-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: PMIs Round Off The Week

- Participants continue to assess the potential for higher U.S. taxes under President Biden after Thursday's headlines.

- Westpac formally adopted a more upbeat assessment of the Australian economy & lifted their 3-Year ACGB yield forecast.

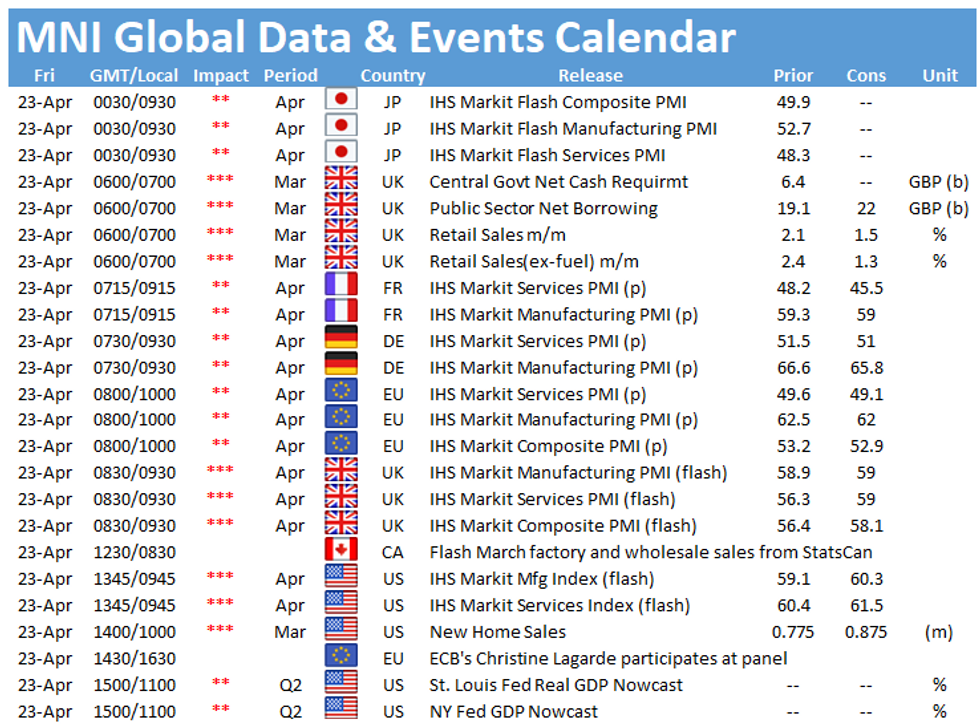

- Flash PMI readings from across the globe headline on Friday.

BOND SUMMARY: Some Light Pressure For Core FI In Asia

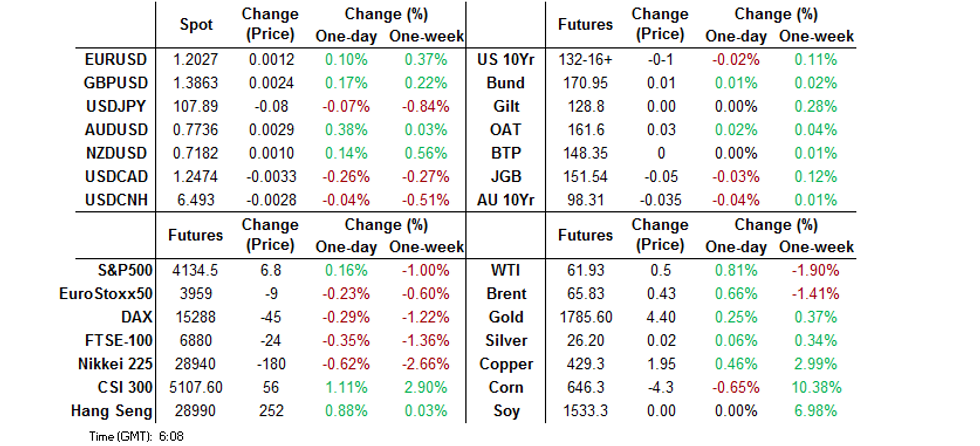

An uptick in e-minis (after Thursday's late U.S. tax-related pressure) and some cheapening in the Aussie bond space applied some light pressure to U.S. Tsys overnight. T-Notes last print -0-01 at 132-16+, 0-02 off lows, operating on a modest ~65K lots. Cash Tsys have seen some bear steepening, with 30s cheapening by ~2.5bp. The flash Eurozone PMI readings headline the broader docket on Friday, with the U.S. equivalents and new home sales data also due to be released on Friday.

- JGBs have had little to go off, with focus on the impending formal declaration of the state of emergency covering Tokyo, Osaka, Kyoto and Hyogo prefectures, which is set to be in play between April 25 & May 11. Futures -5 at typing, with the early uptick more than unwound during the Tokyo afternoon, while yields are little changed across the cash JGB curve. 1- to 10-Year BoJ Rinban operations headline the local docket on Monday.

- A more upbeat assessment of the Australian economy from Westpac's Bill Evans, which was coupled by a call for 3-Year ACGB yields to hit 0.80% come the end of 2022, applied weight to the Aussie bond space. YM -2.0, XM -3.5 at typing. There may have also been some trans-Tasman pressure, with the RBNZ delivering another (expected) cut to its weekly LSAP purchase target. Elsewhere, we found out that next week's AOFM issuance slate is particularly light.

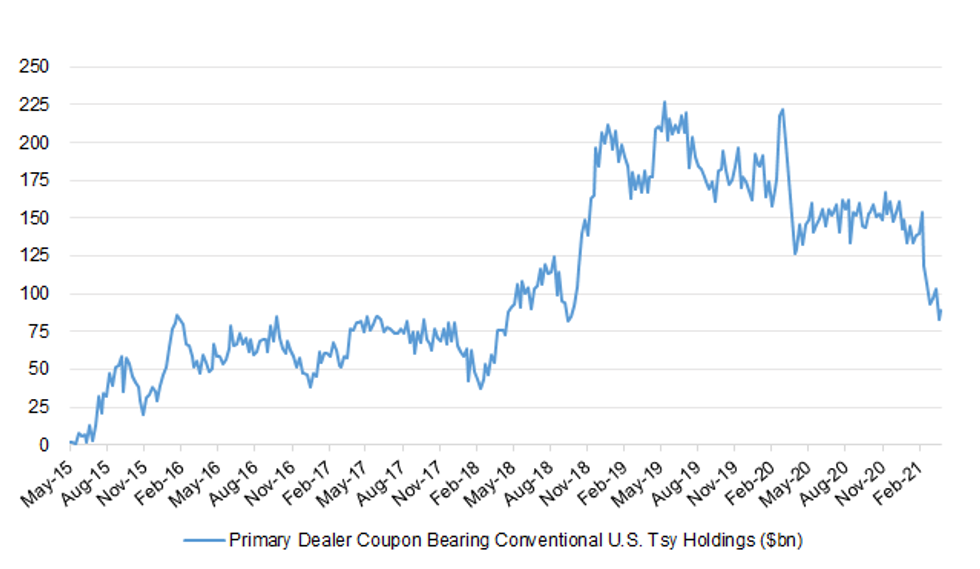

US TSYS: Primary Dealer Holdings Finding A Base?

Cumulative primary dealer holdings of coupon bearing conventional U.S. Tsys ticked higher in the week ending April 14 (rising by $5.961bn), with the 4-week rolling change of the measure now sitting at the most neutral level seen since late February (-$3.763bn), after 3 of the 4 most recent sample weeks saw light growth in primary dealer holdings (although the week previous to the most recent saw their holdings fall by $20.471bn, obviously outweighing the cumulative sum witnessed in the 3 remaining weeks).

Fig. 1: Primary Dealer Coupon Bearing Conventional U.S. Tsy Holdings ($bn)

Source: MNI - Market News/Bloomberg

FOREX: USD Falters As Asia Ends The Week On A Quiet Note

The greenback lost ground in thin Asia-Pac trade, as all three e-mini contracts crept higher, while participants moved on after reports on U.S. Pres Biden's tax plan roiled Wall Street. The DXY seems poised to record its third weekly loss in a row.

- NZD failed to catch a bid alongside its commodity-tied peers, even as there was little in the way of fresh headline flow to undermine the kiwi.

- USD/JPY slipped to a new seven-week low over the Tokyo fix, but clawed back initial losses.

- The PBOC set its central USD/CNY mid-point at CNY6.4934, 2 pips above sell-side estimates. USD/CNH held a familiar range and is set to record its third straight weekly loss.

- Preliminary PMI data from across the U.S. & Europe, U.S. new home sales, UK retail sales, ECB's Survey of Professional Forecasters & comments from ECB Pres Lagarde take focus from here.

FOREX OPTIONS: Expiries for Apr23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1900-05(E714mln), $1.1980-90(E1.2bln-EUR puts)

- GBP/USD: $1.3900(Gbp650mln-GBP puts), $1.4000(Gbp494mln-GBP puts)

- USD/CAD: C$1.2440-50($1.7bln-USD puts), C$1.2500-10($1.2bln-USD puts), C$1.2545-55($575mln), C$1.2580-85($1.3bln-USD puts), C$1.2600-10($786mln)

- USD/CNY: Cny6.65($630mln)

ASIA FX: Mixed Outcomes

A session of mixed outcomes for EM FX, the greenback dipped slightly in Asia but still holds most of its gains sustained post-Biden tax plan yesterday.

- CNH: Offshore yuan is slightly stronger, having given back some earlier gains. China's SAFE was on the wires saying China has conditions to keep forex market balanced.

- SGD: Singapore dollar slightly stronger, Singapore has tightened its borders with India after the country reported a global record of daily COVID-19 cases as the latest wave of the pandemic worsens

- TWD: Taiwan dollar hovers around neutral levels after rising yesterday. Markets await industrial production and money supply data later in the session. The March figure is expected to rise 9.7%, after a 2.96% rise in February

- KRW: The won is weaker, on track for a weekly decline as virus cases continue to rise. South Korea reported 797 daily new virus cases today, nearing 800 as growing untraceable cases, coupled with cluster infections, continued to hamper the country's virus fight

- MYR: Ringgit is stronger. Malaysian CPI report comes out later today. BBG consensus forecast is for consumer price inflation to pick up to +1.6% Y/Y in Mar from 1.1% recorded in Feb. Estimates range from +1.0% to +2.1%.

- IDR: Rupiah is weaker, but on track for a weekly gain. FinMin Indrawati reaffirmed the gov't's 2021 GDP forecast of +4.5%-5.3% Y/Y, anticipating a rebound in consumption starting this quarter, owing to the gov't's stimulus measures & confidence in vaccine roll-out, while Indonesia has extended the travel ban during Ramadan & Eid al-Fitr through May 24, while tightening movement restrictions.

- PHP: The peso is stronger. The national Covid-19 task force suggested that the impact of vaccinations will be seen by Oct/Nov, once residents of densely populated areas become inoculated.

- THB: Baht is weaker. Data earlier in the session showed exports rose 8.47% against -1.5% expected, the trade surplus printed $710.8m, slightly less than expected as imports also jumped.

ASIA RATES: Coronavirus Concerns Across Asia Weigh

Coronavirus concerns across Asia weigh, price action mixed.

- INDIA: Bonds under pressure. The coronavirus situation continues to deteriorate, Indian PM Modi is due to hold meetings with stakeholders and officials to review conditions. Several countries have now banned visitors from India, Singapore the latest. The main focus of the MPC minutes was the COVID resurgence and concomitant growth risks, with members downplaying input-cost driven inflation risks and emphasizing the need to continue the accommodative policy mix until the nascent growth recovery gathers momentum. There was a discussion of options to expand the GSAP. Markets await auction results and the RBI's reverse repos.

- SOUTH KOREA: Bonds lower after earlier being in positive territory. markets still waiting on the linker auction. The coronavirus situation continues to worsen. South Korea reported 797 daily new virus cases today, nearing 800 as growing untraceable cases, coupled with cluster infections, continued to hamper the country's virus fight against the pandemic. Officials have said they are preparing to import J&J's Covid-19 vaccine as scheduled after the inoculation was approved for use by the EU drug regulator, saying benefits outweighed risks. There is no timetable for the import, but it was previously announced South Korea would take 6m doses from Q2.

- CHINA: Futures lower alongside regional bonds as mainland Chinese equity markets rise. China's SAFE was on the wires saying foreign holdings of Chinese bonds is expected to rise, and that China's economy facilitates this. There were also reports that the PBOC may expand liquidity in May to fill in a gap of CNY1 trillion due to the upcoming local government special bond issuances and tax remissions, most likely via MLF. Corporate bond spreads hit their tightest levels since mid-March. Some of the panic around Huarong is receding, while the chairman of the Shanxi State-owned Capital Operation said government in Shanxi province, China's top coal-producing region, won't allow any debt defaults by local SOE's.

- INDONESIA: Yields higher across a curve, bear steepening seen. FinMin Indrawati reaffirmed the gov't's 2021 GDP forecast of +4.5%-5.3% Y/Y, anticipating a rebound in consumption starting this quarter, owing to the gov't's stimulus measures & confidence in vaccine roll-out, while Indonesia has extended the travel ban during Ramadan & Eid al-Fitr through May 24, while tightening movement restrictions. Elsewhere, there were reports that the government is considering a sale of Samurai bonds as early as May. The finance ministry announced it would attempt to sell IDR 30tn of debt next week.

EQUITIES: Mixed After Negative Lead From US

A mixed session for equity indices in the Asia-Pac time zone. Markets in Japan lead the way lower, joined by Singapore and several EM bourses. Markets in Hong Kong and mainland China lead the way higher with gains of around 1%. US markets finished in the red after being riled by US President Biden unveiling of his tax plan which contained a provision to tax high earners 43.4% capital gains. Futures are higher though, the boosted by positive after-hours earnings. Intel are likely to weigh though after reporting a drop in gross profit margin.

GOLD: Pulling Back From $1,800/oz

Spot deals little changed, hovering around $1,785/oz, with Thursday's uptick in the DXY resulting in a pullback from recent highs for bullion. There is little to really flag up on the U.S. yield front, while ETF holdings of gold remain little changed.

OIL: Crude Futures Gain, On Track For Weekly Loss

Oil has eked out a small gain, but is off best levels seen shortly after the Asia-Pac open. WTI & Brent trade ~$0.40 higher into European hours. Despite the small bounce today and yesterday crude is still on track for a weekly decline. A resurgence in virus cases and mixed signals over demand. Yesterday there were reports that Libya's Sirte Oil could have to cut up to 100k bpd of output this week due to its financial situation. Elsewhere there were Reuters reports that OPEC Secretary-General Barkindo told members of the cooperative they could be fined and have assets seized if the US. adopts legislation that authorizes antitrust enforcement against countries in the bloc.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.