-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Trudeau To Keep Working As Opposition Seeks Ouster

MNI EUROPEAN OPEN: Some Geopolitical Tensions Cooling

EXECUTIVE SUMMARY

- EU REACHES DEAL ON COVID-19 PASSES TO RESCUE SUMMER (RTRS)

- BIDEN TEAM SEEKS CHIP INFORMATION SHARING TO EASE SUPPLY CRUNCH (BBG)

- ISRAEL AND HAMAS AGREE TO CEASE-FIRE OVER GAZA CONFLICT (CNBC)

- IRAN READIES OIL EXPORT HIKE AMID OPTIMISM IN VIENNA (NERGY INTELLIGENCE)

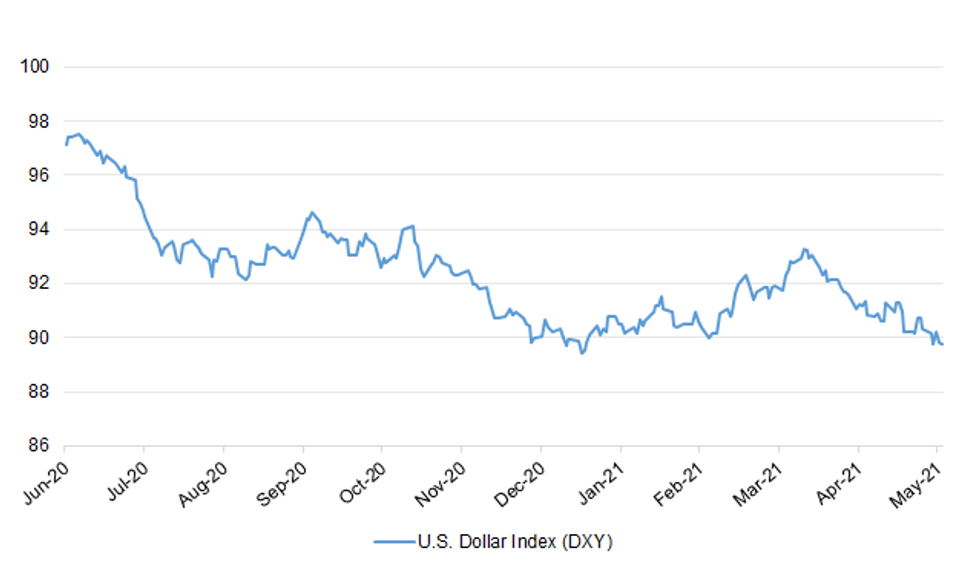

Fig. 1: U.S. Dollar Index (DXY)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: The number of U.K. cases of a worrying coronavirus variant from India more than doubled for a second week as authorities also monitor a new mutation of the virus, adding fresh doubt to U.K. plans to fully unlock the economy. Health officials have now detected 3,424 cases of the B1.617.2 variant, Public Health England said Thursday in a statement. That's up from 1,313 last week, and 520 a week earlier. They're also investigating a mutation called VUI-21MAY-01, with 49 cases logged so far. (BBG)

CORONAVIRUS: Failures in England's Test and Trace system are partly responsible for a surge in the Indian variant in one of the worst affected parts of the country, a report seen by the BBC says. For three weeks in April and May, eight local authorities in England did not have access to the full data on positive tests in their area. The number of missing cases was highest in Blackburn with Darwen, Lancashire. A recent surge in infections there has been linked to the Indian variant. The government said a Track and Trace "software issue" had affected a "handful" of places, but this had been resolved "as quickly as possible". The other areas experiencing incomplete data were Blackpool, York, Bath and North East Somerset, Bristol, North Somerset, Southend-on-Sea and Thurrock. Labour called on ministers to "explain what's gone wrong". (BBC)

CORONAVIRUS: The "one-metre plus" social distancing rule is still on course to be scrapped next month, Boris Johnson has told Conservative MPs. He said it was the "single biggest difference" the government could make to help pubs get back on their feet and that he was determined to remove the restriction on June 21. Pubs, bars, restaurants, theatres and cinemas have warned that they will remain financially unviable until the rule is removed. They have been legally required to keep customers at least a metre apart since last July, forcing many hospitality businesses to remain shut throughout the pandemic. Plans to end social distancing measures next month were put in doubt this week after cases of the faster-spreading Indian variant rose. (The Times)

ECONOMY: MNI REALITY CHECK: UK Retail Sales In Line For Reopening Surge

- UK retail sales surged in April, according to industry leaders, as non-essential stores reopened in England mid-month, suggesting that volumes could exceed the 4.5% monthly increase forecast by City analysts. Sales were boosted by the return of shoppers to a broader range of retailers from April 12, providing an easy comparison with March, when non-essential shops were shuttered. Retailers were somewhat disappointed with footfall, which was down approximately 25% on 2019, according to one industry leader. However, shoppers braved the High Street with purpose, significantly lifting the amount spent per head - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

BREXIT: France said on Thursday that the European Union could not accept any unilateral move by Britain that threatened the integrity of the single market via the Irish border, calling it dangerous to question the Brexit deal's Northern Ireland protocol. (RTRS)

BREXIT: MNI SOURCES: EU Retreats From Equivalence Threat In CCP War

- The European Commission seems to be edging away from the nuclear threat of denying London's clearing industry equivalence as a way to force the euro-denominated derivatives clearing business to move to the eurozone, sources with knowledge of the matter told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

BREXIT: Boris Johnson is pushing for a zero-tariff trade deal with Australia in the next month after over-ruling the concerns of his environment secretary. The prime minister met ministers yesterday to discuss the prospects of a deal. He is understood to have sided with Liz Truss, the trade secretary, over George Eustice. The deal will give Australian food exporters the same terms as those enjoyed by the EU. In an effort to address concerns, there will be a transition period of between 10 and 15 years before the zero-tariff regime is enacted. The plan is being resisted by farming groups, who have warned that it would set a dangerous precedent for trade deals and could result in British farmers struggling to compete with cheap imports. (The Times)

EUROPE

CORONAVIRUS: The European Union reached a deal on Thursday on COVID-19 certificates designed to open up tourism across the 27-nation bloc this summer as a rapid pick-up of vaccinations allows widespread easing of coronavirus restrictions. (RTRS)

FRANCE: The Eiffel Tower, which has been shut to visitors since Nov. 30, will reopen on July 16, its operator said in a statement. Tickets go on sale on June 1. France will open vaccination to all adults from May 31 as it expects increased deliveries of vaccines next month, the government said in a statement. (BBG)

PORTUGAL: Portugal is likely to raise its economic growth forecast for this year to close to 5% as tourists help boost the recovery and Europe's Covid-19 vaccination campaign advances. The government sees gross domestic product expanding as much as one percentage point more than the 4% it forecast in April, Portuguese Finance Minister Joao Leao said in a Bloomberg Television interview in Lisbon. "We're actually very optimistic." (BBG)

RATINGS: Potential sovereign rating reviews of note scheduled for after hours on Friday include:

- Fitch on Switzerland (current rating: AAA; Outlook Stable)

- Moody's on Greece (current rating: Ba3; Outlook Stable)

- S&P on Slovakia (current rating: A+; Outlook Stable)

- DBRS Morningstar on Latvia (current rating: A (Low), Stable Trend) & Lithuania (current rating: Lithuania at A, Stable Trend)

U.S.

FED: The Federal Reserve is moving forward in its efforts to develop its own digital currency, announcing Thursday it will release a research paper this summer that explores the move further. Though the central bank did not set any specific plans on the currency, Chairman Jerome Powell cited the progress of payments technology and said the Fed has been "carefully monitoring and adapting" to those innovations. "The effective functioning of our economy requires that people have faith and confidence not only in the dollar, but also in the payment networks, banks, and other payment service providers that allow money to flow on a daily basis," Powell said in a video message accompanying the announcement. (CNBC)

FED: MNI INTERVIEW: Enhanced UI End Not US Jobs Gain Driver: SF Fed

- Employment gains in states planning to cut enhanced unemployment insurance benefits are unlikely to be tied to those programs' premature end, labor economists at the San Francisco Fed told MNI, although a small number of workers on the margins could be affected - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: President Joe Biden is calling for a crackdown on rich taxpayers who avoid tax by hiding a big chunk of their income from the IRS. Tax compliance is among the many ways Biden is seeking to raise tax revenue from households earning more than $400,000 a year to fund the American Families Plan. The legislation would boost spending for initiatives like expanded education, childcare and paid leave. Underreported income, largely among the wealthy, is the biggest contributor to the so-called "tax gap," according to a Treasury Department report issued Thursday. (CNBC)

FISCAL: The White House pushed back against Republican governors curbing the extra jobless benefits for out-of-work Americans extended in President Joe Biden's March pandemic-relief package. "There will come a day when we do not need these additional supports. There's no question, these were designed to get us to the end of the pandemic. But we're not there yet," Cecilia Rouse, Chair of the Council of Economic Advisers, said at a Bloomberg conference Thursday… Rouse also addressed concerns about inflation stemming from the Covid-19 rescue package and the more than $4 trillion in longer-term spending that Biden has proposed -- saying that the risk of doing too little was still greater than doing too much. (BBG)

CORONAVIRUS: If the United States reaches President Biden's goal of 70 percent of adults getting at least one coronavirus vaccine dose by July 4, that could help ward off surges later in the year, Anthony S. Fauci said. In a Washington Post Live interview Thursday, the government's leading infectious-disease expert said there was a "positive wild card" missing in previous nationwide coronavirus surges: "That was at a point when virtually no one in the country was vaccinated." As of Thursday, 47.9 percent of the U.S. population had received at least one dose. (Washington Post)

CORONAVIRUS: Dr. Anthony Fauci, chief medical advisor to the White House, said that it's conceivable for middle schools and high schools to be completely mask-free in the fall. "If the children get vaccinated, it is conceivable that that would actually wind up being a recommendation. We'll just have to wait and see," said Fauci. Centers for Disease Control and Prevention Director Dr. Rochelle Walensky said Tuesday that more than half a million 12- to 15-year-olds have received a Covid-19 vaccine so far — less than a week since the CDC cleared it for public distribution. (CNBC)

CORONAVIRUS: The U.S. will continue to enforce coronavirus-related restrictions on nonessential travel across U.S. land borders through June 21, the Biden administration announced on Thursday. "We're working closely with Canada & Mexico to safely ease restrictions as conditions improve," the Department of Homeland Security said on Twitter. Essential trade and travel will still be permitted, the DHS tweeted. (CNBC)

CORONAVIRUS: The Zuckerberg San Francisco General Hospital and Trauma Center had no Covid-19 patients for the first time since March 2020, according to Vivek Jain, an infectious disease doctor, who called the day a "huge milestone." (BBG)

CORONAVIRUS: Minnesota Governor Tim Walz announced Thursday that sports fan will be able to get vaccinated when they attend upcoming baseball, basketball or hockey games, in partnership with professional teams. (BBG)

MARKETS: Securities and Exchange Commission Chair Gary Gensler said he would be aggressively pursuing bad financial actors who were "playing with working families' savings." Gensler made his remarks at a Financial Industry Regulatory Authority conference with Robert Cook, president and CEO of FINRA. FINRA is the agency that regulates broker-dealers and exchanges. As he did in his recent Congressional testimony, Gensler emphasized that enforcement would be a key part of protecting the public. (CNBC)

OTHER

GLOBAL TRADE: Corporations around the world should pay at least a 15% tax on their earnings, the Treasury Department said Thursday as part of its push for a global minimum for businesses. The final rate could go even higher than that, according to a Treasury release that said the 15% minimum is a "floor and that discussions should continue to be ambitious and push that rate higher." U.S-based companies currently pay a 21% rate, a level that was slashed during the Trump administration. Previously, the top rate had been 35%. (CNBC)

GLOBAL TRADE: Commerce Secretary Gina Raimondo said the Biden administration is exploring how to help semiconductor producers and buyers share supply chain information to alleviate the global chip supply crisis, and urged Congress to swiftly pass legislation to fund domestic production. "There's a lack of transparency right now in the supply chain," Raimondo said in a call with reporters Thursday following a day of meetings with companies. "We are trying to figure out what role the government can and should play in increasing that information sharing and forecasting so we can alleviate the short-term crunch." (BBG)

EU/CHINA: The EU won't let certain "radical emotions" dominate its eventual strategic choices with China even after the European Parliament passed a motion to freeze discussions on the Comprehensive Agreement on Investment (CAI), due to human rights issues in Xinjiang, the Global Times said in an editorial. China understands that these "radical emotions" have to be released and China should be patient and try to achieve "many things" through bilateral efforts, and expand economic and trade cooperation, the newspaper said. (MNI)

GEOPOLITICS: Japan & Australia plan to hold `2-plus-2' talks in May. (Yomiuri)

CORONAVIRUS: Leaders of the world's largest economies will adopt on Friday a declaration recommending voluntary actions to boost COVID-19 vaccine production, snubbing a push from the United States and other nations on patent waivers, the final text shows. Several G20 leaders will speak at the summit, one of this year's major events to coordinate global actions against the pandemic. U.S. President Joe Biden is not listed among the speakers, with Vice President Kamala Harris representing the United States at the meeting, an EU Commission spokesman said. The White House did not immediately comment. The EU executive, which co-hosts the summit with the Italian government, is set to announce it will set up three manufacturing hubs in Africa this year to boost long-term production of vaccines, one EU official told Reuters. The official said drugmakers are also set to announce on Friday they will provide large supplies of at-cost COVID-19 vaccines to poor nations this year to try to redress a global imbalance. (RTRS)

CORONAVIRUS: New Zealand will push for the removal of tariffs on vaccines and medical supplies when it hosts a virtual summit of APEC trade ministers next month, Dow Jones reported, citing an interview with Trade Minister Damien O'Connor. A commitment to removing barriers to trade in vaccines and related medical supplies will be the "first and core component" of the June 5 meeting, O'Connor said. (Dow Jones)

CORONAVIRUS: Two doses of AstraZeneca Plc's Covid-19 vaccine provide about 85% to 90% protection against symptomatic disease, according to statistics released by Public Health England on Thursday. The health body estimated that 13,000 deaths have been prevented in England as of May 9 in people ages 60 and older. It also suggested that vaccinations have stopped almost 40,000 hospitalizations among the over 65s, a crucial metric in a country where the National Health Service has struggled to contain Europe's highest death toll from the pandemic. (BBG)

JAPAN: Japan's government will discuss whether to extend a state of emergency in Tokyo and other areas by as much as three weeks, broadcaster TBS reported, with daily virus cases still high two months before the Olympics. The emergency, set to expire at the end of this month, may be extended to coincide with the June 20 end of Okinawa's state of emergency, TBS reported. Broadcaster NTV reported Thursday on a possible extension for Tokyo and Osaka. The Olympics, beginning July 23, are expected to bring about 94,000 athletes and officials from overseas to Tokyo. Public opposition to the competition has been building as virus cases surged and the vaccine roll out remained slow.

JAPAN: Japan doesn't have immediate plan to use Astra COVID vaccine. (NHK)

JAPAN: Japan won't submit extra budget to current Diet session. (Yomiuri)

NEW ZEALAND: New Zealand Finance Minister Grant Robertson said he wants to return to a more sustainable fiscal position with lower net debt, but it's too soon to set a target. "For now we don't have a specific target. We'll re-look at that again as the economy starts to recover," Robertson said in an interview with Bloomberg Television late Thursday in Wellington after delivering his annual budget. "We do want to start charting a course for New Zealand to return to a more sustainable fiscal position. That won't happen for some years, debt isn't due to peak until 2023, but we do need to have a mind to the future and starting to see that come down." The budget projected net debt peaking at 48% of GDP in 2023, well above the 18.6% recorded in 2019 before the arrival of the pandemic. Even so, it's a lot lower than the debt levels of international peers. (BBG)

SOUTH KOREA: South Korea will extend its current social distancing measures for another three weeks, the prime minister said Friday, amid continued cluster infections and spreading variant cases. "The number of new daily average patients as of late remains in the 500 level, not budging below that point, and infections are continuing from all quarters in our daily lives," Prime Minister Kim Boo-kyum said as he announced the extension of virus curbs during a regular COVID-19 response meeting in Seoul. Kim, however, noted that the number of critical patients has dropped off somewhat thanks to early vaccinations at senior health care centers, and that the number of sick beds for patients also remains sufficient as of now. (Yonhap)

SOUTH KOREA: South Korea will closely monitor raw material price movements and take pre-emptive steps re: the matter if required. (BBG)

CANADA: Ontario expects to permit outdoor gatherings of up to 10 people and allow non-essential retail to operate at 15% capacity starting the week of June 14, contingent on certain vaccination rates being met, the premier said on Thursday. (RTRS)

CANADA: The Office of the Superintendent of Financial Institutions (OSFI) is changing the qualifying rate on uninsured mortgages. "Effective June 1, the minimum qualifying rate for uninsured mortgages (i.e., residential mortgages with a down payment of 20 percent or more) will be the greater of the mortgage contract rate plus 2 percent or 5.25 percent," said OSFI in a release. OSFI says it received over 170 submissions during the consultation period. "It is clear that there are a wide range of issues facing homebuyers, including high indebtedness, rapidly rising home prices, housing supply, and competitive bidding," said OSFI "While some of the suggestions fall outside of OSFI's mandate, we have included a summary of the input received and our response for information." OSFI also says it's launching a process to review the qualifying rate at least once a year, in December ahead of the busy spring market. The banking regulator says the move will help promote post-pandemic financial stability, especially considering how red-hot many Canadian real estate markets have been. "The current Canadian housing market conditions have the potential to put lenders at increased financial risk," said OSFI in April when the idea was first floated. "OSFI is taking proactive action at this time so that banks will continue to be resilient." The regulator says the move will help protect the financial system in the event of a drop in income or rise in mortgage rates. (Yahoo Finance)

CANADA: Canada's Finance Ministry said on Thursday that it would align the minimum qualifying rate for insured mortgages with that for uninsured mortgages starting on June 1 to try to cool the hot housing market, according to a statement. The new minimum qualifying rate "will be the greater of the borrower's mortgage contract rate plus 2 per cent, or 5.25 per cent," said a statement from Finance Minister Chrystia Freeland. "The recent and rapid rise in housing prices is squeezing middle class Canadians across the entire country and raises concerns about the stability of the overall market," she added. "We know that we need to take energetic action on housing supply and affordability in Canada." (RTRS)

USMCA: Mexican Economy Minister Tatiana Clouthier said her government is willing to work with the U.S. and Canada on their concerns over Mexico's efforts to bolster its state electricity company at the expense of private firms. In an interview with Bloomberg News, Clouthier said Mexico will maintain "an open dialogue" with its North American allies about the new law, which would favor the state utility over private renewables companies. The law has been suspended by local courts. (BBG)

MEXICO: Mexican President Andres Manuel Lopez Obrador criticized the central bank for failing to send the government its windfalls from a foreign exchange surplus while saying he backs the institution's autonomy. Lopez Obrador was riled after the bank in April used the profits obtained as a result of last year's currency moves to settle internal finances. Meanwhile, at least one bank board member has criticized the president's administration for boosting financial support for state oil firm Petroleos Mexicanos. (BBG)

MEXICO: Mexico foreign direct investment increased 14.8% in first quarter of 2021 versus a year ago, according to preliminary data from Mexico's economy ministry. (RTRS)

BRAZIL: Senate's inquiry looking into the government's actions to fight pandemic is shameful, Bolsonaro added, referring to the commission as a circus. (BBG)

BRAZIL: Bolsonaro: Senate not willing to investigate embezzlement. (BBG)

BRAZIL: President Jair Bolsonaro acknowledged in his weekly live on social media that groceries are becoming expensive, but noted that fertilizer imports are on the rise and Brazil is likely to harvest another good crop. (BBG)

BRAZIL: Brazilian government is working to increase the average value of cash handouts through its social program known as Bolsa Familia after the fourth month of Covid-19 emergency aid payments, President Jair Bolsonaro says during an event. Govt knows the pandemic's weight on inflation, which made food more expensive in Brazil. Solutions must be sought so that the people can recover their purchasing power, he says. (BBG)

LATAM: Latin America is poised to receive millions of U.S.-made COVID-19 shots in the coming weeks as the United States emerges as a top exporter of vaccines against the novel coronavirus, according to two people familiar with the matter. (RTRS)

TURKEY: BioNTech SE Chief Executive Officer Ugur Sahin said Thursday that the company plans to both produce and engage in research and development of vaccines in Turkey. BioNTech plans to increase the number of vaccines to be dispatched to Turkey to 120 million, with new shipments planned from July to September, Sahin said during a televised press conference after attending a meeting of the Turkish pandemic board. (BBG)

SOUTH AFRICA/RATINGS: Potential sovereign rating reviews of note scheduled for after hours on Friday include:

- South Africa (current rating: BB-; Outlook Stable)

IRAN: The United States, in its first reaction to the latest round of international talks in Vienna on restoring the Iran nuclear deal, called them positive and said they saw meaningful progress. "The latest round of talks in Vienna was positive and we saw meaningful progress," a senior State Department official said by email today. "Nevertheless, important differences remain, which still need to be addressed," the statement continued. (Diplomatic)

ISRAEL: Israel's security cabinet on Thursday voted to approve a tentative cease-fire after 11 days of fighting with Hamas in Israel and the Gaza Strip. Speaking to the Arabic TV network Al-Mayadeen, a Hamas official said the group "obtained guarantees from the mediators" that Israeli airstrikes on Gaza would be halted, and the cease-fire would begin at 2:00 A.M. Friday local time. President Joe Biden is scheduled to deliver remarks on the cease-fire at 5:45 P.M. Eastern on Thursday. (CNBC)

MIDDLE EAST: U.S. Secretary of State Antony Blinken told Israeli Foreign Minister Gabi Ashkenazi in a phone call on Thursday that he plans to travel to the Middle East in the coming days to meet with his Israeli, Palestinian and regional counterparts, the State Department said. (RTRS)

OIL: Iran is preparing to hike its oil exports to "maximum capacity" in the coming months, according to two Iranian oil sources. The move comes amid indications that negotiations between Washington and Iran in Vienna could soon yield a deal to lift US sanctions. "The expectation is that a deal will be reached next week, and two to three months after that sanctions will be lifted," a source at Iran's oil ministry told Energy Intelligence. "Iran is ready to boost exports and the target will be Asia, but we will be in competition with Saudi [Arabia] and Iraq. The number one priority for Iran once sanctions are lifted is to export at maximum capacity, regardless of what this extra supply does to the market," the source said. A deal would open the door to as much as 2 million barrels per day of Iranian crude returning to the market in the months ahead, and the latest signs of progress have caused oil prices to fall by more than $4 per barrel over the last three days. (Energy Intelligence)

OIL: OPEC has said that an IEA report suggesting that investors should not fund new oil projects to curb emissions could lead to oil-price volatility if it is acted on. (RTRS)

CHINA

PBOC: INTERVIEW: PBOC To Adjust Policy Framework For Climate Goals

- The People's Bank of China is working on ways to incorporate climate change considerations into its policy framework and is designing policy instruments to bolster green investment in line with carbon neutrality goals, a prominent policy advisor told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

PBOC: The People's Bank of China will maintain the continuity and stability of its monetary policy to support the uneven recovery and manage external risks, said the Economic Daily in a commentary in an attempt to ease concerns of monetary tightening. M2 expanded 8.1% y/y in April, down from 9.4% y/y in March, PBOC data showed. The deceleration of April M2 was mainly due to the high comparison base same period last year when the central bank offered easier credit to Covid-hit producers and retailers, the newspaper said. If averaged with last April's figures, M2 and total social financing grew 9.6% and 11.9% respectively, which basically matched the nominal economic growth and maintained a reasonable level, the newspaper said. (MNI)

INFLATION: MNI INTERVIEW: Factory Gate Impact On China CPI Seen Limited

- About a fifth of a jump in Chinese factory gate inflation is likely to feed through into consumer prices, but the People's Bank of China need not take immediate policy action unless it becomes clear that local demand is also causing an acceleration in prices, a prominent policy advisor and former member of the PBOC's monetary policy committee told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

COMMODITIES: Chinese coal producers should actively tap output potential to ensure supply during demand peak this summer, according to a joint statement from China Coal Transport and Distribution Association and China National Coal Association. The two industry groups call on coal producers to prioritize supply to power plants in areas with tight resources. Major coal miners are also told to take the lead to prevent abnormal fluctuations in coal prices and keep them in reasonable range. (BBG)

PROPERTY: China may expand a pilot real estate tax to more cities such as Shenzhen and those of the tropical island Hainan, which have experienced rapid gains in home prices, the China Securities Journal reported citing analysts. The readout of a recent meeting of four ministries including the Ministry of Finance said to "actively and steadily promote real estate tax", more urgent than the previous expression of "steadily promoting", which could mean pilot expansion may come before the legislation, the newspaper said citing Jia Kang, dean of China Academy of New Supply-side Economics. The real estate market in Shenzhen is overheated, while Hainan's resource allocation should be more market-oriented given it's being developed into a free-trade port, the newspaper cited Jia as saying. Currently, only Shanghai and Chongqing have applied a pilot real estate tax. (MNI)

OVERNIGHT DATA

JAPAN APR CPI -0.4% Y/Y; MEDIAN -0.5%; MAR -0.2%

JAPAN APR CORE CPI 0.1% Y/Y; MEDIAN -0.2%; MAR -0.1%

JAPAN APR CORE-CORE CPI -0.2% Y/Y; MEDIAN -0.1%; MAR +0.3%

JAPAN MAY, P JIBUN BANK M'FING PMI 52.5; APR 43.6

JAPAN MAY, P JIBUN BANK SERVICES PMI 45.7; APR 49.5

JAPAN MAY, P JIBUN BANK COMPOSITE PMI 48.1; APR 51.0

Flash PMI data indicated that activity at Japanese private sector businesses saw a renewed reduction in May. Output fell at the quickest pace for four months, while the contraction in new business inflows was the fastest since February. Survey members widely attributed the deterioration in business conditions to a resurgence in COVID-19 cases and the reimposition of state of emergency measures. Positively, private sector firms were not discouraged from further increasing capacity, as employment levels rose for the fourth consecutive month. This was despite another sharp rise in input costs across the Japanese private sector. Disruption to short-term activity is likely to remain until the latest wave of COVID-19 infections passes and restrictions enacted under state of emergency laws are lifted. However, Japanese private sector companies were optimistic that business conditions would improve in the year ahead, albeit to a lesser extent than that seen in April. Positive sentiment stemmed from the expectation that the currently sluggish vaccine rollout would gather pace and aid in the submission of the pandemic, in turn triggering a recovery in demand in both domestic and external markets. (IHS Markit)

AUSTRALIA APR, P RETAIL SALES +1.1% M/M; MEDIAN +0.5%; MAR +1.3%

AUSTRALIA MAY, P MARKIT M'FING PMI 59.9; APR 59.7

AUSTRALIA MAY, P MARKIT SERVICES PMI 58.2; APR 58.8

AUSTRALIA MAY, P MARKIT COMPOSITE PMI 58.1; APR 58.9

Australia's private sector growth eased from April's survey record. That said, growth remained sharp to affirm the continued improvement in economic conditions following the easing of COVID-19 restrictions. Export orders notably continued to improve, reflecting the robust external demand despite concerns of rising COVID-19 cases in the region. In turn, this filtered through to the labour market with employment improving at the fastest pace in the survey's five-year history. The outlook for activity over the coming year remained optimistic, particularly in the service sector in May. Ongoing supply-chain disruptions, however, continued to impact private sector firms, pushing up input cost inflation and thereby output prices. (IHS Markit)

NEW ZEALAND APR CREDIT CARD SPENDING +87.4% Y/Y; MAR +0.5%

NEW ZEALAND APR CREDIT CARD SPENDING +2.7% M/M; MAR +5.7%

SOUTH KOREA MAY 1-20 EXPORTS +53.3% Y/Y; APR +45.4%

SOUTH KOREA MAY 1-20 IMPORTS +36.0% Y/Y; APR +31.3%

SOUTH KOREA APR PPI +5.6$ Y/Y; MAR +4.1%

SOUTH KOREA Q1 SHORT-TERM EXTERNAL DEBT $165.7BN; Q4 $159.3BN

UK MAY GFK CONSUMER CONFIDENCE -9; MEDIAN -12; APR -15

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS FRI; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Friday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2000% at 09:25 am local time from the close of 2.1635% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 38 on Thursday vs 44 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4300 FRI VS 6.4464

People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4300 on Friday, compared with the 6.4464 set on Thursday.

MARKETS

SNAPSHOT: Some Geopolitical Tensions Cooling

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 220.2 points at 28320.1

- ASX 200 up 7.039 points at 7026.6

- Shanghai Comp. down 15.9 points at 3491.044

- JGB 10-Yr future up 7 ticks at 151.44, yield down 0.5bp at 0.080%

- Aussie 10-Yr future up 4.0 ticks at 98.330, yield down 3.7bp at 1.730%

- U.S. 10-Yr future -0-00+ at 132-15, yield up 0.51bp at 1.630%

- WTI crude up $0.32 at $62.26, Gold down $0.87 at $1876.36

- USD/JPY down 2 pips at Y108.76

- EU REACHES DEAL ON COVID-19 PASSES TO RESCUE SUMMER (RTRS)

- BIDEN TEAM SEEKS CHIP INFORMATION SHARING TO EASE SUPPLY CRUNCH (BBG)

- ISRAEL AND HAMAS AGREE TO CEASE-FIRE OVER GAZA CONFLICT (CNBC)

- IRAN READIES OIL EXPORT HIKE AMID OPTIMISM IN VIENNA (NERGY INTELLIGENCE)

BOND SUMMARY: Core FI Little Changed To A Touch Firmer In Asia

T-Notes have stuck to a narrow 0-02+ range overnight, last -0-00+ at 132-15. The major Tsy benchmark yields are virtually unchanged across the cash curve. Headlines were light at best, although some block flow was observed, with the latter coming in the form of a TY/US flattener (-6.0K vs. +2.5K) and a 3,765 block buyer of TYM1 at 132-14+

- The latest round of national Japanese CPI data was largely in line with exp., while some more details surrounding the impending state of emergency in Okinawa prefecture were given as speculation re: the extension of the state of emergency covering other regions of Japan still doing the rounds. The major cash benchmarks run little changed to ~1.0bp richer across the JGB curve, with the belly leading, while futures print +7 ticks vs. yesterday' settlement levels, operating within the confines of a narrow range. An average 20-Year JGB auction was witnessed, with the low price matching dealer expectations (per the BBG survey), tail widening and cover ratio nudging higher.

- Some trans-Tasman impetus seemed to be at play in the Aussie bond space, with a rally in the NZGB space on the back of a well-received round of NZGB supply (building on early momentum stemming from light offer to covers in the latest round of RBNZ LSAP ops). These matters, coupled with likely short positioning, likely allowed the Aussie bond complex to firm. YM +2.5, XM +4.5 at typing, swaps lagging cash ACGBs, resulting in some swap spread widening across most of the curve. Today's ACGB Sep '26 supply was easily digested, with the weighted average yield printing 0.62bp through prevailing mids (per Yieldbroker pricing) as the cover ratio firmed vs. the prev. auction of the line (even when we account for the downtick in the notional on offer at today's auction). It would seem that the supportive factors we highlighted in our auction preview underscored demand.

JGBS AUCTION: Japanese MOF sells Y963.4bn 20-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y963.4bn 20-Year JGBs:- Average Yield 0.445% (prev. 0.438%)

- Average Price 101.00 (prev. 101.12)

- High Yield: 0.450% (prev. 0.439%)

- Low Price 100.90 (prev. 101.10)

- % Allotted At High Yield: 37.4530% (prev. 79.6285%)

- Bid/Cover: 3.478x (prev. 3.343x)

JGBS AUCTION: Japanese MOF sells Y5.1439tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y5.1439tn 3-Month Bills:- Average Yield -0.1046% (prev. -0.0998%)

- Average Price 100.0261 (prev. 100.0249)

- High Yield: -0.1042% (prev. -0.0982%)

- Low Price 100.0260 (prev. 100.0245)

- % Allotted At High Yield: 86.2636% (prev. 76.6471%)

- Bid/Cover: 4.705x (prev. 3.990x)

AUSSIE BONDS: The AOFM sells A$800mn of the 0.50% 21 Sep '26 Bond, issue #TB164:

The Australian Office of Financial Management (AOFM) sells A$800mn of the 0.50% 21 September 2026 Bond, issue #TB164:- Average Yield: 0.8325% (prev. 0.9577%)

- High Yield: 0.8325% (prev. 0.9625%)

- Bid/Cover: 5.1937x (prev. 3.4850x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 97.6% (prev. 94.4%)

- bidders 39 (prev. 56), successful 9 (prev. 17), allocated in full 1 (prev. 11)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance schedule:

- On Tuesday 25 May it plans to sell A$150mn of the 1.25% 21 August 2040 Indexed Bond.

- On Wednesday 26 May it plans to sell A$1.0bn of the 1.25% 21 May 2032 Bond.

- On Thursday 27 May it plans to sell A$1.2bn of the 23 July 2021 Note & A$800mn of the 22 October 2021 Note.

- On Friday 28 May it plans to sell A$1.0bn of the 4.75% 21 April 2027 Bond.

EQUITIES: Mixed Day In Asia; US Futures Build On Gains

A mixed day for equities in the Asia-Pac region. The Taiex is the top of the pile with gains of over 1%, but is off best levels. Taiwanese official has said that the chip industry will be protected if the US extends vaccine aid to Taiwan. Japan also higher, April core CPI fell less than expected at -0.1%, the headline Y/Y reading fell 0.4% against consensus for a 0.5% decline., while composite PMI dropped below 50 as both services and manufacturing softened. Markets in mainland China are lower, as is the Hang Seng. An overhaul of the Hang Seng is set to begin today after its quarterly review. In the US futures are higher, markets building on yesterday's gains.

OIL: Weekly Loss On The Cards

Oil is broadly flat in Asia-Pac trade, holding most of yesterday's losses. WTI is up $0.12 from settlement levels at $62.06/bbl, while Brent is down $0.02 at $65.09. For the week WTI is on track for declines of over 5%, the biggest drop since mid-March. Iran is readying a hike in its oil exports to "maximum capacity", approximately 2m bpd on top of current production, within months as talks with the US make progress. There is chatter a deal could be reached next week which could lead to sanctions lifted in around 3 months.

GOLD: Where To Next?

Gold backed off a little in Asia-Pac hours, with spot trading ~$5/oz softer at typing, just above the $1,870/oz mark, well within the confines of the recent range. The technical backdrop hasn't changed since yesterday's update. U.S. real yields are a touch higher on net over the last 24 hours or so, while the DXY is softer over the same horizon.

FOREX: Iron Ore Weakness Spills Over Into AUD

AUD retreated alongside iron ore futures, leading commodity-tied FX space lower, amid continued worry surrounding China's plans to reign in the recent surge in commodity prices. A beat in Australia's flash retail sales & the best M'fing PMI print on record failed to provide any support to the Aussie dollar. Commodity currencies have been the worst G10 performers this week.

- The PBOC set its central USD/CNY mid-point at CNY6.4300, 13 pips above sell-side estimates. Nonetheless, USD/CNH stuck to a tight range and last trades virtually unchanged.

- The greenback stabilised after yesterday's slide and the DXY wavered within a narrow range around Thursday's close.

- Global flash PMI readings, UK & Canadian retail sales, U.S. existing home sales & EZ consumer confidence take focus from here. Speeches are due from Fed's Kaplan, Bostic, Barkin & Daly, ECB's Lagarde, BoE's Haused & Riksbank's Jansson.

FOREX OPTIONS: Expiries for May21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2080(E869mln), $1.2140-50(E1.0bln-EUR puts), $1.2160-70(E1.3bln-EUR puts), $1.2200(E1.0bln-EUR puts), $1.2225-50(E852mln-EUR puts)

- USD/JPY: Y108.45-60($1.1bln-USD puts), Y109.60-65($650mln-USD puts)

- GBP/USD: $1.4095-1.4100(Gbp477mln-Gbp puts), $1.4200-25(Gbp588mln-GBP puts)

- USD/CHF: Chf0.9000-20($648mln-USD puts)

- AUD/USD: $0.7690-0.7700(A$1.15bln-AUD puts), $0.7750-65(A$544mln-AUD puts)

- USD/CAD: C$1.2150-55($507mln-USD puts)

- USD/MXN: Mxn19.90($1.0bln-USD puts)

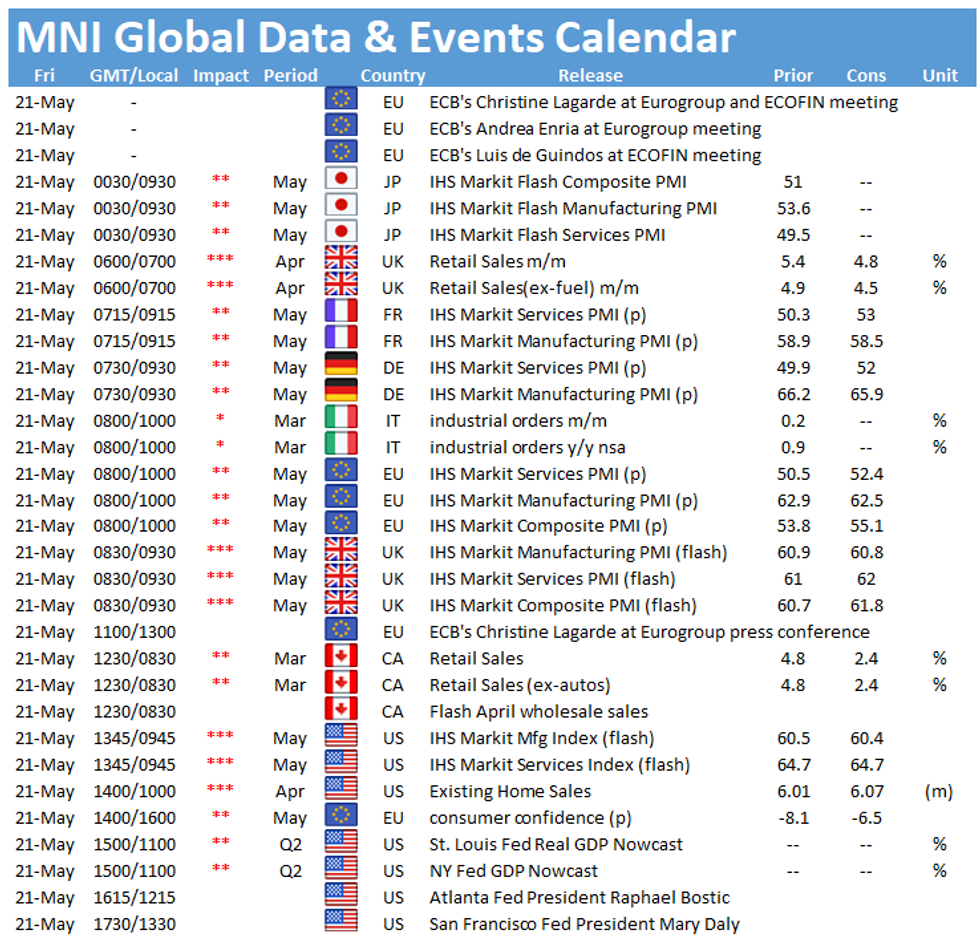

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.