-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Markets Look To Familiar Themes, With Macro News Flow Light In Asia

OVERNIGHT NEWS AND PRESS

EXECUTIVE SUMMARY

* LACK OF NOTABLE MACRO HEADLINE FLOW IN ASIA, MARKETS LOOK TO FAMILIAR THEMES

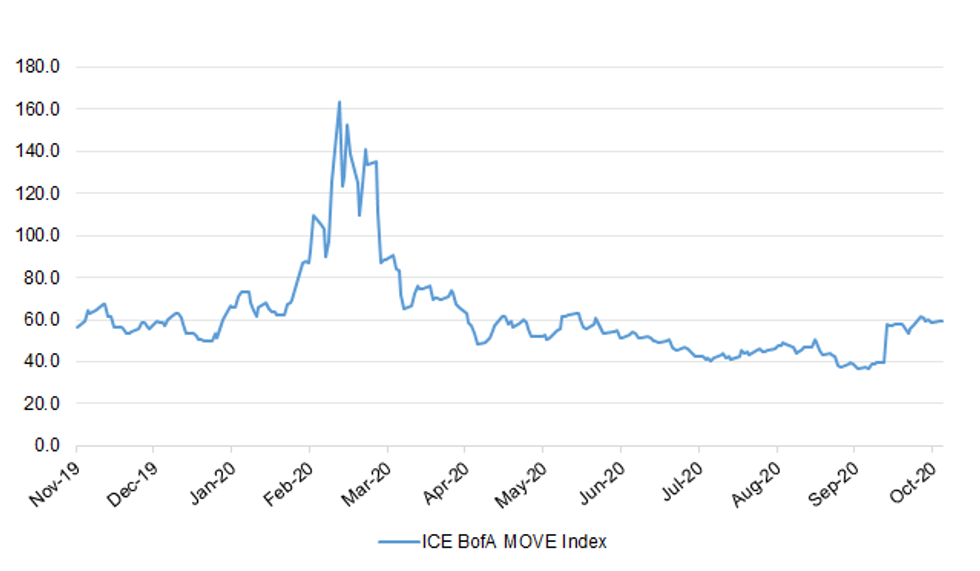

Fig. 1: ICE BofA MOVE Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS/POLITICS: More than 50 of Boris Johnson's own Conservative members of Parliament have demanded a clear route out of lockdown for parts of northern Britain that helped give his party a majority in last year's election. In a letter to the prime minister, the MPs warned that his pandemic strategy of targeting local areas with restrictions was disproportionately damaging the economies of northern regions of the country and deepening the divide between the north and the wealthier south. (BBG)

EUROPE

CORONAVIRUS: European countries may still be able to avoid national lockdowns despite the region being an epicenter of the pandemic now, World Health Organization leaders said on Monday. "We are still hopeful that countries will not need to go into these so-called national lockdowns, that they will be able to use the tools at hand," said Maria Van Kerkhove, WHO's technical lead officer for Covid-19. Public health leaders are worried about European hospitals and intensive-care units filling up as the virus spreads into older populations, she said. (BBG)

FRANCE: France reported the number of people hospitalized because of Covid-19 jumped by 1,307 to 17,784 on Monday, the biggest increase since April 2. Patients in intensive care also rose by the most since early April. Confirmed cases increased by 26,771, after France reported a record 52,010 infections on Sunday. (BBG)

ITALY/BTPS: Italy plans to sell up to 2.5 billion euros of 0.5 percent bonds due Feb 1, 2026 in an auction on Oct 29. The sale is a reopening of previously issued securities with 8.85 billion euros outstanding.

- Italy plans to sell up to 3 billion euros of 0.9 percent bonds due Apr 1, 2031 in an auction on Oct 29. The sale is a reopening of previously issued securities with 5.023 billion euros outstanding.

- Italy plans to sell up to 1 billion euros of floating bonds due Dec 15, 2023 in an auction on Oct 29. The sale is a reopening of previously issued securities with 8.095 billion euros outstanding. (BBG)

EQUITIES: Tiffany & Co has received all regulatory approvals needed for the completion of its $16 billion acquisition by French luxury goods group LVMH, the U.S. jeweler said on Monday after it received a nod from the European Commission. (RTRS)

U.S.

FED: MNI INTERVIEW: Fed Average Inflation Goal Keeps Fiscal Risk Low

- The Federal Reserve's new average inflation target will keep US payments on its record debt pile low even after policy interest rates rise from the zero lower bound, Kansas City Fed economist Huixin Bi told MNI - on MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com.

FISCAL: House Speaker Nancy Pelosi eviscerated the Trump administration on Monday as Washington fails to send more relief to Americans during a record spike in coronavirus cases. The California Democrat's biting letter to House Democrats came only minutes before a nearly hour-long conversation with Treasury Secretary Steven Mnuchin that appeared to yield little progress toward a stimulus agreement. The chances of Congress approving a relief bill before Election Day, Nov. 3, have all but evaporated. (CNBC)

FISCAL: A Fox reporter tweeted the following on Monday: "Aides to @JoeBiden say if elected prez he will push for a $2 trillion #COVID stimulus package immediately upon taking office along w tax increases and infrastructure. The ambitious package will need GOP support if Dems dont control the Senate w House." (MNI)

CORONAVIRUS: Missouri, Kentucky, Utah, and South Dakota will be the next states to get "surge" virus testing sites as Covid-19 cases in the U.S. rise and federal officials push for "smart testing" strategies. (BBG)

CORONAVIRUS: Texas is converting a convention center to a field hospital and erecting tents outside an El Paso medical center in response to the worsening outbreak in the city. (BBG)

CORONAVIRUS: Utah hospitals are preparing to ration care as new Covid-19 cases in the state are shattering records on a daily basis, Greg Bell, president of the Utah Hospital Association, told Governor Gary Herbert. (BBG)

CORONAVIRUS: Deborah Birx, the White House coronavirus response coordinator, "painted a pretty stark picture" of the dangers associated with rising cases in the Midwest during a weekend visit to Minnesota, Governor Tim Walz told reporters Monday. "She couldn't have been clearer," the Democratic governor said. "Her message was this: cases are rising across the upper Midwest and Minnesota is no exception. The infection rates in the upper Midwest, and she specifically stated on our eastern and western borders, are the highest infection rates on the planet right now." (BBG)

CORONAVIRUS: U.S. Surgeon General Jerome Adams says Thanksgiving celebrations "aren't looking up" in 12 "red states" because of the spread of the coronavirus. A note of caution if you live in IA, ID, KS, MO, MT, ND, NE, OK, SD, TN, UT, or WI- things aren't looking up for thanksgiving dinner, but there's still plenty of time to turn it around," he says in a tweet. (BBG)

POLITICS: President Trump holds a slim edge in Texas but is facing big losses from voters in the suburbs, a New York Times/Siena College poll finds. President Trump maintains a narrow edge in Texas, according to a New York Times/Siena College poll on Monday, as he faces a rebellion in the state's once overwhelmingly Republican suburbs. Mr. Trump leads Joseph R. Biden Jr. in Texas by 47 percent to 43 percent among likely voters, the survey found, which is within the poll's margin of error of plus or minus 4 percentage points. The survey of 802 likely voters was mostly conducted before the final presidential debate on Thursday. In the Senate race, the Republican incumbent, John Cornyn, holds a larger lead, 48-38, over the Democrat, M.J. Hegar. (New York Times)

POLITICS: Democratic presidential challenger Joe Biden leads President Donald Trump by a solid margin in Wisconsin and maintains a narrower advantage in Pennsylvania with just over a week until Election Day, Reuters/Ipsos opinion polls showed on Monday. (RTRS)

POLITICS: U.S. President Trump tweeted the following on Monday: "Big problems and discrepancies with Mail In Ballots all over the USA. Must have final total on November 3rd." (MNI)

POLITICS: The Supreme Court on Monday evening voted 5-3 against Democrats who were pushing to extend the deadline for counting absentee ballots in Wisconsin by six days, to Nov. 9. (CNBC)

POLITICS: The US Senate has confirmed Judge Amy Coney Barrett to the Supreme Court in a victory for President Donald Trump a week before the general election. (BBC)

OTHER

CENTRAL BANKS: MNI INTERVIEW: QE Rules Should Be Clearer- Ex-BOE's Forbes

- Central banks should lay down clear principles for future emergency monetary policy action of the sort seen in March, helping investors better anticipate future easing and lessening any pressure to automatically respond to falling markets, Kristin Forbes, a former Bank of England Monetary Policy Committee member and New York Fed adviser told MNI - on MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com.

GLOBAL TRADE: The Trump administration says new agricultural trade data shows that Beijing is on track to fulfil its commitments in the US-China trade deal by the end of the year, including "all-time high" purchases of American beef, pork, corn and soybeans. Other analysts, however, say the administration's claims are misleading. "Using the best methodology, we have calculated that China has purchased approximately 71 per cent of its target for 2020," an administration report published last week said, promoting the new numbers as a victory for US farmers in the face of China's "problematic" trade practices. (SCMP)

GLOBAL TRADE: Samsung Electronics' display unit has received licenses from U.S. authorities to continue supplying certain display panel products to Huawei Technologies, a source familiar with the matter told Reuters on Tuesday. With U.S.-China ties at their worst in decades, Washington has been pushing governments around the world to squeeze out Huawei, arguing that the telecom giant would hand data to the Chinese government for spying. Huawei denies it spies for China. (RTRS)

U.S./CHINA: The Trump administration lost a bid to enforce its prohibitions against the Chinese-owned "super app" WeChat in the U.S. during its appeal of a judge's ruling that the ban probably violates the free-speech rights of its users. (BBG)

U.S./CHINA: A day after US president Donald Trump announced a new initiative to thwart Beijing's alleged efforts to "steal" US technology, senior Chinese financial officials and Wall Street bankers sat down for a teleconference. One participant in the China-US Financial Roundtable, established two years ago at a time of heightened trade tensions between the world's two biggest economies, said it had been a pretty "generic" forum aimed at "fostering goodwill" and enhancing financial integration between the world's two largest economies. But the forum, which convened on October 16 according to four people briefed on the discussions, also highlights a rare positive front in Sino-US relations: finance, as Beijing attempts to speed up market reforms and attract foreign capital. (FT)

CORONAVIRUS: The World Health Organization warned Monday that some countries may need to shut down their nonessential businesses again as a way to take the "heat" out of their worsening coronavirus outbreaks. WHO officials said they are still hopeful most countries won't need to impose nationwide lockdowns, which were imposed by some world leaders earlier in the year as a way to slow the spread of the virus. But as Covid-19 cases now accelerate across the Northern Hemisphere, particularly in the United States and Europe, some countries may need to impose those stricter mitigation measures again, the agency said. (CNBC)

CORONAVIRUS: A paused clinical trial of an Eli Lilly & Co. experimental antibody therapy won't resume after federal researchers concluded the drug likely wouldn't help hospitalized Covid-19 patients with advanced cases. The National Institutes of Health researchers who initially halted the trial due to a safety concern, however, didn't find that the treatment caused any harm, which may bode well for a regulatory review of the antibody's use in a different setting. While the decision to end the NIH-sponsored trial means Lilly's antibody treatment may not work for the most extreme cases, other trials are ongoing to determine whether it helps patients earlier in the disease's course. Notably, the finding that there wasn't a safety issue in the hospital trial could remove a potential roadblock to emergency authorization that Lilly is seeking for using the antibody in patients outside of the hospital. (BBG)

CORONAVIRUS: The proportion of people in Britain with antibodies that protect against Covid-19 declined over the summer, according to research that adds to evidence that natural immunity can wane in a matter of months. (FT)

HONG KONG: Hong Kong will allow six people per table at restaurants and four per table at bars, local broadcaster TVB reports, citing unidentified people. (BBG)

HONG KONG: Hong Kong Chief Executive Carrie Lam said the city would re-open public beaches, as the city slowly lifts strict virus-related restrictions. (BBG)

HONG KONG: Hong Kong leader Carrie Lam said she will travel to Beijing next week to discuss economic support for the territory following the hit from the pandemic. Ms Lam delayed her policy address at short notice this month, saying she would visit Beijing to discuss assistance from the mainland to support Hong Kong's economy. Ms Lam said she would first travel to Shenzhen next Tuesday before continuing to Beijing for a three-day visit alongside five of her ministers. She did not give a detailed itinerary. (FT)

HONG KONG: Hong Kong is drafting a law that would enable the city to make Covid-19 tests mandatory for people with symptoms and other specific groups, the city's leader said. Chief Executive Carrie Lam announced the plan to enact a new law mandating tests for known clusters and high risk groups at a weekly briefing Tuesday, without elaborating. The government said earlier this month that it was studying the legal framework for mandatory coronavirus testing. The move follows a voluntary city-wide summer testing program unearthed only a handful of positive cases. The program was bedeviled by public skepticism and suspicion that the Beijing-backed drive was a move to harvest residents' DNA. The government denied those claims. (BBG)

JAPAN: Japan's northern Hokkaido prefecture is making final arrangements to raise its coronavirus alert level from the lowest of 5 stages as infections rise, public broadcaster NHK reports, without attribution. The alert will be raised by one notch to the second lowest level. (BBG)

RBA: Reserve Bank of Australia Deputy Governor Guy Debelle tells parliamentary panel Tuesday that economic growth elsewhere in the country was more than the drag from Victoria. "Possibly the drag from Victoria was a little less than what we guessed back in August". Declined to comment on QE intentions. (BBG)

SOUTH KOREA: South Korea's 3Q GDP data offers hope that the economy will recover from a difficult period, helped by exports, Finance Minister Hong Nam-ki says in a meeting. The 3Q GDP data suggests South Korea's economy entered a recovery phase toward economic normalization. 3Q economy could have expanded at a mid-2% level if not for the resurgence of the coronavirus in mid-Aug. (BBG)

TAIWAN: The US State Department signalled its approval for a potential US$2.4 billion sale of land-based anti-ship missiles to Taiwan, a move certain to anger Beijing and raise tensions further between the United States and China. The Trump administration said in a statement Monday that it has notified Congress that it backs the proposed sale of as many as 100 Harpoon Coastal Defence Systems built by Boeing, which includes 400 land-based missiles. (SCMP)

CANADA: MNI INTERVIEW: Canada Moving Farther From Fiscal Anchor-Beatty

- Canada is moving even further away from returning to a fiscal "anchor" that would boost business and investor confidence through the rebuild following Covid-19, Perrin Beatty, Chamber of Commerce president and a former revenue and health minister, told MNI - on MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com.

MEXICO: Mexican Energy Minister Rocio Nahle said on Monday so called farmouts, or joint ventures, could be done with state oil firm Petroleos Mexicanos if feasible projects are put forward, marking a potential shift from her previous skepticism. (RTRS)

TURKEY: Decree by President Recep Tayyip Erdogan on extending short-time work payments system by 2 months published in nation's official gazette. (BBG)

IRAN: The United States on Monday imposed fresh Iran-related sanctions targeting the Islamic Republic's oil sector, including the Iranian Ministry of Petroleum, in Washington's latest move to increase pressure on Tehran. (RTRS)

IRAN: A senior administration official told The Wall Street Journal that additional counterterror sanctions will be levied against Iran in the days and weeks ahead, including targeting the petrochemicals, metals and transport industries. "We're not done by a long stretch," the official said. The official also said China was the biggest buyer of Iranian exports in violation of U.S. sanctions, and said the administration would levy sanctions against Chinese firms. (WSJ)

EQUITIES: HSBC Holdings Plc beat profit estimates for the third quarter delivering an upside surprise as it pared back expected credit losses and signaled it may resume limited dividend payments already for this year. Adjusted pretax profit slid 21% to $4.3 billion in the period, beating the $2.8 billion estimate, the London-based bank said in a statement on Tuesday. HSBC said it expects credit losses to be at the lower end of a previously announced $8 billion to $13 billion range. (BBG)

OIL: Gulf of Mexico operators shut 293,656 b/d of oil production ahead of Tropical Storm Zeta, BSEE says in notice. (BSEE)

CHINA

POLICY: China should always put financial security first and prevent systemic risks such as excessive borrowing by local governments, asset price bubbles, and any rapid rise in leverage ratios, the 21st Business Herald reported in an editorial. China's financial opening and financial innovations should always avoid finance becoming a capital game rather than serving the real economy, wrote the Herald. China should beware of the risks financial speculation poses to manufacturing and potential crisis underneath financial bubbles, the Herald said. (MNI)

ECONOMY: China has made technological development and the upgrading of industry the focus of its next stage of growth as it seeks to diversify from reliance on labor-intensive industries and tourism, the Global Times commented in an editorial. Suppression by the U.S., particularly against China's technology industry, is the biggest threat, although the U.S. has been weakened by the pandemic, the newspaper said. China has also set a goal of building a first-class military to protect its national interests and to counter U.S. hostility, the Times said. The editorial was published during the Oct. 26-29 Fifth Plenary Session of the Communist Party, where delegates meet to discuss the country's "14th Five-Year Plan" and long-term goals through to 2035. (MNI)

ECONOMY: China is considering designated areas such as 5G technology, integrated circuits, and biomedicine as special planning projects under the 14th Five-Year Plan (2021-2025) to promote breakthroughs and acquire leadership in core technologies, reported the China Securities Journal citing the Ministry of Industry and Information Technology. China will strive for breakthroughs in computer chips, 5G applications, IoT, and driverless transportation, the Journal reported citing Zhongtai Securities. (MNI)

EQUITIES: China Hits The Brakes On New ChiNext IPOs As Demand Overwhelms. (BBG)

OVERNIGHT DATA

CHINA SEP INDUSTRIAL PROFITS +10.1% Y/Y; AUG +19.1%

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 99.7; PREV. 98.1

Amidst falling active COVID-19 case numbers and hopes of a further easing of restrictions, confidence gained for the eighth straight week. Overall sentiment is just below the neutral level and at a six-month high. It remains well below the long run average, however. Sydney and Melbourne are now close to neutral. People remain cautious about the current economic outlook and, consistent with this, are also cautious about their current financial circumstances. This may constrain spending in the near-term. Confidence in future economic and financial conditions is much more positive, however, holding out the prospect of a recovery in spending if the labour market holds up. (ANZ)

NEW ZEALAND SEP TRADE BALANCE -NZ$1.017BN; MEDIAN -NZ$1.013BN; AUG -NZ$282MN

NEW ZEALAND SEP TRADE BALANCE 12 MTH YTD +NZ$1.710BN; MEDIAN +NZ$1.672BN; AUG +NZ$1.417BN

NEW ZEALAND SEP EXPORTS +NZ$4.01BN; MEDIAN +NZ$4.00BN; AUG +NZ$4.41BN

NEW ZEALAND SEP IMPORTS +NZ$5.02BN; MEDIAN +NZ$5.02BN; AUG +NZ$4.69BN

SOUTH KOREA Q3, P GDP -1.3% Y/Y; MEDIAN -1.8%; Q2 -2.7%

SOUTH KOREA Q3, P GDP +1.9% Q/Q; MEDIAN +1.3%; Q2 -3.2%

CHINA MARKETS

PBOC NET INJECTS CNY30BN VIA OMOS

The People's Bank of China (PBOC) injected CNY100 billion via 7-day reverse repos with the rate unchanged on Tuesday. This resulted in a net injection of CNY30 billion after the maturity of CNY70 billion of reverse repos, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.2061% at 09:29 am local time from the close of 2.2548% on Monday: Wind Information.

- The CFETS-NEX money-market sentiment index closed at 65 on Monday vs 39 on Friday. A higher index indicates increased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.6989 TUES VS 6.6725

MARKETS

SNAPSHOT: Markets Look To Familiar Themes, With Macro News Flow Light In Asia

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 50.61 points at 23443.76

- ASX 200 down 95.327 points at 6061.3

- Shanghai Comp. down 12.088 points at 3239.031

- JGB 10-Yr future up 10 ticks at 152.03, yield down 0.5bp at 0.030%

- Aussie 10-Yr future up 0.5 tick at 99.195, yield down 0.3bp at 0.803%

- U.S. 10-Yr future +0-00+ at 138-21, yield down 0.33bp at 0.798%

- WTI crude up $0.22 at $38.78, Gold up $6.07 at $1908.15

- USD/JPY down 7 pips at Y104.77

- LACK OF NOTABLE MACRO HEADLINE FLOW IN ASIA, MARKETS LOOK TO FAMILIAR THEMES

BOND SUMMARY: Sidelined

A macro headline light Asia-Pac session did very little for broader impetus in the core FI space, after the broader flattening pressure witnessed on Monday. This made for tight ranges, with participants seemingly happy to sit on the sidelines.

- T-Notes held a 0-02+ range as a result, last +0-00+ at 138-21, with cash Tsys sitting unchanged to 0.5bp richer across the curve.

- JGB futures edged above 152.00, last +10, building on overnight gains, with JGBs generally trading richer and within 1.0bp of Monday's closing levels. The latest round of 2-Year JGB issuance wasn't the best received.

- Aussie bond futures held to their respective SYCOM ranges, with YM +0.5 and XM +1.0. An appearance in front of a Senate panel from RBA's Debelle & Bullock provided little of note. 3-Month BBSW set at a fresh all-time low.

JGBS AUCTION: Japanese MOF sells Y2.4458tn 2-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.4458tn 2-Year JGBs:- Average Yield -0.130% (prev. -0.141%)

- Average Price 100.461 (prev. 100.485)

- High Yield: -0.127% (prev. -0.139%)

- Low Price 100.455 (prev. 100.480)

- % Allotted At High Yield: 73.1880% (prev. 64.8471%)

- Bid/Cover: 3.984x (prev. 4.022x)

MONTH-END EXTENSIONS/JGBS: Morgan Stanley See Marginal Contraction

Morgan Stanley expect "the 1y+ JGB index to contract by 0.004y in October, compared to an average month's extension range of ~0.02-0.06y."

MONTH-END EXTENSIONS/AUSSIE BONDS: Morgan Stanley See < Than Usual Extension

Morgan Stanley expect "the 1y+ ACGB index to extend by 0.032y in October, compared to an average October extension of 0.186y and an average month's extension of 0.07y."

EQUITIES: Biased Lower In Asia

The negative impetus from Monday's Wall St. session spilled over into Asia-Pac hours, with the major regional indices sitting a little lower vs. Monday's closing levels. Meanwhile, e-minis stabilised after Monday's tumble, with those particular contracts holding to tight ranges, just above settlement levels.

- The Hang Seng played catch up after the elongated weekend, while the ASX 200 underperformed as the IT and energy sectors found themselves at the bottom of the local sectoral table.

- Nikkei 225 -0.3%, Hang Seng -1.1%, CSI 300 -0.1%, ASX 200 -2.0%.

- S&P 500 futures +3, DJIA futures +39, NASDAQ 100 futures +3.

OIL: Global Demand & Supply Pressures At The Fore, Gulf Weather Eyed

WTI & Brent sit $0.20 above their respective settlement levels after Monday's move lower, which was a direct result of worry re: European mitigation measures surrounding COVID and their impact on oil demand, in addition to a lack of fiscal impetus in DC.

- In terms of crude specifics, incremental Libyan supply and the evolving weather situation in the U.S. Gulf provide the focal points.

- The latest round of weekly API inventory estimates is due later today

GOLD: Rangebound

Very little to add to recent commentary for the yellow metal, as the recent ranges/well-defined technical parameters continue to hold true. Fundamentally, focus remains on the USD & U.S. real yields, spot last sits +$7/oz or so, just shy of $1,910/oz.

FOREX: Greenback Slips In Asia, Regional FX Watch Data

The greenback went offered and landed at the bottom of G10 pile, as e-mini contracts ground higher, with little to change the broader state of play overnight. Commodity-tied FX garnered some modest strength, as the space seemed happy to slightly unwind yesterday's risk-off moves. Addresses from RBA's Debelle & Bullock provided nothing of real note.

- USD/CNH popped higher as onshore markets re-opened, while China reported September industrial profits, which grew slower than in August, in Y/Y terms. The rate faded the move later in the session.

- USD/KRW re-opened on the front foot as South Korean Vice FinMin Kim warned that the gov't monitors FX markets and is ready to take stabilisation measures if needed. That being said, the pair gradually erased gains as local GDP data for Q3 showed that South Korean economy has returned into expansion at a higher rate than forecast.

- Coming up today we have U.S. Conf. Board Consumer Confidence & flash durable goods orders as well as comments from ECB's de Cos.

FOREX OPTIONS: Expiries for Oct27 NY cut 1000ET (Source DTCC):

- EUR/USD: $1.1775-85(E765mln), $1.1800-05(E1.2bln), $1.1850(E469mln)

- USD/JPY: Y104.25-30($1.1bln-USD puts), Y105.00($1.8bln), Y105.25($1.2bln), Y106.00-05($1.2bln)

- EUR/GBP: Gbp0.9135-45(E910mln)

- AUD/USD: $0.6680(A$1.1bln)

- AUD/NZD: N$1.0809-20(A$2.5bln)

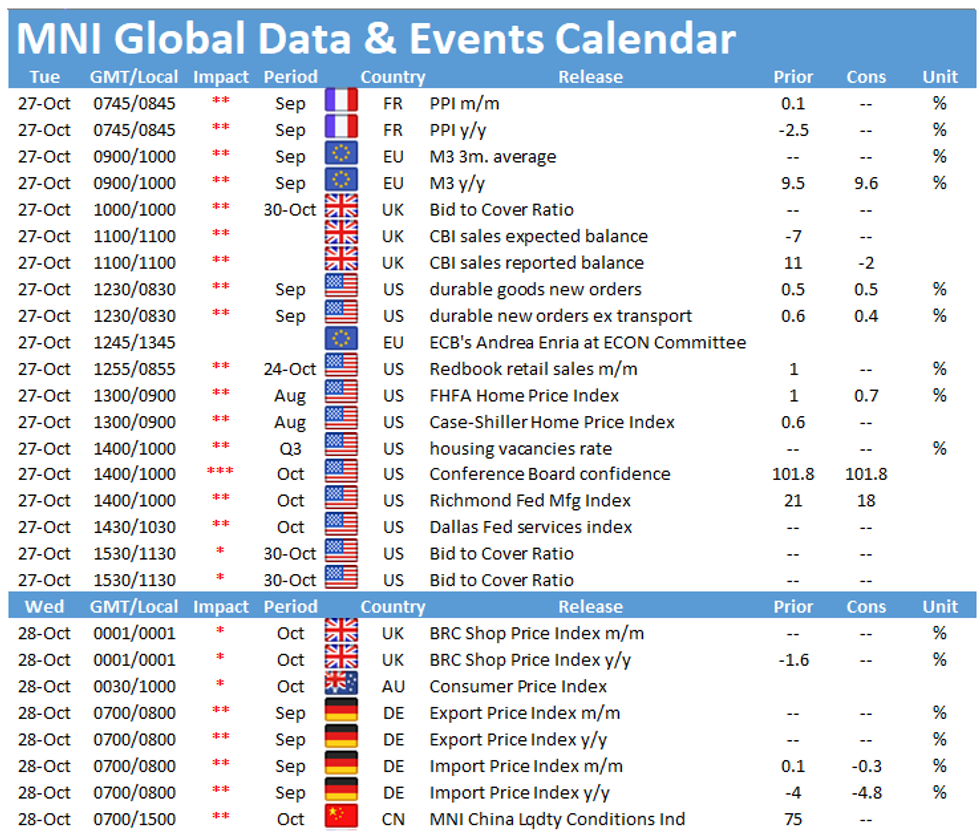

UP TODAY (Time GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.