-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Market Jitters Evident Ahead Of Notable Risk Events

OVERNIGHT NEWS AND PRESS

EXECUTIVE SUMMARY

* UK SET TO ENTER FRESH LOCKDOWN, WITH FURTHER MEASURES GOING INTO PLAY ACROSS EUROPE

* BREXIT TALKS GO INTO ANOTHER WEEK AS EU, UK PUSH TO SALVAGE TRADE DEAL (RTRS)

* BREXIT NEGOTIATORS MOVE CLOSE TO BREAKING IMPASSE OVER FISH (BBG)

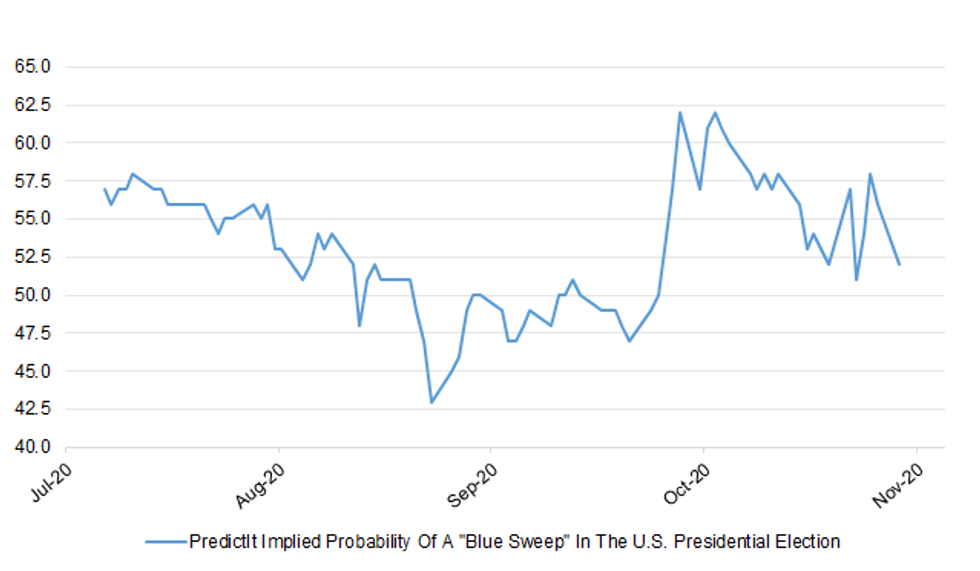

* LITTLE MOVEMENT IN BLUE WAVE U.S. ELECTION BETTING ODDS OVER THE WEEKEND

* OIL TRADES HEAVY. E-MINIS BOUNCE FROM EARLY LOWS

Fig 1: PredictIt Implied Probability Of A "Blue Sweep" In The U.S. Presidential Election

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Prime Minister Boris Johnson has announced a second national lockdown for England to prevent a "medical and moral disaster" for the NHS. He said Christmas may be "very different" but he hoped taking action now would mean families can gather. Pubs, restaurants, gyms and non-essential shops will have to close for four weeks from Thursday, he said. But unlike the restrictions in spring, schools, colleges and universities can stay open. (BBC)

CORONAVIRUS: A month-long partial lockdown announced by Prime Minister Boris Johnson late Saturday might have to be extended if it fails to contain the spread of the coronavirus, Cabinet Office Minister Michael Gove said. "It will get reviewed on Dec. 2, but we're always driven by what the data show," Gove said Sunday on Sky News's Sophy Ridge show. "We will always take the decision in the national interest based on the evidence, the best information that we have." When pressed by Ridge on whether the restrictions could be extended if the data wasn't good, Gove replied, "yes." (BBG)

CORONAVIRUS: England's lockdown could extend into the new year with a brief relaxation over the Christmas period, cabinet ministers have warned amid a backlash from Tory MPs. Michael Gove, the Cabinet Office minister, confirmed yesterday that the second lockdown could last beyond December 2 if the rate of transmission had not fallen. Cabinet ministers told The Times that they believed it would be "very difficult" to end the lockdown if deaths and hospital admissions were still rising. (The Times)

CORONAVIRUS: England has breached its "reasonable worst-case" scenario for COVID-19 infections and hospital admissions, the government's scientific advisers have said. The Scientific Advisory Group for Emergencies (SAGE) also warned that the number of daily deaths in England is in line with that scenario, but "is almost certain to exceed this within the next two weeks". (Sky)

CORONAVIRUS: The travel ban on English visitors to Wales could continue even after the firebreak lockdown ends, the First Minister has warned.Mark Drakeford on Friday said that restrictions introduced last week preventing people from crossing the border into Wales could be extended due to the "significant gap" in transmission rates between England and Wales. (Telegraph)

BREXIT: EU and British Brexit negotiators will continue talks in Brussels on Monday and until around mid-week, sources on both sides said on Sunday, in a sign both sides are still pushing to avoid a damaging breakdown in trade in less than nine weeks. Intensive and secretive, the talks are a final bid to seal a new partnership agreement for when Britain's transition out of the European Union runs its course at the end of this year. If the sides overcome their differences, the new deal would govern everything from trade and energy to transport and fisheries. If they fail, an estimated $900 billion of annual bilateral trade in goods and services would be damaged from Jan.1 by tariffs and quotas. An EU diplomatic source and a UK official said negotiations would continue face-to-face in Brussels on Monday following a full weekend of talks. An update on their progress and the chances of a deal was expected on Wednesday or Thursday, they added. EU Brexit negotiator Michel Barnier said on Friday that "much remains to be done" to seal a deal. Another EU diplomat following Brexit in Brussels told Reuters over the weekend that talks were still difficult on the most sensitive issues, including those of economic fair play, fishing rights and how to settle disputes in future. (RTRS)

BREXIT: U.K. and European Union officials are zeroing in on a solution to break the eight-month deadlock over one of the biggest obstacles to their planned trade deal. In a sign that an agreement could be struck by the mid-November deadline set by both sides, a compromise is emerging on the issue of what access EU boats will have to U.K. fishing waters, according to two people with knowledge of the EU side of the discussions. The potential solution would allow Britain to claim it has won back control of its seas -- a key government demand -- and pave the way for the country's fishing industry to catch more than it does currently. (BBG)

BREXIT: The chief negotiators of the U.K. and European Union may have hatched a plan to give a post-Brexit trade deal one last shot, but one man could yet stand in their way. Dominic Cummings, Boris Johnson's powerful chief adviser, has largely been absent from the discussions in Downing Street about Brexit since the Conservative party's election victory in December as the government grappled with the coronavirus and its overhaul of the civil service. Yet his influence looms large. With a deal in sight -- but likely to require major concessions from Britain to achieve it -- EU officials still fear the architect of the 2016 Vote Leave campaign could make one final dramatic and disruptive intervention. Two weeks ago, Cummings was back, pushing Johnson to leave the talks without an agreement, according to three people with knowledge of the matter. (BBG)

BREXIT: Brexit negotiators fear the crunch trade talks could be scuppered by rising Covid-19 cases. Amid soaring levels of coronavirus infections in Brussels, where detailed talks are taking place this weekend, officials are concerned that the negotiations could collapse if any senior figures test positive for the disease, leading to key negotiators having to isolate. The talks are now centred on draft legal texts of a post-Brexit trade agreement. Officials believe that the negotiations are now at a stage that is too complex to be effectively conducted by video conference - with less than two weeks thought to be remaining to agree a deal. (Telegraph)

FISCAL:. Under the package announced by the prime minister, state payments will be made to furloughed workers of as much as 80% of their wages through the new lockdown period. Another key announcement involved those with a mortgage: Borrowers hurt by the virus will be entitled to a six-month mortgage holiday, and those who have already suspended payments will be allowed to extend the arrangement by the same period without it being recorded on their credit file. (BBG)

FISCAL: Plans to extend the Government's furlough scheme by just a month have been attacked by Britain's big business groups, amid warnings that uncertainty over the duration of a second lockdown risks unleashing a wave of job losses and corporate failures this autumn. (Telegraph)

FISCAL: Pressure is mounting on the Treasury to offer businesses extended loan support to stop a December cash crunch after top state aid lawyers revealed Brussels has already cleared the path for more help. (Telegraph)

FISCAL: Rishi Sunak has warned colleagues that a second lockdown has thrown the Government's ability to maintain current levels of spending on public services into doubt. (Telegraph)

FISCAL: Sadiq Khan and Boris Johnson have struck a rescue deal worth up to £1.8bn for Transport for London to keep bus and Tube services in the capital running for another six months. The agreement, announced early on Sunday — just hours ahead of a crucial deadline — will prevent the collapse of TfL until the end of the financial year. But discussions will continue on a new funding package for the following year, with lockdown restrictions expected to play further havoc on the group's main income stream. (FT)

ECONOMY: A record jobs disaster could be on the way as long-term unemployment is set to hit a record 1.6m next year, if the second wave of Covid crushes the recovery. The youngest and oldest workers are at particular risk of falling out of work for 12 months or more, potentially for many years to come, the Learning and Work Institute has warned. More than 1m could still be in this category by the middle of the decade, withdire implications for families and the wider economy. (telegraph)

ECONOMY: The second lockdown will plunge Britain into a double-dip recession, economists warned yesterday as they downgraded their forecasts for the UK economy sharply. Tighter restrictions will obliterate the country's fragile economic recovery, causing final-quarter GDP to shrink by as much as 8 per cent and undoing the progress of the summer months. (The Times)

POLITICS: The Brexit Party is to be relaunched as an anti-lockdown party called Reform UK, Nigel Farage and Richard Tice will announce on Monday, in a move which could alarm libertarian Conservative MPs. (Telegraph)

EUROPE

ECB: European authorities could "do anything" to help boost the economy, Fabio Panetta, a member of the European Central Bank's executive board, said at an online forum Saturday. "What we'll do I don't know, and if I did know I wouldn't say," Panetta said at the event organized by newspaper Il Foglio. (BBG)

ECB: The European Central Bank doesn't need to further fuel booming demand for green bonds, according to Governing Council member Robert Holzmann. Favoring climate-friendly securities risks distortions in financial markets, Holzmann, who also heads the Austrian National Bank, said in an interview. (BBG)

ECONOMY: Fresh lockdowns announced across Europe in recent days to contain the resurgence of the coronavirus pandemic have triggered a flurry of downgrades to economic growth forecasts as restrictions on activity threaten the continent's recovery. The eurozone economy is now expected to shrink by 2.3 per cent in the fourth q arter of this year, according to economists surveyed by the Financial Times — a worse performance than they had predicted before the restrictions were announced. (FT)

GERMANY: German Foreign Minister Heiko Maas said the country won't close its borders even if the coronavirus numbers get worse, according to the Berlin-based newspaper Tagesspiegel. (BBG)

GERMANY: German Chancellor Angela Merkel's Christian Democrats (CDU) will choose a new leader in mid-January, the party's general secretary said on Saturday after a Dec. 4 party congress was postponed due to the resurgent coronavirus pandemic. (RTRS)

GERMANY: German authorities have confirmed cases of bird flu in the states of Mecklenburg-Western Pomerania, Schleswig-Holstein and Hamburg and called for stepped-up monitoring of poultry farms, the Agriculture Ministry said in a statement. (BBG)

FRANCE: The coronavirus "is circulating slightly more slowly than in the spring," French Health Minister Olivier Veran told Journal du Dimanche. He said the government hopes the renewed lockdown will allow families to reunite for Christmas. "The more we abide by the lockdown, the shorter it will be," Veran said in the Sunday interview. "We are trying to create the conditions for a Christmas that is the least restrictive as possible." (BBG)

ITALY: Italian Prime Minister Giuseppe Conte may approve further restrictions to curb the coronavirus outbreak that would stop short of a nationwide lockdown, according to local media. Conte is due to address parliament on Monday ahead of an evening cabinet meeting that could stop travel between regions and close shopping malls at weekends, Corriere della Sera and La Stampa wrote on Sunday. Stricter localized curbs -- including mini-lockdowns for the worst hit cities such as Milan and Naples -- would be left to regional authorities. Some governors are resisting the plan. Attilio Fontana, chief of Milan's Lombardy region and a close ally of opposition leader Matteo Salvini, said that if a lockdown is necessary it should be applied to the country as a whole, according to newswire Ansa. (BBG)

ITALY: Italy's health minister said on Sunday that new data on the coronavirus was "terrifying" and the country had two days to approve further restrictions to curb its spread. (RTRS)

PORTUGAL: Portugal extended restrictions to more regions, including its capital Lisbon, as the government tries to contain the spread of the coronavirus pandemic while keeping shops and restaurants open. Starting Nov. 4, restrictions that were already in place in three municipalities of northern Portugal will apply to a total of 121 districts that have reported more virus cases, Prime Minister Antonio Costa said at a press conference in Lisbon on Saturday night. (BBG)

GREECE: Greece will expand a night-time curfew on movement and shut restaurants and bars in the most populous areas of the country for one month to contain a resurgence in COVID-19 cases, its Prime Minister said on Saturday. The country has reported less cases of the novel coronavirus than most in Europe, but has seen a gradual increase in infections since early October. (RTRS)

IRELAND: Activity in Ireland's services sector shrank in September for the first time in three months as the government reimposed some COVID-19 restrictions amid a surge in cases across Europe, a survey showed on Monday. (RTRS)

BELGIUM: Belgium has announced a return to a national lockdown as the latest coronavirus figures show it has the highest infection rate in Europe. Non-essential shops and businesses offering personal services like hair salons have been ordered to close from Monday until the middle of December. Any gatherings in public spaces must be limited to a maximum of four people. Supermarkets can only sell essential goods and households are allowed just one visitor. Autumn school holidays have also been extended until 15 November. (BBC)

AUSTRIA: Austria imposed a second lockdown after the coronavirus pandemic got out of control in the past two weeks, with the government surrendering as its plan to make do with lighter, targeted measures failed to stem the surge. Chancellor Sebastian Kurz announced the new restrictions on Saturday, roughly following Germany's example with a partial lockdown. (BBG)

SWITZERLAND: Faced with the worsening Covid-19 situation, canton Geneva will enter a state of semi-confinement from 7pm on Monday. Bars, restaurants and non-essential shops will be closed; schools will remain open. (SwissInfo)

SWEDEN: Swedish industrial employers and labor groups have reached a new agreement for wages to rise by an annual 2.23%, unions said. The increase totals 5.4% over the next 29 months, union IF Metall said in a statement. The new agreement will be in effect from Nov. 1 to March 31, 2023. (BBG)

RATINGS: Sovereign rating reviews of note from after hours on Friday included:

- Fitch affirmed Finland at AA+, Outlook Stable

- DBRS Morningstar confirmed Italy at BBB (high), Negative Trend

AIRLINES: The Netherlands has rejected a cost-cutting plan put forth by Air France-KLM's Dutch arm and withheld a portion of a 3.4 billion-euro ($4 billion) government bailout until it approves the restructuring plan. (BBG)

U.S.

FED: The Federal Reserve won't increase the pace of its asset purchases this year or next, and wouldn't meaningfully boost the U.S. economy even if it did so, according to most economists surveyed by Bloomberg News. Many Fed watchers are eager for more guidance on the future of the central bank's balance-sheet policy, but aren't expecting any new clues when the Federal Open Market Committee gathers Nov. 4-5. (BBG)

FISCAL/POLITICS: If Joe Biden gets elected, he will work to provide two relief packages — a short-term package before inauguration "that delivers relief to working families" and a long-term one to "build back" the economy, his campaign's policy director, Stef Feldman, said Friday at an Axios virtual event. (Axios)

CORONAVIRUS: The U.S. is reporting an "extremely high and quite unacceptable" daily number of Covid-19 cases ahead of the winter season when people will be spending more time indoors and threatening to spread the virus even more, White House coronavirus advisor Dr. Anthony Fauci said. (CNBC)

CORONAVIRUS: Dr. Scott Gottlieb warned that the United States is only "at the beginning of the steep part of the epidemic" as the number of coronavirus infections and hospitalizations across the country break grim records. In an interview on CNBC's "The News with Shepard Smith" on Friday, the former FDA chief said, "You'll see cases start to accelerate into the coming weeks, I think the inflection point really is going to be Thanksgiving." (CNBC)

CORONAVIRUS: New York Gov. Andrew Cuomo is ending a requirement for travelers from places with a high amount of coronavirus cases to quarantine for two weeks upon arriving in the state. Instead, Cuomo will require travelers to get tested for Covid-19 before traveling, and again within three days of entering the state, a spokesperson for Cuomo confirmed to CNBC on Saturday. New York residents returning from travel under 24 hours outside the state do not need to take a test before coming back. However, they must take a test after returning. (CNBC)

CORONAVIRUS: San Francisco will pause its planned reopenings, which included greater capacity for indoor dining at restaurants and movie theaters, as Covid-19 cases continue to surge across the U.S., Mayor London Breed said. (CNBC)

CORONAVIRUS: New York Governor Andrew Cuomo said he has established protocols that would allow students in Covid cluster areas to return to school. Cuomo said he has been working with public and private schools, including yeshivas and Catholic schools, in zones with the highest positive infection rates. (BBG)

FISCAL: Senate Majority Leader Mitch McConnell (R-Ky.) says he expects Congress to move another coronavirus relief package "right at the beginning" of 2021, breaking from Speaker Nancy Pelosi (D-Calif.), who told reporters Thursday she wants to get a deal in the lame-duck session. "We probably need to do another package, certainly more modest than the $3 trillion Nancy Pelosi package. I think that'll be something we'll need to do right at the beginning of the year," McConnell told conservative radio host Hugh Hewitt on Friday. (The Hill)

POLITICS: President Trump trails by 10 percentage points among voters nationally in the final days of his re-election campaign, facing substantial public anxiety over the coronavirus pandemic but with broad approval of his management of the economy, a new Wall Street Journal/NBC News poll finds. (WSJ)

POLITICS: Former Vice President Joe Biden holds an advantage in the upper Midwest states of Wisconsin and Michigan, according to CNN Polls conducted by SSRS, but the race between Biden and President Donald Trump is tighter in the battlegrounds of Arizona and North Carolina. Trump won all four of these states in 2016, and a loss on Tuesday in any of them would make his narrow path to 270 electoral votes more difficult. The polls, conducted as the campaign comes to its close, show little movement in the presidential race compared with previous CNN polls in each state. (CNN)

POLITICS: Democratic nominee Joe Biden narrowly leads President Donald Trump in Pennsylvania, Florida, and Arizona -- and by a wider margin in Wisconsin -- according to a set of New York Times/Siena College polls in those four critical swing states that together could decide the U.S. presidential election. (New York Times)

POLITICS: The pandemic versus the economy defines the presidential contest in two key battlegrounds, with Florida holding firm to its toss-up status while Joe Biden leads slightly in Pennsylvania in the season's final ABC News/Washington Post polls. There's little change in either state. (ABC)

POLITICS: Emerson College released battleground state polls that showed Biden up in Michigan, but the race in Ohio and Iowa within the margin of error and essentially tied. (BBG)

POLITICS: Joe Biden holds a modest six-point lead with likely voters over President Donald Trump in the hard-fought swing state of North Carolina, a new NBC/Marist poll shows. (NBC)

POLITICS: Joe Biden will become "an underdog" if he fails to win Pennsylvania and its 20 electoral votes, FiveThirtyEight founder Nate Silver said on ABC's "This Week" Sunday. (Axios)

POLITICS: Senior officials on Democratic presidential nominee Joe Biden's campaign are increasingly worried about insufficient Black and Latino voter turnout in key states like Florida and Pennsylvania with only four days until the election, according to people familiar with the matter. (BBG)

POLITICS: President Trump has told confidants he'll declare victory on Tuesday night if it looks like he's "ahead," according to three sources familiar with his private comments. That's even if the Electoral College outcome still hinges on large numbers of uncounted votes in key states like Pennsylvania. Speaking to reporters on Sunday evening, Trump denied that he would declare victory prematurely, before adding, "I think it's a terrible thing when ballots can be collected after an election. I think it's a terrible thing when states are allowed to tabulate ballots for a long period of time after the election is over." (Axios)

POLITICS: Republican Party officials say they're already looking to Pennsylvania, Minnesota and Nevada as likely battlegrounds for post-election lawsuits if the results are close. (Axios)

POLITICS: Donald Trump has raised the spectre of "bedlam" after the November 3 vote, magnifying fears that the US president will challenge the result as the number of early voters passes record levels. As of Saturday evening, more than 90m ballots had been cast in the election, according to the US Elections Project, a database compiled by Michael McDonald, a professor at the University of Florida. That is 65 per cent of the total votes cast in 2016, suggesting massive turnout. (FT)

POLITICS: The Texas Supreme Court denied a petition Sunday by a group of Republicans seeking to invalidate nearly 127,000 drive-thru votes in Harris County, while a similar case awaits a decision in federal court just two days before Election Day. (CNN)

POLITICS: The U.S. Postal Service (USPS) must remind senior managers they must follow its "extraordinary measures" policy and use its Express Mail Network to expedite ballots ahead of Tuesday's presidential election, under an order signed by a U.S. judge. U.S. District Judge Emmet Sullivan's order on Sunday, which was agreed to by USPS, said the postal service must reinforce its "special procedures" to ensure it "delivers every ballot possible by the cutoff time on Election Day." (RTRS)

U.S. TSYS: MNI Analysis: November Treasury Refunding Estimate Preview

- MNI has published a preview of sell-side analyst expectations for the Treasury quarterly refunding announcement next week Wednesday, November 4 at 0830ET. Expectations are mixed but TIPS are widely expected to increase - for more details please contact sales@marketnews.com.

EQUITIES: MNI US Earnings Calendar - Firms on Track For Strong Quarter

- 13% of the S&P500 are due to report in the week commencing November 2nd, with a decent mix across sectors. As usual, Thursday is the busiest session for the index - for more details please contact sales@marketnews.com.

OTHER

U.S./CHINA: Huawei is working on plans for a dedicated chip plant in Shanghai that would not use American technology, enabling it to secure supplies for its core telecom infrastructure business despite US sanctions. Two people briefed on the project said the plant would be run by a partner, Shanghai IC R&D Center, a chip research company backed by the Shanghai Municipal government. Industry experts said the project could help Huawei, which has no experience in fabricating chips, chart a path to long-term survival. (FT)

U.S./CHINA: The U.S Commerce Department said on Sunday it would "vigorously defend" an executive order that seeks to bar transactions with Chinese-owned short video-sharing app TikTok after a federal judge halted the action. (RTRS)

U.S./CHINA: Biden also spoke about other issues important to Iowa voters, like the struggles faced by family farmers, severe floods that have swept the Midwest and the trade fight with China. "I'm going to hold China accountable — which he hasn't, from the start of the pandemic!" Biden said of Trump. (Canadian Press)

GEOPOLITICS: The Pentagon has quietly begun withdrawing top military officers from U.S. embassies in Africa and downgrading other such posts world-wide, a move officials say is necessary to shift resources to counter China and Russia on the geopolitical stage and meet congressional caps on the number of generals and admirals in the U.S. military. (Dow Jones)

GEOPOLITICS: Armenia has formally asked Russian President Vladimir Putin to discuss defense assistance to the country if the military conflict with Azerbaijan spills over into Armenian territory, according to a statement from the Armenian Foreign Ministry. (BBG)

GEOPOLITICS: Pakistani Prime Minister Imran Khan said on Sunday his government will give provisional provincial status to part of Kashmir, drawing condemnation from India, which has long objected to any such changes by Islamabad. (Nikkei)

CORONAVIRUS: AstraZeneca Plc said on Sunday Britain's health regulator had started an accelerated review of its potential coronavirus vaccine. "We confirm the MHRA's (Medicines and Healthcare Products Regulatory Agency) rolling review of our potential COVID-19 vaccine," an AstraZeneca spokesman said. In rolling reviews, regulators are able to see clinical data in real time and have dialogue with drug makers on manufacturing processes and trials to accelerate the approval process. (RTRS)

CORONAVIRUS: Two companies behind an at-home rapid COVID-19 test are releasing encouraging clinical trial results ahead of applying for an emergency use authorization (EUA), company executives tell Axios. (Axios)

HONG KONG: Police in Hong Kong arrested seven pro-democracy politicians on Sunday for their involvement in scuffles at a Legislative Council meeting in May. (BBG)

HONG KONG: The Hong Kong Monetary Authority will keep monitoring development of the city's property market, Deputy Chief Executive Arthur Yuen says at the city's legislature Monday, when asked whether the HKMA will relax mortgage measures. Banks' asset quality deteriorated in 3Q but at a slower pace. Hong Kong's financial market and U.S. dollar peg are operating effectively, Chief Executive Eddie Yue says. HKMA sees no need to adjust dollar peg. (BBG)

JAPAN: Japan will exempt qualified business travelers who return after overseas trips lasting one week or less from a 14-day-quarantine requirement starting on Sunday. (Nikkei)

AUSTRALIA: Australia on Sunday recorded its first day with no local cases of coronavirus transmission since June even as a growing number of countries impose renewed measures to stem the resurgent pandemic. (BBG)

AUSTRALIA/CHINA: Australia's former Prime Minister Kevin Rudd is sounding the alarm about U.S.-China tensions over Taiwan, warning a full-blown crisis is an all too real possibility -- especially during a potentially rocky period following Tuesday's American presidential election. (Nikkei)

NEW ZEALAND: New Zealand Prime Minister Jacinda Ardern's Labour Party on Sunday signed an agreement with the Green Party to form government in the Pacific nation of nearly five million. Ardern earlier this month delivered the biggest election victory for her centre-left Labour Party in half a century. Although she no longer needs support from other parties to govern, coalitions are the norm in New Zealand as parties look to build consensus. (RTRS)

NORTH KOREA: South Korea and the United States are closely watching movements at North Korea's main Yongbyon nuclear complex, military authorities said Monday, amid a report on signs of brisk activities there. (Yonhap)

TURKEY: Turkey is waging war against a "devil's triangle" of interest rates, inflation and exchange rates, President Recep Tayyip Erdogan said on Saturday, a day after the lira hit a fresh low. (BBG)

TURKEY: Turkey's central bank has changed the method of setting interest rates for credit-card transactions, leading to an increase in costs for consumers. (BBG)

TURKEY: The French president Emmanuel Macron has accused Turkey of adopting a "bellicose" stance towards its NATO allies, saying tensions could ease if his Turkish counterpart Recep Tayyip Erdoğan showed respect and did not tell lies. In an interview with al-Jazeera broadcast on Saturday, Macron condemned Turkey's behaviour in Syria, Libya and the Mediterranean and said: "Turkey has a bellicose attitude towards its NATO allies." He also sought to calm flaring tensions with Muslims around the world after increasingly heated rhetoric following the murder of French school teacher, Samuel Paty, who showed caricatures of the prophet Muhammad alongside other cartoons as part of a discussion on free speech. (AFP)

MEXICO: Current prices for crude make it likely Mexico's 2020 oil hedge will pay out and cover 80% of lost oil revenue this year, Deputy Finance Ministry Gabriel Yorio said Friday, helping the government compensate for a drop in revenue due to the economic impact of the coronavirus outbreak. (BBG)

BRAZIL: Brazil's government may revise its official 2020 economic growth forecast of -4.7%, an Economy Ministry official said on Friday, adding that the economy is in a strong "V-shaped" recovery from the worst of the COVID-19 crisis earlier this year. In an online presentation, special secretary Waldery Rodrigues also said the treasury is considering taking a $1 billion loan from the World Bank, and said emergency welfare payments and spending will not be extended into next year. (RTRS)

BRAZIL: Brazil's government on Friday revised its 2020 debt and deficit forecasts to new record highs to take into account the heavy borrowing and spending needed to support individuals, businesses and local authorities from the COVID-19 crisis. (RTRS)

IRAN: Iranian hackers have been targeting U.S. state government websites in "an intentional effort to influence and interfere with the 2020 U.S. presidential election," according to an investigation by the FBI and the Cybersecurity & Infrastructure Security Agency (CISA). The hackers have "successfully obtained voter registration data in at least one state," the FBI and CISA advisory report published Friday said. (CNBC)

OIL: Iraqi oil minister Ihsan Ismaael has denied a Reuters report that said Iraq wants to seek an exemption from OPEC+ output cuts in 2021, calling the report "baseless" and reaffirming the country's support for the curbs agreed in April. (Platts)

OIL: Libya's daily crude output has reached 800,000 barrels per day and the country is targeting 1.3 million barrels at the beginning 2021, according to Mustafa Sanalla, the chairman of state-run National Oil Corp. The reopening of the last of Libya's oil fields and ports has prompted a resurgence of the energy industry, with the OPEC nation's daily production jumping from less than 100,000 barrels in early September. (BBG)

OIL: U.S. Gulf Shuts In 852,967 B/D Or 46.11% Oil Production: BSEE (BBG)

OIL: The world's largest independent oil trader doubts that new coronavirus lockdowns in Europe will lead to another significant drop in crude prices following last week's rout. "This is a speed bump," Mike Muller, the head of Asia for Vitol Group, said in an interview Sunday with Dubai-based consultant Gulf Intelligence. "We are not going to see a violent reaction in price on Monday." (BBG)

CHINA

POLICY: MNI POLICY: China to Use Domestic Market to Drive Growth: Xi

- China should use an expansion in domestic consumption to drive sustainable economic growth and help combat the rise of counter-globalization trends, according to Chinese President Xi Jinping. In an article published in the Communist Party magazine QiuShi on Nov. 1, which cited a speech given in April, Xi said that China should focus on innovation and improving the quality of its industrial chains to better integrate with global supply chains, and create a counterbalance to achieve self-circulation under extreme circumstances. "We should not, and cannot simply repeat the models of the past, but seek to create new industrial chains to increase technological innovation and the ability to replace imports," Xi said. China should strengthen the real economy with manufacturing as the foundation, while exploring tools such as a digital currency and digital tax to gain new competitive advantages. State-owned enterprise reforms should be encouraged without weakening and negating the sector's leadership role in future development, said Xi. (MNI)

YUAN: China should keep the current limit on the yuan's movement to 2% to avoid sending a misleading signal which might encourage speculation, wrote Sheng Songcheng, a former counsellor of the People's Bank of China, in an article published by the International Economic Review. China should beware of fast capital inflows and the quick appreciation of the yuan while relaxing restrictions to facilitate outbound investments, Sheng said. (MNI)

EQUITIES: China's 4,066 public companies reported CNY CNY1.27 trillion in combined profits from Q3 as of Nov. 1, up 18% y/y, and confirming the recovering macro indicators reported by the government, the Economic Information Daily reported on Monday citing data from Wind. Revenues from Q3 gained 6.9% from CNY13.47 trillion, according to the Daily. Around 37.6% of the companies reported a decline in net profits. Upstream businesses, including the resource sector, led the rebound from losses in the previous quarter, while airports and transportation also improved as the pandemic effects waned, according to the data. (MNI)

EQUITIES: China will simplify the initial public offering process for companies by introducing a registration-based screening mechanism that emphasizes companies' disclosures, with the changes extended to all boards, according to a statement by Vice Premier Liu He. China will also improve the market-based interest rate system so policy rates can be extended to all participating companies, according to Liu, who heads the Financial Stability and Development Committee of the State Council. (MNI)

BANKING: China's biggest state-owned banks are still plagued by a surge in bad loans even as an early containment of the pandemic and a recovery in the world's second-largest economy helped them trim profit declines. Net income slid less than 5% at Industrial & Commercial Bank of China Ltd. and its three largest rivals in the three months through Sept. 30, compared with an average 25% slump in the prior quarter. Still, the four banks saw their combined non-performing loans climbed to a record 979 billion yuan ($146 billion) after charging 175 billion yuan on credit impairments in the quarter, according to reports released late last week. China's $45 trillion banking industry suffered their worst profit slump in more than a decade in the first half after being put on the front-line in helping millions of struggling businesses hurt by the pandemic. (BBG)

MARKETS: New rules making it easier for international investors to trade in China's booming capital markets have come into force, adding momentum to Beijing's sweeping liberalisation of its financial system. The measures, which went into effect on Sunday, update the official schemes that govern foreign access to the country's enormous capital markets. (FT)

OVERNIGHT DATA

CHINA OCT M'FING PMI 51.4; MEDIAN 51.3; SEP 51.5

CHINA OCT NON-M'FING PMI 56.2; MEDIAN 56.0; SEP 55.9

CHINA OCT COMPOSITE PMI 55.3; SEP 55.1

MNI DATA IMPACT: Caixin China Oct PMI Surges Near 10-Yr High

- The Caixin China PMI for October rose 0.6 of a point to 53.6, the highest level since February 2011, with manufacturing supply and demand booming as the impact of the epidemic fades, according to publisher Caixin in an email announcement - for more details please contact sales@marketnews.com.

CHINA OCT CAIXIN M'FING PMI 53.6; MEDIAN 52.8; SEP 53.0

To sum up, recovery was the word in the current macro economy, with the domestic epidemic under control. Manufacturing supply and demand improved at the same time. Enterprises were very willing to increase inventories. Prices tended to be stable. Business operations improved, and entrepreneurs were confident. But the twists and turns of overseas infections remained a headwind for exports. The full recovery of employment depends on stronger and more-lasting business confidence. As the economic indicators for consumption, investment and industrial output for September were generally better than expected, it is highly likely that the economic recovery will continue for the next several months. But there are still many uncertainties outside of China, so policymakers need to be cautious about normalizing post-coronavirus monetary and fiscal policies. (Caixin)

JAPAN OCT, F JIBUN BANK M'FING PMI 48.7; FLASH 48.0

October PMI data pointed to a further easing in the downturn across the Japanese manufacturing sector, as firms reported slower falls in output and new orders. Japanese manufacturers will be particularly buoyed by the return to growth in export orders, as demand across key overseas markets such as China picked up. The sector reported a weakening employment trend in October, however, as staff numbers fell at a faster pace compared to September. Although ongoing issues surrounding an ageing population have held back the Japanese labour market, recent contractions in staffing levels have been exacerbated by the COVID-19 pandemic, as voluntary leavers have not been replaced. An encouraging finding in October was the sustained improvement in business optimism. Approximately 38% of Japanese manufacturers surveyed foresee an increase in output over the coming 12 months, strengthening the index to its highest reading in over three years. (IHS Markit)

JAPAN OCT VEHICLE SALES +31.6% Y/Y; SEP -15.6%

AUSTRALIA OCT AIG M'FING PMI 56.3; SEP 46.7

The Australian Industry Group Australian Performance of Manufacturing Index (Australian PMI®) increased by 9.6 points to 56.3 points in November (seasonally adjusted), indicating expanding conditions for the first time since July. Results above 50 points indicate expansion with higher results indicating a faster rate of expansion. Respondents across all sectors noted a jump in sales and new orders as a result of pent up demand from the initial activity restrictions. The jump into expansion was driven by large improvements in New South Wales, which rose into expansion, and Victoria, which remained in contraction but improved from a deep contraction in September. (AiG)

AUSTRALIA OCT, F MARKIT M'FING PMI 54.2; FLASH 54.2

The Australian manufacturing upturn lost some momentum at the start of the fourth quarter, with slower increases in output and new orders, according to the latest PMI survey data. While ongoing pandemic measures continued to weigh on manufacturing activity, logistical issues associated with global freight capacity disruptions and industrial actions at Australian docks also led to a reduced availability of input materials, which disrupted the production process. A further disruption to the distribution of manufacturing inputs may therefore affect output growth in the coming months. That said, longer-term prospects remained upbeat as Australian goods producers expect a further easing of coronavirus restrictions and government's stimulus spending on infrastructure spending to drive output higher over the coming year. (IHS Markit)

AUSTRALIA OCT ANZ JOB ADVERTISEMENTS +9.4% M/M; SEP +8.3%

AUSTRALIA SEP BUILDING APPROVALS +15.4% M/M; MEDIAN +1.5%; AUG -2.3%

AUSTRALIA SEP PRIVATE SECTOR HOUSES +9.7% M/M; AUG +4.4%

AUSTRALIA SEP HOME LOANS VALUE +5.9% M/M; AUG +12.6%

AUSTRALIA SEP OWNER-OCCUPIER LOAN VALUE +6.0% M/M; AUG +13.6%

AUSTRALIA SEP INVESTOR LOAN VALUE +5.2% M/M; AUG +9.3%

AUSTRALIA OCT CORELOGIC HOUSE PRICE INDEX +0.2% M/M; SEP -0.2%

AUSTRALIA OCT MELBOURNE INSTITUTE INFLATION +1.1% Y/Y; SEP +1.3%

AUSTRALIA OCT MELBOURNE INSTITUTE INFLATION -0.1% M/M; SEP +0.1%

AUSTRALIA OCT COMMODITY INDEX AUD 97.4; SEP 94.8

AUSTRALIA OCT COMMODITY INDEX SDR -0.3% Y/Y; SEP -5.2%

NEW ZEALAND SEP BUILDING PERMITS +3.6% M/M; AUG +0.3%

NEW ZEALAND OCT CORELOGIC HOUSE PRICE INDEX +8.0% Y/Y; SEP +7.6%

SOUTH KOREA OCT TRADE BALANCE +$5.981BN; MEDIAN +$4.485BN; SEP +$8.696BN

SOUTH KOREA OCT EXPORTS -3.6% Y/Y; MEDIAN -3.5%; SEP +7.6%

SOUTH KOREA OCT IMPORTS -5.8% Y/Y; MEDIAN -2.1%; SEP +1.6%

SOUTH KOREA OCT MARKIT M'FING PMI 51.2; SEP 49.8

October data marks a clear improvement in South Korea's manufacturing sector. A gradual recovery has been seen as the impacts of the COVID-19 pandemic eased and outright expansions in both output and new orders were registered, with both rising at their fastest paces in seven-and-a-half years. Furthermore, the sector was bolstered by a return to expansion in overseas demand. Although the latest data points to only a fractional increase, firms signalled increasing demand in key export markets such as the US and China. Nevertheless, firms signalled evidence of ongoing spare capacity amid further falls in employment levels, extending the current sequence of job losses to 18 months. On a more positive note, South Korean manufacturers reported a more optimistic outlook for activity over the coming 12 months. This positive outlook chimes with the IHS Markit forecast for industrial production to grow by 3.5% in 2021. (IHS Markit)

CHINA MARKETS

SNAPSHOT: Market Jitters Evident Ahead Of Notable Risk Events

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 340.05 points at 23316.55

- ASX 200 up 21.818 points at 5949.4

- Shanghai Comp. down 1.625 points at 3222.907

- JGB 10-Yr future down 4 ticks at 151.84, yield down 0.2bp at 0.04%

- Aussie 10-Yr future up 0.5 ticks at 99.175, yield down 0.4bp at 0.824%

- U.S. 10-Yr future +0-00+ at 138-07+, yield down 1.52bp at 0.859%

- WTI crude down $1.38 at $34.41, Gold up $1.19 at $1880.02

- USD/JPY up 7 pips at Y104.73

- UK SET TO ENTER FRESH LOCKDOWN, WITH FURTHER MEASURES GOING INTO PLAY ACROSS EUROPE

- BREXIT TALKS GO INTO ANOTHER WEEK AS EU, UK PUSH TO SALVAGE TRADE DEAL (RTRS)

- BREXIT NEGOTIATORS MOVE CLOSE TO BREAKING IMPASSE OVER FISH (BBG)

- LITTLE MOVEMENT IN BLUE WAVE U.S. ELECTION BETTING ODDS OVER THE WEEKEND

- OIL TRADES HEAVY. E-MINIS BOUNCE FROM EARLY LOWS

BOND SUMMARY: Choppy, Contained Trade Ahead Of Global Risk Events

Negative news flow evident over the weekend (centred on the lockdown situation in Europe & the UK) resulted in risk-off flow early on in Asia, adding to a degree of caution ahead of this week's risk-laden U.S. docket, providing a bid for Tsys. However, T-Notes are now back from best levels, last +0-00+ at 138-07+, after the Nikkei 225 traded on the front foot, which allowed 5&P 500 e-minis to bottom out and unwind early losses, with cash Tsys sitting unchanged to 1.5bp richer across the curve, with 10s leading. A ~2.5K block sale of T-Notes also helped the space back from early highs. Headline flow has generally been light since the re-open, outside of a stronger than expected round of Chinese Caixin manufacturing PMI data, which had no real impact on the space.

- JGB futures unwound the bulk of their overnight losses in early Tokyo trade, before holding a narrow range. Futures last sit 3 ticks softer than settlement levels. Cash JGB yields are marginally mixed. Comments from PM Suga offered little new, with little of note locally on Monday ahead of Tuesday's holiday.

- In Australia, XM ticked away from early Sydney/SYCOM lows, allowing the space to flatten at the margins, and there has been little in the way of retracement, with YM unch. and XM +0.5. Local data provided little real impetus for the space. Aussie 10s are holding tighter vs. U.S. 10s ahead of tomorrow's RBA decision.

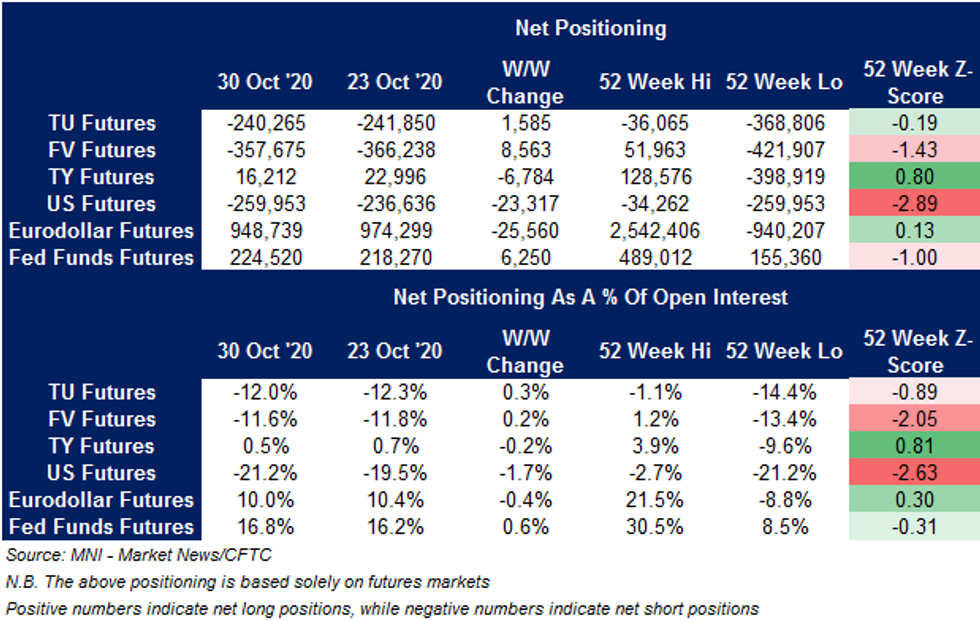

US TSYS: Futures Positioning Twist Steepens Again

Weekly CFTC positioning, covering the week through October 27, pointed to another week of twist steepening in U.S. fixed income futures positions, with another record short position lodged in US (30-Year) futures.

- STIR positioning was a little more mixed, with marginal trimming of net longs in the Eurodollar futures space, while Fed Funds futures positioning gained marginal net length.

AUSSIE BONDS: The AOFM sells A$1.5bn of the 0.25% 21 Nov '25 Bond, issue #TB161:

The Australian Office of Financial Management (AOFM) sells A$1.5bn of the 0.25% 21 November 2025 Bond, issue #TB161:- Average Yield: 0.2745% (prev. 0.3143%)

- High Yield: 0.2750% (prev. 0.3175%)

- Bid/Cover: 6.2733x (prev. 6.1867x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 81.7% (prev. 19.0%)

- bidders 45 (prev. 49), successful 11 (prev. 13), allocated in full 2 (prev. 6)

EQUITIES: E-Minis Bounce As Japan Outperforms In Asia

E-minis bounced from their early Asia-Pac lows (which came on the back of the latest lockdown measures being implemented in the UK/Europe & a heavy start to the week for crude oil), aided by a move higher in the Nikkei 225, in the wake of a slew of Japanese corporate earnings. The move also came ahead of a Japanese holiday, slated for Tuesday, so presented the final opportunity for meaningful pre-U.S. election trade in Tokyo.

- Stronger than expected Chinese Caixin m'fing PMI data also provided a boost for broader sentiment after the official Chinese PMI metrics printed in line with broader expectations over the weekend.

- More broadly, market participants are focused on the incoming round of U.S. risk events, headlined by the aforementioned U.S. election and subsequent FOMC decision.

- Chinese equity trade was choppy, in lieu of a heavy round of corporate earnings in recent days, focus on the Ant Financial IPO, knock on impact from Chinese PMI data and as participants assessed the impact of the U.S. election on Sino-U.S. relations.

- Nikkei 225 +1.3%, Hang Seng +0.9%, CSI 300 +0.4%, ASX 200 +0.3%.

- S&P 500 futures +5, DJIA futures +38, NASDAQ 100 futures +6.

OIL: Headwinds From Both Sides Of The Coin

WTI & Brent sit $1.30-1.40 below their respective settlement levels in early trading this week, with a combination of supply and demand side matters pressuring crude.

- On the supply side there has been another uptick in Libyan crude production (which now sits at 800K bpd vs. less than 100K bpd in early September), while U.S. Gulf of Mexico facilities have started to come back online after the latest round of weather related disruption, with ~46% of the region's production shut in, per the latest BSEE count.

- Meanwhile, the latest round of lockdowns in the UK & mainland Europe provide further pressure from the demand side.

- The sell off came even as trading giant Vitol pointed to no real chance of a violent move lower, referring to the latest round of demand side issues as a "speed bump."

- We should highlight that the benchmarks currently sit the best part of $1.00 off intra-day lows, aided by a bounce in e-minis and the Nikkei 225.

GOLD: U.S. Risk Events Front & Centre

Lower U.S. Tsy yields have provided a modest bid for bullion in early trade this week, outweighing the impact of an uptick for the dollar, with participants focused on the upcoming slew of U.S. risk events. Spot trades a handful of dollars higher at $1,882/oz, with little to note in the way of technical developments since last week's show below initial support.

FOREX: Initial Risk-Off Impulse Sets Tone

Initial risk-off impetus set the tone for G10 FX space at the start of the week, even as e-minis recouped losses. A supply-driven slide in oil prices and deepening lockdowns across mainland Europe & the UK knocked risk on its head as markets re-opened, with commodity-tied FX landing at the bottom of the G10 pile. The likes of AUD, NZD, CAD & NOK remain the worst performers in the space, while safe havens USD, JPY & CHF firmed up. Data releases out of core Asia-Pac economies provoked little to no reaction, with participants preparing for this week's risks, including the U.S. election & monetary policy decisions from the RBA & FOMC.

- GBP took a hit as PM Johnson announced that England will go into a four-week lockdown this Thursday, which could be extended if health data suggests that the spread of new Covid-19 infection has not been contained. Source reports suggesting that the UK & EU are close to reaching agreement over fishing rights may have provided some relief to the sterling, but were overshadowed by the spectre of impending lockdown.

- CNH edged higher as Chinese Caixin M'fing PMI unexpectedly improved to its best level since 2011. The reaction move was relatively limited, with USD/CNH last sitting ~60 pips worse off.

- KRW resisted early pressure from wider risk aversion, as local Markit M'fing PMI returned into expansion, while trade data from over the weekend showed a continued recovery in daily average exports. BoK Gov Lee said that the central bank will hold a special meeting on Nov 4 to assess the impact of the U.S. election.

- PMI from across the globe will continue to trickle out, drawing attention today. Central bank speaker slate features ECB's Rehn & Mersch.

FOREX OPTIONS: Expiries for Nov2 NY cut 1000ET (Source DTCC):

- EUR/USD: $1.1570-85(E549mln-EUR puts), $1.1700(E526mln), $1.1750(E574mln), $1.1795-00(E838mln), $1.1815-20($980mln)

- USD/JPY: Y104.50($440mln), Y104.85-00($693mln)

- GBP/USD: $1.3100(Gbp1.2bln), $1.3150(Gbp961mln)

- EUR/GBP: Gbp0.8900(E2.2bln-EUR puts), Gbp0.9000(E1.5bln mixed/E1.44bln EUR puts)

- AUD/USD: $0.7000-10(A$486mln), $0.7140-45(A$1.9bln)

- USD/CAD: C$1.3300($662mln)

- USD/CNY: Cny6.65($770mln)

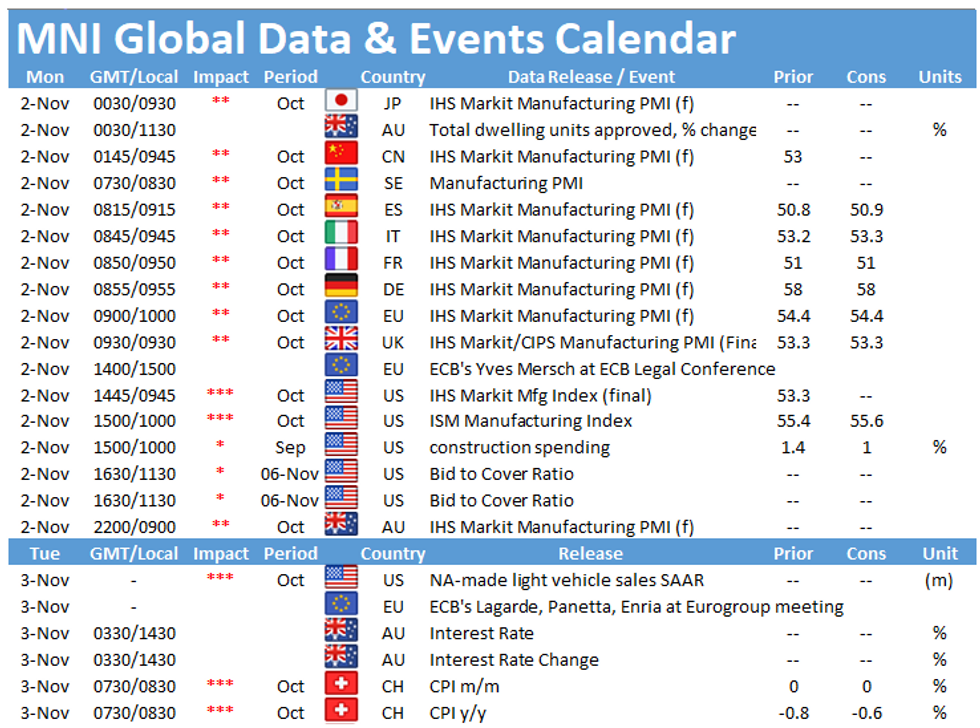

UP TODAY (Time GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.