-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Asia-Pac Sits Back After Monday’s Shot In The Arm For Global Markets

OVERNIGHT NEWS AND PRESS

EXECUTIVE SUMMARY

* FED'S CLARIDA EMPHASIZES LOWER FOR LONGER RATES (MNI)

* ECB'S LANE PLEDGES CHEAP CREDIT AS LONG AS PANDEMIC CRISIS LASTS (BBG)

* FROST TELLS PM TO PREPARE TO SHAKE ON EU TRADE DEAL 'EARLY NEXT WEEK' (THE SUN)

* CHINA NDRC VOWS TO PREVENT RISKS IN CORPORATE BOND SECTOR (BBG)

* ASIA-PAC SITS BACK AFTER MONDAY'S SHOT IN THE ARM FOR GLOBAL MARKETS

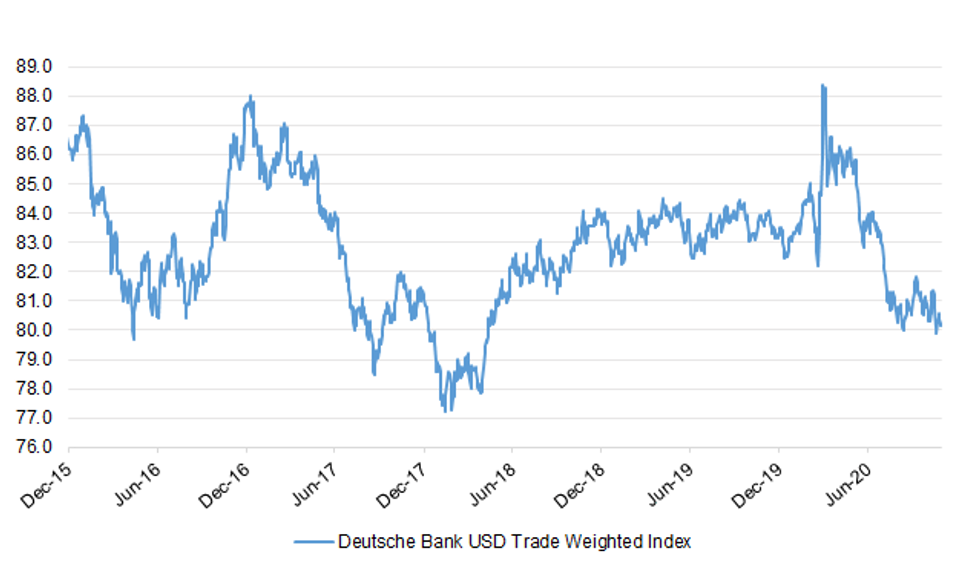

Fig. 1: Deutsche Bank USD Trade Weighted Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Lockdown could carry on beyond December 2, Matt Hancock has admitted, saying it was "too early to know" whether the current restrictions have been effective. (Telegraph)

CORONAVIRUS: England's regional Covid tier system may need to be "strengthened" to get the country "through the winter", a senior government adviser has said. Public Health England's Dr Susan Hopkins said they needed to look at what "tiers there may be in the future" when the lockdown ends on 2 December. A three-tier system was used in England to tackle the spread of coronavirus before the national lockdown began. Matt Hancock said the government hoped to bring back the regional tiers. (BBC)

BREXIT: Brexit boss David Frost has told Boris Johnson to expect a Brussels trade deal "early next week", The Sun can reveal. Britain's chief negotiator has pinpointed "a possible landing zone" as soon as next Tuesday. (The Sun)

BREXIT: David Frost, Boris Johnson's Brexit envoy, was hanging tough as trade talks entered the endgame in Brussels this week, but he once felt far less bullish about the likely outcomes of such negotiations. Writing in a largely forgotten pamphlet just before the 2016 Brexit referendum, Lord Frost warned that in trade talks with the EU "it will be Britain that has to make the concessions to get the deal". (FT)

BREXIT: The European Union will find a "creative solution" to avoid an accidental no-deal Brexit if a trade agreement with the UK is reached too late to beat the end of year deadline, a senior EU diplomat said on Monday. (Telegraph)

BREXIT: The European Union is looking into plans to rush through a Brexit deal before the end of the year, even if talks drag on into December. But senior figures have told Sky News they are "increasingly pessimistic" that a deal can be done. In one scenario, which has been discussed at the highest levels, a deal would be given a new "classification" that, crucially, would remove the need to have it ratified by every European parliament. Instead, it would only require the approval of EU leaders and the European Parliament. (Sky)

BREXIT: A European parliament vote to seal a Brexit trade deal could be delayed until 28 December, three days before the end of the transition period, under an emergency EU plan. With less than seven weeks to go before the UK leaves the single market and customs union, the negotiations remain troubled, with the talks on fishing rights in UK waters not progressing significantly since the summer. (Guardian)

BREXIT: The contours of a Brexit deal between the U.K. and European Union are clear to both sides, Ireland's prime minister said, as the two sides struggle to reach a trade agreement. Negotiating teams understand "the landing zones" around an accord, Micheal Martin said at the Bloomberg New Economy Forum, warning it's not yet fully clear if his U.K. counterpart, Boris Johnson, truly wants an accord. (BBG)

FISCAL: Boris Johnson is considering a temporary cut to Britain's aid spending to help repair the nation's Covid-ravaged public finances. Ministers have drawn up plans to reduce the proportion of Britain's gross national income spent on aid from 0.7 per cent to 0.5 per cent, saving billions, The Times has learnt. Rishi Sunak, the chancellor, is pressing for the move to be announced in next week's comprehensive spending review. His allies have insisted that cutting the aid budget is a political necessity at a time when spending on domestic areas will be limited as a result of the pandemic. Mr Johnson wants the cut to be time-limited and is insisting that aid spending returns to the 0.7 per cent total as soon as 2022. (The Times)

FISCAL: Boris Johnson promised last night to make northern Conservative MPs his "praetorian guard" as ministers moved to rewrite Treasury spending rules and allow billions of pounds of new infrastructure investment. In an attempt to rebuild relations with backbenchers after a tumultuous week in Downing Street, the prime minister promised the Northern Research Group (NRG) of Tories that their seats would benefit from "the largest financial commitment to infrastructure" in nearly a century. (The Times)

EUROPE

ECB: The European Central Bank will prove enough monetary stimulus at its next meeting to make sure governments, companies and households have access to cheap credit throughout the coronavirus crisis, according to chief economist Philip Lane. "This pandemic is tough enough -- we shouldn't add to it by having to deal with some kind of credit freeze, having to deal with rising interest rates," Lane said in an interview with Portuguese TV channel RTP3 on Monday. "Our orientation is to keep financing conditions favorable." ECB President Christine Lagarde said at last month's policy meeting that her institution would "recalibrate" its monetary stimulus to help cushion the shock of renewed lockdowns as coronavirus infections surge. (BBG)

GERMANY: Chancellor Angela Merkel urged people to limit public and private gatherings, while pushing decisions on a road map for the coming months to next week as Germany struggles to stem the coronavirus spread. After more than five hours of tense talks with the country's 16 state premiers, Merkel failed to push through a range of tougher restrictions. She had proposed requiring face masks for all school students and limiting playmates to one other kid, but came up empty after state leaders balked. (BBG)

FRANCE: France reported new confirmed Covid cases rose by 9,406 to 1.99 million, the smallest increase since Oct. 12. The seven-day average of infections fell for a ninth consecutive day to 26,251, reaching the lowest level in more than three weeks. Positive tests fell to 16.4%, declining more than 3 points in a week. "We're seeing this decline in France, we're also seeing it in a number of neighboring countries that took lockdown measures," Health Minister Olivier Veran said during a visit to Lyon-Bron airport to discuss transfers of Covid patients. "We are gradually regaining control over this epidemic." The country reported deaths linked to the virus increased by 506, to 45,054. "If there are signs of improvement in terms of the epidemic, we haven't beaten this virus yet," the minister said. "There are severely ill patients in our hospitals every day."

ITALY: Italy's government approved the draft of next year's budget, a crucial step toward gaining formal backing from parliament later, including another package of aid to help the country get through a second lockdown. Prime Minister Giuseppe Conte's spending plan for next year includes about 38 billion euros ($45 billion) in measures to shore up its virus-ravaged economy, according to a draft. About 400 million euros will be set aside to buy coronavirus vaccines and other drugs, according to the draft. Other measures include support for female employment and investments in the health sector. Officials in the finance ministry have been calculating how much aid will be needed in the coming months as Italy contends with new restrictions to contain the spread of the virus. (BBG)

U.S.

FED: Federal Reserve Chair Jerome Powell will speak on Tuesday at a Bay Area Council Business Hall of Fame awards event, in conversation with former San Francisco Fed chief Alex Mehran, the U.S. central bank said on Monday. The event is due to start at 1 p.m. EST (1800 GMT), the Fed said in what was a late addition to the public schedule for Fed Board officials. (RTRS)

FED: MNI POLICY: Fed's Clarida Emphasizes Lower For Longer Rates

- Federal Reserve Vice Chair Richard Clarida suggested Monday that the FOMC chose a one-year inflation memory in its new operating framework, and laid out several cases where policy makers could delay the interest-rate liftoff - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FED: San Francisco Federal Reserve Bank President Mary Daly said Monday that to tackle long-term problems like racial justice and climate change the U.S. central bank must be both impatient and patient.

FED: MNI POLICY: US at Risk of Rising Permanent Unemployment - SF Fed

- Most U.S. layoffs this year have been temporary instead of more damaging permanent reductions, though that good news is at risk if the pandemic continues to hit the economy, San Francisco Fed researchers wrote in a paper published Monday - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FED: Sen. Lamar Alexander (R-Tenn.) on Monday said he would not support the nomination of Judy Shelton to the Federal Reserve's board of governors, narrowing the path for the controversial economist's confirmation in the final months of the Trump Presidency. Alexander joins Sens. Susan Collins (R-Maine) and Mitt Romney (R-Utah), who said they would vote "no" over the summer. (Washington Post)

ECONOMY: MNI POLICY:US Can Rebound Nearly 100% if Covid Tamed- Goolsbee

- The U.S. economy could quickly return to almost regular levels of activity once Covid-19 is brought under control through a vaccine or strict health rules, and without that Congress may be forced to continue trillion-dollar rescues, former Council of Economic Advisers Chair Austan Goolsbee said Monday - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

ECONOMY: MNI REALITY CHECK: US Retail Sales Slowing After Strong Summer

- U.S. retail sales likely rose only modestly in October, figures due Tuesday should show, as resurgent Covid-19 cases across the nation and waning prospects for another stimulus package before the end of the year curbed demand and spending, industry experts told MNI - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

CORONAVIRUS: The number of coronavirus hospitalisations in the US topped 70,000 for the first time on Monday, reflecting one of the most troubling metrics of the latest phase of the pandemic around the country. A total of 73,014 people were currently in US hospitals being treated for Covid-19, according to data from Covid Tracking Project, up from 69,993 on Sunday. Hospitalisations were at a record for the seventh day running, having last week overtaken the long-standing peak from mid-April when northeastern states like New York and New Jersey were hit hard during the early stages of the pandemic. (FT)

CORONAVIRUS: Health and Human Services Secretary Alex Azar told CNBC that the Food and Drug Administration will move "as quickly as possible" to clear Pfizer and Moderna's coronavirus vaccines for emergency use. Azar, who heads the federal agency that oversees the FDA, said it has dedicated teams working with both companies to "remove any unnecessary bureaucratic barriers" and are completing their authorization applications "as we speak." (CNBC)

CORONAVIRUS: Joe Biden, the US president-elect, has warned that America could suffer more coronavirus fatalities if Donald Trump does not allow a smooth transition of power on the response to the disease and vaccine distribution. "More people may die if we don't coordinate," Mr Biden said in a briefing with reporters on the economic fallout from the pandemic. "To have to wait until January 20 to start that planning puts us behind a month and a half. It's important that there be coordination now — now or as rapidly as we can get done," he added. (FT)

CORONAVIRUS: Dr. Carlos del Rio of Emory University, which is part of Moderna's coronavirus vaccine trials, told CNBC on Monday the company's preliminary efficacy data offers "enormous hope." However, del Rio cautioned that it will take time for its promise to be realized due to the complexity of delivering the vaccine to Americans. "It's going to take a while to roll them out. ... This is a major effort. We probably need to vaccinate close to 200 million to 260 million Americans in order to get to herd immunity," del Rio said on "The Exchange." "That's not going to be easy." (CNBC)

CORONAVIRUS: California Gov. Gavin Newsom said his state is "pulling an emergency brake" on the reopening process, placing almost all of California in the most restrictive tier due to spiraling Covid cases. (CNBC)

CORONAVIRUS: Philadelphia will ban all indoor gatherings and severely limit outdoor events as COVID-19 increases "exponentially" in the sixth largest U.S. city, health commissioner Thomas Farley said Monday. (RTRS)

POLITICS: Plaintiffs aligned with President Donald Trump in four states on Monday abruptly dropped recently filed lawsuits challenging ballots seen as giving President-elect Joe Biden his margin of victory in those locales. The dismissals of the cases, which all involved plaintiffs represented by lawyer James Bopp and the conservative group True the Vote, occurred in Georgia, Michigan, Pennsylvania and Wisconsin. (CNBC)

EQUITIES: U.S. regulators plan on Wednesday to unveil the long-awaited final requirements for allowing Boeing Co.'s grounded 737 Max to return to service after 20 months, according to a person briefed on the plans.

EQUITIES: Tesla will be added to the S&P 500 index on Dec. 21, S&P Dow Jones Indices said in a statement. The move comes at a time Wall Street expects the electric-vehicle maker to post its first full-calendar year of profit in 2020. (WSJ)

OTHER

GLOBAL TRADE: U.S. President-elect Joe Biden on Monday said Washington needs to align with other democracies in trade so that it can start writing the rules, after 15 countries in the Asia-Pacific signed the historic Regional Comprehensive Economic Partnership agreement Sunday. "I talked with a number of these world leaders, and I told them under the law I'm not able to begin to discuss with them -- there's only one president at a time as to who can say what our policy will be," Biden said after delivering a speech on rebuilding the economy, when asked by a reporter if Washington should also join the bloc. "Here's what I can say: We make up 25% of the world's trading capacity of the economy in the world," he said. "We need to be aligned with the other democracies -- another 25% or more -- instead of having China and others dictate outcomes because they are the only game in town." (Nikkei)

U.S./CHINA: China is prepared for any fresh attacks and harm launched by the Trump administration during the post-election U.S. government transition, the Global Times said in an editorial late Monday. Beijing will hit back if the U.S. and Taiwan collude to make a sudden and unacceptable move, the Times said. China has no reason to be afraid of any "final madness" as the Trump administration's extreme words and fault-picking on issues such as on China's human rights record have had no impact, the editorial said. (MNI)

U.S./CHINA: China Securities Regulatory Commission Vice Chairman Fang Xinghai said he hopes Sino-U.S. relations will be in a much better state after four years of a Biden administration than what it is now. Fang, speaking during a session of the Bloomberg New Economy Forum, also said Beijing should be able to resolve accounting issues with Chinese firms under a Biden Administration. (National Post)

U.S./CHINA: Huawei Technologies Co. sold its Honor smartphone business to a Chinese government-backed consortium for an undisclosed amount, hiving off the entry-level devices arm after the Trump administration cut off its access to American technology. (BBG)

GEOPOLITICS: U.S. President-elect Joe Biden should look to develop an "overall constructive relationship" with China following "quite a tumultuous ride" over the past four years, Singapore Prime Minister Lee Hsien Loong said in an interview. A new framework between the nations would allow both countries "to develop the areas of common interest, and constrain the areas of disagreement" on issues such as trade, security, climate change, North Korea and non-proliferation, Lee said in an interview with Bloomberg Editor-In-Chief John Micklethwait at the New Economy Forum. Singapore's leader also rejected any attempt to divide nations "Cold War style." (BBG)

CORONAVIRUS: Pfizer said it started a pilot program on Covid-19 immunizations in four U.S. states to help refine the plan for the delivery and deployment of the company's coronavirus vaccine candidate that is being co-developed with BioNTech. (BBG)

CORONAVIRUS: Johnson & Johnson has begun a new late-stage trial of its experimental COVID-19 vaccine, this time on a two-dose regimen. J&J plans to give up to 30,000 people two doses of the vaccine. It's been testing a one-dose regimen in a 60,000-person trial that began in late September and has enrolled nearly 10,000 volunteers so far. (Associated Press)

CORONAVIRUS: While there is encouraging news about Covid-19 vaccines, the World Health Organization remains cautiously optimistic about the potential for new tools to start to arriving in the coming months. The agency is "extremely concerned" by the surge in cases seen Europe and the Americas, Director-General Tedros Adhanom Ghebreyesus said at a media briefing Monday. WHO officials reiterated the importance of vaccinating front-line workers around the world. "Getting to vaccine efficacy is like building base camp at Everest," said Kate O'Brien, who heads the WHO's vaccination department. "But the climb to the peak is really about delivering the vaccines. The people who need to receive these vaccines are the focus now." (BBG)

HONG KONG: A top Beijing official has said the time had come for authorities to correct a series of "fallacies and misunderstandings" in Hong Kong, and to establish qualification standards for the city's officials and politicians. Zhang Xiaoming, deputy director of the State Council's Hong Kong and Macau Affairs Office, also said on Tuesday he was glad the Hong Kong government had begun creating new policies surrounding national education, and an oath for civil servants, while the city also hotly debated the topic of judicial reform. (SCMP)

RBA: Australia's central bank decided to inject further monetary stimulus into the economy as it became clear that unemployment would stay high and inflation remain subdued for an extended period, according to minutes of its November policy meeting. The package of measures "would complement the significant steps taken by the Australian government, including in the recent budget, to support jobs and growth," the Reserve Bank said Tuesday. "Having the various arms of policy all taking steps in the same direction would deliver a greater impact than the sum of the individual parts." (BBG)

RBA: Reserve Bank Assistant Governor Christopher Kent, who oversees financial markets, says in text of speech in Sydney Tuesday that Australian firms have made progress in their Libor transitions to date, though "continued focus and effort is needed in the year and a bit that remains." (BBG)

AUSTRALIA: South Australia added one local coronavirus case on Tuesday, adding to a cluster linked to a quarantine hotel as the state's premier said hundreds of people had been placed in isolation. (FT)

AUSTRALIA: Between the week ending 14 March and the week ending 31 October 2020: Payroll jobs decreased by 3.0%. Total wages decreased by 4.3%. High level analysis suggests that by 31 October 2020 there were approximately 330,000 fewer payroll jobs in STP-enabled businesses than on 14 March 2020. Between the week ending 17 October 2020 and the week ending 31 October 2020: Payroll jobs increased by 0.5%, compared to a decrease of 0.1% in the previous fortnight. Total wages paid increased by 0.1%, compared to a decrease of 1.7% in the previous fortnight. (ABS)

AUSTRALIA: Treasurer Dominic Perrottet will undertake the state's biggest tax reform in decades with stamp duty to be phased out to boost the economy as NSW records a historic $16 billion budget deficit. In his fourth budget handed down on Tuesday, Mr Perrottet said replacing stamp duty with an annual land tax on new property transactions would be a key stimulus measure, injecting as much as $11 billion into the state's economy over four years. (Sydney Morning Herald)

RBNZ: Reserve Bank of New Zealand launches consultation on the details for implementing the final Capital Review decisions announced last December. (BBG)

SOUTH KOREA: South Koreans in the greater capital area will face stricter social distancing rules under the government's Level 1.5 scheme starting Thursday, including more toughened capacity limits at restaurants and worship services and caps on large gatherings. Under the government's new five-tier scheme, Level 1.5 is issued in the capital area when new domestic cases average 100 or more per day in the preceding week. The government's announcement Tuesday of a one-notch increase from Level 1 to 1.5 in greater Seoul came after the average tally reached 99.4 as of midnight Sunday. (Yonhap)

TURKEY: The U.S. administration and Europe need to work jointly on addressing actions led by Turkey in the Middle East over the past few months, Secretary of State Mike Pompeo told French daily newspaper Le Figaro. "France's president Emmanuel Macron and I agree that Turkey's recent actions have been very aggressive," Pompeo said, citing Turkey's recent support to Azerbaijan in the Nagorno-Karabakh conflict with Armenia as well as military moves in Libya and the Mediterranean. "Europe and the U.S. must work together to convince Erdogan such actions are not in the interest of his people," Pompeo said, referring to Turkish President Tayyip Erdogan. (RTRS)

BRAZIL: Brazil is recording the fastest economic recovery among the emerging market peers, but it is uneven among sectors and will smooth out in the coming months with smaller effect from the government cash handouts, Roberto Campos Neto, the head of central bank, said. (BBG)

IRAN: President Trump asked senior advisers in an Oval Office meeting on Thursday whether he had options to take action against Iran's main nuclear site in the coming weeks. The meeting occurred a day after international inspectors reported a significant increase in the country's stockpile of nuclear material, four current and former U.S. officials said on Monday. A range of senior advisers dissuaded the president from moving ahead with a military strike. The advisers — including Vice President Mike Pence; Secretary of State Mike Pompeo; Christopher C. Miller, the acting defense secretary; and Gen. Mark A. Milley, the chairman of the Joint Chiefs of Staff — warned that a strike against Iran's facilities could easily escalate into a broader conflict in the last weeks of Mr. Trump's presidency. (New York Times)

MIDDLE EAST: The U.S. military will craft plans to withdraw forces from Iraq and Afghanistan in the coming weeks, potentially reducing the deployment in both countries by several thousand, military and defense officials said. (WSJ)

FIXED INCOME: MNI POLICY: Danger Remains From March Market Squeeze - FSB

- The Financial Stability Board is warning Group of 20 leaders to remain on guard against a recurrence of the March squeeze on global fixed income markets, saying it's still unclear what happened and the pandemic means the turmoil could return - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

OIL: OPEC and its allies finished a technical meeting on Monday with most countries supporting a three-month extension of current oil supply cuts from January, OPEC sources told Reuters. (RTRS)

OIL: The OPEC+ oil alliance should consider delaying its planned output boost by between three and six months, a technical panel that advises ministers suggested. (BBG)

OIL: The Trump administration on Monday issued a request to energy companies to identify what specific land areas in the Arctic National Wildlife Refuge should be offered for sale, according to a government document. (RTRS)

CHINA

PBOC: China should stabilize the macro leverage ratio and develop direct financing via reform and opening up, PBOC Governor Yi Gang wrote in a research paper posted Tuesday on the central bank's Weibo account and website. The article was first published in the March 2020 issue of the Economic Research Journal. (BBG)

POLICY: The National Development and Reform Commission will step up oversight of the corporate bond market as there are new challenges in risk prevention, NDRC spokeswoman Meng Wei says at a briefing in Beijing without specifying the challenges. NDRC will step up coordination among bond regulators and strengthen disclosure. Separately, the commission will work with other government departments on new measures to boost service consumption. NDRC approved 4 fixed-asset investment projects with combined value of 10.6b yuan in Oct. (BBG)

ECONOMY: China should set an annual average economic growth target of around 5% for the 2021-2025 period, a senior economist at a Chinese state think tank said on Tuesday. Li Xuesong, deputy director of the Institute of Industrial Economics at the Chinese Academy of Social Sciences, made the remarks during a press briefing in Beijing. Policy sources told Reuters earlier in November that Beijing is close to setting an average annual economic growth target of around 5% for the next five years. (RTRS)

YUAN: The yuan may rise to 6 against the U.S. dollar in the medium term on the strength of China's better-than-expected recovery, extending a rally which started with a weakening dollar, the China Securities Journal reported citing Xie Yaxuan, chief analyst at China Merchants Securities. The appreciation will attract capital inflow, which pushes the currency higher, and this appreciation process may be more sustained, Xie said. The onshore yuan rose above 6.57 to the dollar in intraday trading yesterday, a new high for the current rally, the Journal noted. (MNI)

DEFAULTS: Recent bond defaults in China are not enough to trigger a liquidity crisis as the PBOC pumped liquidity into the system and local governments intervened to quell the panic, the Shanghai Securities News reported citing Industrial Securities. Some high-risk bonds have started to rebound and there has been an across-the-board rise in government bond futures, the newspaper reported citing Wind data. Credit defaults may still lead to a repricing of credit risks and companies may face difficulties obtaining credit guarantees, so financing costs may become higher for some recipients, according to Industrial Securities. (MNI)

DEFAULTS: Yongcheng Coal & Electricity Holding Group is uncertain it can repay 1b yuan 270-day note due Nov. 22 due to lack of liquidity, according to a statement to Shanghai Clearing House. Company also sees uncertainty in repayment of 1b yuan 210-day note due Nov. 23 because of similar reason, according to a separate statement. (BBG)

EQUITIES: China's top financial watchdog said international investors have responded "quite well" to the suspension of Ant Group Co.'s initial public offering. The inflows from investors into China have continued over the past week and Hong Kong has also done well, Fang Xinghai, vice chairman of the China Securities Regulatory Commission, said at the New Economy Forum. (BBG)

OVERNIGHT DATA

JAPAN Q3 HOUSING LOANS +2.4% Y/Y; Q2 +2.5%

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 106.6; PREV. 103.1

This week's 3.4% up-tick in confidence, coming on the back of the previous week's 3.2% rise, is a pretty strong result – especially as it is the 11th gain in a row. The rise comes on the back of gains across the major subindices and takes overall confidence to its highest level since February. The news about the successful vaccine trial no doubt played a major role. The strong result points to a potentially strong Christmas season ahead for retailers. The outbreak of local transmission in South Australia reminds us that we aren't in the clear just yet, but the trend in confidence is very encouraging. (ANZ)

NEW ZEALAND OCT NON-RESIDENT BOND HOLDINGS 48.8%; SEP 49.4%

CHINA MARKETS

PBOC NET DRAINS CNY70BN VIA OMOS TUE

The People's Bank of China (PBOC) injected CNY50 billion via 7-day reverse repos with rates unchanged at 2.2% on Tuesday. This resulted in a net drain of CNY70 billion given the maturity of CNY120 billion of reverse repos today, according to Wind Information.

- The operations aim to maintain the liquidity in the banking system reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) declined to 2.1999% at 09:26 am local time from the close of 2.3821% on Monday.

- The CFETS-NEX money-market sentiment index closed at 35 on Monday vs 36 on Friday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.5762 TUE VS 6.6048

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.5762 on Tuesday, compared with the 6.6048 set on Monday.

MARKETS

SNAPSHOT: Asia-Pac Sits Back After Monday’s Shot In The Arm For Global Markets

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 99.04 points at 26005.97

- ASX 200 up 10.775 points at 6495.1

- Shanghai Comp. down 6.646 points at 3340.323

- JGB 10-Yr future down 1 tick at 152.08, yield up 0.4bp at 0.025%

- Aussie 10-Yr future down 6.0K ticks at 99.05, yield up 6.1bp at 0.952%

- U.S. 10-Yr future -0-01+ at 137-31+, yield up 0.33bp at 0.909%

- WTI crude up $0.23 at $41.58, Gold down $0.43 at $1888.53

- USD/JPY down 9 pips at Y104.49

- FED'S CLARIDA EMPHASIZES LOWER FOR LONGER RATES (MNI)

- ECB'S LANE PLEDGES CHEAP CREDIT AS LONG AS PANDEMIC CRISIS LASTS (BBG)

- FROST TELLS PM TO PREPARE TO SHAKE ON EU TRADE DEAL 'EARLY NEXT WEEK' (THE SUN)

- CHINA NDRC VOWS TO PREVENT RISKS IN CORPORATE BOND SECTOR (BBG)

- ASIA-PAC SITS BACK AFTER MONDAY'S SHOT IN THE ARM FOR GLOBAL MARKETS

BOND SUMMARY: Tight Ranges, AOFM Supply Applies Light Pressure

The pricing of the A$6.0bn tap of ACGB May '41 in Australia applied some light pressure to both U.S. Tsys and Aussie paper during Asia-Pac hours, with little in the way of broader macro headline flow to note.

- T-Notes trade -0-01+ at 137-31+ last, with the contract operating within a 0-05+ range. The cash curve has seen some light twist steepening on the back of the aforementioned ACGB pricing, after light bull flattening was seen on the relatively limited downtick in e-minis during early Asia dealing.

- The Aussie futures curve holds steeper on the back of the aforementioned ACGB pricing from the AOFM, with YM -1.5 and XM -6.0. Cash trade sees underperformance for the 10-15 Year sector,

- JGB futures have held to a narrow range in Tokyo dealing, last -1, with the highlight there being the latest round of BoJ Rinban ops covering 1-10 Year JGBs. The size of the purchases across that zone of the curve remained unchanged, with little in the way of notable movements in the offer/cover ratios.

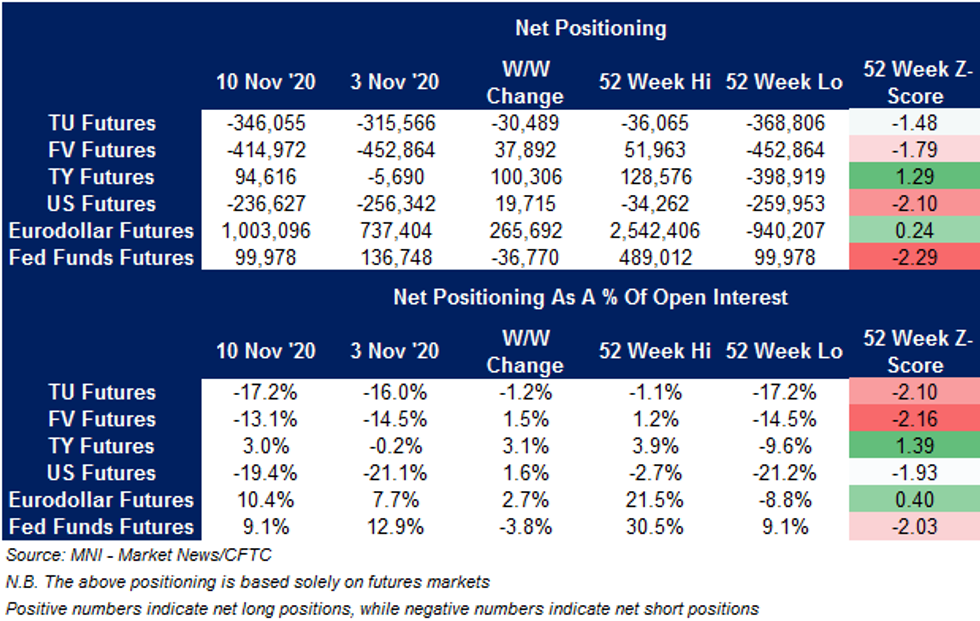

US TSYS: TY & Eurodollar Positions See Largest swings In CFTC COT

The latest weekly CFTC COT report revealed a chunky swing in TY futures positioning, which saw net longs established in cumulative terms.

- There was also a notable net lengthening of Eurodollar positions.

BOJ: 1-10 Year Rinban Sizes Unchanged

The BoJ offers to buy a total of Y1.34tn of JGB's from the market, sizes unchanged from previous operations.

- Y500bn worth of JGBs with 1-3 Years until maturity

- Y420bn worth of JGBs with 3-5 Years until maturity

- Y420bn worth of JGBs with 5-10 Years until maturity

AUSSIE BONDS: ACGB 2.75% 21 May 2041 Syndicated Tap Priced

The AOFM announces that the syndicated tap of the 2.75% 21 May 2041 Treasury Bond has been priced at a yield to maturity of 1.70 per cent. The issue size is $6.0 billion in face value terms. There was a total of $18.5 billion of bids at the final clearing price. Settlement of the issue will occur on 24 November 2020. National Australia Bank Limited, TD Securities, UBS AG, Australia Branch and Westpac Banking Corporation were Joint-Lead Managers for the issue. The AOFM will be mindful of the performance of the bond when considering the timing of future issuance.

EQUITIES: Rangebound

A quiet macro backdrop made for a limited Asia-Pac session, at least within the major regional equity index space, after a solid Monday rally for global equities (surrounding the well-documented Moderna COVID vaccine trial developments), with at least some of Monday's Asia-Pac rally being attributed to expectations surrounding the vaccine trial (as we flagged at the time).

- Rotational flows into cyclicals continue to be eyed.

- The CSI 300 has seen some marginal underperformance, with continued focus on recent local bond defaults/liquidity stress points & the clampdown on the FinTech sector.

- E-minis were marginally mixed, with the announcement of Tesla's inclusion in the S&P 500 providing some light outperformance for the NASDAQ 100 contract.

- Nikkei 225 +0.2%, Hang Seng +0.1%, CSI 300 -0.3%, ASX 200 +0.1%.

- S&P 500 futures -16, DJIA futures -96, NASDAQ 100 futures +3.

OIL: Edging Higher After Monday's Rally

WTI & Brent have added $0.20-0.30 since settlement, sticking to tight ranges in Asia-Pac hours.

- This comes after the benchmarks benefitted from the broader boost for risk appetite on Monday, which stemmed from the developments surrounding Moderna's COVID-19 vaccine trial. Both metrics added over $1.00 come Monday's settlement, after futures eased back from best levels as we moved through NY trade.

- Back to crude-specific matters, the OPEC+ JMMC is set to convene today. A reminder that the gathering comes after source reports pointed to the OPEC+ JTC coming to a consensus of recommending a 3-6 month extension of current oil supply cuts from participating nations (a reminder that OPEC+ production is currently set to ramp up in January).

- The latest round of weekly API inventory estimates will hit after hours on Tuesday.

GOLD: Well Defined Technical Lines Remain Untouched

Gyrations in the yellow metal continue to be driven by a combination of the broader USD and U.S. real yield dynamics, with Monday's sharp pullback retracing. Bulls still need to force a break above the psychological $1,900/oz level, with spot last dealing little changed around the $1,890/oz mark. The key technical lines in the sand are much further away and remain untouched.

FOREX: GBP Strengthens Amid Brexit Optimism, USD/Asia Catch Up With Vaccine News

Sterling eked out gains in Asia after the Sun reported without attribution that the UK and EU may be close to a breakthrough in their Brexit talks. The article noted that the UK's chief Brexit envoy Frost told PM Johnson to expect a deal next week, possibly as soon as next Tuesday, although the negotiations may still collapse over familiar sticking points. Cable popped higher in reaction to the story, but failed to test yesterday's highs, waiting for London traders to get in.

- Other than that, price action across G10 FX space was muted amid sparse headline/data flow. JPY held up well, while NOK brought up the rear. NZD posted a short-lived downtick as NZ Trade Min O'Connor said that a strong exchange rate is "always a concern". USD struggled for any topside impetus and the DXY tested yesterday's trough.

- USD/Asia generally traded on a softer footing as regional currencies reacted to encouraging results of Moderna's latest Covid-19 vaccine trial. USD/CNH slipped, narrowing in on its recent cycle lows. Losses in USD/KRW were limited by South Korea's recent messaging re: readiness to take stabilising measures.

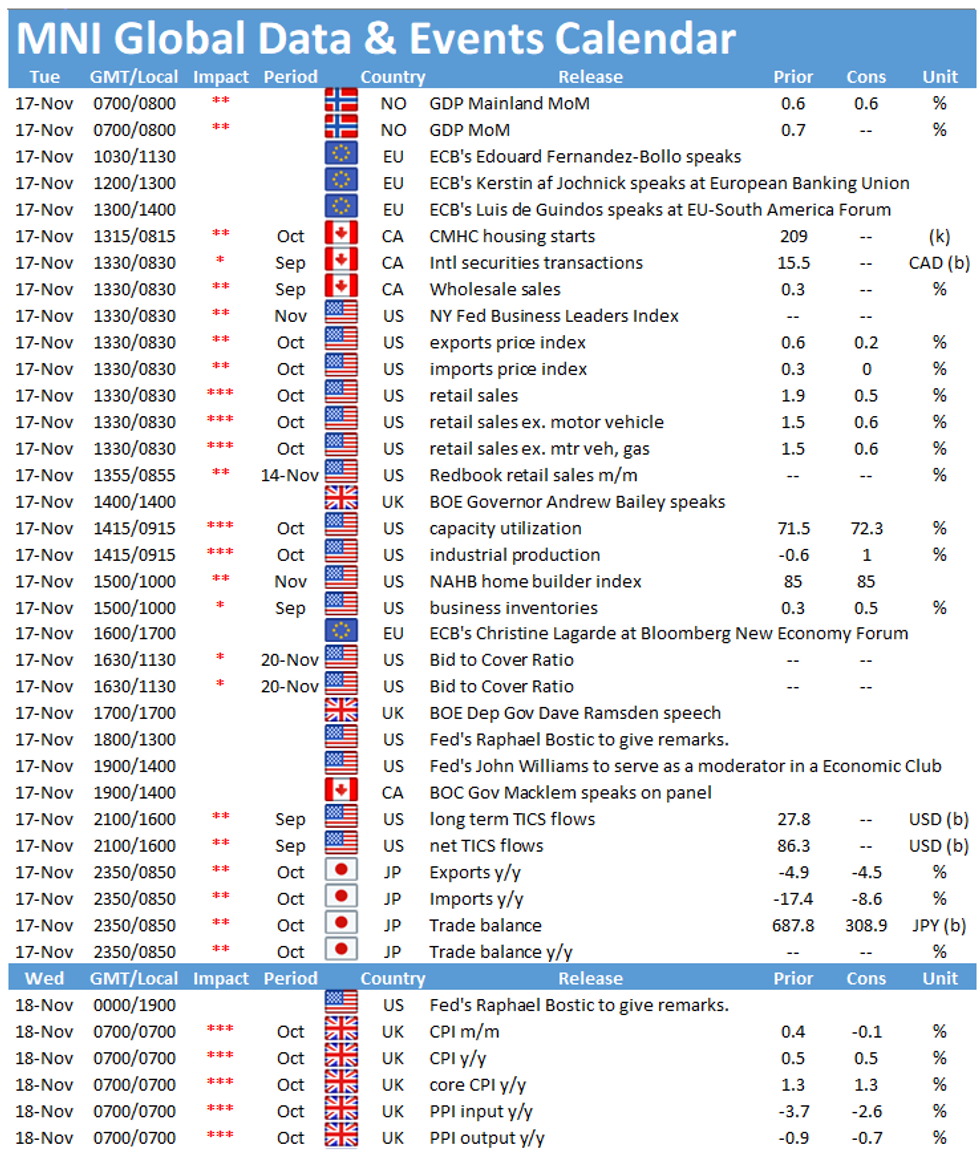

- Focus turns to U.S. retail sales & industrial output, Canadian housing starts, Norwegian GDP & consumer confidence and comments from BoE's Bailey & Ramsden, ECB's Lagarde, BoC's Macklem and Fed's Powell & Barkin.

FOREX OPTIONS: Expiries for Nov17 NY cut 1000ET (Source DTCC):

- EUR/USD: $1.1700-20(E1.4bln), $1.1830(E1.0bln), $1.1850(E2.1bln-EUR calls), $1.1895-1.1905(E1.3bln)

- USD/JPY: Y104.00-09($516mln), Y105.00($636mln)

- EUR/GBP: Gbp0.8900(E923mln), Gbp0.9050(E804mln)

- AUD/JPY: Y76.05(A$552mln), Y76.25(A$604mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.