-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Markets Coil In Asia Ahead Of LNY Break

EXECUTIVE SUMMARY

- FED'S GEORGE SAYS STILL TOO SOON TO DISCUSS TAPERING BOND BUYING (BBG)

- J&J SEEKS EMERGENCY VACCINE CLEARANCE IN U.S. (BBG)

- RECOVERY FASTER SAYS RBA, BUT SUPPORT STILL NEEDED (MNI)

- U.S. TREASURY SAYS CORE MARKET INFRASTRUCTURE RESILIENT AMID FRENZY (BBG)

- ITALY'S DRAGHI STARTS GOVT. TALKS, GETS PD BACKING AND SOFTER STANCE FROM 5-STAR (RTRS)

Fig. 1: U.S. 5-Year & 10-Year Breakevens

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Outdoor sport and socialising are set to be among the first activities to be allowed after schools return next month, The Times has learnt. Boris Johnson's plans for a release from lockdown in the spring will prioritise open-air contact and set out dates for the opening of retail and then hospitality after pupils return to classrooms. Outdoor activity is likely to be permitted first in each phase. Team and individual sports such as golf and tennis, along with limited social gatherings outside, would therefore be possible within weeks of a planned return of schools from March 8. Outside markets are likely to be allowed to open before high street shops, and al-fresco dining before eating indoors. Government sources said that the plans were "tentative". (The Times)

CORONAVIRUS: Boris Johnson is being "over-cautious" in keeping all schools closed until March 8 because there "really isn't a case" for refusing to open them earlier, some of the Government's own scientific advisers have said. (Telegraph)

CORONAVIRUS: Leading medics have warned against complacency over the pace of England's emergence from coronavirus restrictions as coronavirus cases dropped across all regions. It comes as lockdown-sceptic MPs stepped up pressure on Boris Johnson for a return to normal life . The leader of the influential Covid Recovery Group of Conservative MPs, Mark Harper, said restrictions should be removed entirely by the end of May. And another senior backbencher, Sir Graham Brady, told The Independent that the success of the vaccination programme should enable the prime minister to make moves to "reopen normal life" in the coming weeks. (Independent)

CORONAVIRUS: The U.K. will require travelers from coronavirus hot spots to quarantine starting Feb. 15, the government said, adding flesh to a policy first announced last month. Arrivals from countries on the U.K.'s travel ban list will be required to isolate for 10 days in government-approved accommodation, the Department for Health and Social Care said Thursday. The government is seeking bids from hotels near airports and ports to support the program. Meanwhile, British officials are working on a "vaccine passport" to facilitate tourism, the Times reports, without attribution. (BBG)

CORONAVIRUS: Ministers are racing to reserve 28,000 hotel rooms across the UK by 5pm on Friday evening in a bid to launch the Government's "red list" quarantine scheme by the middle of this month. (Telegraph)

CORONAVIRUS: British officials have started work on a "vaccine passport" as Greece prepares to waive quarantine rules for tourists who can prove that they have been inoculated against coronavirus. A certification system is being planned, The Times has learnt. The Foreign Office, Department for Transport and Department of Health and Social Care are working on options for travellers to countries that may demand it as a condition of entry. (The Times)

ECONOMY: MNI BRIEF: UK Retail Footfall Plunges As 3rd Lockdown Kicks In

- UK retail footfall slumped in January, underlining the tough trading conditions for shops across malls and high streets according to the latest BRC-Shoppertrak footfall monitor, declining almost 77% on year, with Helen Dickinson CEO of the British Retail Consortium, saying "uncertainty for closed retailers puts many jobs and stores at risk." However, perhaps not all is doom and gloom. "It's important to remember that when retail has reopened from lockdown, demand for in-store shopping has returned each time." added Andy Sumpter, Retail Consultant EMEA for ShopperTrak - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

ECONOMY: MNI BRIEF: UK Staff Demand Falls Amid Jan Lockdown

- Demand for temporary workers rose across the UK with an uptick in short-term vacancies, James Stewart, Vice Chair at KPMG said Friday, although there was a sharp dip in demand for permanent workers, with the latest KMPG/REC Jobs report showing the largest downturn since June. Recruiters also signalled renewed downward pressure on starting salaries and temporary wages, although the rate of decline was milder than those recorded in 2020. "There is cause for optimism," Stewart noted, "as businesses carefully monitor the vaccine rollout and look forward to the Budget next month" - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

EUROPE

GERMANY: German Chancellor Angela Merkel said it's still too soon to ease the lockdown in Europe's largest economy even as the pandemic shows signs of easing. (BBG)

FRANCE: New, more infectious Covid-19 variants – including those first identified in the UK and South Africa – have risen to 14 per cent of infections in France from 3.3 per cent on January 8, French prime minister Jean Castex announced on Thursday. Mr Castex nevertheless told a news conference that France was not for the moment planning a new coronavirus lockdown, because the epidemic was under control although the situation remained "particularly fragile" and hospitals were under pressure. "A new confinement can only be a last resort," he said, "but if we are forced to...we will not hesitate to do what is necessary." (FT)

ITALY: Former European Central Bank chief Mario Draghi started talks on Thursday on forming a new Italian government as the largest party in parliament as the 5-Star Movement, softened its initial hostility to his appointment. The centre-left Democratic Party (PD) gave Draghi its backing but it was still unclear whether he could muster a majority after Matteo Salvini's right-wing League said it would not support a government backed by 5-Star. (RTRS)

SWEDEN: Sweden's financial watchdog says the prevailing concern that economic support might be withdrawn too soon has started to overshadow the danger that countries and markets might get addicted to relief measures. Erik Thedeen, director general of the Financial Supervisory Authority in Stockholm, said the current level of support is "justified." "But it also locks those economies into perpetual support from a central bank," he said in an interview on Thursday. "I don't think that's fundamentally good, and we must have a discussion that there are such risks." He referred specifically to what he characterized as the European Central Bank's "massive" purchases of government and corporate bonds, singling those out as the "most extreme" example. (BBG)

RATINGS: Ratings reviews of note scheduled for after hours on Friday include:

- Moody's on the Czech Republic (current rating: Aa3; Outlook Stable) & Malta (current rating: A2; Outlook Stable)

- S&P on the European Stability Mechanism (ESM) (current rating: AAA; Outlook Stable)

U.S.

FED: Federal Reserve Bank of Kansas City President Esther George said the U.S. central bank was still "far away" from achieving its goals and it was premature to start a debate on scaling back its massive bond-buying program. "I continue to think it is too soon to try to speculate about that," George said in a Bloomberg TV interview. "Until we see the path to getting past this virus, it will be difficult to make any prognosis about when that time might come." (BBG)

FED: Federal Reserve Bank of Dallas President Robert Kaplan spells out that the timing on reducing the pace of central bank bond buying will be dictated by the path of the virus. "We've left the term 'substantial further progress' intentionally not explicitly defined. I'm going to be very careful to avoid talking anything about timing and I want to avoid being rigid or prejudging how the economy might unfold," he says, referring to the guidance the Fed has laid out for adjusting its $120 billion monthly pace of bond purchases. (BBG)

FED: President Biden on Thursday formally withdrew Judy Shelton's nomination to the Federal Reserve Board, closing the book on her quest to join the central bank. Shelton's nomination was withdrawn with more than two dozen other officials nominated by former President Trump in January shortly before he left office. The Democratic takeover of the Senate in January effectively ended Shelton's chances of confirmation, and Biden's withdrawal of her nomination does little more than clear the way for his eventual pick to fill the final vacant spot on the Fed board. Biden has not yet indicated who he would nominate in Shelton's place. (The Hill)

ECONOMY: MNI REALITY CHECK: US Jan Jobs Seen Recovering; SA Boost

- U.S. job growth likely rebounded in January after falling in December for the first time since the early days of the pandemic, figures due Friday should show, though seasonal adjustment factors are likely to make last month's job creation seem stronger than it actually was, recruiters and industry experts told MNI - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FISCAL: Speaker Nancy Pelosi and other House leaders will meet with President Joe Biden on Friday. The Senate backed by 99-1 a non-binding call to oppose stimulus checks going to "upper-income taxpayers" -- one of a series of messaging votes the chamber is taking in a complex process of preparing Biden's $1.9 trillion Covid-19 relief plan for passage through Congress. The chamber is expected to be tied up for hours voting on a series of proposed amendments to a budget resolution for 2021, a step required for Biden's package to proceed with Democrat-only support. Between the two parties, more than 550 amendments were filed, though most of them will be symbolic votes unrelated to pandemic relief, and actual votes are likely to be far fewer. The so-called vote-a-rama needs to be finished before the Senate can then pass a budget resolution for the 2021 fiscal year -- something lawmakers anticipate Friday. (BBG)

FISCAL: House Speaker Nancy Pelosi is under pressure from moderate Democrats, whose votes will be needed to pass any stimulus bill along party lines, to split a vaccination-funding package from President Joe Biden's broader Covid-19 relief bill. The Blue Dog Coalition of Democrats wrote in a letter to Pelosi released Thursday that the current plan to pass the administration's $1.9 trillion stimulus bill through a special budget process could take "months." But funding for the patchy U.S. vaccination effort is needed right away, they argued. (BBG)

FISCAL: New U.S. Transportation Secretary Pete Buttigieg told Reuters on Thursday there are "very active" conversations between the White House, Congress and stakeholders about including assistance to the struggling transportation sector, which has sought more than $130 billion in a COVID-19 relief bill. (RTRS)

FISCAL: Sen. Mitt Romney (R-Utah) is proposing a monthly cash benefit totaling $4,200 a year for children ages 0-5 and $3,000 a year for children ages 6-17 as a means of combating child poverty. White House chief of staff Ron Klain tweeted that he looked forward to seeing the details of Romney's plan, calling it "an encouraging sign that bipartisan action to reduce child poverty IS possible." Thus far, Biden's $1.9 trillion coronavirus stimulus proposal has garnered little Republican support. (Axios)

FISCAL: The Biden administration is considering using executive action to forgive Americans' federal student debt, the White House's chief spokeswoman said Thursday, responding to pressure from Democratic lawmakers and progressive groups. President Biden has previously questioned his ability to use executive action to forgive some or all of Americans' federal student debt. He has instead urged Congress to pass legislation to write off $10,000 in student debt for every borrower. (WSJ)

FISCAL: Democrats running the powerful Senate Finance Committee are preparing to take on the uber-wealthy, dark money groups and special interest organizations now that their party has taken control of Congress. The chairman of the committee, Sen. Ron Wyden, D-Ore., detailed his priorities to CNBC on Thursday, the day after he officially took over leadership of the panel. (CNBC)

CORONAVIRUS: US coronavirus hospitalisations on Thursday fell below 90,000 for the first time since late November, while cases rose by the most in five days. There were 88,668 people in hospitals across the US with coronavirus, according to Covid Tracking Project data, down from 91,440 on Wednesday. (FT)

CORONAVIRUS: Johnson & Johnson asked U.S. drug regulators to clear its experimental Covid-19 vaccine for emergency use, setting up what is likely to be a fast-moving review process that could lead to millions more doses becoming available to step up a stumbling immunization drive. The drugmaker said in a statement Thursday that it had filed an application for an emergency-use authorization with the U.S. Food and Drug Administration. If cleared, the shot would give the U.S. a third vaccine to try to halt a pandemic that has killed more than 450,000 Americans. (BBG)

CORONAVIRUS: Regulators in the U.S. have begun to review certain data required for clearance of Novavax Inc.'s Covid-19 vaccine while final-phase clinical trials are still underway, the company said in a statement. The process, called a rolling submission, has also begun in the U.K. and Canada, Novavax said. On Wednesday, the company said European regulators were doing a similar review. (BBG)

CORONAVIRUS: The U.S. Food and Drug Administration is working with industry to ensure that updated vaccines for Covid-19 variants are deployed as quickly as possible, Acting Commissioner Janet Woodcock said. The option of "streamlined" clinical trials for altered vaccines is under discussion, she said. "We do not believe there will be the need to start at square one with any of these products," Woodcock said. "We do not want to create obstacles to getting these tools to the frontlines." The FDA is building on experience with vaccines for other evolving infections diseases, such as the flu, she said. (BBG)

CORONAVIRUS: People who have had Covid-19 should still get vaccinated, but it's OK to temporarily delay getting a shot, Centers for Disease Control and Prevention Director Dr. Rochelle Walensky said during a Twitter Q&A event. Reinfection is possible and the vaccine may help boost the immune system. (CNBC)

CORONAVIRUS: Around the U.S., restrictions are relaxing as the outbreak eases: Massachusetts will increase the capacity on business like restaurants and gyms to 40% from 25%Rhode Island is allowing weddings to have as many as 50 guests, and indoor dining now can include two households. Arkansas said it would not extend a directive requiring bars and restaurants selling alcohol to close at 11 p.m. Puerto Rico will shorten its nighttime curfew by an hour -- the new schedule is midnight to 5 a.m. -- and allow many businesses to operate at 50% capacity. Denver began accepting applications for a program that encourages businesses to add Covid-19 safety measures "beyond what is already required by public health orders," the city government announced. "In doing so, businesses will be able to expand operational capacity, which will help Denver's economy recover. (BBG)

CORONAVIRUS: Wisconsin Gov. Tony Evers issued a new statewide mask order on Thursday, an hour after the Republican-controlled Legislature voted to repeal his previous mandate saying he didn't have authority to make such a decree. Evers and the Legislature have been at odds throughout the pandemic but the latest moves created an unprecedented level of whiplash. Republican lawmakers last year persuaded the state Supreme Court to scrap Evers' stay-at-home order and a state appeals court halted the limits he placed on indoor gatherings. (AP)

CORONAVIRUS: Rep. Peter DeFazio, an Oregon Democrat and chairman of the House Committee on Transportation and Infrastructure, is skeptical about potential Covid-19 testing for domestic flights. The Centers for Disease Control and Prevention is "actively looking" at whether to extend Covid testing to domestic air travel but has not yet decided whether to move forward with the policy. The U.S. started requiring negative Covid tests for inbound international travelers last month. (CNBC)

POLITICS: Former President Donald Trump won't testify at his upcoming Senate impeachment trial, his attorneys said Thursday. Bruce Castor, one of the attorneys defending the ex-president, told NBC News that a request from Democrats issued earlier in the day was a "publicity stunt" and that Trump's case was a "winner." (CNBC)

POLITICS: The House voted Thursday to strip Rep. Marjorie Taylor Greene, R-Ga., of her committee assignments as punishment for a laundry list of extreme views and conspiracy theories she promoted before taking office. The vote passed by a margin of 230-199, with a handful of Republicans siding with the Democratic majority. No Democrats voted against the resolution. (CNBC)

POLITICS: Sen. Ted Cruz (R-Texas) on Thursday formally placed a hold on the Senate voting on the nomination of Gina Raimondo, President Biden's pick for Commerce secretary, due to concerns Raimondo has not clarified her stance on Chinese telecom giant Huawei. "I'll lift the hold when the Biden admin commits to keep the massive Chinese Communist Party spy operation Huawei on the Entity List," Cruz tweeted in response to a report from Bloomberg Business that he had blocked a vote on Raimondo. (The Hill)

EQUITIES: The U.S. Treasury noted the following on Thursday: "Secretary of the Treasury Janet L. Yellen convened a meeting with the heads of the Securities and Exchange Commission, Federal Reserve Board, Federal Reserve Bank of New York, and Commodity Futures Trading Commission to discuss recent financial market volatility. They discussed market functionality and recent trading practices in equity, commodity and related markets. The regulators believe the core infrastructure was resilient during high volatility and heavy trading volume and agree on the importance of the SEC releasing a timely study of the events. Further, the SEC and CFTC are reviewing whether trading practices are consistent with investor protection and fair and efficient markets. Secretary Yellen believes it is imperative to uphold the integrity of these markets and ensure investor protection." (MNI)

EQUITIES: Robinhood has removed limits on buying Gamestop, AMC shares on its platform, according to an update on its support page. Yesterday, Robinhood Increases Limits in Buying AMC, GME Shares. (BBG)

OTHER

U.S./CHINA: Biden said he would work more closely with allies in order to mount pushback against China. "We will confront China's economic abuses," Biden explained, describing Beijing as America's "most serious competitor." "But we're also ready to work with Beijing when it's in America's interest to do so. We'll compete from a position of strength by building back better at home and working with our allies and partners." Biden has previously said that during his political career he has spent more time with China's Xi Jinping than any other world leader. (CNBC)

GEOPOLITICS: President Joe Biden announced he's halting and reversing Trump administration foreign policy initiatives -- including troop drawdowns in Germany and support for a Saudi-led offensive in Yemen that turned into a humanitarian disaster -- as he sought to boost morale at the State Department. Biden said Thursday that he's ordering a full Pentagon review of the U.S. military posture worldwide. That includes freezing former President Donald Trump's plan to withdraw about 9,500 soldiers from Germany -- a move that stunned European allies and generated bipartisan protest in Congress. (BBG)

GLOBAL TRADE: Taiwan government and chip manufacturers will work together to help the car industry development in other countries as Taiwan industries play a key role in global supply chain, Ministry of Economic Affairs said in a statement published Thursday. (BBG)

GLOBAL TRADE: The U.S. Court of International Trade upheld former President Donald Trump's "Section 232" U.S. national security tariffs on steel imports on Thursday, denying a steel importer's challenge to the duties. (RTRS)

JAPAN: AstraZeneca plans to submit an application in Japan for manufacture and sales of its coronavirus vaccine, Nikkei reports, without attribution. Application could be made as soon as this afternoon. (BBG)

JAPAN: The vice president of the International Olympic Committee said the Tokyo Games will "100%" go ahead this summer, despite the pandemic, global disparities in vaccine rollouts and low public support in Japan. (Nikkei)

JAPAN: The extension of Japan's state of emergency will have some short-term impact given the limited operating hours for businesses, Finance Minister Taro Aso tells reporters Friday. Government needs to continue effective support for businesses, Aso Says. Also important to maintain stance of seeking virus containment, fiscal health improvement and economic recovery. Asked about ongoing furlough programs, Aso says government should respond appropriately to requests for furlough support. (BBG)

BOJ: Bank of Japan Governor Haruhiko Kuroda said on Friday the central bank's purchases of exchange-traded funds (ETF) helped ease market strains when the coronavirus pandemic destabilized financial markets last year. "Our ETF buying is aimed at preventing market turbulence from hurting household and corporate confidence," Kuroda told parliament. (RTRS)

RBA: MNI BRIEF: Recovery Faster Says RBA, but Support Still Needed

- The Reserve Bank of Australia said the domestic economic recovery has "run faster than expected," but even under its new baseline scenario, the key indicator of inflation will be well below the central bank's target range of between 2% and 3% by June 2023 - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

AUSTRALIA: The latest NAB/SEEK employment report notes that "new job ads rose 4% m/m in January to be 5.8% above pre-pandemic levels. The rise in job ads suggests labour demand continued to improve as we entered 2021. Advertising exceeds pre-Covid February 2020 levels in five states and territories. Advertising was strongest in WA, Tasmania, South Australia, the Northern Territory and Queensland, but relatively weaker in states with significant CBDs/business services sectors (Victoria, NSW and the ACT). Demand for labour is very strong in the farm sector and recovering in professional services. Trends suggest the unemployment rate will continue to improve in the months ahead and possibly fall faster than officially forecast by the RBA and Treasury." (MNI)

AUSTRALIA/CHINA: Farmers have put investment in long-term agricultural trade strategy at the top of their federal budget wish list. The National Farmers' Federation is pushing for the strategy in the wake of China trade sanctions on barley, some beef and sheep meat producers, wine, seafood and timber. The NFF also warned Australia was not keeping up with the biosecurity safeguards needed to protect production and maintain the nation's global reputation as a provider of clean and green food. Farmers also want more than $400 million over the forward estimates to improve telecommunications in regional Australia. NFF chief executive Tony Mahar said recent trade disruptions would cost the industry $36.9 billion this decade. (Australian Financial Review)

NEW ZEALAND: ASB is the latest bank to introduce stricter new borrowing rules for property investors. Loan-to-value restrictions (LVRs) are expected to return next month at the level at which they were set when they were lifted almost a year ago – requiring banks to lend no more than 5 per cent of new lending to investors with a deposit of less than 30 per cent. But ANZ has already said it requires 40 per cent, BNZ requires 40 per cent from investors who use a mortgage broker and now ASB says it will require 40 per cent, too. Chief executive Vittoria Shortt said: "We're concerned the continued high levels of investor demand are unsustainable so effective immediately we are increasing the deposit required from investors to 40 per cent, from the current 30 per cent." (Stuff NZ)

ASIA: Ahead of the Lunar New Year period selected Asia-Pac exchange holiday schedules can be viewed below:

CANADA: Canada's two biggest airlines are calling on Ottawa to provide clearer guidelines around when vaccinated Canadians will be able to fly again, warning that prolonged lockdowns threaten to permanently cripple their bottom lines. In testimony before the House of Commons transport committee Thursday, representatives at WestJet and Air Canada said federal officials ought to expand airport COVID-19 testing to the national level to ensure safety, while also laying out clear criteria for when domestic travel restrictions might be lifted. (RTRS)

CANADA: MNI INTERVIEW: Canada Budget Neglects Investment -CD Howe

- Canada's next federal budget will add to the country's debt load while failing to boost business investment already lagging the U.S. by the widest margin in decades, C.D. Howe Institute CEO Bill Robson told MNI, pointing to weaknesses identified by the Bank of Canada - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

BOC: MNI POLICY: BOC Balance Sheet Grows to Record CAD562B

- The Bank of Canada's balance sheet grew to a record CAD562 billion last month despite expectations for a near-term decline in size of asset holdings, as federal bonds were added while treasury bills and repos were relatively stable, central bank figures showed - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

MEXICO: Mexico President Andres Manuel Lopez Obrador says in an online video he took an antigen test this morning and the results were negative. "I have to wait a few more days, but I'm in good health," Lopez Obrador said. "I'm recovering from Covid." (BBG)

BRAZIL: Lower house speaker Arthur Lira said he talked to Economy Minister Paulo Guedes about the possibility of restructuring the so-called Bolsa Familia social program or another one. Lira's election as the new lower house speaker makes govt confident in the resumption of reforms agenda, Guedes told reporters after the meeting. Speaker said that lower house is in syncrony with the Economy Ministry. Central bank autonomy bill is on the agenda of the lower house next week, he added. (BBG)

BRAZIL: Brazil is in talks to buy an additional 20 million doses of the coronavirus vaccine developed by China's Sinovac Biotech, the governor of Sao Paulo told Reuters in a Thursday interview, in a show of confidence in the Chinese shot. (RTRS)

RUSSIA: President Joe Biden warned Moscow on Thursday that the United States will not hesitate to raise the cost on Russia and defend American interests in his first major foreign policy address since taking office. "I made it very clear to President Putin in a manner very different from my predecessor that the days of the United States rolling over in the face of Russian aggressive actions, interfering with our elections, cyberattacks, poisoning its citizens, are over," Biden said. (CNBC)

RUSSIA: Russian Foreign Minister Sergey Lavrov and US Secretary of State Antony Blinken have discussed the normalization of relations between Moscow and Washington during their phone call on Thursday, along with issues of strategic stability, the fight against the COVID-19 pandemic, Syrian regulation and the Alexey Navalny case, the Russian Foreign Ministry informed. Lavrov congratulated Blinken on his appointment, expressing readiness for constructive dialogue on a wide range of issues. (TASS)

RUSSIA/RATINGS: Ratings reviews of note scheduled for after hours on Friday include:

- Fitch on Russia (current rating: BBB; Outlook Stable)

IRAN: The U.S., British, French and German foreign ministers are expected to discuss soon how to revive the 2015 Iran nuclear deal abandoned by former U.S. President Donald Trump, four sources familiar with the matter said on Thursday. The sources, who spoke on condition of anonymity, declined to say exactly when the high-level call would take place, though two said it could happen as early as on Friday and two others said it could be next week. It could also cover other issues. (RTRS)

IRAN: In a sign of the urgency President Biden feels about Iran, the White House is convening a National Security Council principals committee meeting Friday focused on the country's nuclear program, people familiar with the matter tell Axios. (Axios)

IRAN: French President Emmanuel Macron on Thursday welcomed the U.S. willingness to engage with Iran, offered himself as an honest broker on the nuclear issue and said Saudi Arabia and Israel must ultimately be involved somehow. (RTRS)

MIDDLE EAST: The US is to end its support for offensive operations by its allies in Yemen, which has been devastated by a six-year war in which more than 110,000 people are believed to have died. "The war in Yemen must end," President Joe Biden said in his first major foreign policy speech. (BBC)

CHINA

CORONAVIRUS: Health authorities in China reported six local cases of Covid-19 on Friday, the lowest tally since December after strict measures were introduced to control outbreaks in the north of the country. China implemented lockdown measures in a number of cities and launched rounds of mass testing as it faced the largest surge in infections since early 2020. The uptick came ahead of the lunar new year next week, when workers traditionally travel home for the holiday. Five of the new cases were reported in Heilongjiang, a province that borders Russia, taking its total number of Covid-19 patients recorded this year to more than 640. Shanghai reported two new Covid-19 cases. (FT)

PBOC: The PBOC's net injection of CNY96 billion this week through OMOs was restrained and reflected the prioritization of stability, the Securities Times wrote in a front-page article citing industry analysts. The PBOC's tighter-than-usual liquidity operations were due to significant increases in fiscal spending and the need to prevent risks, the newspaper reported citing Wang Tao, a chief economist with UBS. China should expect the gradual normalization of monetary policies after March, as domestic growth continues and global pandemic controls progress, Wang said. (MNI)

PBOC: The PBOC's benchmark rate for deposits will be retained over the long term and serve as a cornerstone, the central bank said in a statement on Thursday. The PBOC urged regional banks to focus on their own operations, warning them not to attract deposits from areas outside their permitted regions, according to the statement. The PBOC will continue controlling unregulated deposit products to maintain market order, it said. (MNI)

ECONOMY: Chinese factories are pressing their employees to keep working over the country's New Year holiday as the country's booming export businesses rush to keep pace with global demand. Apple suppliers including Foxconn, Pegatron and Luxshare are offering workers bonuses and overtime over the annual holiday, which begins next week, while other exporters in China cite higher orders and travel restrictions disrupting the country's most important festival. "More workers have stayed for work this year than in the past," said Dan Peng, who works at Foxconn in Guangdong. "The reward for staying is very tempting and orders are abundant." (FT)

HK CONNECT: People's Bank of China and Hong Kong Monetary Authority will announce as soon as Friday the MOU of China-Hong Kong wealth management connect, Hong Kong Economic Journal reports, citing unidentified people. Due to difficulty in setting up accounts in person amid Covid-19, the launching day of the wealth connect is yet to be decided. Regulators in Hong Kong and China have reached consensus on framework and some details such as quota, product range and sales requirement; The MOU will serve to clarify responsibilities on both sides in order to further discuss details. (BBG)

DIGITAL YUAN: Launching the digital yuan in China strengthens the regulation of non-bank payment markets and prevents institutions from monopolizing transaction data, the Economic Information Daily said in a front-page editorial. The digital yuan can help counter the decentralized, large-scale trading of cryptocurrencies, which harm China's sovereignty over its currency, the editorial said. The digital yuan will also further expand the scope of current digital payment methods, according to the Daily. (MNI)

OVERNIGHT DATA

JAPAN DEC HOUSEHOLD SPENDING -0.6% Y/Y; MEDIAN -1.8%; NOV +1.1%

MNI DATA IMPACT: BOJ Consumption Index Has 1st Drop In 5 Mths

- The Bank of Japan's Consumption Activity Index fell 0.6% m/m in December, the first sequential drop in five months, data released by the BOJ Friday showed, confirming the slowdown in private consumption that bank officials expected after the earlier boost from pent-up demand and the government's Go To Travel subsidies - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

JAPAN DEC, P LEADING INDEX 94.9; MEDIAN 95.2; NOV 96.1

JAPAN DEC, P COINCIDENT INDEX 87.8; MEDIAN 87.8; NOV 89.0

AUSTRALIA DEC, F RETAIL SALES -4.1% M/M; MEDIAN -4.2%; FLASH -4.2%

AUSTRALIA Q4 RETAIL SALES EX INFLATION +2.5% Q/Q; MEDIAN +1.9%; Q3 +6.5%

AUSTRALIA JAN AIG SERVICES PMI 54.3; DEC 52.9

The Australian Industry Group Australian Performance of Services Index (Australian PSI® ) rose by 1.4 points to 54.3 points (seasonally adjusted) over the summer holiday period (December 2020 and January 2021*), indicating a further improvement in conditions after the COVID-19 recession of 2020. This was the highest monthly result in the Australian PSI® since November 2019. Results above 50 points indicate expansion in the Australian PSI® , with higher numbers indicating a stronger expansion. The Australian PSI® indicated growth in three services sectors and contraction in two of the five sectors covered (trend data). The 'personal, recreation & other services' sector contracted again in December and January, and at a faster pace than in November. Three activity indicators were positive and two contracted in the summer holiday period. Sales, new orders and employment were positive as activity restrictions eased. Stimulus to the construction sector continued to flow through to services industries that support construction or are affected by it, including property services, transport and logistics. Demand for local and imported consumer goods improved in summer due to a backlog of pent-up demand. (AiG)

AUSTRALIA JAN FOREIGN RESERVES A$54.8BN; DEC A$55.8BN

SOUTH KOREA DEC BOP CURRENT ACCOUNT BALANCE +$11.5071BN; NOV +$9.1767BN

SOUTH KOREA DEC BOP GOODS BALANCE +$10.4958BN; NOV +$9.9507BN

CHINA MARKETS

PBOC INJECTS CNY100BN VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY100 billion via 14-day reverse repos with rates unchanged at 2.35% on Friday. This keeps the liquidity unchanged after offsetting the maturity of CNY100 billion repos today, according to Wind Information.

- The operation aims to maintain stable liquidity before the Spring Festival, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.3409% at 09:30 am local time from the close of 2.3168% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 40 on Thursday vs 38 on Wednesday. A higher index indicates increased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.4710 FRI VS 6.4605

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4710 on Friday. This compares with the 6.4605 set on Thursday.

MARKETS

SNAPSHOT: Markets Coil In Asia Ahead Of LNY Break

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 361.08 points at 28702.49

- ASX 200 up 75.004 points at 6840.5

- Shanghai Comp. up 16.231 points at 3518.09

- JGB 10-Yr future down 3 ticks at 151.64, yield down 0.5bp at 0.056%

- Aussie 10-Yr future up 3.0 ticks at 98.795, yield down 3.3bp at 1.196%

- U.S. 10-Yr future +0-02+ at 136-28, yield down 0.51bp at 1.134%

- WTI crude up $0.34 at $56.58, Gold up $2.03 at $1795.97

- USD/JPY up 2 pips at Y105.56

- FED'S GEORGE SAYS STILL TOO SOON TO DISCUSS TAPERING BOND BUYING (BBG)

- J&J SEEKS EMERGENCY VACCINE CLEARANCE IN U.S. (BBG)

- RECOVERY FASTER SAYS RBA, BUT SUPPORT STILL NEEDED (MNI)

- U.S. TREASURY SAYS CORE MARKET INFRASTRUCTURE RESILIENT AMID FRENZY (BBG)

- ITALY'S DRAGHI STARTS GOVT. TALKS, GETS PD BACKING AND SOFTER STANCE FROM 5-STAR (RTRS)

BOND SUMMARY: Bid In Aussie Bonds Supports U.S. Tsys

With a lack of broader headline developments evident it would seem that spill over from the firming in Aussie bonds, TY flow seeing better buyers in the main & a 10K TUH1 block buy combined to support the U.S. Tsy space in Asia-Pac hours, even with a slight uptick in e-minis evident. We should flag that a 5.0K screen seller of TYH1 did help the space away from best levels, with that contract last +0-02+ at 136-28, within a 0-05 range. The cash curve is a touch flatter, with 30s running a little over 1.0bp richer on the day.

- JGB futures held to a tight range, last -2. Cash trade saw richening across the most of curve, although the belly lagged for a third straight day. In the only real point of note, the BoJ left the purchase sizes of its 5-25 Year Rinban operations unchanged, with offer to cover ratios softening a little

- The lack of an immediate ACGB Nov '32 syndication from the AOFM via today's weekly issuance guidance has supported the longer end of the Aussie bond curve, with speculation surrounding the potential for such an announcement in the AOFM's weekly issuance guidance weighing on the space earlier this week (as we flagged). This leaves the curve flatter, with YM +0.5 and XM +3.0. As mentioned earlier, the SoMP did little to rock the boat, with no gamechangers revealed; underlying inflation is seen below 2% under the central scenario over the forecast horizon and unemployment is expected to tick lower as implied on several occasions earlier this week. Much of the latest RBA appearance in front of the House of Representatives Standing Committee on Economics was dedicated to reaffirming the messaging given earlier in the week, but Governor Lowe did note that the Board hasn't ruled out further bond purchases when its pre-announced scheme runs out of ammo later this year. Elsewhere, Lowe suggested that the Bank's bond buying scheme has lowered longer dated bond yields by ~30bp, while stressing that the Bank has zero appetite re: corporate and bank bond purchases.

JGBS AUCTION: Japanese MOF sells Y5.5637tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y5.5637tn 3-Month Bills:- Average Yield -0.0942% (prev. -0.0919%)

- Average Price 100.0253 (prev. 100.0247)

- High Yield: -0.0912% (prev. -0.0875%)

- Low Price 100.0245 (prev. 100.0235)

- % Allotted At High Yield: 30.2901% (prev. 21.2250%)

- Bid/Cover: 3.734x (prev. 3.787x)

BOJ: 5-25 Year Rinban Sizes Unchanged

The BoJ offers to buy a total of Y540bn of JGB's from the market, sizes unchanged from previous operations.

- Y420bn worth of JGBs with 5-10 Years until maturity

- Y120bn worth of JGBs with 10-25 Years until maturity

AUSSIE BONDS: The AOFM sells A$1.0bn of the 0.50% 21 Sep '26 Bond, issue #TB164:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 0.50% 21 September 2026 Bond, issue #TB164:- Average Yield: 0.5434% (prev. 0.3988%)

- High Yield: 0.5450% (prev. 0.4025%)

- Bid/Cover: 5.7000x (prev. 4.0300x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 53.8% (prev. 40.5%)

- bidders 41 (prev. 42), successful 12 (prev. 17), allocated in full 5 (prev. 10)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance schedule:

- On Monday 8 February it plans to sell A$500mn of the 4.50% 21 April 2033 Bond.

- On Tuesday 9 February it plans to sell A$100mn of the 2.00% 21 August 2035 Indexed Bond.

- On Wednesday 10 February it plans to sell A$1.0bn of the 1.00% 21 November 2031 Bond.

- On Thursday 11 February it plans to sell A$1.0bn of the 21 May 2021 Note & A$500mn of the 27 August 2021 Note.

- On Friday 12 February it plans to sell A$1.0bn of the 3.25% 21 April 2029 Bond.

EQUITIES: Green On The Screens

Equity markets are in the green in Asia, led higher by a positive lead from Wall Street. Japan and Australia were the biggest gainers, benchmarks in both up well over 1%.

- Markets in Australia were supported by the RBA SoMP and comments from RBA Governor Lowe that indicated the low rate environment was here until the recovery had firmed. The index was also supported by gains in iron ore.

- US markets rallied for fourth day yesterday, and futures are up around 0.2% in early trade on Friday. Earnings remained in focus as earnings season gathers steam, EBay and PayPal both surged on upbeat forecasts.

OIL: On Track For Strongest Weekly Gain Since October

Crude futures are higher, heading into the end of week on track for 5 consecutive daily gains and a total weekly gain of around 8.5% - its best week since October. WTI is last up $0.40 at $56.63/bbl, brent is $0.39 at $59.23/bbl.

- Saudi Arabia kept oil pricing unchanged for Asia, its main market, defying expectations of a cut as OPEC seeks progress in supply demand dynamics.

- A confluence of positive influences are supporting oil. The vaccine programme globally is underway and hopes over a US stimulus package stoking demand have provided a tailwind for oil.

GOLD: Pressured By The Greenback

Gold has struggled over the last 24 hours, with bulls hampered by the latest uptick in the DXY, while U.S. real yields are ultimately little changed over that horizon, after unwinding an uptick on Thursday. Spot last deals virtually unchanged, hovering around $1,795/oz, a little above yesterday's low, with yesterday's break lower leaving bears focused on the Dec 1 low at $1,775.9/oz.

- ETF holdings of gold continue to flat line, with little meaningful movement seen in that particular metric since the pullback from all-time highs stabilised in early December.

FOREX: Antipodeans Soften In Thin Pre-NFP Trade

G10 FX held relatively tight ranges ahead of the U.S. NFP report, with Antipodean currencies underperforming their peers from the basket. A BBG trader source flagged AUD & NZD sales after a weaker PBoC fix, although China's central bank set its USD/CNY mid-point just a handful of pips above BBG median est. AUD/USD established itself under the 50-DMA breached yesterday as RBA Gov Lowe noted that interest rates will remain low for "quite a while yet." NZD/USD probed the water below its 50-DMA but failed to consolidate south of that moving average ahead of a long weekend in New Zealand.

- The fact that it was the thirteenth consecutive higher miss in the PBoC fix may have amplified pressure to the redback. USD/CNH advanced to new weekly highs, with bulls keeping an eye on the 50-DMA intersecting near the round figure of CNH6.5000.

- The DXY had a look above Thursday's low, printing a fresh two-month high. The index is on course for capping its second straight week of gains.

- The U.S. NFP report headlines today's economic docket, with U.S. trade balance, German factory orders, Canadian unemployment, Italian retail sales & Norwegian industrial output also due. Central bank speaker slate features BoE Gov Bailey & ECB Vice Pres de Guindos.

FOREX OPTIONS: Expiries for Feb05 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1990-1.2010(E988mln), $1.2040-50(E934mln)

- USD/JPY: Y103.00($1.0bln-USD puts), Y104.95-105.00($1.5bln)

- EUR/GBP: Gbp0.8770(E775mln)

- AUD/USD: $0.7600(A$627mln), $0.7650(A$824mln)

- AUD/NZD: N$1.0600(A$520mln), N$1.0650-60(A$570mln)

- USD/CNY: Cny6.4000($700mln), Cny6.4250($815mln)

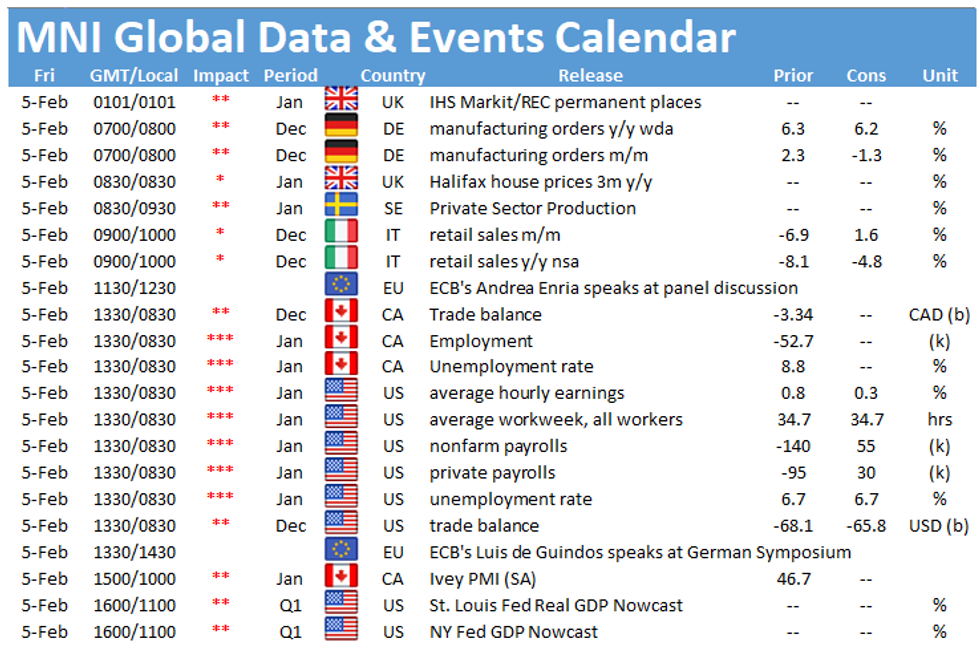

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.