-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Equities Lower Post CEWC

MNI EUROPEAN OPEN: Sharp Fall In China Bond Yields Continues

MNI European Morning FI Analysis: Increased Bets Of Deeper RBA Easing Puts The Spotlight On ACGBs

US TSYS: Another Leg Flatter

A downtick in e-minis (with the S&P 500 contract breaching Wednesday's low) and the bid in the Aussie bond space provided support for U.S. Tsys in Asia-Pac hours, with T-Notes last +0-02 at 139-09, while cash Tsys sit unchanged to 1.7bp richer across the curve, with bull flattening evident as the space operates just shy of richest levels of the session. Diminished prospects of pre-election U.S. fiscal stimulus, COVID worry in Europe and Sino-U.S. tensions were familiar themes driving the major macro headline flow.

- This comes after a fairly subdued Wednesday, as TY volumes sagged. The early goings set the tone for the day, with Tsy Secretary Mnuchin watering down any lingering expectations of a pre-election fiscal pact in DC, while late NY trade saw European COVID worry move to the fore. This allowed cash Tsys to finish unchanged to ~2.0bp richer, although the space edged off richest levels as we moved through NY trade. Fedspeak and data failed to move the needle, with the aforementioned matters dominating.

- Weekly jobless claims data, regional activity surveys from New York & Philadelphia and a slew of Fedspeak headline locally on Thursday.

JGBS: Tight Tokyo Trade As Overnight Range Holds

JGBs held to tight ranges in Tokyo hours, with futures last +7, as the contract respected its overnight trading band. Cash trade saw the 3-5 Year zone outperform. The latest round of 5-15.5 Year off-the-run supply was well received, with the cover ratio nudging higher and spreads tightening when compared to the previous auction.

- The latest weekly international security flow data revealed that foreign investors registered a second consecutive week of net purchases of Japanese bonds, albeit at a slightly slower pace vs. what was seen in the previous week (Y781.5bn), although the 4-week rolling sum moved further into negative territory after a large round of weekly net purchases dropped out of the sample.

JAPAN: Several Rounds Of Weekly Security Flows To Note

The latest weekly international security flow data revealed the largest round of foreign bonds by Japanese investors in the current fiscal year (Y1.9465tn). This came after 2 weeks of relatively modest net selling, allowing the 4-week rolling sum of the measure to extend further into net buying territory. Japanese investors also lodged net purchases of foreign equities (Y312.5bn) in latest week, breaking a streak of 4 consecutive weeks of net sales, although the 4-week rolling sum of the measure remains in negative territory.

- Foreign investors registered a second consecutive week of net purchases of Japanese bonds, albeit at a slightly slower pace vs. what was seen in the previous week (Y781.5bn), although the 4-week rolling sum moved further into negative territory after a large round of weekly net purchases dropped out of the sample. Foreign investors registered a second consecutive fresh FYtD high in terms of weekly net purchases of Japanese equities (Y1.421tn).

AUSSIE BONDS: RBA Set To Go Lowe-r

Aussie bonds were well bid as RBA Governor Lowe failed to play down the prospects of imminent easing, with curve flattening apparent as he alluded to the possibility of the RBA expanding its ACGB purchases to capture a more meaningful chunk of the 5-10 Year zone of the curve (an area untouched since the RBA restarted its ACGB purchases). His language re: labour market and inflation dynamics added to the idea that further easing is imminent, with most of the sell side now looking for a move in September. YM +1.5, XM +6.5, with the latter pulling back from best levels into the close.

- The latest round of Australian monthly labour market data wasn't quite as soft as feared, but still revealed chunky enough job losses, along with elevated unemployment and capacity utilisation readings. A look under the hood of the labour market data revealed a 0.1ppt uptick in the underemployment rate and a 0.2ppt uptick in the underutilisation rate, still some way shy of their respective post-COVID highs.

- Bills sit 1-2 ticks higher through the reds.

- Tomorrow will see A$1.0bn of ACGB 0.25% 21 November 2024 on offer at auction, with the AOFM set to reveal its weekly issuance schedule later in the day.

AUCTIONS/DEBT SUPPLY

JGBS AUCTION: Japanese MOF sells Y497.9bn of 5-15.5 Year JGBs in liquidity enhancement auction:

- Average Spread: -0.007% (prev. 0.000%)

- High Spread: -0.006% (prev. +0.002%)

- % Allotted At High Spread: 4.5298% (prev. 13.5874%)

- Bid/Cover: 4.425x (prev. 4.190x)

TECHS

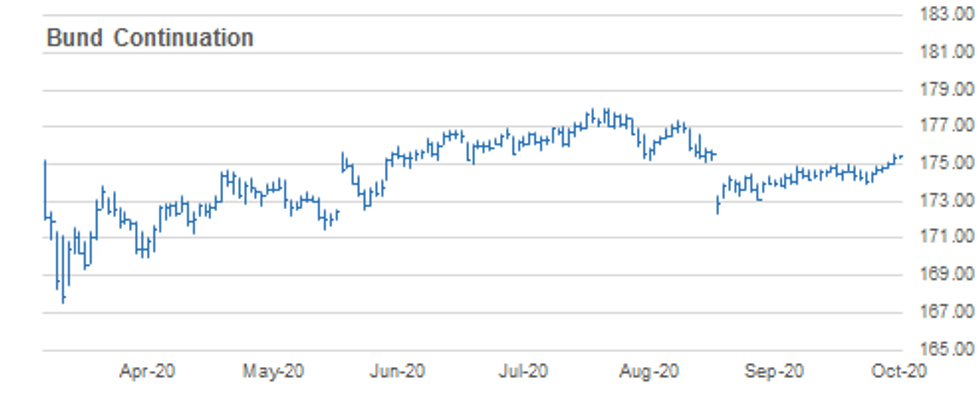

BUND TECHS: (Z0) Extends Gains

- RES 4: 176.06 1.382 proj of Aug 28 - Sep 9 rally from the Sep 10 low

- RES 3: 176.00 round number resistance

- RES 2: 175.74 1.236 proj of Aug 28 - Sep 9 rally from the Sep 10 low

- RES 1: 175.50 High Oct 14

- PRICE: 175.49 @ 04:53 BST Oct 15

- SUP 1: 175.04 Low Oct 14

- SUP 2: 174.54 20-day EMA

- SUP 3: 173.93 Low Oct 7 and the key support

- SUP 4: 173.74 Low Sep 17

Bund futures maintain a positive tone. The contract has traded higher this week having found support last week at 173.93, Oct 7 low. Futures have cleared resistance at 174.97, Oct 2 high and more importantly, the key level at 175.08, Aug 4 high. This confirms a resumption of the broader uptrend and opens 175.74 next, a Fibonacci projection. Support lies at 175.04, yesterday's low.

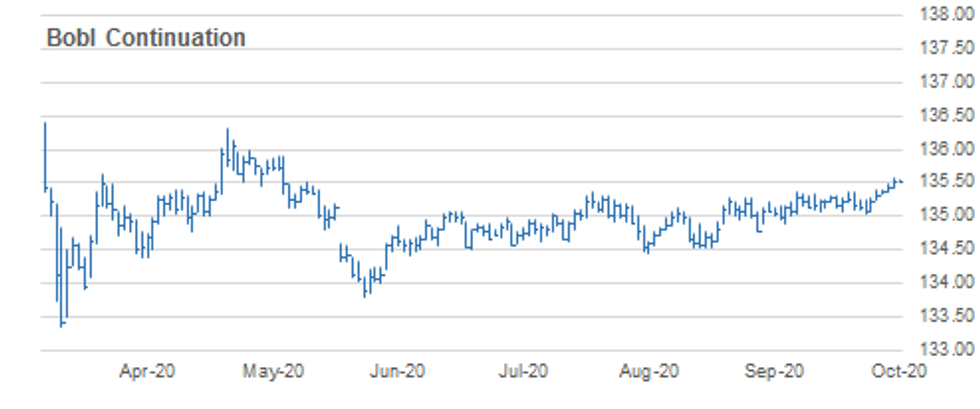

BOBL TECHS: (Z0) Bullish Outlook Intact

- RES 4: 135.757 76.4% retracement of the May - Jun sell-off (cont)

- RES 3: 135.735 1.500 proj of Sep 1 - Sep 9 rally from Sep 10 low

- RES 2: 135.658 1.382 proj of Sep 1 - Sep 9 rally from Sep 10 low

- RES 1: 135.580 High Oct 14

- PRICE: 135.550 @ 04:41 BST Oct 15

- SUP 1: 135.370 High Sep 21 and Oct 5

- SUP 2: 135.241 20-day EMA

- SUP 3: 135.030 Low Oct 6 and key trend support

- SUP 4: 134.900 Low Sep 11 and 17

BOBL futures maintain a bullish tone. The contract rebounded on Oct 7 off 135.030. The subsequent recovery has resulted in a clear break of resistance at 135.370, Sep 21 and the Oct 5 high. This confirms a resumption of the uptrend that started early September and opens 135.658 next, a Fibonacci projection. 135.030 marks the key short-term trend support where a break is required to reverse the trend. Initial support lies at 135.370.

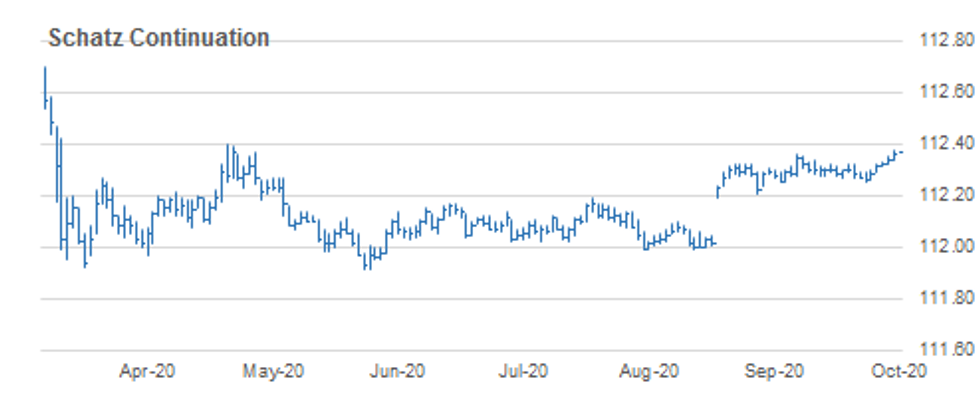

SCHATZ TECHS: (Z0) Clears The Bull Trigger

- RES 4: 112.403 1.382 proj of Aug 26 - Sep 9 rally from the Sep 10 low

- RES 3: 112.400 High May 4 (cont)

- RES 2: 112.383 1.236 proj of Aug 26 - Sep 9 rally from the Sep 10 low

- RES 1: 112.375 High Oct 14

- PRICE: 112.370 @ 05:17 BST Oct 15

- SUP 1: 112.340 Low Oct 14

- SUP 2: 112.305 20-day EMA

- SUP 3: 112.255 Low Oct 7 and key trend support

- SUP 4: 112.250 Low Sep 17

Schatz futures remain firm following last week's rebound off 112.255, Oct 7 low and this week's extension higher. Resistance at 112.360, Sep 21 high high was breached yesterday, reinforcing the current positive tone and this confirms a resumption of the broader uptrend. The move higher has opened 112.383, a Fibonacci Projection. Moving average studies are in a bull mode reinforcing current conditions. Initial support is at 112.340, yesterday's low.

GILT TECHS: (Z0) Finds Support

- RES 4: 137.04 High Sep 21 and a key resistance

- RES 3: 136.60 High Sep 30 and the near-term bull trigger

- RES 2: 136.28 61.88% retracement of the Sep 21 - Oct 7 sell-off

- RES 1: 136.26 High Oct 14

- PRICE: 136.07 @ Close Oct 14

- SUP 1: 135.50 Low Oct 14

- SUP 2: 135.06 Low Oct 7 and the bear trigger

- SUP 3: 134.96 76.4% retracement of the Aug 28 - Sep 28 rally

- SUP 4: 134.59 Low Sep 1

Gilts futures managed to trade higher again yesterday, extending this week's recovery. Futures have cleared the resistance zone highlighted by the 20- and 50-day EMAs strengthening the short-term bullish outlook. Further gains would open 136.28, a Fibonacci retracement and 136.60, the Sep 30 high. On the downside, initial firm support lies at 135.50, Oct 14 low ahead of the key level that has been defined at 135.06, Oct 7 low.

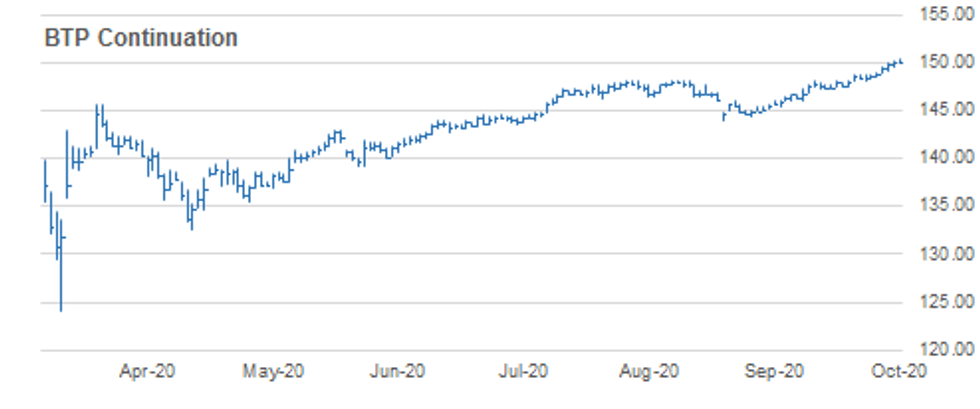

BTP TECHS: (Z0) Extends Gains Above 150.00

- RES 4: 152.00 Round number resistance

- RES 3: 151.17 0.764 of Jun 10 - Aug 20 swing from Sep 9 low (cont)

- RES 2: 150.92 Bull channel top drawn off the Sep 8 low

- RES 1: 150.18 High Oct 13

- PRICE: 150.22 @ Close Oct 14

- SUP 1: 149.23 Bull Channel support drawn off the Aug 9 low

- SUP 2: 148.36 20-day EMA

- SUP 3: 147.32 Low Sep 28 and key near-term support

- SUP 4: 146.98 Low Sep 22

BTPS continues to extend gains, touching a fresh all-time high print of 150.43 yesterday. The move higher once again confirms a resumption of the bull trend and maintains the positive price sequence of higher highs and higher lows. With futures in uncharted territory, Fibonacci projections highlight scope for a climb towards 151.17. The initial objective is 151.11, a bull channel top drawn off the Aug 9 low. Initial support lies at 149.43, the channel base.

EUROSTOXX50 TECHS: Bullish Trend Conditions Remain Intact

- RES 4: 3396.02 High Sep 3

- RES 3: 3348.77 High Sep 16 and key near-term resistance

- RES 2: 3326.79 High Sep 18

- RES 1: 3305.77 High Oct 12 and the intraday bull trigger

- PRICE: 3273.28 @ Close Oct 14

- SUP 1: 3254.13 Low Oct 9

- SUP 2: 3219.33 Low Oct 7

- SUP 3: 3147.28 Low Oct 2 and key support

- SUP 4: 3097.67 Low Sep 25 and the bear trigger

EUROSTOXX 50 maintains a bullish tone despite the pullback off Monday's high. Trend conditions have improved for bulls following last week's breach of 3227.43, Sep 28 high. Furthermore price has traded through the resistance zone defined by the 20- and 50-day EMAs. The move beyond these averages strengthens a bullish argument. Pullbacks are corrective in nature. Attention is on 3348.77, Sep 16 high. Support is at 3254.13.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.