-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Markets Coil In Asia, Await Catalyst

EXECUTIVE SUMMARY

- FED'S QUARLES: U.S. IS BEGINNING STRONG RECOVERY (MNI)

- BIDEN DELAYS REVAMP OF TRUMP'S BLACKLIST FOR CHINA INVESTMENTS (BBG)

- CHINA SAYS U.S. THREATENING PEACE AS WARSHIP TRANSITS TAIWAN STRAIT (RTRS)

- EUROPEAN PARLIAMENT TO VOTE ON FREEZING CHINA DEAL (POLITICO)

- BIDEN ADMINISTRATION ENCOURAGED BY BIPARTISAN INFRASTRUCTURE TALKS

- UK PLANS TO EASE SOCIAL DISTANCING IN 'DISARRAY' AS INDIAN VARIANT CASES RISE (TELEGRAPH)

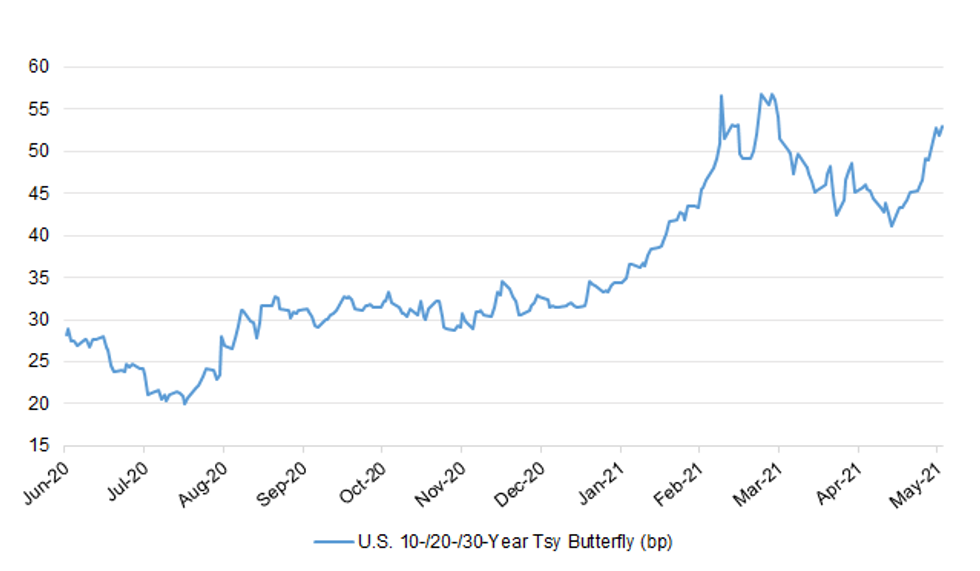

Fig. 1: U.S. 10-/20-/30-Year Tsy Butterfly (bp)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: There is "nothing conclusive" in the data that means England "would have to deviate from the roadmap" out of lockdown, Boris Johnson has said. The government plans to end remaining legal limits on social contact from 21 June, but there is increasing concern about the Indian variant. The situation, including data from hotspots such as Bolton, was "under close review", the prime minister said. Ministers will "let people know in a few days' time" after data is studied. (BBC)

CORONAVIRUS: Boris Johnson is being warned by scientists that a surge in vaccinations in COVID hotspots may not be enough to halt the spread of the Indian variant - and that he should not have relaxed lockdown rules this week. (Sky)

CORONAVIRUS: Plans for easing social distancing rules were said to be in "disarray" on Tuesday amid concerns that pubs and restaurants may still have to serve at limited capacity after June 21. (Telegraph)

CORONAVIRUS: A cross-party coalition is preparing to oppose local lockdowns being imposed across England next month to combat the spread of the Indian variant of coronavirus. A Cabinet minister confirmed on Tuesday that local lockdowns was "an option" being considered by the Government in response to fears that surging numbers of the highly infectious new strain could derail plans to end all Covid restrictions on 21 June. Prime Minister Boris Johnson is understood to support the move only if mass vaccination and surge-testing fails to reduce cases numbers in the worst-affected areas which currently include Bolton, Blackburn, Bedford and parts of London. (The i)

CORONAVIRUS: The government's position on foreign holidays descended into farce last night as ministers gave conflicting advice over the resumption of international travel. Lord Bethell of Romford, a health minister, said that people should "stay in this country" and that all travel abroad this year would be "dangerous". (The Times)

BOE: MNI BRIEF: Ending Reserve Remuneration Fiscal Policy – Bailey

- The Bank of England would not sanction ending reserve remuneration, saying that any such decision would be fiscal policy and a matter for the Treasury, not the Bank, adding that it would complicate monetary policy transmission, Governor Andrew Bailey said Tuesday. Such a move "is actually fiscal policy, it is a tax on the banking system which would get passed through into the economy. It is not monetary policy ... If that decision were to be taken it would not be a decision in my view for the Bank of England," Baily told the Lords Economic Affairs Committee - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

BREXIT: The UK's Brexit Minister has played down the prospects of reaching a new agri-food agreement with the EU. Such an agreement is seen as central to reducing controls on goods moving from Great Britain to Northern Ireland. Lord Frost said there is a "pretty significant difference" between the EU and UK on what sort of deal is possible. He said it is a "fundamental issue of principle" that the UK will not dynamically align with EU rules. Dynamic alignment, otherwise known as a Swiss-style arrangement, would involve the UK following EU rules in this area indefinitely. (BBC)

BREXIT: The new leader of the Democratic Unionist Party (DUP) says maintaining a Brexit border in the Irish Sea is "playing fast and loose with the peace process". In his first interview since his election, Edwin Poots called on the British government to "go it alone" if necessary and scrap the controversial Protocol. When it is fully implemented later this year, he claimed there would 15,000 checks on goods weekly, "having an impact on every home in Northern Ireland". (Sky)

BREXIT: Boris Johnson is prepared to offer Australia tariff-free access to British food markets despite warnings that it could put farmers out of business. The prime minister is backing a plan to give Australian food exporters the same terms as those enjoyed by the European Union in what would be the first bespoke trade deal signed by the government since Brexit. The plan is being resisted by farming groups, which believe that it would set a dangerous precedent for future trade agreements and could result in British farmers struggling to compete with cheap imports. They have been backed by George Eustice, the environment secretary, and Michael Gove, the Cabinet Office minister, who have privately expressed reservations about the deal. (The Times)

POLICY: Prime Minister Boris Johnson attempted to refocus attention on his "leveling up" agenda by unveiling plans to modernize Britain's high streets and moving government officials out of London. Some 57 districts in England will benefit from an 830 million-pound ($1.2 billion) fund to transform town centers into "vibrant places to live, work and shop," Johnson's office said in an emailed statement. More than 3,000 civil service jobs across the Home Office and Business Department will be relocated to Edinburgh, Belfast and the Midlands city of Stoke-on-Trent by 2025. (BBG)

EUROPE

ECB: European Central Bank (ECB) board member Stournaras, Governor of the Greek Central Bank, said that the euro area is not facing the risk of rising inflation in the medium term. "Based on our model, we don't expect inflation to rise in the near future, except for a temporary rise this year," Soturnaras said in a speech at the University of Cyprus. He said that it is highly probable that He noted that the ECB was less flexible than the Federal Reserve, but was more independent than the Fed. Quantitative easing will be a permanent policy tool for the ECB, he said. (RTRS)

IRELAND: Ireland will increase a tax on the bulk buying of homes, amid growing outrage over investment funds hoovering up real estate and squeezing out first-time buyers. The government will raise stamp duty to 10% on purchases of 10 or more residential houses, Finance Minister Paschal Donohoe said late on Tuesday in Dublin. The current levy is 1% on homes of below 1 million euros ($1.2 million) and 2% above that level. The increased tax will apply to bulk purchases as well as the acquisition of 10 or more units over a year, though not to apartment blocks. (BBG)

SNB: "I see very little evidence at this moment that we're close to a break of the dollar's dominance. No other jurisdiction in the world has the same combination of institutional stability, and deep and open capital markets," Swiss National Bank President Thomas Jordan says at Atlanta Fed panel discussion. "It could take a long time for a challenger to displace the U.S. dollar as the dominant currency." Launch of a central bank digital currency probably wouldn't be enough to encroach on U.S. dollar's dominant role. Introduction of a CBDC would have only a limited of openness and deepness of financial markets of a given country. (BBG)

U.S.

FED: MNI BRIEF: Quarles Says U.S. is Beginning Strong Recovery

- Fed Vice Chair for Supervision Randal Quarles said that while a strong U.S. recovery is underway and about to "enter this last stretch of the return to normal," some households and businesses are still vulnerable. "The COVID event is not behind us, and the vulnerabilities it exposed are not gone," said Quarles in written remarks for testimony to be given to Congress Wednesday. The U.S. banking sector handled the Covid shock better than expected but Quarles called for reforms to Treasury and money markets, finalizing the post-crisis Basel III reforms and completing the transition from Libor - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: The White House said in a statement it was encouraged by the talks and would follow up with the Republican senators later this week. Biden's administration has said it is willing to work with Republicans but will forge ahead with only Democratic support if necessary. The White House had set a Tuesday deadline for Republicans to offer a new infrastructure plan. Republicans were not likely to meet it, Capito spokeswoman Kelley Moore said earlier. (RTRS)

FISCAL: U.S. Republican lawmakers met on Tuesday with top officials from President Joe Biden's administration to seek common ground on an infrastructure proposal but said they did not present a new plan of their own. Senators who attended the meeting with Transportation Secretary Pete Buttigieg and Commerce Secretary Gina Raimondo said they discussed how infrastructure investment would be paid for. (RTRS)

FISCAL: President Biden and Treasury Secretary Janet Yellen promoted the administration's infrastructure and tax plans as vital for the U.S. to compete globally, as the White House and Republican lawmakers continued to pursue a deal to improve the nation's bridges, roads and broadband internet. (WSJ)

FISCAL: Business groups were unmoved by Treasury Secretary Janet Yellen's call Tuesday for U.S. companies to accept higher taxes in return for a huge public investment in infrastructure aimed at boosting the American economy. "The data and the evidence are clear: The proposed tax increases would greatly disadvantage U.S. businesses and harm American workers," Suzanne Clark, president of the U.S. Chamber of Commerce, said following Yellen's speech to the group Tuesday morning. "And now is certainly not the time to erect new barriers to economic recovery." The chamber has said it supports investment in infrastructure but favors paying for that largely through user fees. (BBG)

CORONAVIRUS: Covid case counts are declining by 5% or more in nearly every U.S. state, a CNBC analysis of data compiled by Johns Hopkins University shows, as nationwide levels of infections and deaths continue their downward trends. (CNBC)

CORONAVIRUS: People in rural areas are receiving the Covid-19 vaccines at a lower rate than those in urban areas, potentially hindering the nation's progress toward ending the pandemic, according to a new study published Tuesday by the Centers for Disease Control and Prevention. (CNBC)

CORONAVIRUS: Covid-19 booster shots could be needed for fully vaccinated people within a year, the Food and Drug Administration's top vaccine regulator said Tuesday. The current versions of the Pfizer-BioNTech and Moderna Covid-19 vaccines are highly effective at preventing Covid and also appear to protect against the variants circulating in the United States, said Dr. Peter Marks, director of the FDA's Center for Biologics Evaluation and Research. "So, hopefully, you know, it would be nice if it'll turn out that it'll be a year before anyone might need a booster," Marks said during a virtual press conference on the Covid-19 vaccines with high school and middle school journalists. (CNBC)

CORONAVIRUS: Texas Governor Greg Abbott issued an executive order prohibiting governmental entities — including counties, cities, school districts, public health authorities, or government officials — from requiring or mandating mask-wearing. Public schools may continue to follow current mask-wearing guidelines through June 4. After that date, no student, teacher, parent or other staff member or visitor can be required to wear a mask while on campus. (BBG)

POLITICS: New York State Attorney General Letitia James' office — which already was conducting a civil investigation of former President Donald Trump's company — is now probing the Trump Organization "in a criminal capacity," her spokesman said Tuesday night. James' spokesman indicated that her probe is being done in conjunction with the ongoing criminal investigation of Trump and the Trump Organization by the office of Manhattan District Attorney Cyrus Vance Jr. (CNBC)

MARKETS: Archegos Capital Management's implosion signals Wall Street has grown too complacent about potential threats building up in the economy, said Michael Hsu, the new acting chief of the Office of the Comptroller of the Currency. "Banks do deserve credit for having weathered the pandemic fairly well," Hsu, who Treasury Secretary Janet Yellen installed at the OCC this month, told reporters Tuesday. "There is a risk of a bit of overconfidence from that, to think that because everyone has done so well, they're going to do well at everything as we enter a kind of growth phase." (BBG)

EQUITIES: U.S. House passes a bill to codify a ban on insider trading to make it easier for the government to prosecute cases against company insiders and recipients of confidential tips. (BBG)

OTHER

U.S./CHINA: The Treasury Department announced Tuesday that investors face a June 11 deadline to buy shares in subsidiaries of companies already on a U.S. blacklist or sell shares to Americans. Until then, the White House is working to clarify how the China investment ban applies to the subsidiaries, said the people, who discussed the plan on condition of anonymity. (BBG)

U.S./CHINA: House Speaker Nancy Pelosi, D-Calif., on Tuesday called for a "diplomatic boycott" of the 2022 Winter Olympics in Beijing in response to China's human rights record. "We cannot proceed as if nothing is wrong about the Olympics going to China," Pelosi told Congress' Human Rights Commission and the Congressional-Executive Commission on China during a hearing on the games. (CNBC)

U.S./CHINA/TAIWAN: China accused the United States on Wednesday of threatening the peace and stability of the Taiwan Strait after a U.S. warship again sailed through the sensitive waterway that separates Taiwan from its giant neighbour. (RTRS)

EU/CHINA: The European Parliament is expected to pass a motion on Thursday pushing to formally freeze the EU's investment agreement with China, in the wake of what MEPs describe as Beijing's "baseless and arbitrary" sanctions on EU lawmakers earlier this year. The draft motion, seen by POLITICO, will also call on the EU to step up coordination with the U.S. to deal with China, while stressing that any trade deals with Taiwan "should not be held hostage" by the deal with Beijing. If passed, the vote is expected to deal a further blow to initial expectations that the deal — seven years in the making and aimed at opening up the Chinese market — could enter the ratification process in a few months' time. (POLITICO)

GLOBAL TRADE: The Senate will include $52 billion to bolster domestic semiconductor manufacturing in a broader bill to enhance U.S. competitiveness with China, Senate Majority Leader Chuck Schumer said. Schumer on Tuesday called the move "a historic and immediate infusion of federal money" to restore U.S. manufacturing of semiconductors that are crucial to the automobile and electronics industries as well as the military. Among other things, the legislation would set up a program to give financial assistance to build, expand, or modernize semiconductor fabrication plants in the U.S. (BBG)

GLOBAL TRADE: Japan will expand support for domestic production of advanced semiconductors and batteries under this year's growth blueprint as it seeks to buffer against chips shortages that have buffeted the nation's core industries. (Nikkei)

BOJ: The Bank of Japan pays close attention not only to the positive effects of its monetary policy, but also the side effects, Governor Haruhiko Kuroda says. The BOJ won't hesitate to add easing if needed, while closely monitoring the economic impacts of the pandemic, Kuroda says in a speech to an online conference. If necessary, BOJ will extend its special Covid-19 programs past September. Having 2% inflation target helps stabilize foreign exchange rates. (BBG)

JAPAN: Okinawa in southern Japan will ask the central government to expand a coronavirus state of emergency to include the prefecture, Jiji reports in a one-line dispatch. (BBG)

JAPAN: Chief Cabinet Secretary Kato: Will handle adding state of emergency areas flexibly based on situation. (BBG)

JAPAN: Japan's Nuclear Regulation Authority found a safety lapse at Tepco's Fukushima Daini nuclear power plant in a nationwide inspection it conducted after lapses were discovered at the utility's Kashiwazaki Kariwa nuclear plant, public broadcaster NHK reports, citing an unidentified person. Finds lapse in measures against terrorism at a protected area where entries are restricted. Violations weren't as serious as those at Kashiwazaki Kariwa plant, and Tepco has taken measures to fix them. Tepco declined to disclose details to NHK because it involves protection of nuclear materials. (BBG)

AUSTRALIA: Almost one-third of adult Australians say they are unlikely to be vaccinated against COVID-19 in a new sign of concern over the nation's troubled plan to shield most people from the coronavirus by the end of this year. Doubts about vaccine side effects top the list of reasons for the alarming level of vaccine hesitancy, but a new survey also shows many people believe there is no rush to take a jab while the international borders are closed. In the middle of a heated debate about when to open Australia's borders, 15 per cent of adults surveyed said they were "not at all likely" and 14 per cent "not very likely" to be vaccinated in the months ahead. Only 14 per cent of total respondents said they were "extremely likely" and 8 per cent "very likely" to take the jabs, with another 13 per cent "fairly likely" to do so. The exclusive survey, an initiative of The Sydney Morning Herald and The Age with research company Resolve Strategic, found vaccine doubts were stronger than in Ipsos polls carried out in February and September, before an official ruling in April about blood clots linked to AstraZeneca doses for people under 50. (The Age)

NORTH KOREA: The U.S. administration of President Joe Biden will build on a 2018 summit agreement with North Korea, White House Asia czar Kurt Campbell said Tuesday, extending overtures to Pyongyang after completing a monthslong policy review on the North. "Our policy review took a careful look at everything that has been tried before. Our efforts will build on Singapore and other agreements made by previous administrations," Campbell, White House policy coordinator for the Indo-Pacific, said in a written interview with Yonhap News Agency. It marks the first time a ranking U.S. official has said on the record that the Biden administration will inherit the denuclearization agreement signed in Singapore by former President Donald Trump and North Korean leader Kim Jong-un in June 2018. (Yonhap)

CANADA: Prime Minister Justin Trudeau is suggesting that three-quarters of Canadians will need to be vaccinated against COVID-19 before the Canada-U.S. border can be reopened. Trudeau acknowledges that discussions about the border are ongoing, but he's tamping down any expectations that travel restrictions could be lifted soon. (Canadian Press)

CANADA: Montrealers will soon be able to dine at restaurants again, stay out as late as they wish, and visit one another under Quebec's plans to lift some of the continent's toughest Covid-19 restrictions. The Canadian province estimates 75% of adults will have received a first vaccine shot by June 15, making it possible to ease the lockdown, Premier Francois Legault said during a news conference on Tuesday. "We've exceeded our goals with the vaccination campaign," he said. "Thanks to your efforts, we can now announce a reopening plan." A curfew in place since January will be lifted on May 28. Three days later, restaurants will be able to reopen in most regions, including Montreal, followed by bar patios on June 11. The government also shared a timeline for allowing visits inside private homes, starting June 14. (BBG)

CANADA: MNI REALITY CHECK: Canada CPI May Rise Past Most in Decade

- Canadian industry sources told MNI they expect inflation pressures to continue in coming months on strong demand, higher raw material costs and supply disruptions. Consumer price inflation will likely come in at 3.3% for April according to an economist consensus, the highest in a decade, passing the Bank of Canada's target range of 1% to 3%. Most of the gain comes on gasoline and overall price weakness last year as the pandemic struck. BOC Governor Tiff Macklem said last week he remains confident price gains will top out around 3% and later fade away - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

BOC: MNI INTERVIEW: BOC May Adjust Guidance Over Talking Down CAD

- The Bank of Canada would likely react to any unwelcome further strength in the dollar by scaling back economic projections or tweaking other guidance rather than seeking to directly talk it down, Dominique Lapointe, a former economist in the finance department's forecasting branch, told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

MEXICO: A member of Mexico's central bank board said there's no room for further interest rate cuts, and the bank may eventually need to start withdrawing stimulus if inflation pressures remain elevated. Asked in an interview with Bloomberg News if she thought further monetary easing is off the table, Deputy central bank Governor Irene Espinosa said, "Yes, I think so, definitely in this context." (BBG)

USMCA: U.S. trade officials raised digital-services taxes as a priority with Canadian counterparts; Canadians understand Washington's concern, official from U.S. Trade Representative says on call with reporters. Official speaks following the first meeting of the U.S.-Mexico-Canada Agreement Free Trade Commission involving U.S. Trade Representative Katherine Tai, Canadian International Trade Minister Mary Ng and Mexican Economy Secretary Tatiana Clouthier. On lumber, U.S. position remains that it would want to see significant changes in Canadian practices for a deal to be reached; duties remain in place. (BBG)

TURKEY: The United States on Tuesday strongly condemned recent comments by Turkish President Tayyip Erdogan on the Jewish people as anti-Semitic, State Department spokesman Ned Price said. (RTRS)

BRAZIL: Brazil's lower house of Congress will vote on Wednesday on a presidential decree proposing the privatization of state-run power company Eletrobras, House Speaker Arthur Lira said on Tuesday. Lower house lawmakers began debating the measure on Tuesday afternoon. "It is important that there is a broad debate on the topic. We have an agreement that, out of respect for the Senate, we give senators 30 days to analyze presidential decrees," Lira tweeted. The decree's sponsor, lawmaker Elmar Nascimento, presented his proposals to the lower house on Tuesday. (RTRS)

RUSSIA: The Biden administration will waive sanctions on the corporate entity and CEO overseeing the construction of Russia's Nord Stream 2 pipeline into Germany, according to two sources briefed on the decision. The decision indicates the Biden administration is not willing to compromise its relationship with Germany over this pipeline, and underscores the difficulties President Biden faces in matching actions to rhetoric on a tougher approach to Russia. (Axios)

SOUTH AFRICA: South Africa vaccinated 39,371 people over two days as it began a broad rollout of vaccines. The slow-pace of the vaccination program, which is initially using the two-dose Pfizer vaccine, highlights the challenges the country is facing in reaching its aim of the inoculating the 40 million it needs to reach so-called herd immunity. The government has said the program will pick up pace. While almost 480,000 South African health workers have been inoculated as part of trial with single-dose Johnson & Johnson vaccines, the government has come under criticism for delays to the broad rollout. (BBG)

ISRAEL: France's presidency on Tuesday called for a resolution at the United Nations Security Council to stop the fighting between Israel and Palestinian militants in Gaza. (RTRS)

OIL: Oil settled lower on Tuesday, tumbling from a two-month high after media reports said the United States and Iran have made progress on reviving a deal restricting the OPEC country's nuclear weapons development, which would boost crude supply. Prices plunged on the reports that Russian ambassador to the United Nations Mikhail Ulyanov said significant progress had been made, but losses stopped after he said on Twitter that negotiators need more time to finalize an agreement. (RTRS)

OIL: Colonial Pipeline, the crucial U.S. pipeline that's been trying to recover from a debilitating criminal hack, restored a vital communications system that failed and temporarily left customers in the dark about fuel shipments. The computer system that allows oil refiners and other clients to reserve space and monitor the status of fuel traveling through the pipeline was back online after an outage earlier Tuesday, Colonial said in an email. (BBG)

CHINA

PROPERTY: Chinese local authorities must effectively cool surging land and property prices by not using real estate as a short-term stimulus, controlling land release and enforcing property controls, the Economic Information Daily said in an editorial. Property prices in China have rebounded last month, with more than 30 major cities registering faster monthly price gains, a clear sign of nationwide heating up of property markets, despite slowing growths in population and money supply and tighter regulations, the newspaper said. (MNI)

POLICY: China will continue its strong effort to cut capacities of high-polluting industries and strictly control high energy-consuming and high-emission projects, said Vice Premier Han Zheng on Tuesday during his tour at China Research Academy of Environmental Sciences. China must stay committed to realizing carbon neutrality with a clear timetable and roadmap and build a clean, low-carbon, safe and efficient energy system. MNI previously reported that the government may boost coal production to tame skyrocketing prices while controlling the domestic steel production to reach emission controls. (MNI)

OVERNIGHT DATA

JAPAN MAR, F INDUSTRIAL OUTPUT +3.4% Y/Y; FLASH +4.0%

JAPAN MAR, F INDUSTRIAL OUTPUT +1.7% M/M; FLASH +2.2%

JAPAN MAR CAPACITY UTILISATION +5.6% M/M; FEB -2.8%

AUSTRALIA Q1 WAGE PRICE INDEX +1.5% Y/Y; MEDIAN +1.4%; Q4 +1.4%

AUSTRALIA Q1 WAGE PRICE INDEX +0.6% Q/Q; MEDIAN +0.5%; Q4 +0.6%

AUSTRALIA MAY WESTPAC CONSUMER CONFIDENCE INDEX 113.1; APR 118.8

AUSTRALIA MAY WESTPAC CONSUMER CONFIDENCE -4.8% M/M; APR +6.2%

While a 4.8% fall is always going to attract attention we should put this result in perspective. It is still the second highest print for the Index since April 2010 and does follow an 11% rise in the Index over the previous three months. The fall may also represent some disappointment in the Federal Budget as a very generous Budget was still unable to exceed the exuberant expectations of the community. The Budget was announced on May 11 – the half-way point of the survey period. Responses to our annual Budget question show one in five consumers expect this year's Federal Budget to improve their finances over the next 12 months. There has only been one more positive response in the eleven years we have run this question – the 2020 survey which showed just over one in four consumers expected to be better off. The 2020 and 2021 surveys are the first times since we first started surveying Budget responses in 2010 that those expecting the Budget to deliver improvements outnumbered those expecting to be worse off. (Westpac)

NEW ZEALAND Q1 PPI INPUT +2.1% Q/Q; Q4 +0.1%

NEW ZEALAND Q1 PPI OUTPUT +1.2% Q/Q; Q4 +0.5%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS WEDS; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Wednesday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2000% at 09:23 am local time from the close of 2.1914% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 37 on Tuesday vs 44 on Monday. A lower index indicates weaker expectations for tightening liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.4255 WEDS VS 6.4357

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4255 on Wednesday, compared with the 6.4357 set on Tuesday.

MARKETS

SNAPSHOT: Markets Coil In Asia, Await Catalyst

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 506.79 points at 27898.82

- ASX 200 down 143.879 points at 6922.4

- Shanghai Comp. down 14.629 points at 3514.385

- JGB 10-Yr future unch. at 151.41, yield down 1.3bp at 0.075%

- Aussie 10-Yr future up 1.0 tick at 98.285, yield down 1.3bp at 1.768%

- U.S. 10-Yr future unch. at 132-12+, yield up 0.34bp at 1.640%

- WTI crude down $0.69 at $64.79, Gold down $1.97 at $1867.47

- USD/JPY up 4 pips at Y108.94

- FED'S QUARLES: U.S. IS BEGINNING STRONG RECOVERY (MNI)

- BIDEN DELAYS REVAMP OF TRUMP'S BLACKLIST FOR CHINA INVESTMENTS (BBG)

- CHINA SAYS U.S. THREATENING PEACE AS WARSHIP TRANSITS TAIWAN STRAIT (RTRS)

- EUROPEAN PARLIAMENT TO VOTE ON FREEZING CHINA DEAL (POLITICO)

- BIDEN ADMINISTRATION ENCOURAGED BY BIPARTISAN INFRASTRUCTURE TALKS

- UK PLANS TO EASE SOCIAL DISTANCING IN 'DISARRAY' AS INDIAN VARIANT CASES RISE (TELEGRAPH)

BOND SUMMARY: Core FI Coils Overnight

The U.S. Tsy space traded in a confined manner overnight. T-Notes -0-00+ last at 132-12, while cash Tsys trade little changed to 1.0bp cheaper across the curve, with 20s providing the weak point on the curve ahead of today's Tsy auction covering that tenor. Several desks point to the need for further concession to allow smooth digestion of the auction, even after the recent cheapening on the 10-/20-/30-Year fly, with a slower recovery in liquidity vs. longer dated Tsys & the recent refinement of Fed purchases in that area of the curve cited. There has been nothing in the way of meaningful headlines, while the holiday in Hong Kong has removed liquidity from the Asia-Pac region. Flow has been dominated by a 10K block sale of the FVN1 124.00 calls.

- The latest 5-Year JGB auction was on the softer side, with the issues highlighted in our auction preview (namely a lack of pre-auction concession, little in the way of relative value and more desirable carry & roll propositions further out the curve) likely weighing on demand. The yield tail was steady and relatively narrow, although the cover ratio cratered back towards the levels seen at March's 5-Year auction. Elsewhere, the low and average prices that prevailed at auction missed broader dealer expectations for the low price (just). Futures are back from best levels but still in a contained range, last -1, while the belly has moved away from richest levels, unwinding its early outperformance vs. longer dated paper.

- The latest round of ACGB supply (in the form of A$1.2bn of ACGB Jun '31) wasn't the firmest, with the cover ratio on the softer side, albeit not as soft when adjusted for the size differential vs. the prev. auction, while the weighted average yield "only" printed 0.17bp through prevailing mids at the time of supply (per Yieldbroker prices). Still, no real reaction was seen in futures, which held to narrow ranges. YM -0.5, XM +1.0 on the day at typing.

JGBS AUCTION: Japanese MOF sells Y2.0685tn 5-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.0685tn 5-Year JGBs:- Average Yield -0.097% (prev. -0.091%)

- Average Price 100.50 (prev. 100.48)

- High Yield: -0.093% (prev. -0.087%)

- Low Price 100.48 (prev. 100.46)

- % Allotted At High Yield: 94.3092% (prev. 77.7054%)

- Bid/Cover: 3.300x (prev. 4.547x)

JGBS AUCTION: Japanese MOF sells Y2.8674tn 1-Year Bills:

The Japanese Ministry of Finance (MOF) sells Y2.8674tn 1-Year Bills:

- Average Yield -0.1218% (prev. -0.1268%)

- Average Price 100.122 (prev. 100.127)

- High Yield: -0.1198% (prev. -0.1258%)

- Low Price 100.120 (prev. 100.126)

- % Allotted At High Yield: 98.7853% (prev. 80.1260%)

- Bid/Cover: 3.446x (prev. 3.717x)

AUSSIE BONDS: The AOFM sells A$1.2bn of the 1.50% 21 Jun '31 Bond:

The Australian Office of Financial Management (AOFM) sells A$1.2bn of the 1.50% 21 June 2031 Bond, issue #TB157:- Average Yield: 1.7156% (prev. 1.6882%)

- High Yield: 1.7175% (prev.1.6900%)

- Bid/Cover: 2.8292x (prev. 3.3260x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 28.3% (prev. 75.0%)

- bidders 36 (prev. 42), successful 15 (prev. 12), allocated in full 9 (prev. 4)

EQUITIES: Markets Lower

Equity markets in Asia are mostly lower after a negative lead from the US. Bourses in Australia lead the way, nursing losses of almost 2% pressured by losses in the commodity complex as iron ore declines 3%. Markets in Japan have also sustained heavy losses, the Nikkei 225 down around 1.5% as further areas declare a state of emergency. In Taiwan the Taiex is in minor negative territory after gaining 5% yesterday. Bourses in China hovered between small gains and losses. US equity futures are in the red, the Nasdaq leading the way lower, AT7T declined after the company announced intentions to spin off its media operations.

OIL: Crude Futures Extend Losses

After dropping on Tuesday oil is lower in the Asia-Pac time zone on Wednesday, though is holding above yesterday's lows. WTI is down $0.85 from settlement levels at $64.64/bbl, Brent is down $0.87 at $67.84/bbl. Data late yesterday showed headline crude stocks rose 620k bbls while stocks at Cushing rose 52k bbls. The downstream report was more bullish with gasoline stockpiles declining 2.84m bbls, distillate dropping 2.58m bbls. Elsewhere focus in negotiations over Iran's nuclear deal. A Russian representative to the UN IAEA said that while progress had been made, unresolved issues remain. If a deal is reached waivers for Iranian crude are expected to be reinstated which would bring significant supply back to market.

GOLD: Bull Still In Charge With Key Resistance Levels In View

A narrow Asia-Pac session for spot, last dealing little changed just shy of the $1,870/oz mark after bulls failed to force a break of resistance in the form of the Jan 29 high ($1,875.7/oz) on Tuesday. However, bulls still remain in the ascendancy from a technical perspective, and a sustained break of that level would switch bullish focus to the 76.4% retracement of the Jan 6 to Mar 8 sell off ($1,892.7/oz). Please see MNI MARKETS ANALYSIS: Gold Bulls Continue To Shine (published on May 18) for a more detailed technical overview.

- The DXY is operating around multi month lows, while a weighted average of U.S. real yields (based on the weights deployed in the ICE-Bank of America MOVE Index) has consolidated at the lowest levels witnessed since Feb in recent days.

- ETF holdings of gold have started to tick back up in recent weeks after finding a base in late April, although that metric still sits ~16% off of its all-time high, which was registered back in October.

FOREX: Caution Prevails, Commodity FX Falter

A mild sense of caution prevailed in Asia, applying pressure to high-beta FX. Headline flow was relatively light, but a decline in BBG Commodity Index dragged the Antipodeans as well as CAD & NOK lower. Regional liquidity was limited by market holidays in Hong Kong & South Korea.

- The PBOC set the central USD/CNY mid-point at CNY6.4255, just 4 pips above sell-side estimate. USD/CNH crept higher amid simmering Sino-U.S. tensions.

- EUR topped G10 pile but the DXY managed to add a handful of pips nonetheless. The greenback remained resilient ahead of today's publication of minutes from the FOMC's latest MonPol meeting.

- Other than that, focus turns to inflation data from the EZ, UK & Canada as well as comments from Fed's Quarles, Bullard & Bostic and ECB's Lane, de Cos, Panetta & Rehn.

FOREX OPTIONS: Expiries for May19 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2035-50(E1.2bln), $1.2150(E1.5bln-EUR puts), $1.2170-80(E715mln), $1.2200(E498mln)

- USD/JPY: Y108.00-10($712mln), Y108.90-109.00($844mln), Y109.50($905mln-USD puts)

- AUD/USD: $0.7857-80(A$545mln)

- USD/MXN: Mxn19.40($500mln)

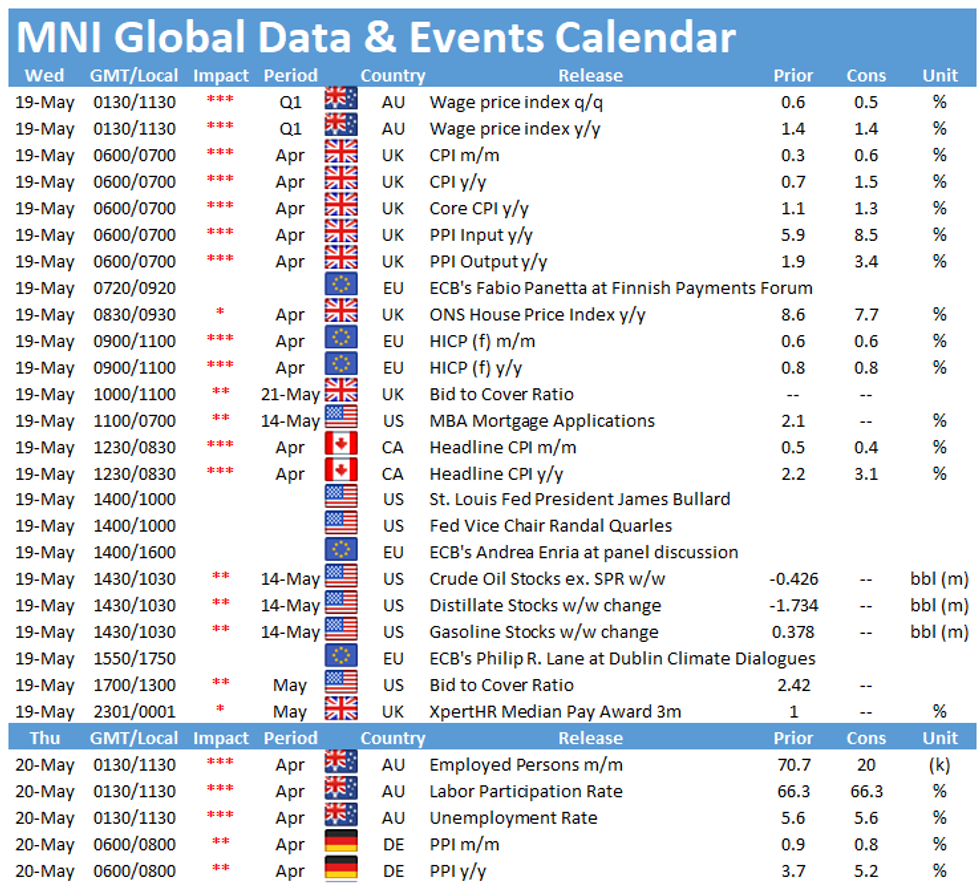

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.