-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Equities Still Struggling

- Equities struggle in Asia, with the Nikkei 225 hampered by local COVID worries.

- Headline flow was light in Asia.

- The Bank of Canada is widely expected to keep its target rate on hold at 0.25% for the ninth consecutive policy announcement on Wednesday. Views surrounding tapering of the Bank's asset purchases are fairly evenly split between a C$1bn decline in asset purchases to C$3bn/week and no change in the rate of purchases.

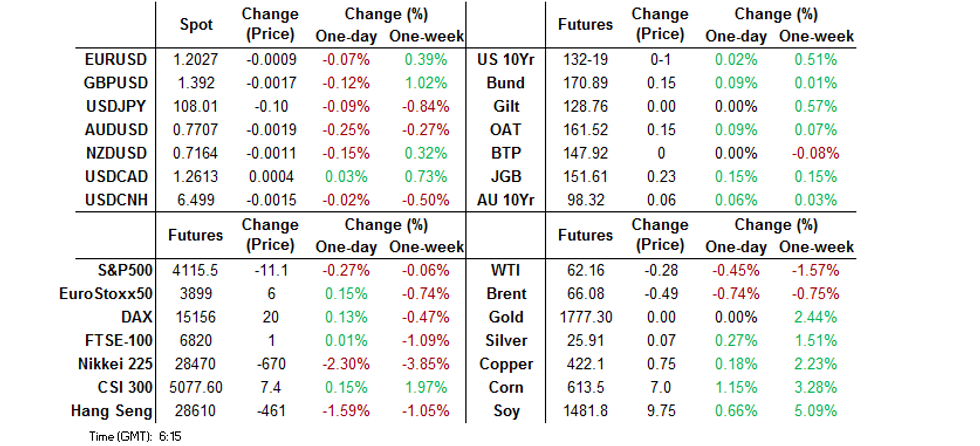

BOND SUMMARY: Core FI Supported By Equity Headwinds, Tsys Little Changed

Participants are seemingly comfortable with current U.S. Tsy valuations, mostly looking through some pressure on the broader equity space during Asia-Pac dealing. T-Notes have stuck to a narrow 0-03 range thus far, last printing +0-00+ at 132-18+, with less than 75K lots changing hands. Cash trade has seen some modest twist steepening of the curve, with 30s cheapening by ~0.5bp while paper out to 7-Years sits ever so slightly firmer on the day. Participants will now assess the setup ahead of today's 20-Year Tsy auction.

- The local COVID situation in Japan & related, seemingly impending, declaration of states of emergency across several regions (including Tokyo) has supported the JGB space as the Nikkei 225 trades heavily again, with the belly of the curve leading (7s richening by a little over 2.5bp on the day). The outperformance in the belly is supporting futures, with that contract last +22 on the day, building on overnight gains. Super-long swap spread spreads sit a touch tighter on the day. The BoJ left the sizes of its 1- to 3- & 5- to 10-Year JGBS as was, with little in the way of meaningful movement in the offer/cover ratios. Elsewhere, local press reports have noted that Japan will maintain its FY25 primary surplus target, while alternate reports played down speculation re: a short-term announcement surrounding a fresh supplementary budget. There is little of note on the local docket on Thursday.

- Aussie bonds drew some light support from the broader backdrop, allowing futures to add to the overnight uptick, YM +1.5, XM +5.5, with nothing in the way of impact from another solid round of ACGB supply, nor from local data (which came in the form of slightly firmer than expected preliminary retail sales data for the month of March). In terms of auction specifics, $1.2bn of ACGB 2.50% 21 May 2030 supply saw the weighted average yield print 0.33bp through prevailing mids at the time of supply (per Yieldbroker pricing), with a decent enough cover ratio witnessed as well documented themes continue to support ACGB demand. There is little of note on the local docket on Thursday, outside of the scheduled round of ACGB purchases from the RBA.

FOREX: Yen Garners Strength In Asia

The yen led gains in the G10 space as reports on the looming emergency declarations in Tokyo, Hyogo and Osaka did the rounds, against the backdrop of a broader coronavirus worry. USD/JPY dipped in early trade, despite the absence of any fundamental catalysts, probing the water under Tuesday's low. The rate recouped its initial losses into the Tokyo fix, but the recovery proved short-lived and USD/JPY slipped back below Y108.00 as JPY returned to the top of the G10 scoreboard.

- The kiwi's reaction to domestic CPI data was negligible, limited to an unimpressive knee-jerk higher. Consumer price inflation accelerated in Q1, matching market expectations. The rangebound NZD/USD struggled for a clear direction, despite charting a shooting star candlestick pattern yesterday & even as the 50-DMA crossed below the 100-DMA.

- Softer oil prices applied a modicum of pressure to NOK & AUD, with the latter looking through a beat in Australia's flash retail sales.

- The PBOC set the USD/CNY mid-point at CNY6.5046, around 5 pips below sell-side estimates. USD/CNH was happy to hug Tuesday's range.

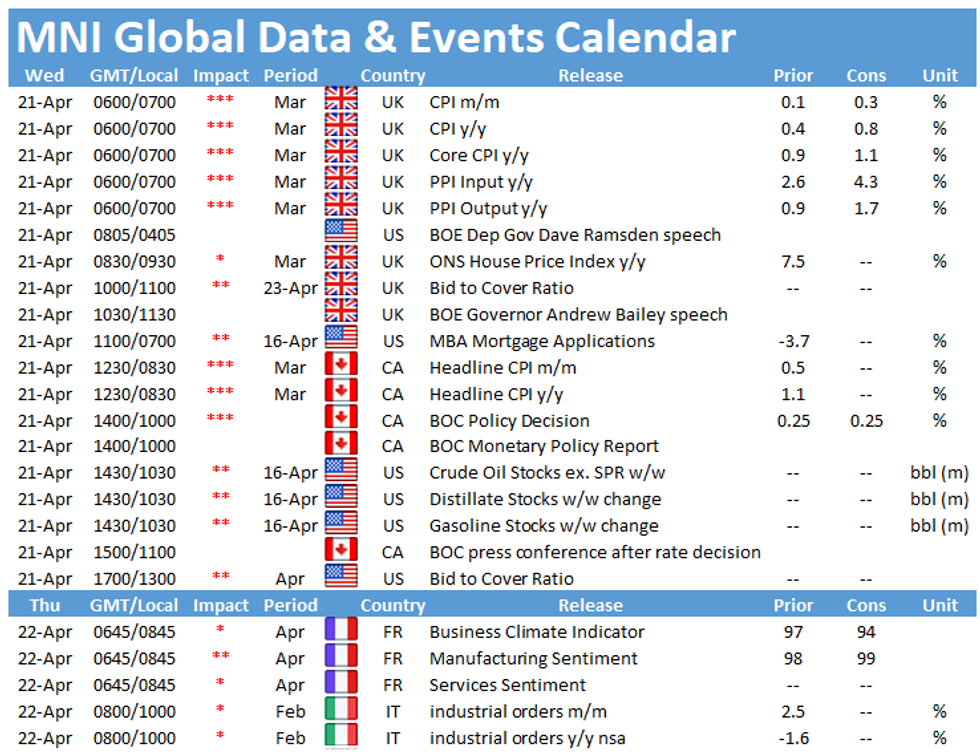

- Today's data docket features UK & Canadian inflation data. The latest monetary policy decision from the BoC will be followed by a a presser with Gov Macklem, with BoE's Ramsden & Bailey due to speak elsewhere.

FOREX OPTIONS: Expiries for Apr21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1890-05(E942mln), $1.1920-40(E922mln)

- EUR/JPY: Y129.90-130.00(E443mln)

- GBP/USD: $1.3700(Gbp582mln), $1.3800(Gbp638mln)

- AUD/USD: $0.7740-50(A$1.15bln-AUD puts)

- USD/CNY: Cny6.40($700mln), Cny6.55($541mln)

ASIA FX: Cautious Tones Sees USD/Asia Crosses Rise

The greenback continued to rally in a quiet session, most USD/Asia crosses higher, concern over a pickup in COVID-19 cases in the region weighs.

- CNH: Offshore yuan backs the trend and has strengthened for an eighth day, on track for its longest winning streak since November 2019.

- SGD: Singapore dollar is flat, moving in a narrow range after a round trip on Tuesday. Resistance seen at 1.3300.

- TWD: The Taiwan dollar is stronger again today, moves muted compared to earlier this week. USD/TWD draws closer to 28.00 with chatter of central bank intervention yesterday.

- KRW: The won is weaker, moving in a narrow range after gapping at the open. PPI and export data were positive, but coronavirus cases rose over 700 again.

- MYR: Ringitt is lower, but one of the better performers in the region. Palm oil futures surged in Malaysia by the most in almost three weeks Tuesday, even as WTI went offered. Malaysia's key export commodity was underpinned by strong shipments data & firmer soybean oil prices.

- IDR: Rupiah is weaker, pausing a three day rally, Bank Indonesia left its monetary policy settings unchanged Tuesday, in line with expectations, but trimmed its GDP forecast for 2021 to +4.1%-5.1% from +4.3%-5.3%. Unsurprisingly, BI continued to stress the need of maintaining rupiah stability amid persistent uncertainties.

- PHP: Peso is lower, the Philippine weather bureau raised Tropical Cyclone Wind Signal no. 2 in parts of Cagayan and Isabela, as Super Typhoon Surigae (Bising) approaches the Philippines' eastern regions.

- THB: Baht has declined, PM Prayuth said that Thailand is in talks with Pfizer to secure the supply of additional 10mn doses of the Covid-19 vaccine, possibly between Jul & the year-end. Pricing deal is yet to be reached. The PM threw his weight behind the national inoculation campaign, refusing to admit that its pace has been to slow and insisting that the gov't has prioritised the safety of jab recipients.

ASIA RATES: Bonds Bid As Coronavirus Worries Linger

Bond markets supported in cautious trade with a risk off tone evident from the start.

- INDIA: Markets closed for a local holiday.

- SOUTH KOREA: Futures higher in South Korea as stocks in Asia retreat, additional coronavirus concerns as cases rise above 700 again outweigh positive data. Some corporate issuance announced. LG Electronics announced plans to sell KRW 300bn of bonds in 5-,7-,10- & 15-year maturities, the size could rise to KRW 600bn. The 5- & 7-year note could feature ESG criteria.

- CHINA: The PBOC matched maturities with injections, the thirty second straight session, the last time the bank injected funds into the financial system was Feb 25. Repo rates are higher, the overnight repo rate up 16bps at 1.8626% but down from 2.11% yesterday, the 7-day repo rate is 4.5bps lower at 2.1145%, below prevailing repo rate after dropping from above the level yesterday. Bond futures are higher, but off highs seen near the open. The general tone in the region is risk off with bonds supported and equity markets looking heavy.

- INDONESIA: Curve bear flattens. Bank Indonesia left its monetary policy settings unchanged Tuesday, in line with expectations, but trimmed its GDP forecast for 2021 to +4.1%-5.1% from +4.3%-5.3%. Unsurprisingly, BI continued to stress the need of maintaining rupiah stability amid persistent uncertainties. Elsewhere, a sukuk sale yesterday missed the government's target, IDR 7.37tn were sold against a target of IDR 10tn.

EQUITIES: Sentiment Sours

After a negative lead from US markets yesterday, bourses in the Asia-Pac time zone started on the back foot. Markets in Japan lead the way lower with losses of over 2% as Japan battled with state of emergency/lockdown worries. The Hang Seng is also nursing heavy losses as tech shares sink, while markets in mainland China are in minor positive territory after opening in negative territory but gradually eroding losses. US futures are lower, the Nasdaq underperforming as earnings disappoint.

GOLD: Calmer Trade After The Recent Rally

Gold continues to coil in the recently established range, with choppy DXY trade witnessed over the last 24 hours or so (that metric ultimately finished a touch higher on Tuesday), while U.S. real yields are marginally lower over that horizon. Spot last deals a handful of dollars higher, just above $1,780/oz, with nothing fresh to note from a technical perspective.

OIL: Crude Futures Pressured Further

Oil is on track to decline for a second day; with WTI & Brent both trading ~$0.50 softer at typing. WTI dropped sharply yesterday as markets assess demand concerns as coronavirus cases surge in several countries including India and Japan. Also sapping demand were reports that the US House Judiciary Committee passed a bill opening OPEC to Antitrust lawsuits over production costs, the so-called 'NOPEC Act'. Data from API yesterday showed headline crude stocks rose 463k bbls last week, but downstream stocks declined with gasoline stocks some 1.6m bbls lower. Markets look ahead to US DOE inventory data later.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.