-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Foreign Interference & DC Fiscal Impasse

OVERNIGHT NEWS AND PRESS

EXECUTIVE SUMMARY

* PELOSI SUGGESTS RELIEF DEAL COULD SLIP PAST NOV ELECTIONS (POLITICO)

* FBI: IRAN & RUSSIA OBTAINED U.S. VOTER REGISTRATION DATA (CNBC)

* WARP SPEED CHIEF SEES ASTRA & J&J TRIALS RESTARTING SOON

* ASTRAZENECA COVID-19 VACCINE TRIAL BRAZIL VOLUNTEER DIES, TRIAL TO CONTINUE (RTRS)

* BRITAIN TO RESUME TRADE TALKS WITH EU AMID SIGNS OF PROGRESS (BBG)

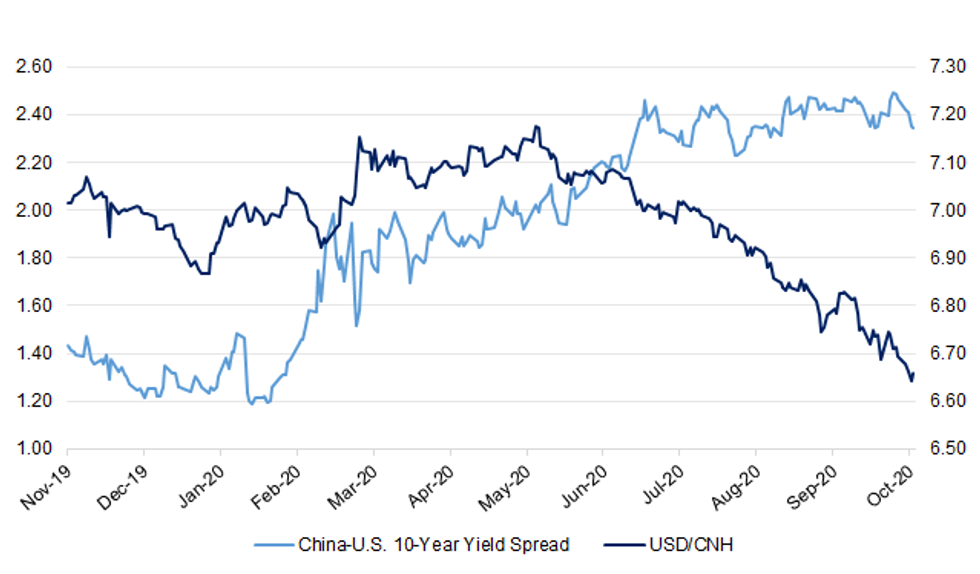

Fig. 1: China-U.S. 10-Year Yield Spread vs. USD/CNH

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BREXIT: The U.K. and the European Union will resume talks over a post-Brexit trade deal, less than a week after Boris Johnson suspended the discussions, amid growing signs an accord is in sight. Negotiators will arrive in London on Thursday to begin intensive daily discussions, Britain's chief negotiator, David Frost, tweeted. The aim is to reach an agreement by the middle of November, officials said. (BBG)

ECONOMY: The UK financial regulator is urging borrowers affected by coronavirus lockdowns to seek support from their banks, as its figures show 12m Britons are likely to struggle with bills or loan repayments. In its strongest call to action yet, the Financial Conduct Authority has told consumers in difficulty to ask their lenders for more support and seek free debt advice from government-backed bodies and charities. It has also stressed that it had told banks to offer more options to borrowers after October 31, when three-month repayment holidays will no longer be automatically available. (FT)

ECONOMY: The value of pay increases has "fallen to the floor" in recent months as a result of the virus crisis, according to a new study. Pay analysts XpertHR said wage growth is expected to remain depressed in the year ahead. Awards have been falling, with the median basic pay rise worth 2.2% over the past 12 months, down from 2.5% this time last year, said the report. Many employers expect to male a median 1% pay award next year against the background of the coronavirus pandemic, which would be the lowest annual figure for more than a decade, said XpertHR. Many workers expected to receive a lower pay award in the coming year, or no increase at all, it was suggested. (Press Association)

FISCAL: Rishi Sunak is expected to announce his fourth package of support for business in as many months amid mounting pressure on the government to help hard-hit companies in lockdown-affected regions. Trades unions and the UK's five big employers' organisations have been summoned to the Treasury on Thursday morning to hear details of the chancellor's plans before he makes a statement to MPs. (Guardian)

FISCAL: Economists are warning Rishi Sunak against a tax raid on millions of earners after borrowing surged again in September as a second wave of Covid hit. (Telegraph)

FISCAL: UK chancellor Rishi Sunak was facing cabinet unrest on Wednesday after he shelved plans to set out multiyear spending programmes for the rest of the parliament because of the chaos caused by Covid-19. Boris Johnson, prime minister, had hoped to use the three-year spending review to map out his post-pandemic "levelling-up" agenda, but reluctantly agreed with Mr Sunak that the exercise would have to be scaled back. But Ben Wallace, defence secretary, said Britain needed to urgently set out its stall on the world stage, while another minister said the decision to axe the multiyear review was "a handbrake turn". (FT)

FISCAL: The Welsh government is poised to nationalise its railways after bailout talks with the current operator were unable to agree a privately-led deal and Covid continued to hammer public transport. (Telegraph)

EUROPE

GERMANY: German total tax revenue, excluding municipal taxes, declines by 12.8% in September compared with the same month a year earlier, Finance Ministry says in latest monthly report. (BBG)

ITALY: Italy's Lazio region, including the capital Rome, is set to introduce a curfew from midnight to 5 a.m. to try to curb its surging COVID-19 infections, a regional government source told Reuters on Wednesday. The new rules will be effective from Friday, the source said, adding the region will also introduce some restrictions on schools and universities. (RTRS)

SPAIN: Spain became the first country in Western Europe to surpass 1 million coronavirus infections, as authorities struggle to control fresh outbreaks and contemplate a curfew for the capital Madrid. (BBG)

GREECE: Greece announced a lockdown covering the northern city of Kastoria and placed five other districts on high alert following a jump in confirmed Covid-19 cases on Wednesday. (FT)

IRELAND: Ireland will be the eurozone's biggest loser from a no-deal Brexit, which threatens to cause an economic "double whammy" on top of the fallout from rising coronavirus infections, the Irish central bank's governor has warned. Gabriel Makhlouf told the Financial Times that if the UK left the EU without a trade deal at the end of this year, the new tariffs on goods would hit Ireland's agricultural and food sectors hardest, knocking 2 percentage points off the country's economic growth next year. "This whole process is lose-lose," said Mr Makhlouf. "People talk about who will be the winners from this, but I would argue that in the short term there will be no winners." (FT)

U.S.

FED: Economic activity in most parts of the country was "slight to modest," according to the Federal Reserve's latest report on economic conditions known as the Beige Book. Some districts report a leveling off of retail sales although demand for autos remained steady. Low inventories have constrained sales. (MarketWatch)

FED: MNI BRIEF: Fed To Discuss Better QE Communications - Quarles

- The Federal Reserve will discuss the path of its asset purchases at upcoming meetings because markets appear confused about future plans, Vice Chair Randal Quarles said Wednesday - on MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com.

FED: St. Louis Federal Reserve Bank President James Bullard on Wednesday repeated his view that U.S. businesses are largely adapting to life amid COVID-19 and the U.S. economy is on track to better-than-trend growth even without further fiscal stimulus. "In terms of the aggregate resources it seems like we should have enough" fiscal aid to bolster growth until the first quarter of next year, when any further need could be reassessed, Bullard said at the Federal Home Loan Bank of Des Moines Leadership Summit. (RTRS)

FED: MNI INTERVIEW: Fed Could Act If Curve Steepens - Wright

- The Federal Reserve stands ready to act if long-term borrowing costs were to spike as the economic impact of Covid-19 evolves, Minneapolis Fed Research Director Mark Wright told MNI. The Fed has not recently considered additional monetary easing through bond buys in part because they may not be effective, Wright said. "Rates are pretty low right now--maybe that means we've been successful. It's not clear exactly how much more QE could do to flatten the curve," he said in an interview - on MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com.

ECONOMY: MNI POLICY: 23% of US Households Expect Income Loss in Next 4W

- Nearly a quarter of U.S. households especially those with low and middle income levels anticipate losing employment income in the next four weeks, according to data published Wednesday by the Census Bureau - on MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com.

FISCAL: House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin worked to resolve outstanding differences over coronavirus stimulus again Wednesday as they run out of time to reach a deal before the 2020 election. In a 48-minute phone call, the negotiators moved "closer to being able to put pen to paper to write legislation" and left "better prepared to reach compromise on several priorities," Pelosi spokesman Drew Hammill said in a tweeted statement. The pair will talk again Thursday. "Differences continue to be narrowed on health priorities, including language providing a national strategic testing and contract tracing plan, but more work needs to be done to ensure that schools are the safest places in America for children to learn," Hammill said. (CNBC)

FISCAL: Speaker Nancy Pelosi suggested Wednesday that a deal on a coronavirus relief package may not come together before the Nov. 3 elections. (POLITICO)

FISCAL: While Senate Majority Leader Mitch McConnell has resisted a bill of the size under negotiation, he "might not mind doing it after the election," Pelosi said on SiriusXM's The Joe Madison Show. White House economic adviser Larry Kudlow said that if the vote on a compromise bill had to wait until post-election, announcing a deal beforehand would still be "very helpful to the economy and markets." Even so, Senate Republicans continued to demonstrate opposition and raise doubts about whether stimulus would be any easier after Nov. 3. Missouri Republican Roy Blunt, a member of McConnell's leadership team, said, "If we're going to do it this year, I think it's now or never." Republican Senator Chuck Grassley of Iowa told reporters, "It's pretty hard to predict because I think that what happens in the presidential election will determine that more than anything we know right now." After meeting with GOP senators, Meadows said that "I don't think our chances get better after election." He also said on Fox News that President Donald Trump was "willing to lean into this" with regard to seeking Senate passage. (BBG)

FISCAL: Senate majority whip John Thune (R-S.D.) to Burgess Everett: "The leader's position is sort of dictated by the math. I mean, he knows where the votes are and as much as we all want to get a deal, a deal that would pass in the Senate with all Democratic votes and a handful of Republicans is not something the leader would like to happen. The leader would like to see a deal that would get a majority of Republicans and policies that are actually good in terms of addressing the virus." (POLITICO)

FISCAL: "The legislation before us is neither Republicans' nor Democrats' idea of a perfect bill. I think we're all clear on that," McConnell said on the Senate floor Wednesday before the vote. "But it would move us past Speaker Pelosi's all-or-nothing obstruction and deliver huge support, right now, for the most pressing needs of our nation." He said Democrats advocated for "silly stuff," allocations he characterized as "wheelbarrows of cash" for state and local governments that "Democrats have mismanaged for decades." "The country needs an outcome," McConnell said. "Let's put aside our differences, agree where we can and move forward. Why not get the country in a better place while Washington continues to argue over the rest?" (USA Today)

FISCAL: U.S. President Trump tweeted the following on Wednesday: "Just don't see any way Nancy Pelosi and Cryin' Chuck Schumer will be willing to do what is right for our great American workers, or our wonderful USA itself, on Stimulus. Their primary focus is BAILING OUT poorly run (and high crime) Democrat cities and states. Should take care of our people. It wasn't their fault that the Plague came in from China!" (MNI)

FISCAL: An NBC reporter tweeted the following on Wednesday: "Asked Meadows if he's confident the WH will be able to convince McConnell to act on a deal before Nov 3: "I'm more working with Pelosi right now trying to get her to be reasonable. Once we get a deal there, hopefully we'll be able to discuss the merits with our Senate colleagues." (MNI)

FISCAL: White House communications director Alyssa Farah said that officials were optimistic there could be "some movement" on a potential deal within 48 hours. "The president's position is we're willing to go up on the number for PPP [Paycheck Protection Program] loans and the direct payments," Farah told reporters at the White House. "Some of the issues still surround state and local and some of the other issues but we're at the table, conversations are happening. I think it's kind of the best place we've been in, so cautious optimism." (The Hill)

FISCAL: It is growing increasingly likely that passing any stimulus deal through Congress will have to wait until after the Nov. 3 elections, according to multiple sources in both parties. While it's possible a deal in principle between the White House and House Democrats can be reached before Nov. 3, passing a bill through both chambers is highly unlikely before then. (CNN)

FISCAL: Senate Democrats blocked Republicans' attempt to pass a $500 billion coronavirus stimulus bill Wednesday as House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin make a last-ditch push to strike a relief deal before the 2020 election. The GOP tried to advance its bill, similar to one Democrats opposed last month. The measure failed in a 51-44 party-line vote, falling short of the 60 votes needed. (CNBC)

CORONAVIRUS: New York Gov. Andrew Cuomo on Wednesday eased some lockdown restrictions on hot spots in New York City, but warned of challenges ahead as virus cases surged in New Jersey, Connecticut and Pennsylvania, making a quarantine policy for out-of-state travelers difficult to enforce. (WSJ)

CORONAVIRUS: Boston Public Schools announced they will be going all remote starting Thursday due to a recent spike in coronavirus cases in the city. Students will remain in remote learning until there are two full weeks of falling infection rates. (NBC)

POLITICS: Donald Trump holds a narrow advantage in Ohio, while voters in the three battleground states that put him over the top in 2016 prefer Joe Biden, according to Fox News statewide surveys of likely voters. Biden leads by 12 points in Michigan (52-40 percent), 5 points in Pennsylvania (50-45 percent), and 5 points in Wisconsin (49-44 percent). Biden's advantage is outside the margin of error in Michigan, but not Pennsylvania and Wisconsin. Trump carried each of these states by less than a percentage point in 2016. (Fox)

POLITICS: Democratic presidential candidate Joe Biden appeared to take the lead over President Donald Trump in Florida, where the race had been a statistical tie a week earlier, Reuters/Ipsos opinion polls showed on Wednesday. The poll also showed the two candidates to be neck and neck in Arizona. (RTRS)

POLITICS: President Trump and former Vice President Joe Biden are deadlocked in Texas, according to a new Quinnipiac University poll, suggesting a competitive race in a state Trump carried by 9 points in 2016. The poll shows Biden and Trump tied at 47 percent. Biden's strongest support comes from Black voters, women, and young voters between the ages of 18 and 34, while Trump is propelled primarily by men and white voters. (The Hill)

EQUITIES: Boeing Co. is gauging interest again in a new commercial aircraft, according to people familiar with the matter, a move that could help it make up lost ground to rival Airbus SE as it navigates its way through the 737 MAX crisis and the coronavirus pandemic. (WSJ)

OTHER

GLOBAL TRADE: Huawei says it's "shocked and disappointed" at Sweden's 5G ban, adding that Sweden's accusations of a security threat have no factual basis, and hopes the government of Sweden will reevaluate its decision. "The decision to ban Huawei was simply based on conjecture and speculation rather than facts. It's unfair to Huawei and we cannot accept it," the Chinese tech firm said in a statement it sent to the Global Times on Wednesday. The response came as Sweden on Tuesday banned Huawei and ZTE from upcoming 5G networks ahead of a spectrum auction in the 3.5-gigahertz band scheduled for November. (Global Times)

U.S./CHINA: U.S. Secretary of State Pompeo tweeted the following on Wednesday: "To ensure greater transparency of the Chinese Communist Parties influence in the U.S., I designated six additional People's Republic of China's propaganda entities as foreign missions. The American people deserve to know what these outlets are and for whom they work." (MNI)

U.S./CHINA: The Editor in Chief of the Global Times tweeted the following on Wednesday: "The US has gone too far. The move will further poison working environment of media outlets in each other's country. As long as Chinese media outlets suffer actual harm, Beijing will definitely retaliate, and US media outlets' operation in HK could be included in retaliation list." (MNI)

GEOPOLITICS: Iran is taking steps to interfere in the U.S. presidential election, and Russia has obtained American voter information, national security officials announced Wednesday night. The revelation came at an abruptly scheduled press conference for what the FBI called a major election security issue. The briefing comes less than two weeks before Election Day, and was scheduled less than an hour before then. Before the press conference, the leaders of the Senate Select Committee on Intelligence issued a joint statement about "threats from adversaries to U.S. election systems and infrastructure." (CNBC)

GEOPOLITICS: The U.S. government has concluded that Iran is behind a series of threatening emails arriving this week in the inboxes of Democratic voters, according to two U.S. officials. Department of Homeland Security officials told state and local election administrators on a call Wednesday that a foreign government was responsible for the online barrage, according to the U.S. officials and state and local authorities who participated in the call, all speaking on the condition of anonymity because of the matter's sensitivity. A DHS officials also said they had detected holes in state and local election websites and instructed those participating to patch their online services. (Washington Post)

GEOPOLITICS: Missile drills in the South China Sea and aeronautical limitations were the reasons a Taiwanese aircraft was denied entry into Hong Kong airspace en route to the Pratas Islands last week, according to a military insider. (SCMP)

GEOPOLITICS: Azerbaijan President Ilham Aliyev on Wednesday said a cease-fire in the contested region of Nagorno-Karabakh has failed and Armenia should promise to return occupied territory so peace negotiations can begin. (Nikkei)

CORONAVIRUS: Moncef Slaoui, the head of Operation Warp Speed, said he expects the U.S. trials of vaccines made by AstraZeneca Plc and Johnson & Johnson to restart as soon as this week. The two companies developing Covid-19 vaccines backed by Operation Warp Speed temporarily halted their trials because participants fell ill, slowing down the race for a shot to halt the pandemic. "It's for the FDA to announce and decide, but I understand that this is imminent," Slaoui said in an interview when asked if AstraZeneca could resume its trial this week. "I hope that the J&J trial also will restart later this week." (BBG)

CORONAVIRUS: Dr. Moncef Slaoui, chief adviser for the Trump administration's Operation Warp Speed effort to accelerate a vaccine rollout, told ABC News Wednesday that every American could be immunized June 2021. (ABC)

CORONAVIRUS: Brazilian health authority Anvisa said on Wednesday that a volunteer in a clinical trial of the COVID-19 vaccine developed by AstraZeneca and Oxford University had died but added that the trial would continue. Oxford confirmed the plan to keep testing, saying in a statement that after careful assessment "there have been no concerns about safety of the clinical trial." A source familiar with the matter told Reuters that the trial would have been suspended if the volunteer who died had received the COVID-19 vaccine, suggesting the person was part of the control group that was given a meningitis vaccine. CNN Brasil reported that the volunteer was a 28-year-old man who lived in Rio de Janeiro and died from COVID-19 complications. (RTRS)

CORONAVIRUS: Brazilian President Jair Bolsonaro blasted a Chinese coronavirus vaccine being tested in the country just a day after his health minister said it would be distributed nationwide. Eduardo Pazuello, the third official leading the health ministry since the pandemic began, had announced a deal to purchase the Coronavac vaccine that's being developed by China's Sinovac Biotech Ltd in partnership with Sao Paulo's Butantan Institute -- under the watch of Governor Joao Doria, one of Bolsonaro's main political enemies. (BBG)

NEW ZEALAND: Statistics New Zealand reports experimental weekly series based on payday filing to the Inland Revenue, on website. Paid job numbers fall 10,680 in week ended Sept 13 to 2,197,010. Numbers fall 2,770 in four weeks ended Sept 13. (BBG)

SOUTH KOREA: South Korea's central bank was suspected of buying dollars on Thursday to curb the won's gains as the currency hovered at an 18-month high, according to two local currency dealers. (RTRS)

SOUTH KOREA: South Korea will take market stabilizing measures in case of one-sided movements in the FX market, Finance Minister Hong Nam-ki says during parliamentary hearing. One-sided movements in FX is not good for the country's economy. The government is closely monitoring FX markets. Hong says FX demand and supply is stable for now. (BBG)

TAIWAN: A Chinese drone entered Taiwan's southwest air defense identification zone Thursday morning, Taipei-based Central News Agency reports, citing Taiwan Defense Ministry's deputy chief of staff Chiu Su-hwa. (BBG)

TAIWAN: The U.S. State Department has approved the potential sale of three weapons systems to Taiwan, including sensors, missiles and artillery that could have a total value of $1.8 billion, the Pentagon said on Wednesday. (RTRS)

TAIWAN: U.S. is reviewing the sale of four more weapon systems to Taiwan, including drones, Taiwan Defense Minister Yen De-fa says in response to lawmakers' inquiry. (BBG)

TAIWAN: The next US administration should strengthen military and economic ties with Taiwan and raise the cost of any Chinese invasion even as it presses Taipei to bolster its own security, according to a blueprint on Taiwan policy released Wednesday by a prominent Washington think tank. (SCMP)

CANADA: Canadians will not be heading to the polls for a snap fall election now that the Liberal government has survived a confidence vote on a Conservative motion to create a special committee to probe the government's ethics and pandemic spending. (CBC)

TURKEY: Istanbul's local government is in talks with JPMorgan Chase & Co., Societe Generale SA and BNP Paribas SA over selling the country's first municipal Eurobond in 28 years, the latest Turkish borrower to brave international debt markets. (BBG)

BRAZIL: The Brazilian Senate late on Wednesday approved the nomination of Kassio Nunes to the Supreme Court, swiftly signing off on right-wing President Jair Bolsonaro's first nominee to the nation's top judicial body. Nunes, a conservative and a former appeals court judge, was approved with 57 votes in favor, 10 opposed and one abstention. As a Catholic, Nunes' nomination came as a surprise after Bolsonaro earlier vowed to pick an evangelical Christian for the bench. But the president has promised to nominate an evangelical justice next year. (RTRS)

BRAZIL: Brazil's Treasury plans to gradually lengthen the maturity of public debt by reducing the offer of fixed-rate bonds due in April 2021 and increasing those maturing in October 2021, according to Public Debt Undersecretary Jose Franco de Morais. Investors are concerned about Brazil's growing public debt, which will end 2020 close to 100% of GDP thanks to heightened government spending during the pandemic. And the market is looking for 10-year bonds, Franco said. They want "to stay in the short-term and don't want volatility." In September, six-month and 12-month fixed-rate bond sales reached more than 75 billion reais ($13.4 billion), with 50 billion due in April. The Treasury expects that leftover funds from repo operations that will not be rolled over by the Central Bank will be directed to government bonds, he said. (BBG)

BRAZIL: Brazil's federal tax revenue rose to 119.8 billion reais ($21.4 billion) in September, the revenue service said on Wednesday, marking the second consecutive increase from a year ago as the recovering economy boosted corporate taxes and contributions. (RTRS)

ARGENTINA: Argentina is considering adjustments to its tax and social security structures as part of a plan to address economic imbalances, its Economy Minister told a group of investors. (BBG)

EQUITIES: Ant Group has cleared the final regulatory hurdle for its massive initial public offering (IPO) with the pricing of its shares slated to be released within the next week. On Wednesday, the China Securities Regulatory Commission gave the green light for Ant Group's dual Shanghai and Hong Kong listing to go ahead. That came after the Hong Kong stock exchange also gave its approval for the offshore portion of the listing. The Chinese financial technology giant, which is 33% owned by Alibaba and controlled by founder Jack Ma, also updated its IPO prospectus with information on the share structure. (CNBC)

CHINA

YUAN: The yuan is unlikely to appreciate from the current level of around 6.64 to the dollar but will become more volatile due to both bullish and bearish factors including China's faster economic recovery, changes in its foreign exchange policies, the global management of the pandemic, and uncertainties around the U.S. election, the Shanghai Securities News reported. Citing commentators including Guan Tao, an economist from BOC International, the report said that the currency's short-term surge may lead to asset bubbles and put exports under pressure. While short-term factors support the yuan, long-term conditions for a stronger yuan haven't taken shape, the newspaper said citing economist Lian Ping of Zhixin Investment. (MNI)

PBOC: China may be forced to tighten monetary policies next year amid increasing liquidity resulting from the expanding balance of payments surplus, Yicai reported in an article written by Zhang Yi, an economist from ZhongHaiShengRong Capital Management, and Zhang Jianyuan, an economist from China Securities Co. The increasing surplus may force the PBOC to add about CNY2.5 trillion in base money from Q4 to Q1 of next year, leading to excess liquidity, wrote the authors. The expected growth of government revenue will likely reduce next year's deficit to less than 3% of the GDP, and thus eliminate the issuance of special treasury bonds for the pandemic, wrote the authors. Limitations on land-related projects are likely to suppress the issuance of special bonds for next year since there are still CNY1.6 trillion of special bonds not yet factored into GDP, the authors wrote. (MNI)

FISCAL: China will improve the transfer of fiscal funding to local governments to ensure this year's growth targets are achieved and that macro policies are consistently carried out, according to a statement following the weekly State Council meeting chaired by Premier Li Keqiang. China will further expand the use of direct funding to cover people's livelihood such as teachers' salaries and ensure operations at the grassroots level, according to the statement. As of Sept. 30, governments at county levels had received CNY1.57 trillion out of CNY1.7 trillion allocated, which was used to support employment, small businesses and to alleviate poverty, the government said. (MNI)

BANKING: China cleans up CNY1.73tn of npls in Jan-Sep. (CSJ)

OVERNIGHT DATA

CHINA SEP SWIFT GLOBAL PAYMENTS CNY 1.97%; AUG 1.91%

CHINA MARKETS

PBOC INJECTS CNY50BN VIA OMOS

The People's Bank of China (PBOC) conducted CNY50 billion via 7-day reverse repos with the rate unchanged on Thursday. This offsets the maturity of CNY50 billion of reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1992% at 09:20 am local time from the close of 2.1925% on Wednesday: Wind Information.

- The CFETS-NEX money-market sentiment index closed at 35 on Wednesday, unchanged from the previous trading day. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.6556 THURS VS 6.6781

The People's Bank of China (PBOC) set the dollar-yuan central parity rate below the 6.7000 level for a third day at 6.6556 on Thursday, following the 6.6781 set on Wednesday.

MARKETS

SNAPSHOT: Foreign Interference & DC Fiscal Impasse

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 168.97 points at 23470.49

- ASX 200 down 16.906 points at 6174.9

- Shanghai Comp. down 27.707 points at 3297.318

- JGB 10-Yr future down 2 ticks at 151.95, yield down 0.2bp at 0.033%

- Aussie 10-Yr future down 3.0 ticks at 99.165, yield up 2.3bp at 0.823%

- U.S. 10-Yr future -0-01 at 138-17+, yield down 1.01bp at 0.8125%

- WTI crude down $0.26 at $39.77, Gold down $10.7 at $1913.71

- USD/JPY up 12 pips at Y104.71

- PELOSI SUGGESTS RELIEF DEAL COULD SLIP PAST NOV ELECTIONS (POLITICO)

- FBI: IRAN & RUSSIA OBTAINED U.S. VOTER REGISTRATION DATA (CNBC)

- WARP SPEED CHIEF SEES ASTRA & J&J TRIALS RESTARTING SOON

- ASTRAZENECA VACCINE TRIAL BRAZIL VOLUNTEER DIES, TRIAL TO CONTINUE (RTRS)

- BRITAIN TO RESUME TRADE TALKS WITH EU AMID SIGNS OF PROGRESS (BBG)

BOND SUMMARY: Core FI Mixed In Asia, Tsys Flatten A Touch, Aussie Curve Steepens

T-Notes continue to hold to the 0-04 range that was established relatively early in the overnight session, with macro headline flow light in Asia-Pac hours, outside of the comments from the U.S. security service which pointed to Russian & Iranian efforts to interfere in the upcoming U.S. election. The DC fiscal impasse also continues to bubble in the background, with talks set to continue on Thursday. Contract last -0-01 at 138-17+, with the curve bull flattening on the aforementioned election intervention story, as cash Tsys sit unchanged to 1.9bp richer across the curve. Eurodollar futures are virtually unchanged through the reds, with the only real flow of note coming in the form of upside exposure via EDZ1 100.00 calls.

- JGB futures have chopped around within a narrow range, as both the JGB and swap curves steepen, with some weakness in the respective super-long ends in the wake of the steepening seen on the U.S. Tsy curve on Wednesday. There was little of note to drive matters on the domestic front.

- The Aussie bond space has also drifted steeper, with e-minis off lows. YM -0.5, with XM -3.5. Once again, weaker longs may be folding, amplifying any modest pressure in the space as XM trades through yesterday's lows. Bills unchanged to -1 through the reds.

JGBS AUCTION: Japanese MOF sells Y3.1320tn 6-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y3.1320tn 6-Month Bills:- Average Yield -0.1002% (prev. -0.1202%)

- Average Price 100.050 (prev. 100.060)

- High Yield: -0.0982% (prev. -0.1122%)

- Low Price: 100.049 (prev. 100.056)

- % Allotted At High Yield: 89.3911% (prev. 44.8082%)

- Bid/Cover: 3.622x (prev. 3.701x)

JAPAN: Weekly Net International Security Flows Moderate

Net flows moderated in outright size terms across all 4 of the major measures eyed in the weekly Japanese international security flow data

- Japanese investors pulled back on net buying of foreign bonds (Y419.8bn). This would suggest that lifers may have pulled back after some H2FY investment plan related deployment in the previous week (which saw a net Y1.9368tn worth of net purchases)

- Japanese investors also flipped to net sellers of foreign equities (Y162.8bn) lodging net sales for a 5th week in 6.

- Foreign investors registered a 3rd straight week of net purchase of Japanese bonds (Y392.4bn), as the 4-week rolling sum of the measure moved into positive territory for the 1st week in 4.

- Foreign investors reverted to net sales of Japanese equities in the most recent week (Y94.0bn), although the 4-week rolling sum jumped further into positive territory as one week of sizable net sales fell out of the sample.

EQUITIES: Struggling On DC Fiscal Impasse & Worry re: U.S. Election Interference

The lack of meaningful fiscal progress in DC and the notice from the U.S. security services re: Russia & Iran looking to interfere in the upcoming U.S. election weighed on risk appetite during Asia-Pac hours.

- Elsewhere, there was little in the way of notable tier 1 macro headline flow to counter the early pressure surrounding the aforementioned comments from the U.S. security services.

- S&P 500 e-minis threatened to break below the 21- & 50-DMAs, before pulling back from worst levels.

- Nikkei 225 -0.8%, Hang Seng -0.3%, CSI 300 -1.1%, ASX 200 -0.6%.

- S&P 500 futures -23, DJIA futures -180, NASDAQ 100 futures -68.

OIL: Broader Risk Weighs

WTI & Brent sit ~$0.25 below their respective settlement levels at typing, with the broader risk negative flows and marginal uptick in the DXY weighing.

- Fiscal impasse in DC applied some pressure, with mixed idiosyncratic matters in play for crude.

- To recap, the latest DoE inventory data provided some discrepancies when compared to the API reading, while the latest weekly U.S. crude production reading pulled back, owing to the weather disruptions in the Gulf of Mexico.

- Elsewhere, Libyan officials pointed to incremental increases in the nation's crude production, although their year-end estimate (1.0mn bpd) is still a little shy of end of 2019 levels (1.2mn bpd)

GOLD: Resistance Holds

A light uptick in the USD, after Wednesday's DXY weakness, has applied modest pressure to bullion in Asia-Pac hours, with spot last trading $8/oz or so softer at $1,916/oz. This comes after spot failed to break the previously outlined bull trigger point, with yesterday's high coinciding with the bottoming out of U.S. real yields and the DXY, at least for the session. The technical lines and fundamental drivers have not moved.

FOREX: U.S. Election Interference Risk Keeps Asia On Cautious Side

Mild risk aversion took hold as top U.S. intelligence officials told reporters that Iran and Russia have been trying to disrupt the upcoming U.S. presidential election. Price action was relatively limited, with little more to give it some further impetus. The greenback outperformed all of its G10 peers. Commodity-linked FX were the laggards, although NZD managed to shake off earlier weakness.

- Demand for USD pushed USD/CNH higher. A softer than expected PBoC fix failed to immediately extend the upswing, but the rate picked up a bid later on amid continued USD purchases.

- USD/KRW moved away from multi-month lows as South Korean FinMin Hong told lawmakers that one-sided FX moves are not good for domestic economy and pledged readiness to stabilise FX markets if needed.

- U.S. initial jobless claims, existing home sales, EZ consumer confidence and speeches from Fed's Barkin & Kaplan, ECB's Panetta, BoE's Bailey & Haldane and Norges Bank's Olsen take focus from here.

FOREX OPTIONS: Expiries for Oct22 NY cut 1000ET (Source DTCC):

- EUR/USD: $1.1600-10(E1.7bln), $1.1644-50(E2.0bln), $1.1665-85(E1.3bln), $1.1710-20(E593mln), $1.1795-00(E1.5bln), $1.1845-50($712mln), $1.1875-80(E551mln), $1.1900(E661mln), $1.2000(E550mln)

- USD/JPY: Y104.00-10($2.2bln), Y104.25-35($803mln), Y104.50-55($2.9bln), Y104.95-105.00($1.2bln), Y105.24-30($1.6bln), Y105.40-50($1.2bln), Y105.80-106.00($2.7bln)

- GBP/USD: $1.3300(Gbp433mln-GBP calls)

- AUD/USD: $0.6850(A$840mln), $0.6890-0.6900(A$686mln), $0.6950(A$853mln), $0.7000(A$509mln), $0.7075-80(A$504mln)

- AUD/JPY: Y76.44(A$2.1bln), Y77.95(A$898mln)

- EUR/AUD: A$1.6565(E816mln)

- USD/CNY: Cny6.80($810mln), Cny6.95($922mln)

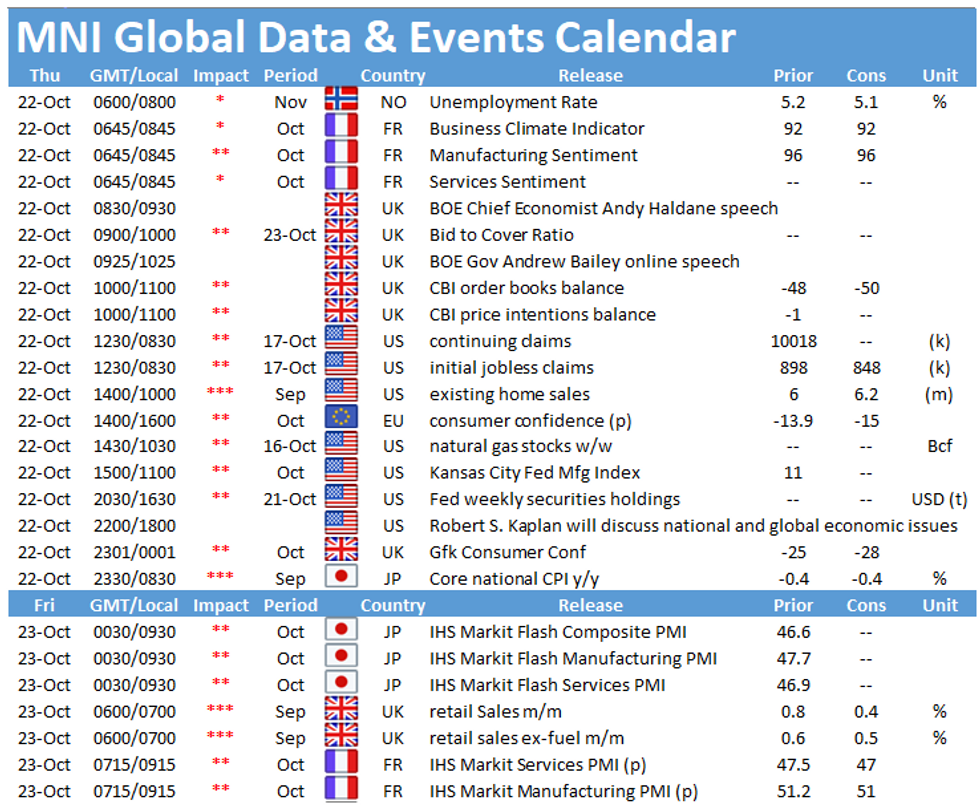

UP TODAY (Time GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.