-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Signs Of Thawing Sino-U.S. Relations

EXECUTIVE SUMMARY

- ECB DRAFT FORECASTS ASSUME ANY INFLATION PICKUP WILL BE FLEETING (BBG)

- HOUSE PASSES $1.9 TRILLION COVID RELIEF BILL, SENDS IT TO BIDEN TO SIGN (CNBC)

- BIDEN ADMIN TO MEET CHINESE OFFICIALS IN ALASKA NEXT WEEK

- CHINA, U.S. SEMICONDUCTOR ASSOCIATIONS SET UP WORK TEAM (BBG)

- BLINKEN: U.S. TO TAKE ACTION AGAINST RIGHTS VIOLATIONS IN HONG KONG (RTRS)

- CHINA FUND INVESTORS SHOULD BE CALM AMID VOLALITILY (SEC. TIMES)

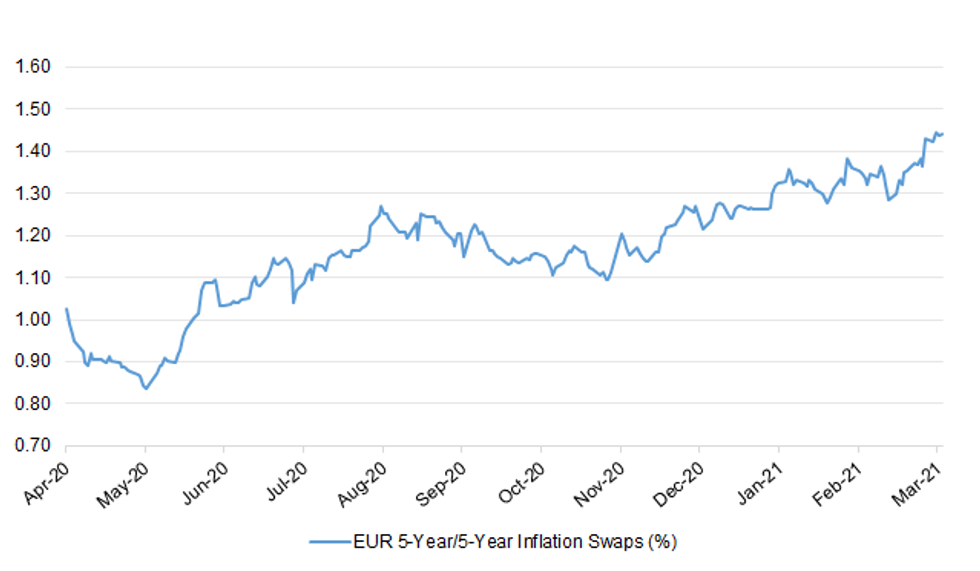

Fig. 1: EUR 5-Year/5-Year Inflation Swaps (%)

Source: MNI - Markets News/Bloomberg

Source: MNI - Markets News/Bloomberg

UK

BREXIT: Three out of every four British manufacturers have experienced Brexit-related delays during the past three months and the government must sort out problems that are still affecting ports, industry group Make UK said on Thursday. Almost a third of firms suffered delays of between one and two weeks and over half saw their costs rise as a result of Britain's departure from the European Union's single market on Jan. 1, the manufacturing trade association said. Companies have had to meet new paperwork requirements for doing business with the EU, ranging from tax and customs documentation to new health checks. (RTRS)

BREXIT: Britain is a more attractive investment proposition for multinational companies than it was before Brexit, a survey of 5,000 global business leaders has found. The UK has overtaken India as the world's fourth most promising growth opportunity, according to PwC's annual CEO Survey. America, China and Germany remained the top three. Writing in The Times today, Kevin Ellis, chairman of PwC UK, says: "The UK's positive standing highlights what matters most to global business leaders. "The EU trade deal drew to a close much of the uncertainty around Brexit. It's hard to overestimate the importance of political certainty and stability when it comes to CEO decision making." (The Times)

BREXIT: A Government representative is set to be dispatched to the US to help counter the EU's efforts to turn President Biden's administration against the UK over its actions in Northern Ireland. (Telegraph)

EUROPE

ECB: The European Central Bank's forecasts this week are likely to justify the current stimulus program with a cautious view that envisages no sustained jump in inflation, according to officials with knowledge of the matter. The outlook that will be presented to policy makers assumes that hoarded savings won't be depleted in a sudden consumption boom when lockdown restrictions ease, said the officials, who asked not to be identified discussing confidential matters. Chief Economist Philip Lane will present projections compiled by ECB staff to the Governing Council before President Christine Lagarde then unveils them at her press conference after the institution's latest monetary decision on Thursday. The outlook is never official until agreed on by policy makers. (BBG)

FISCAL: MNI SOURCES: Berlin Seen Softening On EZ Debt, Fiscal Support

- French and German officials are already in contact over a new regime for limiting eurozone public borrowing as Berlin relaxes its historic affinity for balanced budgets and even indicates it might consider making some Covid fiscal support permanent if the current measures prove successful and in return for strong rules on oversight, sources in Brussels told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

GERMANY: German Finance Minister Olaf Scholz predicted that austerity will lose out to more expansive budget policies in coming years, further distancing himself from Chancellor Angela Merkel's conservatives ahead of September's general election. "The decision is really between austerity or continuing to make sure that the necessary investments are made and there is adequate financing for the welfare state," Scholz, who is running for the Social Democrats as their chancellor candidate to replace Merkel, said Wednesday during an online discussion. "My prediction is: austerity will lose." (BBG)

ITALY: Italy's Matteo Salvini hinted at an early end to Mario Draghi's term in office and indicated the prime minister could be a candidate for head of state when that job becomes available early next year. Draghi should remain premier for "the time needed to come out of the emergency," Salvini said in an interview with Bloomberg on Wednesday, adding he didn't know how long that would be. He was referring to the coronavirus pandemic. (BBG)

IRELAND: Ireland's prime minister on Wednesday quashed hopes of any big easing of the country's tight coronavirus lockdown until at least mid-May, warning that if the country lets its "guard down too quickly" new variants of the virus will begin spreading again. (FT)

U.S.

FISCAL: House Democrats passed a $1.9 trillion coronavirus relief bill on Wednesday, sending one of the biggest stimulus plans in U.S. history to President Joe Biden's desk. The president hopes to sign the bill Friday after Congress formally sends it to the White House, which can take days for large bills. Biden will check off his first major legislative item as the U.S. tries to ramp up Covid-19 vaccinations and jolt the economy. (CNBC)

FISCAL: Treasury, IRS working to start getting payments out this month. (BBG)

FISCAL: A FOX reporter tweeted the following on Wednesday: Joe Biden's infrastructure plan "could be as high as $2.5 trillion over 4 years; some public-private partnerships that could leverage government spending. Details will start to leak in coming days as Biden finishes w the passage of stimulus." (MNI)

FISCAL: Treasury Secretary Janet Yellen said Wednesday that the $1.9 trillion COVID-19 relief bill passed by the House could put the U.S. on track to reach full employment by 2022. In a statement praising the bill's passage, Yellen expressed confidence that it would protect the U.S. from a slow, grueling climb from the coronavirus recession and bring the U.S. to historically low unemployment by next year. "With the passage of the American Rescue Plan, I believe Americans will emerge from the pandemic with the foundations of their lives intact. And that is an enormous economic and moral achievement for America," Yellen said. "Indeed, we are now charting a very different course out of this crisis compared to the one a decade ago. Rather than a long, slow recovery, I expect we could reach full employment by as soon as next year." (The Hill)

FISCAL: The US budget deficit has exceeded $1tn this fiscal year even before President Joe Biden's $1.9tn stimulus package, which secured final approval in Congress on Wednesday, takes effect. The budget deficit swelled to $311bn in February, increasing by almost a third from a year ago, the Treasury Department said, as the government has acted aggressively to cushion US businesses and households from the blow from the coronavirus pandemic. (FT)

CORONAVIRUS: President Joe Biden said he will announce the "next phase" of the U.S. Covid-19 response during his primetime address to Americans on Thursday. "Tomorrow night, I'm going to primetime to address the American people and talk about what we went through as a nation this past year. But more importantly, I'm going to talk about what comes next," Biden said Wednesday following a meeting with the CEOs of Johnson & Johnson and Merck. (CNBC)

CORONAVIRUS: President Joe Biden will double the U.S. order of Johnson & Johnson's one-shot vaccine -- seeking another 100 million doses -- bringing the country's total vaccine supply to enough for 500 million people. Biden made the announcement during an event at the White House on Wednesday with J&J Chairman and Chief Executive Officer Alex Gorsky and Merck & Co. chairman and CEO Ken Frazier. The companies last week struck a collaboration to boost production of J&J's recently authorized Covid-19 vaccine. (BBG)

CORONAVIRUS: Texas will expand vaccine eligibility to anyone 50 or older beginning March 15, Governor Greg Abbott announced. Most of the state's elderly already have received at least one dose, he said in a tweet. (BBG)

CORONAVIRUS: The US should reach herd immunity from Covid-19 by the early autumn, one of the country's top medical scientists has said. Anthony Fauci, the head of the National Institute of Allergy and Infectious Diseases, said on Wednesday that a combination of prior infection and vaccinations should make enough people immune to the disease by later this year that it is no longer able to spread exponentially through the population. (FT)

CORONAVIRUS: New coronavirus strains represent more than half of all current cases in New York City, mayor Bill de Blasio and his team revealed. (FT)

CORONAVIRUS: In-person learning in New York City's public schools wasn't associated with increased Covid-19 infections compared with the general community, according to a peer-reviewed study released Wednesday. The study, led by senior health adviser Jay Varma and published in the Pediatrics medical journal, provides data to back up claims by city officials that school buildings are among the safest places in New York. (BBG)

CORONAVIRUS: A highly infectious Covid-19 variant is probably the dominant strain in Florida, Texas and Georgia, and gaining a foothold across the U.S., according to new data from testing company Helix. In all three states, more than 50% of the latest samples exhibited S gene target failure, a key characteristic of the variant first identified in the United Kingdom, known as B.1.1.7. The variant has prompted warnings of a possible resurgence, even as the seven-day average of new cases fell to the lowest since Oct. 18 in Johns Hopkins University data. (BBG)

CORONAVIRUS: New York City and the neighbouring state of New Jersey will allow restaurants to operate indoor dining at 50 per cent capacity from March 19. (FT)

CORONAVIRUS: Gov. Gavin Newsom said that movie theaters in Los Angeles could reopen as soon as Saturday if enough residents in the county get vaccinated, CNBC's Sarah Whitten reports. Counties in California must have fewer than 10 new Covid-19 cases per 100,000 people before they can reopen. Los Angeles County had just 6.9 new cases per 100,000 residents as of Wednesday. (CNBC)

CORONAVIRUS: Baseball's Texas Rangers said they're clear to totally reopen Globe Life Field to fans on opening day in April, making the game a key test of pro sports' efforts to return to normal. The decision follows Texas Governor Greg Abbott's move last week to lift antipandemic restrictions and allow businesses to open at full capacity. Masks will still be required at the stadium, and the team is planning "distanced seating" sections that will allow for more space between occupied seats -- though those won't be available for the home opener on April 5. (BBG)

MARKETS: President Biden's nominee to oversee Wall Street firms and public companies, Gary Gensler, cleared a key hurdle to Senate confirmation, garnering support from two Republicans in a vote Wednesday. The Senate Banking Committee voted 14-10 in favor of sending Mr. Gensler's nomination for chairman of the Securities and Exchange Commission to the Senate floor for confirmation. Republican Senators Mike Rounds of South Dakota and Cynthia Lummis of Wyoming joined all 12 Democrats in supporting the nomination. (WSJ)

MARKETS: Nellie Liang, President Joe Biden's pick to serve as the Treasury's undersecretary for domestic finance, isn't waiting to be formally nominated before beginning the task of strengthening Wall Street oversight. Already working as an adviser to Secretary Janet Yellen, Liang, 63, has become the point person for cross-agency discussions on financial regulation and stability, according to more than half a dozen people familiar with the matter. (BBG)

EXCHANGE NEWS: The New York Stock Exchange would consider moving if U.S. states such as New Jersey or New York impose financial-transaction taxes. (BBG)

OTHER

U.S./CHINA: For the first time since President Joe Biden took office, senior U.S. officials will hold high-level, in-person talks with Chinese representatives next week in Alaska. Secretary of State Antony Blinken and National Security Advisor Jake Sullivan will meet in Anchorage, Alaska on March 18 with the People's Republic of China's Yang Jiechi, a member of the Communist Party's top decision-making body, and Wang Yi, the foreign minister. (CNBC)

U.S./CHINA: As the White House continues to work on another major spending bill to follow the $1.9 trillion stimulus, momentum is beginning to gather for what might become Congress's second big piece of legislation in the Biden era: a bill aimed at countering China's economic influence. Senate Majority Leader Charles E. Schumer (D-N.Y.) has been working on legislation that seeks to counter China's rising global power and proposes funding aimed at bolstering U.S. manufacturing and supply chains, among other measures. (Washington Post)

U.S./CHINA: China Semiconductor Industry Association set up a work team with its U.S. counterpart Thursday to discuss policies over export curbs, supply chain safety and encryption technology, according to a statement on the Chinese association's website. Ten semiconductor companies from each side will attend the work team. Two meetings per year are planned; meetings this year will be online but face-to-face meetings are possible later on depending on pandemic situation. (BBG)

U.S./CHINA: Cnooc has made a written request to NYSE Wednesday to reverse its decision to delist the company's American depositary shares, according to Hong Kong stock exchange filing. Company also requested trading suspension of the ADRs pending the review result. The review will be scheduled at least 25 business days from the date of review filed: company cites NYSE rules. (BBG)

U.S./CHINA/HONG KONG: U.S. Secretary of State Antony Blinken said on Wednesday the United States will take action against those responsible for violations of human rights in Hong Kong. "We need to continue to follow through on sanctions, for example, against those responsible for committing repressive acts in Hong Kong," he told a House of Representatives hearing. (RTRS)

U.S./CHINA/TAIWAN: USS John Finn, an Arleigh Burke-class guided missile destroyer, conducted a routine Taiwan Strait transit, the U.S. 7th Fleet says in a statement. (BBG)

GLOBAL TRADE: Australia's bid to reach a free-trade deal with Europe just got a little harder, due to its refusal to set a hard target to reach net-zero carbon emissions. The Australian Broadcasting Corp. reported Thursday that lawmakers in Brussels are warning they will not ratify any trade deal with Australia until it does more to reduce its emissions. It cited Kathleen van Brempt, a key parliamentary trade coordinator, saying an agreement was contingent on "a clear vision" from Australia on "when and how they will become climate neutral and by when and how they will phase out of coal." In another shot at Prime Minister Scott Morrison's government, the European Parliament voted to move forward with a carbon levy on products from countries lacking serious pollution reduction programs, the ABC said. While it didn't give a cost to the potential tariffs, it said Australia's exports to Europe were worth more than A$20 billion ($15.5 billion) in 2016. (BBG)

GEOPOLITICS: The UK is exploring additional sanctions on Myanmar, foreign minister Dominic Raab said in a tweet on Wednesday. "UK is exploring additional sanctions too – we are clear the regime should not be allowed to profit from abuse of power and human rights violations," Raab said, shortly after the United States imposed sanctions on children of Myanmar's military leader and companies. (RTRS)

CORONAVIRUS: The world will likely have a better idea about the origins of Covid-19 in a few years as scientists continue to analyze the data, according to a member of the international team of experts that traveled to China to trace the pandemic's emergence. Despite the shortage of clues to the virus's roots and the political tensions around the search, the scientific process will eventually prevail, Peter Daszak, a New York-based zoologist assisting the mission, said at a webinar organized by U.K. think tank Chatham House on Wednesday. (BBG)

CORONAVIRUS: Moderna Inc. said it had dosed the first participants in a study to examine whether booster shots of its Covid-19 vaccines may help protect against emerging variants. In the study, 60 people who received two doses of Moderna's vaccine as part of its original phase 2 study last year, will receive a third shot as part of the study. One third of the participants will receive a booster shot that contains a low dose of the existing vaccine; the second third will receive a booster shot that is customized against the variant that arose in South Africa, called B.1.351; and the final third will receive a single vaccine that contains both the existing vaccine and the one customized against B.1.351. The company says it's pursuing booster shots out of an abundance of caution. (BBG)

CORONAVIRUS: There is no indication that the AstraZeneca Plc vaccine caused the blood clotting that led Austrian authorities to suspend using a batch of the vaccines, the European Medicines Agency said. The agency's safety committee is investigating cases reported with the batch post vaccination, as well as other conditions related to clotting. (BBG)

AUSTRALIA: Australia's government will subsidize 800,000 half-price airfares as part of a A$1.2 billion ($920 million) package to prop up the nation's ailing tourism industry. To run from April 1 to July 31, the discounted fares are designed to help tourism-dependent regions and should support airlines, hotels and hospitality venues, Prime Minister Scott Morrison said in a statement. The package also includes further support for the international aviation industry, and will expand a government-backed loan program to small and medium-sized businesses. (BBG)

AUSTRALIA: Qantas hopes to resume some international flights by the end of October, when Australia expects to complete its national COVID-19 immunisation drive. Morrison has been cautious about reopening the international border, which has been shut since last March to almost everyone but citizens and permanent residents who have to go through a two-week mandatory hotel quarantine on arrival at their expense. "It's still a bit too early to say ... so we're going to take this one step at a time," Morrison told Seven Network News. Shares of travel-related stocks led early gains on the Australian sharemarket, with travel agents Flight Centre Ltd and Webjet Ltd both up more than 6% to trade near one-year intraday highs. Qantas was up 3%. (RTRS)

SOUTH KOREA: South Korea will start inoculating people aged 65 and older with the Oxford/AstraZeneca coronavirus vaccine to accelerate its vaccination drive, Prime Minister Chung Sye-kyun said on Thursday. (FT)

BOK: South Korea's economy is expected to stage a modest recovery from the coronavirus pandemic and the Bank of Korea (BOK) will continue monetary easing to prop up an economic recovery, the BOK said Thursday. In a regular monetary report, the BOK said it will pay close attention to household debts and financial imbalances as companies and households take advantage of cheap credit. "As the pace of the local economic recovery is expected to be modest, (the BOK) will keep monetary easing," the BOK said in a statement. (Yonhap)

BOK: Bank of Korea will end expansion of securities eligible for RP transaction and eligible collateral at the end of March as scheduled, as liquidity situation in local financial markets have improved. (BBG)

TAIWAN: Taiwan central bank governor Yang Chin-long said on Thursday that the United States may label the island a currency manipulator as it has already met Washington's three main criteria for making such a decision. Yang, answering lawmaker questions in parliament, added that if this happens it would not be too serious and that there would be no immediate disadvantage for Taiwan and they did not expect to be subject to so-called "Section 301" measures that might lead to tariffs. Yang said it's important to communicate with the United States about the reasons for Taiwan's strong currency, including the U.S. quantitative easing policy and the effects of the China-U.S. trade war, which have boosted exports of Taiwan tech and expanded its trade surplus with the United States. (RTRS)

LATAM: New COVID-19 cases continue to decline in North America, but in Latin America infections are still rising, particularly in Brazil where a resurgence has caused record daily deaths, the Pan American Health Organization (PAHO) warned on Wednesday. "We are concerned about the situation in Brazil. It provides a sober reminder of the threat of resurgence: areas hit hard by the virus in the past are still vulnerable to infection today," PAHO Director Carissa Etienne said in a briefing. (RTRS)

MEXICO: 100,441 people attempted to cross into the U.S. along the Southwest border last month, a 28% increase since January, Customs and Border Protection senior official Troy Miller told reporters in a Wednesday call. President Biden faces a mounting humanitarian crisis at the border, as children are being held for days in border stations and more migrants flee political oppression and economic devastation. (Axios)

BRAZIL: Brazil's lower house of congress backed a $7.5 billion Covid aid bill in a first vote, hours after Latin America's largest economy posted a record virus death toll for a single day. Lawmakers voted early Thursday in favor of a so-called emergency bill that revives last year's monthly stipends that kept millions of poor households afloat. To assuage investor concern, the bill also includes compensatory fiscal measures to demonstrate a commitment to austerity. As a constitutional amendment, the bill requires a second-round vote in the house, scheduled for Thursday morning, with at least 11 proposals to tweak the legislation. One key amendment is expected to be approved: a proposal to allow for public servants' promotions and salary increases. The government whip in the lower house, Ricardo Barros, said the government had to make a concession as part of a deal that blocked an opposition proposal that would have further watered down austerity measures.

BRAZIL: Brazil reported record deaths from Covid-19 as slow progress of vaccinations adds to worries with the near collapse of the health system. Latin America's largest country saw deaths rise by 2,286 in the last 24 hours, the Health Ministry said, pushing the total to 270,656. Confirmed cases increased by 79,876 to 11,202,305. (BBG)

BRAZIL: Brazil's central bank will extend the reduction on banks' reserve requirements on time deposits to 17% for seven months through to November, maintaining high levels of liquidity in the banking system to support the economy's recovery from the COVID-19 pandemic. In a statement, the central bank said the decision took into account the "cyclical persistence of liquidity restrictions on bank borrowing." "Thus, it is expected that the credit market will continue functioning normally, without additional restrictions," the central bank said, adding that around 40 billion reais ($7 billion) would be drained from the system if the ratio was to go back up to 20% as originally planned. The reduction in the requirement ratio to 17% in March last year was a temporary measure. It was supposed to be raised to 20% in April. Before the pandemic struck a year ago, it was 31%. (RTRS)

IRAN: The United States suggested Wednesday (March 10) it will oppose the release of billions of dollars in Iranian funds from South Korea until Teheran returns to full compliance with a nuclear deal. South Korea said last month that it had agreed on a way forward to release the money frozen from Iran's oil sales but was awaiting the approval of the United States, which under President Joe Biden is looking at returning to a 2015 denuclearisation deal. "If Iran comes back into compliance with its obligations under the nuclear agreement, we would do the same thing," Secretary of State Antony Blinken told the House Foreign Affairs Committee when asked about the Iranian money in South Korea blocked by US sanctions. "That would involve - if it came to that, if Iran made good on its obligations - sanctions relief pursuant to the agreement," he said. "But unless and until Iran comes back into compliance, they won't be getting that relief." (AFP)

MIDDLE EAST: The Saudi-led coalition fighting in Yemen destroyed on Wednesday a "hostile aerial target", belonging to the Iran-aligned Houthi forces in Yemen's Marib city, Saudi state TV reported. The Saudi state news agency showed a video on Twitter saying the coalition "destroyed an enemy air defence system type SAM-6, that belongs to the Houthis," the agency cited the coalition. (RTRS)

OIL: Commodities and energy pricing agency S&P Global Platts will defer changes to its core dated Brent oil benchmark after industry pressure, it said on Wednesday. The company said it has opened further consultation with the market on the benchmark transition. The changes, among which was inclusion of U.S. crude WTI Midland in the Brent assessment, were announced on Feb. 22 and were due to take effect from July 2022. (RTRS)

CHINA

GOVERNMENT: With time running out to stack a pool of candidates that are loyal to President Xi Jinping, China's parliament is set to alter a political selection process that will have deep ramifications on the country's second-most powerful position once held by the legendary Zhou Enlai. The National People's Congress is expected to pass Thursday legislation that will allow a more flexible process for naming or dismissing vice premiers, a pool of talent from which the premier is usually picked. Current law requires that the appointment or removal of vice premiers be approved by the National People's Congress, which usually convenes only once a year. The bill would allow for such decisions to be made by the legislature's Standing Committee, which meets every two months. That could directly affect the selection of future premiers, including the successor to current Premier Li Keqiang. China's constitution limits premiers to two consecutive terms, and Li is set to leave the post in March 2023. Li is rumored to be on bad terms with Xi, and this gives the president a chance to ensure a loyalist is the country's No. 2. (Nikkei)

ECONOMY: China should force domestic industries and government departments to enact tough reforms to meet the stringent criteria of joining the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), said former Minister of Commerce Wei Jianguo in an interview with 21st Century Business Herald. China stands ready to start negotiations to join the CPTPP as well as free trade agreements with the E.U. and possibly with the U.S., Wei said. (MNI)

INFLATION: China's PPI will likely peak at over 5% y/y by June from 1.7% in February as increasing global vaccination lifts sentiments over the pandemic, exports grow and prices of commodities gain, the 21st Century Business Herald reported citing Zhao Wei, the chief economist with Kaiyuan Securities. The surging price of production is unlikely to move monetary policy unless CPI matches the gains, Zhao said. China recorded another negative CPI at -0.2% y/y in February. Inflation may reach 3% y/y in June, within government tolerance, the newspaper said citing Wang Qing, the chief analyst with Golden Credit Rating. (MNI)

RATES: China's overall cost of lending, and in particular mortgage rates, may increase moderately this year as policymakers support innovation, SMEs and sustainability while curbing real estate and local government financing vehicles, the Securities Times reported citing Wang Qing, Chief macro analyst at Golden Credit Rating. Wang was interviewed following the PBOC's release of February loan data, which showed overall social financing increased by 1.71 trillion CNY. M2 and the scale of social financing will moderate to match nominal GDP growth, the official securities newspaper said citing chief researcher Wen Bin at Minsheng Bank. (MNI)

EQUITIES: New investors should keep calm and rational amid sharp volatility in the stock market and they should seek returns for the long term, Securities Times says in a front-page commentary. Equity funds are able to generate investment returns despite short- term setback, thanks to China's fast economic recovery and promising prospects of many industries. Fund management firms should seek balance between size of assets under management and long-term fund performance to better protect investor interest. (BBG)

OVERNIGHT DATA

JAPAN FEB PPI -0.7% Y/Y; MEDIAN -0.7%; JAN -1.5%

JAPAN FEB PPI +0.4% M/M; MEDIAN +0.5%; JAN +0.5%

JAPAN FEB TOKYO AVG OFFICE VACANCIES 5.24; JAN 4.82

AUSTRALIA MAR CONSUMER INFLATION EXPECTATION +4.1%; FEB +3.7%

NEW ZEALAND FEB REINZ HOUSE SALES +14.6% Y/Y; JAN +3.2%

NEW ZEALAND FEB FOOD PRICE INDEX -0.9% M/M; JAN +1.3%

UK FEB RICS HOUSE PRICE BALANCE 52%; MEDIAN 45%; JAN 49%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS; LIQUIDITY UNCHANGED THU

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged on Thursday. The liquidity inthe banking system is unchanged given the maturity of CNY10 billion of reverse repos today, according to Wind Information.

- The operation aims to maintain reasonable and ample liquidity, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions rose to 2.2000% at 09:25 am local time from 1.9911% at Wednesday's close.

- The CFETS-NEX money-market sentiment index closed at 40 on Wednesday vs 35 on Tuesday. A higher index indicates increased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.4970 THU VS 6.5106

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower for a second day at 6.4970 on Thursday, compared with the 6.5106 set on Wednesday.

MARKETS

SNAPSHOT: Signs Of Thawing Sino-U.S. Relations

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 136.72 points at 29173.28

- ASX 200 down 12.406 points at 6701.7

- Shanghai Comp. up 59.889 points at 3417.626

- JGB 10-Yr future up 7 ticks at 151.18, yield down 1.8bp at 0.110%

- Aussie 10-Yr future up 4.3 ticks at 98.338, yield down 4.5bp at 1.664%

- U.S. 10-Yr future -0-01+ at 132-15+, yield up 1.04bp at 1.528%

- WTI crude up $0.55 at $64.99, Gold up $5.10 at $1731.81

- USD/JPY up 24 pips at Y108.62

- ECB DRAFT FORECASTS ASSUME ANY INFLATION PICKUP WILL BE FLEETING (BBG)

- HOUSE PASSES $1.9 TRILLION COVID RELIEF BILL, SENDS IT TO BIDEN TO SIGN (CNBC)

- BIDEN ADMIN TO MEET CHINESE OFFICIALS IN ALASKA NEXT WEEK

- CHINA, U.S. SEMICONDUCTOR ASSOCIATIONS SET UP WORK TEAM (BBG)

- BLINKEN: U.S. TO TAKE ACTION AGAINST RIGHTS VIOLATIONS IN HONG KONG (RTRS)

- CHINA FUND INVESTORS SHOULD BE CALM AMID VOLALITILY (SEC. TIMES)

BOND SUMMARY: Tsys Underperform In Asia Ahead Of 30-Year Supply

E-minis have ticked higher during Asia-Pac hours. The moves are limited in terms of the broader picture, but are managing to keep some light bear steepening of U.S. Tsys in play in the wake of the passage of the U.S. COVID relief Bill and ahead of today's 30-Year Tsy supply. T-Notes sticking to a very narrow 0-03 range thus far, last -0-01 at 132-16, with 30s still providing the weak point on the cash curve, trading ~2.0bp cheaper on the day at typing. No impact on the broader Tsy space as Verizon kicked off a jumbo 7-tranche round of issuance.

- Richening in the long end of the cash curve supported JGB markets in the Tokyo morning. The smooth enough absorption of 20-Year JGB supply allowed the bid to develop during the early part of the Tokyo afternoon, with 30- & 40-Year paper now running ~4bp richer on the day, while swaps have generally widened vs. JGBs across the curve. Futures last +5, unwinding their overnight weakness and more. Local headline flow has been extremely limited to non-existent, with the latest round of weekly international security flow data revealing ~Y750bn of net purchases of Japanese paper by foreign investors (which partially unwinds the large net selling seen in the previous week and coincides with the short-term top in JGB yields).

- Roll flow continues to dominate in Sydney, with no tangible reaction in Aussie bonds to the latest round of fiscal support for the Australian economy (it does pale in comparison to previous rounds of support). The RBA provided its standard scheduled round of ACGB purchases. YM +1.4 & XM +4.0 ahead of the close, with Aussie 10s continuing to narrow vs. their U.S. counterpart in the wake of yesterday's address from RBA Governor Lowe.

JGBS AUCTION: Japanese MOF sells Y970.6bn 20-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y970.6bn 20-Year JGBs:- Average Yield 0.513% (prev. 0.482%)

- Average 99.75 (prev. 100.31)

- High Yield: 0.519% (prev. 0.488%)

- Low Price 99.65 (prev. 100.20)

- % Allotted At High Yield: 33.1567% (prev. 47.0278%)

- Bid/Cover: 3.401x (prev. 3.127x)

JAPAN: The Selling Of Foreign Bonds Comes To A Halt

Japanese selling of foreign fixed income securities paused in the most recent week (after a record round of cumulative net sales over the 2 previous weeks), as U.S. Tsy markets (and global core fixed income on the whole) stabilised to a degree. Japanese FY end and the upcoming round of life insurer interviews re: asset allocation are now eyed.

- Foreigners racked up a net ~Y755bn in purchases of Japanese paper (partially unwinding the large net selling seen in the previous week, coinciding with the short-term top in JGB yields).

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 98.9 | -1719.6 | -3031.5 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | 176.6 | -459.1 | -683.6 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 755.2 | -1277.9 | -954.5 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | -136.9 | -453.8 | -157.7 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

EQUITIES: US Stimulus Exuberance Sees Risk On Persist

A mostly positive day in Asia-Pac equity markets, bourses opened higher after a positive lead from the US and consolidated their gains. The CSI 300 is up around 2.5%, the biggest single day gain in two months, as markets focus on the close of the NPC today. Elsewhere, Taiwan and South Korea gained over 2% as tech stocks rebound, with a further lift from robust South Korean export data. Markets in Australia are the laggard in the region, in minor negative territory despite gains across the commodity complex, Afterpay are dragging the index down, losing around 5% after PayPal announced plans to offer a competing service.

- Futures in Europe and the US are higher, still riding the stimulus wave after US President Biden's $1.9tn stimulus bill was passed yesterday.

OIL: Downstream Dynamics Distract

Crude futures are higher in Asia on Thursday; WTI is $0.59 higher than settlement levels last trading at $65.03/bbl, Brent is $0.58 above settlement at $68.48/bbl last.

- The gains comes amid favourable supply/demand dynamics in downstream products, DOE stockpile data yesterday showed US gasoline inventories and distillate inventories plummeted, falling 11.8 million barrels and 5.5 million barrels, respectively, while implied distillate demand hit the highest since November 2019. This offset a large build in headline crude stocks; inventories rose 13.8m bbls against a 2.7m bbl build expectation. Nominal crude stocks are now 6% above the five-year average.

- Sentiment was also lifted after the US House of Representatives approved a $1.9 trillion stimulus package. Markets now look ahead to the OPEC Monthly Oil Market Report (MOMR) to provide an outlook on the oil market, slated for release today.

GOLD: DXY & U.S. Real Yields Lend Support, ETF Holdings Continue To Fall

Wednesday's move lower in the DXY and U.S. real yields allowed bullion to build on the bounce from the recent lows, with the impetus spilling over into Asia-Pac trade, with spot last dealing +$5/oz at $1,732/oz. After the formation of a bullish engulfing candle on Tuesday bulls target the 20-day EMA as the first technical resistance target of note.

- We should also flag that ETFs have shed their holdings of gold for 18 consecutive sessions.

FOREX: Risk-On Mood Drives Activity, Yen Brings Up The Rear

Positive risk sentiment carried over into the Asia-Pac session, with little in the way of fresh headline flow to jolt the G10 FX space. The DXY extended losses to its worst levels this week, as safe haven currencies struggled.

- JPY was comfortably the worst G10 performer, which allowed USD/JPY to move away from Wednesday's low. Worth flagging that $1.0bn of USD/JPY options with strikes at Y108.50 expire at today's NY cut, with the spot last trading at Y108.51.

- NZD led commodity-tied FX higher, with risk appetite providing the main driver. AUD/NZD ground lower ahead of the expiry of A$2.2bn of AUD puts with strikes at NZ$1.0730 (spot last sits at NZ$1.0740). The pair's 50- & 200-DMAs intersect at NZ$1.0723, leaving participants on the lookout for a "golden cross."

- The PBOC fixed its USD/CNY mid-point at CNY6.4970, 18 pips below sell side estimates, the second day the PBOC has set a stronger than expected central rate. This is the final day of the NPC and Chinese PM Li Keqiang will deliver his closing remarks at 0700GMT.

- The announcement of the ECB's monetary policy decision will be followed by a press conference with Pres Lagarde. The central bank speaker slate also includes BoC's Schembri & Norges Bank's Bache. On the data front, focus turns to U.S. initial jobless claims.

FOREX OPTIONS: Expiries for Mar11 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800(E1.2bln), $1.1900-15(E1.7bln), $1.1995-00(E630mln)

- USD/JPY: Y107.75($1.7bln), Y108.50($1.0bln)

- AUD/USD: $0.7600(A$1.7bln), $0.7720-25(A$777mln), $0.8000(A$1.8bln)

- AUD/NZD: N$1.0730(A$2.2bln-AUD puts)

- USD/CAD: C$1.2600-05($514mln), C$1.2770($860mln)

- USD/CNY: Cny6.4900($868mln)

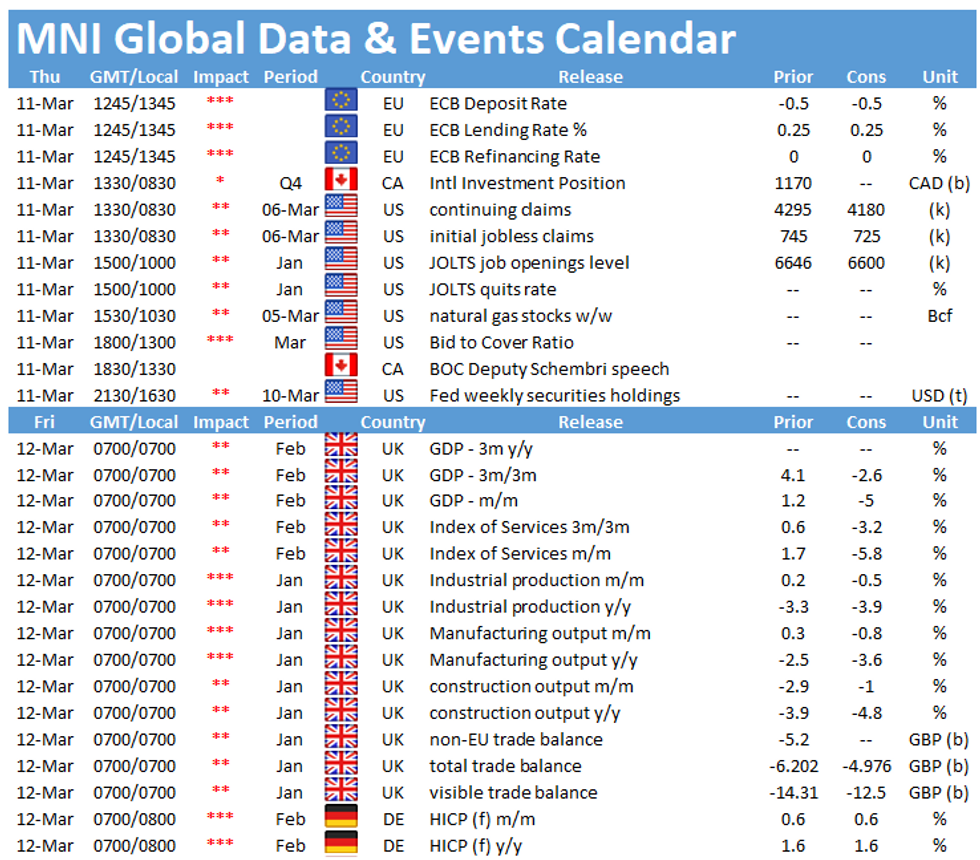

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.