-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Wall Street Rout Spills Over

EXECUTIVE SUMMARY

- FED OFFICIALS SEE STRONG JOB GAINS AFTER APRIL "HEAD-SCRATCHER" (BBG)

- WHO CLASSIFIES TRIPLE-MUTANT COVID VARIANT FROM INDIA AS GLOBAL HEALTH RISK (CNBC)

- FBI NAMES PIPELINE CYBERATTACKERS AS COMPANY PROMISES RETURN (AP)

- QUEEN'S SPEECH TO PAVE THE WAY FOR RE-ELECTION BID BY JOHNSON (FT)

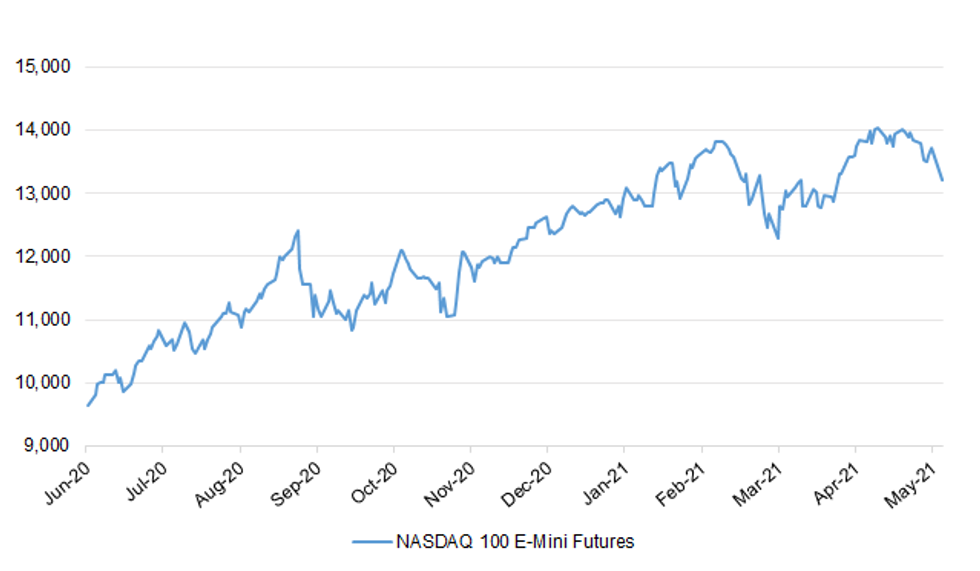

Fig. 1: NASDAQ 100 E-Mini Futures

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: The Queen will on Tuesday set out the legislation that Boris Johnson hopes will pave the way for him to win a second full term as prime minister, but a number of bills will be highly contentious. Johnson is under fire over a bill in the Queen's Speech requiring voters to provide proof of identity, a move which Labour labelled "cynical and ugly" and likely to disenfranchise marginal groups. The prime minister will also reclaim the power to set the date of the next general election, with the repeal of David Cameron's fixed term parliament act, which currently decrees the next election will be in 2024. Senior Labour figures believes Johnson wants to clear the way for a snap general election in 2023, pushing through key bills now and capitalising on his current popularity. The Queen's Speech legislation will include a shake-up of the planning system to allow more housing on undeveloped land, a move which has angered Tory MPs but will be welcomed by younger people trying to buy a home. The prime minister views a simplified planning system as key to delivering on the government's promise of 300,000 new homes a year by the middle of this decade. Meanwhile, Johnson is expected to emphasise the need to clear a massive backlog of NHS operations and that more money will be required to achieve it, casting it as a key priority for the rest of the parliament. (FT)

CORONAVIRUS: The public has been promised full details of "the end of social distancing" within three weeks, as a bullish Boris Johnson pressed the accelerator on a review into the lifting of all Covid-19 rules. As he confirmed Step 3 of the roadmap – allowing indoor serving in pubs, cafes and restaurants in England as well as hugging between family members – the prime minister also dropped his strongest hint yet that almost all regulations will go next month. Mr Johnson said he expected to scrap the "1 metre-plus rule" – and that an announcement on "what we mean by the end of social distancing" would come this month, rather than making businesses wait until June. (Independent)

CORONAVIRUS: The British Virgin Islands and a clutch of Caribbean countries are among a limited number of destinations likely be added to the "green list" for holidays, The Telegraph understands. Hopes of a major expansion including popular destinations in France, Spain, Greece or Italy are, however, likely to be dashed when the Government reviews its current list for quarantine-free travel in three weeks. It means any big summer holiday getaway to the continent for Britons is likely to be delayed until July or even August. (Telegraph)

POLITICS: Labour has talked down to voters for too long Angela Rayner has said, in her first bid to assert her newfound authority as the party's voice of the working class. In an article for the Guardian, the deputy leader said Labour would invest tens of billions of pounds in green industries to boost jobs in areas where manufacturing has declined. The proposal, in her new brief on the future of work, is designed to be an answer to Labour's critics who say the party has offered few bold new policies. In a coded criticism of Starmer's performance as leader, despite the pair's public shaky truce, Rayner said that politics could not be "the language of parliament or party processes". "For too long we have been distant from the people we are here to represent. I know this is the case because it's my mates that I grew up with and who are working minimum wage jobs that we need to speak to and speak for again," she wrote. (Guardian)

SCOTLAND: People in Scotland will be able to travel to some foreign destinations without the need to quarantine on their return, the BBC understands. It will be part of a traffic lights system, similar to that in England, and will come into effect on 24 May. Countries are to be classified as green, amber and red and a review will take place every four weeks. The Scottish government said a Covid briefing would take place on Tuesday and it would not comment on reports. (BBC)

HEALTHCARE: Hundreds of doctors working on the front line during the Covid pandemic have been told they won't have jobs in the NHS training scheme from August, despite the health service being dependent on them to tackle surgical backlogs. (Independent)

EUROPE

ECB: German inflation could climb above 3% as the economy recovers from the pandemic, but it won't last and the European Central Bank will look beyond such volatility, Executive Board member Isabel Schnabel said in an interview. "What we see is that very pronounced fluctuations in inflation have emerged because of the pandemic," Schnabel told German broadcaster RTL/NTV. "Our monetary policy strategy is oriented to the medium term, and this means we look through these short-term fluctuations." (BBG)

EU: German Foreign Minister Heiko Maas on Monday lambasted Hungary for an "absolutely incomprehensible" decision to block an EU statement accusing Beijing of cracking down on democracy in Hong Kong. EU foreign ministers have been unable to adopt the text even though diplomats said it had already been watered down to get Hungary's backing. EU foreign policy decisions require unanimity to pass. "This is not the first time that Hungary has broken away from [the EU's] unity when it comes to the issue of China," Maas told reporters after the latest meeting of the bloc's Foreign Affairs Council on Monday. The meeting was the second in recent weeks at which foreign ministers failed to adopt conclusions on Hong Kong due to Budapest's opposition. (Politico)

EU: The joint debt EU leaders agreed to undertake to finance the pandemic recovery should become a precedent for greater European fiscal integration, the prime ministers of Greece and Spain proclaimed Monday, saying it was up to their governments to show the money is used effectively and to erase any doubts among Northern countries. Appearing on stage together at the Delphi Forum in Athens, for a chat moderated by POLITICO's Florian Eder, Greek Prime Minister Kyriakos Mitsotakis and Spanish Prime Minister Pedro Sánchez demonstrated a united front in applauding the joint debt program (despite coming from rival political families), as well as the EU's recent cooperation to create a "travel certificate" for tourists, and its joint vaccine-purchasing program. Mitsotakis said that Southern EU countries, which suffered from the austerity policies following the 2008 financial crisis, ultimately persuaded frugal countries in the North that the approach had been a mistake and that the joint debt program would benefit everyone — by speeding the recovery of the EU's single market, and helping with the difficult transition in adopting green policies and new digital technologies. (Politico)

GERMANY: Germany is making the Johnson & Johnson coronavirus jab available to all adults irrespective of age or pre-existing health conditions, as the country switches to a twin-track strategy to counteract hesitancy around viral vector-based vaccines among older people. (Guardian)

FRANCE: The government of French President Emmanuel Macron reacted with fury on Monday after a group of serving French soldiers published an open letter warning that "civil war" was brewing over his "concessions" to Islamism, weeks after a similar message from elements in the military rocked the elite. The letter, posted on the website of the right-wing Valeurs Actuelles magazine late Sunday, echoes the one published by the same publication last month but appears to have been written by an unknown number of younger troops still in active service. Interior Minister Gerald Darmanin, a close ally of Macron, accused the anonymous signatories of the second letter of lacking "courage" while Defence Minister Florence Parly dismissed it as part of a "crude political scheme". Prime Minister Jean Castex meanwhile told Le Parisien newspaper that the letter was a "political manoeuvre" by the "extreme right". But it was welcomed by far-right leader Marine Le Pen, seen as Macron's main rival for next year's presidential election. (France24)

U.S.

FED: April's disappointing employment report doesn't change the upbeat outlook for the U.S. labor market amid strong consumer demand, Federal Reserve officials said. "We still think, despite these frictions, that job growth will be strong," Federal Reserve Bank of Dallas President Robert Kaplan said Monday in an interview on Bloomberg Television with David Westin, adding that employers reported problems in attracting workers despite offering higher wages. "You will see fits and starts like we saw here. We still think the trend is going to be strong job growth and recovery, particularly as leisure and hospitality sectors and others open up." Kaplan's confidence on the outlook for the U.S. job market was echoed by other policy makers on Monday. San Francisco Fed chief Mary Daly told Yahoo! Finance: "I remain bullish about the future. But we're not there yet, and we're going to have some fits and starts." Charles Evans of Chicago said he was optimistic that despite the sluggish April report, the U.S. labor market is "going to get back up to very strong numbers" in coming months. (BBG)

FISCAL: President Biden sat down with Sen. Joe Manchin (D-W.Va.) on Monday to discuss the administration's proposed $4 trillion spending package, which the moderate-minded lawmaker has floated busting up. Manchin said Biden didn't take a position on if the proposal should be passed as one piece as opposed to two or more as some Democrats are pushing for, but indicated the issue came up as part of their sit-down at the White House. "We talked about basically, are we going to do one, or do two or do three, things of that sort. Making sure we look at things that need to be done in traditional and human infrastructure, things of that sort," the senator told reporters at the Capitol after the meeting. But asked if Biden expressed a preference on passing his plan as one bill or breaking it up, Manchin replied, "Not really." (Hill)

FISCAL: The Treasury Department on Monday launched its $350 billion program to distribute aid to state and local governments, giving the U.S. economy an added boost as President Joe Biden sought to assure the country that stronger growth is coming. (AP)

FISCAL: Senate Minority Leader Mitch McConnell (R-Ky.) signaled in a new interview that he is open to an infrastructure spending bill totaling as much as $800 billion. "The proper price tag for what most of us think of as infrastructure is about six to 800 billion dollars," McConnell told public television in Kentucky over the weekend. "What we've got here can best be described as a bait and switch," he added. McConnell indicated last week that GOP lawmakers were open to a roughly $600 billion bill. (Hill)

CORONAVIRUS: U.S. regulators on Monday expanded the use of Pfizer's COVID-19 vaccine to children as young as 12, offering a way to protect the nation's adolescents before they head back to school in the fall and paving the way for them to return to more normal activities. Shots could begin as soon as Thursday, after a federal vaccine advisory committee issues recommendations for using the two-dose vaccine in 12- to 15-year-olds. An announcement is expected Wednesday. (AP)

ECONOMY: Commerce Secretary Gina Raimondo plans a summit with companies impacted by the globalsemiconductor shortage, including the largest chip manufacturers and U.S. automakers, according to peoplefamiliar with the plans.Raimondo will convene the meeting on May 20, according to an invitation sent to companies and obtained byBloomberg News. The Commerce Department said in the invitation that it aims to create and maintain "an opendialogue around semiconductors and supply chain matters" and wants to bring together suppliers and consumersof chips. (BBG)

POLITICS: House Republicans will vote on recalling Rep. Liz Cheney (R-Wyo.) as conference chair this Wednesday, House Minority Leader Kevin McCarthy announced in a letter Monday, Punchbowl News reported. Why it matters: Cheney, the No. 3 House Republican, has faced increasing backlash from McCarthy and her Republican colleagues as she continues to criticize former President Trump and his baseless claims of election fraud. (Axios)

POLITICS: A new national poll indicates that most Americans approve of the overall job President Biden is doing in the White House. But, according to AP-NORC survey released Monday, the president's numbers are mixed on gun violence and underwater on immigration. (Fox)

POLITICA: Republicans are preparing to launch an all-out assault on sweeping voting rights legislation, forcing Democrats to take dozens of politically difficult votes during a committee hearing that will spotlight the increasingly charged national debate over access to the ballot. (AP)

OIL: Hit by a cyberattack, the operator of a major U.S. fuel pipeline said Monday it hopes to have services mostly restored by the end of the week as the FBI and administration officials identified the culprits as a gang of criminal hackers. (AP)

OIL: On Monday, Cybereason provided CNBC with a new statement from DarkSide's website that appears to address the Colonial Pipeline shutdown. Under a heading, "About the latest news," DarkSide claimed it's not political and only wants to make money without causing problems for society. "We are apolitical, we do not participate in geopolitics, do not need to tie us with a defined government and look for our motives," the statement said. "Our goal is to make money, and not creating problems for society. From today we introduce moderation and check each company that our partners want to encrypt to avoid social consequences in the future." (CNBC)

CYBERSECURITY: A small group of private-sector companies, with help from several U.S. agencies, disrupted ongoing cyber-attacks against Colonial Pipeline Co. and more than two dozen other victims, according to people with knowledge of the matter. Colonial was able to recover some stolen data because of the intervention, which stopped the flow of stolen data headed to Russia -- believed to be the ultimate destination, according to three people involved with or briefed about the investigation into the breach. The takedown, which occurred on May 8, was enacted by companies that included operators of U.S.-based servers used by the hackers, the people said. The intervention involved the White House, Federal Bureau of Investigation, Cybersecurity and Infrastructure Security Agency and National Security Agency, and shut off key servers used by the hackers, said the people, who requested anonymity because they weren't authorized to discuss the ongoing investigation. (BBG)

BONDS: Amazon.com Inc. sold bonds to refinance debt and buy back stock, as cheap borrowing costs prove too tempting to resist even for a company with tens of billions of dollars in cash. The online retail giant issued $18.5 billion of debt in eight parts. The longest portion, a 40-year security, yields 95 basis points over Treasuries, after initial price talk at around 115 basis points, said the people, according to people with knowledge of the matter, who asked not to be identified because the details are private. (BBG)

OTHER

WHO: A World Health Organization official said Monday it is reclassifying the highly contagious triple-mutant Covid variant spreading in India as a "variant of concern," indicating that it's become a global health threat. Maria Van Kerkhove, the WHO's technical lead for Covid-19, said the agency will provide more details in its weekly situation report on the pandemic Tuesday but added that the variant, known as B.1.617, has been found in preliminary studies to spread more easily than the original virus and there is some evidence it may able to evade some of the protections provided by vaccines. The shots, however, are still considered effective. (CNBC)

NATO: Nine NATO member states in eastern Europe urged the military alliance to boost its presence in the region to address increased security threats stemming from Russia, Romanian President Klaus Iohannis said. After an online meeting with U.S. President Joe Biden and the secretary general of the North Atlantic Treaty Organization, Jens Stoltenberg, the countries agreed to maintain a joint stance during the alliance's summit next month to highlight the importance of the region stretching from the Baltic Sea to the Black Sea. (BBG)

USMCA: U.S. and Mexican unions on Monday filed the first labor complaint against Mexico under the U.S.-Mexico-Canada free trade pact. The complaint argues that Mexico has not lived up to its pledge under the trade accord, known as the USMCA, to guarantee workers the right to freely organize and join the union of their choice. The complaint centers on the Tridonex auto parts assembly plant in the Mexican border city of Matamoros where workers have been fighting to join a new union. The outside organizer of that union, lawyer Susana Prieto, has been jailed, harassed and prohibited from traveling to Tamaulipas, the state where Matamoros is. (AP)

BOJ: MNI BRIEF: BOJ Should Discuss Extension of Facilities

- A Bank of Japan board member believes the central bank should discuss an extension of the Special Program to Support Financing due to finish at the end of September, according to a summary of opinions from the April 26-27 board meeting released on Tuesday. On MNI Policy MainWire now, for more details please contact sales@marketnews.com.

JAPAN: Japan's regional banks are starting to plan mergers and other strategic options to survive shrinking local economies after the government introduced incentives to an industry long seen overdue for consolidation. Aomori Bank Ltd. and smaller rival Michinoku Bank Ltd., based in the northern tip of Japan's main island, said they are considering a merger in separate statements on Tuesday, confirming an earlier NHK report. The banks, with combined assets of about 6 trillion yen ($55 billion), have already announced a business tie-up. The lenders have a loan market share of about 70% in Aomori prefecture and their deal would be the first after the government enacted a law making regional banks exempt from anti-monopoly rules, according to the Nikkei newspaper. (BBG)

ISRAEL: Violent clashes over Jerusalem escalated dramatically on Monday with Gaza health officials saying at least 20 people, including nine children, were killed by Israeli air strikes launched after Palestinian militant groups fired rockets close to Jerusalem Israel's military said it carried out strikes against armed groups, rocket launchers and military posts in Gaza after militants there crossed what Israeli Prime Minister Benjamin Netanyahu called a "red line" by firing on the Jerusalem area for the first time since a 2014 war. The rocket fire and Israeli air strikes continued late into the night, with Palestinians reporting loud explosions close to Gaza City and across the coastal strip. Shortly before midnight local time, Israel's military said Palestinian militants had fired around 150 rockets into Israel, of which dozens were intercepted by its missile defence systems. (RTRS)

NORTH KOREA: North Korea is said to have acknowledged a recent U.S. offer to explain the outcome of its policy review on Pyongyang after earlier overtures from the administration of Joe Biden went unanswered. In response to the U.S. offer last week, the North has reportedly said the proposal has been "well received," a different reaction from when the first dialogue offer was made. Last month, the U.S. said it had sought to engage with the North in mid-February, but the regime remained "unresponsive." (Yonhap)

TAIWAN: Taiwan and European Union should begin bilateral investment talks to further deepen ties, according to a transcript of President Tsai Ing-wen's speech for the Copenhagen Democracy Summit on presidential office's website Monday. (BBG)

HONG KONG: Hong Kong backtracked on a plan to require foreign domestic workers to be vaccinated to secure work visas, caving in to criticism that the policy was discriminatory. The Asian financial hub's authorities reached out to the Indonesian and Philippines consulates and decided not to pursue such a requirement, Hong Kong Chief Executive Carrie Lam said at a regular briefing on Tuesday. (BBG)

IRAN: U.S. Coast Guard ship accompanying a guided-missile submarine and other vessels near the Strait of Hormuz fired warning shots after a group of 13 Iranian fast boats approached them in an "unsafe" manner on Monday, the Pentagon's spokesman said. The group of fast boats controlled by the Islamic Revolutionary Guard Corps came as close as 150 yards (137 meters) to the U.S. ships when a Coast Guard cutter, the Maui, fired about 30 warning shots from a .50-caliber machine gun, spokesman John Kirby told reporters. He said the Iranian vessels were behaving "very aggressively." (BBG)

MALAYSIA: Malaysia's economic contraction slowed at the beginning of 2021, in between surges of Covid-19 cases and tighter restrictions to contain the disease. "The economic recovery remains on track," central bank Governor Nor Shamsiah Yunus said in a briefing. "We have said that there will be speed bumps along the way, but we expect growth to remain within the 6% to 7.5%" forecast range for the full year. The economic reading comes a day after Prime Minister Muhyiddin Yassin announced nationwide movement restrictions to stem the latest surge in cases. Moving forward, the economy will continue to be benefit from strong external demand and improving domestic conditions, Nor Shamsiah said. (BBG)

MOROCCO: Morocco's prime minister condemned Spain for hosting the leader of a movement fighting for the independence of the disputed Western Sahara, signaling a possible second feud between the kingdom and a major European partner. The government plans an "appropriate response" to the presence of the Polisario Front's chief in Spain, premier Saad Eddine El Othmani told lawmakers in Morocco's capital, Rabat, on Monday. The North African nation is already mired in a dispute with Germany, which it accuses of having a "negative attitude" regarding Western Sahara. (BBG)

AIRLINES: Taoyuan-based China Airlines is adjusting its passenger and cargo flights with priority given to cargo routes after tighter Covid rules for its air crew came into place, according to its statement to Taiwan stock exchange late Monday. Overall capacity to and from Taiwan will be reduced in the short-term and it may cancel carrying passengers. (BBG)

CHINA

YUAN: The Chinese Yuan will likely stay strong in the near term supported by trade surpluses and favorable interest spread against the U.S., the China Securities Journal said in a commentary. The yuan may not repeat the one-sided appreciation seen in H2 last year given the Federal Reserve's policy uncertainties, the newspaper said. The strong yuan attracted more foreign holding of yuan assets, with net purchase of yuan bonds reaching CNY130.8 billion in April, up from CNY51.4 billion in March, the journal said. (MNI)

COMMODITIES: The Chinese commodity derivatives industry should increase globalization and help to exert China's price-setting influence globally, the PBOC-run Financial News reported citing Fang Xinghai, a vice-chairman of the China Securities Regulatory Commission. Regulators should actively create conditions to help increase cross-border services and controls of global resources, allow commodity derivatives to service the real economy, and allow commodity trading firms to boost capital, Fang was cited saying. (MNI)

CHINA/U.S.: The Biden administration may be consumed by the disappointing April job report showing 266,000 new jobs added versus estimated more than 1 million, underlying a bumpy recovery, therefore hampering his goal of greater American leadership and stepping up competition with China, the Global Times said in an editorial. Biden doesn't appear to have a solution for the more fundamental problems, including growing economic inequality that exacerbates social divisions and that many services and low-paying jobs may have vanished due to the pandemic, said the tabloid owned by CCP's People's Daily. (MNI)

POPULATION: China posted its slowest population growth since the 1950s, sharply reducing the size of the labor force as the nation ages, and worsening demographic pressures in the economy. There were 1.412 billion people in China last year, the National Bureau of Statistics said Tuesday in Beijing in its once-a-decade census report, slightly lower than a 2017 forecast of 1.42 billion. The annual average growth of 0.53% in the past decade was the slowest since 1953. The share of the working-age population -- those between ages of 15 and 59 -- slumped to 63.4% in 2020, or 894.4 million people, from more than 70%, or 939.6 million, a decade ago, according to the census. Residents aged 60 and above accounted for 18.7% of the population in 2020, up from 13.3% in 2010. (BBG)

OVERNIGHT DATA

CHINA APR CPI +0.9% Y/Y; MEDIAN +1.0%; MAR +0.4%

CHINA APR PPI +6.8% Y/Y; MEDIAN +6.5%; MAR +4.4%

JAPAN MAR HOUSEHOLD SPENDING +6.2% Y/Y; MEDIAN +1.5%; FEB -6.6%

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 111.6; PREV. 112.7

The most notable thing from the latest survey is that the proportion of respondents expecting 'bad times' in 'current economic conditions' dropped to just 12%, its lowest level in over forty years. This sharp improvement came about despite the 1% fall in overall consumer confidence and points to positive sentiment about the near-term outlook being very widespread. The fall in overall confidence was not surprising given that Sydney recorded a mysterious case of COVID-19, and restrictions were imposed to prevent any further spread. As a result, confidence in Sydney took a hit of 7.6%. (ANZ)

NEW ZEALAND APR CARD SPENDING RETAIL +4.0% M/M; MAR +0.8%

NEW ZEALAND APR CARD SPENDING TOTAL +4.0% M/M; MAR +1.9%

NEW ZEALAND APR ANZ TRUCKOMETER HEAVY -1.2% M/M; MAR +3.0%

Heavy traffic (trucks and buses) primarily reflects the movement of goods, while light traffic is all about the movement of people. In March, both types of traffic increased (seasonally adjusted). The Light Traffic Index rose 1.7% versus February, while the Heavy Traffic lifted 2.8%. The data will be hard to interpret over the next couple of months due to both the regionalised snap lockdowns last month, and as the seasonal adjustment process struggles to make sense of the plunge a year ago. The spike in annual growth this month is due to the lockdown in March-April 2020, and it's also causing larger-than-normal revisions in the seasonally adjusted data. We'll wait and see where things settle. But in the big picture, traffic seems to be back on trend. (ANZ)

SOUTH KOREA MAY 1-10 EXPORTS +81.2% Y/Y; APR +24.8%

SOUTH KOREA MAY 1-10 IMPORTS +51.5% Y/Y; APR +14.8%

UK APR BRC SALES LIKE-FOR-LIKE +39.6% Y/Y; MAR +20.3%

CHINA MARKETS

PBOC NET INJECTS CNY10BN VIA OMO TUES

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Tuesday. This resulted in a net injection of CNY10 billion given no maturity of reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2000% at 09:24 am local time from the close of 1.8479% on Monday.

- The CFETS-NEX money-market sentiment index closed at 39 on Monday vs 35 on last Saturday. A higher index indicates greater expectation for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.4254 TUES VS 6.4425

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4254 on Tuesday, compared with the 6.4425 set on Monday, marking the lowest fixing since Jun 19, 2018.

MARKETS

SNAPSHOT: Wall Street Rout Spills Over

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 934.65 points at 28584.13

- ASX 200 down 77.201 points at 7095.6

- Shanghai Comp. down 9.104 points at 3418.887

- JGB 10-Yr future up 6 ticks at 151.46, yield down 1.2bp at 0.075%

- Aussie 10-Yr future down 1 ticks at 98.33, yield up 1.1bp at 1.723%

- U.S. 10-Yr future+0-01+ at 132-21, yield down 1.06bp at 1.591%

- WTI crude down $0.46 at $64.46, Gold up $0.44 at $1836.51

- USD/JPY up 1 pip at 108.82

- FED OFFICIALS SEE STRONG JOB GAINS AFTER APRIL "HEAD-SCRATCHER" (BBG)

- WHO CLASSIFIES TRIPLE-MUTANT COVID VARIANT FROM INDIA AS GLOBAL HEALTH RISK (CNBC)

- FBI NAMES PIPELINE CYBERATTACKERS AS COMPANY PROMISES RETURN (AP)

- QUEEN'S SPEECH TO PAVE THE WAY FOR RE-ELECTION BID BY JOHNSON (FT)

BOND SUMMARY: Risk Aversion Lingers, 10-Year JGB Auction Draws Lowest Bid/Cover Ratio Since 2015

JGB futures crept higher as the Nikkei 225 tumbled alongside other major Asia-Pac equity indices, but pulled back off session highs at 151.48 after the lunch break. The latest 10-year JGB auction drew the lowest bid/cover ratio (3.038x) since 2015, while low price was marginally higher than forecast in the BBG poll. As we type, JGB futures trade at 151.45, 5 ticks north of last settlement. Cash JGB yields are broadly lower across a slightly flattened curve, with 10s outperforming. The space was unfazed by a strong beat in Japanese household spending print for the month of March.

- T-Notes last trade +0-01+ at 132-21 after topping out at 132-23+. Cash Tsy curve bull flattened on the back of broader risk-off impetus, which sent e-minis & major regional equity indices lower; Tsy yields last trade 0.2-1.6bp lower. Eurodollar futures trade -0.5 to +0.5 tick through the reds. There is plenty of Fedspeak coming up today.

- XM unwound their initial uptick and last trade -1.5, with YM unch. Cash ACGB curve has bear steepened a tad, yields last sit -0.5bp to +1.6bp. Bills trade unch. to -1 tick through the reds. The AOFM sold A$100mn of Feb '50 linker, drawing a bid/cover ratio of 3.600x. The bond was last auctioned in 2019. The syndication of AUSCAP May '30 is expected today. Elsewhere, main focus is on Australia's 2021/22 Federal Budget, with recent commodity & jobs mkt developments expected to allow the gov't to boost spending & keep a lid on fiscal deficit.

JGBS AUCTION: Japanese MOF sells Y2.1099tn 10-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.1099tn 10-Year JGBs:- Average Yield 0.072% (prev. 0.123%)

- Average Price 100.27 (prev. 99.77)

- High Yield: 0.074% (prev. 0.124%)

- Low Price 100.25 (prev. 99.76)

- % Allotted At High Yield: 30.3800% (prev. 82.7380%)

- Bid/Cover: 3.038x (prev. 3.543x)

AUSSIE BONDS: The AOFM sells A$100mn of the 1.00% 21 Feb '50 I/L Bond, issue #CAIN415:

The Australian Office of Financial Management (AOFM) sells A$100mn of the 1.00% 21 February 2050 I/L Bond, issue #CAIN415:- Average Yield: 0.3107% (prev. 0.3075%)

- High Yield: 0.3225% (prev. 0.3075%)

- Bid/Cover: 3.6000x (prev. 3.3100x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 70% (prev. 100%)

- bidders 36 (prev. 34), successful 10 (prev. 2), allocated in full 8 (prev. 2)

EQUITIES: Tech Leads The Way Lower

Equity markets in the Asia-Pac region are in the red after taking a negative lead from the US. Losses are broad, but Japanese markets hold the dubious honour of being the biggest decliners with losses of almost 3%., there were also reports in Asahi that a Japan wide emergency shouldn't be ruled out. Tech heavy indices such as the Taiex and the KOSPI have also sustained heavy losses, following in the footsteps of the Nasdaq, inflation concerns amid surging commodity prices was adduced as the reason behind the Nasdaq's decline. In Australia the ASX 200 lost over 1% as iron ore declined over 4% from its highs after surging yesterday. In the US futures are lower, the Nasdaq once again leading the way lower.

OIL: Crude Futures Fall

Oil fell in Asia on Tuesday, WTI down $0.48 from settlement levels at $64.44/bbl while Brent is down $0.51 at $67.81/bbl. Earlier, Colonial Pipeline Co. hit the wires and said service will be mostly restored by the end of this week following a cyberattack. In the meantime fallout from the attack is evident with some gas stations running out of fuel and North Caroline declaring a state of emergency. Markets look ahead to the OPEC report due later today, the cartel is bringing back around 2m bpd of supply by July, starting with 600k bpd this month.

GOLD: Yellow Metal Holds Recent Gains

Gold has squeezed out some gains in the Asia-Pac session, though is still some way below yesterday's peak. The yellow metal last trades at $1836.89 having briefly dropped as low as $1831.47. The market remains focused on inflation pressures being stoked by surging commodity prices; markets will digest a raft of Fed speakers today ahead of CPI data tomorrow.

FOREX: Looking For Clear Direction

It was a mixed Asia-Pac session for G10 FX, with AUD catching a light bid early on amid chatter that local exporters bought the Aussie after its pullback from a multi-week high. Australian Treasurer Frydenberg is set to unveil the 2021/22 Federal Budget today. NZD diverged from its Antipodean cousin and lagged the rest of the G10 pack.

- JPY and USD struggled even as U.S. e-minis slipped in Asia, while regional equity benchmarks registered losses in the wake of yesterday's disappointing session on Wall Street. Safe haven peer CHF remained fairly resilient.

- The PBOC set its central USD/CNY mid-point at 6.4254, 32 pips above sell-side estimates, signalling that it wants to reign in the redback's rally. USD/CNH continued to hover close to its three-year lows, largely looking through China's inflation data.

- German ZEW Survey & Italian industrial output take focus on the data front. Fed speaker slate is tightly packed, with ECB's Knot & de Cos, BoE's Bailey & Norges Bank's Bache also due to speak. The Queen's Speech will outline UK gov't's legislative priorities.

FOREX OPTIONS: Expiries for May11 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2095-00(E1.3bln), $1.2125(E1.3bln), $1.2185-90(E1.5bln)

- USD/JPY: Y108.00($1.4bln), Y109.40-50($1.2bln)

- AUD/USD: $0.7620-30(A$2.7bln)

- NZD/USD: $0.7200(N$661mln)

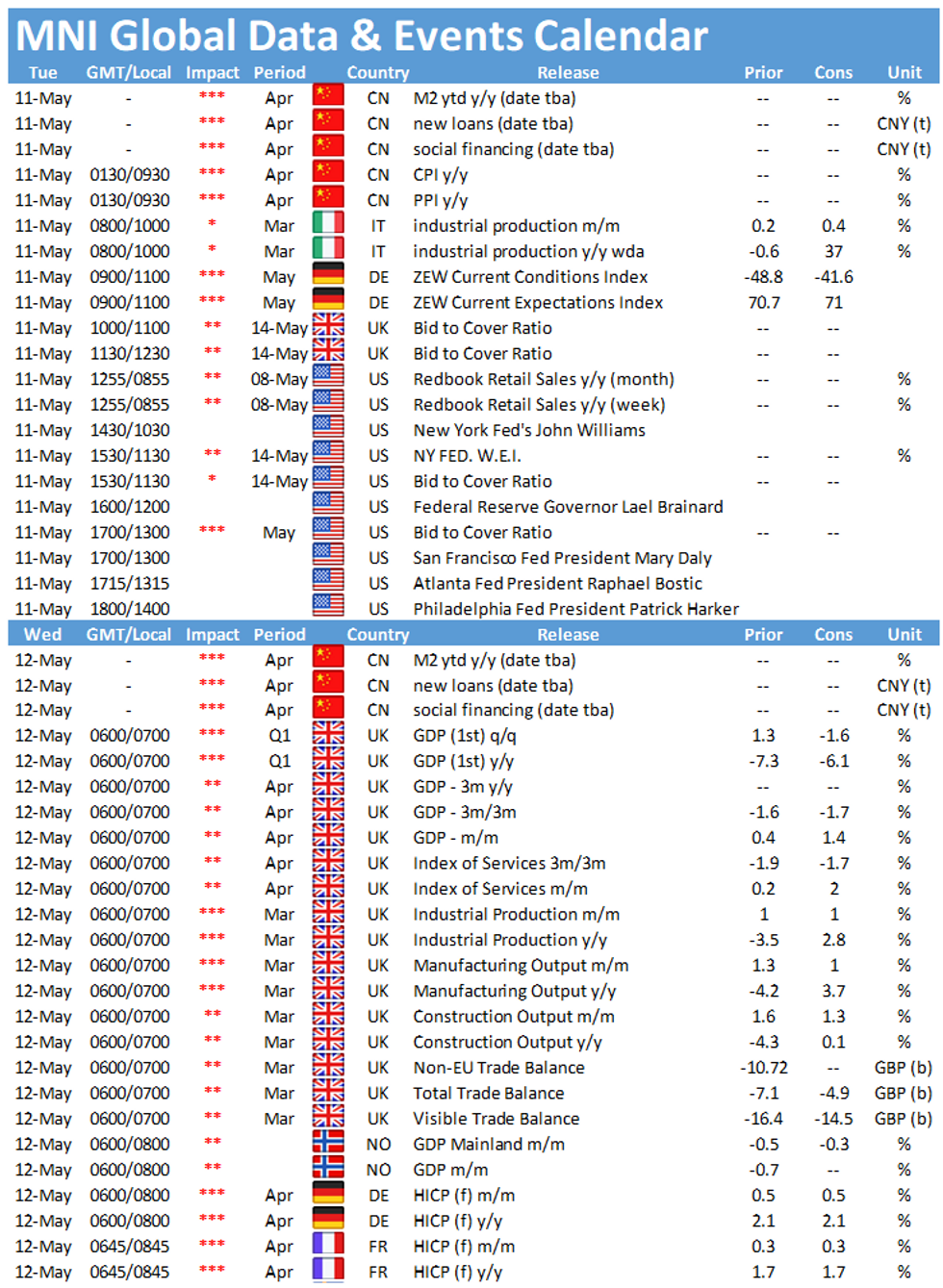

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.