally today.

US TSYS: Weekly CFTC U.S. Fixed Income Positioning: Steepening Impetus Favoured

The latest round of weekly CFTC positioning data (covering the week through Tuesday 20 October) pointed to a broader net exposure to steepeners in the U.S. Tsy futures space, in keeping with the general direction of the cash Tsy market. Still, the move witnessed in futures was more reflective of a twist steepening pattern, as opposed to the outright bear steepening that was seen in the cash Tsy space, while TY futures positioning remains net long (albeit with no real statistical significance).

- ZN positioning registered another fresh record short in the most recent week captured by the CFTC.

RATINGS: Sovereign rating reviews of note from after hours on Friday included:

- Fitch affirmed the Netherlands at AAA; Outlook Stable

- S&P affirmed Greece at BB-; Outlook Stable

- S&P affirmed Italy at BBB; Outlook Revised To Stable From Negative

- S&P affirmed the United Kingdom at AA; Outlook Stable

- DBRS Morningstar confirmed Greece at BB (low), Stable Trend

JGBS: Bid On Broader Risk Tone, Heavy Offers Remain In Long End Rinban

The combination of an uptick in JGB futures (+11 last) and broader risk dynamic helped to support the belly area of the JGB curve during Tokyo trade on Monday, although continued heavy offers in 10-25+ Year BoJ Rinban ops meant that the super-long end of the curve continued to underperform in afternoon trade, after doing the same in the morning.

- The weekend saw Mainichi sources suggest that Japan's government is considering compiling an extra budget worth ~Y10tn to combat the economic headwinds stemming from COVID-19. The piece went on to note that the gov't has ~Y7tn in remaining reserves that it can deploy, and it is considering issuing (a relatively trivial amount of) bonds to fill the gap.

- PM Suga's favourability in the opinion polls has taken a hit in the last couple of weeks but still remains healthy in relative terms.

- As a reminder, after hours Friday saw the Japanese government note that "the Japanese economy is still in a severe situation due to the novel coronavirus, but it is showing signs of picking up."

- 2-Year JGB supply is due on Tuesday.

AUSSIE BONDS: Onshore & Offshore Matters support After Last Week's Backup

The offshore impetus dragged the Aussie bond space flatter during Sydney hours, with YM +0.5 and XM +5.0 come the close, as the latter traded through its SYCOM high. A solid A$1.5bn ACGB Nov '28 offering from the AOFM helped bulls, even after some corporate and offshore A$ deals were launched earlier in the day. The line sits in the proverbial sweet spot if the RBA decides to adopt a broader range of ACGB bond purchases covering 5-10 Year paper, and also benefitted from last week's backup in yields. Cover was above 4.5x, with the average price stopping ~0.9bp through prevailing mids (per BBG prices).

- We also saw the state Premier of Victoria confirm that all retail outlets will be allowed to open from Wednesday. Elsewhere, the weekend saw PM Morrison reveal that all of the nation's states & territories, barring Western Australia, have agreed to a broader framework that would end regional border closures before December 25.

- Bills unchanged to +1 come the close.

- RBA's Debelle & Bullock appear in front of the Senate Economics Legislation Committee on Tuesday.

AUCTION/DEBT SUPPLY

BOJ: 1-5 & 10-25+ Year Rinban Sizes Unchanged

The BoJ offers to buy a total of Y920bn of JGB's from the market, sizes unchanged from previous operations:

- Y420bn worth of JGBs with 1-3 Years until maturity

- Y350bn worth of JGBs with 3-5 Years until maturity

- Y120bn worth of JGBs with 10-25 Years until maturity

- Y30bn worth of JGBs with 25+ Years until maturity

AUSSIE BONDS: The AOFM sells A$1.5bn of the 2.75% 21 Nov '28 Bond, issue #TB152:

The Australian Office of Financial Management (AOFM) sells A$1.5bn of the 2.75% 21 November 2028 Bond, issue #TB152:- Average Yield: 0.6280% (prev. 0.8098%)

- High Yield: 0.6300% (prev. 0.8175%)

- Bid/Cover: 4.6107x (prev. 4.3825x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 68.9% (prev. 15.4%)

- bidders 40 (prev. 49), successful 14 (prev. 15), allocated in full 6 (prev. 8)

TECHS

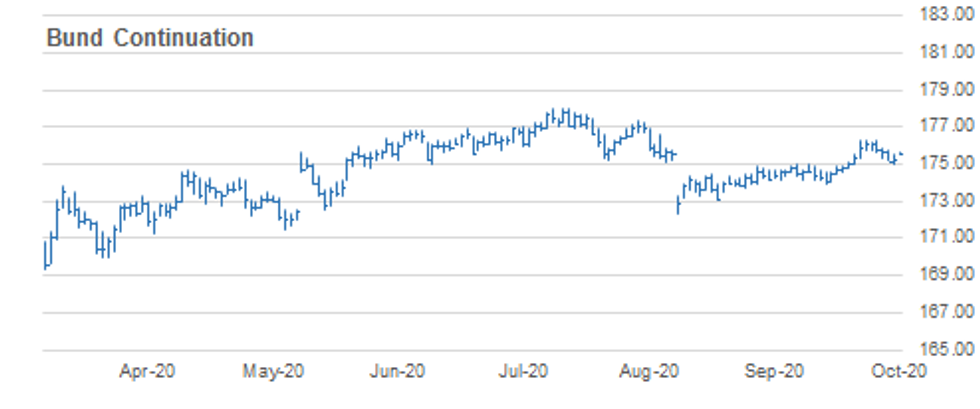

BUND TECHS: (Z0) Corrective Cycle Finds Support

- RES 4: 176.57 1.618 proj of Aug 28 - Sep 9 rally from the Sep 10 low

- RES 3: 176.32 1.500 proj of Aug 28 - Sep 9 rally from the Sep 10 low

- RES 2: 176.29 High Oct 16 and the bull trigger

- RES 1: 175.86 High Oct 21

- PRICE: 175.61 @ 04:57 BST Oct 26

- SUP 1: 175.00 Low Oct 23

- SUP 2: 174.72 Trendline support drawn off the Sep 1 low

- SUP 3: 174.55 50-day EMA

- SUP 4: 174.49 Low Oct 9

Key resistance in Bunds has been defined at 176.29, Oct 16 high.The recent pullback is considered a correction and initial support has been established at 175.00, Friday's low. Note that the key short-term trendline support intersects at 14.72. The trendline is drawn off the Sep 1 low and the trend remains up while price remains above the line. A break of 175.86, Oct 21 high would signal scope for intraday gains ahead of 176.29.

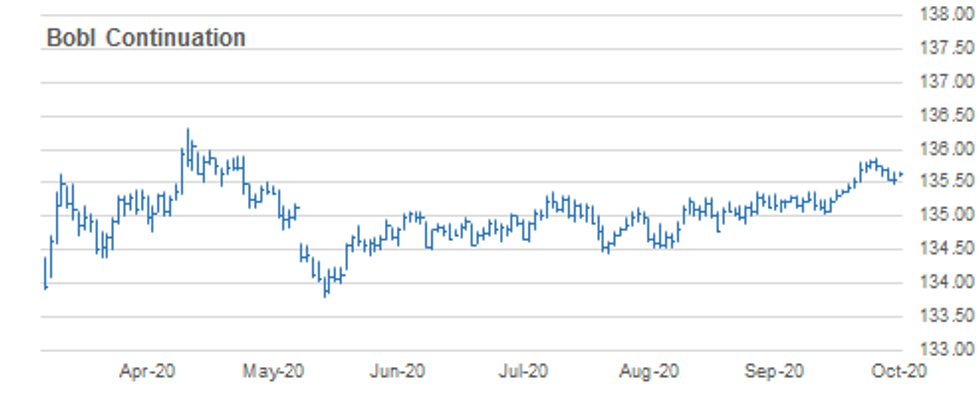

BOBL TECHS: (Z0) Looking For Support

- RES 4: 136.000 Round number resistance

- RES 3: 135.907 1.764 proj of Sep 1 - Sep 9 rally from Sep 10 low

- RES 2: 135.860 High Oct 20 and the bull trigger

- RES 1: 135.760 High Oct 21

- PRICE: 135.640 @ 05:06 BST Oct 26

- SUP 1: 135.470 Low Oct 23

- SUP 2: 135.4661 20-day EMA

- SUP 3: 135.370 High Sep 21 and Oct 5 and former breakout level

- SUP 4: 135.360 Low Oct 13

BOBL gains stalled this week and remain in a corrective cycle. Key resistance has been defined at 135.860, Oct 20 high. Friday's low though of 135.470 is initial support and the recovery off this level is the first signal that the corrective pullback may be over. A break of resistance at 135.760, Oct 21 high would refocus attention on resistance at 135.860. Weakness below 135.470 would again expose 135.370, Sep 21 and Oct 5 high.

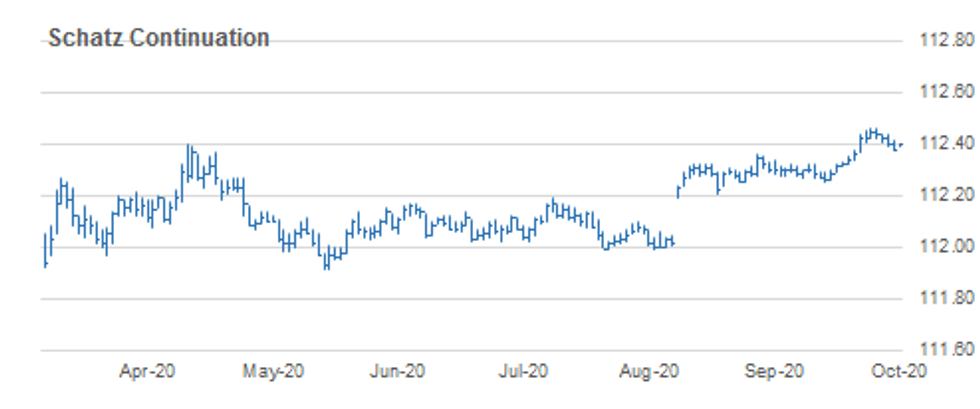

SCHATZ TECHS: (Z0) Monitoring Support

- RES 4: 112.490 2.000 proj of Aug 26 - Sep 9 rally from the Sep 10 low

- RES 3: 112.457 1.764 proj of Aug 26 - Sep 9 rally from the Sep 10 low

- RES 2: 112.460 High Oct 19 / 20 and the bull trigger

- RES 1: 112.440 High Oct 21 /22

- PRICE: 112.395 @ 05:13 BST Oct 26

- SUP 1: 112.375 Low Oct 23

- SUP 2: 112.362 20-day EMA

- SUP 3: 112.360 High Sep 21 and the recent breakout level

- SUP 4: 112.340 Low Oct 14

Schatz futures are trading below last week's high and remain in a corrective cycle . Attention is on support at 112.360, Sep 21 high and recent breakout level. The 20-day EMA intersects at 112.362 reinforcing the short-term importance of support around 112.360. On the upside, clearance of 112.440, Oct 21 and 22 high would refocus attention of the bull trigger at 112.360. Sub 112.60 levels however risk a deeper extension of the recent move lower.

GILT TECHS: (Z0) Remains Heavy

- RES 4: 136.38 Low Oct 20 and a gap high on the daily chart

- RES 3: 136.27 High Oct 21 and a gap low on the daily chart

- RES 2: 136.05 50-day EMA

- RES 1: 135.87 High Oct 22

- PRICE: 135.37 @ Close Oct 23

- SUP 1: 135.04 Low Oct 23 and the intraday bear trigger

- SUP 2: 134.59 Low Sep 1

- SUP 3: 134.32 Low Aug 28 and a key support

- SUP 4: 134.00 1.50 proj of Sep 21 - Oct 7 sell-off from Oct 16 high

Gilt futures remain heavy following last week's sell-off. Friday's move lower resulted in the contract trading through the Oct 7 low of 135.06 before finding support. A clear break of this level would reinforce last week's week's bearish developments and expose 134.32, Aug 28 low. Price needs to trade above 136.05, the 50-day EMA, to ease the current bearish threat. This would open 136.97, Oct 16 high once again.

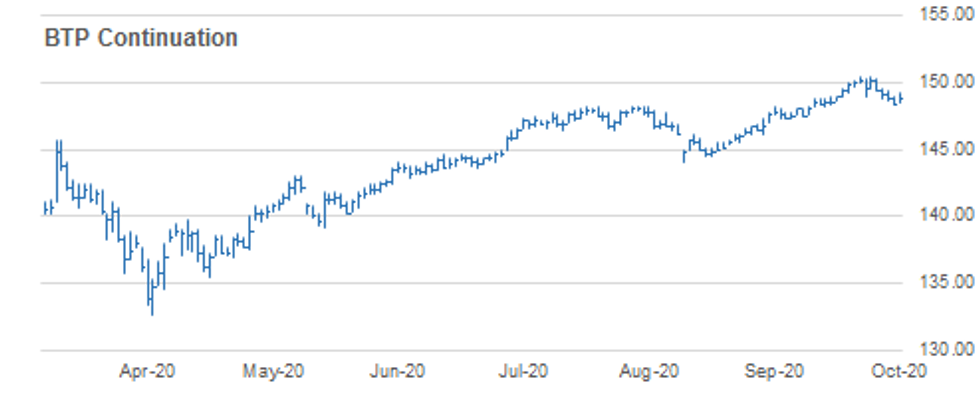

BTP TECHS: (Z0) Testing The 20-day EMA

- RES 4: 152.00 Round number resistance

- RES 3: 151.17 0.764 of Jun 10 - Aug 20 swing from Sep 9 low (cont)

- RES 2: 150.46 High Oct 16 and the bull trigger

- RES 1: 149.58 Oct 20 high

- PRICE: 148.86 @ Close Oct 23

- SUP 1: 148.37 Low Oct 22

- SUP 2: 148.03 38.2% retracement of the Sep 1 - Oct 16 rally

- SUP 3: 147.46 Low Sep 30

- SUP 4: 147.27 50.0% retracement of the Sep 1 - Oct 16 rally

BTPS outlook remains bullish however futures are currently in a corrective cycle with price still trading below recent highs. The contract has breached the 20-day EMA at 148.73 signalling scope for a deeper pullback, potentially towards 148.03, a Fibonacci retracement level. Initial resistance is at 149.58, Oct 20 high. A break of 150.46, Oct 16 high and the bull trigger would resume the uptrend.

EUROSTOXX50 TECHS: Bearish Risk Still Present

- RES 4: 3326.79 High Sep 18

- RES 3: 3305.77 High Oct 12 and the bull trigger

- RES 2: 3282.55 High Oct 19

- RES 1: 3226.97 20-day EMA

- PRICE: 3198.86 @ Close Oct 23

- SUP 1: 3135.48 Low Oct 22

- SUP 2: 3097.67 Low Sep 25 and the bear trigger

- SUP 3: 3054.11 Low June 15

- SUP 4: 3012.50 38.2% retracement of the Mar - Jul uptrend

A bearish EUROSTOXX 50 focus remains intact although near-term support has been established at 3135.48, Oct 22 low. Recent weakness off 3305.77, Oct 12 high has reversed the recent Sep 25 - Oct 12 recovery. Support at 3147.28, Oct 2 low has been breached and attention turns to the primary support handle at 3097.67, Sep 25 low. A break would reinforce bearish conditions. Key near-term resistance is at 3282.55, Oct 19 high.

LOOK AHEAD

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.