-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI EUROPEAN OPEN: The Return Of Draghi Imminent?

EXECUTIVE SUMMARY

- PBOC'S RECENT OMO SHOWS AIM TO STABILIZE LIQUIDITY (SEC. TIMES)

- TREASURY'S YELLEN TO CALL REGULATOR MEETING ON GAMESTOP VOLATILITY, SEEKS ETHICS WAIVER (RTRS)

- FORMER ECB CHIEF DRAGHI TAPPED TO LEAD ITALY OUT OF ITS CRISIS (BBG)

- ASTRA SHOT SHOWS 82% EFFICACY WITH U.K.'S TWO-DOSE INTERVAL (BBG)

- CAIXIN SERVICES PMI WRAPS UP SOFT MONTH OF CHINESE PMIS

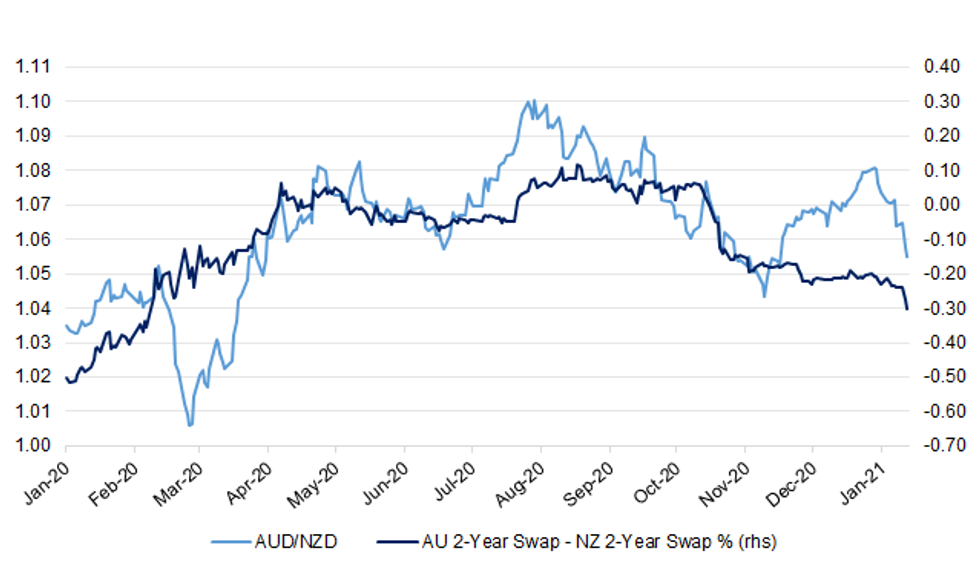

Fig.1 AUD/NZD vs. Australia/New Zealand 2-Year Swap Spread

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BREXIT: Michael Gove will demand today that Brussels take urgent action to relax post-Brexit trade rules between Britain and Northern Ireland because the situation is endangering the peace process. The Cabinet Office minister is expected to tell Maros Sefcovic, his EU counterpart, that the rules do not work and that unionists oppose them. Tension has risen in the province after the European Commission threatened last Friday to renege on elements of the withdrawal agreement. Its officials, who wanted to prevent coronavirus vaccines from being exported to the UK, backed down after an outcry. (The Times)

FISCAL: Ministers will today launch a new more interventionist era for the British state by tearing up European Union aid rules and replacing them with a homegrown subsidy scheme. (Telegraph)

FISCAL: The U.K. is launching a consultation on its post-Brexit subsidies system, which the government has hailed as a "significant milestone" in the country's future outside the European Union. The new U.K.-wide "subsidy control system" will replace the E.U.'s state aid regime, which was a major stumbling block in Brexit talks last year. Prime Minister Boris Johnson's government believes the system will allow the U.K. to be "more dynamic" in providing financial aid to businesses, and better support start-ups, small firms and new industries. (BBG)

BOE: Bank of England ratesetters should leave policy unchanged this week given the remarkable level of uncertainty, with lockdown in force but vaccines being rolled out, The Times' group of nine experts has said. Negative rates should be put in the Bank's policy toolbox but left there untouched, the shadow monetary policy committee added. Tomorrow, the Bank will announce its latest decision on interest rates and quantitative easing alongside its newest forecasts. A review into whether high street banks have the operational capability to apply negative rates will also be published. (The Times)

POLITICS: Labour must make "use of the [union] flag, veterans [and] dressing smartly" as part of a radical rebranding to help it win back the trust of disillusioned voters, according to a leaked internal strategy presentation. The presentation, which has been seen and heard by the Guardian, is aimed at what the party calls "foundation seats", a new term for the "red wall" constituencies that handed Boris Johnson a landslide in 2019, and other seats it fears could also turn blue. It will be seen as a marker of how concerned Labour is about its electoral position. (Guardian)

EUROPE

CORONAVIRUS: The European Commission is proposing to speed up the production of COVID-19 vaccines by helping to upgrade existing pharmaceutical plants or build new ones, according to a letter seen by Reuters on Tuesday. (RTRS)

GERMANY: Angela Merkel has held out the prospect that people vaccinated against Covid-19 could in future enjoy certain privileges over those who refuse to be inoculated against the disease. (FT)

FRANCE: French President Emmanuel Macron said that based on contracts secured at a European level, France will be able to offer the Covid-19 vaccine to all adults who want it "by the end of summer." (BBG)

FRANCE: France will only administer the AstraZeneca coronavirus vaccine to people under age 65, President Emmanuel Macron said Tuesday after the government's health advisory body cited a lack of sufficient data about its effectiveness in older people. The decision could shake up the French vaccination strategy, because the country has prioritized nursing home residents and people over 75. France had counted on the AstraZeneca vaccine for a large part of its upcoming inoculations, until the company announced delays affecting countries around Europe and the world. (AP)

ITALY: Mario Draghi, the former president of the European Central Bank, has been approached to become Italy's next prime minister in a bid to steer the virus-battered country out of its worst recession since the end of World War II. The euro rose on the news that the veteran policymaker, widely praised for his pivotal role during the sovereign debt crisis, would take the helm. Sergio Mattarella, Italy's head of state, will meet Draghi on Wednesday after two rounds of talks failed to seal an agreement among parties on a new premiership for the outgoing Giuseppe Conte, who had hoped to make a comeback. (BBG)

NETHERLANDS: The lockdown in the Netherlands will be extended until March 2, Dutch Prime Minister Mark Rutte announced on Tuesday. Despite decreasing infections since Christmas, Rutte warned of "an inevitable third wave" because the British mutation accounts for about two-thirds of all new infections. A relaxation of measures would have been possible if it weren't for the British variant, he said. (BBG)

IRELAND: Ireland's services sector contracted last month at the sharpest rate since the economy was emerging from an initial COVID-19 lockdown last May after the government imposed its toughest restrictions in nine months, a survey showed on Wednesday. Ireland shut most building sites, shops and the hospitality sector from late December after a four-week reopening led to a huge surge in COVID-19 infections, hospital admissions and deaths. The curbs may be lifted only gradually from March 5. (RTRS)

SNB: Swiss National Bank Governing Board Member Andrea Maechler says Switzerland would be worse off without negative interest rates, according to comments at NZZ Podium discussion in Zurich. "We're convinced that the benefits outweigh the costs". SNB has instruments to reduce monetary base, incl. repos. (BBG)

U.S.

FED: MNI BRIEF: US Must Mind Debt to Keep FX Status - Fed's Kaplan

- Dallas Fed President Robert Kaplan said Tuesday the U.S. must eventually reduce its government debt burden in order to maintain the dollar's global reserve currency status. "We would be wise not to be too sanguine that the dollar is always going to be the world's reserve currency," Kaplan told a webinar, adding the the country must "find ways to deleverage" once the pandemic-related slump is over. Kaplan told MNI in an interview last week he supports the Fed's easy monetary policy. But he said Tuesday that rising stock prices show "there are consequences and side-effects of injecting that amount of liquidity" - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FISCAL: President Biden told Senate Democrats at a virtual lunch on Tuesday that Republicans' current $618 billion coronavirus relief proposal is "too small," but he wants to continue working toward a compromise and is willing to bend on the final price, a source on the call tells Axios. Biden made clear he is not giving up on finding a bipartisan path to passing stimulus legislation, despite many Democrats urging him to use the budget reconciliation process to bypass the GOP. He also said that the White House has red lines that they're unwilling to budge on, including the salary minimums for receiving stimulus checks. (Axios)

FISCAL: U.S. Treasury Secretary Yellen noted the following on Tuesday: "Yesterday's CBO forecast is more evidence that we desperately need Congress to act on a rescue package. Last year, the economy shrunk more than any other since the end of World War II. With the growth that the CBO projects, it will be years before the country reaches full employment again. Then there are the more immediate concerns: Can we get the vaccine distributed quickly? Will people keep a roof over their heads? Will their unemployment benefits last until the end of the crisis? Will families go hungry? Will small businesses survive? All this is why we're proposing the American Rescue Plan: So Americans can make it to the other side of this crisis and be met there by a strong, growing economy." (MNI)

FISCAL: Senator Joe Manchin, a key moderate Democrat from West Virginia, said he'll vote Tuesday to begin the process of passing a stimulus bill using the budget process, though he opposes raising the U.S. minimum-wage to $15 as proposed in President Joe Biden's $1.9 trillion plan. "Our focus must be targeted on the Covid-19 crisis and Americans who have been most impacted by this pandemic," Manchin said in a statement Tuesday, vowing to "only support proposals that will get us through and end the pain of this pandemic." He elaborated to reporters that he opposes a $15 minimum wage because it's too high for his state. (BBG)

FISCAL: Massachusetts Sen. Elizabeth Warren, D-Mass., plans to reignite calls for a wealth tax targeting the nation's richest individuals and families. Warren's office said the progressive Democrat plans to introduce legislation calling for a wealth tax on fortunes valued at more than $50 million as she joins the Senate Finance Committee in the 117th Congress. (Fox Business)

FISCAL: House Democrats plan to act later this year to suspend the debt ceiling through September 2022 using a process that ties the measure to a vote on a budget resolution, according to a committee aide. Democrats plan to use a House rule that treats a vote to adopt a budget resolution as a vote to suspend the debt ceiling for the entirety of the fiscal year, Alexandra Weinroth, spokeswoman for House Budget Committee Democrats, said in an email. The measure would still need support from the Senate and the president, but it could accelerate a debt-limit measure's path through the House. House Democrats plan to use the fiscal 2022 budget resolution to suspend the ceiling through the end of that fiscal year, Sept. 30, 2022, Weinroth said. (BBG)

CORONAVIRUS: The US has reported fewer than 1m new coronavirus cases over the past week, the first time since November that the country has been below that threshold over a seven-day period. The milestone was aided by states reporting an additional 115,619 new infections, according to Covid Tracking Project data on Tuesday. That was the smallest daily increase in cases since November 8 and the third day in a row daily cases have been below 120,000. Over the past week, the US has reported 973,850 coronavirus cases, which marks the first time since November 13 the country has reported fewer than 1m new infections over a seven-day period. A further 3,486 fatalities were attributed to coronavirus, according to Covid Tracking Project data. That was up from 1,562 on Monday and marked the highest daily death toll since Friday. Still, the US has averaged 3,097 deaths a day over the past week, which is the lowest rate in eight days. That gradually declining trend in fatalities is accompanying hospitalisations and cases, which are now at their lowest levels in months. (FT)

CORONAVIRUS: President Joe Biden's administration announced Tuesday that it is moving to expand access to COVID-19 vaccines, freeing up more doses for states and beginning to distribute them to retail pharmacies next week. The push comes amid new urgency to speed vaccinations to prevent the spread of potentially more serious strains of the virus that has killed more than 445,000 Americans. (ABC)

CORONAVIRUS: The United States will begin shipping Covid-19 vaccine doses directly to retail drugstores on Feb. 11 as it looks to expand access to the life-saving shots nationwide, the Biden administration's Covid-19 response team said. (CNBC)

CORONAVIRUS: New York Mayor Bill de Blasio on Tuesday called for the United States to compel vaccine makers to license their products to domestic pharmaceutical companies, saying: "We need wartime mass production here in America." (FT)

CORONAVIRUS: Restaurant workers, taxi drivers and workers at developmentally disabled facilities could become eligible to receive Covid-19 vaccines if local governments choose to include them, New York Governor Andrew Cuomo said. (BBG)

POLITICS: Lawyers for Donald Trump on Tuesday denied that the former president incited a mob of supporters to storm the Capitol or that he tried to stop Congress from confirming President Joe Biden's Electoral College victory. The arguments came one week before Trump's unprecedented second impeachment trial is set to begin in the Senate. Trump was impeached in the House last month on one article of inciting an insurrection. (CNBC)

EQUITIES: U.S. Treasury Secretary Janet Yellen is calling a meeting of key financial regulators this week to discuss market volatility driven by retail trading in GameStop and other stocks Yellen will convene heads of the Securities and Exchange Commission, the Federal Reserve, the Federal Reserve Bank of New York and the Commodity Futures Trading Commission, a Treasury official said on Tuesday. Yellen has sought permission from ethics lawyers to do so, according to document seen by Reuters. (RTRS)

EQUITIES: People close to Robinhood said the startup plans on moving ahead with an IPO. And alternatively, one person said, the brokerage could pursue a debut via direct listing or a deal with a publicly traded "blank-check" firm, known as a special purpose acquisition company. Unicorns including online lender Social Finance Inc., or SoFi, and real estate venture Opendoor Technologies Inc. have agreed to merge with SPACs in recent months. The maneuver avoids a cumbersome IPO process that includes a roadshow, where the response from investors can dramatically reset a company's valuation. (BBG)

EQUITIES: Amazon announced in its earnings report for the fourth quarter of 2020 that Amazon Web Services CEO Andy Jassy will replace Jeff Bezos as Amazon CEO during the third quarter of this year. Bezos will become executive chairman. The company also delivered its largest quarter by revenue of all time at $125.56 billion, pushing it past the symbolic $100 billion mark for the first time. (CNBC)

EQUITIES: Shares of Alphabet, the parent company of Google, rose nearly 8% in extended trading on Tuesday after the company reported fourth-quarter earnings that surpassed analysts' expectations and showed a strong return to growth in its core advertising business. (CNBC)

OTHER

U.S./CHINA: Suspected Chinese hackers exploited a flaw in software made by SolarWinds Corp to help break into U.S. government computers last year, five people familiar with the matter told Reuters, marking a new twist in a sprawling cybersecurity breach that U.S. lawmakers have labeled a national security emergency. (RTRS)

U.S./CHINA/HONG KONG: The United States is "deeply concerned" by China's attempts to disbar and harass Lu Siwei and Ren Quanniu, human rights lawyers representing the Hong Kong 12, State Department spokesman Ned Price said on Tuesday. "We urge Beijing to respect human rights and the rule of law and to reinstate their legal credentials at once," Price said in a post on Twitter. (RTRS)

GEOPOLITICS: Any intervention by the West in Myanmar should be moderate and prevent provoking further confrontations and tensions, the CCP-owned Global Times warned in an editorial. The newspaper warned that any forceful projections of power may not be welcomed by Myanmar or its neighboring states. The West should not complain about China's non-interference approach as the promotion of democracy should be built upon its benefits to the people of Myanmar rather than for gaining political points, the newspaper said. ASEAN countries refraining from intervening in Myanmar's internal affairs were making a practical choice based on goodwill, and the outside world should exercise patience as the situation in Myanmar develops, the editorial said. (MNI)

GLOBAL TRADE: President Joe Biden will issue an executive order requiring the government to review critical supply chains, in an effort to ensure that the US is not too reliant on other countries, including China, for technology and materials. Three people familiar with the order, including one senior US official, said it would demand that government agencies make a broad examination of US supply chains. It would require them to examine procurement, in addition to critical technologies and materials in private-sector supply chains. (FT)

GLOBAL TRADE: A bipartisan group of Senate lawmakers call on NEC Director Brian Deese to work with Congress to resolve the global shortage of semiconductors used for auto manufacturing. (BBG)

CORONAVIRUS: AstraZeneca Plc's Covid vaccine showed 82% effectiveness with a three-month gap between two shots, according to a new study that bolsters the U.K.'s controversial decision to adopt an extended dosing interval. The vaccine may also significantly reduce transmission of the virus, according to analysis of trial data by the University of Oxford, which developed the shot with the British drugmaker. Swabs taken from volunteers in the U.K. arm of the trial showed a 67% reduction in transmission after the first dose, the report showed. (BBG)

CORONAVIRUS: Tedros Ghebreyesus, director general of the World Health Organization, raised the alarm on how weak cooperation between countries could hinder the global recovery from the coronavirus pandemic. (CNBC)

CORONAVIRUS: The Community of Latin American and Caribbean States (CELAC) is worried about measures that would limit exports of vaccines and medical supplies, such as those recently created by the European Union, according to a statement from Mexico's Foreign Ministry. CELAC reiterates the importance of resolution approved by the UN that aims to strengthen universal access to medicine, vaccines and supplies to confront the Covid-19 pandemic, the statement says. (BBG)

CORONAVIRUS: The World Health Organisation team in Wuhan investigating the origins of COVID-19 say they are getting data "which no one has seen before" and are "really getting somewhere" - and have not ruled out the possibility that the virus had escaped from a lab. Dr Peter Daszak, part of the ongoing WHO mission, told Sky News: "We are seeing new information and it's good, it's very valuable stuff that is beginning to help us look at the right directions for this virus." (Sky)

HONG KONG: A series of testing and lockdown actions in Hong Kong on Tuesday night yielded no confirmed infections after officials defended the measures as crucial to bringing down infections ahead of the lunar new year. (FT)

HONG KONG: Hong Kong's education authorities are weighing whether to allow up to a third of a school's student capacity to return for in-person classes after the upcoming holiday, the Post has learned. Two sources said education officials held a meeting with school heads on Tuesday that touched on the arrangements for resuming classes next month after the Lunar New Year holiday. (SCMP)

BOJ: MNI POLICY: BOJ Wakatabe: Must Contain Costs of Easy Policy

- The BOJ should conduct effective monetary easing and must contain the costs of policy measures as much as possible, Bank of Japan Deputy Governor Masazumi Wakatabe said on Wednesday "It is expected that monetary easing will be prolonged, the BOJ should enhance the sustainability of the conduct of monetary policy during normal times and be nimble in responding to changes in developments in economic activity and prices as well as financial conditions," Wakatabe told business leaders in Yokohama City via an online meeting. The Deputy Governor, however, did not elaborate of possible measures to be announced at the March 18-19 policy-setting meeting - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

BOJ: MNI POLICY: Weaker Index Raises BOJ Concerns About Price

- Bank of Japan officials are alert to the possibility of weaker prices after the diffusion index plunged in December but they don't view the underlying price trend as having changed as prices remain solid compared with the big negative output gap, MNI understands - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

RBA: MNI POLICY: QE Needed To Contain AUD, RBA'S Lowe

- The Reserve Bank of Australia's decision to add another AUD100 billion in Quantitative Easing yesterday was largely motivated by the likelihood that if the central bank did not act, there "would be unwelcome upward pressure on the exchange rate" and the AUD. RBA Governor Philip Lowe today explained the decision in a speech entitled "The Year Ahead" at the National Press Club in Canberra, and said that with other central banks recently announcing extensions to their own bond buying programs, any failure to act by the RBA would push the AUD higher - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

NEW ZEALAND: New Zealand medicines regulator Medsafe has provisionally approved the use of a COVID-19 vaccine jointly developed by U.S. drugmaker Pfizer Inc and Germany's BioNTech, the government said on Wednesday. "The provisional approval of the Pfizer-BioNTech vaccine is a positive step in New Zealand's fight against COVID-19," Prime Minister Jacinda Ardern said in a statement. "It means we can now begin preparations for the first stage in our vaccination roll-out." (RTRS)

SOUTH KOREA: South Korea's Financial Services Commission to hold meeting today to decide whether to extend the ban on stock short-selling, Yonhap News says, citing unidentified people. The financial regulator likely to make announcement on its decision after market close today; may also announce proposals to improve short-selling system. (BBG)

NEW ZEALAND: Asian economies roaring back to life have sent Fonterra's whole milk prices to their highest levels in five years, and boosted its forecast payout to farmers this season. Farmers can now expect $6.90 to $7.50 per kilogram of milk solids, a 20c increase from the previous range of $6.70-$7.30, making the midpoint $7.20 per kgMS. Fonterra chief executive Miles Hurrell said the lift was the result of strong demand for dairy being seen at its Global Dairy Trade auctions. Its global dairy index has risen for the last six consecutive auctions. "In particular, we've seen strong demand from China and South East Asia for whole milk powder and skim milk powder, which are key drivers of the milk price," he said. (Stuff NZ)

CANADA: Canada says it has signed a tentative agreement with US vaccine firm Novavax to produce millions of doses of its Covid-19 vaccine candidate at a facility in Montreal. The agreement, announced Tuesday by Canadian Prime Minister Justin Trudeau, is the first of several being developed as Canada says it intends to repatriate vaccine production for decades to come. (CNN)

CANADA: Quebec Premier Francois Legault says non-essential stores, hair salons and museums will reopen throughout the province on Feb. 8, as virus cases and hospitalizations fall. Restaurants' dining rooms, gyms to reopen in a few regions with fewer Covid-19 cases, but will remain closed in Montreal. Nightly curfew to remain in place. (BBG)

MEXICO: U.S. Treasury Secretary Janet Yellen spoke on Tuesday with Mexican Finance Minister Arturo Herrera and underscored her desire to maintain close U.S.-Mexico coordination on economic and security issues, the Treasury Department said in a statement. Yellen told Herrera that Mexico could be a strong partner in working on key priorities, including responding to the COVID-19 pandemic, supporting a robust economic recovery, fighting inequality, and addressing the threat of climate change. She also told Herrera she looked forward to further engagement on shared interests, including combating illicit finance and facilitating economic development in Central America, Treasury said. (RTRS)

MEXICO: Mexico approved the Russian coronavirus vaccine Sputnik V for use Tuesday, just hours after the publication of early results of an advanced study saying it is about 91% effective. Assistant Health Secretary Hugo López-Gatell, the government's pandemic spokesman, said the health ministry signed a contract Monday for 400,000 doses of Sputnik V that will arrive this month. That is still a tiny amount for Mexico's 126 million people. (AP)

RUSSIA: A Russian court on Tuesday handed opposition politician Alexei Navalny a 3½-year jail sentence for parole violations, charges he and his team say are trumped up and politically motivated. Moscow's prison service requested the sentence on Monday, saying he violated the terms of a suspended sentence for fraud charges he received in 2014. (CNBC)

RUSSIA: Russian foreign ministry spokeswoman Maria Zakharova responded by telling Western countries to focus on their own problems. "You should not interfere in the internal affairs of a sovereign state," she said on Russian TV. (BBC)

SOUTH AFRICA: Former President Zuma's decision that he will defy the order of the country's highest court to appear before a commission of inquiry into what happened during his nine years in office is "completely unacceptable," the secretary of the commission says in an emailed statement. (BBG)

IRAN: The U.S. State Department reacted coolly on Tuesday to an Iranian suggestion that Washington and Tehran take synchronized steps to return to the Iran nuclear deal, though a U.S. official said the stance should not be seen as a rejection. (RTRS)

CHINA

CORONAVIRUS: Health authorities in China reported 15 new locally transmitted cases of Covid-19 as strict virus control measures ahead of the lunar new year appeared to be successful. China recorded 12 cases of Covid-19 on Tuesday, the lowest one-day tally this year. (FT)

PBOC: The PBOC may maintain a tight funding balance and soak up excessive funds to prevent risks after demand peaks, the Securities Daily said. The central bank may postpone its scheduled 14-day reverse repo operation planned before the Lunar New Year holiday until after Feb. 4 to relieve pressure resulting from several maturing instruments, the newspaper said. The PBOC's continuous injections in recent days are a normal response to high demand before holidays and do not indicate easing, the newspaper stressed. (MNI)

YUAN: The yuan may edge up as much as 3-5% against the U.S. dollar in the next two years even as the U.S. economy is expected to rebound, lifting Treasury yields, wrote Cui Li, head of macro research at CCB International Securities, in a blog published by the China Finance 40 Forum. China's trade and current account surplus as shares of GDP may stagnate this year, weakening support for the yuan rally, Cui said. He expects the central bank to guide two-way yuan movement, tighten near-term capital inflows to avoid hot money while freeing outbound investments, or restart its balance sheet expansion to hedge short-term inflows. (MNI)

OVERNIGHT DATA

CHINA JAN CAIXIN SERVICES PMI 52.0; MEDIAN 55.5; DEC 56.3

CHINA JAN CAIXIN COMPOSITE PMI 52.2; DEC 55.8

The Caixin China Composite Output Index came in at 52.2 in January, down from 55.8 the previous month. Both supply and demand in the manufacturing and services sectors suffered marginal slowdowns. As a result, the labor market weakened, and employment in the manufacturing industry was worse than that in the services industry. It is noticeable that inflationary pressure soared, with the gauge for input costs reaching the highest level since October 2017. Overall, the manufacturing and services industries continued to recover in January, but the momentum of both supply and demand weakened, dragged by subdued overseas demand. The employment market was under pressure, especially in manufacturing. In addition, we should be careful about rising inflationary pressure in the coming months. This year, we need to keep an eye on the effectiveness of domestic epidemic prevention, and look at how to add momentum to the Chinese economy as uncertainties about overseas demand continue. (Caixin)

JAPAN JAN, F JIBUN BANK SERVICES PMI 46.1; FLASH 45.7

JAPAN JAN, F JIBUN BANK COMPOSITE PMI 47.1; FLASH 46.7

The Japanese services economy started the new year in similar fashion to the way it ended 2020. Latest PMI data signalled a quicker decline in both business activity and new orders, with the latter contracting at the fastest pace since May. Panel members highlighted that a rise in COVID-19 infections and the subsequent implementation of a state of emergency dampened output and demand further. Despite this, Japanese service providers kept staffing levels broadly stable for the fourth month in a row. Moreover, expectations regarding the year-ahead outlook for activity were positive for the fifth consecutive month. Overall private sector activity fell further in January, and at a faster pace. Both the manufacturing and service sectors saw output fall, with the larger service sector noting the sharper contraction. Businesses in the Japanese private sector remained optimistic regarding a rise in activity in the coming 12 months. Although the level of positive sentiment was strong overall, it fell for the third month running due to a rise in COVID-19 cases. Firms cited concerns over when the pandemic would end given the introduction of stricter measures, as well as ever-increasing uncertainty regarding the status of the Tokyo Olympic Games. Nonetheless, businesses were confident that the roll-out of vaccines would enable an end to the pandemic and provide a broad-based boost in demand. As a result, IHS Markit expects the economy to grow 2.3% in 2021. (IHS Markit)

AUSTRALIA DEC BUILDING APPROVALS +10.9% M/M; MEDIAN 3.0%; NOV +3.4%

AUSTRALIA DEC PRIVATE SECTOR HOUSES +15.8% M/M; NOV +6.6%

AUSTRALIA JAN AIG CONSTRUCTION PMI 57.6; DEC 55.3

The Australian Industry Group and HIA Australian Performance of Construction Index (Australian PCI®) improved by a further 2.3 points to 57.6 points in December 2020 and January 2021 (seasonally adjusted, combined result for two months), indicating a stronger pace of recovery in these two months compared to November 2020. This indicates four consecutive months of recovery (results above 50 points) in the Australian PCI and the strongest result since July 2017. All four components of activity expanded strongly in December 2020 and January 2021 (results well above 50 points). The new orders index surged to 58.6 points, its highest level since March 2018, which bodes well for building activity over the next three to six months. Three of the four sectors in the Australian PCI® recovered strongly in December and January (index results well above 50 points), with only apartment building still contracting, albeit at a slower pace. (AiG)

AUSTRALIA JAN, F MARKIT SERVICES PMI 55.6; FLASH 55.8

AUSTRALIA JAN, F MARKIT COMPOSITE PMI 55.9; FLASH 56.0

Latest PMI data pointed to a sustained recovery in business conditions in the Australian service sector at the start of 2021. Both activity and new business recorded further strong expansions in January, with firms citing the lifting of interstate restrictions and resumption of projects on hold due to the COVID-19 pandemic. Companies in the service sector were thus encouraged to increase workforce numbers in the latest survey period, with the latest rise in employment levels the third in succession. Moreover, the increase was the sharpest seen since May 2019. Business sentiment also remained elevated at the start of the new year, supported by expectations that an improvement in the pandemic situation, particularly lifting international restrictions, would trigger a broad recovery in service sector activity and the wider economy. (IHS Markit)

NEW ZEALAND Q4 UNEMPLOYMENT 4.9%; MEDIAN 5.6%; Q3 5.3%

NEW ZEALAND Q4 EMPLOYMENT CHANGE +0.6% Q/Q; MEDIAN +0.1%; Q3 -0.7%

NEW ZEALAND Q4 EMPLOYMENT CHANGE +0.7% Y/Y; MEDIAN -0.1%; Q3 +0.4%

NEW ZEALAND Q4 PARTICIPATION RATE 70.2%; MEDIAN 70.3%; Q3 70.1%

NEW ZEALAND Q4 PVT WAGES EX OVERTIME +0.5% Q/Q; MEDIAN +0.5%; Q3 +0.4%

NEW ZEALAND Q4 PVT WAGES INC OVERTIME +0.5% Q/Q; MEDIAN +0.4%; Q3 +0.4%

NEW ZEALAND Q4 AVERAGE HOURLY EARNINGS +1.1% Q/Q; MEDIAN +0.3%; Q3 +1.4%

NEW ZEALAND JAN ANZ COMMODITY PRICE INDEX +3.6% M/M; DEC +1.8%

SOUTH KOREA JAN FOREIGN RESERVES $442.73BN; DEC $443.10BN

CHINA MARKETS

PBOC NET DRAINS CNY80BN VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) injected CNY100 billion via 7-dayreverse repos with the rate unchanged on Wednesday. This resulted in a net drain of CNY80 billion given the maturity of CNY180 billion of reverse repos today, according to Wind Information.

- The operation aims to keep the liquidity in the banking system reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) dropped to 2.1496% at 09:41 am local time from 2.2410% at Tuesday's close.

- The CFETS-NEX money-market sentiment index closed at 34 on Tuesday vs 36 on Monday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.4669 WEDS VS 6.4736

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4669 on Wednesday. This compares with the 6.4736 set on Tuesday.

MARKETS

SNAPSHOT: The Return Of Draghi Imminent?

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 228.95 points at 28591.12

- ASX 200 up 77.699 points at 6840.3

- Shanghai Comp. up 6.968 points at 3540.653

- JGB 10-Yr future down 1 tick at 151.74, yield up 0.1bp at 0.055%

- Aussie 10-Yr future down 2.5 ticks at 98.815, yield up 2.1bp at 1.176%

- U.S. 10-Yr future -0-00+ at 136-29+, yield up 0.85bp at 1.105%

- WTI crude up $0.21 at $54.97, Gold up $3.19 at $1841.19

- USD/JPY up 3 pips at Y105.01

- PBOC'S RECENT OMO SHOWS AIM TO STABILIZE LIQUIDITY (SEC. TIMES)

- TREASURY'S YELLEN TO CALL REGULATOR MEETING ON GAMESTOP VOLATILITY, SEEKS ETHICS WAIVER (RTRS)

- FORMER ECB CHIEF DRAGHI TAPPED TO LEAD ITALY OUT OF ITS CRISIS (BBG)

- ASTRA SHOT SHOWS 82% EFFICACY WITH U.K.'S TWO-DOSE INTERVAL (BBG)

- CAIXIN SERVICES PMI WRAPS UP SOFT MONTH OF CHINESE PMIS

BOND SUMMARY: Narrow Ranges For Core FI, Mostly Lower In Asia

T-Notes have edged away from their early Asia-Pac lows, but have held to a 0-05+ range, to last trade -0-00+ on the day at 136-29+, 0-02+ off worst levels. Light bear steepening remains in play in the cash space, with 30s 1.0bp or so cheaper on the day, while e-minis are higher on the day in the wake of earnings from tech giants Amazon & Alphabet. The space looked through a softer than expected Caixin services PMI print out of China, given the softer than expected Chinese PMI readings already seen in recent days.

- JGB futures -3 vs. yesterday's settlement, holding tight ranges, with the belly seeing some marginal underperformance in cash trade. The BoJ delivered the expected Y50bn cuts to the purchase sizes of both of the 1-3 & 3-5 Year Rinban buckets, which was in line with broader expectations after the adjustments to the relevant purchase bands in the Bank's February Rinban outline. There was little in the way of meaningful movement in the offer/cover ratios, even against lower purchase volumes.

- Aussie bond futures have operated in the ranges established in early Sydney dealing, with RBA Governor Lowe's address largely reaffirming knowns. The major point of note saw Lowe state that "later in the year, the Board will need to consider whether to shift the focus of the yield target from the April 2024 bond to November 2024 bond. In considering this issue the Board will be giving close attention to the flow of economic data and the outlooks for inflation and jobs. It has made no decision yet." The idea that the RBA's 3-Year yield target may roll forwards at some point in 2021 had been discussed by several analysts in recent days/weeks and gained further traction after the RBA's inclusion of explicit calendar guidance in yesterday's statement. The space ultimately showed little reaction to Lowe's comments, YM +0.5 and XM -2.5 at typing, with the weakness in the longer end stemming from the trans-Tasman impetus in the wake of a stronger than expected NZ labour market report. On the semi front, NSW TCorp launched a benchmark tap of its Mar '33 line, which should price on or before tomorrow.

BOJ: 1-5 Year Rinban Sizes Cut

The BoJ offers to buy a total of Y770bn of JGB's from the market:

- Y400bn worth of JGBs with 1-3 Years until maturity (prev. Y450bn)

- Y370bn worth of JGBs with 3-5 Years until maturity (prev. Y420bn)

AUSSIE BONDS: The AOFM sells A$1.5bn of the 1.00% 21 Dec '30, issue #TB160:

The Australian Office of Financial Management (AOFM) sells A$1.5bn of the 1.00% 21 December 2030, issue #TB160:

- Average Yield: 0.1300% (prev. 1.0656%)

- High Yield: 0.1300% (prev. 1.0675%)

- Bid/Cover: 5.9200x (prev. 2.4725x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 71.4% (prev. 57.7%)

- bidders 38 (prev. 42), successful 6 (prev. 24), allocated in full 0 (prev. 13)

EQUITIES: Third Day Of Gains For Asia-Pac Bourses

Another day of gains for Asia-Pac equities, most indices gaining for a third day. Bourses rose almost across the board in Asia, the Hang Seng is the underperformer with losses of around 0.4% as losses in Alibaba post earnings weigh.

- Markets took a positive lead from the US where indices posted back to back rallies as headlines around the Reddit/GME frenzy subside.

- In Japan the Nikkei rose over 1%, boosted by automakers as Mitsubishi beat earnings with better guidance, while Toyota enjoyed analyst upgrades. The ASX 200 seeing strong gains as well, shaking off losses in iron ore miners as the commodity continues to come under pressure.

- E-mini S&P advanced and Nasdaq futures contracts climbed after Alphabet and Amazon reported revenue that topped estimates, while Amazon also noted that CEO Jeff Bezos will step down from his post, but would stay with the company.

OIL: Crude Futures Build On Gains

Crude futures are higher on Wednesday as they extend Tuesday's gains, benchmarks have hit the highest in over a year on tightening global supplies and indications of strength in physical markets. WTI is up $0.27 at $55.02, brent is up $0.31 at $57.77.

- Data after market yesterday helped support crude; API inventory figures showed a sizable 4.26m bbl draw in headline inventories, while there was also a marginal improvement in fundamentals for downstream markets, reporting 240k bbl and 1.62m bbl draws in US gasoline and distillate inventories, respectively. Data from China showed stockpiles fell to a one year low, declining for the seventh straight week. The market will now look ahead to more comprehensive US DOE data at 1530GMT today.

- OPEC headlines from yesterday continue to offer support. The group said they expect that inventories will fall back below their 5-year averages in June.

- Also supporting prices is robust corporate buying with Shell active in the market again after it engaged in the heaviest buying by a single company since at least 2008.

- The market now focuses on the OPEC+ JMMC meeting scheduled for today, which will provide a preview for the OPEC+ meeting on March 4 when the latest production figures will be announced.

GOLD: Off Tuesday's Lows

The stronger USD has outweighed the impetus from softer U.S. real yields over the last 24 hours, leaving gold a little softer over that timeframe, with spot last dealing around the $1,840/oz mark. Bears managed to have a brief and very shallow look below $1,830/oz on Tuesday, before retracing to current levels during Asia-Pac hours.

FOREX: NZ Jobs Report Sends Kiwi Flying, Gets 2021 OCR Cuts Priced Out

NZD caught a bid in Asia after a strong local Q4 jobs report inspired further unwinding of RBNZ easing bets, with money markets pricing out chances for any OCR reductions this year. The unemployment rate unexpectedly dropped to 4.9% from 5.3%, on the back of a decent beat in employment growth & a marginally slower than projected uptick in the participation rate. Evidence that GDT prices are still on a tear (BNZ & Fonterra raised their respective milk price forecasts for 2020/21) & fresh data reinforcing the belief that NZ housing market remains hot helped the kiwi to build on the impetus provided by the stellar jobs report and the Antipodean currency easily outperformed all of its peers from the G10 basket. NZD/USD extended its rally off the 50-DMA tested yesterday, while NZD/JPY rose to its best levels since Apr 2019.

- NZD gains spilled over into its Antipodean cousin, to a degree, albeit BBG trader sources pointed to AUD/NZD sales by macro & leveraged funds after RBA Gov Lowe signalled potential for the RBA shifting its YCC target from Apr '24 to Nov '24. The pair sank for the fourth day in a row as commodity price dynamics (dairy vs. iron ore prices) combined with QE dynamic differential between the RBA/RBNZ & NZ jobs data rendered AUD/NZD heavy.

- Safe haven currencies traded on a softer note as risk sentiment remained positive, with e-minis ticking higher in the wake of blockbuster earnings reports from Alphabet & Amazon.

- The PBOC fixed USD/CNY at CNY6.4669, a 10 pip miss against sell side estimates, which brings misses to +42 pips so far in February. The bank drained a net CNY 80bn of liquidity via OMO's after three days of injections.

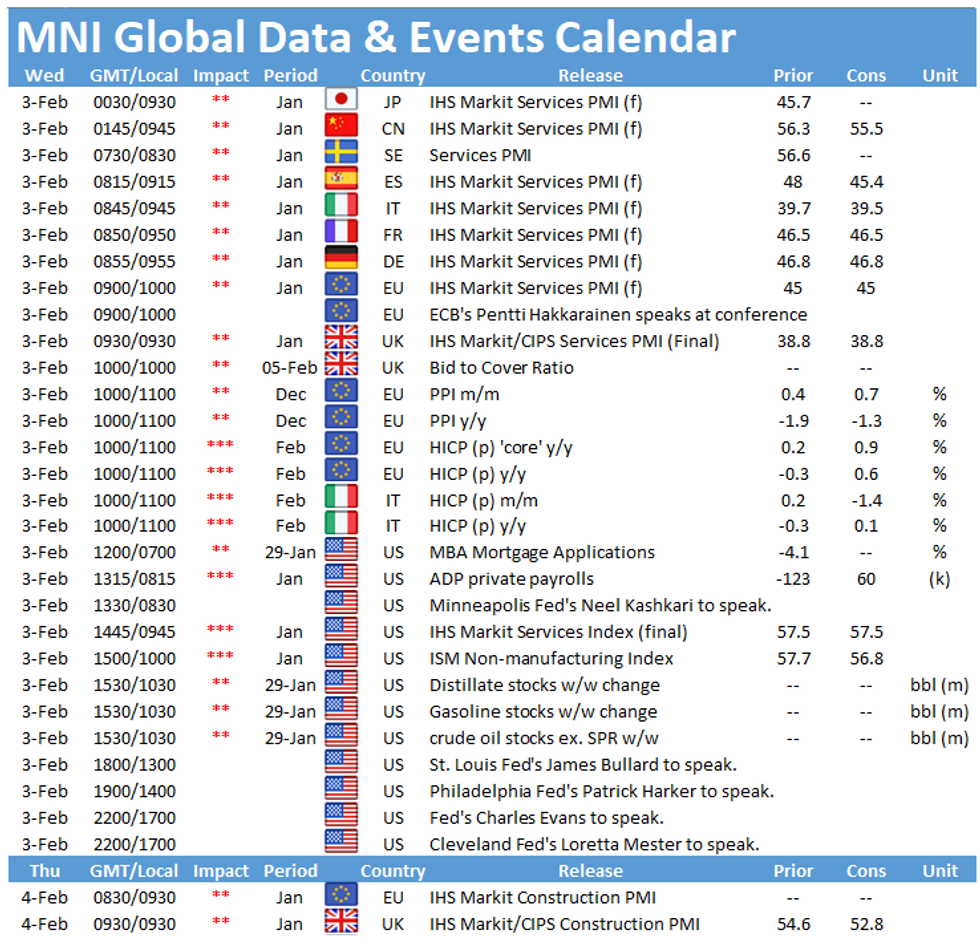

- Preliminary inflation data from the EZ & Italy, U.S. ADP employment report, a number of services PMI readings from across the globe and comments from Norges Bank's Bech-Moen as well as Fed's Kashkari, Bullard, Harker, Mester & Evans.

FOREX OPTIONS: Expiries for Feb03 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1995-15(E526mln), $1.2070-80(E1.2bln-EUR puts), $1.2100-15(E1.0bln)

- USD/JPY: Y103.75-80($610mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.