-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Another Round Of Mildly Defensive Asia-Pac Trade

EXECUTIVE SUMMARY

- JOHNSON & JOHNSON TRIAL SHOWS VACCINE EFFECTIVE, EVEN AGAINST VARIANTS (THE HILL)

- DRAGHI PLANS €220BN OVERHAUL OF ITALY'S ECONOMY (FT)

- UK COVID PASSPORTS TO BE AVAILABLE FOR SUMMER HOLIDAYS (TELEGRAPH)

- GOP SENATORS TO UNVEIL INFRASTRUCTURE FRAMEWORK THURSDAY (CNN)

- U.S. CITES MODEST PROGRESS IN IRAN TALKS, DIALING BACK OPTIMISM (BBG)

- IRAN NUCLEAR DEAL TALKS ADVANCE AS U.S. OFFERS SANCTIONS RELIEF (WSJ)

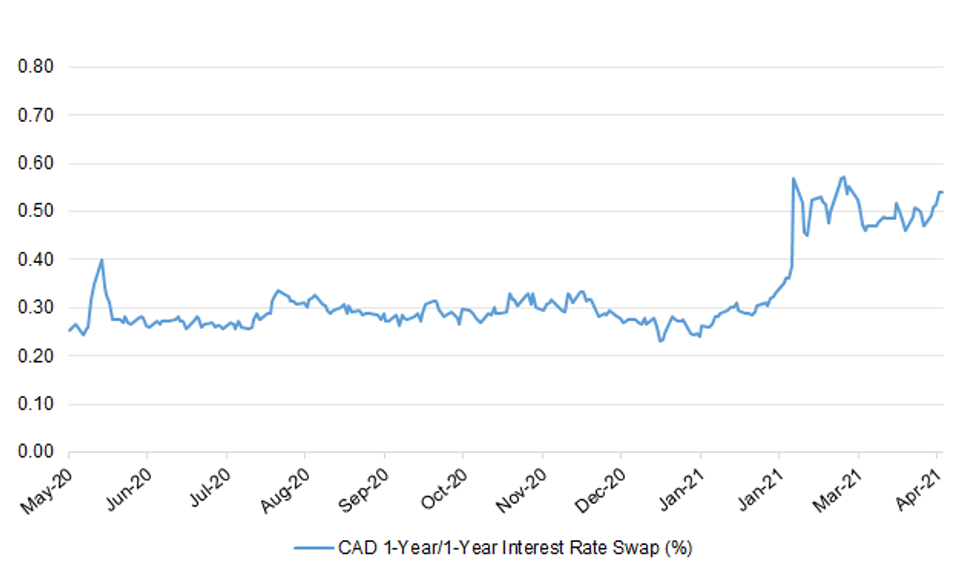

Fig. 1: CAD 1-Year/1-Year Interest Rate Swap (%)

Source: MNI - Markets News/Bloomberg

Source: MNI - Markets News/Bloomberg

UK

CORONAVIRUS: Covid passports will be made available to prove people have been vaccinated as early as next month, in time for summer holidays, the travel industry has been told. The Department for Transport wants an official certification scheme that gives British travellers a document they can show at borders overseas in place by May 17. In a separate development, a European medical agency recommended that fully vaccinated travellers should be able to sidestep tests and quarantine. It potentially smooths the path for holidays to more than 20 countries that have indicated they could ask travellers for proof of vaccination, such as Israel, Croatia, Turkey, Spain, Portugal and Cyprus. (Telegraph)

ECONOMY: MNI DATA BRIEF: UK Pay Awards Remain Subdued In March

- Pay freezes are still dominant among UK employers, although in cases where a pay increase was granted, the most common figure was 2.0%, the latest XpertHR survey showed. The headline pay awards were unchanged at 1.0% for a fourth straight reading in the 3 months to March. Nevertheless, early results for April provide hopes for an upward movement in the headline figure, "as the median for this month alone currently stands at 2%", XpertHR's Sheila Attwood said. "However, pay freezes remain commonplace, and the majority of deals are lower than the same employees received last April," she added - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: The number of companies in significant financial distress has risen at the fastest rate in more than seven years, sparking warnings that "the dam of zombie businesses could be about to break" when government Covid-19 support comes to an end in the summer. Almost 100,000 more businesses were found to be significantly distressed in the first three months of the year compared with the previous quarter, despite the ban on winding up petitions linked to Covid-related debts. More than 720,000 businesses are now in significant financial distress, according to data from insolvency company Begbies Traynor, which said the 15 per cent rise from the previous quarter was the largest increase since its research began in 2014. (FT)

ECONOMY: Britain's jobs growth is being led by cities and towns in the North and Midlands, according to a report. Hiring has gathered pace since lockdown started to ease, but the growth is unevenly spread, joint research by the Centre of Cities think-tank and jobs site Indeed found. (BBC)

EUROPE

CORONAVIRUS: European countries prepared on Wednesday to start using Johnson & Johnson's COVID-19 vaccine and speed up their vaccination campaigns after Europe's drug regulator backed the shot and deliveries started trickling in after a week-long pause. (RTRS)

CORONAVIRUS: Social distancing rules and mask requirements can be relaxed for those who get vaccinated, the European Union's agency for disease prevention said, adding to signs that an accelerated rollout of shots against the coronavirus can pave the way for a gradual return to normality. When fully vaccinated individuals meet other fully vaccinated individuals, physical distancing and the wearing of face masks can be relaxed, the European Centre for Disease Prevention and Control said in a set of guidelines published Wednesday. The rules can be relaxed even when vaccinated meet people who have still to get the shot, as long there are no risk factors for severe disease or lower vaccine effectiveness in anyone present. The reasoning is that people who have received the vaccines have a very low risk of developing severe illness, while the risk of contracting the virus from someone who has been vaccinated is also low. (BBG)

ITALY: Mario Draghi will next week unveil a €221bn recovery package for a radical restructuring of Italy's economy as it seeks to bounce back from its deepest recession since the second world war. The plan, which features big-ticket investments in high-speed rail and green energy, as well fully digitalising the country's public administration, will draw on the EU's pandemic recovery fund. Italy and Spain are expected to be the two largest recipients of grants from the programme. The Draghi recovery plan, which should be approved by the Italian cabinet by the end of this week, involves €30bn of Italian budgetary resources and €191.5bn of loans and grants from the Next Generation EU scheme, people briefed on the plans said. (FT)

ITALY: MNI INTERVIEW: Italy Confident Of Prompt Arrival Of EU Funds

- Italy is confident it will receive funds on time from Europe's EUR750 billion Next Generation EU aid package, though any delays could force additional fiscal measures, Economy Undersecretary Claudio Durigon told MNI. "We are confident that there won't be delays in the disbursement of the funds," said Durigon, speaking in an interview on the same day as Germany's Constitutional Court removed its block on that country's ratification of a key underpinning of NextGenEU - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

GREECE: Greece will ease most key lockdown measures in early May ahead of the country's opening to international tourism in the middle of the month, Prime Minister Kyriakos Mitsotakis said Wednesday. The country's restaurants, bars and cafes can raise their shutters starting May 3 for outdoor dining as part of the easing of measures. The nation's primary and secondary schools will welcome pupils from May 10, and inter-regional movement will be permitted again from May 15 to coincide with the nation's opening to all international visitors, the premier said in a nationally televised address. (BBG)

EQUITIES: Credit Suisse Group AG amassed more than $20 billion of exposure to investments related to Archegos Capital Management, but the bank struggled to monitor them before the fund was forced to liquidate many of its large positions, according to people familiar with the matter. The U.S. family investment firm's bets on a collection of stocks swelled in the lead-up to its March collapse, but parts of the investment bank hadn't fully implemented systems to keep pace with Archegos's fast growth, the people said. (WSJ)

U.S.

FISCAL: The real work of finalizing an infrastructure package that can have widespread Democratic support on Capitol Hill is just beginning as the party must reckon with key differences between progressives and moderates on the scope and cost of the package -- as well as GOP lawmakers offering their own alternative. While progressives are losing patience quickly with any discussion on bipartisanship, Democrats in the middle are still clinging to hopes that they can find consensus. The White House has invited key Republicans for discussions, but still GOP senators are slated to introduce an infrastructure proposal Thursday that is just a sliver of what President Joe Biden has suggested he wants. Republican senators led by Sen. Shelley Moore Capito of West Virginia are slated to introduce at noon ET Thursday a framework of their counter proposal, with a price tag in the neighborhood of $600 billion, focusing on roads, bridges and more traditional infrastructure. (CNN)

FISCAL: MNI BRIEF: Senate GOP Signal Tying Spending Cuts to Debt Limit

- Senate Republicans on Wednesday voted to add language to their own caucus rules to support the idea of one-for-one spending cuts or meaningful structural reforms for raising the debt limit that is currently set to lapse July 31 - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: Democrats are making another push for the Biden administration to include a repeal of the cap on state and local tax deductions in its long-term economic program, a move that would give the write-off a White House seal of approval. Representative Josh Gottheimer, a New Jersey Democrat, sent a letter to Treasury Secretary Janet Yellen Wednesday making a plea to include repeal of the $10,000 cap on the SALT deduction in the administration's proposals to pump trillions of dollars into the economy with spending initiatives in part funded by tax hikes. (BBG)

CORONAVIRUS: President Joe Biden announced a new tax credit Wednesday to reimburse small businesses that give workers paid time off to get vaccinated against Covid-19 as he touted reaching his goal of administering 200 million shots in his first 100 days. The tax credit, which will be funded by the Covid relief bill passed last month, will be available to businesses with fewer than 500 employees, allowing up to $511 a day for each employee. Biden will call on all companies to offer paid time off, regardless of size, and offer other incentives, like gift cards or bonuses, to encourage employees to get vaccinated. As the U.S. reached Biden's goal of administering 200 million shots this week, vaccine supply is starting to outstrip demand in some areas. Even without the supply of Johnson & Johnson vaccine, which is undergoing a safety review, the U.S. has been shipping out more doses than are being used in recent weeks, a senior administration official told reporters on Wednesday. (NBC)

CORONAVIRUS: Almost half of Iowa counties declined some or all of their vaccine allotments for next week because people in the state are delaying or avoiding vaccination, a development that may be linked to federal government's pause in distributing the Johnson & Johnson shot, Iowa Governor Kim Reynolds said. "Vaccine hesitancy is beginning to become a real factor across the country," Reynolds, a Republican, said at a news conference. (BBG)

CORONAVIRUS: Governor Andrew Cuomo said New Yorkers over age 60 will be able to walk into any of the state vaccination sites and get a shot without an appointment starting on Friday. After months of limited vaccine supply, the governor said that New Yorkers now have "no excuse" to not get the vaccine and that residents have a "responsibility" to get a shot. (BBG)

CORONAVIRUS: The U.S. State Department has added at least 116 countries this week to its "Level Four: Do Not Travel" advisory list, putting the UK, Canada, France, Israel, Mexico, Germany and others on the list, citing a "very high level of COVID-19." (RTRS)

MARKETS: U.S. regulators are considering tougher disclosure requirements for investment firms in response to this year's implosion of Archegos Capital Management and trading gyrations in GameStop Corp. Securities and Exchange Commission officials are exploring how to increase transparency for the types of derivative bets that sank Archegos, the family office of billionaire trader Bill Hwang, according to people familiar with the matter. The regulator also faces pressure from Capitol Hill to shed more light on who's shorting public companies after the GameStop frenzy. The review is in its early stages and Gary Gensler, who took over as SEC chairman last week, will decide how to proceed, the people said. A spokesman for Gensler declined to comment. (BBG)

EQUITIES: The collapse of Bill Hwang's Archegos Capital Management in late March took many investors and several banks by surprise when ViacomCBS Inc. and Discovery Inc.'s share prices tumbled. It turns out that some companies were also left wondering why their share prices whipsawed. Executives at online lender LendingClub Corp. and digital streaming service fuboTV Inc. still aren't sure if sudden swings in their stock were from banks unloading billions of dollars in Archegos investments—or if the drop was from something else entirely, according to people familiar with the matter. Archegos had previously told executives at LendingClub and fuboTV that it was a big shareholder, said people familiar with the matter. But without the regular disclosures that investment firms typically make after they build up a sizable stake in a stock, those executives didn't have a way to verify the ownership claim. (WSJ)

OTHER

CORONAVIRUS: Johnson & Johnson's single-shot coronavirus vaccine protected against symptomatic and asymptomatic infection, and prevented hospitalization and death in all participants 28 days after vaccination, according to new clinical trial results published Wednesday. The vaccine was 67 percent effective on average against moderate to severe–critical COVID-19 at least 14 days after administration, and 66 percent effective at 28 days after vaccination, according to data published in the New England Journal of Medicine. The vaccine was about 77 percent effective against severe/critical COVID-19 at 14 days after administration, and 85 percent after 28 days. The results match up to the initial numbers reported by the company in January — the vaccine offers a level of protection above the Food and Drug Administration's (FDA) minimum but lower than the Pfizer and Moderna vaccines. Additional data collected since the announcement in January found no evidence of a decline in protection over time, after following approximately 3,000 participants for 11 weeks and 1,000 participants for 15 weeks, the company said. (The Hill)

CORONAVIRUS: China's Sinopharm said it hasn't found any severe side effects from administering nearly 520,000 doses of its inactivated Covid-19 vaccines, according to a study published in the Chinese Journal of Epidemiology. The side effects it has found include pain at the injection site, fever, fatigue, skin rashes, a lack of appetite and diarrhea. They occur within a week of the vaccination and usually fade in three-to-four days, the study said. But side effects appear to be twice as common among women and men, with an incidence of 1.58% for females and 0.72% for males. The nearly 520,000 doses were given after China granted emergency approval for the two inactivated vaccines last year. Those who received the shots include diplomats, workers, students and custom officials. Working age peopleaged from 19 to 59 years old accounted for 92% of those studied for side effects. (BBG)

CORONAVIRUS: The Biden administration is weighing an appeal from progressive Democrats to accelerate global access to Covid-19 vaccines by supporting a waiver of intellectual-property protections, a move opposed by big drugmakers. Lawmakers led by senators Bernie Sanders and Elizabeth Warren last week called on President Joe Biden to back a proposal before the World Trade Organization that seeks a broad waiver from obligations on the protection of IP rights, including patents, copyrights and trade secrets. (BBG)

GLOBAL TRADE: Ireland will push for a global agreement on corporate taxation which "accommodates" its current low rate and allows "healthy and fair tax competition", the country's finance minister Paschal Donohoe said on Wednesday. The remarks by Donohoe, who chairs the eurogroup of eurozone finance ministers, indicate that Ireland expects to clash with the US over President Joe Biden's ambition to introduce a global minimum corporate tax rate. Biden's proposals, which emerged earlier this month, pledged to "end the race to the bottom over multinational corporate taxation". That left countries with low corporate tax rates, including Ireland, bracing for a struggle. (FT)

GEOPOLITICS: A judge in Canada adjourned the extradition hearing for Huawei Technologies Chief Financial Officer Meng Wanzhou to August. (BBG)

JAPAN: The Japanese government will formally decide Friday to declare coronavirus state of emergency in Tokyo, Osaka, Hyogo and Kyoto prefectures, the Asahi newspaper reports, without attribution. Osaka presented to the government plans to request department stores and cinemas to shut during the emergency and ask eateries to close on weekends, while allowing to open until 8pm during weekdays though alcohol would be banned. Tokyo's plans call for entertainment and amusement establishments such as bars, karaoke parlors, bowling alleys and game arcades be shut; eyes having commercial facilities with floor space of 1,000 square meters or more be closed. While still under discussions, the government considers imposing the emergency from either April 25 or 26 through to May 11 or 16 in Tokyo; emergency in Osaka may be imposed for about 3 to 4 weeks. (BBG)

JAPAN: Tokyo is seeking to reimpose a state of emergency, with the Japanese government expected to announce details Friday, as virus cases surge three months before the capital is set to host the delayed Olympic Games. Tokyo Governor Yuriko Koike made the request to the central government Thursday, she told reporters, adding the extent of restrictions to be introduced was still under discussion. The government will hold a meeting of its virus task force Friday, the Asahi newspaper said, at which the measures are likely to be announced. The western city of Osaka, which has been hit with a record rise in cases, has also asked for the restrictions, while media reports said neighboring Hyogo and Kyoto may also be covered by the new declaration. (BBG)

JAPAN: This year's Tokyo Motor Show will be canceled due to the ongoing pandemic, Japan Automobile Manufacturers Association Chairman Akio Toyoda said. It will be difficult to hold the show, staged every two years in Japan's capital, while seeking to ensure the safety of participants during the pandemic, Toyoda, who is also president of Toyota Motor Corp., told reporters at a briefing for the industry group. "The Tokyo Motor show is being canceled, not delayed," Toyoda said. "It's difficult to hold the event in a way in which many people will be able to experience the appeal of mobility in a safe and secure environment." (BBG)

JAPAN: Japan's health ministry decided after panel discussions Wed. to approve the use of baricitinib, a rheumatoid arthritis treatment from Eli Lilly & Co. and Incyte Corp., in treating Covid-19 patients, public broadcaster NHK reports. The drug will be allowed use in combination with remdesivir on moderate-to-severe adult patients. Would be the third drug to obtain approval for Covid-19 treatment in Japan; other drugs are remdesivir and dexamethasone. (BBG)

BOJ: The Bank of Japan has done everything it can to normalize policy under Governor Haruhiko Kuroda's watch and is now set to ride out the rest of his term without any major changes, according to a former senior central bank official. "The BOJ has reached the end of the line on normalization for now," said Hideo Hayakawa, referring to a series of tweaks to the central bank's stimulus framework in March that enabled it to cut back its asset buying. "Unless the current leadership suddenly says it's gotten policy wrong all this time, it's pretty much done all it can," the former executive director said in an interview, adding that the pandemic has underlined the importance of fiscal policy in helping the economy rather than a monetary approach. (BBG)

AUSTRALIA/CHINA: China will surely respond accordingly if the Australia "continues on the wrong path," the Global Times reported citing Chen Hong, director of the Australian Studies Center at East China Normal University, following the scraping of an agreement for the state of Victoria to cooperate under the Belt and Road Initiative. The move by Australia could further worsen frosty relations and disrupt trade and economic ties, the newspaper said. (MNI)

AUSTRALIA/CHINA: Economic co-dependencies between Australia and China will restrain Chinese policymakers from targeting products such as iron ore that are core to the bilateral trade relationship, even if political and trade frictions between the two countries continue to escalate, says Fitch Ratings. We expect any further punitive trade measures imposed by China to target Australia's smaller export categories. This would reduce the risk of adverse effects on China's labour market or near-term growth prospects, in contrast to targeting products like iron ore – Australia's largest export to China – which are critical inputs for China's industrial development. This suggests that the potential economic spill over to Australia's growth outlook from Chinese trade restrictions would be modest. (BBG)

NEW ZEALAND: New Zealand will guarantee deposits of up to NZ$100,000 per eligible institution as part of new measures to protect New Zealanders' interests in the banking and financial system. "While New Zealand's financial system is sound and well positioned to withstand the stress posed by Covid-19, these reforms ensure the Reserve Bank is better equipped to protect and promote financial stability in the future," Finance Minister Grant Robertson said in a statement Thursday. The reforms will also include a new process for setting lending restrictions, such as loan-to-value ratios, that the government said will give the finance minister a role in determining which types of lending the Reserve Bank is able to directly restrict. (BBG)

ASIA: Singapore and Hong Kong called off an announcement planned for Thursday on an air travel bubble between Asia's two major financial hubs, according to people familiar with the matter, the second time in five months the highly anticipated arrangement appears to have run into obstacles. No reason was immediately provided on why the announcement -- which Bloomberg reported Wednesday was expected as soon as Thursday -- was postponed and a new date has not been set, said the people, who asked not to be identified as they're not authorized to speak publicly. The cancellation was initiated by the Singapore side, one of the people said. Singapore's Ministry of Transport and Hong Kong's Commerce and Economic Development Bureau didn't immediately respond to requests for comment. (BBG)

BOC: The Bank of Canada expects all media organizations to respect the embargo conditions for its key publications. Today, the Bank provided the Monetary Policy Report (MPR) under embargo to trusted media that have signed an undertaking with the Bank. Note that the Bank did not provide embargoed access to the press release that explains the latest monetary policy decisions. One media organization breached the embargo time and published articles on two parts of the MPR: the key inputs to the projection and the section describing the evolution of our balance sheet. We immediately contacted the organization in question and instructed them to provide an account of the circumstances surrounding the breach. In accordance with the Bank's media policy, this organization will not have any further access to Bank embargos, lock-ups or media activities for a prescribed period. (Bank of Canada)

MEXICO: Mexico's lower house of congress on Wednesday approved a reform to the country's hydrocarbon law that removes one of the linchpins to promote private competition against state-run oil company Petroleos Mexicanos. The lower house voted 301 in favor, 147 against and two abstentions to approve the proposal, which eliminates a transitory provision to stimulate competition introduced in 2014 when the market was opened to private companies. The bill will now go to the senate, where a much wider proposal to increase government controls over Mexico's fuel market is also being discussed. The legislation is the latest effort to strengthen Pemex, as Mexico's national oil company is known, a long-sought goal of President Andres Manuel Lopez Obrador.

MEXICO: Mexico vowed to strengthen controls on its southern border amid an increase of migrants who travel through the Latin American country seeking to reach the U.S. The Mexican government will boost personnel acting on the border with Guatemala, President Andres Manuel Lopez Obrador said Wednesday, declining to provide details. The administration wants to ensure the protection of minors and will have a full plan ready in a week, he said, following a meeting with officials from Mexico's southern states of Chiapas, Tabasco and Campeche. "We have to give security to migrants, take care of them, and part of that security is to order the migratory flow so that they don't enter national territory without any protection," Lopez Obrador said in his daily press briefing. "I don't want to give numbers but we will work with more intensity." (BBG)

RUSSIA: The US never expected one set of sanctions to change Russia's behaviour, White House Press Secretary Jen Psaki said on Wednesday. "We have never expected nor have we projected that one set of sanctions or any individual set of sanctions is going to immediately change behaviour," Psaki said during a press briefing when asked if the US administration thinks sanctions against Russia are working. (Sputnik)

RUSSIA: U.S. embassy officials in Moscow met Russian officials on Wednesday to discuss topics that included Russia's response to the latest U.S. sanctions, and the discussions will continue in coming days, the U.S. State Department said. (RTRS)

RUSSIA: Ukraine on Wednesday urged Western allies to show they were prepared to punish Moscow with new sanctions, including kicking Russia out of the global SWIFT payments system, to deter the Kremlin from resorting to more military force against Ukraine. (RTRS)

SOUTH AFRICA: South Africans will be going to the polls for the local government elections on Wednesday, 27 October. The Presidency announced the date in a media statement on Wednesday evening. This will be the sixth time under South Africa's democratic dispensation that voters will elect leadership and public representatives at metropolitan, district and local level. "The Minister of Cooperative Governance and Traditional Affairs will follow the necessary legal process to proclaim the date and undertake other requirements. The President urges eligible – and especially first-time voters – to ensure they are registered to participate in the elections which provide the basis for development and service delivery closest to where citizens live," reads the Presidency statement. The confirmation of the date ends speculation as to whether there would be a postponement of elections as proposed by the EFF. (SABC News)

IRAN: The Biden administration sought to dial back Iranian assessments that the two sides are getting close to an agreement on reviving the 2015 nuclear deal, saying disagreements remain wide on what steps they need to take to come back into compliance. A senior State Department official, speaking to reporters on condition of anonymity, said the two sides are closer to the beginning of negotiations than to the end. The official spoke after a second round of talks in Vienna this past week in which the U.S. and Iran didn't meet directly but negotiated through their European, Russian and Chinese partners. The official's comments appeared intended to counter speculation of an impending deal after Iranian President Hassan Rouhani said the talks are 60%-70% complete and the two sides could soon resuscitate the Joint Comprehensive Plan of Action. (BBG)

IRAN: The Biden administration has signaled it is open to easing sanctions against critical elements of Iran's economy, including oil and finance, helping narrow differences in nuclear talks, according to people familiar with the matter. Despite the progress, senior diplomats warned that weeks of difficult negotiations over the 2015 nuclear agreement lie ahead and progress remains fragile. Talks in Vienna are complicated by domestic politics in Washington and Tehran and by Iran's refusal to meet directly with the U.S. (WSJ)

IRAN: Iran has installed extra advanced centrifuges at its underground uranium enrichment plant at Natanz and plans to add even more, a report by the U.N. atomic watchdog on Wednesday showed, deepening Iran's breaches of its nuclear deal with major powers. (RTRS)

OIL: Iran needs at least three months to flow back its crude in the global oil market as much as it was under the 2015 nuclear deal, former oil minister Rostam Ghasemi said April 21. (Platts)

MIDDLE EAST: The Saudi-led coalition battling Yemen's Houthis has intercepted a drone attack by the Iran-aligned movement on the southern Saudi city of Khamis Mushait, state media said on Thursday. (RTRS)

MIDDLE EAST: The Israeli army struck several rocket batteries in Syria after the neighboring country fired a missile which landed in southern Israel, IDF spokesman Avichay Adraee said in a tweet. The Syrian missile wasn't aiming for a specific target inside Israel, Adraee said. Separately, Syria also confirmed the Israeli attack near Damascus which wounded four soldiers, according to the country's official news agency SANA. Alarms had sounded in Abu Qrenat near Dimona in southern Israel earlier on Thursday, the Jerusalem Post reported. Israel employs an air raid siren system to warn people about incoming rockets or attacks. Residents in central Israel and in Jerusalem reported hearing an explosion, according to the newspaper. (BBG)

CHINA

FISCAL: China will direct CNY2.8 trillion to stabilize the job market, improve livelihoods and support businesses to offset the impact of withdrawing some pandemic stimulus, the State Council said on its website. Provincial governments should direct those funds to local authorities instead of keeping them, and any interception and embezzlement should be severely punished, the government said. (MNI)

GREEN BONDS: China will promote green bonds to help develop green finance and low-carbon projects to achieve carbon-neutral goals, according to a statement on the PBOC website. China will optimize the management model for bond issuance and unify the definition standards of green projects to cut the cost of issuing, trading, and managing green bonds, the PBOC said. (MNI)

OVERNIGHT DATA

CHINA MAR SWIFT GLOBAL PAYMENTS CNY 2.49%; FEB 2.20%

AUSTRALIA Q1 NAB BUSINESS CONFIDENCE 17; Q4 15

The Q1 Business Survey reported further notable business sector improvement. Business conditions and confidence strengthened in the quarter, with both now at +17 index points, well above their long-run averages. All the sub-indices of business conditions improved substantially – profitability, trading and employment are now all well into expansionary territory. According to Alan Oster, NAB Group Chief Economist "The survey suggests that the economic recovery built further momentum in Q1.". "What is particularly welcome is that the improvement is broad-based with conditions and confidence improving in most industries and are at an above-average level in all. Moreover, the lift in trading conditions and profitability over the last two quarters is now being translated into the Survey's employment indicator" said Mr Oster. Capacity utilisation also continued to rise. It increased by almost 2ppts to 82.3% in Q1 and is now above both its historical average and its pre-COVID level. Again, the improvement was broad based with only mining not seeing a gain in the quarter. (NAB)

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS THU; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Thursday. This leaves liquidity unchanged given the maturity of CNY10 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2000% at 09:30 am local time from the close of 2.0815% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 49 on Wednesday vs 36 on Tuesday. A higher index indicates increased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.4902 THU VS 6.5046

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower for the eighth day at 6.4902 on Thursday, compared with the 6.5046 set on Wednesday.

MARKETS

SNAPSHOT: Another Round Of Mildly Defensive Asia-Pac Trade

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 574.98 points at 29079.67

- ASX 200 up 35.717 points at 7033.6

- Shanghai Comp. down 1.704 points at 3471.226

- JGB 10-Yr future up 6 ticks at 151.62, yield down 1.0bp at 0.07%

- Aussie 10-Yr future up 3.5 ticks at 98.345, yield down 3.2bp at 1.7%

- U.S. 10-Yr future +0-06+ at 132-23+, yield down 2.28bp at 1.533%

- WTI crude down $0.30 at $61.05, Gold down $1.55 at $1792.15

- USD/JPY down 13 pips at Y107.94

- JOHNSON & JOHNSON TRIAL SHOWS VACCINE EFFECTIVE, EVEN AGAINST VARIANTS (THE HILL)

- DRAGHI PLANS €220BN OVERHAUL OF ITALY'S ECONOMY (FT)

- UK COVID PASSPORTS TO BE AVAILABLE FOR SUMMER HOLIDAYS (TELEGRAPH)

- GOP SENATORS TO UNVEIL INFRASTRUCTURE FRAMEWORK THURSDAY (CNN)

- U.S. CITES MODEST PROGRESS IN IRAN TALKS, DIALING BACK OPTIMISM (BBG)

- IRAN NUCLEAR DEAL TALKS ADVANCE AS U.S. OFFERS SANCTIONS RELIEF (WSJ)

BOND SUMMARY: Core FI Firms On Several Risk Negative Matters

Core FI nudged a little higher overnight with the U.S. fiscal impasse, suggestions that the U.S.-Iranian talks may not be quite as advanced as some have suggested (per BBG sources), news that a Syrian missile fell near an Israeli nuclear site (triggering a retaliatory attack) & the COVID situation in India all noted in Asia-Pac hours.

- Bulls were not able to overcome technical resistance in T-Notes, in the form of the 50-day EMA, with that contract now 0-01+ off highs, printing +0-06 at 132-23. Meanwhile, cash trade saw the recent low in 10-Year yields hold firm, although that benchmark continues to trade below its 50-DMA (after breaching that metric for the first time since November). Regional participants have seemingly used the uptick to initiate downside plays/hedges, with 20.0K TYM1 131.50/130.50 put spreads lifted on block (after 20.0K TYM1 131.00/130.00 put spreads were lifted on block during Asia-Pac trade earlier this week), and 5.0K FVM1 122.25 puts lifted on screen, although the former may have represented a position rejig.

- JGB futures have latched onto the broader bid in the core FI space, with a continued sprinkling of worry re: the local COVID situation still proving to be a supportive factor. Futures +4 last, back from highs, but more than reversing the modest overnight losses, with the 7-Year zone of the cash curve outperforming, richening by 1.5bp on the day as of typing. 20+-Year swap spreads are tighter once again.

- The bid in U.S. Tsys dragged the Aussie bond space flatter (which may be aided by the A$4.4bn+ round of coupon payments in the ACGB space, paid yesterday), leaving YM -0.5 and XM +3.5. Little to note on the local front, with the RBA delivering the scheduled round of ACGB purchases.

JGBS AUCTION: Japanese MOF sells Y2.7716tn 6-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y2.7716tn 6-Month Bills:- Average Yield -0.1102% (prev. -0.0962%)

- Average Price 100.055 (prev. 100.048)

- High Yield: -0.1082% (prev. -0.0962%)

- Low Price 100.054 (prev. 100.048)

- % Allotted At High Yield: 34.8783% (prev. 61.0235%)

- Bid/Cover: 5.314x (prev. 4.961x)

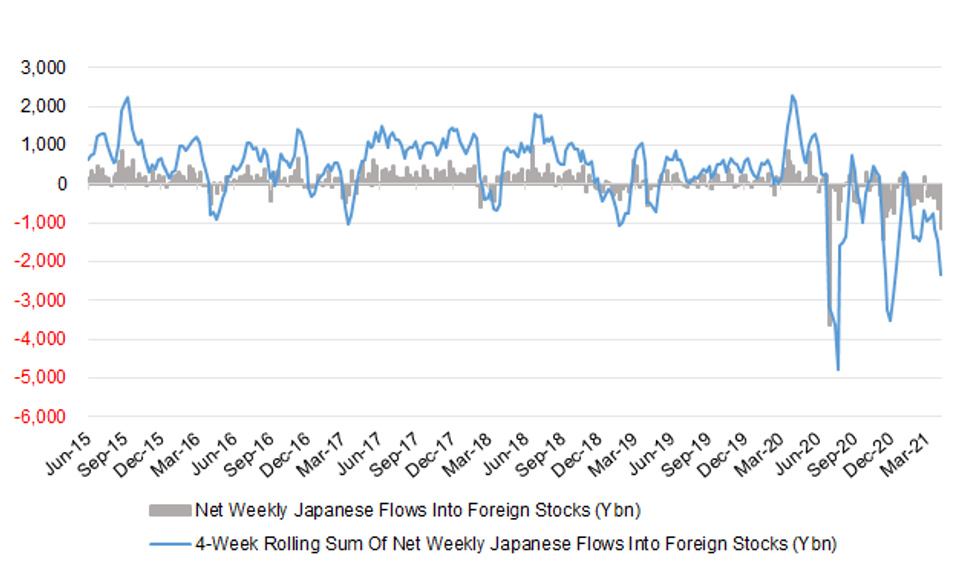

JAPAN: Familiar International Flows Apparent

A quick look at the latest round of weekly Japanese international security flow data revealed that Japanese participants stuck to familiar net flow patterns, i.e. net selling of foreign equities & net buying of foreign bonds, for a fifth consecutive week. While some of this no doubt represents portfolio rebalancing, the net amount of foreign bond purchases exceeds the net amount of foreign equity sales over that time period (to the tune of ~Y1.144tn), which would suggest that some Japanese participants have started to take advantage of the pick ups offered by some of the major offshore global FI markets (we have flagged areas of appeal, in both FX-hedged and -unhedged terms in recent weeks).

- We should also note that the sample week represented the largest weekly round of Japanese net selling of foreign equities witnessed since November.

- On the other side of the ledger, foreign investors remained net buyers of Japanese bonds and equities in the most recent week, although the net buying moderated across both categories.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 906.5 | 1715.5 | 3198.4 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -1145.1 | -622.5 | -2334.5 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 353.2 | 1226.5 | -240.2 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 286.3 | 641.1 | 1052.6 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

EQUITIES: Rebound Following Two-Days Of Declines

Risk sentiment rebounded in Asia-Pac trade on Thursday, taking a positive lead from the US. Markets in Japan lead the way higher, retracing all of yesterday's sharp decline. Markets in mainland China struggled to make significant headway, while Taiwan, South Korea and Antipodean bourses saw modest increases in a quiet session. US futures dipped slightly, markets await the ECB rate announcement while there are reports that Republicans are planning to present their counterproposal to US President Biden's infrastructure plan later today.

OIL: Crude Futures Slip For Third Day

Oil is lower again on Thursday; WTI is down $0.46 from settlement levels at $60.88/bbl, Brent is down $0.46 at $64.86/bbl. Crude futures are on track for a third straight loss.

Oil was pressured yesterday after the a tweet from the WSJ that the US is open to easing sanctions against Iran, while the move was exacerbated by US DOE inventory figures showed the first build in stocks in a month. Headline crude stocks rose 594k against expectations of a 3.265m bbl draw. There are also demand concerns as the coronavirus situation in India worsens, Mumbai and New Delhi have both imposed lockdowns, despite a plea from Indian PM Modi to only use lockdowns as a last resort.

GOLD: $1,800/oz In View

Lower U.S. real yields and a softer DXY (on net) have combined to support bullion over the last 24 hours or so, with bulls now looking to force a break above the $1,800/oz mark to open up the way towards the Feb 25 high at $1,805.7/oz. Spot last deals little changed, just shy of the $1,795/oz mark.

FOREX: Kiwi Goes Offered In Quiet Asia-Pac Trade

NZD helped bring up the rear in G10 basket. Lacklustre news flow made it hard to pin the kiwi's weakness on any fundamental catalyst, but a BBG trader source flagged NZD sales against its Antipodean cousin, with AUD/NZD seemingly forming a base around its 200-DMA.

- The DXY extended yesterday's losses, even as the three e-mini contracts edged lower in Asia. The greenback's weakness may have been related to a slide in USD/CNH, which extended its current losing streak to nine straight days.

- The redback continued to appreciate even as the PBOC set its central USD/CNY mid-point at CNY6.4902, 8 pips above sell-side estimates.

- CAD continued to grind away from yesterday's post-BoC highs in narrow Asia-Pac trade.

- The ECB's latest monetary policy decision and U.S. initial jobless claims provide the main points of note today.

FOREX OPTIONS: Expiries for Apr22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800(E969mln), $1.1900-10(E1.3bln), $1.1975-87(E923mln-EUR puts), $1.2045-50(E558mln-EUR puts)

- USD/JPY: Y108.00-05($1.8bln), Y108.30-40($2.6bln-USD puts), Y108.50-55($505mln), Y108.65-75($801mln-USD puts), Y109.00($693mln), Y109.90-110.00($1.1bln)

- EUR/GBP: Gbp0.8550(E580mln)

- USD/CHF: Chf0.9175($495mln)

- EUR/CHF: Chf1.1050-55(E490mln-EUR puts)

- AUD/USD: $0.7500(A$713mln), $0.7750(A$595mln-AUD puts)

- AUD/JPY: Y83.05-15(A$514mln)

- EUR/AUD: A$1.5525(E443mln-EUR puts)

- NZD/USD: $0.7060(N$917mln-NZD puts), $0.7090(N$942mln-NZD puts)

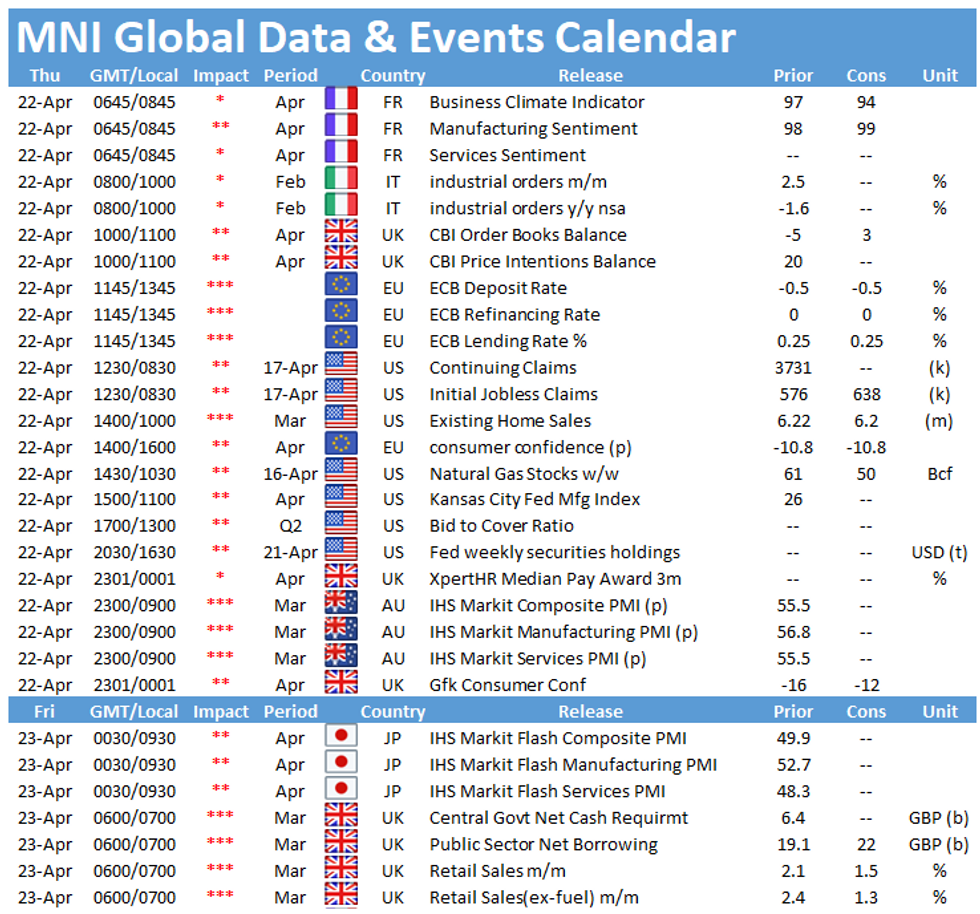

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.