-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: USD Offered Overnight

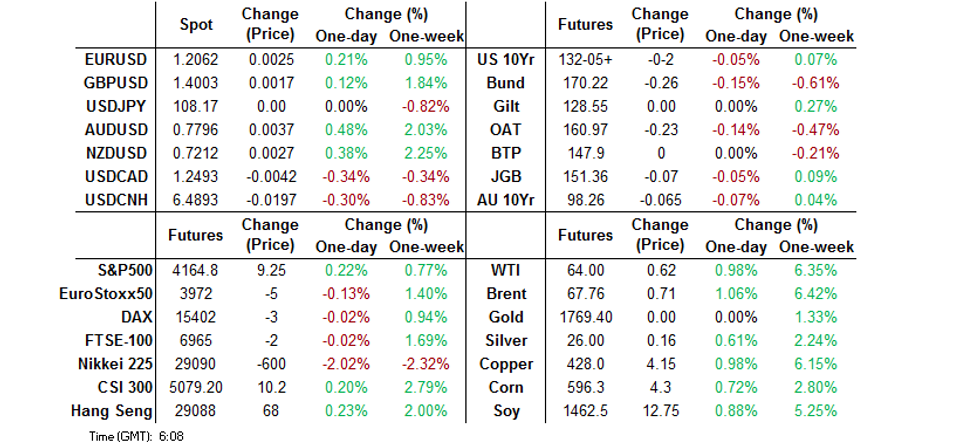

- USD traded on the back foot in Asia, with EUR/USD hitting multi-week highs and USD/CNH back below CNH6.5000.

- Core FI markets were biased a little lower overnight.

- Little in the way of notable tier 1 headline flow was observed in Asia, with familiar matters in play during U.S. hours.

BOND SUMMARY: Core FI Biased A Little Lower In Asia

Some pressure in the Aussie bond space and Chinese President Xi's focus on a multilateral global environment ultimately pressured core global FI markets during Asia-Pac hours, although there was little in the way of outright fresh news apparent re: either of those particular matters, limiting the scope of and participation in the moves.

- T-Notes -0-01+ at 132-06 at typing, 0-02 off the lows and within the confines of a 0-05 range since the re-open, operating on modest volume <75K. Yields are virtually unchanged across the cash Tsy curve, with the two aforementioned matters providing the focal points during Asia-Pac hours.

- JGB futures drifted lower in the Tokyo afternoon, last -6, with the cash curve seeing some light bull flattening vs. Monday's close. A solid enough, albeit unimpressive, round of 20-Year JGB supply saw a fairly steady cover ratio, narrower tail vs. prev. auction and a low price that comfortably topped broader dealer exp. (proxied by the BBG dealer survey). The super-long end has firmed a little in the wake of the auction, with the matters flagged in our auction preview (limited relative value appeal, attractive offshore bond yields and a lack of impending BoJ purchases covering the zone) limiting overall demand. Super-long JGBs were a touch firmer in the wake of the auction after outperforming during the Tokyo morning.

- The RBA's April meeting minutes contained little in the way of fresh information, which left us pining over the release for an explanation re: the pressure that crept into the Aussie bond space. It may just be as simple as the fact that there was no real expansion on the RBA's thought process surrounding the potential extension of the 3-Year yield targeting scheme to cover ACGB Nov '24, in addition to a lack of overt worry and another nod to the wind down of the TFF come the end of June. Hedging surrounding the pricing of TCV's A$1.6bn round of Sep '33 issuance was another likely contributor. YM -2.0, XM -6.0.

FOREX: Greenback Retreats, Risk-On Flows Take Hold

The risk switch in G10 FX space was flicked to on, denting demand for safe haven currencies. The greenback underperformed, closely followed by JPY & CHF. USD/JPY had a brief look below its 50-DMA for the first time in months but quickly unwound losses into the Tokyo fix, possibly on the back of Gotobi day demand or lack of any fundamental drivers behind the initial downswing. BoJ Gov Kuroda provided little in the way of fresh insights during his latest address, with broader headline flow providing no major catalysts.

- Greenback weakness was cemented with USD/CNH dipping below CNH6.5000 for the first time since mid-March, even as China's central banks set the central USD/CNY mid-point at CNY 6.5103, 6 pips above sell-side estimate. The PBOC kept LPR rates unchanged for he twelfth month, which had been widely expected.

- High-beta FX traded on a firmer footing as sentiment improved and commodity prices firmed. Antipodean currencies saw round figures give way, as AUD/USD showed above the $0.7800 mark, while NZD/USD punched through $0.7200.

- EUR/USD climbed past its 100-DMA, which had been intact since early March.

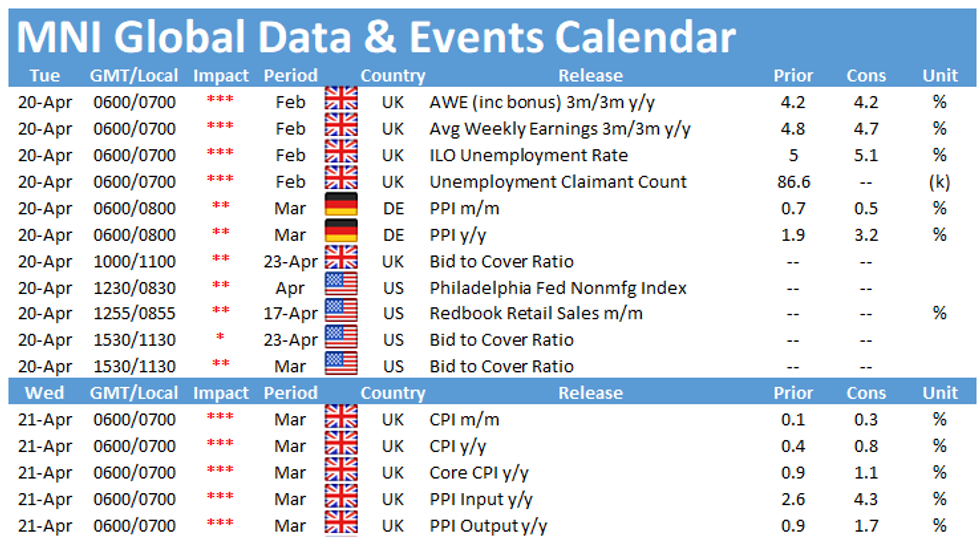

- UK labour market data & a speech from ECB's de Cos take focus from here.

FOREX OPTIONS: Expiries for Apr20 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1885-00(E760mln), $1.1925-40(E1.7bln-EUR puts), $1.2000-05(E725mln), $1.2130-40(E661mln-EUR puts)

- USD/JPY: Y108.65($540mln-USD puts), Y109.95-00($515mln)

- GBP/USD: $1.3650(Gbp570mln)

- EUR/NOK: Nok10.00-10.01(E535mln-EUR puts)

- AUD/USD: $0.7765-95(A$1.2bln-AUD puts)

- USD/CNY: Cny6.40($520mln), Cny6.60($580mln)

ASIA FX: Higher As Greenback Continues Retreat

The greenback retreated for a sixth session, the general negative tone was lifted after a positive speech from Chinese President Xi where he emphasized the need for economic cooperation, rather than a Cold War mentality.

- CNH: Yuan is stronger, advancing after the Xi speech at the economic forum in Boao, the move lower in USD/CNH accelerated after taking out stops around 6.5050. The PBOC kept LPR rates unchanged as expected.

- SGD: Singapore dollar stronger after dropping through yet another resistance level, USD/SGD now at the lowest level since early-March having fallen around 1.6% in April.

- TWD: Taiwan dollar is stronger again, USD/TWD edging perilously close to the 28.00 handle that the central bank has resolutely defended. Officials will reportedly upgrade growth forecasts.

- KRW: Won is stronger, South Korea reported 549 daily new coronavirus cases in the past 24 hours, remaining in the 500s for the second day as health authorities vow to accelerate the country's nationwide vaccination campaign.

- IDR: Rupiah is stronger, markets await the BI decision later today.

- MYR: Ringgit is higher, Malaysian Trade Min Azmin said that a paper on the new investment policy will be tabled to the cabinet today. The new policy was designed to attract more foreign investment and is expected to be swiftly adopted.

- PHP: Peso is stronger. The Philippine regulator approved the J&J Covid-19 jab for emergency use, with vaccine tsar Galvez noting that 10mn doses from J&J are expected. The vaccine produced by India's Bharat Biotech International has also been authorised for emergency use.

- THB: Baht bucks the trend and is weaker amid stock outflows. The BoT said that it stands ready to provide further assistance for businesses hit by the Covid-19 pandemic.

ASIA RATES: Under Pressure

Bonds in general under pressure, a negative tone overall after losses in US equity markets is failing to provide a bid for bonds in the region.

- INDIA: Bonds under pressure as markets continue to digest the elevated number of COVID-19 cases with reports of hospitals under pressure. The PM has said that "The government has been working hard from over a year to ensure that maximum numbers of Indians are able to get the vaccine in the shortest possible of time". Higher oil and rises in US yields also expected to weigh on Indian bonds.

- SOUTH KOREA: Bonds are lower in South Korea, pressured by a global sell off. 10-year future is down 33 ticks, reversing an initial gain. The move lower retraces less than half of the move higher yesterday. The 3-year contract has proven more resilient, down 1 tick. As a reminder, the MOF sold a total KRW 2.8tn of 10-year debt yesterday, while the Bank of Korea will sell KRW 2.1tn 2-year MSB's tomorrow, and the MOF will bring 10-year linkers to market on Friday.

- CHINA: Futures in China are higher, though moves are muted in early trade, but as usual Chinese bond markets are defying the broader regional tone. The PBOC matched maturities with injections, the thirty first straight session, the last time the bank injected funds into the financial system was Feb 25. Repo rates rose, the 7-day repo rate stuck at the prevailing rate of 2.20% after rising above the level yesterday. China kept its Loan Prime Rates (LPR) on hold at 3.85% and 4.65% for the 1-year and 5-year, respectively. This is the twelfth month of unchanged rates, was widely expected and received to little fanfare.

- INDONESIA: Bond yields mostly lower, but moves muted compared to yesterday as markets await the BI rate announcement. Bank Indonesia are set to leave their benchmark interest rate unchanged for a second straight meeting, as rupiah depreciation and preliminary green shoots of economic recovery rule out further policy easing, but subdued inflation calls for keeping monetary policy conditions accommodative.

EQUITIES: US Sets Negative Tone

A mixed picture in the Asia-Pac time zone after a negative lead from the US; markets in Japan lead the way lower, the Nikkei 25 down around 1.8%, pressured by a stronger yen. Mainland Chinese markets are in minor positive territory, boosted by a broadly positive speech from Chinese President Xi where he emphasized the need for economic cooperation, rather than a Cold War mentality. Shares in Taiwan did manage some gains after reports that officials would upgrade growth forecasts, even as tech shares overall lagged after reports of a fatal crash in a self driving Tesla. US futures are higher, indicating a rebound after a fall yesterday.

GOLD: Competing Forces

A lower DXY has provided some counter to higher U.S. real yields over the last 24 hours or so, leaving bullion little changed on net over that horizon, while the latter ultimately prevented bulls from forcing a challenge of $1,800/oz in spot trade on Monday. Spot last deals little changed around $1,775/oz with a well-defined technical picture in play after the formation of a double bottom pattern in early April.

OIL: Crude Futures Continue Climb

Oil is higher in Asia-Pac trade, WTI & Brent sit ~$0.65 above their respective settlement levels. At these levels oil is the highest since mid-March. Oil edged higher as the greenback retreated, with markets assessing the global economic recovery. Chinese President Xi delivered a speech at an economic forum, he was positive on the economy and emphasized the need for economic cooperation, rather than a Cold War mentality.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.