-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: COVID Matters & DC Situation Make For A Cautious Start To The Week

EXECUTIVE SUMMARY

* FISCAL DEAL NOT FORTHCOMING IN DC

* SOME MAJOR EUROPEAN NATIONS SEE DEEPER COVID MITIGATION MEASURES

* ASTRAZENECA AND J&J GET GO-AHEAD TO RESUME COVID-19 VACCINE TRIALS (FT)

* BREXIT TALKS EXTEND, ALTHOUGH FAMILIAR HEADWINDS REMAIN

* ITALY GAINS RATINGS REPRIEVE AS S&P SWITCHES OUTLOOK TO STABLE

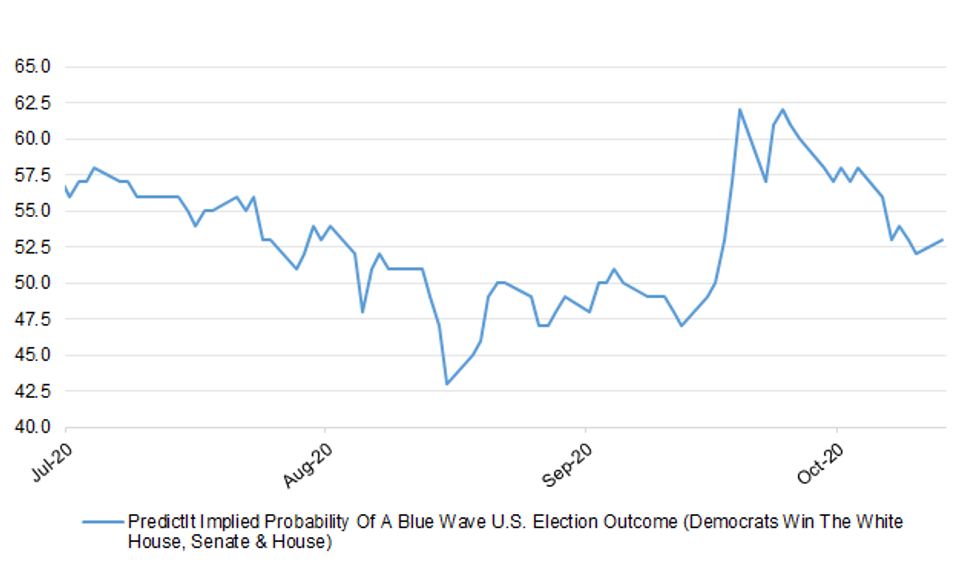

Fig. 1: PredictIt Implied Probability Of A Blue Wave U.S. Election Outcome (Democrats Win The White House, Senate & House)

Source: MNI - Market News/PredictIt

Source: MNI - Market News/PredictIt

UK

CORONAVIRUS: People who are told to stay indoors because a household member has coronavirus will soon have to self-isolate for as little as seven days after widespread refusal to comply with the current 14-day period. Separately, City dealmakers, hedge fund managers and company bosses flying into the UK will be exempt from the 14-day quarantine period under plans to "promote global Britain". (Sunday Times)

CORONAVIRUS: A second Wales-wide lockdown in the new year is looking increasingly likely, according to a cabinet minister. Deputy Economy and Transport Minister, Lee Waters, said the current firebreak was unlikely to be the last in Wales - with England "expected" to follow. Previously the Welsh Government had only gone as far as saying it "could not rule out" another lockdown. (BBC)

COORNAVIURS/POLITICS: Approval of the UK government's handling of the coronavirus pandemic has fallen to its lowest level since March, a poll indicates. The Opinium Research poll showed just 29 per cent of British adults approved of the way the government has handled the pandemic, with 50 per cent disapproving. (FT)

BREXIT: The chief negotiators for the UK and EU will continue post-Brexit trade talks in London until Wednesday, says No 10. Michel Barnier arrived in the UK on Thursday to restart negotiations with Lord David Frost after they stalled last week - but he was due to return home on Sunday. EU sources told the BBC more talks are also planned in Brussels from Thursday. (BBC)

BREXIT: Senior figures in European governments believe Boris Johnson is waiting for the result of the US presidential election before finally deciding whether to risk plunging the UK into a no-deal Brexit, according to a former British ambassador to the EU. Ivan Rogers, who was the UK's permanent representative in Brussels from 2013 to 2017, told the Observer that a view shared by ministers and officials he has talked to in recent weeks in several European capitals, is that Johnson is biding his time – and is much more likely to opt for no deal if his friend and Brexit supporter Donald Trump prevails over the Democratic challenger, Joe Biden. (Observer)

BREXIT: Brexit talks face a roadblock this week after France refused to compromise on fishing, with Government sources hoping Angela Merkel will intervene to break the impasse. (Telegraph)

BREXIT: Irish Prime Minister Micheal Martin said "momentum" is building toward a Brexit deal between the European Union and the U.K., as the coronavirus pandemic underlines the economic challenges facing both sides. (BBG)

BREXIT: On Tuesday afternoon, Boris Johnson held a conference call with the U.K.'s business leaders to urge them to get ready for Brexit to hit at the end of the year. But instead of winning them over, he left them offended. Some executives believed the prime minister was accusing them of being apathetic and dragging their feet when they should be preparing for the upheaval of leaving the single market and European Union customs regime. (BBG)

ECONOMY: Senior Government ministers are increasingly concerned that working from home is leading to less productivity in the economy, The Telegraph understands. (Telegraph)

ECONOMY: Fears of a double-dip recession are growing after consumer confidence slipped in October for the first time since the height of lockdown six months ago. People are becoming increasingly worried about their finances, with much of the country facing severe restrictions again under the government's tier 3 measures. The monthly consumer confidence survey from YouGov and the Centre for Economic and Business Research fell for the first time since April, dropping by 1.1 points from September to 101.3, where any score above 100 means that more households are confident than are not. It was the lowest reading since the survey began in April 2013, excluding the past six months. (The Times)

HOUSING: Banks are turning away mortgage business by increasing interest rates on many new home loans, as they struggle to cope with surging demand for borrowing in a buoyant post-lockdown housing market. (FT)

SCOTLAND: Michael Gove has ordered the creation of a unit to fight Scottish independence as concern grows that the government is failing to defend the Union. At least two full-time government press officers will be assigned to combat Scottish National Party publicity, and further special advisers are likely to be recruited. (Sunday Times)

BANKS: Regulators are considering plans to allow banks to start paying dividends again next year as part of a deal to boost lending and support the economy. The Bank of England and commercial banks are said to be "bartering" an agreement that would allow banks to make shareholder payouts as long as their loss-absorbing capital buffers remain strong and they continue to extend credit to the real economy. (The Times)

RATINGS: Sovereign rating reviews of note from after hours on Friday included:

- S&P affirmed the United Kingdom at AA; Outlook Stable

EUROPE

ECB: European banking regulators, who had been moving closer to lifting a de-facto ban on dividends, are now increasingly worried about the worsening economic outlook and its impact on lenders' balance sheets because of the resurgent coronavirus. As banks press regulators to reinstate dividends, one compromise option being considered by officials is allowing stronger banks to pay a dividend but limit the amount of annual profit they can pay out, according to people with knowledge of the matter. The uncertain outlook caused by the pandemic could still sway officials gathered at the European Central Bank toward extending the ban, the people said, asking not to be identified as the matter is private. (BBG)

GERMANY: Angela Merkel's Christian Democratic Union is considering delaying the election of a new party leader until next year because of a surge in German coronavirus cases. As a result, the CDU-led bloc's appointment of its candidate to replace Merkel as chancellor may be pushed back to March. (BBG)

GERMANY: Chancellor Angela Merkel said the pandemic has worsened in Germany. There's increasing urgency because in a growing number of regions health authorities are struggling to track down infection chains, Merkel said. "We're not powerless against the virus," she said. "Our behavior decides how strong and how fast it spreads." (BBG)

FRANCE: France reported record new infections for the fourth consecutive day, extending a surge that's left it with the most cases in the European Union. The rate of positive tests for the virus that causes Covid-19 jumped to 17% from 16% on Saturday, according to the national health agency. Reported cases increased by 52,010 after three days with more than 40,000. Deaths rose by 116 to 34,761 after 137 reported on Saturday. (BBG)

FRANCE: France will have to live with the coronavirus at least until next summer, President Emmanuel Macron said on Friday. Macron, who was speaking during a visit to a hospital in Pointoise, near Paris, said there were no plans at this stage to reduce curfews aimed at preventing the virus spreading but that curfews could even be extended. "When I listen to scientists I see that projections are for at best until next Summer," he said, adding it was too early to say if France was headed towards new full or partial lockdowns. (RTRS)

FRANCE: French Transport Minister Jean-Baptiste Djebbari said the government was prepared for all possibilities, including another lockdown. On Sunday morning, patients in southern France were transferred between hospitals as intensive-care units came under pressure. Djebbari warned on Europe 1 radio that region-to-region patient transfers won't help as much as before, because the epidemic is spreading to the whole country. (BBG)

ITALY: Italy on Sunday ordered bars and restaurants to close by 6 p.m. and shut public gyms, cinemas and swimming pools to try to halt a rapid resurgence in the coronavirus that has pushed daily infection rates to new records. (RTRS)

ITALY: Italy reported a record 21,273 daily infections as the nation introduced the strongest virus restrictions since the end of a national lockdown in May. More than 1,200 people are being treated in intensive care units for the virus. (BBG)

SPAIN: Buckling under the resurgence of the coronavirus in Europe, the Spanish government on Sunday declared a national state of emergency that includes an overnight curfew in hopes of not repeating the near collapse of the country's hospitals. Prime Minister Pedro Sánchez said the decision to restrict free movement on the streets of Spain between 11 p.m.-6 a.m. allows exceptions for commuting to work, buying medicine, and caring for elderly and young family members. He said the curfew takes effect Sunday night and would likely remain in place for six months. (Associated Press)

SPAIN: Spain is seeking to use its share of the EU's €750bn coronavirus recovery fund to revitalise its stalled economy, with the government likening it to the country's 1986 entry into the bloc or the creation of the European single market. Madrid plans to borrow €27bn against future grants from the fund, long before they are formally approved by the EU. Prime minister Pedro Sánchez's minority administration hopes to use the money to push through a 2021 budget and consolidate power, while boosting an economy hit hard by the coronavirus crisis. (FT)

BELGIUM: Sport and cultural facilities in Brussels must close and residents will face a longer curfew from Monday, the regional government said on Saturday, as COVID-19 infections in Belgium continued to surge to record highs. (RTRS)

SWITZERLAND: Switzerland's health minister has sent a draft proposal for stronger coronavirus measures, the country's Blick newspaper reported. These include the requirement to use masks outdoors in residential areas as well as in offices; a limit of family gatherings to 15 people and the closure of restaurants and bars between 10 p.m. and 6 a.m. (BBG)

RATINGS: Sovereign rating reviews of note from after hours on Friday included:

- Fitch affirmed the Netherlands at AAA; Outlook Stable

- S&P affirmed Greece at BB-; Outlook Stable

- S&P affirmed Italy at BBB; Outlook Revised To Stable From Negative

- DBRS Morningstar confirmed Greece at BB (low), Stable Trend

U.S.

ECONOMY: MNI EXCLUSIVE:US Permanent Joblessness to Eclipse Hiring Burst

- U.S. layoffs will more likely be permanent in the months ahead with the surge of re-hiring after the first wave of Covid-19 now fading away, current and former officials told MNI - on MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com.

FISCAL: With only nine days until Election Day, House Speaker Nancy Pelosi said Sunday she's still "optimistic" about Congress passing a coronavirus relief package before Nov. 3. "I never give up hope. I'm optimistic. We put pen to paper and had been writing the bill based on what we hope will be the outcome, what they said they would get back to us on," Pelosi said on CNN's "State of the Union." (POLITICO)

FISCAL: U.S. President Donald Trump and U.S. Treasury Secretary Steven Mnuchin of Friday said they would back the right deal for more COVID-19 relief but that House Speaker Nancy Pelosi must compromise in order to reach a final agreement. The Republican president, speaking to reporters at the White House, reiterated that he did not support more federal financial aid for U.S. states and cities run by Democrats and said he did not think Pelosi wanted to reach a deal ahead of next month's presidential election. Pelosi, in an interview with MSNBC earlier on Friday, said she hoped to reach a deal before the Nov. 3 contest but that Trump needed to wrangle his fellow Republicans in the Senate to act. (RTRS)

CORONAVIRUS: The United States has seen its highest ever number of new COVID-19 cases in the past two days, keeping the pandemic a top election issue as Vice President Mike Pence travels the country to campaign despite close aides testing positive. (RTRS)

CORONAVIRUS: White House chief of staff Mark Meadows said on Sunday that the U.S. will not get control of the coronavirus pandemic as the country reports a record high in new daily Covid-19 cases. "We're not going to control the pandemic," Meadows said during an interview on CNN. "We are going to control the fact that we get vaccines, therapeutics and other mitigations." (CNBC)

CORONAVIRUS: Anthony Fauci, director of the U.S. National Institute of Allergy and Infectious Diseases, raised his concerns about the latest surge in U.S. cases. He called it "a precarious place to be" in an interview with MSNBC, saying the cases would lead to an increase in hospitalizations and eventually deaths as the colder weather keeps people indoors. "We don't want to shut down the country," he said. "We're talking about doubling down on some of the fundamental public health measures," pointing to universal mask-wearing, social-distancing and avoiding crowds, especially indoors. (BBG)

CORONAVIRUS: Former FDA commissioner Scott Gottlieb said the U.S. has reached a "dangerous tipping point" as hospitalizations from Covid-19 start to rise sharply, undermining the idea that most current incidences of the virus are no worse than a case of the flu. Medical resources in most states aren't "extremely pressed" right now, but "that's going to change over the next two to three weeks," he said. "There's really no backstop here. I don't see forceful policy intervention happening any time soon," Gottlieb said Sunday on CBS. (BBG)

CORONAVIRUS: President Donald Trump hasn't attended a coronavirus task force meeting in "several months," even as new cases in the U.S. continue to climb, White House coronavirus advisor Dr. Anthony Fauci said Friday. Led by Vice President Mike Pence, the task force used to meet every day in the first months of the pandemic, but that's been scaled back to virtual meetings once a week, he said. (CNBC)

POLITICS: President Trump's final debate performance exceeded Americans' expectations, but it wasn't enough to shift the dynamics that left him trailing Joe Biden across most measures, according to a new Axios-SurveyMonkey poll. (Axios)

POLITICS: In the final stretch of the campaign, we find three Southern battlegrounds that could still go either way. Our estimates show Joe Biden with just a two-point edge over President Trump in Florida, Biden up four points in North Carolina, and the contest even in Georgia. Millions have already voted and many others say they've already decided. While early voters in each state told us they substantially favored Biden, those who have not yet voted heavily favor Mr. Trump, setting up a key turnout test running now through Election Day for both parties. (CBS)

POLITICS: President Trump privately told donors this past week that it will be "very tough" for Republicans to keep control of the Senate in the upcoming election because some of the party's senators are candidates he cannot support. (Washington Post)

POLITICS: With November 3rd, the last day of the presidential election, rapidly approaching, officials with the U.S. Postal Service say they have already processed a record amount of election mail this year. The coronavirus pandemic has pushed many more voters to send in their ballots by mail. USPS officials say 100 million ballots have already been sent to or from voters. And while there have been delays reported in a number of key states, experts say that voting by mail has gone relatively smoothly so far. (NPR)

POLITICS: As the 2020 presidential election enters its final week, a majority of Americans appear ready to accept the result of an exhausting campaign even if their preferred candidate loses, a Reuters/Ipsos poll found. (RTRS)

POLITICS: Facebook Inc. teams have planned for the possibility of trying to calm election-related conflict in the U.S. by deploying internal tools designed for what it calls "at-risk" countries, according to people familiar with the matter. (Dow Jones)

POLITICS: Senate Majority Leader Mitch McConnell (R-Ky.) on Friday teed up Judge Amy Coney Barrett's Supreme Court nomination, paving the way for a rare weekend session roughly a week before the November election. (The Hill)

EQUITIES: MNI US Earnings Schedule - By Far The Busiest Week Of The Quarter

- This week is by far the busiest of the quarter for US earnings, with 46% of the S&P500 by market cap reporting. Four $trillion companies are reporting, with Microsoft, Amazon, Alphabet, Apple, Facebook and Visa among the highlights - for more details please contact sales@marketnews.com.

EQUITIES: Boeing Co. is working on a software fix for roughly 280 of its 747 jumbo jets to eliminate hazards of cockpit displays temporarily malfunctioning or going blank. (WSJ)

EQUITIES: Alphabet Inc's Google must respond to the U.S. Justice Department's antitrust lawsuit by Dec. 19, according to a court filing on Friday. The Justice Department on Tuesday sued the $1 trillion company and accused it of illegally using its market muscle to hobble rivals in the biggest challenge to the power and influence of Big Tech in decades. Google called the lawsuit "deeply flawed." (RTRS)

EQUITIES: Facebook CEO Mark Zuckerberg and Twitter CEO Jack Dorsey will testify before the Senate Judiciary Committee on Nov. 17, the panel announced Friday. (Axios)

OTHER

GLOBAL TRADE: China has substantially increased purchases of U.S. farm goods and implemented 50 of 57 technical commitments aimed at lowering structural barriers to U.S. imports since the two nations signed a trade deal in January, the U.S. government said on Friday. In a joint statement, the U.S. Trade Representative's (USTR) office and the U.S. Department of Agriculture (USDA) said China had bought over $23 billion in U.S. agricultural goods to date, or about 71% of the target set under the so-called Phase 1 deal. (RTRS)

GLOBAL TRADE: Italy has prevented telecoms group Fastweb from signing a deal for Huawei to supply equipment for its 5G core network, three sources close to the matter said, the clearest sign yet Rome is adopting a tougher stance against the Chinese group. The decision, made at a cabinet meeting late on Thursday, marks the first time Italy has vetoed a supply deal over 5G core networks with Huawei. (RTRS)

U.S./CHINA: The Trump administration defended its attempt to ban Americans from using popular Chinese-owned video-sharing app TikTok over national security concerns, saying in court papers that the app makes U.S. user data susceptible to influence by Chinese leaders. Lawyers for the U.S. government urged Judge Carl Nichols of the U.S. District Court in Washington, D.C., to allow them to move forward with restrictions on TikTok designed to make the app unusable on Nov. 12. The move comes as part of its effort to crack down on the national security threats posed by Chinese-owned apps. (WSJ)

U.S./CHINA: A U.S. judge in San Francisco on Friday rejected a Justice Department request to reverse a decision that allowed Apple Inc and Alphabet Inc's Google to continue to offer Chinese-owned WeChat for download in U.S. app stores. (RTRS)

U.S./CHINA: President Donald Trump, who declared "I don't make money from China" in Thursday night's presidential debate, has in fact collected millions of dollars from government-owned entities in China since he took office. Forbes estimates that at least $5.4 million has flowed into the president's business from a lease agreement involving a state-owned bank in Trump Tower. (Forbes)

GEOPOLITICS: The U.S. and European Union have initiated a series of regular diplomatic exchanges on China, highlighting efforts to forge a common transatlantic approach toward its growing geopolitical assertiveness. U.S. Secretary of State Michael Pompeo and EU foreign-policy chief Josep Borrell on Friday began a "bilateral dialog" between the State Department and the 27-nation bloc's diplomatic service. (BBG)

GEOPOLITICS: Armenia and Azerbaijan agreed to a U.S.-brokered cease-fire in their five-week conflict over a disputed region, the U.S. State Department said on Sunday. The two countries agreed to abide by the terms of a cease-fire negotiated in Moscow Oct. 10 as of 12:00 a.m. Monday in Washington, or 8 a.m. local time, after their foreign ministers met Saturday with Deputy Secretary of State Stephen Biegun, according to a joint statement. (BBG)

CORONAVIRUS: Some countries are on "a dangerous track" in the coronavirus pandemic and hospitals are beginning to reach capacity ahead of winter, the head of the World Health Organization said Friday. ″Too many countries are seeing an exponential increase in cases and that's now leading to hospitals and ICU running close or above capacity and we're still only in October," Director-General Tedros Adhanom Ghebreyesus said during a press briefing. (CNBC)

CORONAVIRUS: Major US Covid-19 vaccine trials from AstraZeneca and Johnson & Johnson were given the green light to restart on Friday, after the US regulator concluded it was safe to resume testing the experimental candidates. The two drugmakers' US trials had been paused as the Food and Drug Administration investigated whether serious adverse events could be linked to the vaccines. (FT)

CORONAVIRUS: A vaccine considered a frontrunner in the race to protect the global population from Covid-19 has produced a robust immune response in elderly people, the group at highest risk from the disease, according to two people familiar with the finding. The discovery that the vaccine being developed by the University of Oxford, in collaboration with AstraZeneca, triggers protective antibodies and T-cells in older age groups has encouraged researchers as they seek evidence that it will spare those in later life from serious illness or death from the virus. (FT)

CORONAVIRUS: Health officials reviewing Gilead Science Inc's remdesivir against COVID-19 should consider all evidence, including a trial in which the medicine failed, before giving it the green light, the top WHO scientist said on Friday. (RTRS)

CORONAVIRUS: Israel will begin human trials for a potential COVID-19 vaccine developed by a research institute overseen by the Defence Ministry on Nov. 1 after receiving regulatory approval, the ministry said on Sunday. (RTRS)

CORONAVIRUS: Brazil's health regulator authorized the import of a Chinese-produced vaccine after claims from President Jair Bolsonaro that the country lacked the creditability to develop a cure for the coronavirus. The Butantan Institute, a Sao Paulo research center that has partnered with Sinovac Biotech Ltd, was granted an "exceptional" permission to bring six million doses of the unregistered Coronavac drug into the country for phase three trials, the Brazilian Health Surveillance Agency, or Anvisa, said in a statement Friday afternoon. (BBG)

HONG KONG: Hong Kong's exports rebounded in September on the back of a recovering Chinese economy, Financial Secretary Paul Chan said his blog post Sunday. The city's third-quarter gross domestic product should show a significant improvement from the two preceding three-month periods, Chan said. (BBG)

JAPAN: Japan's government is considering compiling an extra budget worth around $95.5 billion to offset the economic drag caused by the coronavirus pandemic, the Mainichi newspaper reported on Saturday. The government is likely to debate using the 10 trillion yen ($95.52 billion) budget to extend a labour subsidy programme scheduled to end in December and to pay for the distribution of a coronavirus vaccine, the Mainichi reported, without citing sources. (RTRS)

JAPAN: After kicking off his tenure with the third-highest cabinet approval rating in history, Japanese Prime Minister Yoshihide Suga appears to be losing his initial momentum amid a brewing controversy over academic freedom. The approval rating for Suga's cabinet came to 63% in a Nikkei/TV Tokyo poll over the weekend, down 11 points from the previous poll conducted in September. (Nikkei)

AUSTRALIA: Victorian Premier Daniel Andrews has announced COVID-19 restrictions will ease in the beleaguered state. Cafes and pubs are set to re-open with limits from midnight tomorrow night. (9 News)

AUSTRALIA: Australia is considering reopening state borders in time for Christmas and is also weighing plans to create alternative options to hotel quarantine so that more of its citizens can return from abroad. All states and territories except for Western Australia agreed to a framework that would end regional border closures before Dec. 25, Prime Minister Scott Morrison said. (BBG)

TAIWAN: The Editor in Chief of the Global Times tweeted the following on Friday: " I think international capital in Taiwan should seriously assess risks. Danger of cross-Straits tensions escalating into a war rises continuously due to worsening political stalemate and increasing misjudgments. In the middle and long term, it's wise to reduce investment in Taiwan." (MNI)

TURKEY: The U.S. said it's temporarily suspending all American citizen and visa services at its missions in Turkey after receiving credible reports of terrorist attacks and kidnappings. (BBG)

TURKEY: The US has warned Nato ally Turkey that it risked seriously damaging its relationship with Washington after testing a Russian-made S-400 air defence system despite repeated pleas from the US. (FT)

TURKEY: France is recalling its ambassador in Ankara after Turkish President Recep Tayyip Erdogan criticized Emmanuel Macron's policy toward Islam and said the French president needed "mental treatment." (BBG)

TURKEY: Turkey stepped up its criticism over Europe's treatment of Muslims, with President Recep Tayyip Erdogan repeating his call for French President Emmanuel Macron to get psychiatric help, threatening to deepen the rift between the NATO country and its European allies. "I've said it on Saturday and am repeating it again," Erdogan said in a televised speech Sunday. "Macron needs to get himself checked out." (BBG)

RUSSIA: The US Treasury Department on Friday announced sanctions on a Russian government research institution linked to a malware system "designed specifically to target and manipulate industrial safety systems." Friday's sanctions are not related to election interference and the designation was made under a section of the Countering America's Adversaries Through Sanctions Act (CAATSA). (CNN)

RUSSIA: Russia is planning for more conflict with the West as confrontation grows over the poisoning of an opposition leader, the crisis in Belarus and fresh charges of meddling in the American presidential vote. Rejecting U.S. and European accusations that it's to blame for the mess in relations after years of targeting opponents, pressuring neighbors and hacking foreign governments' computers, the Kremlin says it's giving up any pretense of wanting to calm things down. (BBG)

RUSSIA: Britain has launched a series of covert attacks on Russian leaders and their interests, the former cabinet secretary has revealed. Lord Sedwill said that clandestine operations had been mounted to punish President Putin and his senior allies and signalled that this included deploying Britain's newly declared offensive cyber-capability. (The Times)

IRAN: The Trump administration plans a pre-election volley of sanctions against Iran intended in part to fortify its pressure campaign against any future effort to unwind it, according to people familiar with the matter. (WSJ)

ARGENTINA: Argentina extended its virus prevention measures for 14 days, President Alberto Fernandez said, without giving dates. The country's cases may plateau at 15,000 per day, he added. (BBG)

CHILE: Chile voted overwhelmingly on Sunday to draft a new constitution, launching a two-year struggle over first principles expected to blunt the neo-liberalism that has made it an investor favorite but plunged it into riots over inequality. With 87% of votes counted, a larger-than-expected 78.2% backed a fresh charter, a key demand of protesters who took to the streets last year in the largest civil unrest in decades. The current document dates back to the dictatorship of Augusto Pinochet. (BBG)

EQUITIES: Some large Chinese fund managers have submitted bids in the range of 68-69 yuan per share for the Shanghai leg of the financial technology giant Ant Group's likely $35 billion dual-listing, people with direct knowledge of the matter said. The expected $35 billion listing in Hong Kong and Shanghai of Ant, backed by e-commerce behemoth Alibaba, would be the world's largest IPO, beating Saudi Aramco's record $29.4 billion float last December. The people declined to be named as they were not authorised to speak to the media. (RTRS)

OIL: Many OPEC+ ministers appear increasingly open to keeping the current cuts in place -- a move sure to be welcomed by Trump -- though no final decision has been made and not all members are convinced, delegates have told S&P Global Platts. (Platts)

OIL: Libya's National Oil Corp (NOC) has lifted force majeure on exports from the ports of Es Sider and Ras Lanuf, it said on Friday, adding that output would reach 800,000 barrels per day (bpd) within two weeks and 1 million bpd in four weeks. Al Waha Oil Co, the NOC company that runs Es Sider, said the port would start operating again on Saturday with the first tanker expected within 48 hours. (RTRS)

OIL: Canada's main oil-producing province of Alberta will lift curbs on crude production ahead of schedule at the start of December, as coronavirus-related shutdowns ease pipeline congestion, Energy Minister Sonya Savage said on Friday. (RTRS)

OIL: The General Hazi Aslanov oil tanker was hit by a fire and explosion in the Sea of Azov on Oct. 24, Russian federal agencies reported. The tanker was empty at the time, according to the Krasnodar region branch of the emergencies ministry, which is coordinating the rescue operation. There were 13 crew members on board when the accident happened, and 10 have been rescued while 3 remain missing. (Platts)

OIL: Tropical Storm Zeta, the Atlantic's 27th system of the year, is set to sweep over Mexico's Yucatan Peninsula as a hurricane Tuesday before turning north and threatening the U.S. Gulf coast from Louisiana to Mississippi with another direct hit. (BBG)

FOREX: U.S. Treasury Secretary Steven Mnuchin is unlikely to release a much-watched report on international currency manipulation that was due in April until after the Nov. 3 presidential election, according to people familiar with the matter. The semi-annual report to Congress has been largely written and ready for release since the spring. But Mnuchin's focus on combating the economic collapse precipitated by the coronavirus pandemic was, at first, the reason it was delayed, the people said.

CHINA

POLICY: China's leadership will start discussions on Monday to set the country's long-term priorities, with Beijing expected to focus on boosting technological self-sufficiency and domestic demand. The Fifth Plenum, a meeting of the Communist party's leadership, will run until Thursday. It will conduct the country's most important goal-setting exercise, drafting the next Five-Year Plan, against the backdrop of a worsening global economy and US sanctions. (FT)

CORONAVIRUS: A cluster of asymptomatic coronavirus cases in Kashgar, a city near China's central Asian borders, has sparked a testing drive and strict restrictions on movement in one of China's most heavily monitored regions. Local authorities launched extensive contact tracing and testing after a 17-year-old tested positive for Covid-19 in a routine test. Another 137 infections, all without symptoms, were discovered on Sunday, each linked to a clothing factory in Shufu district where the teenager and her parents work, local health officials said on Sunday evening. (FT)

YUAN: China will seek to improve the flexibility of its yuan currency and will reduce restrictions on cross-border use of the yuan, the country's central bank governor Yi Gang said on Saturday. Yi said such moves were needed to promote the opening of the country's financial services industry. He was speaking at the Bund Summit conference held in Shanghai. China will "improve flexibility of the yuan, and let exchange rates play a better role as an automatic stabilizer in the macro economy and international balance of payments," he said. To promote yuan internationalization, China will further improve the infrastructure for cross-border use of the yuan, he said. (RTRS)

YUAN: MNI POLICY: PBOC to Be More Proactive on Yuan Globalization

- Chinese regulators will be more proactive in facilitating the yuan's global use given increasingly complex domestic and external environments, even as it the market plays a major role in the process, said Zhu Jun, the director of the international department of the People's Bank of China (PBOC) - on MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com.

YUAN: The market should be prepared for the yuan to swing both ways and should avoid following the "herd" in chasing new highs after the recent spike, the Economic Information Daily said in a commentary on Monday. The yuan has appreciated by more than 2% this month, and exporters' profits will decline if they haven't hedged against exchange rate risks, the newspaper said. While the resilience and potential of the Chinese economy will provide fundamental support for exchange rate stability, the simple "buy low and sell high" principle would help prevent excessive corrections later, the Daily said. (MNI)

CAPITAL ACCOUNT: China should slow the opening of capital accounts given external uncertainties, weak growth momentum and rising systemic risks in the domestic markets, Sina Finance reported citing Zhang Ming, researcher at the Institute of World Economics and Politics at the Chinese Academy of Social Sciences. There is no so-called "new cycle of yuan appreciation" given capital controls are lenient on the entry and strict on exit, as well as the countercyclical regulations which apply, Zhang said. (MNI)

FDI: Foreign investment in China is likely to continue increasing this year as China's economic recovery beats the the global curve, the Shanghai Securities News reported citing Zong Changqing, head of foreign investment at the Ministry of Commerce. The ministry will facilitate the increase with more preferential policies and expand pilot programs which are opening up the service industry, the newspaper said. Non-financial foreign investment in China grew 25.1% y/y in September, a record high this year, with the accumulated growth for the first three quarters turning positive in both dollar and yuan terms, the News said. (MNI)

ECONOMY: MNI POLICY: China to Curb Risks as Markets Open: Vice Pres

- China must increase its ability to prevent and manage risks as it opens up its economy and strictly adheres to the three principles of safety, liquidity, and profitability, Vice President Wang Qishan said. Regulators must crack down on excessive speculation, prevent cycles of financial bubbles and fraud, Wang said on Saturday at the 2020 Bund Summit co-hosted by China Finance 40 Forum - on MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com.

OBOR: MNI POLICY: China to Defer Some Nations' Debts: Ex-PBOC Head

- China plans to allow the deferment of debt repayments by some countries hit by the Covid-19 outbreak on a case-specific basis, Zhou Xiaochuan, former governor of the People's Bank of China, told the 2020 Bund Summit in Shanghai - on MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com.

OVERNIGHT DATA

JAPAN SEP PPI SERVICES +1.3% Y/Y; MEDIAN +1.0%; AUG +1.1%

JAPAN AUG, F LEADING INDEX 88.4; FLASH 88.8

JAPAN AUG, F COINCIDENT INDEX 79.2; FLASH 79.4

SOUTH KOREA SEP DEPARTMENT STORE SALES -6.2% Y/Y; AUG -6.5%

SOUTH KOREA SEP DISCOUNT STORE SALES +5.3% Y/Y; AUG -2.3%

CHINA MARKETS

PBOC NET INJECTS CNY50BN VIA OMOS

The People's Bank of China (PBOC) injected CNY50 billion via 7-day reverse repos with the rate unchanged on Monday and also deposited CNY50 billion at commercial banks. This resulted in a net injection of CNY50 billion as CNY50 billion of reverse repos matured, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.1996% at 09:36 am local time from the close of 2.2170% on Friday: Wind Information.

- The CFETS-NEX money-market sentiment index closed at 39 on Friday vs 35 on Thursday. A higher index indicates increased market expectations for tighter liquidity.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher for a second trading day at 6.6725 on Monday, compared with the 6.6703 set on Friday.

MARKETS

SNAPSHOT: COVID Matters & DC Situation Make For A Cautious Start To The Week

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 11.41 points at 23505.68

- ASX 200 down 7.848 points at 6159.2

- Shanghai Comp. down 23.462 points at 3254.535

- JGB 10-Yr future up 9 ticks at 151.91, yield down 0.6bp at 0.035%

- Aussie 10-Yr future up 5.0 ticks at 99.190, yield down 4.8bp at 0.808%

- U.S. 10-Yr future +0-05 at 138-16+, yield down 2.68bp at 0.816%

- WTI crude down $0.74 at $39.11, Gold down $3.79 at $1898.26

- USD/JPY up 20 pips at Y104.91

- FISCAL DEAL NOT FORTHCOMING IN DC

- SOME MAJOR EUROPEAN NATIONS SEE DEEPER COVID MITIGATION MEASURES

- ASTRAZENECA AND J&J GET GO-AHEAD TO RESUME COVID-19 VACCINE TRIALS (FT)

- BREXIT TALKS EXTEND, ALTHOUGH FAMILIAR HEADWINDS REMAIN

- ITALY GAINS RATINGS REPRIEVE AS S&P SWITCHES OUTLOOK TO STABLE

BOND SUMMARY: Core FI Bid To Start The Week

The trifecta of broader COVID mitigation measures in Europe, a lack of fiscal impulse coming from the Hill and the recent re-pricing of a "Blue Wave" U.S. election scenario weighed on risk at the start of the new week, providing a bid for U.S. Tsys, extending on the flattening witnessed on Friday. T-Notes last +0-05 at 138-16+, with cash Tsys running 0.6-3.6bp richer across the curve, bull flattening.

- The offshore impetus dragged the Aussie bond space flatter, with YM +0.5 and XM +4.5 last, as the latter trades through its SYCOM high. A solid ACGB '28 offering helped bulls, even after some corporate and offshore A$ deals were launched earlier in the day. We also saw the state Premier of Victoria confirm that all retail outlets will be allowed to open from Wednesday.

- The combination of an uptick in JGB futures (+11 last) and broader risk dynamic helped to support the belly area of the JGB curve, although continued heavy offers in 10-25+ Year BoJ Rinban ops meant that the super-long end of the curve continued to underperform in afternoon trade.

US TSYS: Weekly CFTC U.S. Fixed Income Positioning: Steepening Impetus Favoured

The latest round of weekly CFTC positioning data (covering the week through Tuesday 20 October) pointed to a broader net exposure to steepeners in the U.S. Tsy futures space, in keeping with the general direction of the cash Tsy market. Still, the move witnessed in futures was more reflective of a twist steepening pattern, as opposed to the outright bear steepening that was seen in the cash Tsy space, while TY futures positioning remains net long (albeit with no real statistical significance).

- ZN positioning registered another fresh record short in the most recent week captured by the CFTC.

BOJ: 1-5 & 10-25+ Year Rinban Sizes Unchanged

The BoJ offers to buy a total of Y920bn of JGB's from the market, sizes unchanged from previous operations:

- Y420bn worth of JGBs with 1-3 Years until maturity

- Y350bn worth of JGBs with 3-5 Years until maturity

- Y120bn worth of JGBs with 10-25 Years until maturity

- Y30bn worth of JGBs with 25+ Years until maturity

AUSSIE BONDS: The AOFM sells A$1.5bn of the 2.75% 21 Nov '28 Bond, issue #TB152:

The Australian Office of Financial Management (AOFM) sells A$1.5bn of the 2.75% 21 November 2028 Bond, issue #TB152:- Average Yield: 0.6280% (prev. 0.8098%)

- High Yield: 0.6300% (prev. 0.8175%)

- Bid/Cover: 4.6107x (prev. 4.3825x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 68.9% (prev. 15.4%)

- bidders 40 (prev. 49), successful 14 (prev. 15), allocated in full 6 (prev. 8)

EQUITIES: COVID & Blue Wave Repricing Applies Pressure In Early Trade This Week

Participants looked to the uptick in COVID cases in Europe and mitigation measures that have been enacted over the weekend (most notably in Italy & Spain). While it is true that the latest round of infections has not been subjected to the mortality rate witnessed during the first major round of European cases, governments are still willing to impose lockdown/mitigation measures, which will have an economic impact. The latest COVID cluster outbreak in China (in the Xinjiang province) was also noted, as was the recent re-pricing of "Blue Wave" election outcome odds on the PredictIt platform.

- E-minis were offered as a result, as the S&P 500 contract bounced around within the confines of its early Asia-Pac range, even as the cash equity open in China saw some fresh weakness for the contract. Still, the nearby cluster of shorter-term DMAs (21-, 50- & 55-DMA metrics) hasn't been tested as of yet.

- Hong Kong observed a market holiday, sapping liquidity from the region.

- Chinese mainland equity indices felt some extra pressure on the back of softer than expected Q3 earnings from Kweichow Moutai. Participants await any leaks from the meeting re: China's next 5-Year plan, with policymakers sitting down to discuss the matter from today.

- Nikkei 225 -0.1%, Hang Seng closed, CSI 300 -0.5%, ASX 200 unch.

- S&P 500 futures -20, DJIA futures -164, NASDAQ 100 futures -50.

OIL: Plenty Of Headwinds To Consider

Fresh COVID-19 mitigation measures in Europe dominated weekend news flow, while equity traders also looked to the decline in the probability of a "Blue Wave" outcome (judged by PredictIt markets) as a risk negative. The uptick in the USD added further pressure to crude, leaving WTI & Brent ~$0.60 shy of their respective settlement levels at typing, but off early Asia lows.

- This comes after crude softened on Friday, with a focus on Europe's Covid-19 situation (and knock on for crude demand) already evident then, expectations of a further uptick in Libyan crude supply and news that the Canadian province of Alberta will lift crude production limits ahead of schedule. The lack of fiscal developments in DC also did little for bulls. Partially countering this, Platts sources noted that "many OPEC+ ministers appear increasingly open to keeping the current cuts in place… though no final decision has been made and not all members are convinced." Elsewhere, there was some focus on the next tropical weather offering in/around the Gulf of Mexico, which is expected to develop further in the coming days.

GOLD: An Indecisive Narrative

Not much to note for bullion in early dealing this week, with the impulse of an uptick in the USD keeping bulls in check, even with broader markets having a defensive feel. Spot last trades a handful of dollars softer on the day, just below $1,900/oz, with little new to note re: fundamental and technical perspectives.

FOREX: Asia Starts The Week On Cautious Note, GBP Rises On Brexit Talks Optimism

The combination of Covid-19 situation and U.S. fiscal saga resulted in broader risk aversion, providing tailwinds to safe haven currencies and pushing USD to the top of the G10 scoreboard. Continued rapid spread of infections in Europe entailed further restrictions across the continent, while the U.S. reported a record daily surge in new cases. Meanwhile, U.S. House Speaker Pelosi and White House Chief of Staff Meadows exchanged accusations of "moving the goalposts" during their fiscal negotiations. Commodity-tied FX generally struggled to regain poise, albeit NZD managed to recover with liquidity thinned by a market holiday in New Zealand.

- AUD failed to draw much support from the news that Australian Coca-Cola Amatil agreed to a A$9.3bn takeover offer from Coca-Cola European Partners.

- GBP picked up a bid after EU Chief Negotiator Barnier extended his stay in London through Wednesday to continue Brexit talks with the UK. The current phase of negotiations had been scheduled to wrap up on Sunday and resume in Brussels on Thursday.

- USD/CNH crept higher in sync with the greenback's appreciation, ignoring weekend comments from Chinese officials, who underscored willingness to facilitate the process of economic opening-up, while boosting China's capacity to manage associated risks. Elsewhere, CPC leaders convened to discuss the country's next five-year economic plan.

- USD/KRW defied broader risk-off feel and dipped to its worst levels since Mar 2019 ahead of tomorrow's release of South Korea's flash Q3 GDP data. Speculation about a potential hike in Samsung dividends drew some attention locally, with some analysts suggesting that the conglomerate might want to help children of the late chairman Lee Kun-hee pay the inheritance tax, estimated at KRW10.9tn.

- Hong Kong markets are shuttered for a local holiday.

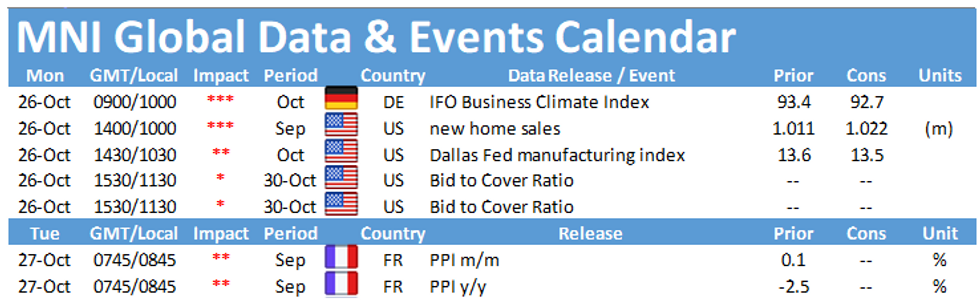

- Focus today falls on German Ifo Survey, U.S. new home sales and comments from ECB's de Cos.

UP TODAY (Time GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.