-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: USD Offered In Asia

EXECUTIVE SUMMARY

- XI CHALLENGES U.S. GLOBAL LEADERSHIP, WARNS AGAINST DECOUPLING (BBG)

- LASCHET KEEPS CHANCELLOR BID ALIVE, SURVIVING CDU PARTY VOTE (BBG)

- BOJ TO MULL SLASHING THIS YEAR'S INFLATION FORECAST (NIKKEI)

- RBA WAITS ON YIELD CONTROL DECISION (MNI)

- NORMANDY-FORMAT TALKS ON UKRAINE END WITHOUT RESULTS (RTRS SOURCE)

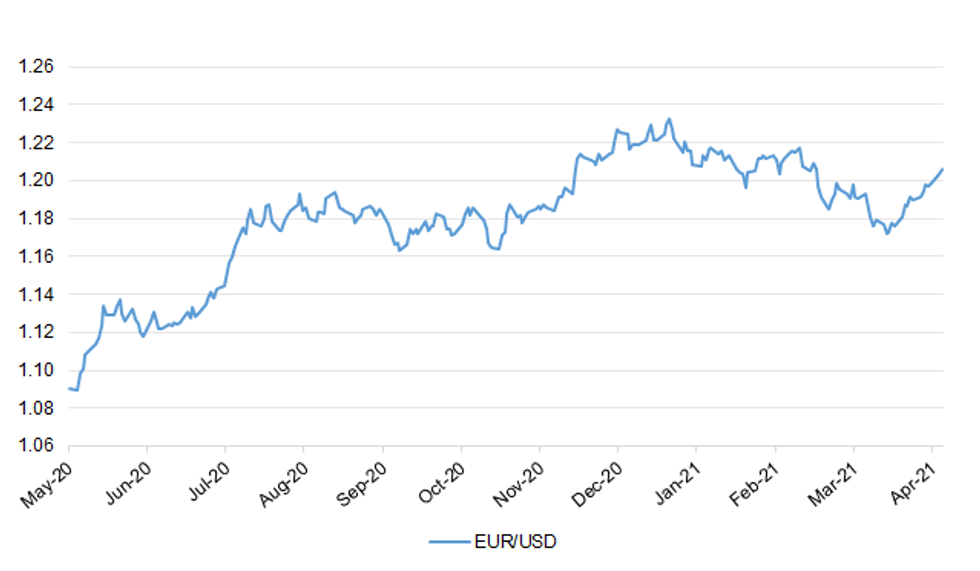

Fig. 1: EUR/USD

Source: MNI - Markets News/Bloomberg

Source: MNI - Markets News/Bloomberg

UK

ECONOMY: The number of people visiting shops increased by almost 200% last week in England as non-essential retailers were allowed to open their doors to consumers for the first time since early January as Covid restrictions were relaxed. Industry figures from the British Retail Consortium and separate data from Springboard, a research provider, revealed a sharp rise in footfall on high streets and at retail parks and shopping centres across the country. Taken from sensors at the doors of thousands of retail stores, footfall jumped by 195.5% in England on the six days to Saturday 17 April compared with the week before. The biggest gains were recorded in cities such as Portsmouth, where footfall was up more than 100%, and Manchester, Leeds, Liverpool and Birmingham – all up more than 300%. (Guardian)

EUROPE

GERMANY: Armin Laschet won a vote of the leadership of Angela Merkel's Christian Democratic Union in the early hours of Tuesday as he fought to revive his faltering bid to succeed her as chancellor. Laschet, the head of the CDU, won 31 out of the 46 votes from the party's top committee in ballot to determine who should lead the center-right bloc into September's national election, according to a person familiar with the outcome. His rival, Bavarian State Premier Markus Soeder won nine votes and there were six abstentions. Laschet will still need the backing of the CDU's smaller Bavarian sister party, led by Soeder, in order to confirm his nomination. (BBG)

FRANCE: The French government strengthened its grip over Air France-KLM, using a new share issue to increase its stake to more than three times that of the Netherlands. The struggling airline raised 1.04 billion euros ($1.25 billion) from investors, taking France's holding to 28.6%, according to a statement Monday. China Eastern Airlines emerged from the sale as the second-biggest shareholder with 9.6%, while the Dutch state was diluted to 9.3%. France's newfound dominance upsets a politically sensitive equilibrium with the Netherlands that lasted for about two years. The countries each held about 14% before the capital increase, which was part of a 4-billion-euro French rescue plan unveiled earlier this month to help the Air France side of the company through the Covid-19 pandemic. (BBG)

EQUITIES: Credit Suisse Group AG's prime-brokerage co-heads are leaving the bank in the wake of its $4.7 billion loss from the implosion of Archegos Capital Management, according to a company memo. (BBG)

U.S.

FISCAL: Top Republicans are saying they are open to some kind of bipartisan infrastructure bill and Joe Biden himself says he is too. During his meeting with a bipartisan group with lawmakers today the president said: "I am prepared to compromise... It's a big package but there are a lot of needs," according to a White House pool report. (Guardian)

FISCAL: Biden is pushing a more than $2 trillion jobs-and-infrastructure proposal, branded the American Jobs Plan, that calls for spending on traditional infrastructure projects like roads and bridges alongside other priorities such as addressing climate change and expanding access to home and community-based care. The money allocated would be spent over eight years and be paid for by increasing the corporate tax rate from 21% to 28%, and by limiting the ability of American companies to avoid taxes by shifting profits overseas. Representative Crist, a former governor, said Biden felt "pretty strongly" about raising the corporate tax rate to 28 percent as part of the package. He said Biden was "a bit skeptical" about scaling back the hike, as some Democrats like Senator Joe Manchin of West Virginia, a key vote in the Senate given the razor-thin majority his party has there , have suggested. (RTRS)

CORONAVIRUS: Emergent BioSolutions Inc. was told by U.S. regulators to stop making Johnson & Johnson's vaccine at a plant where 15 million doses worth of a key ingredient had to be discarded, adding to roadblocks preventing wider use the single-dose shot. The U.S. Food and Drug Administration began inspecting a plant in Baltimore on April 12 where Emergent was making the drug substance used in the J&J vaccine. Four days later, the FDA asked the company to stop making new materials there and quarantine existing materials until the inspection and any remediation are concluded, according to a company filing. Use of J&J's vaccine has been paused in the U.S. since last week as health officials probe a possible link to life- threatening blood clots. The halt at Emergent could add to questions about how many Americans will ultimately receive J&J's shot even if it's found to be safe. (BBG)

CORONAVIRUS: The State Department on Monday announced plans to issue new, more stringent travel advisories for many countries and urge U.S. citizens not to travel abroad, a decision it says is meant to better reflect public health guidelines. (Forbes)

CORONAVIRUS: White House chief medical advisor Dr. Anthony Fauci said Monday it is "disturbing" that some Americans won't take a Covid-19 vaccine due to political reasons. Fauci said those refusing to get vaccinated against the virus are the same ones who say the U.S. government is "encroaching on our liberties" by asking Americans to wear masks and implement other pandemic safety measures. He said the "easiest" way to get out of the pandemic is to get a vaccine. (CNBC)

CORONAVIRUS: New York Governor Andrew Cuomo boosted the capacity at indoor venues as statewide infections continue to decline. Starting April 26, capacity at museums and zoos will be raised to 50%, and to 33% at movie theaters. On May 19, capacity at large indoor arenas like Madison Square Garden will be increased to 25%. (BBG)

CORONAVIRUS: Arizona Governor Doug Ducey issued an executive order on Monday banning vaccine passports, preventing local governments from requiring residents to provide their COVID-19 vaccine status in order to receive service or enter a specific area. (Fox)

OTHER

GEOPOLITICS: Chinese President Xi Jinping called for greater global economic integration and warned against decoupling while calling on the U.S. and its allies to avoid "bossing others around." "International affairs should be conducted by way of negotiations and discussions, and the future destiny of the world should be decided by all countries," Xi said on Tuesday at the Boao Forum on Asia, without naming the U.S. specifically. "One or a few countries shouldn't impose their rules on others, and the world shouldn't be led on by the unilateralism of a few countries." In a veiled critique of U.S. efforts to reduce dependence on Chinese supply chains and withhold exports of goods like advanced computer chips, Xi said "any effort to build barriers and decouple works against economic and market principles, and would only harm others without benefiting oneself." (BBG)

GEOPOLITICS: The Chinese people support the government's confident approach to handling "provocations and stigmatizations" by the West over an approach driven by compromise, the Global Times reported citing a survey conducted by the newspaper. About 90% of over 1,200 respondents believe China should not "look up to the West", the government-run newspaper said. The West should also accept Chinese public opinion rather than labeling the population's brimming confidence as nationalism, the Times said. (MNI)

JAPAN/CHINA: China's military is thought to have instructed a hacker group to conduct cyberattacks on nearly 200 Japanese research institutions and firms, public broadcaster NHK reported, citing unidentified people in a police investigation. The investigators found a member of China's Communist Party made contracts under a false name for rental servers in Japan that were used in the attacks on the Japanese space agency JAXA in 2016, the broadcaster said Tuesday. Investigators believe the cyberattacks were carried out by a group known as Tick under the instruction of the People's Liberation Army. Two men involved with contracts for the servers have left Japan, NHK said. The reported allegations, the latest in a series of similar incidents, come amid increasingly difficult relations between Japan and its biggest trading partner. The topic of ties with China dominated the agenda at Prime Minister Yoshihide Suga's summit with U.S. President Joe Biden in Washington last week. (BBG)

BOJ: Bank of Japan Governor Haruhiko Kuroda said on Tuesday it was too early to debate an exit from the central bank's purchases of exchange-traded funds (ETF). "When we are to unload our ETF holdings, we will set guidelines on how to do this at a policy-setting meeting," Kuroda told parliament. "But we're not at a stage now to debate an exit." (RTRS)

BOJ: The Bank of Japan will consider slashing this fiscal year's inflation forecast in quarterly forecasts due out at its policy meeting on April 26-27, the Nikkei newspaper reported on Tuesday. The downgrade will reflect the impact of cuts in cellphone charge fees, which analysts say could push down core consumer inflation by around 0.2 percentage point. The central bank is also seen projecting inflation to hover around 1% in fiscal 2023, the paper said without citing sources. The BOJ currently expects core consumer prices to rise 0.5% in the year that began in April. (RTRS)

JAPAN: Japan's health ministry is asking AstraZeneca to provide additional data on blood clots as it assesses its vaccine for approval, the Asahi newspaper reported, without saying who provided the information. Approval was expected as soon as May but could be delayed as a result, Asahi said. (BBG)

RBA: MNI BRIEF: RBA Waits On Yield Control Decision

- The Reserve Bank of Australia is paying "close attention to the flow of economic data" and will consider whether to extend its yield target to Australian government bonds maturing in November 2024 later in the year based on the outlook for inflation and employment, according to the minutes of its last board meeting released Tuesday. The RBA left interest rates on hold at the historic low of 0.10% at the Apr 6 meeting and agreed to maintain other stimulus policies, such as the AUD200 million quantitative easing program and the yield target on bonds maturing in April 2024. The minutes also show the RBA does not expect economic conditions to require an interest rate rise "until 2024 at the earliest" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

AUSTRALIA: Voters have swung against the federal Coalition in a warning to Prime Minister Scott Morrison over his hold on power, cutting the government's primary vote from 41 to 38 per cent since the last election. The rebuff has delivered gains to the Greens and Pauline Hanson's One Nation as some Australians shift their votes to minor parties amid concern at the Coalition's performance. But Labor has missed out on a boost to its core support, with its primary vote unchanged at 33 per cent despite the government's failure to meet targets for the rollout of COVID-19 vaccines. The exclusive survey, the first in a new initiative from The Sydney Morning Herald and The Age with research company Resolve Strategic, shows Mr Morrison has an advantage on personal leadership despite the setbacks for his party. Mr Morrison is the preferred prime minister for 47 per cent of voters, compared to 25 per cent for Labor leader Anthony Albanese, with 28 per cent undecided. (Sydney Morning Herald)

NEW ZEALAND: A border worker at Auckland International Airport has returned a positive test result for Covid-19, the Ministry of Health said in an emailed statement. The worker was "fully vaccinated, quite early on in the campaign," New Zealand Prime Minister Jacinda Ardern told reporters on Tuesday. The person had been tested twice, on April 12 and 19, as part of normal procedure, she said. (BBG)

CANADA: MNI POLICY: Canada Lifts 2021-22 Deficit to CAD155B on Spending

- Canadian Finance Minister Chrystia Freeland on Monday unveiled an increase in this year's budget deficit to CAD155 billion from an earlier estimate of CAD121 billion, spending beyond the windfall from Covid-19 vaccines on relief checks and a new national daycare program. While the stronger economy improved government finances by CAD16 billion since an informal November fiscal update, the Freeland budget allocated CAD49 billion of new measures for the fiscal year that began April 1 - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

CANADA: B.C. Premier John Horgan has announced that travel restrictions will be put into place across the province on Friday to combat the third wave of COVID-19, as the bans on social gatherings and in-restaurant dining were extended through the May long weekend. "(Provincial health officer) Dr. (Bonnie) Henry has been saying for months and months and months: 'Stay in your territory, stay in your community,'" Horgan said. "This is not the time to load up the Winnebago and travel around British Columbia." The province is asking everyone to stay in their health authority and only travel outside for essential reasons. (Global News)

BRAZIL: Brazil's Congress on Monday approved a law that allowed it to pass this year's budget after making certain modifications, sending it to President Jair Bolsonaro for him to sign. The 1.5 trillion reais ($264 billion) budget was approved by Congress last month but not signed off on by Bolsonaro after it emerged it could break one of the government's key fiscal rules. The new law tweaked those issues ahead of an April 22 deadline. (RTRS)

RUSSIA: A round of talks involving political advisors and diplomats in the so-called Normandy format on Ukraine have ended on Monday without yielding results, a source familiar with the talks said. (RTRS)

RUSSIA: U.S. National Security Adviser Jake Sullivan on Monday discussed with his Russian counterpart bilateral issues, those of regional and global concern and the prospects of a summit between the U.S. and Russian presidents, the White House said. (RTRS)

RUSSIA: The United States ambassador to Russia is refusing to leave the country after the Kremlin "advised" him to return home following new Biden administration sanctions, two sources briefed on the situation tell Axios. (Axios)

RUSSIA: The U.S. has "deep concern over Russia's plans to block foreign naval ships and state vessels in parts of the Black Sea, including near occupied Crimea and the Kerch Strait," State Dept. Spokesperson Ned Price says in a statement. Move "represents yet another unprovoked escalation in Moscow's ongoing campaign to undermine and destabilize Ukraine," Price says, noting it comes amid "credible reports of Russian troop buildup in Crimea and around Ukraine's borders." Calls on Russia "to cease its harassment of vessels in the region and reverse its build-up of forces in the region." (BBG)

RUSSIA: The Pentagon said on Monday that Russia's military buildup near Ukraine was larger than that in 2014. (RTRS)

RUSSIA: The European Union's top diplomat said that Russia's military presence on the border with Ukraine has grown to 150,000 personnel, the largest ever buildup on the frontier between the two countries, raising the possibility of further conflict. "The military deployment of Russian troops with all kind of materials, deploying campaign hospitals and all kind of warfare, has been continuing," Josep Borrell, high representative of the EU, told reporters following a virtual meeting of the bloc's foreign ministers on Monday. "When you deploy a lot of troops, a spark can jump here or there." (BBG)

RUSSIA: U.S. Federal Aviation Administration issues advisory recommending "extreme caution" when flying over some areas of Russia and Ukraine. Advisory cites "regional tensions between Russia and Ukraine, which could potentially result in no-notice cross-border skirmishes". (BBG)

SOUTH AFRICA: Deliveries of Pfizer Inc.'s Covid-19 vaccine to South Africa were delayed by demands from the U.S. drugmaker that it determine the guarantees needed to indemnify the company from any negative effects from the shots. The condition was resisted by the government and Pfizer eventually backed down, agreeing to supply 30 million doses of the vaccine co-developed with Germany's BioNTech SE. (BBG)

IRAN: Iran and world powers have made some progress on how to revive the 2015 nuclear accord later abandoned by the United States, and an interim deal could be a way to gain time for a lasting settlement, Iranian officials said on Monday. Tehran and the powers have been meeting in Vienna since early April to work on steps that must be taken, touching on US sanctions and Iran's breaches of the deal, to bring back Tehran and Washington into full compliance with the accord. "We are on the right track and some progress has been made, but this does not mean that the talks in Vienna have reached the final stage," Foreign Ministry spokesman Saeed Khatibzadeh told a weekly news conference in Tehran. (RTRS)

MIDDLE EAST: Up to 200 fighters were killed in an airstrike on a rebel camp in Syria by Russian fighter jets, according to military sources in Moscow on Monday. In addition, large quantities of ammunition and other combat material were destroyed at the camp near Palmyra, reported the TASS news agency, citing Russian military leaders in Syria. About two dozen trucks with heavy machine guns and around 500 kilograms of weapons material were destroyed, it said. According to the information, the camp was used to train combat groups to stage terrorist attacks in various parts of Syria. The Russian information cannot be independently verified Militants from the Islamic State terrorist group are active in the region. (DPA)

IRON ORE: Rio Tinto Group, the world's top iron ore producer, said shipments fell 12% on the previous quarter after cyclone activity in the Pilbara mining region of Western Australia impacted output. Total shipments from Rio's iron ore operations in the Pilbara were 77.8 million tons in the three months ended March 31, the company said in a statement on Tuesday, while production dipped 11% with activity disrupted by wetter than usual weather. Quarterly shipments were just above a consensus forecast of 77.6 million tons. Rio's 2021 shipments are still forecast in the range of 325-340 million tons, up from 330.6 million tons in 2020, although the group said that Tropical Cyclone Seroja had also impacted mine and port operations in April. Demand in China, which accounts for more than half of revenue, continues to be underpinned by the country's strong economic momentum, while strong steel demand and margins -- at their highest since 2018 -- have lifted demand for higher quality products. (BBG)

IRON ORE: The world's second-largest producer of iron ore just gave another boost to rallying prices of the steelmaking ingredient at a time of strong Chinese demand. Vale SA churned out less iron ore than expected last quarter after lower productivity at one mine and a ship loader fire, with its recovery from an early-2019 tailings dam disaster proving a little slower than thought. The ramp-up means Vale has an outsized impact on prices in a tight market, especially after Chinese steel output jumped in March. Since surging last year amid robust demand from Chinese steel mills and pandemic-related supply disruptions, iron ore futures moved around in a trading range of about $145 to $175 a ton, before breaking out to multiyear highs in recent days. (BBG)

OIL: OPEC+ is discussing whether to downgrade its April 28 talks, holding only a ministerial panel instead of a full-blown meeting of all members, delegates said. The talks are continuing and nothing has been decided yet, the delegates say, asking not to be named because the talks are private. (BBG)

OIL: Libyan oil production fell below 1 million barrels a day for the first time in months, as delays in funds for infrastructure repairs forced a halt at a main port. The National Oil Corp. declared force majeure on exports from the eastern port of Hariga in a statement late Monday. The state oil firm attributed the stoppage to the central bank's "refusal to release the budget for the oil sector for long months." The situation has led to accumulations of debt for companies such as Arabian Gulf Oil Co., forcing it to stop pumping 280,000 barrels a day, the NOC said. Force majeure is a clause in contracts allowing deliveries to be suspended. OPEC member Libya was producing a daily 1.29 million barrels of crude before. (BBG)

CHINA

BOP: China will keep large movements in foreign capital from destabilizing its internal financial markets and suspend trading activities by foreign-held accounts if deemed necessary, the China Securities Journal reported citing Fang Xinghai, Vice Chairman of the China Securities Regulatory Commission. China forbids illicit forex transactions and other violations, the newspaper said citing Xuan Changneng, Deputy Director of State Administration of Foreign Exchange. (MNI)

OVERNIGHT DATA

JAPAN FEB TERTIARY INDUSTRY INDEX +0.3% M/M; MEDIAN +0.5%; JAN -1.0%

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 114.0; PREV. 114.1

The strong labour market report released last week, with a drop of unemployment rate to 5.6% and underemployment below 8%, didn't provide the boost to sentiment we might have expected. Confidence did, however, remain above its long-run average, and perhaps the good news on employment offset any fallout from the vaccine disappointment. The opening of the trans-Tasman travel bubble this week has also most likely helped maintain a positive sentiment. (ANZ)

NEW ZEALAND MAR NON-RESIDENT BOND HOLDINGS 51.5%; FEB 51.7%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS TUE; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Tuesday. This leaves liquidity unchanged given the maturity of CNY10 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.2012% at 09:25 am local time from the close of 2.2167% on Monday.

- The CFETS-NEX money-market sentiment index closed at 33 on Monday 41 on Friday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.5103 TUES VS 6.5233

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower for a sixth day at 6.5103 on Tuesday, compared with the 6.5233 set on Monday.

MARKETS

SNAPSHOT: USD Offered In Asia

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 589.31 points at 29094.61

- ASX 200 down 44.24 points at 7021.4

- Shanghai Comp. up 10.048 points at 3487.597

- JGB 10-Yr future down 7 ticks at 151.36, yield down 0.1bp at 0.086%

- Aussie 10-Yr future down 6.0 ticks at 98.265, yield up 5.6bp at 1.773%

- U.S. 10-Yr future -0-02 at 132-05+, yield up 0.17bp at 1.606%

- WTI crude up $0.53 at $63.91, Gold up $0.82 at $1772.26

- USD/JPY up 1 pip at Y108.17

- XI CHALLENGES U.S. GLOBAL LEADERSHIP, WARNS AGAINST DECOUPLING (BBG)

- LASCHET KEEPS CHANCELLOR BID ALIVE, SURVIVING CDU PARTY VOTE (BBG)

- BOJ TO MULL SLASHING THIS YEAR'S INFLATION FORECAST (NIKKEI)

- RBA WAITS ON YIELD CONTROL DECISION (MNI)

- NORMANDY-FORMAT TALKS ON UKRAINE END WITHOUT RESULTS (RTRS SOURCE)

BOND SUMMARY: Core FI Biased A Little Lower In Asia

Some pressure in the Aussie bond space and Chinese President Xi's focus on a multilateral global environment ultimately pressured core global FI markets during Asia-Pac hours, although there was little in the way of outright fresh news apparent re: either of those particular matters, limiting the scope of and participation in the moves.

- T-Notes -0-01+ at 132-06 at typing, 0-02 off the lows and within the confines of a 0-05 range since the re-open, operating on modest volume <75K. Yields are virtually unchanged across the cash Tsy curve, with the two aforementioned matters providing the focal points during Asia-Pac hours.

- JGB futures drifted lower in the Tokyo afternoon, last -6, with the cash curve seeing some light bull flattening vs. Monday's close. A solid enough, albeit unimpressive, round of 20-Year JGB supply saw a fairly steady cover ratio, narrower tail vs. prev. auction and a low price that comfortably topped broader dealer exp. (proxied by the BBG dealer survey). The super-long end has firmed a little in the wake of the auction, with the matters flagged in our auction preview (limited relative value appeal, attractive offshore bond yields and a lack of impending BoJ purchases covering the zone) limiting overall demand. Super-long JGBs were a touch firmer in the wake of the auction after outperforming during the Tokyo morning.

- The RBA's April meeting minutes contained little in the way of fresh information, which left us pining over the release for an explanation re: the pressure that crept into the Aussie bond space. It may just be as simple as the fact that there was no real expansion on the RBA's thought process surrounding the potential extension of the 3-Year yield targeting scheme to cover ACGB Nov '24, in addition to a lack of overt worry and another nod to the wind down of the TFF come the end of June. Hedging surrounding the pricing of TCV's A$1.6bn round of Sep '33 issuance was another likely contributor. YM -2.0, XM -6.0.

JGBS AUCTION: Japanese MOF sells Y961.8bn 20-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y961.8bn 20-Year JGBs:- Average Yield 0.438% (prev. 0.513%)

- Average Price 101.12 (prev. 99.75)

- High Yield: 0.439% (prev. 0.519%)

- Low Price 101.10 (prev. 99.65)

- % Allotted At High Yield: 79.6285% (prev. 33.1567%)

- Bid/Cover: 3.343x (prev. 3.401x)

EQUITIES: US Sets Negative Tone

A mixed picture in the Asia-Pac time zone after a negative lead from the US; markets in Japan lead the way lower, the Nikkei 25 down around 1.8%, pressured by a stronger yen. Mainland Chinese markets are in minor positive territory, boosted by a broadly positive speech from Chinese President Xi where he emphasized the need for economic cooperation, rather than a Cold War mentality. Shares in Taiwan did manage some gains after reports that officials would upgrade growth forecasts, even as tech shares overall lagged after reports of a fatal crash in a self driving Tesla. US futures are higher, indicating a rebound after a fall yesterday.

OIL: Crude Futures Continue Climb

Oil is higher in Asia-Pac trade, WTI is up $0.37 from settlement levels at $63.75/bbl, Brent is up $0.54 at $67.59/bbl. At these levels oil is the highest since mid-March. Oil edged higher as the greenback retreated, with markets assessing the global economic recovery. Chinese President Xi delivered a speech at an economic forum, he was positive on the economy and emphasized the need for economic cooperation, rather than a Cold War mentality.

GOLD: Competing Forces

A lower DXY has provided some counter to higher U.S. real yields over the last 24 hours or so, leaving bullion little changed on net over that horizon, while the latter ultimately prevented bulls from forcing a challenge of $1,800/oz in spot trade on Monday. Spot last deals little changed around $1,775/oz with a well-defined technical picture in play after the formation of a double bottom pattern in early April.

FOREX: Greenback Retreats, Risk-On Flows Take Hold

The risk switch in G10 FX space was flicked to on, denting demand for safe haven currencies. The greenback underperformed, closely followed by JPY & CHF. USD/JPY had a brief look below its 50-DMA for the first time in months but quickly unwound losses into the Tokyo fix, possibly on the back of Gotobi day demand or lack of any fundamental drivers behind the initial downswing. BoJ Gov Kuroda provided little in the way of fresh insights during his latest address, with broader headline flow providing no major catalysts.

- Greenback weakness was cemented with USD/CNH dipping below CNH6.5000 for the first time since mid-March, even as China's central banks set the central USD/CNY mid-point at CNY 6.5103, 6 pips above sell-side estimate. The PBOC kept LPR rates unchanged for he twelfth month, which had been widely expected.

- High-beta FX traded on a firmer footing as sentiment improved and commodity prices firmed. Antipodean currencies saw round figures give way, as AUD/USD showed above the $0.7800 mark, while NZD/USD punched through $0.7200.

- EUR/USD climbed past its 100-DMA, which had been intact since early March.

- UK labour market data & a speech from ECB's de Cos take focus from here.

FOREX OPTIONS: Expiries for Apr20 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1885-00(E760mln), $1.1925-40(E1.7bln-EUR puts), $1.2000-05(E725mln), $1.2130-40(E661mln-EUR puts)

- USD/JPY: Y108.65($540mln-USD puts), Y109.95-00($515mln)

- GBP/USD: $1.3650(Gbp570mln)

- EUR/NOK: Nok10.00-10.01(E535mln-EUR puts)

- AUD/USD: $0.7765-95(A$1.2bln-AUD puts)

- USD/CNY: Cny6.40($520mln), Cny6.60($580mln)

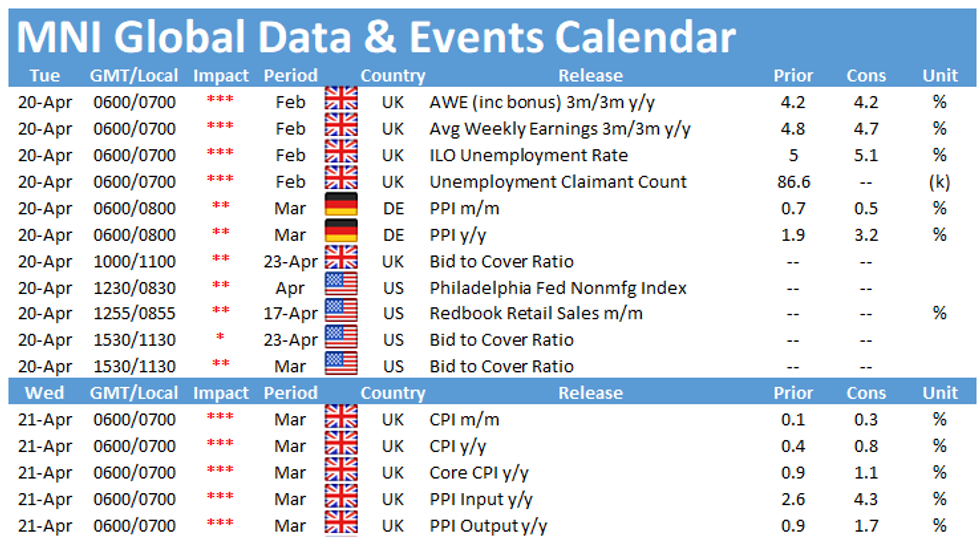

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.