-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI European Morning FI Analysis: Sidelined

US TSYS: A Pause After The Flattening

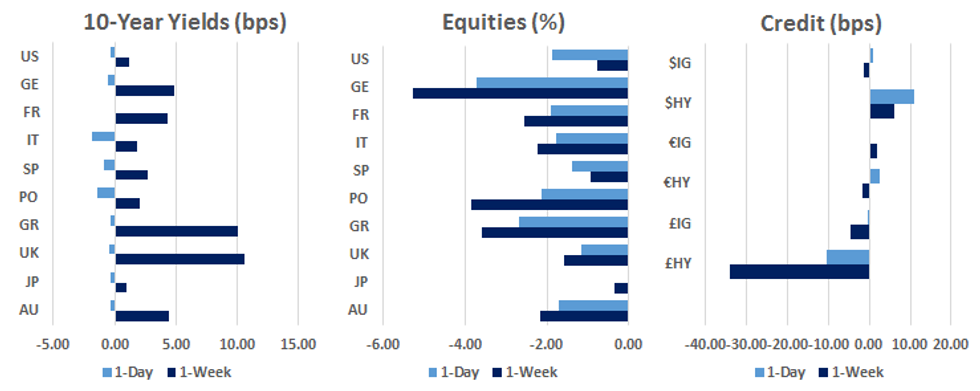

A macro headline light Asia-Pac session did very little for broader impetus in the core FI space after the broader flattening pressure witnessed on Monday. This made for tight ranges, with participants seemingly happy to sit on the sidelines. T-Notes held a 0-02+ range as a result, last unch. at 138-20+, with cash Tsys sitting unchanged to 0.5bp richer across the curve.

- The fiscal impasse on the Hill coupled with European COVID worry supported Tsys and pressured e-minis on Monday, with further defensive posturing witnessed on the back of China's retaliatory sanctions towards U.S. corporates re: matters surrounding Taiwan. The curve bull flattened as cash Tsys richened by up to 5bp across the curve come the NY closing bell, with T-Notes closing a touch shy of best levels. A TY block buy during the NY afternoon helped support the broader bid theme.

- Eurodollar futures -0.5 to +0.5 through the reds.

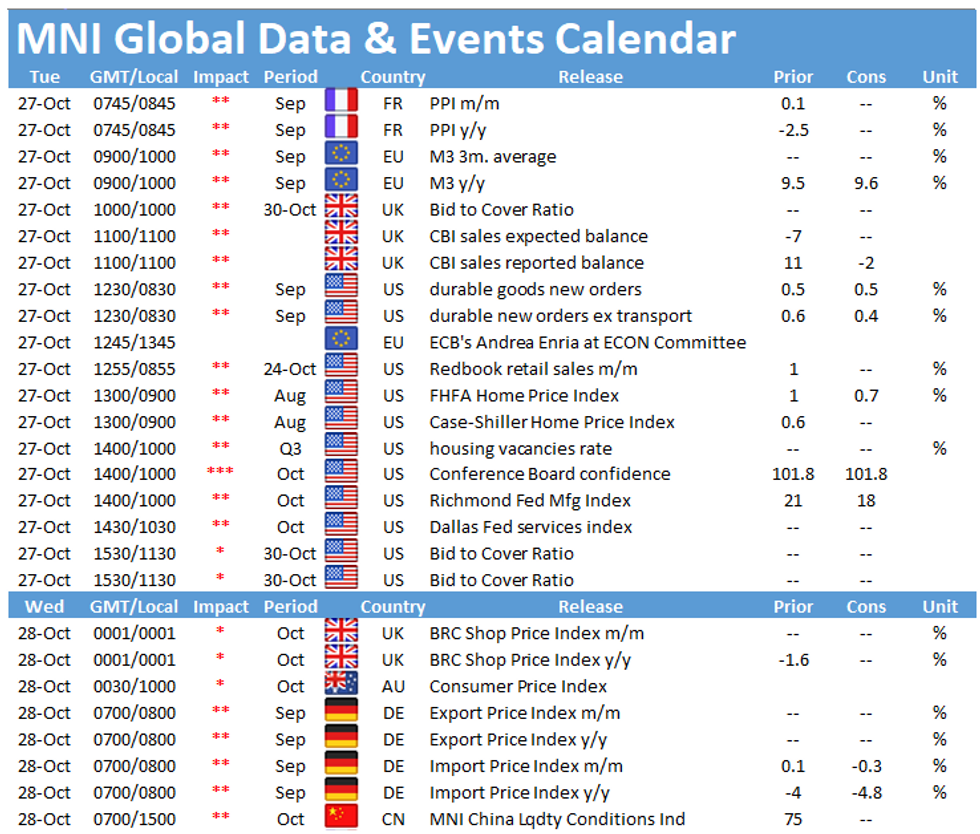

- 2-Year Tsy supply is due Tuesday. Elsewhere, the flash durable goods data and consumer confidence readings are due, as is the Richmond Fed manufacturing index.

JGBS: Contained Ranges

JGB futures edged above 152.00 during Tokyo trade, last +8, building on overnight gains but holding to a tight range, with cash JGBs generally trading richer and within 1.0bp of Monday's closing levels. The latest round of 2-Year JGB issuance wasn't the best received, with cover ratio sliding below 4.0x.

- After hours on Monday Nippon Life noted that it aims to boost its JGB holdings by ~Y500bn in H220 (mainly via 20- and 30-year bonds), in addition to boosting its domestic and offshore corporate bond holdings by the same cumulative amount.

- Also worth noting that Japan's Hokkaido prefecture is making arrangements to raise its coronavirus alert level by one notch from the lowest of 5 stages as local infections rise, per NHK sources.

- There is nothing of any real note on the local docket on Wednesday, outside of the BoJ's 2-day monetary policy meeting getting underway.

MONTH-END EXTENSIONS/JGBS: Morgan Stanley See Marginal Contraction

Morgan Stanley expect "the 1y+ JGB index to contract by 0.004y in October, compared to an average month's extension range of ~0.02-0.06y."

AUSSIE BONDS: SYCOM Ranges Respected

Aussie bond futures held to their respective SYCOM ranges in Sydney hours, with YM & XM closing +0.5. Swaps generally lagged vs. cash at the margin.

- An appearance in front of a Senate panel from RBA's Debelle & Bullock provided nothing of real note. The latest weekly ANZ-Roy Morgan consumer confidence index reading revealed another uptick, with the headline index now hovering just shy of 100. ANZ noted that "Sydney and Melbourne are now close to neutral. People remain cautious about the current economic outlook and, consistent with this, are also cautious about their current financial circumstances. This may constrain spending in the near-term. Confidence in future economic and financial conditions is much more positive, however, holding out the prospect of a recovery in spending if the labour market holds up."

- Bills closed -1 to +1 through the reds, while 3-Month BBSW fixed at a fresh record low of 0.0563%.

- Domestic focus really is centred on next week's RBA decision, although there are plenty of sources of potential offshore impulse between now and then. Tomorrow's domestic CPI reading won't be a needle mover for next week's RBA decision.

MONTH-END EXTENSIONS/AUSSIE BONDS: Morgan Stanley See <Than Usual Extension

Morgan Stanley expect "the 1y+ ACGB index to extend by 0.032y in October, compared to an average October extension of 0.186y and an average month's extension of 0.07y."

AUCTION/DEBT SUPPLY

BTPS: Italy to sell up to EUR2.5bn of 0.5% bonds due Feb 1, 2026 on Oct 29

Italy plans to sell up to 2.5 billion euros of 0.5 percent bonds due Feb 1, 2026 in an auction on Oct 29. The sale is a reopening of previously issued securities with 8.85 billion euros outstanding.Italy plans to sell up to 3 billion euros of 0.9 percent bonds due Apr 1, 2031 in an auction on Oct 29. The sale is a reopening of previously issued securities with 5.023 billion euros outstanding.Italy plans to sell up to 1 billion euros of floating bonds due Dec 15, 2023 in an auction on Oct 29. The sale is a reopening of previously issued securities with 8.095 billion euros outstanding. (BBG)

JGBS AUCTION: Japanese MOF sells Y2.4458tn 2-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.4458tn 2-Year JGBs:- Average Yield -0.130% (prev. -0.141%)

- Average Price 100.461 (prev. 100.485)

- High Yield: -0.127% (prev. -0.139%)

- Low Price 100.455 (prev. 100.480)

- % Allotted At High Yield: 73.1880% (prev. 64.8471%)

- Bid/Cover: 3.984x (prev. 4.022x)

TECHS

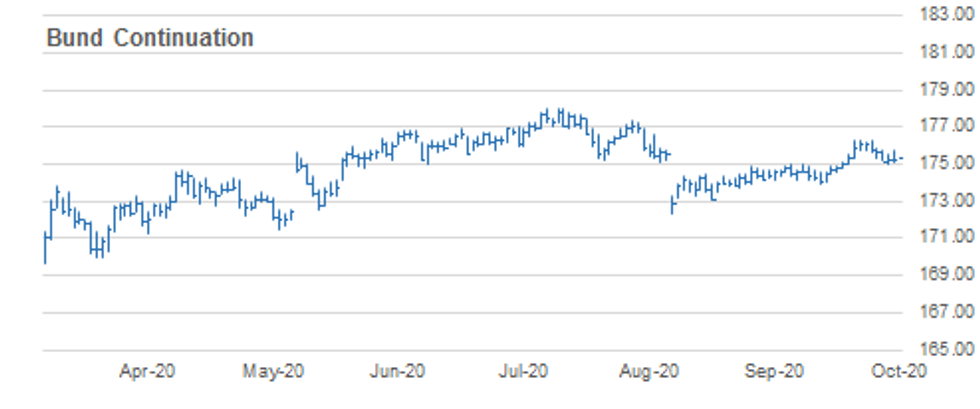

BUND TECHS: (Z0) Trendline Support Intact

- RES 4: 176.57 1.618 proj of Aug 28 - Sep 9 rally from the Sep 10 low

- RES 3: 176.32 1.500 proj of Aug 28 - Sep 9 rally from the Sep 10 low

- RES 2: 176.29 High Oct 16 and the bull trigger

- RES 1: 175.86 High Oct 21

- PRICE: 175.43 @ 04:41 GMT Oct 27

- SUP 1: 175.00 Low Oct 23

- SUP 2: 174.78 Trendline support drawn off the Sep 1 low

- SUP 3: 174.58 50-day EMA

- SUP 4: 174.49 Low Oct 9

Bunds remain below key resistance at 176.29, Oct 16 high.The recent pullback is still considered a correction and initial support has been established at 175.00, Oct 23 low. Note that the key short-term trendline support intersects at 174.78. The trendline is drawn off the Sep 1 low and the uptrend remains intact while price trades above the line. A break of 175.86, Oct 21 high would signal scope for intraday gains ahead of 176.29.

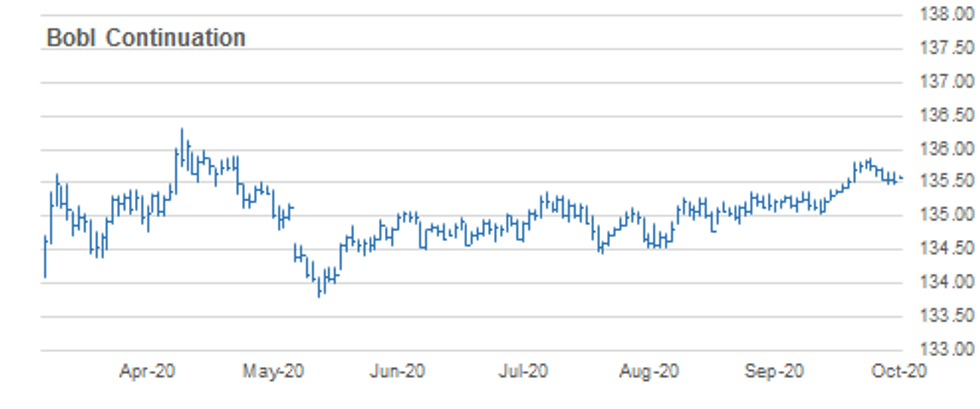

BOBL TECHS: (Z0) Corrective Cycle

- RES 4: 136.000 Round number resistance

- RES 3: 135.907 1.764 proj of Sep 1 - Sep 9 rally from Sep 10 low

- RES 2: 135.860 High Oct 20 and the bull trigger

- RES 1: 135.760 High Oct 21

- PRICE: 135.570 @ 04:56 GMT Oct 27

- SUP 1: 135.470 Low Oct 23

- SUP 2: 135.468 20-day EMA

- SUP 3: 135.370 High Sep 21 and Oct 5 and former breakout level

- SUP 4: 135.360 Low Oct 13

BOBL gains stalled last week and remain in a corrective cycle with key resistance defined at 135.860, Oct 20 high. Friday's low of 135.470 marks initial support and the recovery off this level is the first signal that the corrective pullback may be over. A break of resistance at 135.760, Oct 21 high would refocus attention on resistance at 135.860. Weakness below 135.470 would again expose 135.370, Sep 21 and Oct 5 high.

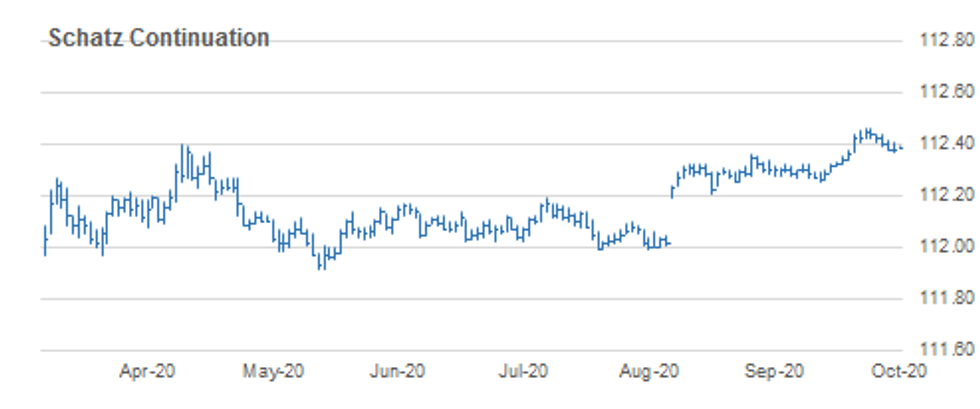

SCHATZ TECHS: (Z0) Trading Ahead Of Key Near-Term Support

- RES 4: 112.490 2.000 proj of Aug 26 - Sep 9 rally from the Sep 10 low

- RES 3: 112.457 1.764 proj of Aug 26 - Sep 9 rally from the Sep 10 low

- RES 2: 112.460 High Oct 19 / 20 and the bull trigger

- RES 1: 112.440 High Oct 21 /22

- PRICE: 112.385 @ 04:58 GMT Oct 27

- SUP 1: 112.365/4 Low Oct 26 / 20-day EMA

- SUP 2: 112.360 High Sep 21 and the recent breakout level

- SUP 3: 112.340 Low Oct 14

- SUP 4: 112.325 50-day EMA

Schatz futures are trading below last week's high and remain in a corrective cycle. Attention is on support at 112.360, Sep 21 high and recent breakout level. The 20-day EMA intersects at 112.364 reinforcing the short-term importance of support around 112.360. On the upside, clearance of 112.440, Oct 21 and 22 high would refocus attention on the bull trigger at 112.360. Sub 112.60 levels however risk a deeper extension of the recent pullback.

GILT TECHS: (Z0) Still Vulnerable

- RES 4: 136.38 Low Oct 20 and a gap high on the daily chart

- RES 3: 136.27 High Oct 21 and a gap low on the daily chart

- RES 2: 136.03 50-day EMA

- RES 1: 135.87 High Oct 22

- PRICE: 135.43 @ Close Oct 26

- SUP 1: 135.04 Low Oct 23 and the intraday bear trigger

- SUP 2: 134.59 Low Sep 1

- SUP 3: 134.32 Low Aug 28 and a key support

- SUP 4: 134.00 1.50 proj of Sep 21 - Oct 7 sell-off from Oct 16 high

Gilt futures remain heavy following last week's sell-off. Weakness Oct 23 resulted in the contract trading through the Oct 7 low of 135.06 before finding some support. A clear break of 135.06l would reinforce last week's week's bearish developments and expose 134.32, Aug 28 low. Price needs to trade above 136.03, the 50-day EMA, to ease the current bearish threat. This would open 136.97, the Oct 16 high once again.

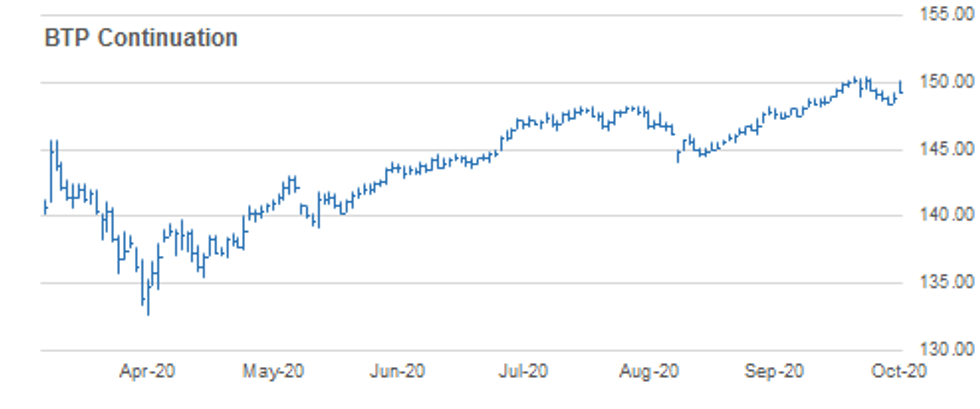

BTPS TECHS: (Z0) Focus Is On Support

- RES 4: 152.00 Round number resistance

- RES 3: 151.17 0.764 of Jun 10 - Aug 20 swing from Sep 9 low (cont)

- RES 2: 150.46 High Oct 16 and the bull trigger

- RES 1: 150.12 Oct 26 high

- PRICE: 149.34 @ Close Oct 26

- SUP 1: 148.37 Low Oct 22

- SUP 2: 148.03 38.2% retracement of the Sep 1 - Oct 16 rally

- SUP 3: 147.46 Low Sep 30

- SUP 4: 147.27 50.0% retracement of the Sep 1 - Oct 16 rally

BTPS outlook remains bullish however futures are currently in a corrective cycle with price still trading below recent highs. Yesterday's gap higher at the open failed to deliver a bullish extension and price traded lower to fill the gap. Key S/T support has been defined at 148.37, Oct 22 low. A break of this level would signal scope for a deeper pullback, potentially towards 148.03, a Fibonacci retracement level. Key resistance and the bull trigger is at 150.46.

EUROSTOXX50 TECHS: Sharp Sell-Off

- RES 4: 3330.54 Bear channel top drawn off the Jul 21 high

- RES 3: 3305.77 High Oct 12 and the bull trigger

- RES 2: 3282.55 High Oct 19

- RES 1: 3217.96 High Oct 23 and the near term key resistance

- PRICE: 3105.25 @ Close Oct 26

- SUP 1: 3097.67 Low Sep 25 and the bear trigger

- SUP 2: 3065.82 Bear channel base drawn off the Jul 21 high

- SUP 3: 3054.11 Low June 15

- SUP 4: 3012.50 38.2% retracement of the Mar - Jul uptrend

A bearish EUROSTOXX 50 session yesterday saw the index sell-off sharply and resume the most recent decline that started on Oct 12. Price has cleared former support at 3147.28, Oct 2 low and attention turns to the next key support handle at 3097.67, Sep 25 low. A break would reinforce bearish conditions and open 3054.11, Jun 15 low. Key near-term resistance is at 3217.96, Oct 23 high.

LOOK AHEAD

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.