-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: E-Minis Hit On Big Tech Earnings, Eyes On Familiar Risks

OVERNIGHT NEWS AND PRESS

EXECUTIVE SUMMARY

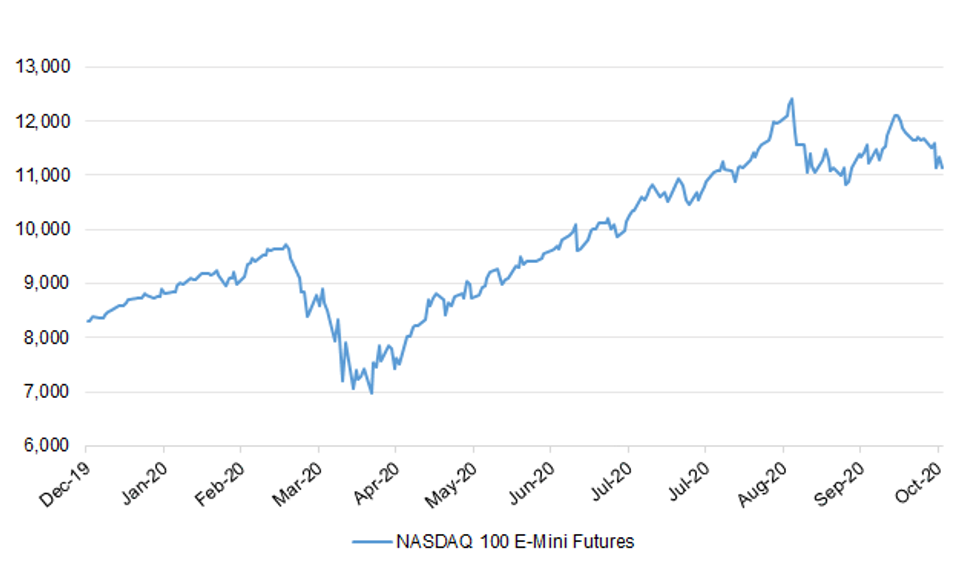

* E-MINIS STRUGGLE AFTER BIG TECH EARNINGS

* ECB POLICYMAKERS DEBATED MORE BOND PURCHASES, BANK LOANS (RTRS SOURCES)

* FAUCI: RETURN TO NORMAL WILL TAKE AT LEAST A YEAR (BBG)

* SENIOR CCP OFFICIAL: COMPLETE U.S.-CHINA DECOUPLING UNREALISTIC (RTRS)

Fig 1: NASDAQ 100 E-Mini Futures

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: England is heading for a national lockdown by proxy ministers have said after the government announced new restrictions that will put 60 per cent of the population under strict curbs. It announced yesterday that 2.3 million people in West Yorkshire will be moved into Tier 3 lockdown from Sunday night, with pubs closed unless they serve food. A further 3.5 million people in 16 areas, including Oxford, Luton, East Riding, Kingston Upon Hull, Derbyshire Dales, Derby and Staffordshire, will be moved into Tier 2 at midnight, meaning that they face restrictions on socialising indoors. The curbs will mean that 21 million people are under Tier 2 restrictions and a further 11 million under Tier 3, meaning 32 million people, 58 per cent of the population, are under higher tiers. (The Times)

CORONAVIRUS: Downing Street came under pressure on Thursday to introduce a more stringent national lockdown across England, as growing scientific evidence indicated that infections are now spreading at an alarming rate. One infection study released by Imperial College London concluded that the pace of the epidemic is accelerating, with almost 100,000 people catching coronavirus every day in England and the R number at 1.56 — meaning infections are doubling every nine days. But another report, published later in the day by the MRC Biostatistics Unit at Cambridge university, underlined the dilemma facing Boris Johnson as he weighs whether to scrap his three-tiered, local lockdown approach. (FT)

EUROPE

ECB: European Central Bank policymakers already debated the ingredients of their next anti-pandemic stimulus package on Thursday, with more bond purchases and multi-year loans to banks getting the most attention, sources told Reuters. President Christine Lagarde said after the meeting the ECB would "recalibrate" its policy in December to contain the growing fallout from a second wave of coronavirus infections, but she would not be drawn on what that meant in practice. Two sources told Reuters some policymakers favoured expanding the ECB's Pandemic Emergency Purchase Programme (PEPP), which has exhausted nearly half of its 1.35 trillion euro ($1.60 trillion) firepower. Others put greater emphasis on even more generous credit for banks under the ECB's Targeted Longer-Term Refinancing Operations (TLTRO) while others still wanted a package featuring both, the sources said. (RTRS)

ECB: Investors will not have to contribute a single euro to finance the vast budget deficits of eurozone governments next year, according to analysts who forecast that the European Central Bank will buy a greater quantity of debt than all the new bonds hitting the market. (FT)

FISCAL: MNI SOURCES: EU Commission To Tell Countries To Boost Stimulus

- The EU Commission is likely to send a strong signal to Eurogroup finance ministers that their 2021 draft national budget plans will probably need to be revised in light of the second wave of the Covid virus and further widespread economic shutdowns, an EU official indicated today - on MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com.

FISCAL: Attempts to strike a political deal unlocking the EU's €1.8tn budget package have stalled, triggering predictions that the first tranche of Brussels recovery fund money will be delayed as the European economy is hit by a second wave of lockdowns. EU officials and MEPs said talks on Wednesday night between member states and the European Parliament failed to make headway as the two sides haggle over the exact size of the upcoming seven-year EU budget and Covid-19 recovery plan. A parallel set of negotiations on how to design a mechanism tying payments to adherence to the rule of law is on the cusp of a breakthrough, but the broader package could still take weeks of further talks to settle. (FT)

CORONAVIRUS: The European Union's healthcare system are at risk of being overwhelmed by the number of coronavirus cases unless authorities act quickly, the head of the Eurpean Commission Ursula von der Leyen told a news conference ion Thursday. "The spread of the virus will overwhelm our healthcare systems if we do not act urgently," she said after a video conference of EU leaders to coordinate the EU's response to the COVID-19 pandemic. She said the Commission made available 220 million euros to finance cross-border transfer of COVID-19 patients across EU countries to avoid healthcare systems in the most affected countries not being able to cope. (RTRS)

FRANCE: France is aiming to limit the drop in economic activity to 15% during the country's second coronavirus lockdown starting on Friday, Finance Minister Bruno Le Maire said in a government briefing on Thursday. That would be half of the 30% drop in activity during the country's first lockdown that started in March, which was caused in particular by a halt of construction work, Le Maire said. (BBG)

FRANCE: France will offer aid to companies totaling an estimated 15 billion euros ($17.5 billion) per month of lockdown, Finance Minister Bruno Le Maire said as new stay-at-home measures start Friday.

ITALY: Italy's coronavirus cases reached a another daily record on Thursday with new 26,831 cases. More than 200,000 tests were carried out, and 217 deaths related to Covid-19 were reported, bringing the total to 38,122. (BBG)

ITALY: Banca Monte dei Paschi di Siena SpA is holding preliminary talks with the Italian government over a potential capital increase of about 1.5 billion euros ($1.75 billion). Officials at the Italian Treasury have reviewed with Paschi Chief Executive Officer Guido Bastianini options to boost the bank's capital, said people familiar with the discussion, who asked not to be named as the matter is private. (BBG)

RATINGS: Sovereign rating reviews of note scheduled for after hours on Friday include:

- Fitch on Finland (current rating: AA+; Outlook Stable)

- Moody's on the Netherlands (current rating: Aaa; Outlook Stable)

- DBRS Morningstar on Italy (current rating: BBB (high), Negative Trend)

U.S.

FED: MNI BRIEF: Fed Balance Sheet Slips From Record High

- The Fed's balance sheet tumbled USD31 billion over the last week to USD7.15 trillion on MBS, data released Thursday showed, pushing the balance sheet down from last week's record high of USD7.18 trillion - for more details please contact sales@marketnews.com.

FISCAL: Treasury Secretary Steven Mnuchin accused House Speaker Nancy Pelosi of pulling a "political stunt" and holding up a new stimulus bill by refusing to offer compromises, in an escalation of acrimonious finger-pointing over stalled virus-relief negotiations. "Your ALL OR NOTHING approach is hurting hard-working Americans who need help NOW," Mnuchin said in a response to a letter from the speaker earlier Thursday that demanded responses on seven critical areas of continuing differences. (BBG)

CORONAVIRUS: The US reported its biggest single-day jump in coronavirus cases of the pandemic, with more than 88,000 new infections on Thursday and more than 1,000 deaths for the second day running. In a further reflection of worrying trends, hospitalisations topped 46,000 for the first time since mid-August. States reported a collective total of 88,452 cases, according to Covid Tracking Project data, streaking past the country's previous one-day record of 83,057 on October 23. (FT)

CORONAVIRUS: The Institute for Health Metrics and Evaluation, an influential modeling group, is projecting a higher U.S. death toll amid a surge in virus cases and hospitalizations. The group now projects about 405,000 Covid-19 deaths by Feb. 1, representing a nearly 20,000 increase from a previous projection of about 386,000 deaths. "Europe is seeing a surge right now and Europe is ahead about a month from the United States. So basically we are watching what would unfold here in the United States," Ali Mokdad, a professor of health metrics sciences with IHME, said Thursday morning in a briefing held by the Infectious Diseases Society of America. The full data are set to be released later Thursday, he said. (BBG)

CORONAVIRUS: Even with an effective vaccine, it could take until the end of 2021 at least for social life in the U.S. to return to normal, Fauci said on a Facebook live event. The earliest a vaccine might be available is the end of December or early January, he said. "I can foresee that even with a really good vaccine mask wearing will continue well into the third or fourth quarter of 2021," said Fauci, the director of the National Institute of Allergy and Infectious Diseases. (BBG)

CORONAVIRUS: El Paso County Judge Ricardo Samaniego said Thursday he is ordering a two-week shutdown of all non-essential services for two weeks to curb the spread of COVID-19. "Our hospitals are at capacity. Our medical professionals are overwhelmed. If we don't respond, we will see unprecedented levels of deaths," Samaniego said at a news briefing. (New York Post)

CORONAVIRUS: New York City's seven-day average of positive test results has taken "a meaningful jump" to 1.92%, its highest point since mid-June, a development Mayor Bill de Blasio described as worrisome. The data, recorded as of Oct. 27, also showed a daily positive test rate for that one day of 2.70% -- twice as high as the previous day. "What worries me but we cannot allow that number to keep growing," de Blasio said, advising New Yorkers to avoid travel and holiday gatherings. "We're really going to have to double down." (BBG)

CORONAVIRUS: U.S. transportation officials and airlines are at odds with public-health officials over whether people who test negative for coronavirus before they travel should still have to quarantine when they arrive in the U.S., according to people familiar with the matter. The rift has emerged as U.S. officials have also been looking to strike deals with their foreign counterparts to establish safe-travel corridors between major American and international cities. (WSJ)

CORONAVIRUS: Utah Governor Gary Herbert warned that the state's hospital system is at risk of being overwhelmed as the virus continues its surge there. "We're very concerned about the direction we're going now," he told reporters. "The hospitals just frankly can't keep up." (BBG)

POLITICS: Former Vice President Joe Biden holds a narrow lead over President Trump in Florida, according to a new Quinnipiac University Poll survey, the latest to show the Democratic presidential nominee with a slight advantage in the nation's largest swing state. With five days to go until Election Day, Biden has the support of 45 percent of likely voters in the Sunshine State, while Trump notches 42 percent support. Another 11 percent of respondents said they are either undecided or declined to name their preference. (The Hill)

POLITICS: Democratic presidential nominee Joe Biden has leads in Pennsylvania and Ohio in a new survey from Quinnipiac University Poll, indicating strength in two key Rust Belt states the former vice president is looking to return to the Democratic column this November. Biden gets the support of 51 percent of likely voters in Pennsylvania, compared to 44 percent for President Trump. Another 4 percent are undecided. The Democrat has a 48 percent to 43 percent advantage in Ohio, where another 8 percent of likely voters are undecided. (The Hill)

POLITICS: Joseph R. Biden Jr. holds a small but durable lead over President Trump in North Carolina, where fully 64 percent of likely voters say they have already cast their ballots, according to a New York Times/Siena College poll released on Thursday. And in a North Carolina race crucial to the control of the Senate, the Democratic challenger, Cal Cunningham, maintains a 46 to 43 percent edge over Senator Thom Tillis, a Republican, despite a late-breaking scandal over romantic texts Mr. Cunningham sent to a woman who is not his wife. Mr. Biden leads Mr. Trump 48 percent to 45 percent in the survey, which was conducted after the final presidential debate last week. Nearly seven in 10 voters said they had watched the debate. Mr. Trump's performance received mixed reviews in North Carolina, with voters split nearly evenly on who they thought won. (New York Times)

POLITICS: More than 80 million Americans have cast ballots in the U.S. presidential election, according to a tally on Thursday from the U.S. Elections Project at the University of Florida, setting the stage for the highest participation rate in over a century. The record-breaking pace, more than 58% of total 2016 turnout, reflects intense interest in the vote, in which incumbent Donald Trump, a Republican, is up against Democratic nominee Joe Biden, a former vice president. (RTRS)

POLITICS: A federal appeals court ruled on Thursday that Minnesota election officials must segregate any ballots that arrive after 8 p.m. on Election Day, reversing the state's seven-day grace period that had been in place for ballots postmarked by Election Day. (New York Times)

AIRLINES: Delta Air Lines and the union that represents its pilots have reached a preliminary cost-cutting agreement that would avoid furloughs until Jan. 1, 2022, the union said Thursday. (CNBC)

EQUITIES: Apple posted record top-line results for the September quarter despite a 21 per cent fall in iPhone sales as people working from home during the pandemic increased the demand for Macs and iPads. The technology group reported $64.7bn of revenue in its fiscal fourth quarter ending in September, compared with expectations of $64bn. Revenue from iPhone sales last quarter amounted to $26.4bn, versus $33.4bn a year ago, as a result of the delayed launch of the iPhone 12. Usually Apple's latest smartphone begins selling in the final two weeks of the September quarter, but this year two of the four models are still not available for sale. (FT)

EQUITIES: Amazon reported better-than-expected third-quarter results after the bell on Thursday, including soaring profits and 37% revenue growth. The stock bounced around in extended trading, falling as much as 2%, after Amazon provided a wide guidance range for the fourth quarter. (CNBC)

EQUITIES: Alphabet Inc. returned to growth in the third quarter after a decline in the previous period, fueled by digital advertising that has rebounded along with the American economy. The shares rose about 7% in extended trading in New York. The Google parent reported third-quarter revenue, minus the cost of distribution deals for its search engine, rose 15% to $38 billion. While that was slower than the pace of growth a year ago, it was a stark change from the 2% drop in the second quarter and better than what analysts were expecting. YouTube, the fastest-growing part of Google's ad business, brought in $5 billion, 32% more than last year. (BBG)

EQUITIES: Facebook Inc. posted a better-than-projected gain in third- quarter revenue, indicating that a major advertiser boycott had a limited impact against the backdrop of a broader revival of spending on digital marketing. (BBG)

EQUITIES: Boeing Co. sold new bonds to help repay nearly $3 billion of debt, announcing the sale just minutes after a downgrade to the company's credit rating. The planemaker issued $4.9 billion of unsecured notes in four parts, according to a person with knowledge of the matter. The debt sale was announced in a filing earlier Thursday, just minutes after Fitch Ratings put out a report cutting Boeing one notch to BBB-, the lowest investment-grade rating, with a negative outlook. (BBG)

OTHER

U.S./CHINA: Complete decoupling between China and the United States is unrealistic, said Han Wenxiu, a senior official in China's Communist Party, at a news briefing in Beijing on Friday. China will promote high-level opening to provide more opportunities for the rest of the world, said Han. (RTRS)

CORONAVIRUS: Germany could be one of the first Western countries to start immunizing people against Covid-19 under a plan being rolled out by the government and a German company that is testing a vaccine, according to people with knowledge of the strategy. The plan is for doses of the vaccine now being held in central storage in Germany to be shipped to more than 60 regional vaccination centers within hours of the substance being approved. (WSJ)

JAPAN: Japan lowered Friday travel advisories issued for eight countries, including China and South Korea, plus Taiwan, as the pace of new coronavirus infections is slowing, Foreign Minister Toshimitsu Motegi said. Japan lowered travel alerts for infectious diseases for Australia, South Korea, Singapore, Thailand, Taiwan, China, New Zealand, Brunei and Vietnam to Level 2 on its scale of four, requesting citizens avoid nonessential trips. Japan previously warned citizens against all overseas travel. (Kyodo News)

JAPAN: The Tokyo government is set to boost the daily coronavirus testing capacity to about 60,000 tests from current 10,200 as the flu season begins, NHK reported. The government will deploy antigen tests in addition to PCR tests to boost the capacity by year end. (BBG)

JAPAN: Japan Finance Minister Taro Aso says he'd like to see an increase in capital spending and wages, in response to a question about a rise in firms' cash holdings. (BBG)

JAPAN/SOUTH KOREA: South Korean President Moon Jae-in's chief of staff and Japan's vice minister for foreign affairs have been directly communicating to resolve wartime forced labor issue, DongA Ilbo newspaper reports, citing an unidentified diplomatic source in Japan. (BBG)

AUSTRALIA/CHINA: Australia lashed out at China's anti-dumping duties on its barley exports in a statement made at the World Trade Organization (WTO) this week, Geneva sources said. (SCMP)

AUSTRALIA: SEEK have noted that "in the fortnight ended 25 October 2020, job ad volumes across Australia were 90% of pre-COVID levels. October has continued the strong growth from September. This is the highest national job ad figure since COVID began having an impact in March. Queensland has now joined Western Australia, South Australia, Northern Territory and Tasmania as states and territories that have more job ads than pre-COVID levels. We have often talked about the close correlation between restrictions easing and more jobs advertised, and this is again evident. The relaxation of restrictions in Victoria from 18 October and the announcement of further restrictions easing now allowing retail and hospitality, in particular, to re-open in the run-up to Christmas has led to strong growth in Victorian job ad volumes. In the last four weeks, Victoria has had a 20-percentage point increase from 56% to 76% of job ads when compared to pre-COVID levels. This growth in job ads for Victoria in the last week brings job ad percentage levels to a similar level with New South Wales and the ACT. If job ads continue to trend upwards in line with restriction lifting, then we will see Victoria overtake New South Wales in terms of percentage of jobs compared to pre-COVID levels in the coming month. In the last fortnight, job ads in New South Wales were at 84% of pre-COVID levels and continues to climb steadily." (MNI)

AUSTRALIA: Queensland will open its borders to travellers from most of New South Wales but continue to ban travellers from Greater Sydney, Premier Annastacia Palaszczuk has announced. (ABC)

NEW ZEALAND: Ministry of Business, Innovation and Employment publishes jobs online report for three months through September, on website. Trend measure of all vacancies index falls 9.9% q/q. Follows revised 13% decline in 2q -- was previously reported as a 32% drop. Trend measure falls for a sixth straight quarter and is back to levels seen in 2013. (BBG)

CANADA: Prime Minister Justin Trudeau's government is considering as much as C$20 billion ($15 billion) in annual permanent spending for new programs that may be revealed as early as next month, according to a senior government official. Finance Minister Chrystia Freeland's fiscal statement at the end of November could include details on government funding plans for child care, prescription drugs and other long-term priorities that will be structural in nature, the official said, speaking on condition they not be identified because they aren't authorized to discuss the plans in public. (BBG)

CANADA: MNI REALITY CHECK: Canada GDP Slows on 2nd Wave, Trade Tension

- Canada's GDP growth is seen slowing for a second month in August from the burst of spending after the spring Covid lockdown, with future obstacles including a second wave of the virus and trade tensions following next week's U.S. election, industry sources told MNI. Output will gain 0.9% according to economists surveyed by MNI, which in normal times would be an outstanding month but today is a big slowdown from gains of 3% in July and 6.5% in June. Retail sales and housing are seen as drivers of growth, while a slowdown in the auto industry hurts manufacturing and wholesales - for more details please contact sales@marketnews.com.

BRAZIL: Brazilian President Jair Bolsonaro, a longtime critic of stay-at-home measures to combat the coronavirus pandemic, said on Thursday that it was "crazy" for countries to start locking down again to control second waves of the virus. (RTRS)

BRAZIL: Brazil expects to have a vaccine against COVID-19 approved and ready for use in a national inoculation program by June, the head of the country's health regulator Anvisa, Antonio Barra Torres, said on Thursday. (RTRS)

BRAZIL: Brazil is studying what import tariffs to drop, the country's Economy Minister Paulo Guedes said on Thursday, adding that if rice, and soy prices rise, tariffs will go to zero. (RTRS)

BRAZIL: Rule that regulates the conditions for registering payment card receivables come into force on Nov. 3 and has been postponed to Feb. 17, according to a central bank statement. Monetary Council also decided that the central bank will require financial institutions that negotiate receivables to carry out tests. (BBG)

BRAZIL: Brazil's economy created a record number of jobs in September as massive government spending sustained output and demand after the coronavirus pandemic spread to the region. The country's labor market added 313,564 net formal jobs last month, the Economy Ministry reported Thursday. That surpassed even the most optimistic forecast from 20 economists surveyed by Bloomberg and compares to a median estimate of 242,500. It was the third straight positive result and represents the biggest one-month gain since the Labor Ministry began the series in 1992. (BBG)

OIL: Kuwait said on Thursday it would support any decision made by OPEC and its allies on future oil supply policy after OPEC and industry sources told Reuters some producers would prefer to pump more from January rather than extend output curbs. (RTRS)

OIL: U.S. Gulf Shuts In 1.57mln B/D Or 84.8% Oil Production: BSEE (BBG)

OIL: The US government has seized four Iranian gasoline cargoes totaling 1.12 million barrels bound for Venezuela, the latest move in the Trump administration's increased sanctions pressure on both oil-producing countries. (Platts)

OIL: The oil fields prioritized for development since 2019 by Petroleos Mexicanos have significantly underperformed the Mexican state oil company's targets, data from the national oil regulator (CNH) showed on Thursday. Of 20 priority fields, 16 have executed investments - 13 of which are offshore in the southern Gulf of Mexico - and only 10 have completed wells through August. (RTRS)

FOREX: South Korea's National Pension Service will increase its holdings in FX havens, such as the Swiss franc and the U.S. dollar, in case of heightened financial anxiety as part of its plan to reduce the risk of its portfolio being exposed to FX volatility, the nation's health ministry says in a statement. (BBG)

CHINA

ECONOMY/POLICY: China will strive for more balanced "high-quality" development during the 2021-2025 Five-Year Plan, focusing on areas such as technology innovation, the real economy and internal demand, the 21st Business Herald said in an editorial, Published following the Fifth Plenary Meeting of the 19th Central Committee of the CPC, the Herald editorial said that China should achieve self-reliance in science and technology through promoting innovation capacity among technology enterprises and individual talents. China should develop a more advanced and modernized industrial system and service industry to promote the development of the real economy, and a strong domestic market under the "dual circulation" model would encourage comprehensive consumption and expand the investment space, the Herald said. (MNI)

ECONOMY: China can raise per capita income to that of a mid-tier developed country by 2035 if the country can maintain an annual growth rate of 5-5.5% in the next five years and 4-5.5% over the next 15, the National Business Daily reported citing Yan Se, associate professor at Guanghua School of Management, Peking University. Total factor productivity needs to stay above 2%, so China needs to improve its scientific and technological strength to become an innovation-driven economy and push reforms to make production more market-oriented, Yan said. (MNI)

BONDS/PROPERTY: Domestic bond issuance by Chinese property developers rose 56.9% y/y from September to Oct. 29 to CNY101.75 billion, taking the total for the year to CNY628.35 billion, up 20.5% y/y, the Securities Daily reported citing data from Wind. Land premiums in Q4 were likely to drop as developers with higher debts slow land acquisition and focus on debt reduction, the Daily reported citing Wang Xiaoqiang, a data analyst from Zhuge Zhaofang. The increasing debt issuance during September and October reflected companies' utilization of the policy window before new regulations, and also the relatively low financing costs, Wang said. (MNI)

OVERNIGHT DATA

JAPAN SEP, P INDUSTRIAL OUTPUT -9.0% Y/Y; MEDIAN -9.8%; AUG -13.8%

JAPAN SEP, P INDUSTRIAL OUTPUT +4.0% M/M; MEDIAN +3.0%; AUG +1.0%

JAPAN SEP UNEMPLOYMENT 3.0%; MEDIAN 3.1%; AUG 3.0%

JAPAN SEP JOB-TO-APPLICANT RATIO 1.03; MEDIAN 1.03; AUG 1.04

MNI DATA IMPACT: Japan Sep Jobless Rate Stays at 3-Year High

- Japan's average unemployment rate stood at a seasonally-adjusted 3.0% in September, unchanged from August's 3.0% and maintaining a three-year high as businesses in non-manufacturing sectors remained weak, according to data released by the Ministry of Internal Affairs and Communications on Friday - for more details please contact sales@marketnews.com.

JAPAN OCT TOKYO CPI -0.3% Y/Y; MEDIAN -0.1%; SEP +0.2%

JAPAN OCT TOKYO CORE CPI -0.5% Y/Y; MEDIAN -0.5%; SEP -0.2%

JAPAN OCT TOKYO CORE-CORE CPI -0.2% Y/Y; MEDIAN -0.2%; SEP 0.0%

JAPAN SEP HOUSING STARTS -9.9% Y/Y; MEDIAN -8.6%; AUG -9.1%

JAPAN SEP ANNUALIZED HOUSING STARTS 0.815MN; MEDIAN 0.823MN; AUG 0.819MN

JAPAN SEP CONSTRUCTION ORDERS -10.6% Y/Y; AUG +28.5%

AUSTRALIA Q3 PPI -0.4% Y/Y; Q2 -0.4%

AUSTRALIA Q3 PPI +0.4% Q/Q; Q2 -1.2%

AUSTRALIA SEP PRIVATE SECTOR CREDIT +2.0% Y/Y; MEDIAN +2.0%; AUG +2.2%

AUSTRALIA SEP PRIVATE SECTOR CREDIT +0.1% M/M; MEDIAN +0.1%; AUG 0.0%

NEW ZEALAND OCT ANZ CONSUMER CONFIDENCE INDEX 108.7; SEP 100.0

NEW ZEALAND OCT ANZ CONSUMER CONFIDENCE +8.7% M/M; SEP -0.2%

The ANZ-Roy Morgan Consumer Confidence Index bounced in October. The profile is remarkably similar to business sentiment indicators: a sharp bounce, a wobble, then renewed improvement to still slightly under-par levels. (ANZ)

SOUTH KOREA SEP INDUSTRIAL OUTPUT +8.0% Y/Y; MEDIAN +1.3%; AUG -2.6%

SOUTH KOREA SEP INDUSTRIAL OUTPUT +5.4% M/M; MEDIAN +3.1%; AUG -0.3%

SOUTH KOREA SEP CYCLICAL LEADING INDEX CHANGE 0.4; AUG 0.6

UK OCT LLOYDS BUSINESS BAROMETER -18; SEP -11

CHINA MARKETS

PBOC NET INJECTS CNY30BN VIA OMOS

The People's Bank of China (PBOC) injected CNY100 billion via 7-day reverse repos with the rate unchanged on Friday. This resulted in a net injection of CNY30 billion after the maturity of CNY70 billion of reverse repos, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.2000% at 09:21 am local time from the close of 2.4962% on Thursday: Wind Information.

- The CFETS-NEX money-market sentiment index closed at 46 on Thursday vs 39 on Wednesday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.7232 FRI VS 6.7260

MARKETS

SNAPSHOT: E-Minis Hit On Big Tech Earnings, Eyes On Familiar Risks

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 197.99 points at 23136.71

- ASX 200 down 32.141 points at 5928.2

- Shanghai Comp. down 3.277 points at 3269.45

- JGB 10-Yr future down 8 ticks at 151.94, yield up 0.4bp at 0.036%

- Aussie 10-Yr future down 2.0 ticks at 99.165, yield up 1.3bp at 0.829%

- U.S. 10-Yr future +0-04+ at 138-17+, yield down 1.51bp at 0.808%

- WTI crude up $0.08 at $36.24, Gold up $7.36 at $1875.07

- USD/JPY down 25 pips at Y104.36

- E-MINIS STRUGGLE AFTER BIG TECH EARNINGS

- ECB POLICYMAKERS DEBATED MORE BOND PURCHASES, BANK LOANS (RTRS SOURCES)

- FAUCI: RETURN TO NORMAL WILL TAKE AT LEAST A YEAR (BBG)

- SENIOR CCP OFFICIAL: COMPLETE U.S.-CHINA DECOUPLING UNREALISTIC (RTRS)

BOND SUMMARY: Month-End, Soft E-Minis & Risk Events Eyed

T-Notes operated in a 0-05+ range, last +0-04+ at 138-17+, with yields across the cash curve unchanged to 1.7bp richer, as the curve bull flattens. Little to note on the headline front in Asia-Pac hours, with the space drawing support from the dip in e-minis, which came on the back of big tech earnings, allowing Tsys to move away from their respective Thursday lows. Eurodollar futures sit unchanged to +1.0 through the reds, with a ~20K sale of EDU1 triggering a burst activity across the front end of the strip in Asia-Pac hours.

- JGBs were offered in Tokyo, owing to the New York impetus in U.S. Tsys, with futures last -8 vs. settlement, hugging a tight range. Yields across the curve generally cheapened at the margins, excl. 2s. The latest round of BoJ Rinban operations saw the purchase sizes of the buckets covering 1-10 Year paper left as was, with offer/cover ratios as follows: 1-3 Year: 2.75x (prev. 1.56x), 3-5 Year: 3.23x (prev. 3.48x), 5-10 Year: 2.66x (prev. 3.17x).

- Aussie bonds have looked through ACGB supply matters and in line with exp. local private sector credit release, with focus well and truly on next week's headline risk events, namely the RBA decision and U.S. election. Curve holds steeper, YM unch., XM -1.5, with the cash space twist steepening vs. settlement. Swaps are generally wider vs. ACGBs. Larger than usual ACGB month-end extensions & the proximity to the RBA decision may be cushioning the long end, promoting some outperformance vs. Tsys since yesterday's Sydney close.

JGBS AUCTION: Japanese MOF sells Y6.1679tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y6.1679tn 3-Month Bills:

- Average Yield -0.0845% (prev. -0.0793%)

- Average Price 100.0227 (prev. 100.0213)

- High Yield: -0.0800% (prev. -0.0744%)

- Low Price 100.0215 (prev. 100.0200)

- % Allotted At High Yield: 33.9886% (prev. 54.9827%)

- Bid/Cover: 3.230x (prev. 3.228x)

BOJ: 1-10 Year Rinban Sizes Unchanged

The BoJ offers to buy a total of Y1.19tn of JGB's from the market, sizes unchanged from previous operations:

- Y420bn worth of JGBs with 1-3 Years until maturity

- Y350bn worth of JGBs with 3-5 Years until maturity

- Y420bn worth of JGBs with 5-10 Years until maturity

AUSSIE BONDS: The AOFM sells A$2.0bn of the 1.50% 21 Jun '31 Bond, issue #TB157:

The Australian Office of Financial Management (AOFM) sells A$2.0bn of the 1.50% 21 June 2031 Bond, issue #TB157:- Average Yield: 0.8498% (prev. 0.9395%)

- High Yield: 0.8525% (prev. 0.9400%)

- Bid/Cover: 4.7175x (prev. 4.9275x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 10.6% (prev. 90.6%)

- bidders 54 (prev. 45), successful 28 (prev. 13), allocated in full 17 (prev. 4)

AUSSIE BONDS: Nothing Of Note On Next Week's AOFM Issuance Schedule

The AOFM has released its weekly issuance schedule:

- On Monday 2 November October it plans to sell A$1.5bn of the 0.25% 21 November 2025 Bond.

- On Thursday 5 November it plans to sell A$1.0bn of the 26 February 2021 Note & A$1.0bn of the 21 May 2021 Note.

- On Friday 6 November it plans to sell A$2.0bn of the 1.00% 21 December 2030 Bond.

EQUITIES: E-Minis Struggle After Big Tech Earnings

E-minis have struggled since the closing bell on Wall St., although the 3 major contracts have not forced a real test of Thursday lows, yet, with the space struggling in the wake of after-market earnings reports from tech giants including Apple, Alphabet, Amazon & Facebook. While the headline numbers seen in the reports (revenue & EPS) were mostly beats, Thursday's Wall. St. rally (the buy the rumour sell the fact narrative) and some of the idiosyncracies surrounding the earnings releases, including guidance, are being identified as the drivers behind the pull back.

- The NASDAQ e-mini underperformed owing to the tech-centricity of the move, although all 3 major contracts are off worst levels.

- Regional Asia-Pac equities also struggled as a result.

- Nikkei 225 -0.6%, Hang Seng unch., CSI 300 -0.2%, ASX 200 unch.

- S&P 500 futures -27, DJIA futures -177, NASDAQ 100 futures -130.

OIL: Crude Nudges Off Thursday Lows

WTI and Brent sit ~$0.20 above their respective settlement levels at typing, after correcting from lows during Thursday's NY session. Thursday's price action wasn't as choppy as what was seen in the equity space, with Brent & WTI shedding over $1.00 apiece come settlement, although the uptick in equities and news that 85% of U.S. Gulf of Mexico production was shut in, per the latest BSEE count, allowed the overmentioned uptick from lows.

- The previously flagged COVID-19 demand worry surrounding Europe remains, while rumours re: the potential for the OPEC+ group to delay its planned uptick in production is swirling. Kuwait officials noted that the country would support any decision made by the group re: future oil production.

GOLD: A Lower Low

USD & U.S. real yield dynamics remain in the driving seat, with another lower low printed on Thursday, before bullion recovered from worst levels. Gold has nudged higher in Asia-Pac trade to last print at $1,875/oz. Technically, bears need to force their way through the Sep 28 low and bear trigger at $1,848.8/oz.

FOREX: USD Loses Ground Into Month-End, CNH Well Bid

The USD went offered in Asia as we are nearing the month-end and a downtick in the three major e-mini contracts did little to help the dollar. Demand for the yuan added pressure to the greenback, with USD/CNH shedding ~300 pips thus far as communique surrounding China's next five-year economic plan received scrutiny. There was little that we wouldn't already know in comments from Chinese leaders, who reiterated desire to turn the country into a global technological hub and promote the role of domestic market in driving economic growth.

- CHF joined USD in losing steam, but JPY help up fairly well, even as it is the last Gotobi Day of the month today.

- AUD tracked gains in the yuan, topping the G10 pile as a result. Commodity-tied peers CAD & NOK also firmed up, but NZD failed to pick up a bid. AUD/NZD recoiled from a three-month low and advanced towards its 200-DMA, but failed to test the level as of yet.

- KRW garnered some strength owing to a faster than expected recovery in South Korea's industrial production.

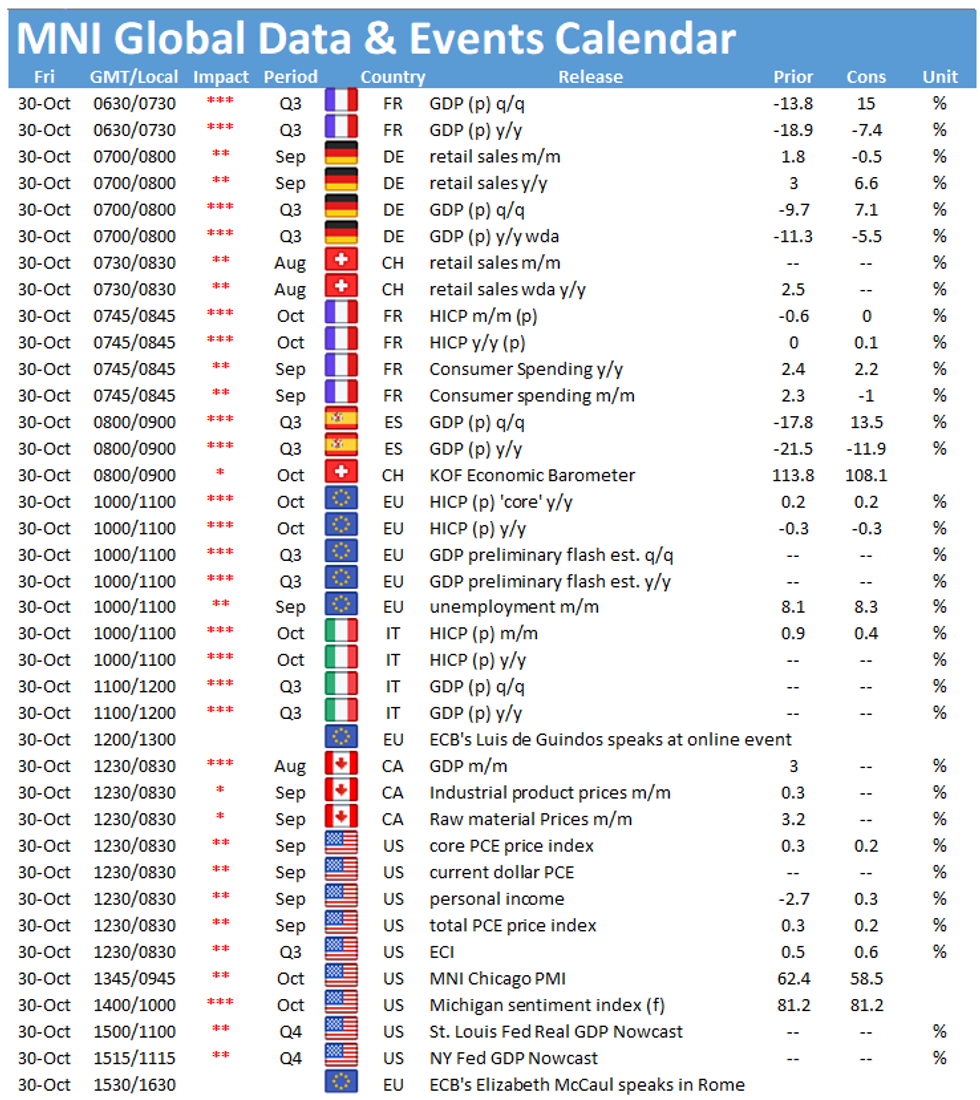

- On the radar today we have EZ unemployment & advance GDP, flash French & Italian GDPs & CPIs, Canadian GDP, personal income/spending & MNI Chicago PMI out of the U.S., ECB Survey of Professional Forecasters as well as comments from ECB's de Guindos, Visco, Weidmann & Mersch.

FOREX OPTIONS: Expiries for Oct30 NY cut 1000ET (Source DTCC):

- EUR/USD: $1.1700(E830mln), $1.1750-54(E1.5bln), $1.1800(E2.2bln), $1.1850(E1.7bln), $1.1870-75(E573mln), $1.1925(E571mln), $1.1950(E1.7bln-EUR calls), $1.2000(E1.3bln)

- USD/JPY: Y103.00($915mln), Y104.00($1.4bln), Y104.50($2.6bln), Y104.80-85($1.9bln), Y104.95-105.00($1.2bln), Y106.00-05($2.2bln), Y106.50($760mln)

- GBP/USD: $1.3100-10(Gbp543mln)

- EUR/JPY: Y123.50-55(E562mln), Y124.50(E497mln)

- USD/NOK: Nok9.80($500mln), Nok10.00($1.54bln)

- EUR/NOK: Nok10.75-76(E638mln), Nok10.77(E790mln), Nok10.80(E585mln), Nok10.90(E525mln)

- AUD/USD: $0.7180-85(A$783mln), $0.7200(A$632mln)

- AUD/JPY: Y76.75(A$602mln), Y77.45(A$1.2bln)

- AUD/NZD: N$1.0695-00(A$752mln), N$1.0750(A$1.2bln)

- USD/CAD: C$1.3025($1.1bln), C$1.3150($1.3bln), C$1.3225-30($626mln)

- USD/CNY: Cny6.63($883mln), Cny6.65($640mln), Cny6.67($500mln), Cny6.70($532mln), Cny6.72($860mln), Cny6.74($500mln)

UP TODAY (Time GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.