-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Deeper Liquidity Sees Greater Activity In Asia

- Sino-Aussie tensions caught the eye, although the latest move from Beijing isn't expected to have much, if any material impact, but will no doubt sour relations.

- The DXY firmed on the initial headlines surrounding Sino-Aussie tensions, but has eased back from best levels since.

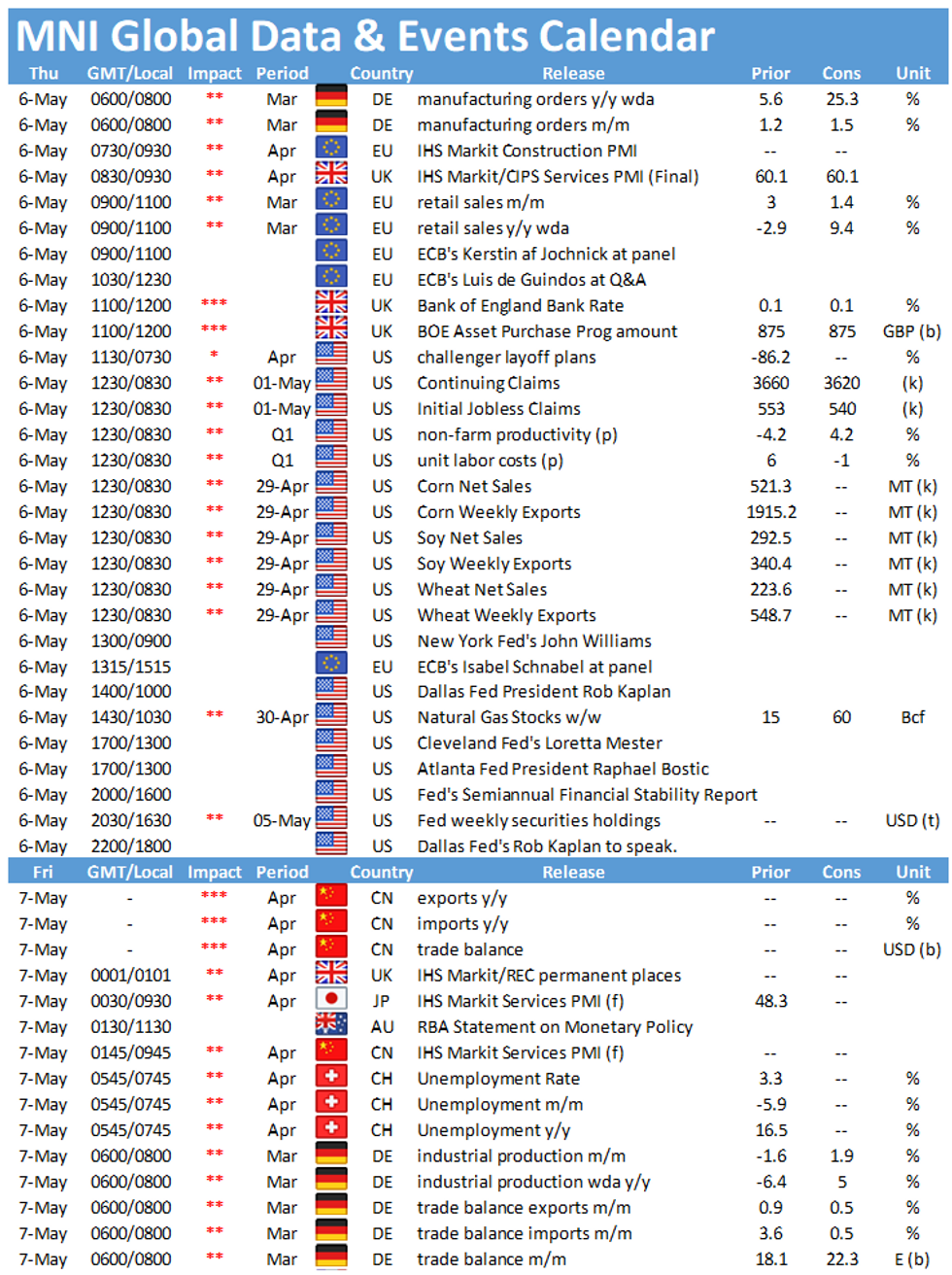

- Central bank decisions from the BoE, Norges Bank, CBRT, BNM & CNB are all due today.

BOND SUMMARY: A Mixed Bag In Asia

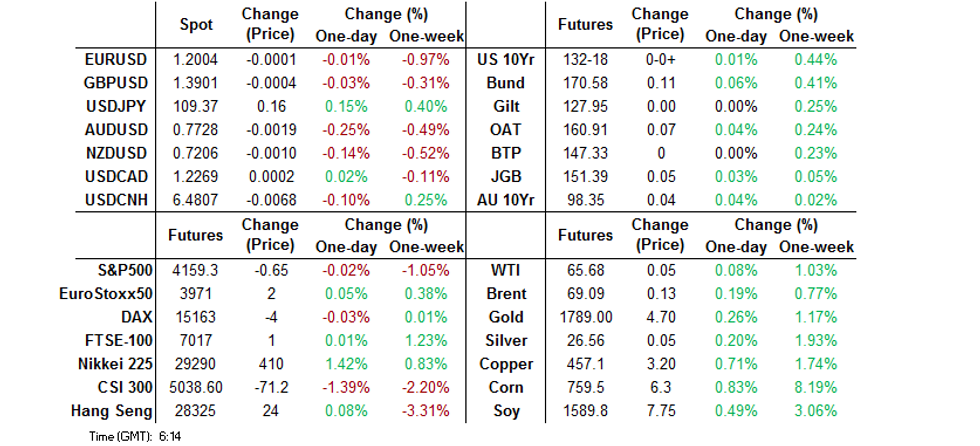

Commentary from Boston Fed President Rosengren failed to add much in the way of tangible new information during Asia-Pac hours, with T-Notes sticking to the confines of a 0-03+ range, last +0-00+ at 132-18. Regional participants were happy to sell cash Tsys at the re-open (in what was the first round of cash trade during Asia-Pac hours for the week), with the longer end of the curve running ~1.5bp cheaper at typing, albeit back from softest levels of the day. Activity was headlined by a 20K screen lift of the TYM1 130.00 puts. Fedspeak from Williams, Kaplan & Mester will hit on Thursday, as will the latest Financial Stability Report from the Fed. We will also see the release of weekly jobless claims data, challenger job cuts and the Q1 labour cost readings.

- JGBs benefitted from the richening in play in U.S. Tsys since Friday's Tokyo close as participants returned from their elongated weekend. The presence of the latest round of BoJ Rinban operations (covering 5- to 25-Year paper) and seemingly impending extension of the state of emergency in Tokyo (and perhaps some of the other areas under their own such declarations) added to the bid. Still, the bid in local equities seemed to cap and then counter the rally, with futures now only 5 ticks higher on the day. The belly outperforms in cash trade, with 5s leading, sitting 1.5bp richer on the day at typing. A quick look at the results of today's BoJ Rinban operations revealed mixed movements in the offer/cover ratios: Wage data and a liquidity enhancement auction for off-the-run JGBs with 1- to 5-Years until maturity headline the local docket on Friday.

- Aussie bonds stuck to a narrow range, failing to really kick on in early Sydney trade, even with short snap COVID restrictions coming into play in the greater Sydney area (on the back of a couple of COVID cases being found in the last 48 hours). Later in the day we saw headlines note that China's NDRC has halted activities under the China-Australia economic dialogue indefinitely. Still, some local participants and some experts in the field have equated the impact of the cessation of the discussions to 0, with the AUD unwinding a portion of its knee-jerk move lower, while ACGBs were limited in terms of their reaction to the news. The latest round of scheduled RBA ACGB purchases was another supportive factor. YM +0.5 & XM +4.0 on the day at typing. An address from RBA Deputy Governor Debelle headlines the local docket today with the topic of "Monetary Policy during Covid," but it doesn't hit until 19:00 Sydney, 10:00 London. Tomorrow's local docket is headlined by the release of the RBA's SoMP, A$800mn of ACGB 0.25% 21 November 2024 supply and the release of the AOFM's weekly issuance slate.

FOREX: Risk Retreats After Sino-Australian Tension Resurfaces

Headlines noting that China's NDRC has halted activities under the China-Australia economic dialogue indefinitely caught many off guard, with one local AUD participant/strategist in Australia signalling that it is "fair to say most of us have forgotten about such a thing." The news delivered a blow to the Antipodeans, sending them to the bottom of G10 pile. Liquidity picked up as trading activity in China, Japan and South Korea resumed after holidays.

- U.S. dollar picked up a bid as the Sino-Australian headlines crossed. The greenback jumped to the top of G10 scoreboard, albeit the DXY failed to break above yesterday's high. The upswing in the dollar index coincided with a downtick in e-mini futures.

- The first post-holiday PBOC fix was closely watched and offshore yuan strengthened as the central USD/CNY mid-point was set 18 pips shy of sell-side estimates. USD/CNH moved away from session lows but still sits ~60 pips lower on the day.

- The BoE & Norges Bank will announce their MonPol decisions today. Speeches are awaited from Fed's Williams, Kaplan & Mester, ECB's Lagarde, de Guindos & Schnabel, RBA's Debelle & Norges Bank's Olsen. Data docket features U.S. initial jobless claims, EZ retail sales, German factory orders & Norwegian industrial output.

FOREX OPTIONS: Expiries for May06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800-15(E525mln), $1.1850-65(E703mln), $1.1875-85(E573mln), $1.1900-05(E511mln), $1.2000-20(E1.8bln), $1.2025-35(E630mln), $1.2050-55(E737mln), $1.2100-20(E1.3bln)

- USD/JPY: Y107.00-15($1.2bln), Y107.80-00($676mln), Y108.80-00($1.0bln), Y109.60-80($1.2bln)

- GBP/USD: $1.4000(Gbp711mln)

- AUD/USD: $0.7700-20(A$705mln), $0.8000(A$1.0bln-AUD puts)

- NZD/USD: $0.7000(N$577mln)

- USD/CAD: Cny6.45($1.4bln-USD puts)

ASIA FX: China Return Catalyses Price Action

Participants in China and South Korea returned to the fray today, returns mixed as markets play catch up.

- CNH: Offshore yuan is stronger, CNH rose following a stronger than expected fix from the PBOC, but gave some of the move higher after the NDRC announcement of the indefinite halt of all activities under the China-Australia economic dialogue.

- SGD: Singapore dollar is weaker, data late yesterday showed retail sales rose 6.2% Y/Y in March, below estimates at 7.1%. Elsewhere as coronavirus infections rise, Singapore is limiting events and quarantining travelers

- TWD: Taiwan dollar is weaker, data yesterday showed Taiwan's foreign reserves rose to $541.11bn, up from $539.04bn in March. The central bank has been warned off intervention by the US Treasury who claim TWD could be up to 21% undervalued. USD/TWD declined around 2.2% during April and closed below 28.00 for the first time since 1997.

- KRW: Won is weaker after a market holiday yesterday, minutes of the BoK's April meeting were released late on Tuesday (followed by a market closure on Wednesday), the minutes showed members expect export and investments likely to continue to improve, while consumption and employment are expected to gradually recovery.

- MYR: Ringgit is weaker, Defence Min Ismail Sabri announced that Kuala Lumpur will be placed under MCO from May 7 through May 20, noting that MCO will also be imposed in several areas in Perak, Johor and Terengganu. The newly implemented MCOs will cover next week's Hari Raya celebrations. Industrial production rose 9.3% Y/Y, above estimates of 8.7%.

- IDR: Rupiah is stronger, Indonesian Economic Min Hartarto said Wednesday that the gov't expects domestic economy to rise 6.9-7.8% Y/Y, which would be the fastest pace of growth since 2008. Hartarto noted that "the trend of economic recovery is toward positive growth" and "the curve is V-shaped."

- PHP: Peso has risen, Philippine unemployment rate eased further to 7.1% in March from 8.8% recorded in February, while underemployment slipped to 16.2% from 18.2% over the same period. Participation rate climbed to 65.0% from 63.5%.

- THB: Baht is lower, the BoT unanimously decided to leave the main policy rate unchanged at the historical low of 0.50%, looking through multiplying coronavirus cases and resultant restrictions. However, they recognised fresh risks to the current growth outlook and said GDP may rise just 1-2% Y/Y (depending on when Thailand achieves herd immunity, which will affect reopening tourism) rather than 3% projected earlier.

ASIA RATES: The Twist You Can See Coming

Indian bond markets remain centre of attention after RBI Governor Das's unscheduled speech unveiled several new measures yesterday, while OMO operations today will be eyed.

- INDIA: Yields mostly lower in early trade, adding to declines yesterday. Bond traders will focus on the INR 100bn operation twist today, as well as digesting the additional measures announced by RBI Governor Das at an unscheduled press conference yesterday.

- SOUTH KOREA: Futures are higher in South Korea, 10-year future near session highs, up 22 ticks at 125.77, 3-year future up 7 ticks at 110.83, both contracts rose at the open. On the coronavirus front South Korea reported 574 new cases on Thursday, down from 676 on Wednesday. Minutes of the BoK's April meeting were released late on Tuesday (followed by a market closure on Wednesday), the minutes showed members expect export and investments likely to continue to improve, while consumption and employment are expected to gradually recovery. Members were cognizant of risks of another wave of the virus, and also agreed to look through inflation.

- CHINA: Futures added to gains after safe have assets went bid following the NDRC announcement of the indefinite halt of all activities under the China-Australia economic dialogue. The PBOC conducted a net drain from the financial system today to the tune of CNY 40bn, the last time the bank injected liquidity was Feb 25. The overnight repo rate declined to 2.10% after jumping as high as 2.40% on Friday prior to the Labor Day break.

- INDONESIA: Yields mostly lower with some bull flattening, data showed GDP fell 0.74% Y/Y in Q1, against estimates of a 0.65% fall, dragged down by consumer spending. Indonesian Economic Min Hartarto said Wednesday that the gov't expects domestic economy to rise 6.9-7.8% Y/Y, which would be the fastest pace of growth since 2008. Hartarto noted that "the trend of economic recovery is toward positive growth" and "the curve is V-shaped."

EQUITIES: Risk Appetite Wanes After China-Australia Trade Announcement

Another mixed day for equity markets in the Asia-Pac region as Japan, mainland China and South Korea return from holidays. Markets in mainland China are lower, the move accelerating after China's National Development and Reform Commission announced an indefinite half of all activities under the China-Australia economic dialogue. Bourses in Japan are the outperformer with gains of over 2%, there were reports that Japan considered relaxing emergency restrictions on departments stores, though Tokyo could seek an extension of the virus emergency. In the US futures are lower, dropping into negative territory after the reports of Sino-Aussie trade tensions alongside a safe haven bid in the greenback.

GOLD: Range Respected

Wednesday's combination of lower U.S. real yields and a flat DXY ultimately supported gold, although there was some chop evident intraday. Still, spot remains within the confines of the recent range, last trading little changed just shy of $1,790/oz.

OIL: Crude Futures Recover Early Losses

Oil recovered early losses to see minor positive territory in the Asia-Pac time zone; WTI is up $0.11 from settlement levels at $65.73/bbl, while Brent is up $0.18 at $69.14/bbl.

- Data from the DoE showed US oil stockpiles declined 8.0m bbls, denoting the largest weekly drop since 22 January. The fall in US oil stockpiles was mostly driven by US oil exports rising to record highs. The decline was steeper than the API's estimate of a 7.7m bbl decrease. The downstream figures were less bullish which weighed on oil, gasoline stockpiles rose 700k bbls. Elsewhere the demand picture is positive, pent up travel demand due to the pandemic is estimated to increase jet fuel use by 30% this summer according to the US governments, and elsewhere refineries run rates rose to almost 87% in the latest week, the highest since March 2020 as fuel production ramps up ahead of the summer driving season.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.