-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

MNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

MNI BRIEF: Aussie Labour Market Tightens, Unemployment At 3.9%

MNI EUROPEAN OPEN: Doubling Down

EXECUTIVE SUMMARY

- BIDEN DOUBLES VACCINE GOAL TO 200MN IN FIRST 100 DAYS (FT)

- FED ENDING BUYBACK, DIVIDEND LIMITS FOR MOST FIRMS (MNI)

- EU LEADERS CAUTIOUSLY BACK VACCINE CURBS THAT INVITE RETALIATION (BBG)

- DRAGHI TELLS EU LEADERS TO KICKSTART EUROPEAN BONDS (MNI)

- BANKS AND INSURERS TO FACE TOUGH CYBER STRESS TESTS UNDER BOE PLAN (Sky)

- US-UK TRADE DEAL TALKS SET TO MISS CRUCIAL WASHINGTON DEADLINE (FT)

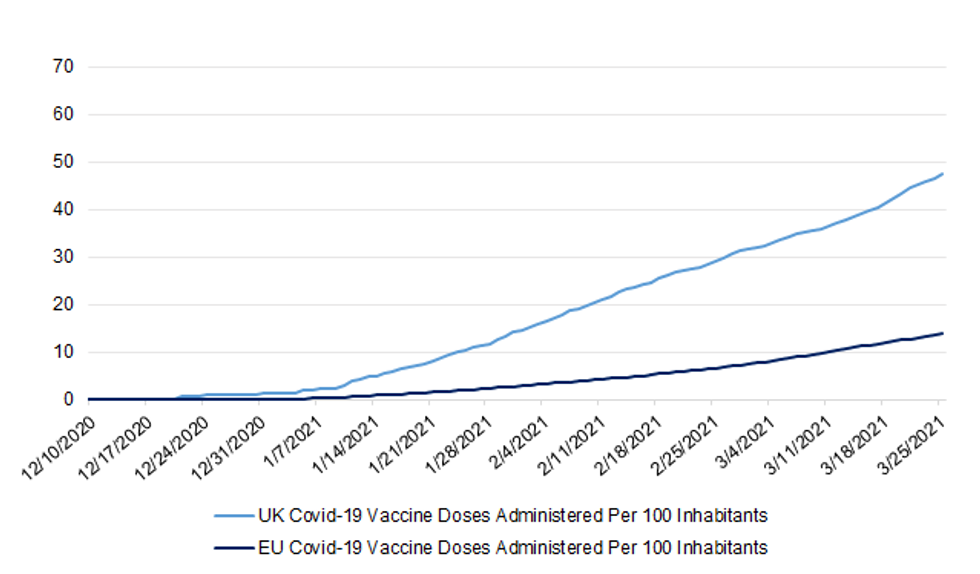

Fig. 1: UK vs. EU Covid-19 Vaccine Doses Administered Per 100 Inhabitants

MNI - Market News/Bloomberg/ONS/Eurostat

MNI - Market News/Bloomberg/ONS/Eurostat

UK

BOE: Britain's biggest banks and insurance companies are to face the toughest test to date of their resilience to a major cyberattack under plans being assembled by the Bank of England. Sky News has learnt that the Bank's Financial Policy Committee (FPC) will highlight preparations for the stress test when it publishes its quarterly Financial Stability Report on Friday. Industry sources said they expected the examination of their ability to withstand a coordinated global series of cyberattacks to form the centrepiece of the Bank of England's stress scenario when it is conducted later this year. (Sky)

UK/U.S.: UK hopes of clinching a trade deal with the US — seen as one of the biggest prizes of Brexit — are facing a further setback as negotiators are set to miss a critical deadline for securing swift passage through Congress. Trade negotiators were racing to put a deal before Congress before the end of the month, but will now lose the chance to be covered by "fast-track" legislation known as the Trade Promotion Authority, raising the prospect of a more difficult passage on Capitol Hill. According to people familiar with the negotiations, the deal has also been held up by the Biden administration's decision to focus talks on resolving the long-running Airbus-Boeing dispute, which is related to aircraft subsidies. The US trade representative's office made clear this month that a settlement was needed in the 16-year dispute between the US, UK and EU to address challenges posed by Chinese entrants to the aircraft sector. Beijing has made it a priority to break the global duopoly of Airbus and Boeing that has dominated for decades. If a trade deal is eventually agreed, it will either be put before Congress without the fast-track protections — and risk being bogged down in disputes — or UK officials could wait for a new TPA to be negotiated. (FT)

CORONAVIRUS: MPs have overwhelmingly backed the continuation of emergency coronavirus powers as the government refused to rule out extending them beyond October. Matt Hancock, the health secretary, said that Covid-19 cases were likely to rise. A Tory rebellion over a six-month extension of the Coronavirus Act failed to stop the measure passing by 484 votes to 76. Ministers insist that the extension is necessary to continue to furlough workers and give sick pay to those self-isolating. Regulations to implement the government's road map out of lockdown passed without a vote. (Times)

CORONAVIRUS: Landlords and politicians united today in condemnation of plans for vaccine passports to enter pubs, describing the proposals as unworkable, absurd and unfair. The backlash came as Boris Johnson clarified the position to say that no decision had yet been taken on the idea and confirmed that any such system would not be in place before pubs are due to reopen for outdoor service in 18 days' time. (Times)

CORONAVIRUS: Covid passport checks could be introduced at theatres, football matches, business conferences, wedding venues and even some workplaces, The Telegraph understands. People would have to show proof of getting a Covid jab, recently testing negative or having antibodies after recovering from the virus to gain admittance under the plans. Government supporters argue it would allow for social distancing rules to be relaxed sooner than planned – possibly some by May 17 – so big groups can gather again indoors. But it could also mean millions of people across the country regularly showing parts of their medical status for everyday activities – a situation unimaginable 18 months ago. Ministers are understood to be looking at using the NHS Covid-19 contact tracing app, or creating a new similar version, to produce a scannable QR code showing you are Covid safe. (Telegraph)

CORONAVIRUS: All hauliers entering England face a mass testing regime to combat the threat of new Covid-19 variants from the Continent, despite fears it could disrupt food supplies. Ministers are to scrap the current exemptions for all lorry drivers, border force officials and other specialist workers entering the country and replace them with mandatory "bespoke" tests to prevent coronavirus variants reaching the UK from the Continent, and particularly France. (Telegraph)

CORONAVIRUS: Rishi Sunak is calling on Britain's employers to end working from home and allow staff back in the office - or risk them voting with their feet and quitting. Looking beyond the pandemic, the chancellor says working in an office is crucial for young people to get to know colleagues and seek out mentors to help their career. "I'm probably in the camp of saying that it's good that people are in offices together," he said, as he appealed to bosses to start investing and hiring when coronavirus lockdown rules are lifted. (Sky)

CORONAVIRUS: EU attacks on AstraZeneca call into question its decision not to profit from its coronavirus vaccine, according to a leading member of the scientific team that delivered the breakthrough. Sir John Bell, the Oxford University professor who helped mastermind the AstraZeneca Covid vaccine, warned that the company's morale is being damaged by unwarranted criticism of its safety and efficacy. He said AstraZeneca had "never had credit" for its early decision not to profit from the vaccine and that repeated attacks from the EU and figures including Emmanuel Macron have called it into question. (Telegraph)

ECONOMY: Thousands of UK companies are set to be refused business rates relief after ministers pledged to legislate to stop appeals against bills for the property-based tax because of disruption during the coronavirus crisis. The government said on Thursday it would set aside £1.5bn in business rates relief for companies affected by the Covid-19 pandemic outside of the retail, hospitality and leisure sectors. (FT)

POLITICS: Boris Johnson has suggested that NHS nurses in England could receive a further pay increase after coming under renewed pressure following a Scottish government decision to offer most NHS staff a 4 per cent salary rise. (FT)

UK/CHINA: China slapped sanctions on U.K. entities on Friday, saying that Britain's sanctions on Chinese individuals over alleged human rights abuses in Xinjiang were based on "lies and disinformation." The Ministry of Foreign Affairs imposed sanctions on four U.K. entities and nine individuals that will be prohibited from doing business with China. Their assets in the country will also be frozen, the ministry said. (CNBC)

EUROPE

EU: MNI BRIEF: Draghi Tells EU Leaders To Kickstart European Bonds

- The EU needs to start the journey towards a common European bond, Italy's Prime Minister Mario Draghi told bloc leaders Thursday, MNIunderstands. Accepting it was a long-term goal, Draghi, formerly President ofthe ECB, said 'it's important to have a political goal' in place. A veteran ofthe GFC and the following eurozone debt crisis, Draghi also said a top priority for all leaders was to ensure no mistakes were made during the economic recovery from Covid-19 - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

EU: European Union leaders gave their guarded support to a plan to restrict vaccine exports after it emerged the bloc sent more shots to the rest of the world than it has given to its own people. As the bloc's bumbling vaccine program continues to turn up the pressure on governments, European Commission President Ursula von der Leyen made the case for a new, tougher mechanism to secure vaccine supplies pointing to the 77 million shots that companies have shipped out of the bloc, compared with the 62 million that have been administered to EU citizens. The strong-arm tactics, however, risk retaliatory measures that could jeopardize the supply of ingredients and equipment for vaccine plants in Europe - not to mention set back the global effort to contain the coronavirus. "There was a broad sense of agreement that if it needs to be used, and of course we hope it will not be used, broader consequences should be taken into account," Dutch Prime Minister Mark Rutte told reporters following an online summit. "Global supply and production chains need to remain intact." (BBG)

EU: Emmanuel Macron on Thursday night backed EU export bans on AstraZeneca vaccines to Britain, saying that no company that broke contracts with Brussels should be allowed to ship jabs out of the bloc. Despite the French president's support, EU leaders refused to jointly back Ursula von der Leyen's plans for tougher export controls on vaccines on Thursday night amid fears of sparking a vaccine trade war. The European Commission president has introduced legislation giving Brussels the power to impose vaccine export bans on countries with higher vaccination rates than the EU, such as Britain. (Telegraph)

EU: EU divisions over vaccine distribution were laid bare at a summit on Thursday as Austria's chancellor Sebastian Kurz clashed with fellow leaders over the allocation of 10m extra doses of the BioNTech/Pfizer jab. Kurz was leading efforts to ensure that Austria is part of a group of EU countries that are given additional vaccine supplies after being affected by AstraZeneca's delivery shortfalls. But his demands were rebuffed by fellow leaders including Germany's Angela Merkel who have questioned Vienna's need for extra jabs over more stricken countries in eastern Europe. EU officials have spent the past week at loggerheads over how to distribute a portion of the 10m jabs, with countries including the Czech Republic, Latvia, Lithuania, Croatia and Estonia arguing they are suffering from immediate shortfalls, having ordered large quantities of the AstraZeneca vaccine. Kurz, who has railed against Brussels' allocation system for vaccines, has said that Vienna will veto any distribution deal that does not include Austria. Without a deal, the 10m will be distributed to countries on a pro-rata system based on population. (FT)

EU: Ursula von der Leyen has revealed to EU leaders that 21m doses of Covid vaccine have been exported to the UK from suppliers based in the bloc's member states as she emphasised the need to secure jabs at home. At a virtual summit of the 27 heads of state and government, the European commission president used an address to highlight the dependency of the British government on EU supplies. She disclosed that 77m doses made by producers in the EU had been shipped to 33 countries since 1 December. Of those 21m went to the UK of which just over 1 million were from AstraZeneca, with the rest supplied by Pfizer. "While remaining open, the EU needs to ensure Europeans get a fair share of vaccines," she tweeted. (Guardian)

EU: The EU should step back from waging a "stupid vaccine war" with the UK, former European Commission president Jean-Claude Juncker has said. In a rare intervention that is likely to enrage is successors in Brussels Mr Juncker said the bloc was risking "major repetitional damage". His comments come as EU leaders meet for an online summit on Thursday to thrash out a way forward on vaccine supplies. (Independent)

EU: The European Parliament voted on Thursday to sue the European Commission unless the EU executive quickly applies new legislation that makes access to billions of EU funds conditional on respecting the rule of law. Poland and Hungary, both under formal EU investigation for breaking the rule of law, stand to lose billions of euros in EU funds when the new regulation is applied. In force since Jan, 1 but suspended in practice, the legislation is designed to safeguard EU money from misuse in cases where, for example, politicised courts do not guarantee a fair trial for a complaint about a tender for an EU-funded project. (RTRS)

EU: Novavax is delaying signing a contract to supply its COVID-19 vaccine to the European Union, an EU official involved in the talks told Reuters, as the U.S. biotech company warned it was struggling to source some raw materials. Prolonging the talks might further complicate the EU's vaccination plans as the bloc had planned to sign a deal early this year for at least 100 million doses of Novavax's vaccine, with an option for another 100 million. The EU official, who asked not to named as the talks are confidential, said the company had postponed signing a deal for weeks, citing legal issues in meetings with the bloc's vaccine negotiators. (RTRS)

EU/TURKEY: European Union leaders on Thursday offered new incentives to Turkey to improve cooperation on migration and trade despite democratic backsliding in the country and lingering concerns about its energy ambitions in the Mediterranean Sea. Seizing on the recent conciliatory tone from Turkish President Recep Tayyip Erdogan, the leaders said, should the relative calm continue, "the European Union is ready to engage with Turkey in a phased, proportionate and reversible manner to enhance cooperation in a number of areas of common interest." (AP)

GERMANY: The German Health Ministry announced on Thursday that people flying into Germany will be required to undergo coronavirus testing as of midnight (2300 UTC) on Sunday, March 28. Travelers will be required to take a COVID test before departure, regardless of the coronavirus risk level in their country of origin. Airlines will only be allowed to let passengers with proof of a negative COVID test on board. News of the changes were first reported by the tabloid newspaper, Bild. The stricter rules were originally supposed to have been enacted on Friday. However, health officials said they would push them back to Sunday to allow passengers and airlines time to prepare. Travelers will have to pay for the tests themselves. The old rules had required tests only from travelers coming from high-risk areas. Now, travelers coming from popular vacation destinations with lower case numbers, like Mallorca, will need a negative test. The testing requirements are expected to last until mid-May. (Deutsche Welle)

ITALY: Italian premier Mario Draghi needs a new stimulus program within weeks to bankroll higher monthly lockdown costs of as much as 15 billion euros ($18 billion) and keep the economy afloat, according to people with knowledge of the matter. With a slow vaccine rollout, persistent lockdowns, and furloughs and other aid still in place, the government's average recurring bill is swelling, said the people, who declined to be identified talking about undisclosed public accounts. Monthly costs that were previously as much as 10 billion euros now sometimes range about 50% higher than that, they said. While Draghi only just secured approval of a 32 billion-euro package originally requested by his predecessor, Giuseppe Conte, empty government coffers and only a gradual prospective easing of lockdowns mean he must return to Parliament in April to seek permission for more borrowing, the people said. (BBG)

ITALY: Italy will fail to met an EU target of vaccinating 80% of citizens aged over 80 by the end of March, a leading health institute has said, questioning the vaccine policies of many local health authorities. Some 4.4 million people aged over 80 live in Italy, and just 19.1% of them, or 846,000, have received the recommended double dose, while 27.4% had received an initial COVID-19 jab, the report by the Gimbe institute said. "The percentage of those who have had twin shots puts Italy at the bottom of Europe," Gimbe president Nino Cartabellotta told Radio24. (Guardian)

GREECE: U.S. President Joe Biden, in phone call with Greek Prime Minister Kyriakos Mitsotakis on Thursday, conveyed his hope for stability in the Eastern Mediterranean, the White House said. (RTRS)

SCANDINAVIA: Iceland will resume the use of AstraZeneca's Covid-19 vaccine after suspending it on 11 March pending investigations into reports that it might be linked to blood clots in some people who had been vaccinated, the government has said. It comes after Sweden said it would resume use of the jab but only people aged 65 and older, while Denmark announced an extension of the suspension for another three weeks. (Guardian)

DENMARK: After taking a cautious approach for much of the coronavirus pandemic, Denmark is breaking ranks with some of its neighbors with far-reaching plans to ease lockdown over the coming weeks. An agreement signed off by nine of the 10 parties in the Danish parliament this week provided a timetable for the relaxation of restrictions in stages every two weeks starting April 6. If all goes to plan, the country would open up fully just as all over-50s have been vaccinated, but before many of those under that age have had their jabs. From April 6, certain services including hairdressers will reopen and students will continue a process of returning to schools and colleges. Smaller shopping centers will also be allowed to receive customers. From April 21, larger shopping centers, restaurants and cafes with outdoor dining will open while indoor dining will be allowed from May 6. By the end of May, virtually all of Danish society is expected to be open, although the agreement suggests some questions remain over what to do about gatherings at major events and with nightclubs. (Politico)

U.S.

FED: MNI BRIEF: Fed Ending Buyback, Dividend Limits for Most Firms

- The Federal Reserve said Thursday it will halt remaining restrictions on most bank stock buybacks and dividends after June 30, citing resilience in the latest stress testing - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

- Chicago Fed President Charles Evans said Thursday that rising bond yields can be a signal of policy success in helping the economy rebound, and doubly so if they reflect higher inflation expectations - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

- Chicago Fed President Charles Evans said Thursday the central bank may not raise its key interest rate until 2024, saying the biggest challenge will be bringing inflation up - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

- Atlanta Federal Reserve President Raphael Bostic said Thursday that he is expecting a pick-up in growth this year but the jury is out on how coming fiscal spending will change inflation, even as there is hope that full employment can be reached in 2022 - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: MNI POLICY: US Debt Could Reach 623% of GDP by 2095--Treasury

- The U.S. federal debt will grow to more than six times the size of the economy over the next seven decades, increasing the risk of afiscal crisis over time, the Treasury Department said Thursday - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

CORONAVIRUS: US president Joe Biden declared "hope is on the way" as he doubled his goal for coronavirus vaccinations to 200m within his first 100 days in office and trumpeted his $1.9tn fiscal stimulus deal for already delivering a stronger recovery. Biden's optimism in the fight against the coronavirus and the economic downturn came on Thursday during his first press conference since entering the White House in January. The president noted that economic forecasters were already upgrading their projections for gross domestic product growth to more than 6 per cent. He said that was evidence that the relief package was working and the battle against Covid-19 was making progress. "We're starting to see new signs of hope in our economy," Biden said at the start of the White House press conference. "Help is here and hope is on the way." (FT)

POLITICS: President Biden on Thursday said it's his "expectation" to run for re-election in 2024, and that he "would fully expect" Vice President Kamala Harris to be his running mate again. Why it matters: There's been widespread speculation that Biden, 78, may only serve one four-year term, due to age or other reasons. The president has not yet to set up a reelection campaign for a 2024 bid. Yes, but: Biden did leave room for doubt, stating, "I'm a great respecter of fate. I've never been able to plan four and a half, three and a half years ahead for certain." (Axios)

POLITICS: President Biden on Thursday signaled he is open to making significant changes to the legislative filibuster in the Senate if it continues to be a roadblock to passing legislation on key agenda items like voting rights. Biden, in his first formal press conference since taking office, reiterated his belief that the Senate should go back to the talking filibuster, which requires senators to hold the floor in order to block legislation. He acknowledged the current system is being "abused in a gigantic way," and indicated he may be willing to support exceptions to the filibuster or changing the rule entirely. (Hill)

POLITICS: Former President Trump is growing frustrated with the lack of movement around a new super PAC intended to further solidify his influence over the GOP, according to two people familiar with the conversations. Trump advisers first shared the plans in late February for a super PAC as part of a post-presidency political operation. Trump told allies at the time that he'd chosen his onetime campaign manager Corey Lewandowski to run the organization, but roughly one month later, the 45th president has started lashing out about the lack of movement on the project, sources said. The sources, one of whom heard the comments from Trump directly, said the former president is agitated that there has been little tangible or visible progress on establishing the super PAC and ramping up activity in the month since the idea for the new super PAC was first made public. "He's lashing out that nothing's happening. He viewed this super PAC as something that's supposed to have his back, and it's nowhere to be found," one source said. (Hill)

ECONOMY: The U.S. Senate on Thursday voted to extend the COVID-19 pandemic Paycheck Protection Program (PPP) until the end of May, giving small businesses more time to apply and the government more time to process requests. (RTRS)

BANKING: Democratic U.S. lawmakers will seek to repeal a banking rule put in place under former President Donald Trump that they argue allows banks to skirt stricter state lending rules, pursuing a resolution to undo the so-called "true lender" regulation. Staff with Senator Chris Van Hollen's office told Reuters the senator, along with other Democrats including Senate Banking Committee Chairman Sherrod Brown, plan to introduce the measure later on Thursday in the Senate. A similar resolution is expected to be introduced in the House of Representatives on Friday, according to congressional sources familiar with the matter. (RTRS)

US TSYS: MNI BRIEF: Dealers Dropped $118 Bln in Treasuries in 3 Weeks

- US primary dealers have continued to drop Treasuries, data released Thursday showed, with holdings falling USD36.9 billion in the week to March 17 alone - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

COMOMODITIES: The American Petroleum Institute said Thursday that it supports putting a price on carbon emissions — a term that typically refers to emissions taxes or permit trading systems. Why it matters: The new posture marks a major shift for the powerful K Street lobbying group, though signs of the endorsement emerged weeks ago. (Axios)

OTHER

ASIA: A three-speed recovery is taking hold across East Asia and the Pacific, with China and Vietnam already beating their pre-pandemic levels of economic growth while other countries could take years more to heal, according to World Bank projections. The developing countries of the region, excluding China, are set to expand 4.4% after contracting 3.7% last year, the World Bank said in a release Friday. Underneath those regional figures is a broad disparity, with Pacific Island nations set to grow just 1% after contracting 11.3% last year, and many recovering but still significantly behind their pre-pandemic levels of growth. Inequality in access and efficacy of vaccines underlies much of the unevenness, Aaditya Mattoo, the World Bank's chief economist for the East Asia and Pacific region, said in an interview ahead of the report's release. "The rollout numbers we have seen recently are very low," especially in the Philippines and Indonesia, which have a problem with "vaccine hesitancy" and distribution capacity, he said. On the upside, economies in the region -- much like those across emerging markets and the developing world -- are set to see a boost from spillover effects after the U.S. recently passed a $1.9 trillion stimulus package. (BBG)

BOJ: Central banks must take forward-looking steps and make steady progress in overcoming climaterelated financial risks, according to Bank of Japan Governor Haruhiko Kuroda. "The size and number of challenges is no reason to delay addressing this issue," Kuroda said Thursday in the text of his speech for a climate risk workshop hosted by the BOJ. "Financial authorities have established frameworks based on their experience of previous crises in order to avoid another. However, this pattern cannot be repeated in the case of climate-related financial risks." (BBG)

JAPAN: Japanese Prime Minister Yoshihide Suga said on Friday he would probably invite U.S. President Joe Biden to the Olympic Games to be held in Tokyo this summer, domestic media said, citing comments in a parliament session. "It's only natural," Suga said, since the heads of other Group of Seven industrialised nations had voiced support for the Summer Games to be held, according to Kyodo News. (RTRS)

KOREA: President Moon Jae-in on Friday censured North Korea's recent ballistic missile launches, saying that military provocations by Pyongyang are "undesirable" amid efforts to revive stalled international negotiations on the North's nuclear program. In his speech to a ceremony to mark the sixth anniversary of the Yellow Sea Defense Day held at the Navy's 2nd Fleet Command in Pyeongtaek, 70 kilometers south of Seoul, Moon said that "actions providing difficulty for the mood for dialogue are undesirable." (Yonhap)

TAIWAN: Taiwan and the United States have signed their first agreement under the Biden administration, the establishment of a Coast Guard Working Group to coordinate policy at a time when China's maritime actions have caused growing regional concern. (RTRS)

HONG KONG: As China imposed a sweeping national security law in Hong Kong last year after massive protests, residents of the city moved tens of billions of dollars across the globe to Canada, where thousands are hoping to forge a new future. Capital flows out of Hong Kong banks reaching Canada rose to their highest levels on record last year, with about C$43.6 billion ($34.8 billion) in electronic funds transfers (EFT) recorded by FINTRAC, Canada's anti-money laundering agency, which receives reports on transfers above C$10,000. The previously unreported outflows, the highest since 2012 when the earliest FINTRAC records are available, are the first evidence of a significant flight of capital overseas from the Asian financial hub following the security turmoil. (RTRS)

ISRAEL: Prime Minister Benjamin Netanyahu and his right-wing allies fell short of winning a parliamentary majority in Israel's latest election, according to a final vote count released Thursday, leaving a political deadlock that put the long-time leader's future in question. The fourth election in just two years brought a stinging rebuke for Netanyahu, the most dominant figure in Israeli politics in a generation. Adding to the pain, he lost ground to former partners who vowed never to sit in a government with him again. (AP)

ISRAEL/IRAN: A cargo ship owned by an Israeli company was damaged by a missile in the Arabian Sea on Thursday in what was suspected to be an Iranian attack, an Israeli security official said. The official, who spoke on condition of anonymity, said the ship was on its way from Tanzania to India and was able to continue its voyage after the attack. (RTRS)

TURKEY: Turkey has begun initial talks to acquire the Russian-made Sputnik-V vaccine, the health minister Fahrettin Koca said on Thursday. The minister added that the capital, Ankara, would receive a total of 100 million doses of Covid-19 vaccines by the end of May. (Guardian)

MEXICO: MNI STATE OF PLAY: Bank of Mexico Holds Rates Steady at 4%

- The Bank of Mexico held interest rates steady at 4% Thursday asrising inflation and financial market pressures made policy makers reticent toreduce borrowing costs further despite a weak economic backdrop - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

BRAZIL: Brazil on Thursday registered a record 100,158 new coronavirus cases within 24 hours, the Health Ministry said, underlining the scale of a snowballing outbreak that is becoming a major political crisis for President Jair Bolsonaro. The record caseload, along with 2,777 more COVID-19 deaths, comes a day after Brazil surpassed 300,000 fatalities from the pandemic, the world's worst death toll after the United States. (RTRS)

ARGENTINA: Argentina's Economy Minister Martin Guzman said on Thursday "important steps" have been taken towards the goal of refinancing the roughly $45 billion the country owes to the International Monetary Fund. Guzman, who met with IMF officials earlier in the week, said on Twitter that a macroeconomic policy scheme must be sustainable and support economic recovery, in what he called a "radical change" from the philosophy of the failed deal signed with the fund in 2018, which the current negotiations aim to replace. (RTRS)

ARGENTINA: Argentina has decided to suspend flights from Brazil, Chile and Mexico starting on Saturday to prevent different strains of the coronavirus from entering the country as it braces for a second wave of infections. The government said in a statement on Thursday that the measures, which include tests and mandatory isolation for citizens who return from other regions, will take effect on Saturday. (RTRS)

MALAYSIA: Beset by a year of growing fissures, Malaysia's biggest political party, Umno, faces a reckoning at this weekend's annual general assembly, a meeting that will have ramifications for the country's political future. Twice delayed since December due to the Covid-19 pandemic, the gathering is likely to see party president Zahid Hamidi's faction push forward a resolution to formally break ties with Prime Minister Muhyiddin Yassin's Parti Pribumi Bersatu Malaysia. (Straits Times)

IRAN: Beijing has told Washington there have been "new developments" in the Iran nuclear situation and urged it to restart talks on the issue. Chinese foreign vice-minister Ma Zhaoxu's plea to the US special envoy for Iran, Robert Malley, came with Chinese Foreign Minister Wang Yi due to arrive in Iran. (SCMP)

AFGHANISTAN: President Biden said on Thursday that it would be "hard" for the U.S. to meet a May 1 deadline to withdraw from Afghanistan, but he "can't picture" U.S. troops still being in the country next year. Why it matters: A deal struck by the Trump administration with the Taliban last year states that all U.S. forces are to withdraw from Afghanistan by May 1. But Biden said during Thursday's press conference that former President Trump's deal doesn't seem to be working, and "in terms of tactical reasons, it's hard to get those troops out." (Axios)

AFGHANISTAN: Germany paved the way for its troops to stay in Afghanistan beyond an April 30 deadline that the United States last year agreed with the Taliban for the withdrawal of U.S. forces after nearly two decades of war. Lawmakers approved late on Thursday a new mandate which allows the German military to keep up to 1,300 troops in Afghanistan as part of a NATO mission until Jan 31, 2022. (RTRS)

NIGERIA: Africa's largest crude producer says it's spending up to 120 billion naira ($294 million) monthly on gasoline subsidies, setting up the stage for policy reforms. While Nigeria produces 1.6 million barrels of crude a day, the state-owned Nigerian National Petroleum Corp. imports virtually all its fuel from abroad due to the country's low refining capacity, reselling it locally at a subsidized price. "Our current consumption and evacuation from the depots is about 60 million liters a day," NNPC Group Managing Director Mele Kyari said at a briefing Thursday. "We are selling at 162 naira ($0.40) a liter, compared to actual market price of around 234 naira," he said. (BBG)

COMMODITIES: Fears of significant disruption to global trade have risen after rescuers warned that the Suez Canal could remain blocked for "weeks" by the grounding of a giant container ship. Specialist dredgers arrived on Thursday to attempt to dig out and refloat the 220,000-tonne Ever Given after it became wedged across the canal during a sandstorm on Tuesday. Despite efforts to move the ship, as at 5pm London time satellite tracking showed the vessel was still stuck across the canal. (FT)

CHINA

POLITICS: Chinese consumers have the right to punish western companies, including H&M and Nike, which participate in sanctions against Xinjiang for alleged forced labor practices, the Global Times, an official newspaper of the Communist Party of China, said in a Friday editorial. The confrontation over Xinjiang may further escalate into a hot-spot issue with the U.S., which is exploiting the issue to incite confrontation between China and Islamic countries, it said. China should show "strength and attractiveness" and promote favorable changes, the newspaper said. (MNI)

ECONOMY: China will inject more credit into less developed provinces to balance uneven growth and prevent worsening risks of regional financial crises, the Securities Times said citing a PBOC online forum. China will boost funding to key sectors including small enterprises, low-carbon industries, and high-tech manufacturing while limiting mortgage lending, the newspaper said. The central bank urges closer collaboration among financial institutions, regulators and local governments, the Times report said. (MNI)

EQUITIES: China's Xiaomi Corp plans to make electric vehicles (EVs) using Great Wall Motor Co Ltd's factory, said three people with direct knowledge of the matter, making it the latest tech firm to join the smart mobility race. (RTRS)

YUAN: The Chinese yuan may not maintain last year's momentum through the early part of this year, and is unlikely to trade past 6 against the U.S. dollar in 2021, Guan Tao, chief economist of BOC International and a former official at the State Administration of Foreign Exchange, said in a forum on Wallstreetcn.com on Thursday. The PBOC is likely to increase yuan flexibility, control capital inflows and expand outflows to ease the pace of appreciation, even as it has refrained from forex market interventions, Guan said. The yuan closed at 6.5340 at 16:30 Beijing time Thursday, hitting the weakest level this year, MNI noted. (MNI)

OVERNIGHT DATA

JAPAN MAR TOKYO CPI -0.2% Y/Y; MEDIAN -0.2%; FEB -0.3%

JAPAN MAR TOKYO CORE CPI -0.1% Y/Y; MEDIAN -0.2%; FEB -0.3%

JAPAN MAR TOKYO CORE-CORE CPI +0.3% Y/Y; MEDIAN +0.2%; FEB +0.2%

SOUTH KOREA MAR CONSUMER CONFIDENCE 100.5; FEB 97.4

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Friday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.2000% at 09:28 am local time from the close of 2.2110% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 40 on Thursday vs 49 on Wednesday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.5376 FRI VS 6.5282

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher for a third day at 6.5376 on Friday, compared with the 6.5282 set on Thursday.

MARKETS

SNAPSHOT: Doubling Down

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 428.04 points at 29157.92

- ASX 200 up 33.641 points at 6824.2

- Shanghai Comp. up 47.471 points at 3410.717

- JGB 10-Yr future up 4 ticks at 151.38, yield down 0.5bp at 0.081%

- Aussie 10-Yr future up 2 ticks at 98.31, yield down 2.3bp at 1.656%

- U.S. 10-Yr future -0-02 at 132-02+, yield down 0.67bp at 1.627%

- WTI crude up $0.64 at $59.2, Gold up $0.23 at $1727.16

- USD/JPY up 5 pips at Y109.24

- BIDEN DOUBLES VACCINE GOAL TO 200MN IN FIRST 100 DAYS (FT)

- FED ENDING BUYBACK, DIVIDEND LIMITS FOR MOST FIRMS (MNI)

- EU LEADERS CAUTIOUSLY BACK VACCINE CURBS THAT INVITE RETALIATION (BBG)

- DRAGHI TELLS EU LEADERS TO KICKSTART EUROPEAN BONDS (MNI)

- BANKS AND INSURERS TO FACE TOUGH CYBER STRESS TESTS UNDER BOE PLAN (Sky)

- US-UK TRADE DEAL TALKS SET TO MISS CRUCIAL WASHINGTON DEADLINE (FT)

BOND SUMMARY: Core FI Ebb Off Session Highs, But RBA Chatter Keeps ACGBs Afloat

ACGBs extended gains to fresh session highs after Westpac revised their RBA call and said they now expect the Reserve Bank to extend its QE programme by a further A$100bn in mid-Oct rather than by A$50bn. Core FI crept higher before the release of Westpac's research note, which provided a shot in the arm for ACGBs. XM pulled back from highs but held onto the bulk of earlier gains and last trades +2.0 ticks, with YM last seen -0.5. Cash ACGB yields trade lower across the curve, with belly outperforming as 10s lead the way. Bills trade unch. to -1 tick through the reds. The AOFM tapped ACGB 0.25% 21 Nov '24, amid speculation that this bond might be included in the RBA's YCC purchases. The A$800mn auction was small by historical standards and saw a tighter price tail vs. the previous auction & a slightly smaller bid/to cover ratio, which nonetheless held above 4.00x. Elsewhere, the AOFM released a relatively light issuance slate for next week. Across the Tasman, the RBNZ trimmed its LSAP purchase target for next week, which was expected after NZ Tsy said it will reduce bond issuance in Apr.

- U.S. Tsys were capped after U.S. Pres Biden doubled his Covid-19 vaccination target & the Fed signalled imminent termination of dividend curbs for banks. T-Notes popped higher to the session high of 132-04 in early Tokyo trade as reaction bid in ACGBs spilled over. The contract ebbed off best levels as broader sentiment remained positive, before posting another uptick with little in the way of headline catalysts crossing the wires. T-Notes last trade -0-02+ at 132-02. Cash Tsy yields sit a touch lower across the curve, with the 5-7 Year sector outperforming despite yesterday's weak 7-Year Note sale. Eurodollar futures last sit +0.5 to -0.5 tick through the reds. Focus in the U.S. turns to personal income/spending & PCE data.

- Despite a softer re-open, JGB futures rallied through Thursday's peak before the Tokyo lunch break, printing their session high of 151.41 as the BoJ left the sizes of its 1-3 & 5-10 Year JGBs unch. Futures trimmed gains thereafter and last sit at 151.37, +3 tick vs. settlement. Cash JGB yields sit lower across the curve, with 2s outperforming. Tokyo CPI, a bellwether of national inflation, showed a marginal slowdown in headline & core deflation in March.

JGBS AUCTION: Japanese MOF sells Y5.4748tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y5.4748tn 3-Month Bills:

- Average Yield -0.0990% (prev. -0.1009%)

- Average Price 100.0266 (prev. 100.0271)

- High Yield: -0.0930% (prev. -0.0986%)

- Low Price 100.0250 (prev. 100.0265)

- % Allotted At High Yield: 51.4948% (prev. 50.3051%)

- Bid/Cover: 2.880x (prev. 3.280x)

BOJ: 1-3 & 5-10 Year Rinban Sizes Unchanged

The BoJ offers to buy a total of Y820 of JGBs from the market, sizes unchanged from previous operations.

- Y400bn worth of JGBs with 1-3 Years until maturity

- Y420bn worth of JGBs with 5-10 Years until maturity

AUSSIE BONDS: The AOFM sells A$800mn of the 0.25% 21 Nov '24 Bond, issue #TB159:

The Australian Office of Financial Management (AOFM) sells A$800mn of the 0.25% 21 November 2024 Bond, issue #TB159:

- Average Yield: 0.2523% (prev. 0.1793%)

- High Yield: 0.2525% (prev. 0.1800%)

- Bid/Cover: 4.3312x (prev. 4.6000x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 97.4% (prev. 90%)

- bidders 45 (prev. 39), successful 8 (prev. 12), allocated in full 1 (prev. 4)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance schedule:

- On Wednesday 31 March it plans to sell A$2.0bn of the 1.00% 21 November 2031 Bond.

- On Thursday 1 April it plans to sell A$500mn of the 23 July 2021 Note & A$500mn of the 24 September 2021 Note.

EQUITIES: Green To Finish The Week

Major Asia-Pac bourses are in the green on Friday, large gains reversing some of the declines seen earlier this week. The technology sector is driving gains, TSMC has helped the Taiex higher. Major benchmarks in China are up around 2%, the biggest single day advance in two weeks. In South Korea Samsung Heavy helped buoy the index after winning a KRW 2.81tn order, while Samsung Display reported a 50% share in the smartphone panel market.

- Futures in Europe and the US are higher, Nasdaq futures are the outperformer on the tech rally. Positive sentiment has been further boosted by US President Biden's declaration that he wants to double the target for vaccinations administered.

OIL: Higher On The Day, Lower On The Week

Crude futures have risen on Friday, WTI is last up $0.61 at $59.17/bbl, while Brent is up $0.49 at $62.44/bbl. On a weekly basis oil is on track for a third weekly decline.

- Markets are still weighing the implications of the trapped container ship in the Suez canal, reflation efforts have so far failed, which has raised the prospect that the ship could continue to block the route for days. The route facilitates almost 10% of total seaborne oil trade.

- Upside could be tempered by renewed COVID-19 concerns as infection numbers in Europe rise, which has forced countries to extend their mobility restrictions, dampening the demand outlook for oil. Markets look ahead to the next OPEC+ meeting on April 1 where the coalition is expected to roll over production cuts.

GOLD: Hovers Near Week's Low

The yellow metal is lower, losing ground for the second straight session and the fourth day this week, on track for its first weekly decline since March 5. Markets are still assessing the weak 7-year US auction which briefly saw yields spike. A broad risk on tone has pressured gold, with equity markets recouping some of their recent losses. Gold last trades down $2.69 at $1724.32/oz, touching the lowest level this week, a break of $1720 brings $1700 into focus before looking at the 2021 low around $1680.

FOREX: Antipodeans Trim Weekly Losses, Yen Lags On Firmer Sentiment

The Antipodeans led high-beta FX higher amid a broader pick-up in risk sentiment, with regional equity benchmarks posting gains amid light news and data flow. Some saw U.S. Pres Biden's pledge to double his Covid-19 vaccination target & German Cll'r Merkel's decision to abandon her plan to implement a five-day lockdown over Easter. AUD/USD crossed above the $0.7600 mark and approached its 100-DMA after charting a Doji candlestick yesterday. The Aussia looked through a research note from Westpac, who now expect the RBA to extend its QE programme by a further A$100bn rather than by A$50bn.

- USD/JPY extended gains after completing a bullish flag pattern. The rate was bought into the Tokyo fix but eased off highs later on, while the yen remained the worst G10 performer.

- The PBOC fixed its USD/CNY mid-point at CNY6.5376, 8 pips below sell side estimates. USD/CNH extended its pullback from Thursday's high, despite China's tensions with a number of Western countries.

- Focus turns to U.S. personal income/spending & PCE data, German Ifo survey, Italian sentiment gauges, Swedish retail sales & Norwegian unemployment as well as comments from ECB's Rehn, BoE's Saunders & Tenreyro.

FOREX OPTIONS: Expiries for Mar26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800(E487mln-EUR puts), $1.1900(E749mln)

- USD/JPY: Y108.75-80($680mln)

- EUR/GBP: Gbp0.8600(E416mln-EUR puts)

- AUD/USD: $0.7500(A$539mln), $0.7765(A$1.7bln)

- USD/CAD: C$1.2900($520mln)

- USD/CNY: Cny6.40($1.1bln)

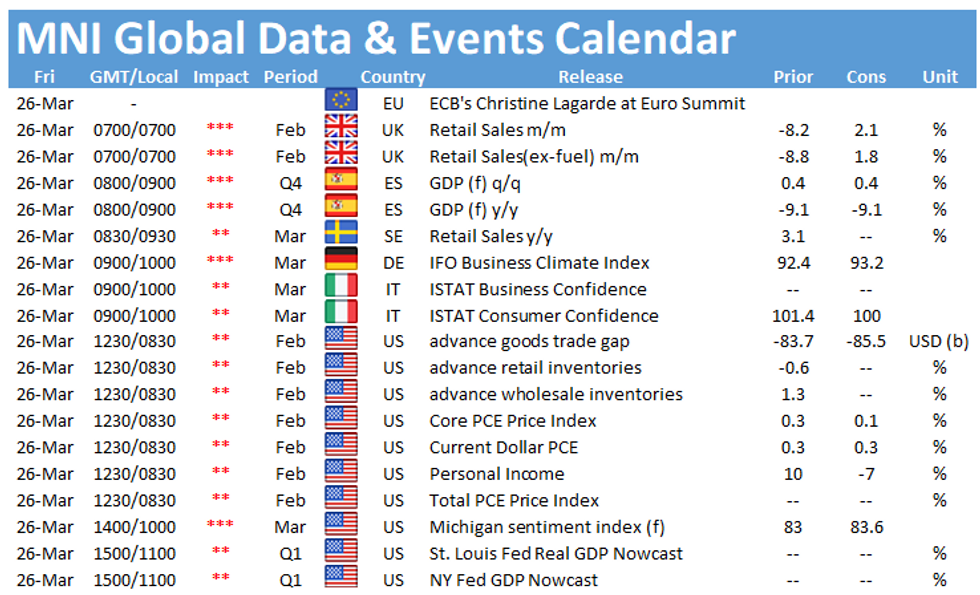

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.