-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Thursday's Defensive Tone Spills Into Asia

OVERNIGHT NEWS AND PRESS

EXECUTIVE SUMMARY

* WHITE HOUSE LEAVES STIMULUS TO CONGRESS AS BIDEN ENTERS FRAY (BBG)

* TRUMP BANS INVESTMENTS IN COS THAT WHITE HOUSE SAYS AID CHINA'S MILITARY (CNBC)

* ECB'S MULLER SAYS ULTRA-CHEAP LOANS ARE KEY FOR NEXT STIMULUS (BBG)

* POLAND THREATENS TO VETO EU RECOVERY FUND OVER RULE-OF-LAW FIGHT (BBG)

* PFIZER VACCINE FACES BREXIT RISK, UK PARTNER WARNS (SKY)

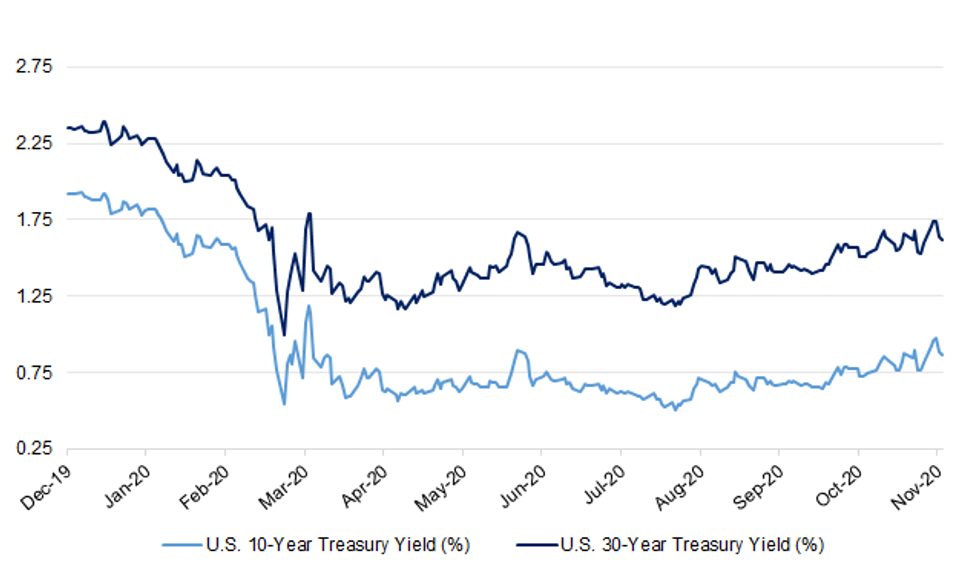

Fig. 1: U.S. 10-Year vs. 30-Year Treasury Yield (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: A panel of distinguished economists has painted a gloomy picture of the global outlook, arguing that further monetary stimulus would not be as effective as it had been in the past, and that the economy is facing a much wider and more protracted downturn than after the 2008 financial crisis. Speaking at the Financial Times' Global Boardroom event, Bill Dudley, the former president of the Federal Reserve Bank of New York, said monetary policy had "done a tremendous job in terms of supporting the economy". (FT)

CORONAVIRUS: Travellers arriving into the UK from mainland Greece will need to self-isolate for two weeks starting from 4am on November 14, transport secretary Grant Shapps has announced. Northern Ireland's devolved government has reached an agreement to prolong its coronavirus lockdown for one week from Friday, ending days of deadlock and rancour within the power-sharing executive. (FT)

BREXIT: The "penny is dropping" in Brussels over the UK's post-Brexit status as an independent nation as the deadline for a trade deal nears, says Michael Gove. The cabinet office minister told the BBC that British negotiators needed to see "movement on the EU side". The two sides resumed talks in London this week, with a UK government source saying they were in the "final stage". But gaps remain, such as on fishing rights, with the UK source saying the EU's position was "wholly unrealistic". Negotiations are set to continue in Brussels next week. (BBC)

BREXIT: The UK financial regulator's head of Brexit preparations has warned that banks and investment firms still face three "cliff-edge" risks when the transition period for leaving the EU expires in seven weeks. Speaking at Thursday's City & Financial summit on post-transition regulation, Nausicaa Delfas — the Financial Conduct Authority's executive director of international — said issues with derivatives trading, the transfer of personal data and offering services to customers in the EU remained a real possibility after January 1. "We should not assume, even if a deal is agreed, that it will mitigate outstanding risks in financial services," she said. The first two of those threats could yet be addressed by a last-minute deal with the EU, she said. (FT)

BOE: MNI BRIEF: UK/EU Trade Deal As Best Outcome: BOE Bailey

- A UK-EU trade deal would be the best outcome from current Brexit negotiations and "I really hope there will be one," Bank of England Governor Andrew Bailey said Thursday. In other remarks at the ECB forum in Sintra, Bailey also said that the BOE has had to rethink how quantitative easing works and how it can be done in future. "We have had to think about QE for the financial sector and quantitative measures for main street," he said. On the outlook, Bailey said it was an important benefit for monetary policy from the news of a Covid vaccine was that it should reduce uncertainty from its current extreme levels - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FISCAL: Rishi Sunak has been warned that he risks a furious backlash from entrepreneurs if he acts upon proposals to reform capital gains tax to help pay for the cost of the coronavirus pandemic. Business leaders said that plans to align capital gains rates with higher income tax levels would stifle economic recovery, encourage an exodus of entrepreneurs and further damage morale among bosses of embattled private companies. (The Times)

ECONOMY: The number of job adverts posted has risen to levels not seen since before lockdown in March, a study indicates. There were 1.36 million active UK job adverts in the first week of November, according to the Recruitment & Employment Confederation (REC). However, it said regional disparities were clear, with north-west England and Wales leading the recovery, while London had seen a fall in vacancies. There were more adverts for jobs in nursing than any other sector, it said. (BBC)

ECONOMY: Footfall on high streets and retail parks has fallen to its lowest level since the spring lockdown after shops were closed under new government restrictions designed to slow the spread of coronavirus. Road traffic has also dived after the second lockdown came into force on November 5, according to the Office for National Statistics' weekly report on real-time data. On Monday this week the number of vehicles on the roads was 24 per cent lower than pre-pandemic levels, the lowest level since mid June. (The Times)

POLITICS: Boris Johnson's senior adviser Dominic Cummings is expected to leave his position by the end of the year. Mr Cummings told the BBC "rumours of me threatening to resign are invented", after speculation this week. But he added that his "position hasn't changed since my January blog" when he said that he wanted to make himself "largely redundant" by the end of 2020. And a senior Downing Street source said that Mr Cummings would be "out of government" by Christmas. It follows a turbulent week at No 10 in which Lee Cain - the director of communications and an ally of Mr Cummings - also stood down amid reports of internal tensions at Downing Street. (BBC)

POLITICS: Boris Johnson is planning to reset his premiership after the resignation of his director of communications by ending culture wars, promoting the green agenda and taking a less dogmatic approach to the Union. As part of a new strategy, which is backed by his fiancée, Carrie Symonds, the prime minister will seek to soften the government's image and rebuild relations with MPs. (The Times)

RATINGS: Sovereign rating reviews of note scheduled for after hours on Friday include:

- DBRS Morningstar on the UK (current rating: AAA, Negative Trend)

EUROPE

ECB: MNI BRIEF: ECB Lagarde - Welcome Vaccine But Urge Caution

- Although the early emergence of what appears to be a successful vaccine should be welcomed, there must still be a sense of caution as even if further testing is sussessful, many problems are still present including manufacture in quantity and distribution logistics, European Central Bnak President said Thursday - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

ECB: Bank of France Governor Francois Villeroy de Galhau says it may make sense for the European Central Bank to extend exceptional measures at its December meeting. Villeroy says ECB acted fast in March with TLTRO measures for bank lending and then PEPP asset purchase program. "As the crisis goes on for longer than expected, there could be a strong logic to extending the duration of these exceptional measures," Villeroy says on BFM Business TV. "We will recalibrate our monetary measures," Villeroy says when asked about the December meeting. He adds that ECB will be "as reactive and innovative" as necessary. (BBG)

ECB: The European Central Bank should put ultra-cheap loans at the core of its next stimulus package being prepared for December, Governing Council member Madis Muller said. Speaking in an interview from Tallinn, the Estonian central bank chief emphasized the need for a renewed so-called TLTRO push rather than additional bond buying via the Pandemic Emergency Purchase Program, saying the situation isn't like it was in March when the ECB was fighting market dislocation. "Perhaps PEPP by itself is not the best tool to provide further support, and we should at least think about a combination of different measures," Muller said. "It's best if we can find measures that more directly address the financing conditions for the private sector in particular. In that sense, speaking of TLTROs it would be a possible tool that should be on the table." (BBG)

ECB: MNI INTERVIEW: ECB To Up PEPP, Cut TLTRO Rate - Ex Markets Chief

- The European Central Bank may boost its Pandemic Emergency Purchase Programme and cut the rate of TLTRO loans to banks at its Dec. 10 meeting, but needs new policies to push inflation to target, former ECB market operations director general Francesco Papadia told MNI - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FISCAL: Polish Prime Minister Mateusz Morawiecki joined his Hungarian counterpart in threatening to veto the European Union's 1.8 trillion-euro budget over the bloc's efforts to make sure funds only go to countries that adhere to democratic standards. Morawiecki sent a letter to European Commission President Ursula von der Leyen criticizing the mechanism, a commission spokesman confirmed on Thursday. (BBG)

FRANCE: French coronavirus victims needing hospital treatment rose to a record, stiffening the government's resistance to easing lockdown restrictions early. Hospitalizations rose by 737 to 32,683, climbing above the previous April 14 high, after the country reported record infections in the past three weeks, health authorities said on Thursday. Earlier, French Prime Minister Jean Castex ruled out relaxing the nation's curbs, dashing the hopes of many retailers. "My role is not today to give in to pressure," he said. (BBG)

ITALY/BTPS: Italy's government will ask parliament to approve as much as 20 billion euros in extra borrowing as soon as this month to cover aid during the country's latest lockdowns, according to people familiar with the matter. Prime Minister Giuseppe Conte's government wants the funds to cover measures to protect stores, restaurants and other businesses affected by new coronavirus restrictions, the people said on condition of anonymity. The spending would be pushed into the 2021 budget, they said. A Treasury official said the department doesn't comment on speculation. Officials in the finance ministry have been working on estimates for how much aid will be needed in the coming months, particularly if the health situation worsens and restrictions need to be toughened. The monthly cost could be between 6 billion euros and 10 billion euros, Bloomberg reported earlier this week. (BBG)

PORTUGAL: The Portuguese government extended existing restrictions to more regions as it tries to contain the spread of the coronavirus outbreak. From Monday, limits to movement that were already in place in 121 municipalities including Lisbon will apply to a total of 191 municipalities that have reported more infections, Prime Minister Antonio Costa said at a press conference on Thursday. (BBG)

RATINGS: Sovereign rating reviews of note scheduled for after hours on Friday include:

- Fitch on Austria (current rating: AA+; Outlook Stable) & France (current rating: AA; Outlook Negative)

- Moody's on Austria (current rating: Aa1; Outlook Stable)

- S&P on the Netherlands (current rating: AAA; Outlook Stable)

- DBRS Morningstar on Cyprus (current rating: BBB (low), Stable Trend)

U.S.

FED: MNI BRIEF: Fed Powell - Next Few Months To Be Challenging

- There are growing risks to the U.S economy from the reemerging spread of Covid-19 infections across the country, Federal Reserve Chairman Jerome Powell said Thursday. Although accepting any successful vaccine would be a boost in the medium to longer-term, he said the next few months could be very challenging - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FED: Judy Shelton appears now to have enough Republican support for her controversial nomination to the Federal Reserve's board of governors to get through. Senate Majority Leader Mitch McConnell said Thursday he will advance Shelton's name to the Senate floor after Sen. Lisa Murkowski (R-Alaska) told reporters she now will support the economic advisor to President Donald Trump, CNBC's Ylan Mui reported. (CNBC)

FED: MNI BRIEF: Fed's Balance Sheet Assets Close to Record High

- The Federal Reserve's balance sheet edged up to USD7.175 trillion this week on increased holdings of Treasuries, putting its total assets just shy of the previous record set in late October, data released Thursday showed - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

ECONOMY: MNI DATA IMPACT:1/3 US Shoppers to Cut Holiday Spending:Gallup

- Americans are more likely to spend less this holiday season compared to last year if another round of federal stimulus checks aren't sent out before the end of the year, according to data published Thursday by public opinion research group Gallup - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FISCAL: Prospects for a new stimulus bill this year just about hit rock bottom on Thursday. Democratic leaders Nancy Pelosi and Chuck Schumer said they have no plans to budge from their position of demanding a $2 trillion coronavirus relief measure, and no less. Barely an hour later, Senate Majority Leader Mitch McConnell rejected their approach in remarks to a pair of reporters. Still, there may be more happening behind the scenes. Pelosi has spoken to Senate Appropriations Chair Richard Shelby (R-Ala.) in recent days about the stimulus, though it's unclear if they've made any progress. Publicly, the two sides seem as dug in as ever. (POLITICO)

FISCAL: The Trump administration is stepping back from negotiations on a new stimulus package and leaving it to Senate Majority Leader Mitch McConnell to revive long-stalled talks with House Speaker Nancy Pelosi, according to two people familiar with the matter. While the White House probably would consult with GOP lawmakers on details of a Covid-19 relief bill, it's now unlikely to take the lead on talks, according to the people, who spoke on condition of anonymity to discuss internal deliberations. The White House would only take over if negotiations have to be restarted completely, the people said. (BBG)

FISCAL: President-elect Joe Biden on Thursday spoke with top congressional Democrats about the "urgent need" for a deal on a bill that would provide more resources to fight the COVID-19 pandemic and support workers and state governments. Biden, House Speaker Nancy Pelosi and Senate Democratic Leader Chuck Schumer said such a bill is needed in the lame duck session of Congress, according to a joint statement. (MarektWatch)

FISCAL: The U.S. government started fiscal 2021 with an October budget deficit of $284 billion, a record for the month, as coronavirus-related outlays spiked sharply from a year earlier and revenues declined, the Treasury Department said on Thursday. That was 111% higher than the October 2019 deficit of $134 billion and 61% higher than the previous October record of $176 billion in 2009, during the financial crisis and recession. It follows a record full-year deficit of $3.132 trillion for fiscal 2020, which ended Sept. 30, more than tripling the previous year's shortfall due to COVID-19 aid spending. (RTRS)

CORONAVIRUS: The latest data also showed that 67,096 people were in hospital with coronavirus, surpassing the previous high of 65,368 the day before. However, the number of additional deaths eased. States reported a combined 1,104 fatalities attributed to coronavirus, compared with 1,565 on Wednesday. (FT)

CORONAVIRUS: Covid-19 cases are increasing in 94% of U.S. jurisdictions, and the death rate in non-metro areas is more than double that in urban areas, according to U.S. Centers for Disease Control and Prevention. (BBG)

CORONAVIRUS: Whitehouse coronavirus advisor Anthony Fauci, speaking on Thursday at Washington National Cathedral shared some thoughts about what Americans need to do to get the coronavirus under control. With cases rising across the country, Fauci said it's time for people to band together to follow the guidelines including social distancing, hand hygeine and wearing a mask. I was talking with my U.K. colleagues who are saying the U.K. is similar to where we are now, because each of our countries have that independent spirit," he said on stage. "I can understand that, but now is the time to do what you're told." (CNBC)

CORONAVIRUS: A member of U.S. President-elect Joe Biden's coronavirus task force said Thursday she doesn't view a nationwide lock down as necessary. Céline Gounder's comments backed away from comments by epidemiologist Michael Osterholm a day earlier. "With all due respect to Dr. Osterholm, that doesn't necessarily represent the entire advisory board or what the Biden-Harris transition team is planning to do," Gounder said on CNN. (BBG)

CORONAVIRUS: New York is preparing for the possibility of closing its schools and going to an all-remote program, Mayor Bill de Blasio said. The city recorded a 2.6% seven-day rate of positive tests, approaching the shutdown level of 3%. "We're preparing for that possibility," de Blasio said. "It's a rule we put out very clearly. If any day we see in the morning indicators come out and they reach that level, then we will move immediately -- the next day, schools will be shut down."

CORONAVIRUS: Chicago Mayor Lori Lightfoot on Thursday asked all residents to cancel Thanksgiving plans and stay at home unless they need to go to work or school or to tend to essential needs like the doctor's office or grocery store. Chicago said it was issuing the 30-day stay-at-home advisory, asking people to refrain from traveling, having guests in their home or leaving for non-essential business "in response to the rapid rise of COVID-19 cases and hospitalizations in the city." (CNBC)

CORONAVIRUS: Hospitals across the University of Wisconsin health system are facing staffing crunches as the state gets slammed with a surge in coronavirus cases and front-line caregivers get infected. "We are short of staff all times, either because they have Covid or they have some other illness and we need to rule out Covid before we bring them back to work," UW Health CEO Dr. Alan Kaplan said Thursday on CNBC' "Squawk on the Street." (CNBC)

CORONAVIRUS: The Kentucky Supreme Court upheld Democratic Gov. Andy Beshear's emergency coronavirus executive orders, which imposed a statewide mask mandate and placed health precautions on businesses. (CNBC)

POLITICS: Pennsylvania's top election official on Thursday asked a federal judge to toss out a Trump campaign lawsuit seeking to block the state from certifying the results of the election between President Donald Trump and President-elect Joe Biden. "The voters of Pennsylvania have spoken," lawyers for Commonwealth Secretary Kathy Boockvar wrote in the 45-page motion for dismissal. "The Court should deny Plaintiffs' desperate and unfounded attempt to interfere" with the vote-counting process, they wrote. (CNBC)

POLITICS: A group of election security groups including the Department of Homeland Security's Cybersecurity and Infrastructure Security Agency (CISA) on Thursday appeared to shoot down unproven claims of widespread election tampering pushed by President Trump. (Forbes)

EQUITIES: Sen. Amy Klobuchar, D-Minn., is not shy about discussing breakups when it comes to alleged tech monopolies. During a virtual keynote speech for the American Bar Association's Fall Forum, Klobuchar praised the Justice Department for leaving open the option of so-called structural remedies in its recent antitrust lawsuit against Google. (CNBC)

OTHER

U.S./CHINA: President Donald Trump on Thursday signed an executive order barring Americans from investing in a collection of Chinese companies that the White House believes support Beijing's military. The order prohibits American companies and individuals from owning shares — outright or through investment funds — in companies the administration says help the advancement of the People's Liberation Army. (CNBC)

U.S./CHINA: The Commerce Department said Thursday it wouldn't enforce its order that would have effectively forced the Chinese-owned TikTok video-sharing app to shut down, in the latest sign of trouble for the Trump administration's efforts to turn it into a U.S. company. (WSJ)

U.S./CHINA: Trade frictions between the United States and China may not ease in the near term even if Joe Biden becomes president of the United States, former Chinese finance minister Lou Jiwei said on Friday. Lou, who is now retired and serves as a member of a consultative body to the Chinese parliament, made the remarks during the Caixin Summit event in Beijing. When asked about the outlook for U.S.-China economic and trade relationship after the U.S. election, the outspoken former minister said, "Even if Biden is elected, the U.S. suppression of China will be inevitable." (RTRS)

GEOPOLITICS: The Editor in Chief of the global Times tweeted the following on Thursday: "Gap of stance between China and the West on Hong Kong is far too big that it's impossible to communicate. But Hong Kong is a Chinese city and that matters. How Hong Kong should govern itself is decided by Beijing. Those who oppose this huge reality will suffer losses." (MNI)

GEOPOLITICS: Japan and Australia are set to sign a broad agreement facilitating joint military exercises in a bid to strengthen the broader "Quad" partnership and project a show of unity against Chinese maritime expansionism. Japanese Prime Minister Yoshihide Suga and Australian Prime Minister Scott Morrison will discuss the framework when Morrison visits Japan next Tuesday, Nikkei has learned. A pact to facilitate joint military exercises will ease restrictions on the Japan Self-Defense Forces as well as on Australian military personnel while they are staying in each other's country for such drills. (Nikkei)

CORONAVIRUS: The boss of the British company supplying a crucial ingredient of the Pfizer-BioNTech COVID-19 vaccine has warned that avoiding Brexit border disruption will be "a crucial step" in ensuring it is available to millions of people. Yorkshire-based Croda International has provided a key chemical element of the vaccine to Pfizer in the trial phase, and has won a five-year contract that will see it deliver materials for 1.3 billion doses next year alone, worth around £75m. Distributing the doses is a huge challenge and, deal or no-deal, the UK will have new customs controls from 1 January. (Sky)

CORONAVIRUS: A pill ordinarily prescribed to treat obsessive compulsive or anxiety disorder prevented symptoms of non-hospitalized Covid-19 patients from worsening compared to placebo, a small randomized controlled trial concludes, suggesting the drug's immune-modulating effects could be further explored as a treatment for the disease. The authors say their results, published Thursday in JAMA, fall short of demonstrating efficacy because the study was so small and looked at relatively few measures of illness. But experts say the idea merits further study in a larger group of patients. (STAT News)

JAPAN: Japanese Prime Minister Yosihide Suga says experts are not calling for the country to issue an emergency declaration or halt government- funded domestic travel subsidies now, even as the number of virus cases reaches a record. Suga tells reporters he gave instructions for the government to be on the highest alert to deal with the virus. (BBG)

JAPAN: Japan's government is considering creating a new post to combat infectious diseases to help bolster its coronavirus response, broadcaster NHK reports, without attribution. (BBG)

AUSTRALIA: Australia will raise its daily cap on overseas arrivals, allowing more citizens to return home, but the country does not have the quarantine capacity to accept international students, Prime Minister Scott Morrison said on Friday. Quarantine capacity has been increased to allow a further 150 people to return to Australia each day, Mr Morrison said, adding that demand continues to outstrip the space available. (FT)

AUSTRALIA/CHINA: "Consistent with our comprehensive strategic partnership, Australia is open to moving ahead with China for our mutual benefit," says Christopher Langman, deputy secretary of Australia's Department of Foreign Affairs and Trade. "As my trade minister Simon Birmingham recently noted, he stands ready to engage on the current challenges in our bilateral trade relationship." (BBG)

RBNZ: New Zealand's central bank governor Adrian Orr said a new community case of Covid-19 in Auckland is a reminder of the uncertainties around the economic outlook. "If the economy continued to grow and do what it's doing, well that's a beautiful world, but that's a big if," Orr told Bloomberg Television in an interview Friday. "So today's news around Covid just puts it back into perspective. Be careful out there, be prepared, don't run around on predictions." (BBG)

NEW ZEALAND: The ongoing pick-up in job ads in October is, to some extent at least, consistent with the recent lifting of COVID-19 restrictions. Advertising rose a further 5.9% in the month, in seasonally adjusted terms. This is after September's amount rebounded 8.8%, from an August that stalled in the face of markedly re- tightened COVID-19 restrictions that month. By early October, Auckland had joined the rest of the country down on a Level 1 restriction, after being placed at Level 3 when COVID-19 resurfaced in the community. So, it was not surprising to see this region's job ads gain faster than the national average in October, and September, after stuttering more than most during August. Still, Auckland still has a ways to go to reclaim pre-COVID levels, when many smaller cities and regions have approximately achieved this already – at least in seasonally adjusted level terms. (SEEK)

NEW ZEALAND: The New Zealand government is not raising COVID-19 alert levels in Auckland after linking a new community case to a string of other infections. However, it plans to reinstate mask-wearing rules on public transport in the country's biggest city and for flying nationwide after flirting with another community outbreak. On Friday, COVID-19 Minister Chris Hipkins announced whole genome sequencing from the latest community case matched with a border worker who tested positive last week. (AAP)

SOUTH KOREA: South Korean health authorities are considering strengthening social distancing measures as the country's new coronavirus cases rose to the highest level in more than two months. The US registered its third consecutive day with a record number of new coronavirus cases, while hospitalisations also continued to climb. There were 150,526 new infections tallied on Thursday, according to Financial Times analysis of Covid Tracking Project data. Cases have jumped 9.6 per cent in the past week, bringing the overall count to 10.4m since the pandemic began. (FT)

BOC: MNI POLICY: BOC: Canada Faces Pandemic 'Still in Full Throttle'

- The Covid-19 pandemic is still raging and policy makers must find new ways to boost long-term productivity that offsets scarring to laid-off workers and struggling businesses owners, Bank of Canada Senior Deputy Governor Carolyn Wilkins said Thursday - for more details please contact sales@marketnews.com.

MEXICO: Mexico's central bank surprised markets by halting a record monetary easing cycle that has lent one of the few supports to an economy expected to contract nearly 10% this year. Banco de Mexico, led by Governor Alejandro Diaz de Leon, voted 4-1 to hold borrowing costs at 4.25%, after inflation held above the bank's target ceiling for three straight months. The Mexican peso briefly trimmed losses after the decision, which was expected by only six of 22 economists surveyed by Bloomberg. Sixteen of them forecast a quarter-point cut. "This pause provides necessary space to confirm a path for inflation to converge to its goal," bank board members wrote in a statement accompanying the decision. "Going forward, monetary policy will depend on the evolution of factors that affect headline and core inflation." (BBG)

MEXICO: Mexican Finance Minister Arturo Herrera said he will meet President Andres Manuel Lopez Obrador later on Thursday to discuss a new round of private-public infrastructure investments, following a nearly $14 billion plan announced last month. (RTRS)

ARGENTINA: Argentina hiked interest rates Thursday after an October inflation report showed consumer prices surged at the fastest pace this year. Central bank board members raised the benchmark Leliq rate to 38% from 36%, along with increases in repo rates and retail certificate deposits, according to a spokesman. The move came minutes after government authorities reported October inflation at 3.8% compared to the previous month, exceeding economists' median estimate for a 3.1% jump. The hike represents Argentina's latest step toward using orthodox policy actions to curb both inflation running at 37.2% on an annual basis and a surge in dollar demand after a fresh round of currency controls in September. (BBG)

IMF: Nations shouldn't withdraw economic support too early, IMF Managing Director Kristalina Georgieva says Friday in a recorded message at Caixin Summit in Beijing. "Because of the decisive action of governments and central banks, we managed to put a floor under the world economy. And we are seeing the green shoots of recovery." (BBG)

EQUITIES: Chinese President Xi Jinping personally made the decision to halt the initial public offering of Ant Group, which would have been the world's biggest, after controlling shareholder Jack Ma infuriated government leaders, according to Chinese officials with knowledge of the matter. (WSJ)

OIL: Iran's oil exports could rise by as much as 500,000 barrels per day by February, according to a senior Iranian official, if US President-elect Joe Biden takes a less rigorous approach to enforcing "brutal" sanctions imposed under incumbent Donald Trump. "If China is assured that Trump leaves, it is possible that from January they can increase imports and could easily reach up to 500,000 b/d [of incremental imports] by February," the senior Iranian oil official told Energy Intelligence. Biden has signaled that he intends to take the US back into the multilateral nuclear deal with Iran that Trump withdrew from in May 2018. (Energy Intelligence)

CHINA

PBOC: China's monetary policies are not likely to be influenced by the near-zero inflation given that food prices rather than monetary contractions are driving the weak consumer prices, the Economic Daily reported on Friday citing Liu Xuezhi, a researcher from the Bank of Communications. Policymakers should focus on precise structural policies to further support the recovery of demand, the Daily reported citing Wen Ben, an analyst from China Minsheng Bank. The PBOC will use various interbank operations to maintain ample fluidity and to ensure the reasonable growth of the money supply and social financing, according to Sun Guofeng, the head of the PBOC's Monetary Policy Department. (MNI)

YUAN: The PBOC is requiring financial institutions to improve the efficiency of yuan cross-border and offshore clearing, according to an official statement Friday following a meeting of the PBOC and the State-Owned Assets Supervision and Administration Commission. The yuan's exchange rate has become more flexible and more companies are using it for cross-border transactions. Companies at the meeting suggested improving the infrastructure for cross-border yuan transactions, the statement said. (MNI)

POLICY: MNI POLICY: China Should Step in Int'l Order: Fmr PBOC Governor

- China should strengthen research in multilateralism and multilateral institutions to drive China's influence in the global agenda and establish a rule-based international order, Zhou Xiaochuan, the former Governor of the People's Bank of China said in a speech at the 11th Caixin Summit on Friday - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

BONDS: A number of Chinese banks are cutting their holdings of corporate bonds, with some focusing on notes sold by state-owned firms, after a string of defaults roiled the market, according to people familiar with the matter. At least six banks, including one of China's four largest lenders, are reducing their overall corporate bond exposure, the people said, asking that they and their institutions not be identified discussing private matters. (BBG)

DEFAULTS: Chinese state-owned Yongcheng Electricity Coal Group has defaulted on CNY1 billion of triple-A bonds, causing panic and driving the prices of similar bonds issued by SOEs and local government financing vehicles around 10% lower on Thursday, according to the Shanghai Securities News. Issuers will continue to see high interest rates on bonds in Q4, the newspaper reported citing Wang Qing, the chief economist with Golden Credit Rating. Credit conditions are expected to tighten next year so highly leveraged corporations will have difficulties servicing bonds, the News reported citing a report by Industrial Securities. (MNI)

DEBT: Coronavirus-related stimulus and sizeable infrastructure spending will drive a significant rise in China's overall public sector debt to 45% of GDP by 2024 from close to 39% of GDP in 2019, testing the government's ability to mitigate the associated risks especially amid a slower growth trajectory, according to a new report from Moody's. (Moody's)

OVERNIGHT DATA

NEW ZEALAND OCT BUSINESSNZ M'FING PMI 51.7; SEP 54.0

New Zealand's manufacturing sector experienced a drop in expansion during October, according to the latest BNZ - BusinessNZ Performance of Manufacturing Index (PMI). The seasonally adjusted PMI for October was 51.7 (a PMI reading above 50.0 indicates that manufacturing is generally expanding; below 50.0 that it is declining). This was down 2.3 points from September. BusinessNZ's executive director for manufacturing Catherine Beard said that the sector remains in a state of flux, although still managing to keep in positive territory. "Despite a relatively strong showing with the key indices of production and new orders in September, October saw both slide to lower levels of expansion. On a brighter note, employment (52.6) reached its highest level since April 2018". BNZ Senior Economist, Craig Ebert said that "October's PMI serves as a gentle reminder of not getting too carried away with the sense of recovery, even if the worst of COVID's impacts can be assumed to be behind us". (BNZ)

NEW ZEALAND OCT FOOD PRICE INDEX -0.7% M/M; SEP -1.0%

SOUTH KOREA SEP MONEY SUPPLY L +0.7% M/M; AUG 0.0%

SOUTH KOREA SEP MONEY SUPPLY M2 +0.5% M/M; AUG +0.3%

CHINA MARKETS

PBOC NET INJECTS CNY160BN VIA OMOS FRI

The People's Bank of China (PBOC) conducted CNY160 billion via 7-day reverse repos with rates unchanged at 2.2% on Friday. This resulted in a net injection of CNY160 billion given no reverse repos matured today, according to Wind Information.

- The operations aim to maintain the liquidity in the banking system reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) declined to 2.2411% at 09:26 am local time from the close of 2.5829% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 63 on Thursday vs 59 on Wednesday. A lower index indicates decreased market expectations for tighter liquidity.

MARKETS

SNAPSHOT: Thursday's Defensive Tone Spills Into Asia

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 189.72 points at 25325.62

- ASX 200 down 13.024 points at 6405.2

- Shanghai Comp. down 31.643 points at 3307.823

- JGB 10-Yr future up 13 ticks at 152.13, yield down 0.9bp at 0.021%

- Aussie 10-Yr future up 3.0 ticks at 99.115, yield down 2.7bp at 0.887%

- U.S. 10-Yr future +0-04+ at 138-09+, yield down 1.3bp at 0.869%

- WTI crude down $0.72 at $40.41, Gold up $1.19 at $1878.34

- USD/JPY down 23 pips at Y104.9

- WHITE HOUSE LEAVES STIMULUS TO CONGRESS AS BIDEN ENTERS FRAY (BBG)

- TRUMP BANS INVESTMENTS IN COS THAT WHITE HOUSE SAYS AID CHINA'S MILITARY (CNBC)

- ECB'S MULLER: ULTRA-CHEAP LOANS ARE KEY FOR NEXT STIMULUS (BBG)

- POLAND THREATENS TO VETO EU RECOVERY FUND OVER RULE-OF-LAW FIGHT (BBG)

- PFIZER VACCINE FACES BREXIT RISK, UK PARTNER WARNS (SKY)

BOND SUMMARY: Bonds Hold Firm In Asia After Thursday Rally

There was little to really counter the negative feeling that surrounded Thursday trade. As a result, T-Notes traded through Thursday's high, but lacked any meaningful follow through, last trading +0-04+ at 138-09+. Cash trade saw yields richen by 0.4-1.5bp, with the curve bull flattening. Macro headline flow has been light since the re-open, with little of note on the Asia-Pac docket on Friday.

- JGB futures held a tight range, with the only real news flow of note for the space surrounding COVID worry in Japan. The contract is last +12 vs. Tokyo settlement levels, while the cash curve richened, although the long end lagged for a second day, allowing super-long swap spreads to tighten.

- In Australia, the AOFM's announcement re: next week's syndicated tap of ACGB 2.75% 21 May 2041, which will be up to A$6.0bn in size, added some pressure to the longer end of the space, before the broader defensive feel (and perhaps an eye on the upcoming cash flow dynamic within the space) provided fresh support. YM unchanged and XM +3.5 at typing. Worth flagging that early desk discussions covered some apparent overnight flattening flow, lodged via a block trade of 6.0K YM and 1.7K XM.

JGBS AUCTION: Japanese MOF sells Y6.1609tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y6.1609tn 3-Month Bills:

- Average Yield -0.0938% (prev. -0.0878%)

- Average Price 100.0252 (prev. 100.0236)

- High Yield: -0.0912% (prev. -0.0837%)

- Low Price 100.0245 (prev. 100.0225)

- % Allotted At High Yield: 80.2802% (prev. 4.9642%)

- Bid/Cover: 3.464x (prev. 3.450x)

AUSSIE BONDS: The AOFM sells A$1.0bn of the 4.75% 21 Apr '27 Bond, issue #TB136:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 4.75% 21 April 2027 Bond, issue #TB136:- Average Yield: 0.4439%

- High Yield: 0.4450%

- Bid/Cover: 5.6970x

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 77.9%

- bidders 51, successful 15, allocated in full 6

AUSSIE BONDS: The AOFM has released its weekly issuance schedule:

- Subject to market conditions, a syndicated tap of the 2.75% 21 May 2041 Treasury Bond is planned to be conducted in the week beginning 16 November 2020. Issuance will be up to $6 billion. The Joint Lead Managers are National Australia Bank Limited, TD Securities, UBS AG, Australia Branch and Westpac Banking Corporation.

- On Thursday 19 November it plans to sell A$1.0bn of the 23 April 2021 Note & A$1.0bn of the 25 June 2021 Note.

EQUITIES: Equities Struggle In Asia On Wall St. Spillover, E-Minis Mixed

The negative impetus from Wall St. spilled over into Asia-Pac hours, with little in the way of macro headline flow to counter the momentum after markets chose to re-focus on familiar risks on Thursday (COVID worry, related U.S. social mobility restrictions, DC fiscal impasse & U.S. political clouds). This biased the major regional indices lower in the final session of the week, while e-minis dealt either side of unchanged.

- Nikkei 225 -0.9%, Hang Seng -0.6%, CSI 300 -1.0%, ASX 200 -0.2%.

- S&P 500 futures +2, DJIA futures -27, NASDAQ 100 futures +44.

OIL: Little To Support Crude Overnight

WTI & Brent sit ~$0.70-0.80 softer than settlement levels at typing, with little to support the space in a news light Asia-Pac session. This comes after the benchmarks shed ~$0.30 come Thursday's settlement, with a more risk averse feel evident on well documented, and familiar sources of risk, with regional equities adding to the pressure during the final Asia-Pac session of the week.

- The latest round of weekly DoE inventory data saw a surprise build in headline crude stocks (which was at odds with the drawdown seen in the API estimate), while refinery utilisation saw a surprise downtick. Elsewhere, products saw larger than expected/surprise draws, in line with the picture provided by the API estimates, while Cushing stocks saw a small drawdown. U.S. crude production was essentially unchanged in the most recent week.

- Thursday also saw the release of an Energy Intelligence source piece, which noted that "Iran's oil exports could rise by as much as 500,000 barrels per day by February, according to a senior Iranian official, if US President-elect Joe Biden takes a less rigorous approach to enforcing "brutal" sanctions imposed under incumbent Donald Trump."

- Finally, the IEA's latest monthly oil market report saw the Agency slash its '20 global crude demand forecast, noting that it does not expect COVID vaccines to provide a significant boost for crude demand until well into '21.

GOLD: Confined

Little to report for bullion over the last 24 hours or so, with a push lower in benchmark & real U.S. Tsy yields providing support, as well documented risks (outlined elsewhere) came back to the fore. The USD has been a little more mixed, providing no real decisive input for gold. Spot last dealing little changed, just shy of 1,880/oz, with bulls still needing to force a break above the 50-EMA.

FOREX: Defensive Flows Take Hold In Asia, Orr's Warning Undermines Kiwi

Coronavirus worry kept riskier FX in check, as Japan and the U.S. reported new daily records of infections Thursday, while a number of central bank heads warned against premature optimism. The yen topped the G10 scoreboard as participants sought a safe haven. Lingering concerns over the deadlocked fiscal talks and political transition in the U.S. helped undermine risk appetite.

- NZD led commodity FX lower as a new community transmission of Covid-19 was found in Auckland and RBNZ Gov Orr joined other central bankers in reminding that the economic recovery is a "big if". The Governor cited the new infection as a pointing to continued uncertainty and noted that the last MPS was based on a "very bold" assumption that New Zealand's will re-open by 2022.

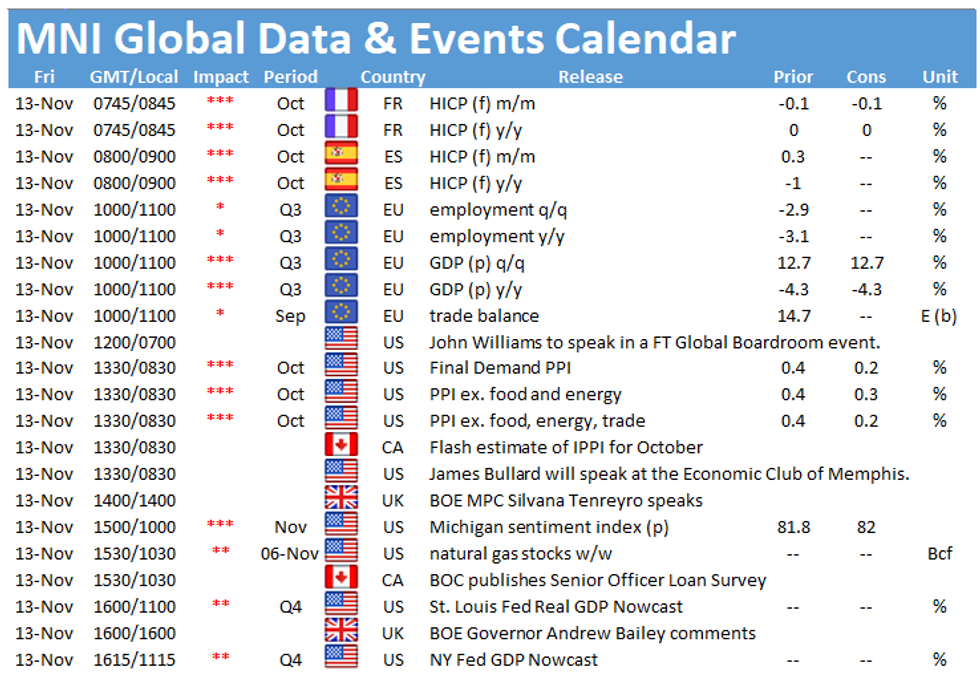

- Focus today turns to EZ trade balance & flash GDP, final French CPI, flash U.S. U. of Mich. Survey. Central bank speaker slate includes Fed's Williams & Bullard, ECB's Rehn, de Cos & Weidmann and BoE's Bailey, Cunliffe & Tenreyro.

FOREX OPTIONS: Expiries for Nov13 NY cut 1000ET (Source DTCC):

- EUR/USD: $1.1600(E703mln), $1.1735-40(E935mln), $1.1770-75(E522mln), $1.1795-00(E1.4bln), $1.1840-55(E1.8bln), $1.1870-75(E952mln), $1.1900(E512mln), $1.2000(E1.78bln-EUR calls)

- USD/JPY: Y101.00($995mln-USD puts), Y104.65-75($502mln), Y105.50($560mln)

- EUR/GBP: Gbp0.8950(E586mln), Gbp0.9045-50(E807mln)

- AUD/USD: $0.7300(A$599mln-AUD calls), $0.7325-35(A$763mln), $0.7400(A$568mln-AUD calls)

- USD/CAD: C$1.3125($900mln)

- USD/CNY: Cny6.51($500mln), Cny6.60($1.1bln), Cny6.75($600mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.