-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: A Defensive Feel In Asia

EXECUTIVE SUMMARY

- J&J TO RESUME EU VACCINE SHIPMENTS AFTER REVIEW OF CLOT RISK (BBG)

- GERMAN GREENS OVERTAKE CONSERVATIVES IN POLL AS C'LLR CANDIDATES ANNOUNCED (RTRS)

- CHINA, U.S. CLOSE TO NAMING NEW AMBASSADORS AS RIVALRY GROWS (WSJ)

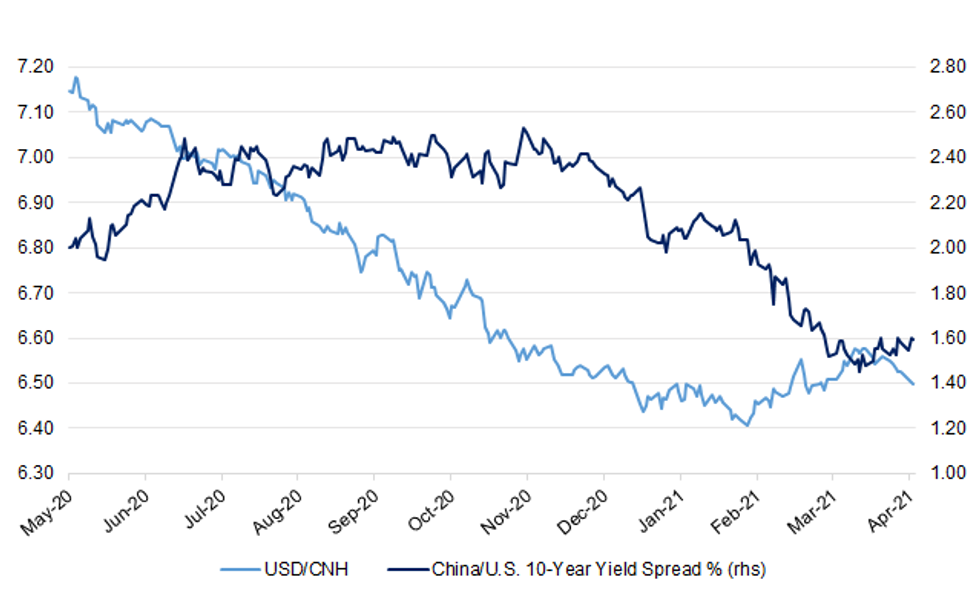

Fig. 1: USD/CNH Vs. China/U.S. 10-Year Yield Spread (%)

Source: MNI - Markets News/Bloomberg

Source: MNI - Markets News/Bloomberg

UK

CORONAVIRUS: U.K. Prime Minister Boris Johnson said Britain must stand ready for another wave of coronavirus later this year, as he launched a new program to find home treatments to limit the impact of mutant Covid strains. Johnson insisted the U.K. is still on track to reopen the economy according to the government's "road map" -- which aims to end restrictions by June 21 -- but warned: "We cannot delude ourselves that Covid has gone away." Cases of the disease have been steadily falling in the U.K. since January but infections have hit dangerous levels in some European countries and there are growing concerns that new variants could knock Britain's progress off course if one emerges that can evade vaccines. (BBG)

CORONAVIRUS: Boris Johnson has announced a new "antivirals task force" to find "promising new medicines" to treat Covid by autumn. Speaking at the Downing Street briefing on Tuesday, the prime minister is hoping that people will be able to take a pill or tablet at home. (BBC)

EUROPE

CORONAVIRUS: Johnson & Johnson will restart deliveries of its Covid-19 vaccine to the European Union after the bloc's drug regulator said the benefits of the shot outweigh the risks of a possible link with cases of rare blood clots. The European Medicines Agency assessment on Tuesday echoed its review of the vaccine from AstraZeneca Plc, which has also been linked with the rare clot. In both cases, the regulator noted that Covid can be fatal and the use of vaccines is crucial to fighting the virus. (BBG)

GERMANY: Germany's Greens overtook the conservatives to top an opinion poll released on the day that Angela Merkel's conservative bloc named Armin Laschet as its candidate to succeed her as chancellor in a September election. A Forsa poll for RTL/n-tv put the conservative bloc on 21%, down 7 points, while the Greens, who on Monday presented their chancellor candidate, Annalena Baerbock, jumped 5 points to 28%. "The nominations of Annalena Baerbock and Armin Laschet are greatly influencing the political mood," said pollster Manfred Guellner in a statement, adding that while voters viewed Baerbock favourably, Laschet had a negative effect for the conservatives. (RTRS)

FRANCE: France's health authorities said on Tuesday an additional 14 patients had been take to intensive care units (ICU) with COVID-19 infection, bringing the total to a new 2021 high of 5,984. (RTRS)

ITALY: Italy to invest EU56b on top of EU funds in 2022-2033 period, Finance Minister Daniele Franco tells lawmakers in parliamentary hearing. "We need to reflect on how to reduce the current excessive debt." (BBG)

ITALY: Italy's GDP likely fell 1.2% in 1Q, but will expand again in 2Q and "accelerate more" in 2H, Italian Finance Minister Daniele Franco tells lawmakers in parliamentary hearing. "We will use the deficit for a very ambitious program of spending that is essential to sustain the economy and ensure a lasting and solid recovery." (BBG)

NETHERLANDS: Lockdown measures in the Netherlands will be eased from next week as pressure to reopen society mounts despite high coronavirus infection rates, Prime Minister Mark Rutte said on Tuesday. (RTRS)

EQUITIES: Regulators in Switzerland and the U.S. asked Credit Suisse Group AG for more information in recent days about additional stock sales related to the collapse of Archegos Capital Management, according to people familiar with the matter. The sales could result in additional losses that go beyond the $4.7 billion hit the bank disclosed earlier this month, one of the people added, and any additional losses are expected to be small in relation to the earlier amount. Since disclosing the loss, Credit Suisse has looked to unload roughly $4 billion in stock tied to Archegos, including a sale as recently as last week, according to people familiar with the trades. Regulators asked Credit Suisse for information about the sales and any potential losses, the people said, and how the bank is managing its exposure to Archegos. A Credit Suisse spokesman declined to comment. (Dow Jones)

U.S.

FED: The U.S. economy is going to temporarily see "a little higher" inflation this year as the recovery strengthens and supply constraints push up prices in some sectors, but the Federal Reserve is committed to limiting any overshoot, Fed Chair Jerome Powell said in an April 8 letter to Senator Rick Scott. "We do not seek inflation that substantially exceeds 2 percent, nor do we seek inflation above 2 percent for a prolonged period," Powell said in a five-page response to a March 24 letter in which the Florida Republican raised concerns about rising inflation and the U.S. central bank's bond-buying program. Those modifiers - "substantially" exceeding 2% inflation or above that level for a "prolonged" period - help to more sharply define the upper bounds of the Fed's comfort zone as prices rise. (RTRS)

FED: MNI EXCLUSIVE: Fed Edges Closer to 'Substantial Progress' Mark

- The Federal Reserve is likely to define "substantial further progress" toward its maximum employment goal, part of its criteria for tapering QE, as just over halfway between where the labor market stood in December and policymakers' judgement of full employment, former officials tell MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI BRIEF: Congress Debates Directing Fed to Target Disparities

- A U.S. House of Representatives committee Tuesday advanced a bill that would open up the Federal Reserve Act to require the central bank to report on racial and ethnic disparities in labor market trends as well as direct the Fed to minimize disparities across racial and ethnic groups with respect to employment, income, wealth, and access to credit - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: More than 300,000 Americans lost unemployment benefits prematurely during the Covid pandemic, according to a study published Tuesday by the California Policy Lab. That's due to a way many states account for unemployed workers, which has understated the severity of the recession, the analysis said. (CNBC)

FISCAL: President Joe Biden's next economic recovery package will cost at least $1 trillion and extend the beefed-up child tax credit, a source familiar with the proposal confirmed Tuesday. Biden is set to follow the first phase of his infrastructure plan, a more than $2 trillion proposal, with a package known as the American Families Plan. While details are still in flux, the measure is expected to include roughly $1 trillion in new spending and $500 billion in tax credits, according to the source, who declined to be named. The White House is expected to roll out the plan within days. (CNBC)

FISCAL: A group of Senate Republicans is aiming to present a broad counteroffer to President Joe Biden's $2.25 trillion infrastructure and jobs plan later this week. Senator Shelley Moore Capito, a West Virginia Republican, told reporters Tuesday she anticipates GOP lawmakers will provide their own infrastructure proposal "in the next several days." It won't be detailed, but it will have a top-line number and include projects and how to pay for them, said Capito, who floated a $600 billion to $800 billion figure last week, far below Biden's plan. (BBG)

FISCAL: Republican senators Tuesday discussed a counterproposal to President Joe Biden's infrastructure plan, likely coming in at $600 billion to $800 billion and paid for with user fees and unspent Covid relief money. Two people who attended Tuesday's GOP lunch said the plan, spearheaded by Environment and Public Works ranking member Shelley Moore Capito (R-W.V.) on behalf of a group of centrist Republicans, would cost roughly $600 billion to $800 billion, depending how many years the plan lasted. One of the sources was more specific, putting the plan estimate between $550 billion and $880 billion. The latter number would be for an eight-year plan, the same duration as Biden's $2.2 trillion proposal. (POLITICO)

FISCAL: A top Treasury Department official met on Tuesday with 20 top bankers to discuss President Joe Biden's $2.3 trillion infrastructure plan and ways to use public-private partnerships to expand economic inclusion, the agency said in a statement. U.S. Deputy Treasury Secretary Wally Adeyemo told 20 bank chief executives who are members of the nonpartisan Bank Policy Institute research group, that "now is the moment to reimagine and rebuild a new American economy" that rewards work, not wealth, and create a tax code that helps end "profit shifting and tax games." Adeyemo and the CEOs also discussed economic inclusion and ways to improve access to credit for low- and moderate-income communities, particularly with regard to mortgage finance as a pathway to building wealth, the statement said. (RTRS)

FISCAL: President Biden told a group of lawmakers that he intends to propose a temporary extension of an enhanced child tax credit, rebuffing requests from some Democrats who favor making the new benefit permanent. As part of a $1.9 trillion Covid-19 relief package Democrats passed earlier this year, Congress raised the child tax credit to $3,000 from $2,000, setting it at $3,600 for parents of children under age 6 and making parents of 17-year-olds eligible. The credit, which scales down above certain income thresholds, is fully refundable and was designed to be paid in intervals, rather than in one lump sum. (WSJ)

CORONAVIRUS: Convention Business Commissioners in Clark County, Nevada, home to Las Vegas, voted to allow large gatherings to be held at 80% of capacity starting May 1. The decision paves the way for a return of the city's convention business, which ground to a halt as a result of the pandemic and related restrictions. If 60% of the population is vaccinated, all county restrictions will be lifted. (BBG)

CORONAVIRUS: Colorado's fourth wave of Covid-19 is intensifying with hospitalizations reaching the highest since the end of January at 553, Governor Jared Polis said at a Tuesday news conference. Most patientsadmitted to Colorado hospitals are between 20 and 50, a "concerning trend," said Rachel Herlihy, state epidemiologist. The state has opened four on-demand vaccine sites to reverse the trend. (BBG)

CORONAVIRUS: U.S. House Democratic Whip James Clyburn said he's concerned about the track record of Emergent BioSolutions Inc., a manufacturer expected to produce Johnson & Johnson's Covid-19 vaccine at its Baltimore plant, and has launched an investigation into how the company came to be awarded its federal contracts. (BBG)

SOCIETY: A jury has unanimously convicted Derek Chauvin of the murder of George Floyd. Former Minneapolis police officer Chauvin had denied charges of second-degree murder, third-degree murder and second-degree manslaughter. But after 10 and a half hours of deliberations, the jury convicted the 45-year-old on all counts. (Sky)

OTHER

U.S./CHINA: China and the U.S. are getting close to naming new envoys to both capitals as the two world powers get locked into an increasingly heated competition for global leadership. Beijing plans to appoint Qin Gang, an adept diplomat who has acted as President Xi Jinping's chief protocol officer, as the next ambassador to Washington, according to officials with knowledge of the matter. Washington is widely expected to name R. Nicholas Burns, a veteran diplomat who has served in both Democratic and Republican administrations, as its ambassador to Beijing, say people familiar with the administration's decision making. (WSJ)

GLOBAL TRADE: A U.S.-driven effort to reach a global accord on taxing big tech companies' overseas profits is getting bogged down over ensnaring one firm in particular: Amazon.com Inc. A Treasury Department proposal, which was distributed to other governments earlier this month and has been seen by Bloomberg, would subject about 100 of the largest and most profitable companies to greater taxation in countries where the firms' users and consumers are located, as opposed to the countries where they're headquartered. (BBG)

JAPAN: The Japanese government has decided to declare a fresh coronavirus state of emergency in Tokyo, Osaka and Hyogo prefectures, the Sankei newspaper reported without attribution. A formal decision is expected to come as soon as this week, the paper said. (BBG)

JAPAN: The Japanese government is expected to receive additional 50 million doses of Pfizer vaccine by the end of September, Nikkei reported without attribution. The government and Pfizer will sign a contract as soon as this month, according to the report. Together with Moderna's vaccine, pending approval, Japan has secured enough doses to vaccinate thoseaged 16 and above by the end of September with the arrangement, Nikkei said. (BBG)

JAPAN: The Japanese government plans to maintain its target to return to a primary balance surplus in fiscal 2025 when it compiles a basic economic and fiscal management policy in June, Jiji reports, without attribution. Meeting the target would be difficult given expenditures have swollen to cope with coronavirus pandemic, but by maintaining it the government will show its intent to undertake budget reforms, Jiji says. (BBG)

BOJ: MNI DATA IMPACT: Japan Corp Loan Demand Rises, says BOJ Survey

- Demand for financing by Japanese corporates through bank loans rose in April as companies attempted to pre-emptively increase funds amid concerns over a pick-up in their businesses, according to the BOJ's latest quarterly survey of senior loan officers at 50 banks released on Wednesday. The index for corporate fund demand -- calculated by subtracting the number of banks reporting a decline in lending from the number of those reporting an increase -- stood at +9 in April, up from -5 in January - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

NEW ZEALAND/RATINGS: New Zealand's (Aaa stable) resilient economy, strong policy frameworks and robust fiscal buffers have supported its credit profile amid the unprecedented economic shock due to the pandemic, according to Moody's Investors Service in a new report. Institutional effectiveness also mitigates vulnerabilities related to reliance on external financing and elevated household debt. "We expect New Zealand's economy to remain resilient in the face of external headwinds because of its trade openness, diverse and competitive agricultural export base, flexible labour and product markets, high wealth levels and supportive demographics, driven by solid net immigration," says Michael S. Higgins, a Moody's Analyst. "These attributes underscore New Zealand's medium-term growth potential of around 2.5%-3.0%, a level higher than that of many advanced economy Aaa-rated peers." (Moody's)

SOUTH KOREA: Moderna Inc.'s vaccine will be supplied to South Korea in the second half of 2021, Finance Minister Hong Nam-ki told lawmakers Tuesday. South Korea said last year Moderna agreed to provide enough vaccines for 20 million people, with shipments starting in the second quarter. South Korea is still aiming for herd immunity nationwide by November. (BBG)

SOUTH KOREA: Finance Minister Hong Nam-ki said Wednesday the government is guarding against potential instability in the housing market as home prices in Seoul picked up amid expectations for eased rules on redevelopment housing projects. The minister also said the government plans to unveil measures next month to overhaul the Korea Land and Housing Corp., the public housing developer at the center of a land speculation scandal involving public officials. (Korea Herald)

NORTH KOREA: North Korea is continuing to work on a submersible missile test stand barge at its Nampo shipyard, a U.S. think tank said Tuesday, suggesting the work could be part of preparations for a ballistic missile test. Citing satellite imagery taken Monday, the think tank said the North has positioned a "cylindrical object on the submersible missile test barge at Nampo." It said the image alone could not confirm an imminent missile launch, but noted the round object could be a launch tube for a submarine launched ballistic missile (SLBM). (Yonhap)

CANADA: Toronto health authorities will order workplaces across Canada's biggest city to close if they have more than five confirmed cases of Covid-19. The decision Tuesday overrides less stringent provincial orders, and follows a similar move by Peel Region, a western suburb. It comes as the city struggles to contain a surge in variant cases that threatens to collapse the local health-care system. Workplaces, or portions of workplaces, will be required to close for at least 10 calendar days if five or more confirmed cases of Covid-19 have been identified in a two-week period. Some -- notably childcare centers, healthcare facilities and those providing critical services -- may be exempt. The order will be issued on April 23rd, the city said. (BBG)

TURKEY: Turkish President Recep Tayyip Erdogan fired Ruhsar Pekcan as trade minister on Wednesday following allegations that she has favored her husband's company in government tenders. The president named Mehmet Mus, a parliamentary whip of the ruling AK Party, as new trade minister in a decree published in the Official Gazette. (BBG)

MEXICO: Mexico's congress on Tuesday passed a bill to regulate labor outsourcing in a move that's likely to increase operation costs for companies. Senators approved the proposal in general terms 118 in favor, with 2 abstentions, while reserving some articles for ongoing debate. The bill will go to President Andres Manuel Lopez Obrador to be signed into law after having passed the lower house last week. (BBG)

MEXICO: The energy committee of Mexico's lower house approved a new reform to the hydrocarbons law that would allow Pemex to once again control fuel sales, Reforma reports. (BBG)

BRAZIL: Brazilian policy makers should have been more cautious when cutting interest rates last year and now need to stress they will raise them as needed to bring inflation to target, according to former central bank President Ilan Goldfajn. Rather than committing to a "partial adjustment" of monetary stimulus, the bank needs to show it's ready to do whatever is necessary to control prices that will soon be rising by 8% a year, Goldfajn said in an interview on Tuesday. Likewise, the bank may have gone too far when it cut rates to an all-time low of 2% and signaled they would stay there for the foreseeable future, he added. (BBG)

BRAZIL: Brazil's federal tax revenue hit a record high for the month of March, the revenue service said on Tuesday, another bumper month that suggests the economy may be withstanding the deadly second wave of the COVID-19 pandemic better than many had predicted. Strong growth in corporate taxes and firms' social contributions on net profits accounted for much of the rise, although figures for March last year were already blighted by the onset of the pandemic. The tax take last month was 137.9 billion reais ($25 billion), up 18.5% in real terms from a year ago, a record for that month since the data series began in 1994 and more than the 126.2 billion reais median forecast in a Reuters poll of economists. It took the total tax take for the first three months of 2021 to 445.9 billion, up 5.6% in real terms from the first quarter of last year and also the highest since 1994, the revenue service said. (RTRS)

RUSSIA: U.S. State Department spokesman Ned Price said on Tuesday that Washington would not hesitate to use additional policy tools against Russia over its treatment of dissident Alexei Navalny, after the United States imposed sanctions over his poisoning last month. (RTRS)

RUSSIA: U.S. ambassador to Moscow John Sullivan said on Tuesday he would travel to the United States this week for consultations, four days after the Kremlin suggested that Washington recall him amid a diplomatic crisis between the two countries. (RTRS)

IRAN: Iran's President Hassan Rouhani said negotiations on how to the revive the 2015 nuclear deal were 60% to 70% complete and could be resolved quickly if the U.S. acts with "honesty," according to a statement on his official website. (BBG)

IRAN: Iran and world powers have made headway in talks to save the 2015 nuclear accord, although much more work is needed, a senior European Union official said on Tuesday, with meetings to resume next week after consultations in their respective capitals. (RTRS)

IRAN: Saudi Arabia renewed its call for Iran to engage in ongoing negotiations in Vienna, avoid escalation and not expose the region to more tension. This came following a council of ministers meeting, chaired by King Salman on Tuesday. The cabinet also urged the international community to reach an agreement with stronger and longer determinants that are implemented through monitoring and control measures to prevent the Iranian regime from obtaining nuclear weapons and developing the necessary capabilities. (Arab News)

MIDDLE EAST: A Washington-backed Afghan peace conference in Turkey has been postponed due to the Taliban's non-participation, three sources told Reuters on Tuesday. (RTRS)

IRON ORE: BHP Group reported its iron ore shipments slipped almost 7% last quarter on weather-related disruptions at its port and mine operations in Western Australia, as global miners struggle to keep up with soaring demand from Chinese steel mills. Total iron ore sales in the three months to Dec. 31 were 66 million tons, BHP said Wednesday in a statement, down from 70.8 million tons in the December quarter and below a median forecast of 67.1 million tons (4 analysts). (BBG)

CHINA

PBOC: The PBOC is likely to maintain the loan prime rate at its current level after leaving it unchanged yesterday for the 12th month, the China Securities Journal reported citing analysts. However, banks may slightly increase their lending rates by a few basis points on the LPR given that some market rates climbed this year, it said. The rates for private and small companies as well as loans to support technological innovation and green development will decrease, while rates for the real estate sector will rise, the newspaper said citing Wang Qing, chief analyst at Golden Credit Rating. (MNI)

PENSIONS: China should boost old age pensions and channel them into capital markets needing long-term funds, the Shanghai Securities News reported citing PBOC Deputy Governor Li Bo. Chinese financial markets lack long-term capital, particularly owners' equity, while its economy is too dependent on loans and its industries lack technology investments, Li said at the Boao forum. The pension contribution in OECD countries accounted for 126% of GDP in 2018 while in China it was only 10%, Li said. (MNI)

OVERNIGHT DATA

AUSTRALIA MAR, P +1.4% M/M; MEDIAN +1.0%; FEB -0.8%

AUSTRALIA MAR WESTPAC LEADING INDEX +0.38% M/M; FEB +0.16%

The growth rate of the Leading Index continues to point to above trend growth in 2021. Westpac is forecasting growth of 4.5% in 2021 largely driven by the consumer who is expected to contribute three of those percentage points. The reopening of the economy; cashed up households; and an eleven year high in Consumer Sentiment all point to strong spending. The housing market is booming. Westpac expects dwelling price growth of 15% in 2021 along with surging dwelling construction. (Westpac)

NEW ZEALAND Q1 CPI +1.5% Y/Y; MEDIAN +1.5%; Q4 +1.4%

NEW ZEALAND Q1 CPI +0.8% Q/Q; MEDIAN +0.8%; Q4 +0.5%

SOUTH KOREA APR 1-20 EXPORTS +45.4% Y/Y; MAR +12.5%

SOUTH KOREA APR 1-20 IMPORTS +31.3% Y/Y; MAR +16.3%

SOUTH KOREA MAR PPI +3.9% Y/Y; FEB +2.1%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS WEDS; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Wednesday. This leaves liquidity unchanged given the maturity of CNY10 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.1892% at 09:35 am local time from the close of 2.1610% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 36 on Tuesday vs 33 on Monday. A higher index indicates increased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.5046 WEDS VS 6.5103

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower for a seventh day at 6.5046 on Wednesday, compared with the 6.5103 set on Tuesday.

MARKETS

SNAPSHOT: A Defensive Feel In Asia

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 560.2 points at 28540.18

- ASX 200 down 52.867 points at 6964.9

- Shanghai Comp. up 5.118 points at 3478.061

- JGB 10-Yr future up 21 ticks at 151.59, yield down 1.9bp at 0.07%

- Aussie 10-Yr future up 5.5 ticks at 98.315, yield down 5.3bp at 1.729%

- U.S. 10-Yr future +0-00+ at 132-18+, yield unch. at 1.559%

- WTI crude down $0.51 at $62.16, Gold up $1.75 at $1780.48

- USD/JPY unch. at Y108.11

- J&J TO RESUME EU VACCINE SHIPMENTS AFTER REVIEW OF CLOT RISK (BBG)

- GERMAN GREENS OVERTAKE CONSERVATIVES IN POLL AS C'LLR CANDIDATES ANNOUNCED (RTRS)

- CHINA, U.S. CLOSE TO NAMING NEW AMBASSADORS AS RIVALRY GROWS (WSJ)

BOND SUMMARY: Core FI Supported By Equity Headwinds, Tsys Little Changed

Participants are seemingly comfortable with current U.S. Tsy valuations, mostly looking through some pressure on the broader equity space during Asia-Pac dealing. T-Notes have stuck to a narrow 0-03 range thus far, last printing +0-00+ at 132-18+, with less than 75K lots changing hands. Cash trade has seen some modest twist steepening of the curve, with 30s cheapening by ~1.0bp while paper out to 7-Years sits ever so slightly firmer on the day.

- The local COVID situation in Japan & related, seemingly impending, declaration of states of emergency across several regions (including Tokyo) has supported the JGB space as the Nikkei 225 trades heavily again, with the belly of the curve leading (7s richening by a little over 2.5bp on the day). The outperformance in the belly is supporting futures, with that contract last +20 on the day, building on overnight gains. The BoJ left the sizes of its 1- to 3- & 5- to 10-Year JGBS as was, with little in the way of meaningful movement in the offer/cover ratios.

- Aussie bonds drew some light support from the broader backdrop, as futures added to the overnight uptick, YM +1.5, XM +5.0, with nothing in the way of impact from another solid round of ACGB supply, nor from local data.

BOJ: Rinban Conducted

The BoJ offers to buy a total of Y955bn of JGB's from the market

- Y475bn worth of JGBs with 1-3 Years until maturity

- Y450bn worth of JGBs with 5-10 Years until maturity

- Y30bn worth of floating rate JGBs

AUSSIE BONDS: The AOFM sells A$1.2bn of the 2.50% 21 May '30 Bond, issue #TB155:

The Australian Office of Financial Management (AOFM) sells A$1.2bn of the 2.50% 21 May 2030 Bond, issue #TB155:- Average Yield: 1.5282% (prev. 0.9794%)

- High Yield: 1.5300% (prev. 0.9800%)

- Bid/Cover: 4.5167x (prev. 6.0275x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 37.8% (prev. 91.1%)

- bidders 39 (prev. 51), successful 13 (prev. 15), allocated in full 7 (prev. 4)

EQUITIES: Sentiment Sours

After a negative lead from US markets yesterday, bourses in the Asia-Pac time zone started on the back foot. Markets in Japan lead the way lower with losses of over 2% as Japan battled with state of emergency/lockdown worries. The Hang Seng is also nursing heavy losses as tech shares sink, while markets in mainland China are in minor positive territory after opening in negative territory but gradually eroding losses. US futures are lower, the Nasdaq underperforming as earnings disappoint.

OIL: Crude Futures Pressured Further

Oil is on track to decline for a second day; WTI down $0.46 from settlement levels at $62.21, Brent is down $0.44 at $66.13/bbl. WTI dropped sharply yesterday as markets assess demand concerns as coronavirus cases surge in several countries including India and Japan. Also sapping demand were reports that the US House Judiciary Committee passed a bill opening OPEC to Antitrust lawsuits over production costs, the so-called 'NOPEC Act'. Data from API yesterday showed headline crude stocks rose 463k bbls last week, but downstream stocks declined with gasoline stocks some 1.6m bbls lower. Markets look ahead to US DOE inventory data later.

GOLD: Calmer Trade After The Recent Rally

Gold continues to coil in the recently established range, with choppy DXY trade witnessed over the last 24 hours or so (that metric ultimately finished a touch higher on Tuesday), while U.S. real yields are marginally lower over that horizon. Spot last deals a handful of dollars higher, just above $1,780/oz, with nothing fresh to note from a technical perspective.

FOREX: Yen Garners Strength In Asia

The yen led gains in the G10 space as reports on the looming emergency declarations in Tokyo, Hyogo and Osaka did the rounds, against the backdrop of a broader coronavirus worry. USD/JPY dipped in early trade, despite the absence of any fundamental catalysts, probing the water under Tuesday's low. The rate recouped its initial losses into the Tokyo fix, but the recovery proved short-lived and USD/JPY slipped back below Y108.00 as JPY returned to the top of the G10 scoreboard.

- The kiwi's reaction to domestic CPI data was negligible, limited to an unimpressive knee-jerk higher. Consumer price inflation accelerated in Q1, matching market expectations. The rangebound NZD/USD struggled for a clear direction, despite charting a shooting star candlestick pattern yesterday & even as the 50-DMA crossed below the 100-DMA.

- Softer oil prices applied a modicum of pressure to NOK & AUD, with the latter looking through a beat in Australia's flash retail sales.

- The PBOC set the USD/CNY mid-point at CNY6.5046, around 5 pips below sell-side estimates. USD/CNH was happy to hug Tuesday's range.

- Today's data docket features UK & Canadian inflation data. The latest monetary policy decision from the BoC will be followed by a a presser with Gov Macklem, with BoE's Ramsden & Bailey due to speak elsewhere.

FOREX OPTIONS: Expiries for Apr21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1890-05(E942mln), $1.1920-40(E922mln)

- EUR/JPY: Y129.90-130.00(E443mln)

- GBP/USD: $1.3700(Gbp582mln), $1.3800(Gbp638mln)

- AUD/USD: $0.7740-50(A$1.15bln-AUD puts)

- USD/CNY: Cny6.40($700mln), Cny6.55($541mln)

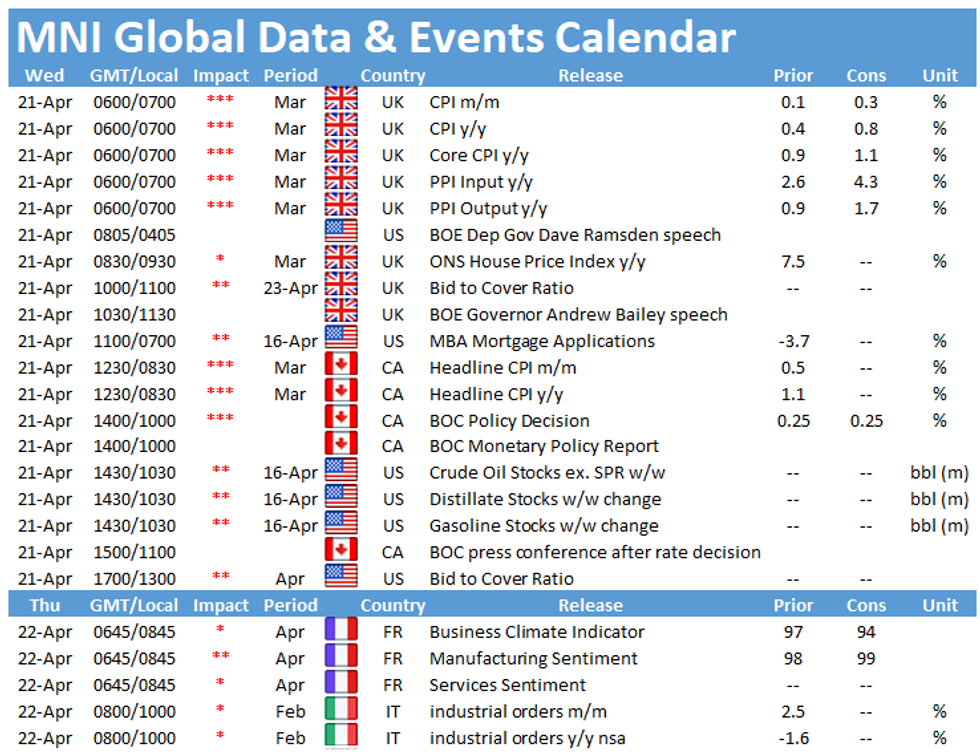

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.