-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Aus CPI Disappoints, FOMC Eyed

EXECUTIVE SUMMARY

- BIDEN PLANS TO ASK CONGRESS TO PAY FOR $1.8 TRILLION IN NEW SPENDING (AXIOS)

- BIDEN TO OMIT ESTATE-TAX EXPANSION FROM COMING ECONOMIC PLAN (BBG)

- EU THREATENS FINES AND MERGER BANS FOR CHINESE STATE FIRMS (BBG)

- ANALYSTS: YUAN MORE LIKELY TO SEE TWO-WAY TRADE IN '21 (CSJ)

- MACKLEM: BOC WILL SUPPORT ECONOMY THROUGH ENTIRE RECOVERY (MNI)

- RBNZ TO PROVIDE ADVICE ON MORTGAGE RESTRICTIONS IN LATE MAY (INTEREST NZ)

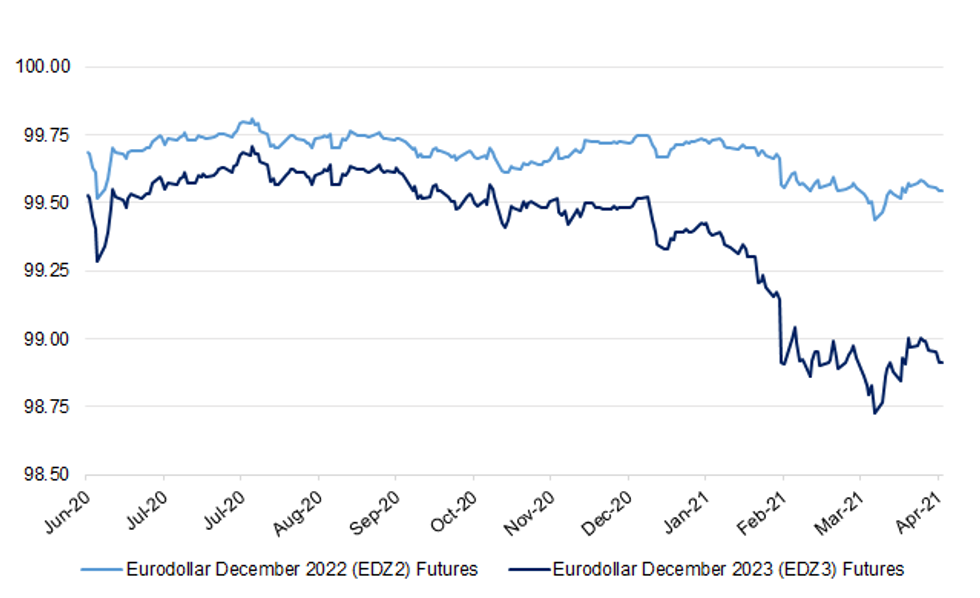

Fig. 1: Eurodollar December 2022 & December 2023 (EDZ2 & EDZ3) Futures

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Spain has confirmed for the first time it will welcome Brits back to its beaches in June. UK holidaymakers are to be allowed to travel there with a digital health pass following discussions between the two governments. Spanish tourism minister Fernando Valdes Verelst said: "June will be the start of the recovery of tourism in Spain. "By then, we will have a digital vaccination certificate in place and we will be able to reopen our borders." (The Sun)

BREXIT: Solutions can be found to the outstanding issues around trade in Northern Ireland post-Brexit, Ireland's Foreign Affairs Minister said. "The Protocol is the only solution to the problems created by Brexit for the island of Ireland and we firmly support ongoing contacts between EU and UK on its implementation," Mr Coveney told an Irish parliamentary committee. (Belfast News Letter)

NORTHERN IRELAND: Northern Ireland first minister Arlene Foster is facing a revolt against her leadership of the Democratic Unionist party amid problems in the region with Brexit and calls for a border poll. Two people close to the DUP told the Financial Times they had knowledge of a letter signed by its representatives in Stormont and Westminster calling for the first party leadership contest in its 40-year history. One senior DUP figure said it was "inevitable" that an annual vote to confirm the leader would be held "in the next two to three weeks". The vote is usually a formality held at the party's annual conference in September. (FT)

EUROPE

GREECE/RATINGS: It is "quite likely" that Greece's credit rating will be raised again in the next 12 months, one of S&P Global's top analysts has said, although the prospect of regaining a coveted investment grade score remains some way off. Greece, the trigger point of the euro zone debt crisis a decade ago, had its rating lifted to within two notches of investment grade on Friday despite COVID having pushed its debt-to-GDP ratio above 200%. It follows a string of upgrades in the last few years as fears the country could quit the euro have eased and extensive support from other euro zone governments, the IMF and the European Central Bank have reduced financing pressures. (RTRS)

FINLAND: Finland's five-party cabinet remained in a limbo after seven days of efforts to bridge differences over spending produced no deal. The government of the Nordic region's only euro member has teetered on the edge of collapse since the weekend, with Social Democrat Prime Minister Sanna Marin offering various compromise proposals that one of its key partners, the Center Party, continued to reject. By noon on Tuesday, the party signaled it was losing faith in the coalition's credibility. (BBG)

U.S.

FED: Federal Reserve Chairman Jerome Powell is a heavy favorite on Wall Street to be renominated for a second term by President Joe Biden even while there are substantial disagreements with the some aspects of Fed policy. The CNBC Fed Survey for April finds 76% of respondents believe President Joe Biden will choose Powell again. Nominated to be chair by President Donald Trump, Powell began his first four-year term in 2018. It ends in early 2022 and presidents have typically unveiled their choices in the summer or fall before the chair's term expires. (CNBC)

FISCAL: Top White House officials have quietly been meeting — on the Hill and over the phone — with Republican senators who drafted a counterproposal to President Biden's infrastructure plan, multiple sources tell Axios. The GOP senators say they're optimistic the Biden administration is open to concessions and can reach a compromise. They've been heartened by their talks with White House Chief of Staff Ron Klain, counselor to the president Steve Ricchetti and legislative affairs director Louisa Terrell.

FISCAL: In April 2011 Barack Obama invoked the support of Warren Buffett, the billionaire investor, to try to persuade Congress to impose a minimum 30 per cent tax on Americans earning more than $1m per year. A wall of Republican opposition and scepticism from some moderate Democrats scuttled his effort. Ten years later, Joe Biden is pursuing his own version of that mission with a plan for even more aggressive tax increases on the well-paid to help fund more than $1.5tn in spending on healthcare and education spanning a decade. But tax lobbyists caution that the Democratic US president faces another uphill climb, putting the plan at risk of being watered down as lawmakers wrestle with it in the months to come. One stumbling block is likely to be Democrats from affluent districts including suburbs in New York, New Jersey, California and Illinois, on top of the predictable Republican opposition. "Democrats have come to be reliant and responsive to a relatively wealthy base of support. So over-reach could expose them to political attacks and economic woes, which can alienate those voters," Mac Campbell, a former Democratic congressional aide and senior vice-president at Lincoln Policy Group, a lobbying firm, said. (FT)

FISCAL: President Joe Biden and his economic team are planning to forgo an expansion of the estate tax in the administration's coming individual tax-hike proposals, according to people briefed on the plan. Biden during the 2020 campaign pledged to increase the estate tax, along with raising rates on capital gains and corporate income, as part of an effort to force companies and the wealthy to pay a greater share of federal revenue. But the estate-tax boost won't be part of the funding measures in the "American Families Plan" the president will unveil Wednesday, the people said, asking not to be named as the plan isn't yet public. Included in the plan is a near doubling in the capital-gains rate for the wealthy, Bloomberg has reported. The White House decided that that move was dramatic enough that the estate-tax hike could be excluded, according to people familiar with the discussions. (BBG)

FISCAL: President Biden plans to ask Congress to pay for the entirety of the $1.8 trillion in new spending on health care, child care and education he'll unveil on Wednesday night, people familiar with the matter tell Axios. (Axios)

FISCAL: The Biden administration rolled out new programs Tuesday to bolster the U.S. power grid, framing them as part of its effort to fight climate change through infrastructure improvements needed to expand use of alternative energy. The core initiatives provide more than $8 billion of Energy Department financing for new high-voltage transmission lines. In addition, the White House said it was issuing new guidance to states on how to remove obstacles to construction of new power lines along highways, railroads and other rights of way. (WSJ)

FISCAL: Americans broadly back the big-ticket spending proposals that have defined President Joe Biden's first 100 days in office, a variety of recent polls show. Surveys show many more Americans approve than disapprove of the $1.9 trillion coronavirus relief bill Biden signed into law in March — by far his most significant legislative victory to date. (CNBC)

CORONAVIRUS: "Next week, I'll be laying out the path ahead to continue our fight against COVID-19, to get us to July 4th," Biden said outside the White House. "This is our target date to get life in America closer to normal and begin to celebrate our independence from the virus together with our friends and our loved ones as we celebrate Independence Day." (U.S. News & World Report)

CORONAVIRUS: The Centers for Disease Control and Prevention revised its public health guidance Tuesday, saying fully vaccinated people can exercise and attend small gatherings outdoors without wearing a face mask. People two weeks removed from their last vaccine can exercise alone or with other household members outside without a face covering, the CDC said. They can also meet outdoors with a small group of other fully vaccinated people, or a mixture of fully vaccinated and unvaccinated people, the agency added. The guidance did not say what counts as a small gathering. (CNBC)

CORONAVIRUS: A group of Republican lawmakers in the U.S. with backgrounds as medical professionals launched a public service campaign to encourage people to get vaccinations as polls show a substantial minority of their party supporters are resisting getting the shot. Wyoming Senator John Barrasso, a physician, said that vaccine hesitancy in his home state is one of the reasons that he wanted to take part in the campaign, which was initiated by Senator Roger Marshall of Kansas, who is also a medical doctor. "You want to get kind of blanket immunity. You want to have enough people to have had vaccinations, and they're not perfect but they're pretty darn good," Barrasso said in an interview. "And that's the way out of it." (BBG)

CORONAVIRUS: New York Governor Andrew Cuomo will open all state-run mass vaccination sites to walk-ins on Thursday, removing the barrier to make an appointment ahead of time for adults age 16 and over. Cuomo said the change comes as demand for the vaccine has dropped. "We were doing 175,000 vaccines statewide every 24 hours; that number is down to about 115,000 vaccines every 24 hours," he said during a briefing Tuesday. Nearly 46% of New Yorkers have received at least one dose of the vaccine, compared with the U.S. average of 42.5%, according to the Bloomberg Vaccine Tracker. (BBG)

CORONAVIRUS: County leaders in suburban Houston have decided to shut a mass-vaccination hub due to dwindling demand. The site at a high school football stadium in the Houston suburb of Shenandoah may close as soon as mid-June, Jason Millsaps, executive director of the Montgomery County Office of Emergency Management and Homeland Security, told the Houston Chronicle. The decision comes a week after the Texas port city of Galveston announced it'll shutter its mass-vaccination center on May 1 amid dropping demand and the expanding availability of shots from alternative sources (BBG)

MARKETS: The U.S. securities regulator is considering new guidance to rein in growth projections made by listed blank-check companies, and clarify when they qualify for certain legal protections, according to three people with knowledge of the discussions. (RTRS)

MARKETS: A FOX reporter tweeted the following on Wednesday: "Banks strengthen oversight of family offices following Archegos fiasco, investigate leverage of family office clients but found Bill Hwang's risk profile is largely an outlier. They believe SEC likely to announce new rules on family office risk." (MNI)

OTHER

EU/CHINA: The European Commission is seeking powers to levy fines or block deals by foreign state-owned companies in a thinly veiled response to the growing economic threat posed by China. The proposed new rules, obtained by Bloomberg, don't mention China directly but try to answer complaints from European businesses that the nation's firms get support they can't match. (BBG)

CORONAVIRUS: The White House is considering options for maximizing global production and supply of COVID-19 vaccines at the lowest cost, including backing a proposed waiver of intellectual property rights, but no decision has been made, press secretary Jen Psaki said on Tuesday. (RTRS)

CORONAVIRUS: U.S. Trade Representative Katherine Tai discussed increasing COVID-19 vaccine production in a virtual meeting on Tuesday with an executive with drugmaker Novavax, Tai's office said in a statement. Tai and Novavax Executive Vice President John Trizzino also discussed a proposal before the World Trade Organization to waive certain intellectual property rights in response to the coronavirus pandemic, the USTR statement said. "Ambassador Tai sought Mr. Trizzino's views on steps Novavax is taking to quickly increase equitable production and distribution of vaccines in the United States and around the world," the statement said. (RTRS)

CORONAVIRUS: President Joe Biden said he intends to send vaccines from the U.S. to India as the country battles the worst coronavirus surge in the world, but did not specify timing for a decision or shipments. Biden said Tuesday that in a call with Indian Prime Minister Narendra Modi, he discussed "when we'll be able to send actual vaccines to India, which is my intention to do." In the meantime, the U.S. is providing aid including the therapeutic drug remdisivir and machinery for vaccine manufacturing, Biden said. (BBG)

CORONAVIRUS: The U.S. is moving to assert greater influence over a scientific investigation led by the World Health Organization into the origins of Covid-19, with plans to submit recommendations to the agency for a new phase of studies. Experts from the Department of Health and Human Services, the Department of State, the Agriculture Department and five other federal agencies are developing recommendations to be submitted to the WHO for its planned second phase of the inquiry into how the new coronavirus started spreading, State Department officials said. (WSJ)

CORONAVIRUS: An technical advisory group at the World Health Organization is assessing Covid-19 vaccines from China's Sinopharm and Sinovac Biotech and expects to reach a decision for the shots shortly, WHO assistant director-general Mariângela Simão said at an online briefing on Monday. A decision on the Sinopharm shot will be reached by the end of this week, while Sinovac's will take until the end of next week. The WHO is will also Friday to assess the Moderna's vaccine, she added. (BBG)

CORONAVIRUS: Russia protested a decision by Brazilian health regulators to block imports of the Sputnik V vaccine, citing a "lack of consistent and reliable data" on the shot's safety, quality and efficacy. (BBG)

JAPAN: The Japanese government is considering raising the cap of subsidies it pays to large commercial facilities cooperating to shut during the coronavirus state of emergency, broadcaster TV Asahi reports, without attribution. The government plans to raise the limit, currently at 200,000 yen/day, by several hundred thousand yen depending on the size of facilities; number of tenants will be considered for shopping facilities and number of screens for cinemas. (BBG)

JAPAN: The Japanese government is planning to use Moderna vaccine, pending approval, in inoculating the public at planned large-scale vaccination sites in Tokyo and Osaka, broadcaster NHK reports, without attribution. Kyodo separately reported that a health ministry panel will make a decision on Moderna vaccine approval as soon as May 20. (BBG)

AUSTRALIA: Payroll jobs fell by 1.8 per cent in the fortnight to 10 April 2021, compared with an increase of 0.2 per cent in the previous fortnight, according to figures released by the Australian Bureau of Statistics (ABS) today. The latest fortnight included the Easter holiday period which regularly sees a seasonal fall in a range of labour market indicators, especially hours worked. These seasonal factors make it difficult to gauge any effect of the end of the JobKeeper wage subsidy on 28 March. The next fortnight of data (available on 11 May) should provide a better sense of the state of the labour market after JobKeeper. Comparisons with the same fortnight a year ago are also difficult, as nationwide pandemic restrictions were in place. (ABS)

RBNZ: The wait continues for those interested in whether or not the Reserve Bank (RBNZ) will go further to restrict bank mortgage lending. The RBNZ plans to respond in late-May to the Government's request for more information on restricting interest-only mortgages and lending to people seeking large mortgages compared to their incomes. Some observers may have expected the RBNZ to release this advice at the same time it publishes its biannual Financial Stability Report on May 5, to effectively kill two birds with one stone. But, the RBNZ told interest.co.nz: "We will be providing advice on policy options for responding to the Government's section 68B direction on housing-related matters late next month. "This will be released separately to the publication of the May Financial Stability Report." (Interest NZ)

ASIA: Economic growth in developing Asia is set to rebound to 7.3% this year, supported by a healthy global recovery and early progress on coronavirus disease (COVID-19) vaccines, according to a new report from the Asian Development Bank (ADB). (ADB)

BOC: MNI BRIEF: Macklem: BOC Will Support Economy Through Entire Recovery

- Bank of Canada Governor Tiff Macklem told lawmakers Tuesday he will support the economy through the entire rebound from the pandemic and look through a temporary pick-up in inflation, a week after the BOC shifted forward its timing for withdrawing monetary support. "This economy still has some ways to go," Macklem said. "We have seen impressive resilience of this economy" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

MEXICO: Mexico's highest electoral court ruled Tuesday that President Andrés Manuel López Obrador's Morena party has to remove two state governorship candidates from ballots and choose replacements to run in the June 6 elections. One of the candidates, Félix Salgado, was accused of rape, but has not been charged. Despite the accusations, López Obrador has supported Salgado's right to run in the Guerrero state governor's race, angering women's groups. However, that was not why the court ruled the candidacies invalid. Instead, the Federal Electoral Tribunal ruled that both candidates violated electoral rules because they did not report how much they spent in primary races. (BBG)

BRAZIL: Brazil's senate has opened a wide-ranging probe into the federal government's erratic response to the coronavirus pandemic, as opponents of President Jair Bolsonaro try to seize on a key source of vulnerability ahead of his 2022 re-election bid. The 11-member parliamentary inquiry committee started working on Tuesday by electing centrist Senator Omar Aziz as its president, who then appointed Renan Calheiros as its rapporteur. Calheiros, a powerful political enemy of Bolsonaro, has been warming ties with former President Luiz Inacio Lula da Silva, now a likely contender in next year's election. While senators are also expected to investigate alleged misuse of federal Covid funds by states and municipalities, it's Bolsonaro who stands to lose the most. The probe is the latest and possibly the most politically damaging push yet to hold the far-right president accountable for one of the world's worst coronavirus outbreaks, and follows dozens of impeachment requests already filed against him. (BBG)

BRAZIL: Bruno Funchal to be the new Special Finance Secretary, replacing Waldery Rodrigues, who will be special advisor to Minister Paulo Guedes, Guedes told journalists in Brasilia. Changes are aimed at easing dialogue with Congress, Guedes said "There is no personal problem with anyone, there was no political pressure." Under an almost inhumane pressure, Guedes said. Jeferson Bittencourt takes over as Treasury Secretary, replacing Funchal. Ariosto Culau becomes Budget Secretary, the Ministry said in a note. Isaias Coelho replaces Vanessa Canado as Minister's special Advisor. Guedes admitted making unfortunate remarks on China this Tuesday. Foreign Minister Carlos Franca is expected to talk to China to undo the misunderstanding, Guedes said. Minister also said that formal job creation numbers that will be released on Wednesday are likely to show improvement. (BBG)

RUSSIA: U.S. Secretary of State Blinken U.S.-Russia talking on timing of Biden-Putin meeting. (BBG)

IRAN: World powers and Iran sought on Tuesday to speed up efforts to bring Washington and Tehran back into compliance with the 2015 nuclear accord, as the United States reassured its Gulf Arab allies on the status of the talks. Iran, Britain, China, France, Germany and Russia began a third round of meetings in Vienna to agree steps that would be needed if the agreement, which was abandoned by then-U.S. President Donald Trump in 2018, is to be revived. The main differences are over what sanctions the United States will need to remove, what steps Iran will need to take to resume its obligations to curb its nuclear programme, and how to sequence this process to satisfy both sides. (RTRS)

IRAN: He stated that he believes that all sides are on the right track, yet "there are still challenges and difficult details." He elaborated, "The more we enter into details, the more time is needed for discussions. I cannot say when this round of talks will end, but I hope we'll get to a more specific point before going back to capitals." He also stated that at the meeting, it was decided to set up a third expert group called the "executive arrangements expert group" to discuss practical arrangements needed to implement the process of lifting of sanctions and then the return of the United States to the JCPOA. "The first and second expert groups (removal of sanctions, and nuclear issues) will start their work today and will prepare the drafts. But the 3rd expert group on practical arrangements will still need to discuss broader issues like verification," Iran's top negotiator said. (Tehran Times)

IRAN: For the second time in a month, vessels from Iran and the United States came dangerously close in the Persian Gulf on Monday night, the Navy said on Tuesday, escalating tensions between the two nations as their negotiators have resumed talks toward renewing the 2015 nuclear deal. (New York Times)

SAUDI ARABIA: Saudi Arabian Crown Prince Mohammed bin Salman said in remarks aired on Tuesday that the United States was a strategic partner and that Riyadh had only a few differences with the Biden administration which it was working to resolve. (RTRS)

METALS: China steelmakers to boost iron ore exploitation to curb prices. (BBG)

OIL: The global oil market "is on the one hand positive, we see a recovery of demand and higher global GDP estimates," Russia's Deputy Prime Minister Alexander Novak told Rossiya 24 television after the OPEC+ committee's conference call. Nevertheless, the group must keep monitoring the coronavirus situation across many regions, including Asia, he added. "We see that some countries record higher coronavirus numbers, like in India and Latin America, which raises some concerns about further growth of demand," Novak said. (BBG)

OIL: Saudi Arabia's crown prince said the kingdom is in talks to sell off a 1% stake in state oil giant Saudi Aramco to a "leading global energy company" as he forecast a rebounding economy in the aftermath of the coronavirus pandemic. The kingdom is looking at the potential sale -- which could be worth about $19 billion -- as a way to lock in customer demand for the country's crude, Crown Prince Mohammed Bin Salman said in a rare interview on a Saudi television channel late Tuesday. While providing few details on which company is involved in the talks, he said the sale could take place in the next two years. "I don't want to give any promises about deals finalizing, but there are discussions happening right now about a 1% acquisition by one of the leading energy companies in the world," Prince Mohammed, the country's de facto ruler, said. (BBG)

CHINA

YUAN: The Chinese yuan may fluctuate in both directions after gaining nearly 1,000 bps against the U.S. dollar in the past month as market views on the dollar index diverge, the China Securities Journal reported. Some observers see the dollar index weakening as supporting factors such as U.S. bond yield gains and the short-term impact of fiscal stimulus fade, while some believe the dollar will strengthen from mid-Q2 as the U.S. economic recovery outpaces Europe and Japan, the newspaper said. The yuan may still be supported by China's steady recovery and booming exports as overseas supply could still be interrupted by the resurgence of Covid-19, the Journal said. (MNI)

BONDS: MNI INTERVIEW: PBOC Should Boost CGB Liquidity-FinMin Advisor

- The People's Bank of China should increase holdings of China Government Bonds to help fill out the yield curve and make the securities more liquid, a former member of the central bank's monetary policy committee and current advisor to the Ministry of Finance told MNI, adding that public borrowing should also be rebalanced toward more short-term debt - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

DEBT: MNI INTERVIEW: China Must Stem Household Debt Surge-Advisor

- China must act against an alarming rise in household debt but still avoid a painful house price crash, a former People's Bank of China monetary policy advisor told MNI, pointing to a property tax, continued tight controls on mortgage lending, and boosting the home rental market as policy options - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: The number of people travelling in China during the May 1-5 Labor Day holiday may reach a record 250 million, as hotel, airline and scenic site bookings have significantly exceeded the same period in 2019, Caixin reported citing data from the Ministry of Public Security. The online booking of plane tickets increased by 20-30% relative to 2019, before the pandemic, said Caixin. Long-distance travel has surged as pandemic restrictions have been lifted and organized tours promoted, Caixin said. (MNI)

ECONOMY: Gross domestic product (GDP) in the People's Republic of China (PRC) is forecast to surge this year despite persistent uncertainties over the coronavirus disease (COVID-19) pandemic, according to a new report by the Asian Development Bank (ADB) released today. (ADB)

BANKING: China's top banking regulator intends to guide banks to portion more loans, particularly long-term lending, to manufacturers, the Shanghai Securities News reported citing the China Banking and Insurance Regulatory Commission. The CBIRC also encourages banks to negotiate independently with small manufacturers to extend their loan repayment period. National commercial banks are encouraged to write off non-performing loans in the manufacturing sector, the newspaper said. (MNI)

OVERNIGHT DATA

JAPAN MAR RETAIL SALES +5.2% Y/Y; MEDIAN +4.7%; FEB -1.5%

JAPAN MAR RETAIL SALES +1.2% M/M; MEDIAN +0.6%; FEB +3.1%

JAPAN MAR DEPT STORE, SUPERMARKET SALES +3.0% Y/Y; MEDIAN +5.2%; FEB -4.8%

AUSTRALIA Q1 CPI +1.1% Y/Y; MEDIAN +1.4%; Q4 +0.9%

AUSTRALIA Q1 CPI +0.6% Q/Q; MEDIAN +0.9%; Q4 +0.9%

AUSTRALIA Q1 CPI TRIMMED MEAN +1.1% Y/Y; MEDIAN +1.2%; Q4 +1.2%

AUSTRALIA Q1 CPI TRIMMED MEAN +0.3% Q/Q; MEDIAN +0.5%; Q4 +0.4%

AUSTRALIA Q1 CPI WEIGHTED MEDIAN +1.3% Y/Y; MEDIAN +1.3%; Q4 +1.3%

AUSTRALIA Q1 CPI WEIGHTED MEDIAN +0.4% Q/Q; MEDIAN +0.5%; Q4 +0.5%

AUSTRALIA MAR, P TRADE BALANCE +A$8.496BN; FEB +A$7.529BN

AUSTRALIA MAR, P EXPORTS +15% M/M; FEB -1%

AUSTRALIA MAR, P IMPORTS +15% M/M; FEB +5%

SOUTH KOREA APR CONSUMER CONFIDENCE 102.2; MAR 100.5

UK APR BRC SHOP PRICE INDEX -1.3% Y/Y; MAR -2.4%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS WEDS; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Wednesday. This leaves liquidity unchanged given the maturity of CNY10 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.2000% at 09:35 am local time from the close of 2.2087% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 37 on Tuesday, flat from the close of Monday. A higher index indicates increased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.4853 WEDS VS 6.4924

People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4853 on Wednesday, compared with the 6.4924 set on Tuesday.

MARKETS

SNAPSHOT: Aus CPI Disappoints, FOMC Eyed

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 98.25 points at 29090.14

- ASX 200 up 31.869 points at 7065.7

- Shanghai Comp. down 1.516 points at 3441.095

- JGB 10-Yr future down 9 ticks at 151.36, yield up 0.5bp at 0.090%

- Aussie 10-Yr future up 1.0 tick at 98.315, yield down 1.2bp at 1.725%

- U.S. 10-Yr future -0-01+ at 131-31+, yield up 0.71bp at 1.629%

- WTI crude down $0 at $62.94, Gold down $5.12 at $1771.48

- USD/JPY up 14 pips at Y108.84

- BIDEN PLANS TO ASK CONGRESS TO PAY FOR $1.8 TRILLION IN NEW SPENDING (AXIOS)

- BIDEN TO OMIT ESTATE-TAX EXPANSION FROM COMING ECONOMIC PLAN (BBG)

- EU THREATENS FINES AND MERGER BANS FOR CHINESE STATE FIRMS (BBG)

- ANALYSTS: YUAN MORE LIKELY TO SEE TWO-WAY TRADE IN '21 (CSJ)

- MACKLEM: BOC WILL SUPPORT ECONOMY THROUGH ENTIRE RECOVERY (MNI)

- RBNZ TO PROVIDE ADVICE ON MORTGAGE RESTRICTIONS IN LATE MAY (INTEREST NZ)

BOND SUMMARY: ACGBs Firm On Soft CPI, JGB Traders Look To BoJ Rinban Schedule

T-Notes corrected from overnight lows as Aussie bonds moved higher, printing fresh session highs on the move, before moving back from best levels. The contract last trades -0-01 at 132-00, in the middle of a 0-05 range. Cash Tsy trade has seen some light twist steepening of the curve. Macro headline flow was light, with continued speculation surrounding the tax side of U.S. President Biden's fiscal plan. On the flow side we saw 10.0K of the TYM1 133.50 calls lifted at 0-09 via a block trade (we saw a 10.0K block buy of the same option at 0-24 ahead of European hours on 21 April). There was also a 2,350 block seller of UXYM1 futures.

- JGB added to overnight losses, last -10. Cash trade saw yields little changed to a touch higher across the curve, given the move in futures since yesterday's close. A well-received round of 2-Year JGB supply saw the tail narrow when compared to the previous auction, with the cover ratio moving higher and low price topping broader expectations. A reminder that the BoJ's Rinban schedule for May will hit after hours today, with participants seemingly eying the Golden Week holiday exit.

- Aussie bonds firmed, paring all of their overnight/early Sydney losses in the wake of the softer than expected local Q1 CPI data. YM +2.0, XM +1.0 at typing. The ACGB Apr '24/Nov '24 yield spread has flattened by 3.5bp today and sits 6bp shy of its intraday steeps. The softer than expected Q1 CPI reading has also been the driving factor here. A reminder that this spread is often used to gauge market pricing of the chances of the RBA extending its 3-Year yield targeting measure to ACGB Nov '24 from ACGB Apr '24. Elsewhere, ~30K of IRM1 traded in the wake of the CPI print, at one price, with ~20K lifted and ~10K given.

JGBS AUCTION: Japanese MOF sells Y2.4483tn 2-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.4483tn 2-Year JGBs:- Average Yield -0.130% (prev. -0.126%)

- Average Price 100.270 (prev. 100.263)

- High Yield: -0.128% (prev. -0.119%)

- Low Price 100.265 (prev. 100.250)

- % Allotted At High Yield: 62.8454% (prev. 21.9279%)

- Bid/Cover: 4.492x (prev. 3.624x)

EQUITIES: Minor Positive Moves For Most

Most Asia-Pac stocks found minor positive territory on Wednesday, after US stocks recovered from early losses to finish flat. Markets in Japan are higher, while mainland China have struggled to make decisive gains. Markets in South Korea are lower in a heavy day for earnings. Bourses in Australia are higher, earlier in the session Australia reported a CPI data that missed expectations. In the US futures are higher, the Nasdaq leading the way higher after falling behind its peers yesterday, the index lagged as Tesla and Alphabet came under pressure following earnings. Markets are focused on the FOMC rate announcement later today.

OIL: Crude Futures Oscillate Around Neutral

Oil is flat in Asia-Pac trade hovering around neutral levels after rising yesterday. WTI is up $0..01 from settlement levels at $62.95/bbl, while Brent is up $0.01 at $66.43/bbl.

- Participants are still digesting the news that the OPEC+ group will proceed with plans to increase supply by 2m bpd over the next three months. The group estimates that demand will rebound by 6m bpd in 2021, but were cognizant of risks from coronavirus. OPEC+ will now skip its meeting originally scheduled for today. Elsewhere, Saudi Arabia is in talks to sell a 1% stake in Aramco to "one of the leading energy companies", and could offer a secondary share offering within two years. Data yesterday showed headline crude stocks rose 4.3m bbls, while stocks in Cushing, OK rose 700k bbls. The downstream report was more bullish, distillate stocks fell 2.4m bbls, while gasoline stocks fell 1.3m bbls.

GOLD: Sticking Sticking Within The Lines

Gold has nudged lower during Asia-Pac hours, with the U.S. Tsy curve twist steepening and the DXY ticking higher. Spot last deals ~$5/oz or so softer, just above $1,770/oz. The previously flagged technical picture remains intact, with the 50-day EMA acting as initial support.

FOREX: Australian CPI Miss Pulls The Rug From Under AUD

Australia's underwhelming Q1 CPI report triggered AUD sales, as consumer prices rose just 1.1% Y/Y, missing expectations of a 1.4% increase, while the key metric of core inflation printed at the weakest level on record. The Aussie remained comfortably the worst performer in G10 FX space, even as AUD crosses edged away from respective lows, with a market contact flagging demand from exporters.

- The DXY resumed its upward drift as participants prepared for today's monetary policy decision from the FOMC & U.S. Pres Biden's first speech to the Congress.

- GBP went offered as simmering tensions between London and Brussels have overshadowed the expected ratification of the Brexit deal by MEPs, to be confirmed today.

- The PBoC set its central USD/CNY mid-point at CNY6.4853, 7 pips below sell-side estimates. USD/CNH briefly showed above yesterday's peak, but then pared the bulk of its earlier gains.

- FOMC MonPol decision & subsequent presser with Fed Chair Powell provide the main points of note today. ECB speak from Lagarde, Schnabel, Centeno & Rehn as well as flash U.S. wholesale inventories & Canadian retail sales are also due.

FOREX OPTIONS: Expiries for Apr28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1900(E2.0bln), $1.1980-85(E1.8bln-EUR puts), $1.2000(E2.6bln, E2.35bln of EUR puts), $1.2030-50(E1.5bln), $1.2080(E1.1bln), $1.2100-05(E1.4bln), $1.2125-45(E1.7bln-EUR puts), $1.2150(E823mln)

- USD/JPY: Y108.10-15($1.0bln-USD puts)

- GBP/USD: $1.4000(Gbp362mln)

- EUR/GBP: Gbp0.8550-55(E500mln)

- EUR/NOK: Nok10.00(E400mln), Nok10.08(E568mln), Nok10.29(E561mln)

- AUD/USD: $0.7700(A$516mln), $0.7720-35(A$753mln-AUD puts), $0.7800-05(A$520mln-AUD puts)

- USD/CAD: C$1.2600($1.1bln-USD puts), C$1.2800($800mln)

- USD/CNY: Cny6.60($683mln)

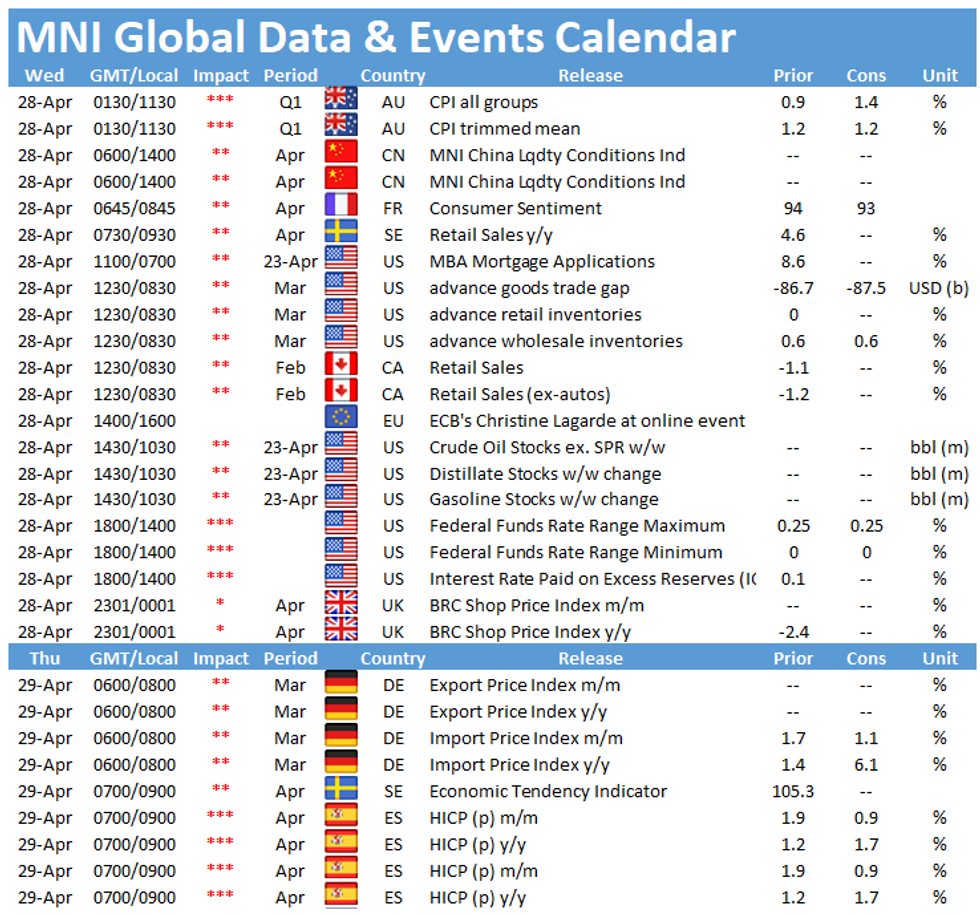

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.