-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Reflation Trade Still Running Hot

EXECUTIVE SUMMARY

- PFIZER-BIONTECH SHOT STOPS COVID SPREAD, ISRAELI STUDY SHOWS (BBG)

- SCHUMER PREDICTS BIDEN WILL SIGN STIMULUS BEFORE MAR 14 UNEMPLOYMENT DEADLINE (FORBES)

- CHINA CALLS FOR RESET IN SINO-U.S. RELATIONS (RTRS)

- UK'S JOHNSON TO SAY ALL SCHOOLS IN ENGLAND TO OPEN MARCH 8 (BBG)

- DUP TO LAUNCH LEGAL ACTION AGAINST N IRELAND POST-BREXIT PROTOCOL (BBG)

- ECB SET TO DISAPPOINT CAMPAIGNERS ON CLIMATE CHANGE (FT)

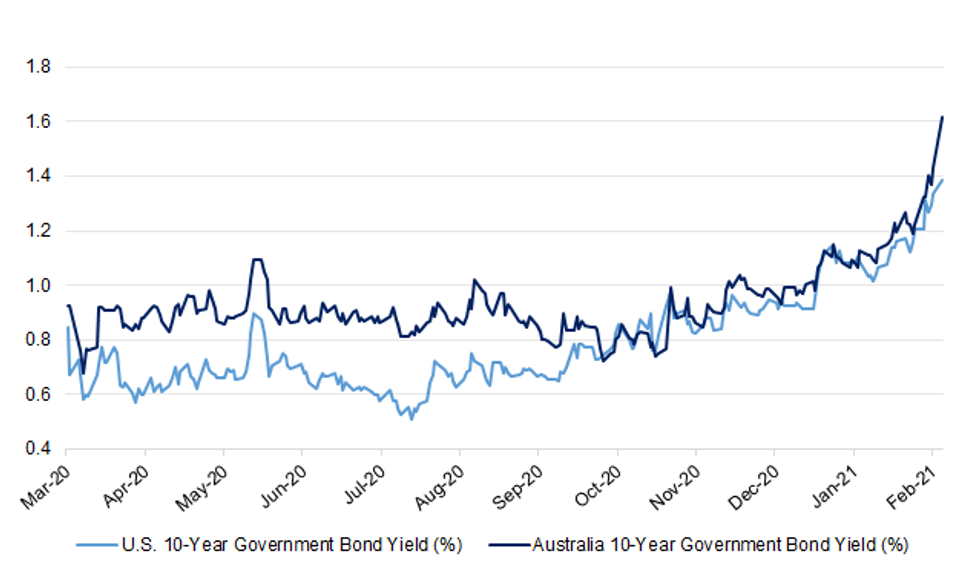

Fig. 1: U.S. & Australian 10-Year Government Bond Yields

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: U.K. Prime Minister Boris Johnson will announce that all schools in England will reopen from March 8, as he outlines how the national coronavirus lockdown will be lifted over the coming months. Along with the reopening of schools to all pupils, people will be allowed to meet one-on-one to sit down for a coffee or picnic outdoors, and after-school activities outside can restart from the same date, according to a person familiar with the plans. In a statement to Parliament on Monday, Johnson is also expected to allow more social contact from March 29, when outdoor gatherings of either six people or two households can take place, and outdoor sports such as tennis and football can resume. (BBG)

CORONAVIRUS: All adults in the UK will be offered their first dose of a coronavirus vaccine by the end of July, the prime minister has pledged. More than 17 million people have been given a jab since the UK's Covid vaccine rollout began in December 2020. But Boris Johnson said he now wants the programme to "go further and faster". He said the July target would allow vulnerable people to be protected "sooner" and would help to further ease lockdown rules across the country. NHS England chief executive Sir Simon Stevens said there were "early signs" the vaccine rollout was contributing to a fall in hospital admissions. (BBC)

CORONAVIRUS: Children should be vaccinated against coronavirus as quickly as possible to bring disruption in schools to an end, a leading member of the Sage advisory committee has said. Prof John Edmunds said there was a "significant risk of a resurgence" of the virus until everyone in the country had been vaccinated, including children. Meanwhile, Matt Hancock confirmed that early data suggested Covid vaccines were cutting transmission of the virus by around two thirds, raising hopes of stopping the spread of disease. Prof Edmunds, a leading member of Sage, said the speed of the vaccine rollout had put the UK in a "strong position", but warned it would take months to vaccinate the entire population. (Telegraph)

CORONAVIRUS: A row has broken out over Boris Johnson's hopes for a "big bang" reopening of schools, as sources claimed it had run into resistance from Prof Chris Whitty. The chief medical officer for England was said to be reluctant to put his name to a public show of support for the policy this week. Education sources had told the Guardian that Whitty was "very unhappy" with the idea of all 10 million children and staff returning to schools in England on 8 March, although the government denied this and insisted that Whitty was not opposed to any of the options being discussed. (Guardian)

CORONAVIRUS: A five-minute Covid test made in the UK could be the key to kick-starting the return of clubs, live sporting matches and concerts. Yorkshire firm Avacta have developed a new super-fast lateral flow test which is understood to be in its last testing stage at the Government's top-secret Porton Down lab. (Daily Mail)

CORONAVIRUS: Vaccine passports are "feasible" but there are significant hurdles that must be overcome before their widespread use, leading scientists have concluded. A report from experts at the Royal Society has set out 12 tests that should be passed before approval of the passports. These include the need for better information on how effective vaccines are at preventing infection and transmission of all the variants in circulation at present, and how long any protective immunity lasts in order to work out how long a passport should be valid. There are also technical, legal and ethical challenges, the report added. (The Times)

CORONAVIRUS: Pub and travel bosses have demanded that the prime minister produce a detailed roadmap for easing lockdown restrictions in England, amid mounting friction between the government and business leaders. Ahead of an update on the government's plans, due on Monday, increasingly irate pub executives urged Boris Johnson to mend fences with the industry by offering clarity about the way forward. (Guardian)

FISCAL: Rishi Sunak will announce much-anticipated plans to increase corporation tax in the Budget next month, in a bid to repair the UK's pandemic-hit economy. (Telegraph)

FISCAL: Rishi Sunak is considering increasing tax relief for manufacturing firms and factories as part of a budget package to heal the North-South divide, The Telegraph has learned. (Telegraph)

ECONOMY: More than half of UK employers intend to recruit staff in the next three months, according to new research. The CIPD and recruiter Adecco say about 56% of 2,000 firms surveyed said they plan to hire in the first quarter of 2021 - the highest figure in a year. The sectors with the strongest hiring intentions include healthcare, finance and insurance, education and ICT. "These are the first signs of positive employment prospects that we've seen in a year," said the CIPD's Gerwyn Davies. "Our findings suggest that unemployment may be close to peak and may even undershoot official forecasts, especially given the reported fall in the supply of overseas workers." At the same time, the survey found that the number of firms planning to make redundancies in the first quarter of 2021 dropped from 30% to 20%, compared with the previous three-month period. (BBC)

ECONOMY: Some 292 British employers made plans to cut jobs in January, the lowest figure since the pandemic began. A total of 32,000 redundancies were proposed, up 9% on last January, despite new lockdown rules closing businesses across most of the UK. The figures suggest that the decision to extend the furlough scheme has helped to prevent wider job losses. The numbers were released by the Insolvency Service in response to a BBC Freedom of Information request. (BBC)

ECONOMY: Rishi Sunak is preparing to unveil new "tech visas" in the Budget to bolster Britain's dynamic industries and attract more foreign investment after Brexit, the Telegraph understands. (Telegraph)

BREXIT: Northern Irish unionists will step up their campaign against the Brexit deal which effectively keeps the region in the European Union's customs area and much of the single market, by joining legal challenges to the accord. Democratic Unionist Party leader Arlene Foster said she'd join "like-minded unionists from across the United Kingdom" in judicial review proceedings challenging the Northern Ireland protocol, designed to keep the Irish border free of checkpoints after Brexit. "Neither the Northern Ireland Assembly, the Northern Ireland Executive nor the people of Northern Ireland consented to the protocol being put in place or the flow of goods from GB to NI being impeded by checks," Foster said on Sunday. "They certainly did not consent to the arrangements for those checks being determined by a power over which we have no democratic say." (BBG)

BREXIT: The import of European mineral water and several food products into Britain could be restricted under retaliatory measures being considered by ministers over Brussels' refusal to end its blockade on UK shellfish. The Telegraph can disclose that ministers are looking at proposals dubbed "Water Wars" which could see the UK end a number of continuity arrangements it has agreed with the EU. Senior Government sources pointed to potential restrictions on the import of mineral water and seed potatoes, the latter of which the EU has secured a temporary agreement on until the end of June. (Telegraph)

SCOTLAND: Boris Johnson's main adviser on keeping the UK together has departed, saying his position was made "untenable" by others within Downing Street. Oliver Lewis, an ally of the prime minister's former chief adviser, Dominic Cummings, was a key part of the campaign for the UK to leave the EU. His departure comes as the Scottish National Party is calling for another referendum on independence. Mr Lewis was confirmed in his role just two weeks ago. (BBC)

EQUITIES: The Treasury is coming under pressure to reform an "unfair" system that excludes private investors from the vast majority of flotations in Britain. Two million private investors are being unfairly disadvantaged because they are excluded from buying shares in most initial public offerings, according to the heads of Hargreaves Lansdown, AJ Bell and Interactive Investor, the three biggest trading platforms. They wrote last week to John Glen, the City minister, calling on him to intervene. They asked him to consider imposing a regulatory obligation on companies to consider a retail offer in new flotations and to open a wider consultation. (The Times)

EUROPE

ECB: The European Central Bank is likely to adopt a less aggressive approach to tackling climate change than many campaigners want. It will rely mostly on improved financial modelling and disclosure rather than green asset purchases, according to several top policymakers. When the ECB governing council discussed climate change as part of its strategy review last week, there was broad consensus on the need for action. But there was limited enthusiasm for the most ambitious policy ideas, a widespread reluctance for the central bank to take the lead on tackling environmental issues with a preference for leaving that to governments, according to three council members. (FT)

GERMANY: Germany needs to further slow the spread of the coronavirus before the government can consider additional steps to loosen restrictions on Europe's largest economy. Children in 10 of Germany's 16 states are set to return to schools and daycares for the first time in weeks on Monday, and authorities will need to evaluate the impact of the move before considering whether other curbs can be eased, Health Minister Jens Spahn said Sunday. (BBG)

GERMANY: German Finance Minister Olaf Scholz warned next year's federal budget will be a "challenge," while pledging not to cut investment or welfare spending. Scholz, who is running as the Social Democrats' candidate for chancellor in September's election, is due to present a draft 2022 budget next month. His comments highlight the fiscal conundrum facing the next government, which polls suggest will again be led by Chancellor Angela Merkel's conservative bloc after she steps down. (BBG)

FRANCE: French Health Minister Olivier Veran called for tighter restrictions in the Nice area, which is facing a surge in coronavirus infections. Veran invited the local authorities to pursue their consultations to come up with new measures, such as an extended curfew or a partial lockdown, by the end of the weekend. (BBG)

ITALY: Regional governors will request the Italian government increase efforts to find more vaccine doses as they also seek new parameters for the tightening restrictions in parts of the country. The requests were outlined in a joint statement after the regional leaders met to discuss ways to deal with the pandemic.

ITALY: Italian Prime Minister Mario Draghi's administration is about to accelerate Italy's Covid-19 vaccination program, taking inspiration from the U.K. campaign, in an effort to contain the outbreak of the coronavirus, La Stampa daily reported on Sunday, without citing sources. (BBG)

ITALY: Italy's business lobby sees a higher chance of a return to economic growth in the second quarter of 2021 as a consequence of the rally in financial markets since Mario Draghi took the reins as prime minister. The rebound in markets may boost confidence among households and businesses, and improve the economic outlook for 2021, Confindustria wrote in a report published on Saturday. (BBG)

ITALY/BTPS: Italy plans to sell 6.5 billion euros ($7.9 billion) of bills due Aug 31 in an auction on Feb 24. (BBG)

NETHERLANDS: Dutch Prime Minister Mark Rutte won parliamentary backing for a contested nighttime curfew to contain the coronavirus, capping a roller-coaster week that tested his popularity less than a month before a general election. The legislation passed by the Senate late Friday in The Hague means the nighttime curfew, which began on Jan. 23 and triggered riots in Dutch cities, can stay in place through early March. The vote blunts a court order to lift the curfew after a judge said the situation didn't constitute an extreme emergency, such as a break in the country's dike system. (BBG)

SWITZERLAND: Switzerland may resell its 5.3 million doses of AstraZeneca's vaccine amid questions over its efficacy, Neue Zürcher Zeitung reported Sunday. There are considerations about passing the material on, said Nora Kronig, the deputy director of the Federal Office of Public Health. The country's regulator, Swissmedic, has not yet approved the shot and is requesting more data from a trial underway in North and South America. (BBG)

RATINGS: Sovereign rating reviews of note from Friday include:

- S&P affirmed Estonia at AA-; Outlook Stable

U.S.

FED: New York Federal Reserve President John Williams said on Friday he's not worried the economy will overheat due to government overspending, adding that employment and inflation are far below levels that would prompt the U.S. central bank to dial back its own support. "The economy has quite a ways to go to get back to maximum employment, and we have a ways to go to get back to our 2% inflation target, so I'm not really concerned about stimulus, about fiscal support right now being excessive or anything like that." (RTRS)

FED: New York Federal Reserve President John Williams said Friday that high prices for stocks and other assets are justified in light of a growing economy and low interest rate landscape. With stocks pushing to new heights on valuations not seen in decades, and as corporate bond yields plunge, the central bank official said he's not worried about current pricing.

FED: The $1.9 trillion fiscal relief package lawmakers are considering is appropriately large given the pandemic's effects on the labor market and policymakers will have time to pull back support as the economy approaches full employment, Boston Federal Reserve Bank President Eric Rosengren said on Friday. "It is a big fiscal package that is being considered right now - I think it's appropriately big," Rosengren said in an interview with Reuters. "I am much less concerned than some commentators about it being a problem of overheating the economy." His comments were in line with remarks made by other Fed officials, including Fed Chair Jerome Powell, who called last week for a broad national effort to get Americans back to work after the pandemic. (RTRS)

FISCAL: Senate Majority Leader Chuck Schumer on Friday vowed to pave a smooth road in the Senate for President Joe Biden's nominees and legislative priorities and predicted Biden's coronavirus relief bill will be signed into law before a critical unemployment deadline. In a letter to colleagues, Schumer urged Republicans to propose "constructive amendments" to the coronavirus package but vowed to "not allow Republican obstructionism" to block relief. Schumer said the bill, which is currently making its way through the House, is "on track" to be on Biden's desk ahead of the March 14 unemployment benefits cliff, stating "we will meet this deadline." (Forbes)

FISCAL: House Democrats took another step Friday in their effort to advance a $1.9 trillion stimulus bill, releasing the full bill text, which includes an increase in the federal minimum wage to $15 per hour, $1,400 direct checks for Americans making $75,000 or less a year, an extension of $400 federal unemployment benefits and more money for small businesses struggling amid the pandemic. (CNN)

FISCAL: Business leaders are warning they will fight moves to raise corporate taxes, tighten regulation and double the federal minimum wage under the Biden administration — even as they signalled strong support for the new president's plans to tame the pandemic and stimulate the US economy. Trade associations and individual executives have publicly affirmed the legitimacy of Mr Biden's election, pulled campaign contributions from Republicans who contested his victory and given parts of his agenda a warmer welcome than Democrats have been used to from the business community. They have also welcomed a number of proposed policy reversals including rejoining the Paris climate accord and re-entering the World Health Organisation and creating a path to citizenship for 11m undocumented immigrants. (FT)

FISCAL: Democratic Sen. Joe Manchin will vote against Neera Tanden's nomination to lead the Office of Management and Budget, jeopardizing her confirmation to a key Biden administration post. Unless a Republican backs Tanden, Manchin's opposition would sink her confirmation in a Senate split 50-50 by party. In a statement to NBC News on Friday, the West Virginia senator cited Tanden's tweets skewering sitting senators across the political spectrum. (CNBC)

FISCAL: The Biden administration continues to call for K-8 public schools to reopen for in-person learning by the end of April, and said the provision of additional funds will be key. White House press secretary Jen Psaki on Sunday drew a direct line from the timetable for classrooms to be back in action to the $1.9 trillion Biden-backed stimulus plan now moving through Congress almost entirely with Democratic support. "Many schools across country don't have the resources to be able to invest in improving facilities, on hiring more bus drivers, on hiring more temporary teachers so we can have smaller class sizes," Psaki said on ABC. (BBG)

CORONAVIRUS: US Covid-19 hospitalisations fell for a 40th consecutive day as the number of new cases and fatalities also declined. The number of people receiving hospital treatment for Covid-19 fell to 56,159 on Sunday from 58,222 a day earlier, according to the Covid Tracking Project. The country reported 58,429 new cases of the virus, down from 71,951 a day earlier, taking the seven-day average to 64,301. Fatalities slowed to 1,286 from 2,074 on Saturday as the total number of deaths for the country nears 500,000. (FT)

CORONAVIRUS: White House Chief Medical Advisor Dr. Anthony Fauci said there's been "a bit of confusion" about the vaccine rollout timeline, during an interview with "Pod Save America" Thursday. There are three benchmarks to consider, he said. It will likely take until May or early June to get through the priority groups recommended by the Advisory Committee on Immunization Practices (ACIP), so that "anybody and everybody" will be eligible for the vaccine, Fauci told "Pod Save America" co-host Jon Favreau. Fauci previously expected that April would be "open season" for vaccines, meaning anyone can walk into a pharmacy and receive the vaccine. (CNBC)

CORONAVIRUS: Severe winter weather across large parts of the US has resulted in a backlog of about 6m coronavirus vaccine doses as distribution chains ground to a halt and more than 2,000 vaccination sites were left without power. All 50 US states have been adversely affected, the White House's senior advisor on the coronavirus response, Andy Slavitt, said at a press briefing on Friday morning. "The 6m doses represents about three days of delayed shipments and many states have been able to cover some of this delay with existing inventory," he said. (FT)

CORONAVIRUS: The top U.S. infectious diseases specialist said the backlog of vaccinations from last week's severe weather should be mopped up by midweek. (BBG)

CORONAVIRUS: Mayor Eric Garcetti said vaccines that were delayed due to weather conditions have been shipped to Los Angeles. The city's six vaccination sites will resume operations on Tuesday after appointments were postponed since Friday. (BBG)

CORONAVIRUS: Americans wearing face masks in 2022 is "possible," NIAID director Anthony Fauci told CNN's "State of the Union" on Sunday. (Axios)

CORONAVIRUS: Scientists and health officials told Congress Friday the federal government needs to ramp up its supply of Covid-19 vaccine doses as they work to streamline the process for getting the shots. Those two changes are key if federal officials want to increase the number of people who will get the shots, scientists and public health officials testified before the House Committee on Science, Space & Technology. (CNBC)

CORONAVIRUS: President Joe Biden on Friday slammed Donald Trump for failing to secure enough Covid-19 shots as he toured a Michigan facility where Pfizer Inc. is manufacturing its vaccine. "My predecessor -- as my mother would say, God love him -- failed to order enough vaccines," Biden said, repeating criticism he's repeatedly made of his predecessor. "Failed to mobilize the effort to administer the shots. Failed to set up vaccine centers." In remarks delivered at the facility, Biden sought to reassure the public that the shots are safe. (BBG)

CORONAVIRUS: Gov. Andrew Cuomo said on Sunday that a Covid-19 variant first identified in South Africa has reached New York. The governor said at a press conference that the mutation, which experts worry may be resistant to some vaccines, was detected in a resident of Nassau County. The announcement comes days after a Connecticut resident tested positive for the variant in a New York City hospital. (CNBC)

CORONAVIRUS: Restaurants in New York City will be allowed to increase indoor dining capacity to 35 per cent from February 26 in order to match the level in neighbouring New Jersey. Governor Andrew Cuomo said at a press conference on Friday the decision to increase the threshold from 25 per cent was made because residents were crossing state lines to take advantage of higher indoor dining capacity limits. (FT)

CORONAVIRUS: California will set aside 10% of vaccination first doses for teachers and child-care workers in an effort to speed up the reopening of schools, Governor Gavin Newsom said. (BBG)

POLITICS: Former President Donald Trump will speak at the Conservative Political Action Conference in Orlando, Florida, next Sunday, according to a source familiar with the matter, while former Vice President Mike Pence declined an invitation to speak at the conference, two sources told CNN. One source said organizers still hope to change Pence's mind about attending, while another source said Pence is planning to stay under the radar for the next six months. Politico first reported that Pence declined the invitation. The divergence between the two former leaders, which comes as the GOP is grappling with its future in the wake of the Trump presidency, follows tensions between Trump and Pence surrounding the January 6 riot at the US Capitol and Pence's role certifying the results of the election for President Joe Biden. (CNN)

MARKETS: The White House supports studying the merits of a financial transaction tax — a move favored by progressives and despised by Wall Street — in the wake of the GameStop trading frenzy. The GameStop situation highlights the serious issues of investor protection and market integrity, a White House spokesperson told CNN Business on Sunday. The potential impact of a financial transaction tax on GameStop-like trading deserves additional study and can be part of a greater evaluation of such a tax for revenue and market stability, the spokesperson said. (CNN)

EQUITIES: U.S. aviation regulators ordered emergency inspections of fan blades on the type of engine that failed Saturday over suburban Denver, spraying metal debris over a wide area. Federal Aviation Administration officials ordered the inspections after examining the hollow fan blade that failed, triggering the failure Saturday, the agency said in an emailed statement. Japan's Civil Aviation Bureau ordered operators of the Boeing Co. 777 involved in Saturday's incident to halt operations, according to the FAA. Meanwhile, Japan's transport ministry on Sunday ordered ANA Holdings and Japan Airlines to ground Boeing 777 planes they operate following the Denver engine failure. ANA operates 19 planes and JAL 13 with Pratt & Whitney's PW4000 engine that saw a failure with United Airlines plane. (BBG)

OTHER

U.S./CHINA: China Foreign Minister Wang Yi on Monday urged the U.S. to abandon what he called unreasonable tariffs on Chinese products, remove sanctions on Chinese companies and scientific and educational institutions and stop "unreasonable suppression" of China's technological progress, Global Times reported. In a statement posted on the ministry's website, Wang said the phone call between the two countries' Presidents in early February was a bilateral development welcomed by the world. (MNI)

U.S./CHINA: China and the United States must clearly define their policy boundaries and have an accurate understanding of each other's strategic intentions, Chinese Ambassador to the United States Cui Tiankai said on Monday. Cui, who made the comments during a forum in Beijing, said matters such as Taiwan, Xinjiang and Tibet are red line issues for Beijing. (RTRS)

U.S./CHINA: The US has expressed concern about a new law that authorises the Chinese coastguard to fire on foreign ships operating in disputed waters claimed by Beijing in the South China Sea and East China Sea. The state department said it was "specifically concerned" that the law ties the use of force to Beijing's enforcement of its maritime claims, including in the East China Sea where its coastguard conducts frequent patrols around the Senkaku Islands, which are controlled by Tokyo but claimed by China. (FT)

JAPAN/CHINA: Two Chinese coast guard vessels entered Japan's territorial waters near the Senkaku Islands on Sunday for the second day in a row, the Japan Coast Guard said. (Kyodo)

UK/CHINA: The UK foreign secretary wants UN investigators to be given urgent access to Uighur camps in Xinjiang as he warned that human rights abuses in the Chinese province are taking place on an "industrial scale". Dominic Raab will use an address to the UN human rights council on Monday to urge fellow members to address rights violations in China, Myanmar, Belarus and Russia, with particular emphasis on initiating an independent investigation by the UN high commissioner for human rights into forced labour camps run by Beijing. (FT)

GEOPOLITICS: Leaders of the Group of Seven industrialized nations tiptoed around the issue of China during their first, virtual, gathering of 2021 and failed to disguise a growing sense that it's a problem they will need to confront soon. Joe Biden's debut on the world stage as U.S. president showed further efforts to reset the transatlantic relationship and highlighted an increasing unease with Beijing's behavior. European Union leaders didn't always share those U.S. concerns during Donald Trump's four years in the White House. (BBG)

G7: Leaders of the Group of Seven industrialized nations pledged during a call on Friday to sustain government spending to help economies recover from the coronavirus pandemic as they attempted to start a new chapter in multilateral cooperation. (BBG)

GLOBAL TRADE: The UK competition watchdog has told Big Tech companies it is planning a series of antitrust investigations into their practices over the next year, signalling a tougher approach to reining in the sector in the wake of Brexit. In an interview with the Financial Times, Andrea Coscelli, chief executive of the Competition and Markets Authority, said the watchdog plans to mount a number of probes into internet giants including Google and Amazon in the coming months. The moves come as the watchdog looks to assert its newfound independence after Britain left the EU's regulatory orbit in January. The CMA is due to be granted additional powers to police Big Tech later this year with the creation of a new sector-specific unit. (FT)

GLOBAL TRADE: Britain should follow Australia in requiring Facebook to pay for news content it hosts, Matt Hancock signalled as the government confirmed it was considering legislation to crack down on the social media giant. Hancock, the health secretary, said that Oliver Dowden, the digital, culture, media and sport secretary, was looking "very closely" at how the UK could make Facebook compensate media outlets for content on its sites. (The Times)

CORONAVIRUS: The vaccine developed by Pfizer Inc. and BioNTech SE is 98.9% effective at preventing Covid-19 deaths, according to Israel's Health Ministry. Protection was highest two weeks after getting the second shot, while effectiveness was at 94.5% a week after the second dose, according to data the ministry released on Saturday. (BBG)

CORONAVIRUS: Pfizer Chief Executive Officer Albert Bourla said Friday that the company will expand manufacturing and work with new suppliers to ramp up production of the Covid-19 vaccine it developed with BioNTech SE. (BBG)

CORONAVIRUS: A panel of scientists advising the Hong Kong government on Covid-19 vaccines says there is not enough data to show how effective a Chinese manufactured shot was at protecting elderly patients. The panel also said there was no data yet about the ability of Sinovac Biotech's CoronaVac vaccine to protect patients against some new variant strains such as the strain that was first detected in South Africa. (FT)

CORONAVIRUS: Leaders from the USA, Germany, the European Commission, Japan, and Canada have committed $4.3 billion in new investments to fund the development and equitable rollout of coronavirus tests, treatments and vaccines needed to end the acute phase of the Covid-19 pandemic, according to a WHO statement. (BBG)

HONG KONG: Calls from pro-Beijing figures in Hong Kong to radically reform the territory's judiciary could spell "the end of the present legal system", the new head of the city's Bar Association has warned. Paul Harris said the measures could potentially undermine judicial independence in the city. Under the suggested changes judges would be forced to consult a new council made up of members of the community before handing down sentences. The proposed council would amount to "a powerful body which would tell judges what to do" and would be "a major backward step", Harris told the Financial Times. (FT)

JAPAN: Fujifilm Holdings Corp. plans to restart the clinical trials of Avigan in April, the Nikkei newspaper reported without citing anyone. (BBG)

AUSTRALIA: Australia's Covid-19 vaccination program started on Sunday, with Prime Minister Scott Morrison joining a group of nursing home residents and staff in receiving the first shots. Morrison and the nation's chief medical and nursing officers were among the small group that received the first Pfizer/BioNTech shots to help build public confidence in the safety of the program. (BBG)

AUSTRALIA: Australia has not ruled out mandating Covid-19 vaccinations for workers in aged care centres, a top doctor said on Monday. Professor Michael Kidd, one of the country's deputy chief medical officers, said the national Cabinet has asked a top scientific panel to look at the issue. (FT)

AUSTRALIA/RATINGS: Fitch affirmed Australia at AAA; Outlook Negative

AUSTRALIA/NEW ZEALAND: New Zealanders can enter Australia quarantine-free after a "travel bubble" suspended in late January was resumed from Sunday. Passengers require proof of a negative coronavirus test result less than 72 hours prior to departure, if they have been in Auckland any time in a two-week period before travelling. The one-way travel bubble was suspended in response to a strain of Covid-19 detected in New Zealand that was first identified in South Africa. (FT)

NEW ZEALAND: Auckland will step down to Alert Level 1 from midnight Monday, New Zealand Prime Minister Jacinda Ardern told reporters. The change from Level 2 means there will be no limit on the size of gatherings at public events or hospitality outlets. Auckland ended a three-day lockdown last week after authorities expressed confidence that a community outbreak was contained. Ardern said Monday that officials advised there is no evidence of undetected Covid clusters. (BBG)

NEW ZEALAND: New Zealand began vaccinating border control workers at the weekend, as the country began to roll out an inoculation programme. Dr Ashley Bloomfield, the country's director-general of health, said the jabs were the culmination of a week of preparation. "Today, we kick off the largest immunisation programme in our history, by vaccinating the first of our border workforce, a critical step in protecting everyone in Aotearoa," Bloomfield said on Saturday, using the Maori name of the country. (FT)

NEW ZEALAND/RATINGS: S&P revised New Zealand to AA+; Outlook Stable

RBNZ: In light of recent developments, we have once again revised the format of the views we are seeking from our Shadow Board on what the Reserve Bank should do with monetary policy. Given the Reserve Bank's growing arsenal of monetary policy tools which includes the Official Cash Rate, quantitative easing, and Funding for Lending Programme, we decided to simply ask our Shadow Board on what stance the Reserve Bank should take 1) at the upcoming meeting, and 2) over the coming 12 months. There was a wide range of views amongst board members. For the upcoming meeting, members were generally in favour of leaving the monetary policy stance unchanged given the improving outlook balanced against the high degree of uncertainty. However, beyond that board members were divided between leaving the monetary policy stance unchanged and tightening monetary policy. Those who indicated a tightening of monetary policy was appropriate cited a lift in inflation pressures and the overheating housing market as key factors warranting the change. (NZIER)

SOUTH KOREA: South Korea reported 332 new coronavirus cases over the last 24 hours, the smallest increase in eight days. The country on Friday is scheduled to begin using AstraZeneca Plc's vaccine to inoculate about 272,000 patients and workers at nursing homes and related facilities who are younger than 65. Pfizer Inc.'s vaccine will be used to inoculate medical workers beginning Saturday. (BBG)

SOUTH KOREA: South Korea will commence its vaccinations on Friday using AstraZeneca's shot, Prime Minister Chung Sye-kyun said Sunday in a televised briefing. Pfizer's vaccine will be used to inoculate medical personnel from Saturday, a day after enough supplies to treat 117,000 people are due to arrive in the country, he said. (BBG)

SOUTH KOREA: Finance Minister Hong Nam-ki instructed officials Monday to thoroughly prepare to submit an extra budget proposal next week in a bid to buttress smaller merchants hit hard by the pandemic. The finance ministry is working on details about this year's first supplementary budget to provide another round of emergency relief funds to merchants and shop owners battered by the pandemic and virus restrictions. The ruling Democratic Party and the government are in consultations over the size of an extra budget, which some party officials said may surpass more than 15 trillion won (US$13.5 billion). (Yonhap)

ASIA: Hong Kong and Singapore are in discussion again over the postponed travel bubble, with both cities mulling extra safeguards amid the coronavirus pandemic, the Post has learned. A government source said authorities on both sides were in talks over the arrangement, but it was still too early to say when it would begin. The quarantine-free travel arrangement, touted at the time as the world's first, was initially set for last November 22 but put on hold indefinitely on its eve following a fresh Covid-19 outbreak in Hong Kong. "The old [conditions] still apply. But of course, both sides are discussing additional safeguards too," the insider said without offering more details. (SCMP)

CANADA: Ontario's government has scrapped plans to allow more businesses to reopen in Toronto after city officials warned it would be a deadly mistake. Stay-at-home orders will remain in place until at least March 8 in Canada's largest city and financial center, as well as two other regions of the province. Toronto had been expected to return to less-stringent measures on Feb. 22, allowing for limited opening of some retail businesses that have been closed to in-person activity since November. (BBG)

TURKEY: The common interests of Turkey and the United States outweigh their differences and Ankara wants improved cooperation with Washington, President Tayyip Erdogan said on Saturday striking a rare conciliatory tone. Ties between the two NATO allies have been strained over a host of issues. In December, the United States sanctioned Turkey for its purchase of Russian S-400 defence systems, while Ankara has been infuriated by U.S. support for the Kurdish YPG militia in Syria, which it considers a terrorist organisation. (RTRS)

TURKEY/RATINGS: Sovereign rating reviews of note from Friday include:

- Fitch affirmed Turkey at BB-; Outlook revised to Stable from Negative

MEXICO: The first 120,000 doses of KoviVac will be available next month, Prime Minister Mikhail Mishustin said in a televised meeting with officials on Saturday. As many as 20 million doses will be made this year, Chumakov's director general, Aydar Ishmukhametov, said. As many as 3.2 million Russians have received a first dose of vaccine, the RBC news website reported Saturday, citing regional health data. (BBG)

MEXICO: Mexico President Andres Manuel Lopez Obrador announced new tax benefits for Pemex as the beleaguered state oil company seeks to reverse long-term production declines and reduce debt. Petroleos Mexicanos will get an additional 14% credit stimulus to apply to the taxes it pays on hydrocarbons capped at 73.3 billion pesos ($3.6 billion) for this year, according to a presidential decree. The new benefit comes in addition to previous measures that reduced Pemex's profit-sharing duty from 65%, to 58% in 2020 and 54% in 2021, respectively. (BBG)

BRAZIL: Brazilian President Jair Bolsonaro's nominee to lead state-run oil company Petrobras said on Saturday the company needs to find "balance" in fuel pricing, considering the impact on shareholders, investors, sellers and consumers. Joaquim Silva e Luna, a retired army general and former defense minister overseeing the state-run Itaipu hydroelectric dam on the border with Paraguay and Argentina since 2019, was tapped on Friday to be the next chief executive of Petróleo Brasileiro SA. (RTRS)

RUSSIA: Russian opposition leader Alexey Navalny could be transferred to a prison camp within days after losing an appeal on Saturday of his jailing, which has sparked mass protests and a spike in tensions with the West. (BBG)

RUSSIA: The Biden administration is not inviting Russia to join the G7 group of world leaders, White House spokeswoman Jen Psaki said on Friday, backing away from former President Donald Trump's push for Moscow's membership. Any invitation for Russia to join the G7 would be made in partnership with all of the group's members, she told reporters, speaking aboard Air Force One. Trump last June had called the G7 "a very outdated group of countries" and said that he wanted to add Russia, Australia, South Korea and India to their ranks. (RTRS)

RUSSIA: The Biden administration singled out a Russian ship for violating U.S. prohibitions on constructing the Nord Stream 2 pipeline from Russia to Germany, clearing the way for a new round of sanctions as part of its effort to stop the nearly-completed project. In a report released late Friday, the U.S. cited the ship, the Fortuna, and its owner, KVT-RUS. The report also listed other entities that were exempt from sanctions because they're unwinding their work on Nord Stream 2. Notably absent from the congressionally mandated report were any German or other European entities also aiding construction of the pipeline. (BBG)

RUSSIA: The first 120,000 doses of KoviVac will be available next month, Prime Minister Mikhail Mishustin said in a televised meeting with officials on Saturday. As many as 20 million doses will be made this year, Chumakov's director general, Aydar Ishmukhametov, said. (BBG)

SOUTH AFRICA: Nedbank Group Ltd. is leading discussions to restructure South African power utility Eskom Holdings SOC Ltd.'s 464 billion ($32 billion) debt load, according to people familiar with the talks. The parties met in recent days, and one of the options is to transfer at least 100 billion rand of debt to a special-purpose vehicle that would be overseen by the Public Investment Corp., Africa's biggest fund manager, the people said. (BBG)

SOUTH AFRICA: South Africa's loss of skilled and high earners could limit room to raise income taxes as the Treasury seeks to plug a budget shortfall that's above wartime levels. A fourth-quarter estate agent survey by FirstRand Ltd.'s First National Bank shows a more than fifth of all houses valued at 2.6 million rand ($176,939) or more that were put on the market by the end of last year was because people planned to move abroad. (BBG)

IRAN: The Biden administration is in contact with Iran to demand the release of Americans held in the Islamic republic, an issue that will help determine future relations between the countries, U.S. National Security Adviser Jake Sullivan said. While Iran says it won't negotiate unless the U.S. rejoins a nuclear accord abandoned by the Trump administration, Sullivan said "the script has been flipped" because President Joe Biden has offered to re-engage with Tehran. (BBG)

IRAN: Iran said it won't negotiate with the U.S. until it rejoins the nuclear deal, digging in to longstanding positions as it nears a crucial deadline to restrict nuclear inspections. "Once everybody implements their parts of the obligation there will be talks, and those talks will not be about changing the terms of the agreement, regional issues or missile issues. We're not going to discuss those," Iran's Foreign Minister Mohammad Javad Zarif said in an interview with state-run Press TV. Any negotiations with the U.S. would have to address the need for a guarantee that Washington won't quit the deal again, Zarif added. (BBG)

IRAN: A top Iranian foreign ministry official on Feb. 21 said the US needs to remove its sanctions before talks can begin to revive the nuclear deal with world powers at a time when the Islamic Republic is expected to bring as much as 1 million b/d of crude back to the market by the end of this year. "For us, the criteria is removing the sanctions," Abbas Araghchi, Iran's deputy foreign minister for political affairs, said in a television interview published Feb. 21 by state news agency IRNA. He noted Iran has set a self-imposed Feb. 23 deadline for sanctions to be removed or Tehran will quit additional commitments to the Joint Comprehensive Plan of Action. (Platts)

IRAN: The U.N. nuclear watchdog found uranium particles at two Iranian sites it inspected after months of stonewalling, diplomats say, and it is preparing to rebuke Tehran for failing to explain, possibly complicating U.S. efforts to revive nuclear diplomacy. The find and Iran's response risk hurting efforts by the new U.S. administration to restore Iran's 2015 nuclear deal, which President Joe Biden's predecessor Donald Trump abandoned. (RTRS)

IRAN: The head of the United Nations' nuclear watchdog met Sunday with Iranian officials in a bid to preserve his inspectors' ability to monitor Tehran's atomic program, even as authorities said they planned to cut off their surveillance cameras at those sites. Rafael Grossi's arrival in Tehran comes as Iran tries to pressure Europe and the new Biden administration into returning to the 2015 nuclear deal, which President Donald Trump unilaterally withdrew America from in 2018. (AP)

OIL: The number of fracking crews active in the U.S. shale patch plunged this week to a record low as frigid weather brought most of the Texas oil industry to a halt. Three-quarters of the U.S. frack fleet was lost this week, leaving 41 crews working to blast water, sand and chemicals underground to release trapped oil and natural gas, Matt Johnson, chief executive officer at Primary Vision Inc., wrote Friday in an email. The company has tracked data on frack crews since 2013. Fracking is the last major step to get a new well ready for production, following a separate team of field workers who come in with a drilling rig. Baker Hughes Co. reported earlier on Friday that total U.S. oil and gas drilling was unchanged this week, citing numbers finalized days ahead of publication. Freezing conditions triggered power outages throughout Texas and led to a reduction of close to 40% in total U.S. oil production at one point this week. (BBG)

OIL: Texas oil refineries shut by cold-weather disruptions may take several weeks to resume normal operations, industry experts said on Friday, helping to push up fuel prices. About a fifth of oil processing was halted by power outages, shortages of natural gas and water this week. Average retail gasoline prices rose 6 cents on the week and are up 9 cents in the last month, to $2.33 a gallon, the American Automobile Association said. It forecast inventories would fall, keeping prices higher through month's end. (RTRS)

OIL: Saudi Arabia and Russia are once again heading into an OPEC+ meeting on opposite sides of a crucial debate about the oil market. Riyadh is publicly urging fellow members to be "extremely cautious," despite prices rebounding to a one-year high. In private, the kingdom has signaled it would prefer that the group broadly holds output steady, delegates said. Moscow, on the other hand, is indicating that it still wants to proceed with a supply increase. (BBG)

OIL: Iran is set to attend the meeting of an OPEC+ advisory committee next month, according to a delegate who declined to be identified. While Iran -- exempted from OPEC's production cuts because it's output has been hit by U.S. sanctions -- isn't a member of the Joint Ministerial Monitoring Committee (JMMC), it will be represented at the panel's March 3 gathering, the delegate said. The Organization of Petroleum Exporting Countries and its allies, which include Russia, meet the following day to consider output levels for April. (BBG)

OIL: Iraq has decided to freeze its first crude oil prepayment deal, which had aimed to boost its finances, because oil prices are rising, the country's oil minister told BBC Arabic on Sunday. "We had concerns that oil prices would not rise above $40 when we announced this deal for the first time in the history of Iraq," Ihsan Abdul Jabbar told the channel. Brent crude has been trading above $60 a barrel recently. (RTRS)

CHINA

PBOC: The PBOC decision to leave the loan prime rates unchanged this month showed its intention to support economic recovery through "consistent, stable and sustainable" policies, the Financial News, owned by the central bank, said in a report. On Saturday, the PBOC kept the interbank loan benchmarks unchanged for the 10th month, with 1-Y LPR at 3.85% and 5-Y 4.65%, in line with market expectations, the newspaper said. While the PBOC soaked up some liquidity last week, market rates are largely in line with the central policy benchmarks, the newspaper said citing analyst Wen Bin of Minsheng Bank. (MNI)

ECONOMY: Despite wide speculation that China has not so far set a national target for GDP growth in 2021, most of China's provinces and regions have set their own targets above 6 percent this year, signaling confidence to achieve further economic rebound from the coronavirus bite in a "big year" for the Chinese economy. Among the 31 provinces and regions that have announced economic growth targets for 2021, Central China's Hubei Province, which was hit hardest by the coronavirus last year, and South China's Hainan Province where China is building a high-level free trade port, have both banked on goals "above 10 percent," the highest among all provinces and regions in China. (Global Times)

INFLATION: China should anticipate imported inflation as other countries implement monetary easing to bolster their pandemic-hit economies, said the Economic Information Daily in a front-page commentary. Inflation expectations have also contributed to the fast appreciation of digital currencies such as Bitcoin, the Daily said. Large liquidity flowing into the virtual economy renders policies less effective and increases asset bubbles and financial risks, the Daily said.

POLICY: China on Sunday laid out an annual policy document on agricultural development, vowing to promote grain production, rural governance and environmental conservation, China Daily reported. China aims to maintain grain output this year at 650 million metric tons while cutting use of chemicals, and stresses protecting its 120 million hectares of arable land from other uses, the newspaper said. China also seeks to cut use of fertilizers and pesticides. China removed the last rural counties from its poverty list last year, a key part of the goal of building a more prosperous society. (MNI)

FINTECH: China's bank regulator on Saturday tightened requirements on the internet loan business of commercial banks, amid heightened scrutiny of online lending by internet giants such as Ant Group Co, the finance arm of Alibaba Group Holding Ltd. Commercial banks must jointly contribute funds to issue internet loans with a partner, and the proportion of capital from the partner in a loan should not be less than 30%, the China Banking and Insurance Regulatory Commission said in a notice. The balance of internet loans issued by a bank with one partner, including its related parties, must not exceed 25% of the bank's net tier-one capital, it said. In addition, the balance of internet loans issued jointly by commercial banks and cooperative institutions may not exceed 50% of the bank's total balance, the guidelines state. In a separate Q&A document, the regulator said firms must comply with the new rules by July 17, 2022. The regulations will increase the potential capital needs for technology platforms such as Ant Group, which was on its way to raising $37 billion in an IPO based on its vast range of online lending services. (RTRS)

OVERNIGHT DATA

CHINA JAN FX NET SETTLEMENT - CLIENTS CNY 263.7BN; DEC 426.7BN

JAPAN JAN PPI SERVICES -0.5% Y/Y; MEDIAN -0.4%; DEC -0.3%

JAPAN JAN CONVENIENCE STORE SALES -4.9% Y/Y; DEC -4.0%

SOUTH KOREA FEB 1-20 EXPORTS +16.7% Y/Y; JAN +10.6%

SOUTH KOREA FEB 1-20 IMPORTS +24.1% Y/Y; JAN +1.5%

CHINA MARKETS

PBOC NET DRAINS CNY40BN VIA OMOS MONDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged on Monday. This resulted in a net drain of CNY40billion given the maturity of CNY50 billion of reverse repos today, according to Wind Information.

- The operation aims to maintain reasonable and ample liquidity in the banking system, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2000% at 09:31 am local time from 2.0122% on last Saturday's close.

- The CFETS-NEX money-market sentiment index closed at 35 on last Saturday vs 36 last Friday. A higher index indicates increased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.4563 MON VS 6.4624

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4563 on Monday. This compares with the 6.4624 set on Friday.

MARKETS

SNAPSHOT: Reflation Trade Still Running Hot

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 210.19 points at 30226.78

- ASX 200 down 1.094 points at 6792.7

- Shanghai Comp. down 2.289 points at 3693.879

- JGB 10-Yr future down 22 ticks at 150.97, yield up 1.1bp at 0.120%

- Aussie 10-Yr future down 17.5 ticks at 98.390, yield up 17.6bp at 1.609%

- U.S. 10-Yr future -0-11+ at 135-03, yield up 4.93bp at 1.386%

- WTI crude up $0.72 at $59.96, Gold up $2.21 at $1786.56

- USD/JPY up 22 pips at Y105.67

- PFIZER-BIONTECH SHOT STOPS COVID SPREAD, ISRAELI STUDY SHOWS (BBG)

- SCHUMER PREDICTS BIDEN WILL SIGN STIMULUS BEFORE MAR 14 UNEMPLOYMENT DEADLINE (FORBES)

- CHINA CALLS FOR RESET IN SINO-U.S. RELATIONS (RTRS)

- UK'S JOHNSON TO SAY ALL SCHOOLS IN ENGLAND TO OPEN MARCH 8 (BBG)

- DUP TO LAUNCH LEGAL ACTION AGAINST N IRELAND POST-BREXIT PROTOCOL (BBG)

- ECB SET TO DISAPPOINT CAMPAIGNERS ON CLIMATE CHANGE (FT)

BOND SUMMARY: Another Torrid Day For Bulls

Spillover from Friday trade and incrementally positive news flow surrounding the Pfizer COVID vaccine helped weigh on the Tsy complex in Asia-Pac hours, while comments from senior Chinese diplomats/ministers offered little new re: Sino-U.S. tensions/de-escalation. Weakness in T-Notes has taken the contract below downtrend support drawn off the August 28 low, with bears now looking to projections off the Jan 4-12 sell off vs. the Jan 27 high, layered in at 135-00 and 134-22. Contract last trades -0-11+ at 135-03, lows of 135-02 registered thus far, volume running at a very solid and above average ~385K. Longer dated yields marched to fresh cycle highs in Asia, with cash 7s & 10s trading the best part of 5.0bp cheaper on the day.

- JGB futures have lacked any real follow through during Tokyo trade, but are threatening a more meaningful break below the overnight lows, -21 on the day at typing. Cash JGBs little changed, but biased marginally cheaper, 10s printing at ~0.115%, with eyes on the March '20 vol high at 0.125%. Super long swap spreads are wider on the day. Local news flow remains light, with the BoJ leaving the purchase sizes of its 10-25+ Year Rinban ops unchanged, with offer to cover ratios nudging higher, but not meaningfully so.

- Aussie bonds have also succumbed to the broader round of weakness, with YM -4.5, XM -15.5, albeit with a brief pause as the RBA stepped in to enforce its 3-Year yield target, although markets ultimately overpowered the impact from the announcement, resuming the move lower. Re: the Aussie/U.S. 10-Year yield spread, recent weeks have seen many chopped around by the crosswinds created by the U.S. fiscal impulse/reflation trade narrative, RBA policy and the Aussie bond space's high beta status re: the global growth narrative. This has resulted in most sell-side names reverting to a play the range mantra. The recent range has now broken, with the spread hitting the widest levels seen since October '20 during Monday trade.

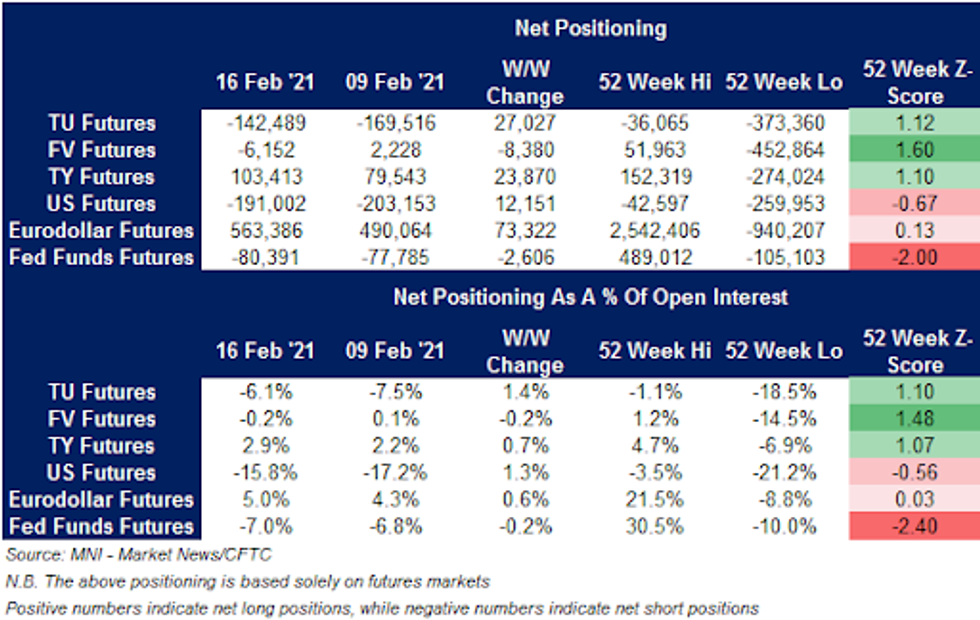

US TSYS: Not Much To See In CFTC CoT

Little to extract from the latest CFTC CoT report, with net length generally added to/shorts reduced in most bond futures contracts, FV being the exception.

BOJ: Rinban Sizes Unchanged

The BoJ offers to buy a total of Y230bn of JGB's from the market, sizes unchanged from previous operations.

- Y120bn worth of JGBs with 10-25 Years until maturity

- Y30bn worth of JGBs with 25+ Years until maturity

- Y50bn of floating rate JGBs

- Y30bn of JGBis

EQUITIES: Mixed Day As Early Gains Reversed

A mixed day for Asia-Pac equities; Japan, Taiwan and Hong Kong have seen gains, while mainland China, South Korea and Australia see markets under pressure. Positivity surrounding global vaccination programmes initially supported equity markets, but the bid dissipated with the arrival of China. The PBOC drained a net CNY 40bn via OMOs, after a net drain of CNY 270bn last week, while repo rates were broadly unmoved markets interpreted this as an indication of tighter policy settings in China which sparked some equity outflows.

- Losses in South Korea were tempered by reports that Hyundai Mipo Dockyard won a KRW 101.1bn order to build two LPG carriers, while gains across the commodity complex also helped limit losses in Australia. Copper hit the highest in more than nine years while WTI eyed the $60/bbl.

- Futures in the US and Europe are lower.

OIL: Rally Resumes

Crude is higher on Monday in Asia, resuming its recent rally after dropping sharply on Friday. WTI is up $0.51 at $59.75/bbl, brent is up $0.67 at $63.58/bbl.

- The drop last week was due to capacity coming back on line after the big freeze affected US production, the pickup today is being attributed to progress on global coronavirus vaccinations and hopes for a pick-up in global activity.

- Meanwhile, an Iranian foreign ministry official said the US needs to remove its sanctions before talks can begin to revive the nuclear deal. Iran is expected to bring as much as 1m bpd of supply back to the market by the end of this year.

- Goldman Sachs have increased oil price estimates, the bank now expects brent will reach $70/bbl in Q2 and $75/bbl in Q3.

- Elsewhere, markets look ahead to the OPEC+ meeting on March 4, observers expect a difference of opinions from Saudi Arabia and Russia.

GOLD: Narrow to Start A New Week

Gold has looked through the latest uptick in U.S. Tsy yields, with spot holding to a narrow range, last dealing little changed at ~$1,784/oz after the bounce from session lows on Friday, which left the July '20 lows intact. It looks like participants are taking a breather after last week's gyrations, with the DXY little changed and Tsy yields extending on their recent run higher.

FOREX: Commodity FX Pull Back From Highs Amid Moderation In Risk-On Flows

Commodity FX led the way in Asia-Pac trade as reflation trade narrative and optimistic news from the vaccine front continued to do the rounds, boosting risk appetite in the early part of the session. Initial price swings were corrected as the risk-on mood moderated somewhat, but NOK managed to remain atop the G10 pile amid renewed gains in crude oil prices. The two Antipodean currencies firmed up in tandem, each hitting their best levels since 2018 against the U.S. dollar, before they pulled back from respective highs.

- NZD caught a fresh bid as S&P raised New Zealand's credit rating to AA+ from AA (outlook changed to stable from positive), but looked through PM Ardern's announcement that Auckland will move to Covid-19 alert level 1 from level 2 at midnight. The kiwi narrowly outperformed its cousin from across the Tasman, as Fitch affirmed Australia at AAA with a negative outlook.

- Safe havens recovered from worst levels, but remained at bay with JPY & CHF lagging their G10 peers as we head for the London session. USD/JPY snapped its three-day losing streak and ground higher but rejected the prior intraday high.

- The PBOC fixed the USD/CNY mid-point at CNY6.4563, around 10 pips above sell side estimates, after delivering an expected decision to leave LPR settings unchanged over the weekend. USD/CNH wavered around neutral levels.

- Focus today falls on German Ifo Survey as well as speeches from Fed's Kaplan & Bowman, ECB's Lagarde, BoE's Vlieghe and Riksbank's Floden.

FOREX OPTIONS: Expiries for Feb22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2135-45(E408mln-EUR puts), $1.2295-1.2300(E506mln-EUR puts)

- USD/JPY: Y103.25($750mln), Y104.00($600mln)

- AUD/USD: $0.7715(A$640mln)

- NZD/USD: $0.7175-85(N$515mln)

- USD/CAD: C$1.2600($420mln)

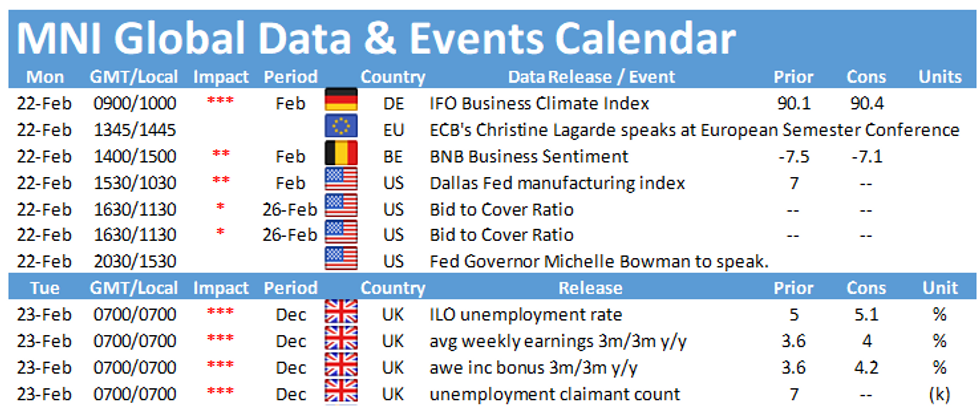

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.