-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

MNI EUROPEAN OPEN: A$ & Local Yields Surge Following Jobs Data

MNI EUROPEAN OPEN: Imminent RBA Easing More Likely, European COVID Worries Swirl

OVERNIGHT NEWS AND PRESS

EXECUTIVE SUMMARY

* CORONAVIRUS RELIEF DEAL REMAINS ELUSIVE AS PELOSI AND MNUCHIN CONTINUE TALKS (CNBC)

* COVID FIGHTING MEASURES DEEPEN IN FRANCE, GERMANY AND IRELAND

* TRUMP ADMIN TO CONSIDER ADDING CHINA'S ANT GROUP TO TRADE BLACKLIST (RTRS SOURCES)

* BORIS JOHNSON WILL DELAY DECISION ON QUITTING BREXIT TRADE TALKS (TELEGRAPH)

* GIVE BREXIT TALKS TIME, JOHNSON'S CHIEF NEGOTIATOR FROST ADVISES (THE TIMES)

* LOWE FLAGS RBA POLICY SHAKE UP (AFR)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Londoners are to be banned from socialising with other households indoors within days, according to civic leaders in the capital, as infection rates soar in many boroughs. (FT)

CORONAVIRUS: A decision on whether to extend tier 3 restrictions – closing pubs that do not serve food and banning household mixing – to Greater Manchester and Lancashire is expected on Thursday. (Guardian)

CORONAVIRUS: MPs in Greater Manchester and London have been invited to briefings with a government minister this morning - amid reports that both areas could be placed into a higher coronavirus tier. Health minister Helen Whateley is going to hold a call with London MPs at 9.30am, followed by Greater Manchester MPs at 10.45am. (Sky)

CORONAVIRUS: Ministers want to place universities in England into lockdown for two weeks before Christmas, with students told to remain on campus and all teaching carried out online, the Guardian has learned. (Guardian)

CORONAVIRUS: The Chancellor described a temporary national lockdown as "a blunt instrument" on Wednesday, saying it would "cause needless damage to parts of our country where virus rates are low". (Telegraph)

BREXIT: Boris Johnson will delay a decision on whether to quit the Brexit trade negotiations until after the European Council summit ends on Friday, after it became clear his no-deal deadline will be missed on Thursday. The Prime Minister spoke to Ursula von der Leyen, the president of the European Commission, and Charles Michel, the European Council president on Wednesday night. He warned the EU had to agree to round-the-clock talks or he would carry out his threat, which would mean trading on WTO terms. Mrs von der Leyen said after the call: "The EU is working on a deal, but not at any price. Conditions must be right, on fisheries, level-playing field and governance. Still a lot of work ahead of us." Following the call, a Downing Street spokesperson said: "The Prime Minister noted the desirability of a deal, but expressed his disappointment that more progress had not been made over the past two weeks. (Telegraph)

BREXIT: Boris Johnson's chief Brexit negotiator, Lord Frost, has told the prime minister not to walk out of trade talks because deals to cover security and fishing are possible over the next two weeks. Last month Mr Johnson set the European Union summit today as the deadline for an agreement or it would be time to "move on" and accept that there would be no deal. A source close to the talks said Lord Frost advised Mr Johnson that a deal with the EU was not impossible, although time was tight to agree 500 pages of legal text this month. He told Downing Street both sides would need to work hard, with a shift to daily talks, but that a deal could be reached in time. (The Times)

BREXIT: MNI SOURCES: France Faces EU Calls To Ease Brexit Fish Stance- This week's European Union summit will see efforts by some member states to push back against French demands on fisheries in Brexit talks, but any breakthrough is unlikely with officials prepared to see negotiations press ahead through October, sources close to preparations told MNI - on MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com.

BREXIT: The head of policy for London's financial district has called on Brexit negotiators on both sides to reach an agreement and avoid further economic turmoil. (BBG)

EUROPE

GERMANY: Chancellor Angela Merkel announced a series of piecemeal measures to contain a second wave of the pandemic in Germany, and cautioned that more would follow if the rise in virus infections didn't stop in 10 days. In hard-hit areas, bars and restaurants must shut down by 11 p.m., while gatherings will be limited to 100 people. The use of masks in public will be extended. "Economically we can't afford a second wave with the same consequences as we had in the spring," Merkel said, mainly appealing to citizens to abide by hygiene and distancing rules and avoid groups. "What we do and don't do in the coming days and weeks will be key to the question of how we make it through this pandemic." (BBG)

FRANCE: A state of emergency has been declared in France, and President Emmanuel Macron has announced a curfew between 9pm and 6am for the areas worst-affected by coronavirus. Ile-de-France and eight metropolitan areas - including Grenoble, Lille, Lyon, Aix-Marseille, Saint Etienne and Toulouse - will face the curfews for four weeks. Speaking on French television, Mr Macron said the situation was "worrying" but the country had not yet "lost control" of the pandemic. (Sky)

IRELAND: Ireland is introducing new measures to curb the spread of the virus, after daily cases increased at the fastest rate since April. All household visits will end, and a number of districts close to the border with Northern Ireland will move to a so- called Level 4 lockdown. In addition to existing restrictions in those areas, including the closure of most bars and restaurants, most business and services deemed non-essential will shut, wedding guests will be limited to six and gyms will close. (BBG)

US

FED: MNI POLICY: Fed's Quarles Says Recovery, Banks Are Resilient

- Federal Reserve Vice Chair Randal Quarles said Wednesday he is optimistic for a continued strong economic recovery from Covid-19 and the nation's resilient banks don't deserve stress tests that exacerbate any strains. "I am optimistic that the recovery from the COVID event will continue to be robust," he said in a speech, adding it still has a "ways to go." The weaknesses include a "deeply depressed" job market and some measures of inflation expectations that have ticked down, he said - on MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com.

FED: The massive size of the U.S. Treasury market may have outpaced the ability of the private sector to cope during periods of stress, potentially requiring lasting central bank involvement to support market functioning, says Federal Reserve Vice Chair for Supervision Randal Quarles. (BBG)

FED: Federal Reserve Bank of Cleveland President Loretta Mester says the U.S. economic recovery from the impact of Covid-19 should continue over the next couple years, provided the central bank keeps monetary policy easy and lawmakers bring additional fiscal support. (BBG)

FED: Women and minorities, who have been affected by pandemic-related job losses, will need help getting back to work as more economic activity shifts to sectors less dependant on face-to-face interaction, Dallas Federal Reserve President Robert Kaplan said on Wednesday. (RTRS)

FED: MNI EXCLUSIVE: Credibility To Help Fed Hit Price Goal: Staff- The Federal Reserve should manage to reach and maintain its longer-run 2% inflation target as the Covid-19 pandemic passes, because markets and the public trust policy makers' commitment to get there, two Kansas City Fed economists told MNI - on MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com.

FISCAL: House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin failed to come to a coronavirus stimulus deal after another conversation. The pair would still need to resolve a range of disputes to strike a comprehensive agreement before Election Day on Nov. 3. Mnuchin said the White House and Democrats "continue to be far apart" on some issues, as the economy struggles to recover from the outbreak. (CNBC)

FISCAL: President Donald Trump says the administration is trying to get more stimulus money to the airline and cruise industry. He spoke remotely to the the Economic Club of New York remotely from the Rose Garden. (BBG)

POLITICS: A new national NBC News/Wall Street Journal poll - conducted after Trump returned to the White House from his hospitalization for the coronavirus - finds Biden ahead of Trump by 11 points among registered voters, 53 percent to 42 percent. That's down from Biden's 14-point lead in the NBC News/WSJ poll conducted immediately after the first presidential debate on Sept. 29, although the movement is within the poll's margin of error. (NBC)

POLITICS: Joseph R. Biden Jr. leads President Trump by seven percentage points in Georgia in a new poll from Quinnipiac University, and the two are roughly tied in Ohio — two states without which Mr. Trump most likely cannot win re-election. The polls were conducted from Oct. 8-12, after the vice-presidential debate and Mr. Trump's release from the hospital following his coronavirus diagnosis. (New York Times)

POLITICS: President Trump trails Joseph R. Biden Jr. by four points in the latest Times/Siena survey of North Carolina, and Senator Thom Tillis is lagging behind his Democratic challenger in a crucial Senate race. (New York Times)

POLITICS: President Donald Trump pulled into a statistical tie with Democratic rival Joe Biden in Florida, one of the election's most important battlegrounds, but Biden's lead appeared to widen in Arizona, Reuters/Ipsos opinion polls showed on Wednesday. (RTRS)

POLITICS: Democrats have outvoted Republicans in Florida in vote-by-mail ballots by a margin of over 400,000 as of 11am on Wednesday, according to state election data. (Axios)

POLITICS: One of Joe Biden's economic advisors said Wednesday that he's not ready to "litigate" the timing of a planned corporate tax hike with the U.S. economy still recovering from the coronavirus recession. Asked by Washington Post economics reporter Heather Long to clarify if a Biden administration would still pursue a corporate tax hike if the U.S. economy was still struggling, informal campaign advisor Jared Bernstein declined to offer specifics. "I'm not going to litigate the timing of that set of policies," said Bernstein, who served as chief economist to Vice President Biden during the Obama administration. (CNBC)

POLITICS: Facebook said Wednesday it decided to limit the distribution of a New York Post story that claims to show "smoking gun" emails related to Democratic presidential nominee Joe Biden and his son. (CNBC)

OTHER

GLOBAL TRADE: A group of prominent members of the European Parliament have singled out Chinese 5G vendors Huawei and ZTE as "high-risk" companies that pose a security threat to network security in Europe, according to a letter obtained by POLITICO. Members from five political groups called for national capitals and the Commission to cut European public funding for the two companies in the letter, which was sent to national telecom ministers and senior EU Commission officials. Telecom ministers meet for an informal videoconference on Thursday. (POLITICO)

GLOBAL TRADE: US tech giants are facing the threat of an EU attempt to break them up after France and the Netherlands jointly issued a call for the bloc's competition authorities to take pre-emptive measures as they prepare sweeping legislation to curb the companies' market power. Cedric O, France's digital minister, and Mona Keijzer, the Netherlands state secretary for digital affairs, have signed a position paper calling on regulators in Brussels to take swift action against emerging tech giants and existing "gatekeeper" platforms — including options to break them up. (FT)

GLOBAL TRADE: France will go ahead with plans to collect its contentious digital services tax mid-December, Finance Minister Bruno Le Maire said, keeping Europe on course for a trade battle with the U.S. over the taxation of tech giants like Facebook Inc. and Alphabet Inc.'s Google. The French government suspended the payment of its national levy on digital revenues as the U.S. agreed to hold off on retaliatory tariffs. The truce was designed to give time for international negotiations to find a global deal this year on new rules for taxing profits in the digital era. But those talks have stumbled and won't conclude until mid-2021. (BBG)

GLOBAL TRADE: EU antitrust regulators may narrow the scope of their year-long investigation into Amazon to speed up the case against the U.S. online retail giant, people familiar with the matter told Reuters. Splitting up the Amazon case could address complaints by rivals that antitrust enforcers take too long to address harm done to them through anti-competitive practices and that rulings fail to keep pace with evolving markets. (RTRS)

GLOBAL TRADE: Japan will significantly ramp up a program encouraging businesses to build production sites in Southeast Asia to diversify supply chains that are too dependent on China. (Nikkei)

U.S./CHINA: Trump administration may wait to rule in TikTok-Oracle deal until after election. Sources tell FOX Business' Charlie Gasparino that some in the administration worry the TikTok-Oracle deal is still a security concern because China owns the algorithm. (Fox)

U.S./CHINA: The U.S. State Department has submitted a proposal for the Trump administration to add China's Ant Group to a trade blacklist, according to two people familiar with the matter, before the fintech arm of e-commerce giant Alibaba is slated to go public. It was not immediately clear when the U.S. government agencies that decide whether to add a company to the so-called Entity List would review the matter. But the move comes as China hardliners in the Trump administration are seeking to send a message to deter U.S. investors from taking part in the initial public offering, worth up to a record $35 billion. (RTRS)

U.S./CHINA/HONG KONG: The U.S. State Department on Wednesday formally warned international financial institutions doing business with individuals deemed responsible for the crackdown on democracy in Hong Kong that they could face sanctions. In a report to Congress seen by Reuters, the State Department named 10 individuals, including Hong Kong's chief executive Carrie Lam, already sanctioned over China's crackdown, and noted that U.S. law required a list of any financial institutions that conduct significant financial transactions with them within 60 days. (RTRS)

U.S./CHINA/TAIWAN: China said on Thursday the United States was seriously undermining peace and stability in the Taiwan Strait after a U.S. Navy destroyer sailed through the waters amid escalating tensions between Beijing and Taipei. Zhang Chunhui, spokesman for China's eastern theatre command, said in a statement that the Chinese military followed and monitored the USS Barry when the destroyer made what the U.S. Navy called a "routine Taiwan Strait transit" on Wednesday. (RTRS)

GEOPOLITICS: Turkish President Tayyip Erdogan told his Russian counterpart Vladimir Putin in a phone call on Wednesday that Ankara wanted a permanent solution to the Nagorno-Karabakh issue, a statement from Erdogan's office said. (RTRS)

CORONAVIRUS: Fauci also predicted a vaccine would likely be available to most Americans by April 2021 – contingent on all vaccines in clinical trials being proven safe and effective – despite Trump's claim 100 million doses will be available by the end of 2020. (Forbes)

CORONAVIRUS: Healthy young people might not get the coronavirus vaccine until 2022 as public health officials focus on immunizing the elderly and other vulnerable groups first, top officials from the World Health Organization said Wednesday. (CNBC)

CORONAVIRUS: The Centers for Disease Control and Prevention said it may not recommend the coronavirus vaccine for children at first. That's because many of the early-stage clinical trials testing potential vaccines have only involved non-pregnant adults, the CDC said on its website. The trials will eventually include children, but researchers may not have enough data to make a recommendation on children before the vaccines are available. (CNBC)

CORONAVIRUS: Japanese drugmakers don't think they can roll out a possible coronavirus vaccine until 2022, NHK reported late Wednesday, citing remarks made by companies at an industry symposium. (BBG)

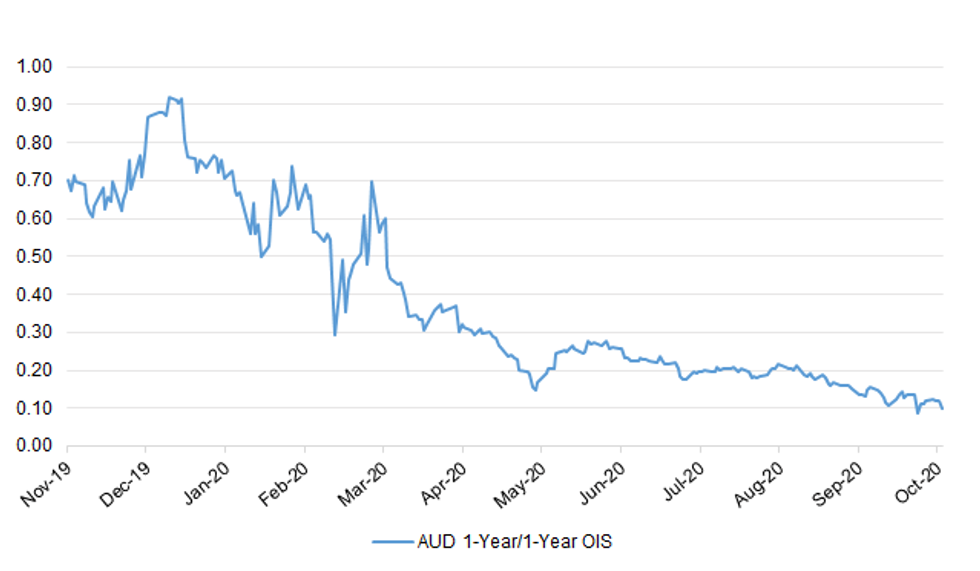

RBA: Reserve Bank of Australia governor Philip Lowe's incredibly dovish speech on Thursday, paving the way for more imminent marginal monetary stimulus, sets up a historic turning point for interest rate policy. Not only is Lowe flagging the bank will soon trim interest rates even closer to zero and buy longer term government debt to try to put downward pressure on the currency and support jobs. (AFR)

AUSTRALIA: The latest SEEK Employment Report shows a "strong return to positive m/m performance with a 9.2% national growth in jobs advertised. Comparing September 2020 with September 2019, job ads are 20.9% lower, which is the smallest difference in y/y comparison since the pandemic began, improving further from August which had a y/y difference of 29.1%. This month we have seen strong growth across all states and territories nationally, resulting in a healthy month-on-month growth of 9.2%. With last week's Federal Budget including a focus on jobs and employment, together with the potential easing of restrictions in Victoria, we will be watching with interest to see if this positive trend continues. Topping the list of industries contributing the most to growth in jobs listed on seek.com.au is Hospitality & Tourism. This is particularly pleasing as we know this industry has been impacted heavily over the course of the year. Its recovery is closely linked to the easing of restrictions, and we are also starting to see businesses prepare for the summer and Christmas holiday period by beginning seasonal hiring… In September the m/m growth rate for New South Wales and Victoria has accelerated sharply, with both experiencing big gains in SEEK job ads growth, at 10.9% and 12.9% respectively. This upturn signals the two states have begun to recover ground after previously tracking behind other states and territories in job ad rates comparable to pre-COVID levels." (MNI)

AUSTRALIA/NEW ZEALAND: From Oct. 16, passengers traveling from New Zealand will be able to travel to Australia's NSW state without the need for quarantine on arrival in Australia, according to emailed statement for Air New Zealand. (BBG)

NORTH KOREA: U.S. Defense Secretary Mark Esper on Wednesday said North Korea's nuclear and missile programs pose a global threat, after Pyongyang's unveiling of previously unseen intercontinental ballistic missiles at a predawn military parade. (RTRS)

CANADA: Canada is facing a second wave of coronavirus cases as the provinces of Quebec and Ontario report the bulk of the country's Covid-19 death toll, the Pan American Health Organization's top health official warned Wednesday. "Canada is currently facing its second wave, and areas that were not previously affected are now surpassing the numbers seen during the first wave," Carissa Etienne, director of PAHO and World Health Organization regional director for the Americas, said at a news briefing. "The state of the pandemic in the Americas remains complex," she said. (CNBC)

BRAZIL: Bolsonaro: Brazil's Covid-19 Problems Solved Thanks To Guedes. (BBG)

BRAZIL: Guedes: Maia And I Have More Convergences Than Divergences. (BBG)

BRAZIL: Brazil's Central Bank Monetary Policy Director Bruno Serra said that if the conditions set by the institution on its forward guidance tool are no longer met, this would not necessarily trigger a mechanical raise in basic interest rates. Serra sees the fiscal issue as the main factor of upward asymmetry in the balance of risks for inflation, and for this reason it is highlighted by the central bank. (BBG)

G20: Financial leaders from the Group of 20 major economies on Wednesday underscored the urgent need to bring the spread of the coronavirus pandemic under control, and vowed to "do whatever it takes" to support the global economy and financial stability. In a lengthy communique, G20 finance ministers and central bank governors also agreed in principle for the first time on a "Common Framework" to deal on a case-by-case basis with the rising number of low-income countries facing debt distress. The final draft of the communique, viewed by Reuters on Wednesday during the annual meetings of the International Monetary Fund and World Bank, said the officials would finalize the new framework at an extraordinary meeting before G20 leaders meet next month. An earlier draft had the ministers adopting the framework, but officials were unable to reach agreement on that step this week. (RTRS)

METALS: BHP's Escondida and a union representing supervisors will extend mediated talks until Friday in a bid to stave off a strike at the world's biggest copper mine. "We inform that the negotiating committees of Union No. 2 and the company have decided to extend the mediation until Friday, October 16, which corresponds to the final term established by law," Escondida said. (BBG)

OIL: OPEC+ compliance with a pact to cut oil supply in September was seen at 102%, two OPEC+ sources told Reuters. OPEC conformity with the oil output reduction in September was 105%, while non-OPEC compliance was 97%, one of the sources said. (RTRS)

OIL: More than 30% Gulf of Mexico crude production was still offline due to Hurricane Delta as of midday Oct. 14, US Bureau of Safety and Environmental Enforcement data showed. Around 568,505 b/d of crude production and 489.32 MMcf/d of gas production remained shut-in Oct. 14, representing 30.73% and 17.95% of total Gulf of Mexico output, respectively, a BSEE survey of 33 companies showed. (Platts)

OIL: Occidental Petroleum Corp expects global oil supply and demand to rebalance by the end of 2021, its chief executive told the Energy Intelligence Forum on Wednesday. (RTRS)

CHINA

CORONAVIRUS: An outbreak of the coronavirus in China's northeastern city Qingdao is likely to be contained and limited to local infections while a "second wave" of large-scale infections is unlikely, the China News Service reported citing infections disease specialist Wu Zunyou of the China Center for Disease Control and Prevention. As of yesterday, there were no new cases in the tourist city of Qingdao in addition to the 12 previously reported, though the actual scale may only be known after another week of observation, the news agency said. The local government said the outbreak is likely to be limited to a hospital and unlikely to spread outside the premises, China News said. (MNI)

CORONAVIRUS: Beijing is strengthening management of entry into the capital by requiring screening and testing for anyone entering the city from mid- and high-risk regions, among other prevention and control measures, a meeting participated by top municipal officials decided on Wednesday. (Global Times)

YUAN: The yuan is likely to maintain two-way fluctuations given uncertainties such as movements in the dollar index, lower export demand due the pandemic, the slow economic recovery and rising protectionism, Liu Ying, a researcher from Renmin University's Chongyang Institute for Financial Studies, commented to the 21st Century Business Herald. The yuan is unlikely to be on an appreciation trajectory as any abrupt movements could damage China's international trade, said Liu. Monetary policies will likely target liquidity and keep the currency fluctuating at an appropriate level, Liu told the Herald. (MNI)

PROPERTY: Chinese property developers are purchasing less land to reduce debt as governments tighten policies for the market, the China Securities Journal reported citing data collectors. Land volumes in 40 major cities transacted in the week ending Oct. 11 fell 71% from a week ago, while sales dropped 83%, the newspaper said citing the China Index Academy. Developers including Evergrande have sought to reduce their land holdings, the newspaper said. Local governments including Xuzhou and Chengdu have implemented further curbs while the central bank has reiterated its stance against property speculation, the Journal said. (MNI)

OVERNIGHT DATA

CHINA SEP CPI +1.7% Y/Y; MEDIAN +1.9%; AUG +2.4%

CHINA SEP PPI -2.1% Y/Y; MEDIAN -1.8%; AUG -2.0%

MNI DATA IMPACT: China Sep CPI 19-Mon Low; PPI Falls Further

- China's September inflation slowed further to 1.7% y/y from 2.4% in August, the lowest level in 19 months, as food costs moderated the impact of a rising CPI. Analysts had expected 1.9% y/y - on MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com.

AUSTRALIA SEP UNEMPLOYMENT 6.9%; MEDIAN 7.0%; AUG 6.8%

AUSTRALIA SEP EMPLOYMENT CHANGE -29.5K; MEDIAN -40.0K; AUG +129.1K

AUSTRALIA SEP FULL-TIME EMPLOYMENT CHANGE -20.1K; AUG +12.1K

AUSTRALIA SEP PART-TIME EMPLOYMENT CHANGE -9.4K; AUG +117.0K

AUSTRALIA SEP PARTICIPATION RATE 64.8%; MEDIAN 64.8%; AUG 64.8%

AUSTRALIA OCT CONSUMER INFLATION EXPECTATION +3.4% Y/Y; SEP +3.1%

AUSTRALIA SEP RBA FX TRANSACTIONS MARKET +A$1.017BN; AUG +A$553MN

AUSTRALIA SEP RBA FX TRANSACTIONS GOV'T -A$1.040BN; AUG -A$567MN

AUSTRALIA SEP RBA FX TRANSACTIONS OTHER +A$187MN; AUG +A$768MN

SOUTH KOREA AUG MONEY SUPPLY L 0.0% M/M; JUL +0.8%

SOUTH KOREA AUG MONEY SUPPLY M2 +0.3% M/M; JUL +0.5%

CHINA MARKETS

PBOC NET INJECTED CNY550BN VIA MLF AND REPOS THURS

- The People's Bank of China (PBOC) injected CNY500 billion via one-year medium-term lending facility (MLF) with the rate unchanged at 2.95% on Thursday. This aims to roll over the CNY200 billion of MLFs maturing this month and fully meet liquidity needs, the PBOC said on its website.

- The PBOC also injected CNY50 billion via 7-day reverse repos. In total, the central bank net injected CNY550 billion today as no repos mature today.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.1905% at 09:33 local time from the close of 2.1302% on Wednesday: Wind Information.

- The CFETS-NEX money-market sentiment index closed at 36 on Wednesday vs 40 on Tuesday. A lower index indicates decreased market expectations for tighter liquidity.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.7374 on Thursday, compared with 6.7473 set on Wednesday.

MARKETS

SNAPSHOT: Imminent RBA Easing More Likely, European COVID Worries Swirl

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 143.08 points at 23483.65

- ASX 200 up 36.634 points at 6215.8

- Shanghai Comp. up 3.47 points at 3344.248

- JGB 10-Yr future up 8 ticks at 152.05, yield down 0.7bp at 0.025%

- Aussie 10-Yr future up 8.5 ticks at 99.245, yield down 8.5bp at 0.753%

- U.S. 10-Yr future +0-02 at 139-09, yield down 1.49bp at 0.711%

- WTI crude up $0.08 at $41.12, Gold down $3.52 at $1897.99

- USD/JPY up 12 pips at Y105.29

- CORONAVIRUS RELIEF DEAL REMAINS ELUSIVE AS PELOSI AND MNUCHIN CONTINUE TALKS (CNBC)

- COVID FIGHTING MEASURES DEEPEN IN FRANCE, GERMANY AND IRELAND

- TRUMP ADMIN TO CONSIDER ADDING CHINA'S ANT GROUP TO TRADE BLACKLIST (RTRS SOURCES)

- BORIS JOHNSON WILL DELAY DECISION ON QUITTING BREXIT TRADE TALKS (TELEGRAPH)

- GIVE BREXIT TALKS TIME, JOHNSON'S CHIEF NEGOTIATOR FROST ADVISES (THE TIMES)

- LOWE FLAGS RBA POLICY SHAKE UP (AFR)

BOND SUMMARY: Increased Bets Of Deeper RBA Easing Puts The Spotlight On ACGBs

A downtick in e-minis and the bid in the Aussie bond space provided light support for U.S. Tsys in Asia-Pac hours, with T-Notes last +0-02+ at 139-09+, while cash Tsys sit unchanged to 1.9bp richer across the curve, with bull flattening evident. Diminished prospects of pre-election fiscal stimulus, COVID worry in Europe and Sino-U.S. tensions were familiar themes driving the major macro headline flow.

- Aussie bonds were well bid as RBA Governor Lowe failed to play down the prospects of imminent easing, with curve flattening apparent as he alluded to the possibility of the RBA expanding its ACGB purchases to capture a more meaningful chunk of the 5-10 Year zone of the curve (an area untouched since the RBA restarted its ACGB purchases). His language re: labour market and inflation dynamics added to the idea that further easing is imminent, with most of the sell side now looking for a move in September. YM +1.5, XM +8.5.

- JGBs were tight, with futures last +9. Cash trade saw the 3-5 Year zone outperform. The latest round of 5-15.5 Year off-the-run supply was well received.

JGBS AUCTION: Japanese MOF sells Y497.9bn of 5-15.5 Year JGBs in liquidity enhancement auction:

- Average Spread: -0.007% (prev. 0.000%)

- High Spread: -0.006% (prev. +0.002%)

- % Allotted At High Spread: 4.5298% (prev. 13.5874%)

- Bid/Cover: 4.425x (prev. 4.190x)

JAPAN: Several Rounds Of Weekly Security Flows To Note

The latest weekly international security flow data revealed the largest round of foreign bonds by Japanese investors in the current fiscal year (Y1.9465tn). This came after 2 weeks of relatively modest net selling, allowing the 4-week rolling sum of the measure to extend further into net buying territory. Japanese investors also lodged net purchases of foreign equities (Y312.5bn) in latest week, breaking a streak of 4 consecutive weeks of net sales, although the 4-week rolling sum of the measure remains in negative territory.

- Foreign investors registered a second consecutive week of net purchases of Japanese bonds, albeit at a slightly slower pace vs. what was seen in the previous week (Y781.5bn), although the 4-week rolling sum moved further into negative territory after a large round of weekly net purchases dropped out of the sample. Foreign investors registered a second consecutive fresh FYtD high in terms of weekly net purchases of Japanese equities (Y1.421tn).

EQUITIES: E-Minis Offered, Asia Mixed

E-minis continued to tread lower in Asia-Pac hours, as the hangover surrounding diminished prospects of pre-election fiscal stimulus in the U.S. and Sino-U.S. tension surrounding the Taiwan Strait weighed on the space.

- Performance among the major regional Asia-Pac indices was a little more mixed.

- The Hang Seng underperformed on the back of the U.S. State Department formally warning international financial institutions re: sanctions surrounding conducting business with individuals that have been implicated in the political crackdown in Hong Kong.

- The ASX 200 outperformed, as it benefitted from increased prospects of imminent RBA easing in the wake of the latest address from RBA Governor Lowe.

- Chinese mainland equities were supported by a CNY300bn net MLF injection from the PBoC.

- Nikkei 225 -0.5%, Hang Seng -1.1%, CSI 300 unch., ASX 200 +0.8%.

- S&P 500 futures -14, DJIA futures -93, NASDAQ 100 futures -92.

OIL: Tight Overnight After Wednesday's Uptick

WTI & Brent are little changed vs. settlement levels, holding tight ranges during Asia-Pac hours, after the benchmarks added ~$0.85 come settlement time on Wednesday, with a softer US$ providing support, even as equities moved lower during NY trade.

- Tuesday saw a couple of newswire source reports point to OPEC+ production pact compliance of 102% during the month of September, largely in line with levels seen in August.

- The IEA's monthly oil market report added little to the discussion.

- On the private side, Occidental's chief executive noted that the firm expects global oil supply and demand will rebalance by the end of 2021.

- On the inventory side the weekly API inventory estimates revealed sharper than expected drawdowns in headline crude and distillate stocks, while stocks at Cushing saw a build and gasoline stocks witnessed a largely in line with expected drawdown. Weekly DoE inventory data is due Thursday. These numbers are likely distorted by goings on in the gulf of Mexico, with a little over 30% of U.S. gulf crude production still shut in, per yesterday's BSEE tally.

GOLD: Familiar Territory

Little to pen for gold, with the well-defined technical lines in the sand still intact, while the US$ and U.S. real rates continue to drive flows. Spot a touch below $1,900/oz at typing after a show and close above on Wednesday.

FOREX: Lowe's Speech Sends AUD Diving

RBA Gov Lowe's speech was widely interpreted as dovish and AUD went offered across the board as participants ramped up RBA easing bets. Lowe failed to rule out ACGB purchases farther out along the curve (he specifically mentioned the 5-10 Year sector) and flagged Australia's higher 10-Year yield relative to its global peers. RBA chief added that the Bank will focus on actual inflation rather than the outlook and wants to see something more than just progress towards full employment. Australia's labour market report wasn't as bad as some feared, with unemployment ticking higher to 6.9% from 6.8%, falling short of the expected 7.0%. AUD reacted with just a limited, brief knee-jerk higher, as earlier RBA rhetoric continued to take centre stage. AUD/USD crossed below support from Oct 13 low of $0.7150, while AUD/JPY slid into the Y75.00-Y74.93 support zone.

- AUD weakness spilled over into NZD, to some degree, with NZD/USD probing the water under yesterday's low. AUD/NZD approached support from Sep 25 low of NZ$1.0718, but failed to attack the level.

- Downticks in all three main e-mini contracts applied some further light pressure to commodity-tied FX, while benefitting safe havens. JPY lagged behind USD & CHF and most of its other G10 peers after taking a hit from a round of sales into the Tokyo fix, possibly linked to Gotobi day flows.

- USD/CNH was happy to hug a tight range, even as China's CPI & PPI inflation missed expectations.

- Focus turns to U.S. initial jobless claims, Empire M'fing & Philly Fed Survey, Swedish unemployment and comments from Fed's Bostic, Bullard, Quarles, Kaplan, Barkin & Kashkari, ECB's Lagarde, BoC's Lane & BoE's Cunliffe.

FOREX OPTIONS: Expiries for Oct15 NY cut 1000ET (Source DTCC):

- EUR/USD: $1.1675(E564mln), $1.1695-1.1700(E960mln), $1.1725-30(E528mln), $1.1800(E1.1bln), $1.1820-30(E663mln), $1.1835-40(E594mln), $1.1845-55(E1.1bln), $1.1870-75(E815mln)

- USD/JPY: Y104.80-85($1.6bln), Y105.00-10($1.7bln), Y105.20-30($3.4bln), Y105.35-40($669mln), Y106.05-15($1.3bln), Y106.25-30($887mln), Y106.50-55($867mln)

- GBP/USD: $1.2980(Gbp616mln), $1.3100(Gbp451mln)

- AUD/USD: $0.7220-30(A$657mln)

- USD/CNY: Cny6.7000-6.7050($1.1bln-USD puts), Cny6.75($785mln)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.