-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

MNI BRIEF: Aussie Labour Market Tightens, Unemployment At 3.9%

MNI FOMC Hawk-Dove Spectrum

MNI EUROPEAN OPEN: A Cautious Start To The Week On Geopolitical Risk & Alibaba Fine

EXECUTIVE SUMMARY

- FED'S POWELL: U.S. ECONOMY AT AN 'INFLECTION POINT' (CBS)

- ECB'S LAGARDE SEES STRONG REBOUND FOR EU ECONOMY IN H221 (CNBC)

- ECB'S PANETTA: MUST ACCEPT NO FURTHER DELAY IN LIFTING INFLATION (RTRS)

- SÖDER DECLARES AMBITION TO SUCCEED MERKEL AS GERMAN CHANCELLOR (FT)

- IRAN CALLS NATANZ ATOMIC SITE BLACKOUT 'NUCLEAR TERRORISM' (AP)

- CHINA HITS ALIBABA WITH RECORD FINE

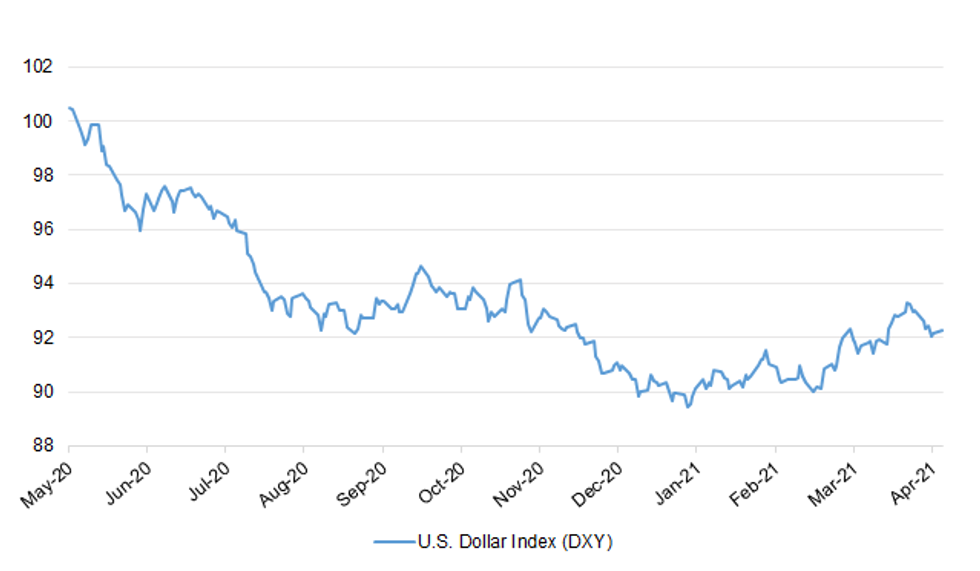

Fig. 1: U.S. Dollar Index (DXY)

Source: MNI - Markets News/Bloomberg

Source: MNI - Markets News/Bloomberg

UK

CORONAVIRUS: Boris Johnson has called Monday's easing of lockdown a "major step forward" to "freedom", but warned people must still behave "responsibly". Pubs, restaurants, cafes and social clubs will be able to start serving outdoors again for the first time this year, with takeaway pints allowed too. (Telegraph)

CORONAVIRUS: Leading scientists warned that the government was risking a third wave of Covid-19 by easing the lockdown at a time when official data still shows virus hotspots across many parts of the country. With the UK poised to lift many Covid restrictions on Monday, the scientists accuse ministers of abandoning their promises to "follow the data, not dates" in a rush to reopen society and the economy. (Observer)

BREXIT: The UK and the EU are making progress in talks on how to apply post-Brexit trade rules in Northern Ireland, raising hopes of an agreement that could help reduce tensions that have spilled over into violence on the streets of Belfast. Officials on both sides said that recent days of intensive contacts had given cause for optimism that the UK and EU can craft a "work plan" on how to implement the Northern Ireland protocol, which sets the post-Brexit terms for goods to flow between the region and Great Britain. EU Brexit commissioner Maros Sefcovic and his UK counterpart David Frost may meet to review progress this week. "They are advancing on a technical level and probably we will see a [Frost-Sefcovic] meeting rather sooner than later", said one EU diplomat, while cautioning progress depended on firm commitments from the UK and its "unequivocal support" for the Brexit withdrawal agreement. (FT)

BREXIT: A cross-party group of MPs and several business figures have set up an independent commission to scrutinise and improve the UK's trade deals with the EU and the rest of the world. The move comes after the government in January ordered the closure of a House of Commons select committee with a remit to examine Britain's relations with the EU, leading to accusations from MPs that it was avoiding scrutiny of the Brexit trade deal. The new trade and business commission, which formally launches this week, will involve MPs from all political parties and include Hilary Benn, Labour chair of the now defunct Commons committee on the future relationship with the EU. (FT)

ECONOMY: U.K. business leaders were the most optimistic on record last quarter as the country set out its plan to exit Covid restrictions and Brexit risks receded. The upswing in confidence helped push expectations for hiring and business investment to their highest levels in almost six years, according to a survey of chief financial officers by Deloitte. Respondents said they anticipate a strong recovery in profits over the next year. The brighter outlook reflects the easing of lockdown curbs amid a mass vaccination program and hopes that disruptions caused by Britain leaving the European Union will dissipate this year. Companies that sought to minimize new spending on staff and equipment last year are now moving away from defensive strategies, the poll found. (BBG)

ECONOMY: The economy is poised to roar back to life amid high levels of business and consumer confidence, improving job prospects and a buoyant stock market. Consumer confidence has risen to its highest level since August 2018, according to an analysis by YouGov, the pollster, and the Centre for Economics and Business Research. For the first time since the start of the pandemic, more households than not believe their finances will improve over the coming year, the research found. People feel more secure in their jobs, with sentiment close to pre-pandemic levels. Kay Neufeld, CEBR head of forecasting, said: "We expect the positive sentiment to translate into a noticeable pick-up in economic growth in the second and third quarter of this year, supported by strong consumer spending and higher employment levels. "The end of the furlough scheme later in the year is still expected to lead to an increase in redundancies but, for the time being, consumers seem to be focusing on the opportunities ahead as the economy reopens, starting with outdoor hospitality and non-essential retail." (The Times)

POLITICS: Overall approval for the government's handling of the Covid pandemic is now positive for the first time since May last year, in the latest sign that the vaccine rollout has helped transform its fortunes. The latest Opinium poll for the Observer found that 44% now approve of the government's Covid handling, with 36% disapproving. Overall, it recorded a nine-point lead for the Conservatives over Labour, the largest Tory lead since last May. (Observer)

POLITICS: Former prime minister David Cameron has accepted he should have acted differently over his role in the Greensill lobbying controversy. In his first statement in weeks over the scandal, Mr Cameron insisted he broke "no codes of conduct and no government rules", but having "reflected on this at length" accepted there were "lessons to be learnt". He said he accepted "communications with government need to be done through only the most formal of channels, so there can be no room for misinterpretation". (Sky)

SCOTLAND: Boris Johnson will not oppose a second independence referendum if the Scottish National party wins a majority in the election next month, Nicola Sturgeon has said, with some UK government ministers reportedly conceding it is an inevitability. In an interview with the Guardian, Scotland's first minister said: "If people in Scotland vote for a party saying, 'when the time is right, there should be an independence referendum', you cannot stand in the way of that – and I don't think that is what will happen." (Guardian)

SCOTLAND: Senior ministers think Boris Johnson will be forced to give Scotland a new referendum on independence if nationalists win a "supermajority" in the Holyrood elections next month — and it may be preferable to offer one quickly. (Sunday Times)

NORTHERN IRELAND: The Government must begin engaging with loyalist paramilitary groups in Northern Ireland to prevent a repeat of the violence that has erupted in recent days, Belfast security sources have warned. (Telegraph)

NORTHERN IRELAND: Downing Street is considering intergovernmental talks over rising tensions in Northern Ireland despite concerns that involving Dublin would further inflame unionist anger. Boris Johnson has not ruled out travelling to the province if the disorder continues but any visit might be delayed until the official mourning period for the Duke of Edinburgh has concluded. (The Times)

M&A: Business secretary Kwasi Kwarteng has watered down the government's proposed hard-line approach to foreign takeovers amid concerns that the new rules could deter overseas investors. The government has quietly tabled an amendment to the National Security and Investment Bill that will slash the number of overseas deals monitored in the crackdown. The bill was seen as a way of scrutinising investment from China more closely. Ministers have proposed revising the stake threshold at which the business department must be notified about a deal, from 15 per cent to 25 per cent — in line with the Committee on Foreign Investment in the United States. (Sunday Times)

EUROPE

ECB: Despite a difficult struggle against the Covid-19 pandemic, the European Union will hit its economic stride later this year, European Central Bank President Christine Lagarde told CNBC on Friday. Multiple parts of the euro zone have been hit by a renewed wave of coronavirus cases, leading officials to institute another round of shutdowns just as other developed economies are looking to rev up. While acknowledging that the lockdowns are putting a dent in growth, Lagarde said she's optimistic that things will pick up. "Light is at the end of the tunnel," Lagarde told CNBC's Sara Eisen on "Closing Bell." "We can see it. It's not yet within touching distance. We still have a few innings to go." She added that in the second half of the year "that will be [a] recovery that will be moving fast, actually." (CNBC)

ECB: The European Central Bank should accept no further delay in lifting inflation back to its target as the current outlook is unsatisfactory and persistent misses risk damaging the economy, ECB board member Fabio Panetta told Spanish newspaper El Pais. The ECB has already undershot its nearly 2% target for eight years and its projections indicate that it will continue to miss for years to come as bloc struggles to absorb the slack left behind a pandemic-induced recession. (RTRS)

FISCAL: Poland's finance minister has urged the country's political parties to vote in favour of the EU recovery fund, saying it would be "suicidal" to vote it down as Warsaw would lose out on essential cheap financing to boost the economy. Poland is one of around a dozen EU countries yet to ratify the so-called own resources decision, which allows for common EU borrowing to finance the €750bn pandemic recovery fund. The matter is threatening to morph into a political crisis for Warsaw, with one party in the conservative-nationalist coalition vowing to vote against the bill when it comes to parliament, raising questions about the government's survival A failure by Poland to ratify the fund could in theory hold up the disbursement of billions of euros to the rest of EU this year, hampering Europe's hopes of bouncing back from a third wave of coronavirus infections. Poland stands to receive €58bn in grants and loans from the fund. (FT)

CORONAVIRUS: The European Union's drug regulator has started a review to assess blood clots in people who received Johnson & Johnson's Covid-19 vaccine. Four serious cases of unusual clots accompanied by low blood platelets, one of which was fatal, have emerged after immunization with the J&J shot, the European Medicines Agency said Friday. The regulator is now scrutinizing potential safety issues for two Covid vaccines, after AstraZeneca Plc's shot was possibly linked to a rare blood-clotting disorder. (BBG)

CORONAVIRUS: CureVac NV could win European Union approval for its vaccine as early as May, sooner than expected, a German newspaper cited a company spokesman as saying. "We're already very far advanced in the third phase of clinical trials and are awaiting data for the final application package," CureVac spokesman Thorsten Schueller told Augsburger Allgemeine. "We hope the approval will come in May or June." (BBG)

GERMANY: German Chancellor Angela Merkel's coalition has drafted legislation that would shift the power to impose Covid-19 restrictions to the federal government from regional leaders to combat a surge in infections. Merkel's administration plans to impose a nightly curfew from 9 p.m. to 5 a.m. in areas where the seven-day incidence rate of infections surpasses 100 cases per 100,000 people for three days in a row. All non-essential stores would have to close and companies would be required to test employees twice weekly, according to the 13-page draft law seen by Bloomberg. Schools would be shut again in areas with an incidence rate of more than 200. (BBG)

GERMANY: Bavarian leader Markus Soeder, whose party is part of German Chancellor Angela Merkel's governing coalition, said he's ready to enter the race to succeed her, a person familiar with the discussions said, setting up a potential fight for the nomination. (BBG)

FRANCE: "It's too early to say yet when it'll be possible to resume travel to Europe," French Junior Minister for European Affairs Clement Beaune said on RTL radio on Sunday. "Hopefully it'll be possible this summer. We're doing everything we can to restore travel within France before the summer to start with, then in Europe, and then more globally, but it's impossible to give more precise a timetable." (BBG)

FRANCE: French far-right leader Marine Le Pen is increasing her chances of winning the first round of next year's presidential elections, according to an Ifop-Fiducial poll published by Le Journal du Dimanche. The National Rally party leader would come first in six out of 10 scenarios in the first round if the ballots were cast this Sunday, the poll showed. She would then be beaten in the second round for the top two candidates, with 46% in a runoff against President Emmanuel Macron's 54%, it said. (BBG)

ITALY: Italy's biggest industrial lobby group cut its forecast for economic growth after a surge in infections in the country earlier this year. Confindustria now sees Italy's economic growth at 4.1% this year, 0.7 percentage points below its October forecast, after the health crisis led to a weaker than expected performance in the final quarter of 2020 and first quarter of 2021. It said the new forecast hinges on progress in vaccinations in Italy and the rest of Europe. (BBG)

PORTUGAL: A Lisbon judge ruled Friday to put former Portuguese Prime Minister José Sócrates on trial for alleged money-laundering and forgery but said the statute of limitations had expired on more than a dozen corruption allegations. (AP)

GREECE: Greece's economy is seen growing by 4.8% in 2022 after an estimated 4.2% recovery this year, the country's central banker said in a TV interview on Sunday. The economy contracted by 8.2% last year, less than expected, despite much lower tourism revenues and tough restrictions the Greek government imposed to contain the spread of the coronavirus pandemic. In an interview with Greek Antenna television aired on Sunday, Bank of Greece Governor Yannis Stournaras said that the bank's growth projections were uncertain as the pandemic still posed serious risks. (RTRS)

IRELAND: General practitioners across Ireland have been advised not to administer the AstraZeneca vaccine to very high-risk patients until the National Immunisation Advisory Committee (Niac) reports back on its review of the jab early next week. In an email sent to GPs on Friday, and seen by The Irish Times, the Irish Medical Organisation (IMO) advised GPs to hold off on AstraZeneca vaccinations until Niac releases its latest recommendation. (Irish Times)

NORWAY: Norway's unions and employers averted a strike by clinching a wage agreement with the help of the state mediator. "After very demanding negotiations, and with good help from State Mediator Mats W. Ruland, the social partners managed to find a common solution in this year's interim settlement," the Confederation of Norwegian Enterprise said in a statement. A 2.7% wage increase was agreed, it said. VG was first to report the deal. Regular talks between the employer group and the Norwegian Confederation of Trade Unions, or LO, covering wages for about 180,000 workers broke down last month, leading to mandatory mediation. LO said on Friday that about 23,000 workers would strike if a final round of mediated talks didn't produce a deal by midnight on Saturday. In addition, the Confederation of Vocational Unions warned 5,500 of its bus drivers would join the walkout. (BBG)

EQUITIES: BlackRock and Jean-Pierre Mustier's blank-check firm are among investors expressing interest in Credit Suisse's asset management arm, three sources told Reuters, as the Swiss lender explores options for the unit after a run of costly scandals. U.S. investment firm State Street Corp is also eyeing a rival bid for all or part of the Swiss bank's fund management business, while European asset managers including Germany's DWS are waiting in the wings, the sources said, speaking on condition of anonymity. (RTRS)

U.S.

FED: The U.S. economy is at an "inflection point" with expectations that growth and hiring will pick up speed in the months ahead, but also risks if a hasty reopening leads to a continued increase in coronavirus cases, Federal Reserve Chair Jerome Powell said. In an interview on the CBS news magazine "60 Minutes" that aired on Sunday night, Powell echoed both his recent optimism about the economy and a now-familiar warning that the COVID-19 pandemic had not yet been fully defeated. "There really are risks out there. And the principal one just is that we will reopen too quickly, people will too quickly return to their old practices, and we'll see another spike in cases," Powell said in the interview, recorded on Wednesday. (RTRS)

FED: Citing his concerns about excessive risk-taking in financial markets and potential inflation, Dallas Federal Reserve President Robert Kaplan said on Friday he will push for reducing the U.S. central bank's support for the economy sooner than later. "You don't want to be preemptive, but I also don't want to be so reactive that we are late," Kaplan said in a virtual appearance at the Engage Undergraduate Investment Conference. Once the coronavirus pandemic is weathered and it is clear there has been progress toward full employment and 2% inflation, Kaplan said he "will advocate" for pulling back on "some of the Fed's extraordinary actions," starting with trimming its bond-buying program. (RTRS)

FED: MNI INTERVIEW: Fed's Gruber Sees 'Messy' Inflation Outlook

- It will take some time before the Federal Reserve has enough clarity on the inflation outlook to be confident a pickup in the rate of price rises is temporary, even if a shift toward more persistent price rises appears unlikely for now, Kansas City Fed Research Director Joseph Gruber told MNI.

ECONOMY: Recent reports show the U.S. economy is on a solid recovery path, but real-time indicators suggest the magnitude of the consumer-led rebound could be even more dramatic. Sectors that have lagged in the Covid-19 pandemic shutdowns –- including airlines, hotels and even movie theaters –- are showing a strong improvement as vaccinations accelerate. (BBG)

FISCAL: President Joe Biden will meet with bipartisan members of Congress on Monday as he tries to sell his more than $2 trillion infrastructure plan, White House press secretary Jen Psaki said Friday. (CNBC)

CORONAVIRUS: Almost a quarter of Covid-19 vaccine doses distributed across the U.S. haven't been administered, according to the Centers for Disease Control and Prevention. While the CDC data don't specify reasons, health officials have expressed concern about distribution equity and vaccine hesitancy, notably among rural and minority populations. Of some 233 million doses delivered nationwide, 179 million, or about 76%, were reported administered as of Friday. The CDC says some vaccine will always be kept back to maintain inventory, including for second shots. Alabama, Alaska, Georgia, Mississippi and Wyoming have the lowest rates of administering first doses they have in hand. (BBG)

CORONAVIRUS: The federal government needs to urgently surge vaccine doses into the state of Michigan in order to combat a spike in coronavirus cases there, Governor Gretchen Whitmer said. More contagious variants, widespread pandemic fatigue, and large numbers of people who have never been exposed to Covid-19 have created a critical infection situation in the state, she said in an interview on CBS's "Face the Nation." "We are seeing a surge in Michigan despite that we have some of the strongest policies in place," Whitmer said. (BBG)

CORONAVIRUS: The U.S. Centers for Disease Control is working with health departments in four states to evaluate symptoms experienced after Johnson & Johnson vaccinations but has "not found any reason for concern," a spokeswoman said in a statement. "Many people don't have any side effects after Covid-19 vaccines, but some people will have pain or swelling at the injection site or fever, chills, or a headache," spokeswoman Kristen Nordlund said. "These typically don't last long and are signs that your body is building protection." (BBG)

CORONAVIRUS: A healthcare provider in North Carolina will resume giving Johnson & Johnson vaccines on Saturday after as many as 10 people experienced fainting or dizziness on Thursday after receiving shots. None of the apparent side effects were serious, said Alan Wolf, a spokesman for UNC Health, though the provider suspended J&J vaccines Thursday and Friday. (BBG)

CORONAVIRUS: The Colorado National Guard seized thousands of doses of Covid-19 vaccines from a private clinic as health officials launched an investigation into storage, handling and documentation at the facility, the Colorado Springs Gazette reported in Sunday's edition. The clinic in Colorado Springs was administering Pfizer and Moderna jabs, the newspaper said. Last week, 11 people took ill at a community vaccination site in Commerce City, Colorado, administering the Johnson & Johnson shot but state officials found no irregularities. (BBG)

CORONAVIRUS: Pfizer on Friday requested to expand use of its Covid-19 vaccine to adolescents ages 12 to 15. The request asks the Food and Drug Administration to amend the emergency use authorization, which the FDA originally granted late last year for people ages 16 and up. (NBC)

OTHER

U.S./CHINA: The Senate Foreign Relations Committee will consider sweeping legislation to counter China's influence on April 21 instead of the planned date of April 14, committee aides said on Friday. Democratic and Republican leaders of the panel announced the "Strategic Competition Act of 2021" on Thursday. It includes a range of diplomatic and strategic initiatives to counteract Beijing, reflecting hard-line sentiment on dealings with China members of both political parties. (RTRS)

U.S./CHINA: Secretary of State Antony Blinken danced around the notion of a 2022 China Winter Olympic boycott Sunday on NBC's Meet the Press, calling such talk "premature." (Deadline)

U.S./CHINA: Secretary of State Anthony Blinken criticized the Chinese government for its lack of transparency in the early stages of the COVID-19 pandemic on Sunday's "Meet the Press," and called for a more thorough investigation into the of the origins of COVID-19. (Axios)

U.S./CHINA: The Biden administration is stepping up scrutiny of China's plans for a digital yuan, with some officials concerned the move could kick off a long-term bid to topple the dollar as the world's dominant reserve currency, according to people familiar with the matter. Now that China's digital-currency efforts are gathering momentum, officials at the Treasury, State Department, Pentagon and National Security Council are bolstering their efforts to understand the potential implications, the people said. American officials are less worried about an immediate challenge to the current structure of the global financial system, but are eager to understand how the digital yuan will be distributed, and whether it could also be used to work around U.S. sanctions, the people said on the condition of anonymity. (BBG)

U.S./CHINA: Chinese Ambassador to the United States Cui Tiankai on Saturday said that the United States should remove the barriers to cultural and people-to-people exchanges between the two countries to jointly build foundations for friendship and cooperation. Cui made the remarks in a video speech during a special event held in Shanghai to commemorate the 50th anniversary of Ping-Pong Diplomacy between China and the U.S. (CGTN)

U.S./CHINA/TAIWAN: U.S. Secretary of State Antony Blinken said on Sunday the United States is concerned about China's aggressive actions against Taiwan and warned it would be a "serious mistake" for anyone to try to change the status quo in the Western Pacific by force. (RTRS)

U.S./CHINA/TAIWAN: US officials can meet more freely with their Taiwanese counterparts under new Biden administration guidelines, in the latest move by the White House aimed at checking increased aggression by China in the region. The new rules, which were issued by the US state department on Friday, according to American officials, will ease decades-old restrictions that have hampered meetings between American and Taiwanese diplomats. The state department decision comes amid mounting US-China tensions over Taiwan, with Beijing stepping up its military posturing around the island in recent months. Senior US military and civilian officials have expressed concern that China is flirting with the idea of invading Taiwan. (FT)

GLOBAL TRADE: Almost 20 major companies worried about a global semiconductor chip shortage that has roiled the automotive industry will send senior executives to a White House summit Monday, a senior official said on Friday. (RTRS)

GLOBAL TRADE: The Association of Southeast Asian Nations is making its presence felt in the U.S.-bound marine transportation market. Total shipping volume originating in the ASEAN region increased in 2020, pushing its global share above the 20% mark for the first time. In contrast, the share of shipping originating in China, which is the highest globally, has decreased for two straight years. (Nikkei)

CORONAVIRUS: The coronavirus variant first discovered in South Africa may be more likely than other strains to "break through" and reinfect people who had two doses of the Pfizer/BioNTech vaccine, according to an Israeli study released Saturday. The study compared infected Israelis who had not been vaccinated with those who had either one or two doses of the vaccine. It found the prevalence of the South African strain was eight times higher in those who had two doses of the vaccine compared with those who had not been vaccinated -- suggesting a reduced effectiveness against the strain. (BBG)

CORONAVIRUS: AstraZeneca's Covid-19 vaccine has a "communication problem" rather than a "science" problem, Lauren Sauer, Johns Hopkins University's associate professor of Emergency Medicine, said in a Bloomberg Radio interview. The vaccine could help in areas where there's community spread, particularly among the elderly. "This is just another tool in our toolkit and part of it is about the potential risk of these rare events," Sauer said. "But we do know that it is overall safe and quite effective especially in our older population." (BBG)

CORONAVIRUS: Germany's Paul Ehrlich Institute said it has now counted 42 cases of a rare type of brain blood clot in people who were vaccinated with AstraZeneca's shot. All but seven of the cases were in women aged 20 to 63, the drug safety oversight body said. Doctors also found low blood platelet counts in 23 of the cases. The figures, released late Friday, are up-to-date through April 2. Eight people died. (BBG)

CORONAVIRUS: A Norwegian study into blood clots and abnormally low levels of platelets in five people who were given the AstraZeneca vaccine for Covid-19 has found that their condition was a vaccine-induced syndrome, according to an article in the New England Journal of Medicine. "By providing a link between thrombosis and the immune system, these results strengthen the view that vaccination may have triggered the syndrome," the article cited the study as saying. (BBG)

JAPAN: The governor of Osaka prefecture in western Japan warned that he may need to ask the central government to declare a state of emergency if current measures to quell the coronavirus outbreak are deemed insufficient. (BBG)

AUSTRALIA: Australia won't set any targets for completing first doses of Covid-19 vaccines in the wake of recommendations regarding the AstraZeneca Plc treatment and new doses acquired from Pfizer Inc., Prime Minster Scott Morrison wrote in a post on Facebook on Sunday. "While we would like to see these doses completed before the end of the year, it is not possible to set such targets given the many uncertainties," he wrote. (BBG)

NEW ZEALAND: The latest BNZ/SEEK employment report notes that "the 55.3% annual growth in March's job advertising reflected a weakened base period, when COVID-induced shutdowns were starting to bite. However, this is not to belittle the latest result. As perspective, March 2021 ads proved 5.8% higher than they were back in March 2019 (in seasonally adjusted form). This sense of solidity was shored up by the fact advertising lifted 10.6% in the month of March. This was the strongest monthly gain since July, and came after a period where monthly growth trended down to almost naught by February." (MNI)

SOUTH KOREA: South Korean authorities said on Sunday they will move ahead with a coronavirus vaccination drive this week, after deciding to continue using AstraZeneca PLC's vaccine for all eligible people 30 years old or over. South Korea on Wednesday suspended providing the AstraZeneca shot to people under 60 as Europe reviewed cases of blood clotting in adults. (RTRS)

CANADA: Canada's Prime Minister Justin Trudeau on Saturday said any adult in the country who wants to be vaccinated can be fully inoculated by the end of summer. "We're on track to meet our commitment that every Canadian who wants to will be fully vaccinated by the end of the summer," he said at a speech. The government's original goal was to vaccinate every citizen by the end of September. (BBG)

CANADA: Tougher measures are needed to combat a rising number of COVID-19 infections fuelled by more contagious variants, Canada's top doctor said Friday, but she stopped short of saying what exactly those measures should be. "The race between vaccines and variants is at a critical point," said Dr. Theresa Tam told a briefing in Ottawa with government officials. "It is clear that we need stronger control to combat variants of concern that are driving rapid epidemic growth in many areas of the country." (Toronto Star)

TURKEY: European Council President Charles Michel said he risked creating a more serious diplomatic incident if he had reacted when European Commission President Ursula von der Leyen was left without a chair at a meeting with Turkish President Recep Tayyip Erdogan in Ankara. "If I had reacted (differently) in front of all the cameras, it could have contributed to the creation of a much more serious incident, an incident not only of the protocol but of politics too," Greek newspaper Ta Nea cited Michel as saying to journalists in Brussels. (BBG)

BRAZIL: Brazil's Sao Paulo state and the city of Rio de Janeiro are easing restrictions on hospitality businesses and other activities, authorities said on Friday, even as Latin America's largest country continues to break its own grim records for daily COVID-19 deaths. Sao Paulo will allow customers to pick up takeaway food from bars and restaurants starting on Monday, while professional sports games will be permitted without crowds, along with a series of other specific activities, Vice-Governor Rodrigo Garcia told journalists. (RTRS)

RUSSIA: Secretary of State Antony Blinken said Sunday he was concerned about the number of Russian troops amassing on the Ukrainian border and warned Moscow that "there will be consequences" for aggresive behavior. "I have to tell you I have real concerns about Russia's actions on the borders of Ukraine. There are more Russian forces massed on those borders than at any time since 2014 when Russia first invaded," Blinken said during an interview on "Meet the Press" Sunday. (CNBC)

RUSSIA: President Biden is considering appointing Matthew Rojansky, head of the Wilson Center's Kennan Institute, as Russia director on the National Security Council, according to a source familiar with the situation. (Axios)

IRAN: U.S. and Iranian officials clashed on Friday over what sanctions the United States should lift to resume compliance with the 2015 nuclear deal, with Washington predicting an impasse if Tehran sticks to a demand that all sanctions since 2017 be removed. The two nations laid out tough stances as indirect talks in Vienna on how to bring both back into full compliance with the agreement wound up for the week, with some delegates citing progress. (RTRS)

IRAN: Iran on Sunday described a blackout at its underground Natanz atomic facility an act of "nuclear terrorism," raising regional tensions as world powers and Tehran continue to negotiate over its tattered nuclear deal. While there was no immediate claim of responsibility, suspicion fell immediately on Israel, where its media nearly uniformly reported a devastating cyberattack orchestrated by the country caused the blackout. (AP)

MIDDLE EAST: The Arab Coalition intercepted and destroyed a ballistic missile and six explosive-laden drones launched by Yemen's Houthis towards Saudi Arabia's Jazan, Saudi's state-run al-Ekhbariya television said on Sunday. This was the latest in a series of escalated aerial attacks on the Kingdom by the Iran-backed Houthi militia in Yemen. (Al Arabiya)

OIL: Saudi Arabia's energy giant said it struck a $12.4 billion deal to sell a 49% stake in a newly formed oil pipeline business to an international consortium led by U.S. investment firm EIG Global Energy Partners. Abu Dhabi sovereign-wealth fund Mubadala Investment Co. is also a member of the consortium, which will likely eventually include Chinese and Saudi investors as well, people familiar with the matter said. (WSJ)

OIL: Shares of U.S. energy companies tied to the Dakota Access Pipeline rose on Friday after the U.S. Army Corps of Engineers (ACE) said it would allow the crude pipeline to run while it conducts an environmental review. That move leaves a decision on whether to shut the pipeline with U.S. District Judge James Boasberg in the District of Columbia. On Friday he gave Dakota Access operators 10 days to present a case to keep the line flowing. (RTRS)

CHINA

CORONAVIRUS: The Director of the Chinese Center of Disease Control (China CDC) on Sunday refuted claims by some media outlets and overseas social media platform users that the director "admitted" Chinese COVID-19 vaccines have a low protection rate, saying that "it was a complete misunderstanding." In an exclusive interview with the Global Times, Gao Fu, head of the China CDC, said as scientists around the world are discussing vaccine efficacy, he offered a scientific vision: that to improve the efficacy, adjustment of vaccination procedures and sequential inoculation of different types of vaccines might be options. (Global Times)

CORONAVIRUS: China has approved the third vaccine from Sinopharm Group Co. to start clinical trials, the company said. The green light to begin testing comes after two inactivated vaccines from Sinopharm were approved and widely used both at home and in developing countries. (BBG)

POLICY: China should beware of potential risks from rising bad debts and defaults in the second half of 2021, the Securities Times said citing Huang Yiping, a former PBOC monetary policy advisor. While bank lending last year helped protect the economy and provided a lifeline to SMEs, it is questionable whether all the loans will be repaid, Huang said. He also said the advantages China has enjoyed over other economies since last year may shrink and even have a "lethal" impact, citing U.S. expansion policies affecting investors' sentiment. However, Huang was "very optimistic" that China's performance will be good this year, the Times reported. (MNI)

PBOC: The PBOC's policy rates may not change if the CPI doesn't rise significantly, given that policy rates are partly pegged to inflation, China Securities Daily reported citing Guan Tao, the chief economist of Bank of China International and a former forex regulatory official. Policy rates are also tied to employment, which is still weaker now than in 2018-2019, Guan said. Liquidity will be tightly balanced in Q2, and Q1 GDP to be released on Friday will likely show double-digit yearly growth but weak monthly growth, the newspaper said citing market participants. (MNI)

PBOC: The rapid rise of local government borrowing is the biggest systemic risk in China today, CASS researcher Zhang Bin says Beijing should take its lead from the US Federal Reserve and adopt a more aggressive monetary policy. (SCMP)

FINTECH: The world's biggest online retailer - China's Alibaba - has been hit with a record fine equivalent to $2.75bn (just over £2bn). Regulators in China said the internet giant had abused its dominant market position for several years. In a statement the company said it accepted the ruling and would "ensure its compliance". Analysts say the fine shows China intends to move against internet platforms that it thinks are too big. (BBC)

FINTECH: China's technology giants are expecting increased scrutiny and penalties after Alibaba's record $2.8bn fine on Saturday for antitrust violations. Employees at Tencent Music and Meituan are concerned they could be targeted next by Beijing's emboldened competition regulators, who have stepped up scrutiny on dealmaking and anti-competitive practices in its once lightly regulated technology sector. Unlike the antitrust investigation into Alibaba's ecommerce practices, an antitrust investigation into social media giant Tencent would be more complicated, said a Shenzhen official who oversees tech companies. (FT)

OVERNIGHT DATA

JAPAN MAR PPI +1.0% Y/Y; MEDIAN +0.5%; FEB -0.6%

JAPAN MAR PPI +0.8% M/M; MEDIAN +0.4%; FEB +0.6%

JAPAN MAR BANK LENDING INC-TRUSTS +6.3% Y/Y; FEB +6.2%

JAPAN MAR BANK LENDING EX-TRUSTS +5.9% Y/Y; FEB +5.8%

CHINA MARKETS

PBOC NET INJECTS CNY10BN VIA OMOS MONDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Monday. This results in a net injection of CNY10 billion given no reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2000% at 09:29 am local time from the close of 1.9730% on Friday.

- The CFETS-NEX money-market sentiment index closed at 43 on Friday vs 35 on Thursday. A higher index indicates increased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.5578 MON VS 6.5409

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.5578 on Monday, compared with the 6.5409 set on Friday.

MARKETS

SNAPSHOT: A Cautious Start To The Week On Geopolitical Risk & Alibaba Fine

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 214.88 points at 29550.95

- ASX 200 down 26.776 points at 6968.7

- Shanghai Comp. down 27.976 points at 3422.701

- JGB 10-Yr future unch. at 151.24, yield down 0.5bp at 0.105%

- Aussie 10-Yr future down 1.5 ticks at 98.265, yield up 1bp at 1.767%

- U.S. 10-Yr future +0-01+ at 131-25, yield down 0.36bp at 1.655%

- WTI crude unxh. at $59.33, Gold down $5.67 at $1738.32

- USD/JPY down 13 pips at Y109.54

- FED'S POWELL: U.S. ECONOMY AT AN 'INFLECTION POINT' (CBS)

- ECB'S LAGARDE SEES STRONG REBOUND FOR EU ECONOMY IN H221 (CNBC)

- ECB'S PANETTA: MUST ACCEPT NO FURTHER DELAY IN LIFTING INFLATION (RTRS)

- SÖDER DECLARES AMBITION TO SUCCEED MERKEL AS GERMAN CHANCELLOR (FT)

- IRAN CALLS NATANZ ATOMIC SITE BLACKOUT 'NUCLEAR TERRORISM' (AP)

- CHINA HITS ALIBABA WITH RECORD FINE

BOND SUMMARY: Core FI Supported By Downtick In Equities

Global core fixed income markets caught a modest bid as we moved through Asia-Pac hours, with the downtick in the majority of the major equity indices (linked to geopolitical tensions and a huge antitrust fine for Alibaba in China, which dented broader sentiment even as the single name rallied) unwound some early supply related weakness. T-Notes last +0-02 at 131-25+, the cash curve seeing some light twist flattening, with almost all of the early, supply related cheapening (which was led by the belly) unwinding. Comments from Fed Chair Powell reflected the usual tinge of cautious optimism, albeit caveated with well-documented COVID-related risks and the need to continue to support the economy until the recovery "is complete." Headline flow was sparse. Market flow was headlined by a FV/US block steepener (+10.0K vs. -2.8K) and ~4.0K screen lift of the TYK1 130.25 puts. 3- & 10-Year Tsy supply headline the local docket on Monday.

- JGB futures stuck to the confines of the overnight range for almost all of the Tokyo session, last -1. Cash trade has seen the entire curve richen (to varying degrees), with the 3- to 5-Year sector of the curve outperforming, as yields in that zone of the curve fell by 1.5bp. There is nothing in the way of conventional JGB supply due this week, with liquidity enhancement auctions covering the 5- to 15.5-Year and 15.5- to 39-Year buckets providing the only supply points of note.

- YM unch., XM -1.0 at typing, XM moving off lows alongside U.S. T-Notes. There was little reaction to the official launch of the syndication of ACGB Nov '32, with the initial price guidance generally around the firm to average end of broader market expectations.

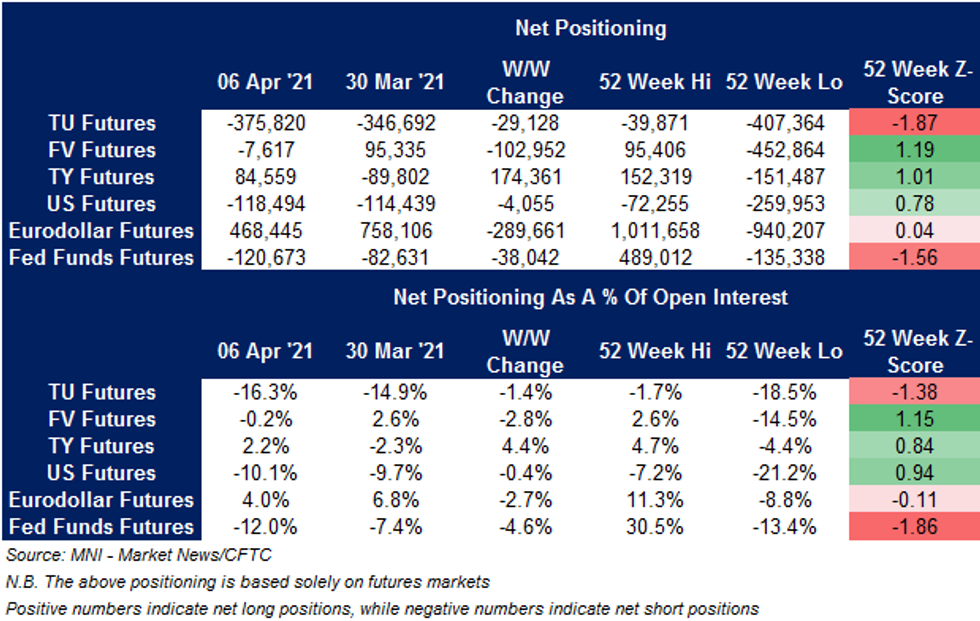

US TSY FUTURES: A Mixed Bag In CFTC Futures Positioning

The latest CFTC CoT report saw TU & US net shorts build, while FV net positioning flipped net short. TY positioning was the exception to the broader rule, flipping back to net long territory. Net positioning across the major bond futures contracts remains off of recent extremes.

- In the short end Eurodollar net longs were trimmed while net short positioning in Fed Funds extended back towards the recent extreme.

EQUITIES: Lower To Start The Week

A broadly negative day for stocks in the Asia-Pac time zone, markets in mainland China and Hong Kong were the subject of heavy selling which put pressure on other indices in the region. China's antitrust regulator imposed a record fine on Alibaba following a long investigation, Alibaba managed to rally despite the fine and even as the broader market declined. Markets in South Korea proved resilient, buoyed by shipmakers after another large order and the National Pension Service increases upper limit of strategic investment weighting of local stocks to 19.8% from the current 18.8%. Japan came under pressure as markets assess a rise in coronavirus infections and reports the Osaka may declare a state of emergency. US futures are lower after rallying into the end of last week, Fed chair Powell was on the wires earlier, he said that while the outlook had brightened substantially there were still risks. He also reiterated that the Fed would keep supporting the economy until the recovery was complete.

OIL: Crude Treads Water

Crude futures are broadly flat, WTI last up $0.02 from settlement levels at $59.34/bbl, while Brent is up $0.05 at $63.00.bbl.Oil market specific commentary was sparse, but a few comments from Fed's Powell crossed the wires, he noted that while the outlook had brightened substantially there were still risks. He also reiterated that the Fed would keep supporting the economy until the recovery was complete.

- Elsewhere, there were reports on Saturday that initial talks in Vienna between the US and Iran wee rea good first step, but officials said that Iran still needs to take further steps to come back into compliance with the terms of the nuclear deal, meaning Iranian supply will not be returning to market in the near term.

GOLD: Off Recent Highs

Bullion trades little changed early this week, with spot last printing around the $1,740/oz mark. This comes after an uptick in U.S. real yields and the DXY provided some pressure on Friday, pulling gold away from recent highs and leaving the previously flagged technical backdrop intact.

FOREX: Risk Aversion Materialises

Lingering geopolitical tensions inspired a degree of risk aversion overnight, amid the absence of headlines that would affect broader sentiment. JPY led gains in the G10 basket, while AUD brought up the rear, with a BBG trader source flagging AUD/JPY sales by Japanese exporters and AUD/USD selling by funds.

- The greenback fared well, outperforming most of its G10 peers, but the DXY failed to take out the prior trading day's peak. Fed Chair Powell said that the economy is at an "inflection point" and is "about to start growing much more quickly," but warned against the principal risk of a renewed spread of Covid-19.

- The PBoC set its central USD/CNY mid-point at CNY6.5578, virtually matching sell-side estimates. USD/CNH hovered above neutral levels ahead of this week's Chinese data deluge.

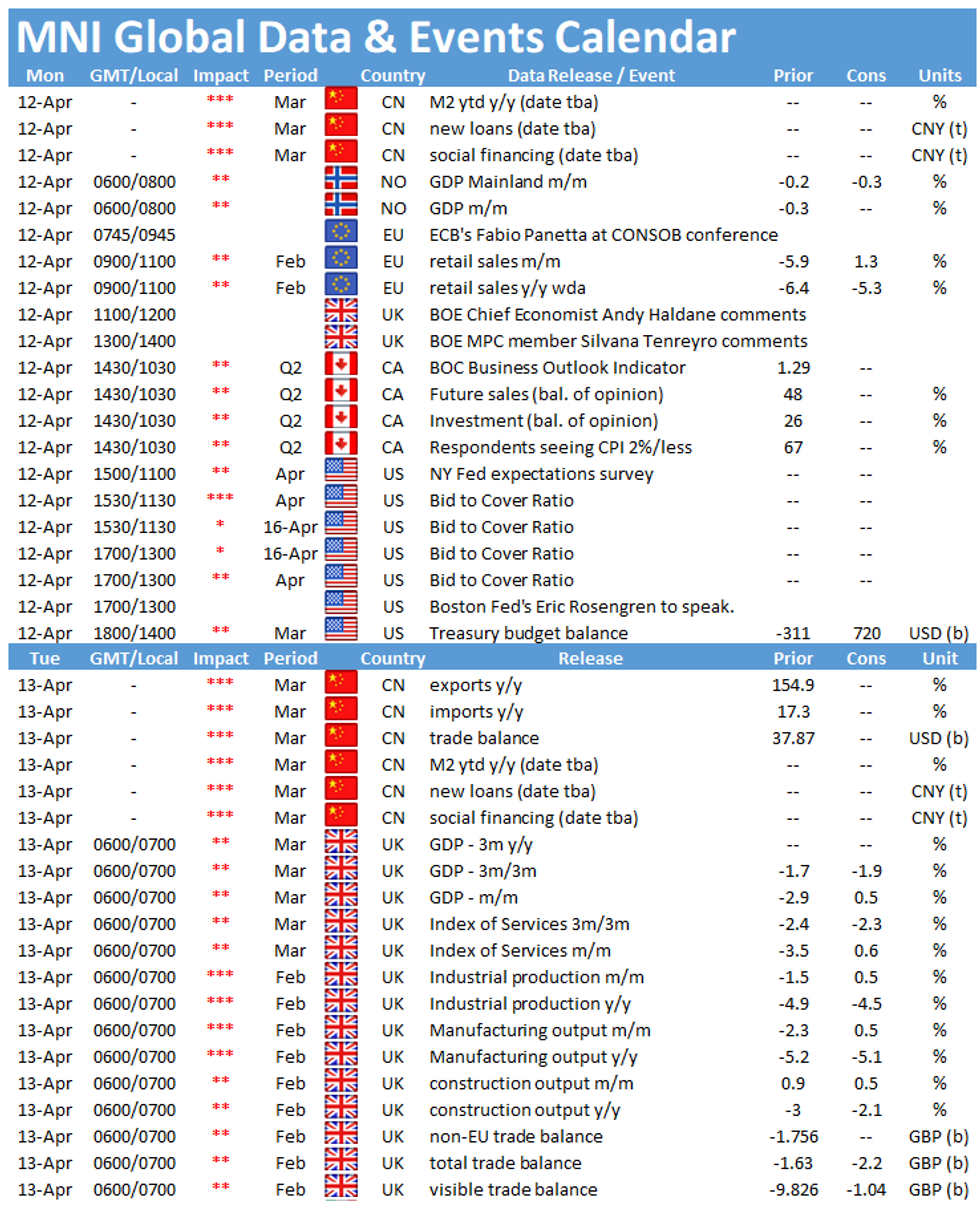

- Today's economic docket is rather uninspiring, with EZ retail sales and comments from ECB's Panetta & de Cos, Fed's Rosengren, BoE's Tenreyro & Riksbank's Ohlsson providing the main highlights.

FOREX OPTIONS: Expiries for Apr12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1915-30(E1.45bln, E1.4bln EUR puts)

- EUR/GBP: Gbp0.8600-05(E530mln)

- USD/CAD: C$1.2600-15($600mln-USD puts)

- USD/CNY: Cny6.4925($500mln), Cny6.5500-15($500mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.