-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Equities Soften, PBoC Liquidity Injection Underwhelms

EXECUTIVE SUMMARY

- WHITE HOUSE: BIDEN BELIEVES U.S. NEEDS TO WORK CLOSELY WITH ALLIES ON CHINA ISSUES (RTRS)

- BIDEN COMMERCE PICK SEES NO REASON TO PULL HUAWEI OFF BLACKLIST

- YELLEN TO MEET MARKET REGULATORS ON THURSDAY

- SEC HUNTS FOR FRAUD IN SOCIAL-MEDIA POSTS HYPING GAMESTOP (BBG)

- PBOC ROLLS SOME LIQUIDITY TO COVER LNY HOLIDAY

- EQUITIES A LITTLE DEFENSIVE IN ASIA

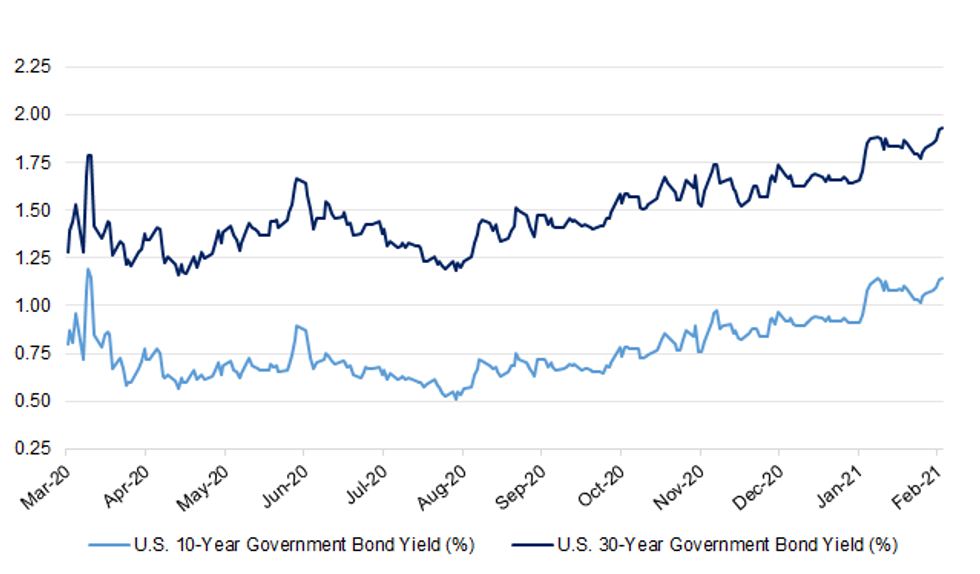

Fig. 1: U.S. 10- & 30-Year Government Bond Yields (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: The coronavirus infection rate in the UK is "still alarmingly high", the prime minister has said, but England's chief medical officer has suggested we are past the current peak. Boris Johnson told a Downing Street news briefing that there were "signs of hope" as he hailed the UK passing the milestone of having administered 10 million first doses of a COVID-19 vaccine. (Sky)

CORONAVIRUS: Rishi Sunak fears scientific advisers are "moving the goalposts" on the requirements for ending lockdown amid growing frustration within the Government. (Telegraph)

CORONAVIRUS: Ministers are considering extending hotel quarantine to more countries as the Brazilian and South African variants have emerged in 27 more nations including Spain. (Telegraph)

BREXIT: Arlene Foster has said the protocol governing post-Brexit trade in Northern Ireland "cannot work" and must be scrapped, as Boris Johnson warned Brussels he could override parts of the agreement. (Telegraph)

POLITICS: Support for the Labour party jumped after Keir Starmer became leader 10 months ago but the progress in winning over British voters has stalled in recent weeks despite the error-strewn handling of the Covid-19 pandemic by Boris Johnson. Much of the newfound support for the UK's main opposition party has come from former supporters of the smaller Liberal Democrats and Green party, often in Labour-held seats, according to recent internal Labour polling. But, worryingly for Sir Keir, it showed that the party had won over just 4 per cent of people who had voted Conservative when Mr Johnson, the UK prime minister, secured a resounding election victory in 2019. This failure explains why the Labour leader has adopted a pro-family, patriotic message to try to win back working-class voters in the so-called "Red Wall" seats, former Labour strongholds that went Tory at the election. The approach mirrors Joe Biden's successful strategy that helped him claw back blue-collar voters from Donald Trump in the US. (FT)

EUROPE

CORONAVIRUS: Johnson & Johnson told German officials the company expected an approval for its Covid-19 vaccine soon, "but won't be able to deliver before April either way," German Health Minister Jens Spahn says. (BBG)

CORONAVIRUS: Russia filed for approval of its Sputnik V coronavirus vaccine by the European Union medicines regulator, Kirill Dmitriev, the head of co-developer the Russian Direct Investment Fund, said on state television, according to Tass. Approval is expected later this month or next month, he said. (BBG)

ITALY: Di Maio says Italy needs alternative to Draghi government. Five Star Movement's Luigi di Maio says that Italy should have a political government, according to comments cited by Ansa. Di Maio reported to praise Draghi for responding to the President's call during a party meeting. (BBG)

ITALY: The leader of the far-right Brothers of Italy party said on Wednesday she had proposed to her conservative allies to abstain in a confidence vote over the new government being put together by former ECB President Mario Draghi. Such a move would make it much easier for Draghi to take office and might prevent a schism developing within the opposition bloc over his appointment. "As a compromise, we can come together on abstention. That's as far as I can go," Giorgia Meloni told state broadcaster RAI after meeting her allies, the League and Forza Italia. "I am taking for granted that Draghi will succeed in forming a government," said Meloni, who had initially indicated she would vote against any government headed by the former banker. (RTRS)

SPAIN: Spain's government is considering debt relief for companies as extended pandemic restrictions and a slow European vaccine rollout tip the economy into another downturn, according to officials. One proposal would excuse a portion of the debt borrowed through Spain's state-backed loan guarantee program for companies that stand a good chance of surviving after the pandemic, the officials said. They asked not to be identified because the talks are confidential and no decision has been reached. Another action being contemplated is to use state guarantees to encourage banks to offer companies what are known as participatory loans, the officials said. Such subordinated debt is treated as similar to equity and improves the financial situation of a company by reducing its debt ratio. France has proposed something similar. (BBG)

U.S.

FED: MNI POLICY: Evans- 'Mid-2020s' Before The Fed's Goals Are Met

- Chicago Federal Reserve President Charles Evans said Wednesday that policy makers should overlook any short-lived burst of inflation as the pandemic eases, and several years are likely needed before their goals are met and monetary settings could be tightened again. "It will be critical for monetary policymakers to look through temporary price increases and not even think about thinking about adjusting policy until the economic criteria we have laid out have been realized. So I see us staying the course for a while," Evans said in the text of a speech - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FED: MNI BRIEF: Fed's Bullard Says Too Soon to Talk Taper Timing

- It's too soon for the Federal Reserve to begin talking about the timing of a reduction in the central bank's monthly USD120 billion asset purchases despite strong prospects for a second half economic rebound, St. Louis Fed President James Bullard told reporters Wednesday. "It's still too early to initiate that discussion," he said. "I look for the leadership of the chairman for when to begin that discussion." Bullard also downplayed concerns that low Fed interest rates may be sparking a stock market bubble - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FED: MNI BRIEF: Fed's Mester Sees Inflation Staying Modest

- Cleveland Fed President Loretta Mester said Wednesday she does not worry about spiking inflation because "the experience of the last expansion shows that there is a lot of structural pressures that keep inflation down." Mester said monetary policy is "in a good spot now," but added additional fiscal relief is needed to help distribute vaccines. Even when the recovery is moving along, not all industries will come back at once, holding down inflation pressure, she said in the Council for Economic Education event - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FED: INTERVIEW: Inflation Risks Mount, St Louis Fed Economist Says

- The Federal Reserve must watch inflation closely as the pandemic eases to ensure an expected spike later this year does not become a more permanent feature of a post-Covid economy reliant on surging public borrowing, St. Louis Fed economist and senior vice president David Andolfatto told MNI - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FED: America's small businesses remain under stress from coronavirus pandemic disruptions, and many of them say continued government support is crucial to their survival, according to a new report from the Federal Reserve's 12 regional banks released on Wednesday. Just under 90% of companies surveyed by the Fed banks said business had not returned to pre-pandemic levels almost a year after the crisis began. Of those that lost ground, 30% said that without more government aid, their companies might not survive, the report said. (Dow Jones)

ECONOMY: MNI INTERVIEW: US Service Recovery Faster Than Fed Expects- ISM

- The U.S. services sector is on track for a speedier recovery than most economists and the Federal Reserve are projecting, Institute for Supply Management survey chair Anthony Nieves told MNI Wednesday. Forecasts from the Fed are likely too conservative, and "we should see a good first half, and a better second half," he said - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FISCAL: President Biden indicated in a call with House Democrats that he was open to sending $1,400 payments to a smaller group of Americans in the next round of coronavirus relief legislation and changing the overall price tag of his $1.9 trillion plan, according to people familiar with the call. Mr. Biden told House Democrats on Wednesday that he wouldn't change the amount of the proposed $1,400 payments, saying people had been promised that amount, according to the people. Instead, he said he would consider targeting them differently than the previous two rounds of direct aid to Americans. Members of both political parties have questioned whether the $1,400 payments he has proposed would go to people who don't need the aid. (WSJ)

FISCAL: Senate Majority Leader Charles Schumer (D-N.Y.) on Wednesday said Democrats are "united" about going big on coronavirus relief after a meeting with President Biden. "There's agreement, universal agreement. We must go big and bold," Schumer told reporters. Biden met with Schumer and ten incoming Democratic committee chairmen who will have a hand in crafting the coronavirus relief bill. The Senate still needs to pass a budget resolution that greenlights passing coronavirus relief without needing to overcome a 60-vote filibuster. (The Hill)

FISCAL: Treasury Secretary Janet Yellen held a virtual discussion today with a bipartisan group of mayors to outline state and local aid as a part of President Biden's Covid relief package. Yellen also emphasized that a lack of aid to states during the last recession "led to a weaker labor market and undercut the broader economic recovery". (BBG) The U.S. House of Representatives passed a budget that helps clear the path for a fast-tracking of President Joe Biden's $1.9 trillion Covid-19 relief plan. The Senate plans to pass an identical version of the budget later this week. The House vote followed action by the Senate to consider a similar budget resolution -- beginning a process that would let Democrats proceed with the stimulus without Republican votes. Still, the president told reporters before an Oval Office meeting with Democratic senators that he thought some Republicans would support his package. (BBG)

FISCAL: Senator Mitt Romney told reporters that "not a single Republican" would support President Biden's Covid relief package if modifications are not made. (BBG)

FISCAL: President Joe Biden's coronavirus rescue plan, and two of its key economic provisions, have broad support as Democrats try to push it through Congress, a poll released Wednesday found. More than two-thirds, or 68%, of Americans support the $1.9 trillion package, the Quinnipiac University survey showed. Only 24% of respondents oppose the measure. The $1,400 direct payments in the plan, a key sticking point as lawmakers negotiate legislation, are more popular than the overall proposal. The poll found 78% of Americans support the stimulus checks, and 18% oppose them. (CNBC)

CORONAVIRUS: The US on Wednesday reported new coronavirus cases and hospitalisations that were at their lowest levels since November, although the country's death toll rose by almost 3,700. States reported 116,960 new infections, according to Covid Tracking Project, down from a revised 117,616 cases on Tuesday. That is the smallest single-day increase in cases since November 8. (FT)

CORONAVIRUS: California Governor Gavin Newsom announced a partnership with the Biden administration to open a mass vaccination site at the Oakland-Alameda County Coliseum, home of the Oakland A's baseball team, as the most-populous state tries to ramp up an inoculation effort that has trailed other parts of the U.S. Speaking in Oakland, Newsom said the site and one at California State University in Los Angeles should be operational on Feb. 16. California has tripled the number of daily shots it administers and expects to get 1.06 million doses this week, Newsom said. (BBG)

POLITICS: The U.S. Senate approved a two-year power sharing deal negotiated by top leaders of both parties that gives Democrats committee chairmanships and sets other ground rules, allowing the chamber to begin fully functioning after weeks of procedural limbo. The agreement approved by unanimous consent Wednesday is based on a 2001 deal reached the last time the 100-member chamber was divided 50-50. The accord allows the same number of Republicans and Democrats on committees and gives each party an even split of panel budgets. Democrats, though, will control committee gavels and Majority Leader Chuck Schumer will set the agenda on the floor. (BBG)

POLITICS: House Republican Leader Kevin McCarthy declared on Wednesday that he supports keeping Rep. Liz Cheney in her leadership role and opposes stripping Rep. Marjorie Taylor Greene of her committee seats at this time, sources familiar with his closed-door remarks told Axios. (Axios)

EQUITIES: Thursday will see Treasury Secretary Yellen convene a meeting with the heads of the Securities and Exchange Commission, Federal Reserve Board, Federal Reserve Bank of New York, and Commodity Futures Trading Commission to discuss recent volatility in financial markets. (MNI)

EQUITIES: Robinhood Markets Inc. is facing more than 30 civil lawsuits in relation to trading restrictions imposed by the online brokerage that temporarily limited purchases of certain securities last week, according to court records. (WSJ)

EQUITIES: U.S. Securities and Exchange Commission investigators are combing social media and message board posts for signs that fraud played a role in dizzying stock swings for GameStop Corp., AMC Entertainment Holdings Inc. and other companies, according to people familiar with the matter. The scrutiny is being done in tandem with a review of trading data to assess whether such posts were part of a manipulative effort to drive up share prices, said the people, who requested anonymity because the review isn't public. The regulator is specifically on the hunt for misinformation meant to improperly tilt the market, the people said. (BBG)

EQUITIES: Republican Rep. Patrick McHenry says it is important that a House Financial Services Committee hearing on GameStop find out whether laws were broken in addition to what created the atmosphere for recent market volatility. Need to bring in some of the app developers, no-cost brokerage platforms and regulators to discuss the issue, McHenry, the top Republican on the panel, says in a Bloomberg TV interview. It is "not the right approach to bring in everyday investors" and it is important to understand what happened with liquidity: McHenry. McHenry also says he hopes there will be legislation to address the issue. (BBG)

EQUITIES: A FOX reporter tweeted the following on Wednesday: "Will lawmakers/regulators take aim at a seemingly esoteric Wall Street practice known as "payment for order flow" following @RobinhoodApp - @reddit trading frenzy? Capitol Hill chatter says they might. That cld pose a big problem commission-free trading." (MNI)

OTHER

U.S./CHINA: U.S. President Joe Biden will speak broadly about foreign policy when he visits the State Department on Thursday, but will not offer specifics on policy, White House spokeswoman Jen Psaki told a news briefing. Psaki reiterated that Biden believes the United States must work closely with allies on China, a relationship his Secretary of State Antony Blinken has said is arguably the most important Washington has in the world. (RTRS)

U.S./CHINA: Gina Raimondo, President Biden's pick to be commerce secretary, said she has "no reason to believe that entities" placed on U.S. restricted trade lists, including Huawei Technologies and ZTE Corp., "should not be there." (BBG)

GEOPOLITICS: Comments by Japan's State Minister of Defense saying China was opposing 'politically free democratic nations' on the Myanmar situation reflect Japan's Cold War mentality, the Global Times said citing Xu Liping, director of the Center for Southeast Asian Studies at the Chinese Academy of Social Sciences. The military takeover does not mean joining 'the league of China', Xu said. Smaller countries have been given little choice in their form of governance as western democracies actively promote their models, the newspaper said. (MNI)

GLOBAL TRADE: The EU and the UK are set to open in-depth competition investigations into Nvidia's $40bn acquisition of the UK chip designer Arm, after rivals called for the deal to be blocked. Officials and advisers in both Brussels and the UK said that serious scrutiny of the deal was warranted, given the growing importance of Arm's designs, which are used in almost all smartphone processors and many other devices that require low-power chips. (FT)

CORONAVIRUS: The number of Covid-19 vaccinations globally has surpassed the total number of confirmed cases, a landmark moment that underscores progress made in taming the pandemic despite mounting concern about the threat of new variants. According to the Financial Times vaccine tracker, the number of doses administered climbed close to 104m on Wednesday while the number of confirmed cases was just over 103m. (FT)

CORONAVIRUS: The team behind the Oxford-Astrazeneca vaccine plan to have a second-generation jab ready by the autumn to protect against mutant strains of the coronavirus. They are confident that the existing vaccine, a workhorse of the NHS immunisation campaign, will be effective against the fast-spreading "Kent variant", which fuelled a surge of cases across Britain late last year. (The Times)

JAPAN: Japan could start vaccinating medical personnel as soon as Feb. 17, FNN reported, citing unidentified government officials. The health ministry is expected to approve the use of Pfizer vaccines scheduled to arrive in the country around Feb. 14. (BBG)

AUSTRALIA: Victorian health authorities are probing the possibility of aerosol transmission of COVID-19, as restrictions are tightened statewide after a Melbourne hotel quarantine worker tested positive. As well as the Australian Open hotel worker, who is considered a case of community transmission, health authorities reported two new cases in hotel quarantine on Thursday. (The Age)

NEW ZEALAND: Person is family member of two previously-reported community cases, Covid Response Minister Chris Hipkins says at news conference Thursday. (BBG)

SOUTH KOREA: South Korea says it will boost available housing nationwide with a positive supply "shock" as President Moon Jae-in struggles to tame soaring home prices that are weighing on his approval ratings. The government will ramp up supply by another 836,000 homes, including 323,000 in Seoul, by 2025 and speed up construction, according to a statement released Thursday by the Ministry of Land, Infrastructure and Transport. (BBG)

NORTH KOREA: The South Korean and U.S. presidents agreed on the need for a comprehensive strategy on North Korea as they push to work together to achieve denuclearization on the Korean Peninsula, officials said. (AP)

BOC: Bank of Canada Deputy Governor Lawrence Schembri said the central bank's research suggests any adjustments to the inflation targeting mandate should be incremental. "Maybe there's an opportunity to overshoot the target a little bit or tolerate an overshoot if we want to be aggressive in reducing the risk of being at the effective lower bound," Schembri said. "We might be willing to tolerate a small overshoot or, like the Fed has done, actually aim for an overshoot. And that's a question we are pondering right now" (BBG)

BRAZIL: The new heads of Brazil's lower house and senate pledged to work on key economic reforms and additional Covid-19 assistance, as they held their first meeting with President Jair Bolsonaro in a display of unity. House Speaker Arthur Lira and Senate President Rodrigo Pacheco, who swept to the key congressional jobs with Bolsonaro's support, wrote in a Wednesday joint-statement they would prioritize bills to reform the tax system and the careers of public servants while also discussing ways to assist Brazilians who lost their income during the pandemic. (BBG)

RUSSIA: The Biden administration has extended a crucial nuclear weapons treaty with Russia for five more years, America's top diplomat announced Wednesday. The New Strategic Arms Reduction Treaty, or New START, was set to expire this week. The agreement is the sole arms control treaty in place between Washington and Moscow following former President Donald Trump's withdrawal from the Intermediate-Range Nuclear Forces, or INF, treaty. (CNBC)

RUSSIA: The suspected Russian hackers that attacked U.S. companies and government agencies were interested in accessing "sensitive but unclassified communications" mostly stored on Microsoft Corp. products, according to the U.S. Department of Homeland Security's top cybersecurity official. (BBG)

IRAN: Secretary of State Tony Blinken has asked newly appointed Iran envoy Rob Malley to form a negotiating team made up of diplomats and experts with a range of views on the path forward with Iran, U.S. officials tell me. Those instructions indicate the Biden administration is attempting to avoid groupthink when drafting its policies on Iran, while also signaling to critics that a diversity of views will be taken into consideration. (Axios)

MIDDLE EAST: Israeli airstrikes targeted a number of sites in southern Syria late Wednesday night, the country's state media reported, in the latest in a series of attacks on Iran-linked facilities attributed to the Jewish state. (Times Of Israel)

METALS: Vale SA, the last iron ore major to report on production, churned out less than expected in the fourth quarter, delivering a welcome boost to a shaky global market for the steel-making ingredient. The Rio de Janeiro-based company produced 84.5 million metric tons compared with the 86.6 million-ton average estimate. The result also fell short of the third quarter due to higher rainfall and tailings disposal restrictions. Pandemic-related disruptions are slowing Vale's recovery from a 2019 dam disaster that cost the company the title of world's biggest producer. That may help ease concerns after rivals BHP Group and Rio Tinto Group said they're targeting higher production at a time China may look to rein in steel making amid weak margins and rising port stockpiles. (BBG)

METALS: Brazilian miner Vale SA and authorities in the state of Minas Gerais said on Wednesday they have defined potential settlement terms regarding a 2019 mining disaster, with a source saying the deal is worth about 37 billion reais ($6.89 billion). A dam containing mining waste burst in January 2019 at a Vale facility in the town of Brumadinho in Minas Gerais, releasing a torrent of sludge that killed some 270 people. In a statement, Minas Gerais officials, alongside state and federal prosecutors, said the terms would be further discussed at a meeting set for Thursday, when a deal could potentially be signed. Neither Vale nor the officials commented on the value of the deal. (RTRS)

CHINA

POLICY: China will emphasize the sustainability of its macro-economic policies and ensure they are based on normalized fundamentals, while also ensuring that any withdrawal of stimulus will be measured to avoid abrupt changes and potential risks, Chen Changsheng, a director from the Development Research Center of the State Council said in an interview with Economic Daily. China's CPI this year should be relatively low as regional pandemic control measures subside and consumer demand recovers, said Chen. China should see a lower dependence on real estate finances to make quick asset turnovers as new regulations curb unregulated real estate loans, Chen said. (MNI)

YUAN: The Chinese yuan may strengthen further to as high as 6.2 against the U.S. dollar amid increased volatility, the China Securities Journal reported citing Zhang Ming, deputy director of the Institute of Finance at the Chinese Academy of Social Sciences. In the long term, the yuan's rally may be difficult to support given China's current account surplus will likely narrow after other economies recover, the newspaper said citing Liu Zhengning, a CICC analyst. (MNI)

EQUITIES: Initial public offerings in China have undervalued companies by up to $200bn over the past six years, academic research indicates, reflecting a struggle to price listings in the world's second-biggest equity market. Limits on the valuations at which companies can sell shares in IPOs on most Chinese bourses mean that groups listing onshore may have raised just a quarter of what they otherwise could have, according to a working paper provided exclusively to the Financial Times by researchers at the University of Hong Kong. Researchers determined the extent of IPO under-pricing by tallying up the early share price gains across almost 1,300 market debuts from 2014 to July 2020 on the main stock exchanges in Shanghai and Shenzhen, as well as the latter's tech-focused ChiNext market and its small business-oriented SME Board. (FT)

FINTECH: Ant Group Co. and Chinese regulators have agreed on a restructuring plan that will turn Jack Ma's fintech giant into a financial holding company, making it subject to capital requirements similar to those for banks. The plan calls for putting all of Ant's businesses into the holding company, including its technology offerings in areas such as blockchain and food delivery, people familiar with the matter said. One of Ant's early proposals to regulators had envisioned putting only financial operations into the new structure. An official announcement on the overhaul could come before the start of China's Lunar New Year holiday next week, the people said, asking not to be identified discussing private information. (BBG)

OVERNIGHT DATA

AUSTRALIA DEC TRADE BALANCE +A$6.785BN; MEDIAN +A$8.750BN; NOV +A$5.014BN

AUSTRALIA DEC EXPORTS +3% M/M; MEDIAN +6%; NOV +3%

AUSTRALIA DEC IMPORTS -2% M/M; MEDIAN -2%; NOV +9%

AUSTRALIA Q4 NAB BUSINESS CONFIDENCE 14; Q3 -8

The Q4 survey showed a continued recovery across the business sector, following the turnaround in Q3. Both conditions and confidence rose strongly – turning positive – and are now at relatively high levels. Confidence rose 22pts to +14 index points, led by gains in the services sectors as well as manufacturing and retail. Conditions rose to an above average +9 index points, with conditions now positive in all industries following a fairly rapid recovery following the low point in Q2. According to Alan Oster, NAB Group Chief Economist "like many other indicators the survey shows that the economy continued to rebound strongly late in Q4. Optimism in the business sector continued to strengthen as the impacts of severe lockdowns faded". (NAB)

NEW ZEALAND DEC BUILDING PERMITS +4.9% M/M; NOV +1.2%

NEW ZEALAND FEB, P ANZ BUSINESS CONFIDENCE 11.8; JAN 9.4

NEW ZEALAND FEB, P ANZ ACTIVITY OUTLOOK 22.3; JAN 21.7

The preliminary ANZ Business Outlook data for February improved further. Business confidence lifted 3 points to +12% while the activity outlook inched over +22%. Some of the details were strong too, with investment intentions up 9 points, employment intentions up 2 points, and capacity utilisation up 7 points – all are sitting well above where they ranged in 2019, pre-COVID. Expected costs rose 14 points. It's quite telling that a net 71% of firms expect higher costs ahead (with the net figure comprising 72% expecting higher costs, 27% expecting no change, and just 1% expecting lower costs). Firms are intending to pass the costs on where they can, with a net 49% of firms intending to raise their prices, up 13%pts. But that's a lot fewer firms than are experiencing higher costs, no doubt going a long way to explaining why expected profits dropped 6 points to 1%. Inflation expectations lifted too, from 1.65% to 1.78%, another step closer to the 2% RBNZ CPI target midpoint. We are forecasting a wobble in demand in the first few months of this year as the true cost of the closed border for the tourism industry starts to become apparent. But it's fair to say there's not much sign of it yet, with the roaring housing and construction sectors filling the void, albeit fuelled by credit rather than foreign exchange earnings. Further monetary stimulus is looking less necessary by the week, and we no longer expect any more OCR cuts this cycle. The RBNZ has taken the line for a few years now that too much inflation would be a 'quality' problem, after years of undershooting the target. At the rate things are going, they might just get what they wish for. But a lot of it is likely due to temporary factors and can be expected to unwind. There should be some awesome 'Boxing Day' sales once all that Christmas retail stock finally arrives. (ANZ)

CHINA MARKETS

PBOC INJECTS CNY100BN VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY100 billion via 14-dayreverse repos with rates unchanged at 2.35% on Thursday. This keeps the liquidity unchanged after offsetting the maturity of CNY100 billion repos today, according to Wind Information.

- The operation aims to maintain stable liquidity before the Spring Festival, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.3256% at 09:25 am local time from the close of 2.1181% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 38 on Wednesday vs 34 on Tuesday. A higher index indicates increased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.4605 THUS VS 6.4669

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4605 on Thursday. This compares with the 6.4669 set on Wednesday.

MARKETS

SNAPSHOT: Equities Soften, PBoC Liquidity Injection Underwhelms

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 291.15 points at 28358.65

- ASX 200 down 59.105 points at 6765.5

- Shanghai Comp. down 42.913 points at 3473.656

- JGB 10-Yr future down 11 ticks at 151.63, yield up 0.2bp at 0.060%

- Aussie 10-Yr future down 6.0 ticks at 98.760, yield up 5.1bp at 1.225%

- U.S. 10-Yr future -0-02+ at 136-23, yield up 0.52bp at 1.143%

- WTI crude up $0.31 at $56.01, Gold down $12.87 at $1821.26

- USD/JPY up 12 pips at Y105.14

- WHITE HOUSE: BIDEN BELIEVES U.S. NEEDS TO WORK CLOSELY WITH ALLIES ON CHINA ISSUES (RTRS)

- BIDEN COMMERCE PICK SEES NO REASON TO PULL HUAWEI OFF BLACKLIST

- YELLEN TO MEET MARKET REGULATORS ON THURSDAY

- SEC HUNTS FOR FRAUD IN SOCIAL-MEDIA POSTS HYPING GAMESTOP (BBG)

- PBOC ROLLS SOME LIQUIDITY TO COVER LNY HOLIDAY

- EQUITIES A LITTLE DEFENSIVE IN ASIA

BOND SUMMARY: Core FI Mostly Lower

Asia-Pac trade saw fresh ~12-month highs for 30-Year Tsy yields and Alibaba launch a $5bn round of multi-tranche $ supply, covering 10-, 20-, 30- & 40-Year paper, although the Tsy space moved off worst levels, with equities trading on the defensive as U.S. President Biden's nominee for Commerce Secretary noted that the likes of Huawei & ZTE should remain on the restricted trade list (we would argue that this doesn't provide a shock, but dented broader risk sentiment in a limited overnight session). T-Notes still -0-02+ on the day at 136-23, while the cash curve has seen some modest twist steepening. Swap spreads are a little wider on the day, which would have helped the early upward momentum in yields (10s and 30s have cheapened for 5 consecutive days on a closing basis). On the flow side, an 800 lot block buyer of WNH1 was seen.

- The wings of the cash JGB curve were firmer, looking through the offshore impetus. However, the belly lagged all day, and has actually cheapened during afternoon trade, underperforming for a second straight day as futures added to their overnight losses, with the latter last -10. The latest 30-Year JGB auction wasn't the firmest, but wasn't as weak as last month's, with the tail pretty steady, although the low price did match broader dealer exp. (as proxied by the BBG poll), while the cover ratio recovered from last month's dip to print at "normal" levels.

- YM -1.0, XM -5.5, with the latter operating through its recent lows. The curve holds steeper on the day, with no respite for those of a bullish disposition, even with any hedging flow surrounding the pricing of the A$1.6bn tap of NSWTC's Mar '33 line subsiding. As we have flagged previously, there is speculation that the syndication of a new ACGB Nov '32 could be announced via the weekly AOFM issuance slate, due to be released on Friday, while fresh multi-month highs for U.S. 30-Year yields and the trans-Tasman impetus from NZ bonds stemming from RBNZ re-pricing will be adding pressure from abroad.

JGBS AUCTION: Japanese MOF sells Y734.8bn 30-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y734.8bn 30-Year JGBs:- Average Yield 0.662% (prev. 0.648%)

- Average Price 100.94 (prev. 101.30)

- High Yield: 0.665% (prev. 0.652%)

- Low Price 100.85 (prev. 101.20)

- % Allotted At High Yield: 3.2505% (prev. 37.7084%)

- Bid/Cover: 3.474x (prev. 2.977x)

JAPAN: Bland Weekly International Security Flows

Once again, little stands out in terms of headline net flow in the latest round of weekly Japanese international security flow data, which is outlined below.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 729.6 | 756.2 | 2498.3 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -569.2 | -264.5 | -588.5 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 62.1 | 143.3 | 486.7 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | -187.5 | 209.8 | 712.3 |

EQUITIES: Rally Loses Steam

Asia-Pac equities couldn't manage to extend their rally into a fourth day, most indices in the region are lower. The move lower started near the end of the US session as the S&P wiped out the majority of the day's gains, while the Nasdaq dropped into negative territory.

- The move lower started with US futures as after-market earnings disappointed. Qualcomm dropped as the chipmaker missed on sales estimates. US futures have extended declines, e-mini S&P down around 0.5% at the time of writing.

- Markets in South Korea and Hong Kong lead the way lower with losses over 1%, bourses in mainland China are lower are comments regarding a trade blacklist from US President Biden's nominee for commerce secretary.

OIL: Rally Extends

Crude futures gained for fourth session, extending their rally after comments from OPEC+ ministers indicated the group would continue to work on reducing the supply surplus. WTI is up $0.41 at $56.10/bbl, brent is up $0.36 at $58.82/bbl.

- In a post JMMC meeting communique, OPEC+ "stressed the importance of accelerating market re-balancing without delay" and also noted uncertain demand prospects headings forward. The group kept output levels for February and March unchanged as expected. On the supply front the EIA projected that American oil production wouldn't surpass 2019 levels until 2023.

- US DOE supply data was also supportive, the figures showed a drawdown in headline inventories of 994k which takes stocks down to a 10-month low. Also supportive on the supply front were projections from the EIA that US oil production won't surpass 2019 levels until 2023. Upside was tempered by a large build in gasoline inventories of 4.47m/bbls.

GOLD: Still Biased Lower

Bullion has softened over the last 24 hours, with spot sitting a little over $10/oz softer during Asia-Pac trade, last printing a touch above $1,822/oz, with the technical upside break in the DXY and uptick in longer dated U.S. real yields allowing bears to switch their focus to the Jan 18 low at $1,804.7/oz.

FOREX: Commodity Market Dynamics Underpin AUD

AUD topped the G10 pile on the back of firmer commodity prices, as crude oil extended its rally after OPEC+ pledged to continue reducing the supply surplus, while iron ore gained after Vale's quarterly output undershot forecasts. In addition, the Australian Bureau of Statistics highlighted a surge in iron ore exports to a fresh record of A$12.6bn in December. The data was part of the monthly trade report, which saw trade surplus widen less than expected, owing to a miss in exports. However, also on the data front, a recovery in Australia's NAB Business Confidence helped keep the Australian dollar buoyant. BBG trader source flagged demand for the Aussie from local exporters, with option-related offers reportedly placed ahead of sizeable $0.7650 strikes. AUD/NZD snapped its four-day losing streak and showed above the prior day's range.

- USD/JPY edged higher, extending its winning streak to seven days in a row. There are some chunky option expiries coming up at today's NY cut, including $1.6bn of options with strikes at at Y104.30-40, $1.4bn at Y105.00 & 41.0bn at Y105.55-65.

- The greenback fared relatively well, but the DXY struggled to break out of yesterday's range despite adding a handful of pips through the session.

- The PBOC fixed USD/CNY at CNY6.4605 today, 14 pips above sell side estimates and the twelfth straight fix above the estimate. The PBOC matched liquidity withdrawals with injections today, but used the 14-day repo tool as we get closer to LNY.

- GBP went offered ahead of today's announcement of the BoE's latest monetary policy decision. Cable printed worst levels in two weeks and narrowed in on the $1.3600 mark.

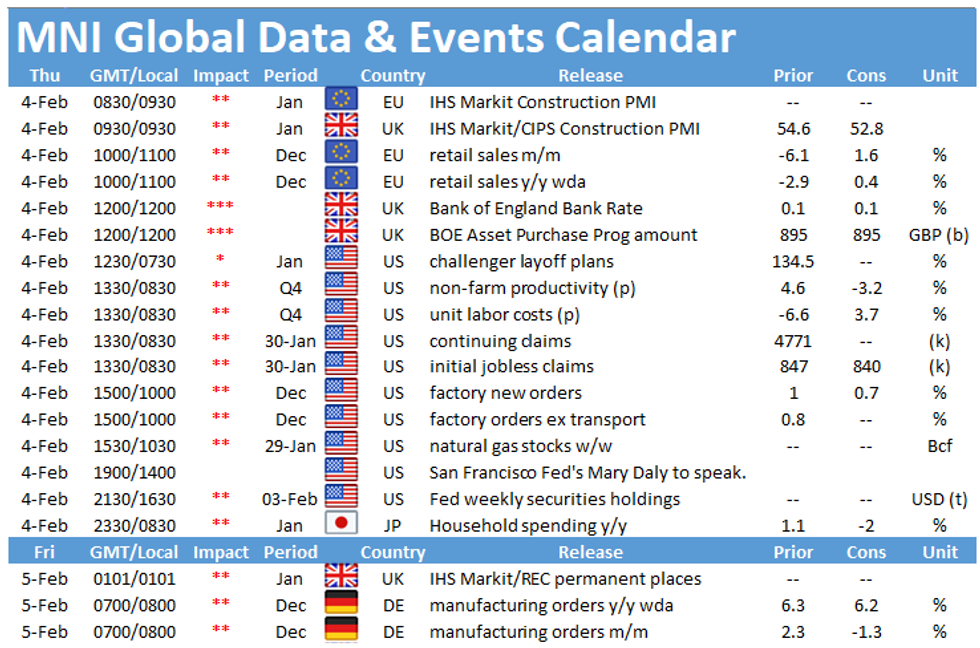

- Other than the BoE decision, focus turns to U.S. initial jobless claims, factory orders & final durable goods orders, EZ retail sales, ECB economic bulletin and comments from ECB's de Cos and Fed's Kaplan & Daly.

FOREX OPTIONS: Expiries for Feb04 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1890(E585mln), $1.2000-10(E1.15bln), $1.2025-35(E1.4bln), $1.2045-50(E1.7bln), $1.2125-35(E575mln), $1.2150-60(E886mln)

- USD/JPY: Y102.00($780mln), Y104.30-40($1.6bln), Y105.00($1.4bln), Y105.55-65($1.0bln)

- AUD/USD: $0.7550(A$828mln), $0.7595-00(A$697mln)

- AUD/NZD: N$1.0690-1.0700(A$615mln-AUD puts)

- NZD/USD: $0.7100(N$853mln), $0.7375(N$502mln)

- USD/CAD: C$1.2590-1.2600($760mln)

- USD/CNY: Cny6.39($625mln), Cny6.43($580mln), Cny6.45($876mln)

- USD/MXN: Mxn19.50($609mln), Mxn19.75($605mln), Mxn20.00($817mln), Mxn20.50($1.8bln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.