-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

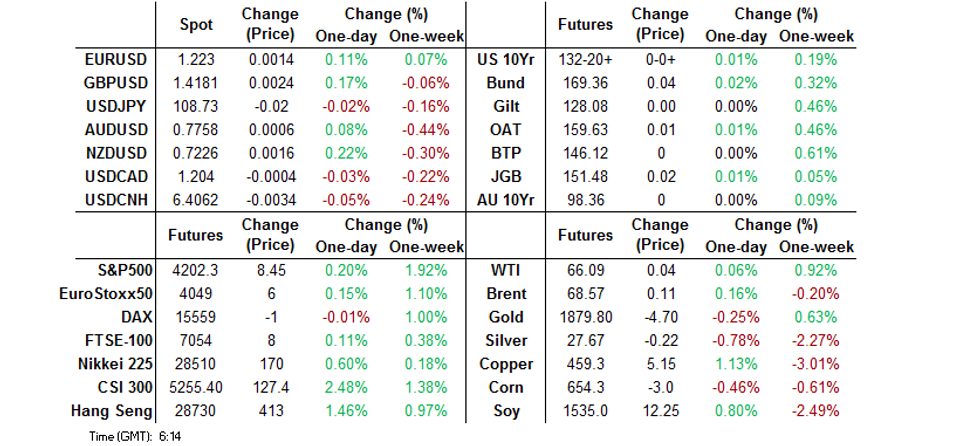

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Calm Markets Overnight

- Familiar themes dominated news flow in Asia, headlined by U.S. fiscal matters & China looking to counter the recent commodity price rise.

- The DXY nudged lower, with U.S. Tsy yields little changed and equity markets higher in general.

BOND SUMMARY: Very Tight Ranges For Core FI Markets

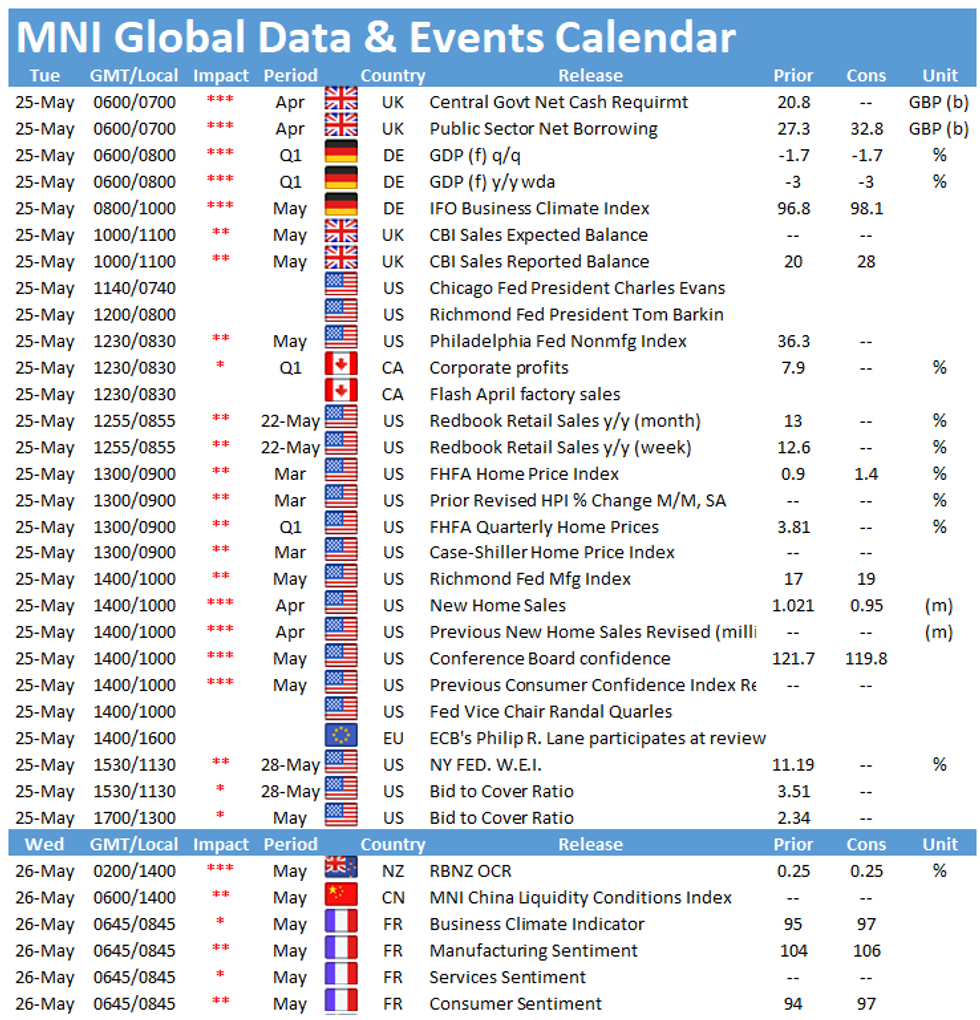

T-Notes have operated in a very narrow 0-01+ range thus far, last printing +0-00+ at 132-20+, with yields little changed across the cash Tsy curve. ~100K T-Notes have traded, with ~60% of that coming in the roll. There has been nothing of note on the broader macro headline front. Comments from Kansas City Fed President George ('21 non-voter) had no impact on the space, while the limited round of COVID cases evident in China & Australia have failed to generate a reaction given the respective track records in containing the virus. In more detail, Fed's George noted that although current factors boosting inflation are likely to be transitory, she cannot dismiss today's pricing signals. On broader monetary policy matters she stressed that a flexible approach has served the central bank well and that it should maintain highly accommodative policy for some time. Tuesday's U.S. economic docket will be headlined by consumer confidence, Richmond Fed m'fing & new home sales data, which will be supplemented by Fedspeak from Quarles, Barkin & Evans, in addition to 2-Year Tsy supply.

- JGB futures nudged higher early on in Tokyo, but bulls failed to force a notable break through the overnight session peak, contract last +3 on the day, operating within the confines of a narrow range. The major benchmarks in the cash JGB space trade little changed to 0.5bp richer. There was little in the way of meaningful idiosyncratic headline flow for participants to trade off. Japanese Finance Minister Aso confirmed the extension of the government's zero-interest loan scheme for businesses through year end, in line with earlier reports. The latest liquidity enhancement auction for off-the-run 5- to 15.5-Year JGBs passed smoothly. Services PPI data headlines locally on Wednesday.

- Aussie bond futures have stuck to tight ranges, leaving YM -0.5 and XM +0.5 on the day. The Greater Melbourne area has re-introduced some COVID restrictions given the 5 cases discovered over the past 24 hours or so, with the cases being linked back to the South Australian hotel quarantine outbreak. The restrictions are not as draconian as a full-scale lockdown. The restrictions go into play this evening, remaining in place until at least 4 June. On the economic front, the latest round of ABS payrolls data saw a modest downtick in the headline figures, with the ABS noting that "in early May, payroll jobs were 1.5% above pre-pandemic levels and 1.5% lower than the end of March 2021." No real surprises there given the downtick in the headline reading in April's labour market report. The ABS noted that "the end of JobKeeper, seasonality in the labour market around Easter and short-term restrictions in some states may influence payroll job levels in the weeks between the end of March and 8 May 2021," once again providing no surprises. Elsewhere, the preliminary round of trade data pointed to stable Australian exports in the month of April, although imports fell by the best part of A$2.0bn vs. March, per the release. The pricing of A$500mn of SAFA '32 paper had no impact on the space. Q1 completed construction work, the latest Westpac leading index readings & A$1.0bn of ACGB 1.25% 21 May 2032 supply will hit on Wednesday.

FOREX: USD Extends Losses, NZD Marginally Outperforms

The greenback remained heavy as regional players assessed recent Fedspeak, which poured cold water on inflation concerns. The absence of notable news/data flow helped make this the main talking point in Asia-Pac hours. The DXY extended yesterday's losses, while USD underperformed all of its G10 peers.

- NZD outperformed at the margin, amid chatter that buy stops were cut above May 21 high of $0.7222 (per BBG). The kiwi's relative strength failed to translate into any notable bid into commodity FX space, even as BBG Commodity Index edged higher.

- JPY lagged all G10 currencies save for USD, as regional equity benchmarks firmed a tad. Gotobi Day flows may have applied some pressure to the yen.

- The PBOC set their USD/CNY mid-point at CNY6.4283, 20 pips above sell-side estimate. BBG fixing survey had a narrow range, which added to its significance. That being said, the weaker than expected fixing failed to lend support to USD/CNH, which slipped into negative territory.

- German GDP (f) & Ifo Business Survey, U.S. Conf. Board Consumer Confidence & new home sales as well as comments from Fed's Barkin, Evans & Quarles, ECB's Lane & Villeroy and BoE's Tenreyro take focus from here.

FOREX OPTIONS: Expiries for May25 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2095-1.2105(E1.3bln-E1.2bln of EUR puts), $1.2150-60(E518mln), $1.2215-25(E629mln-EUR puts),

$1.2260-75(E1.2bln-EUR puts), $1.2325-45(E679mln-EUR puts) - USD/JPY: Y107.50-60($1.1bln), Y107.85-108.05($1.5bln), Y108.85-109.00($657mln)

- USD/NOK: Nok8.40($410mln-USD puts)

ASIA FX: EM Currencies Rise; BI Rate Announcement Awaited

The greenback retreated again amid a constructive risk environment which saw most Asia EM FX gain.

- CNH: Offshore yuan is stronger, but off best levels. USD/CNH briefly moved to the lowest levels since 2018 but bounced at 6.4008 with chatter of large banks stepping in on behalf of the PBOC to stem yuan strength.

- SGD: Singapore dollar is stronger, data earlier showed a beat for Singapore Q1 GDP, following the release the MAS said the broader economy should continue to recover, and that new virus containment measures don't mean that GDP estimates will be downgraded.

- TWD: Taiwan dollar is stronger, coronavirus cases remain elevated with 334 cases reported on Monday, Health Minister Chen said Taiwan was considering extending the soft lockdown, after previously raising the alert to level 2 from May 19 to May 28.

- KRW: Won was higher from the open and continued to gain, pre-market data showed that consumer confidence rose to 105.2 in May from 102.2 previously, the May print was the highest since June 2018. The uptick in sentiment was helped by a bumper GDP figure in Q1 as well as soaring exports.

- MYR: Ringgit is stronger, Malaysia extended quarantine period for Malaysians entering the country from Sri Lanka, Bangladesh, Nepal and Pakistan to 21 days from 14 days.

- IDR: Rupiah gained, FinMin Indrawati told lawmakers Monday that a recovery in consumption & low-base effect will support Q2 GDP reading. She added that budget deficit reached 0.38% of GDP or IDR138.1tn at the end of Apr. Bank Indonesia are set to deliver their monetary policy decision today. Virtually all analysts expect the MPC to hold steady.

- PHP: Peso is weaker. Health Undersec Vergeire that the Philippines may not reach herd immunity against Covid-19 by the end of the year.

- THB: Baht is stronger, Thailand's National Economic and Social Development Council warned Monday that the critically important tourism sector may not be able to recover to pre-pandemic levels until 2026, which will affect as many as 7mn workers.

ASIA RATES: China's Repo Rates Rise

Bonds struggled amid positive risk appetite, China's repo rates rise while markets await the Bank of Indonesia rate announcement.

- INDIA: Yields mixed in early trade, India are to sell a total of INR 360bn of bills later today, the sale consists of INR 150bn 91-day, INR 150bn 182-day and INR 60bn 364-day bills. The RBI announced the details of Friday's bond sale, to sell a total INR 260bn from 2023, 2030 and 2061 tenors. Meanwhile coronavirus related deaths rise to 307k with confirmed cases at just shy of 27 million.

- SOUTH KOREA: Futures are flat and have hugged a narrow range through the session. A 20-year auction was taken down smoothly, the MOF sold KRW 50bn more than indicated. Pre-market data showed that consumer confidence rose to 105.2 in May from 102.2 previously, the May print was the highest since June 2018. The uptick in sentiment was helped by a bumper GDP figure in Q1 as well as soaring exports.

- CHINA: The PBOC matched maturities with injections, repo rates have risen, the overnight repo rate just 1bps below the 7-day repo rate, the 7-day repo rate last up 3 bps at 2.20% from highs of 2.386%. Futures are lower as equity markets make decent gains. There has been focus on the outlook for China's policy following gradually firming rhetoric against the rise in commodity prices recently.

- INDONESIA: Yields mixed as markets await the Bank of Indonesia rate announcement. The meeting seems poised to be another non-event, with policymakers facing conflicting demands of their policy mandate. With inflation still subdued and the rupiah still vulnerable, the MPC will likely stand pat on the 7-day reverse repo rate. Elevated uncertainty around the local Covid-19 outbreak provides another reason for policymakers to hold fire this time, while green shoots in high-frequency economic recovery mean that they are in a position to wait and watch upcoming developments.

EQUITIES: Green Across The Board

A positive day for equities in the Asia-Pac region, markets in mainland China lead the way higher after muted gains yesterday, the CSI 300 is up over 2%. Tech shares are outperforming after a rally in the US with Apple and Tesla both posting strong gains. In Japan markets the Nikkei 225 is up around 0.6%, there were reports in the Yomiuri have noted that Japan will extend the life of its zero-interest loan programme. In Taiwan the Taiex is up over 1.5% driven by the tech rally, shares in Australia are supported by a bounce in iron ore. Futures higher in the US, Fed's George spoke late on Monday and said she is not dismissing the risk of higher inflation, she was positive on the outlook for the economy but noted that progress still needed to be made in the recovery.

GOLD: Watching, Waiting

Little to add for gold over the last 24 hours, with spot dealing around the $1,880/oz mark at typing. The DXY continues to operate around the lower end of its recent range, while U.S. real yields ticked lower around on Monday. The previously defined technical setup remains in play.

OIL: Crude Futures Set For Third Straight Gain

Oil is higher in Asia, on track for the third day of gains. The surge over the previous two sessions equates to 6%. WTI & Brent sit ~$0.10 above settlement levels. Talks between Iran and the international community are set to continue this week with chatter that a deal can be reached soon, which would pave the way for a return of Iranian crude to the market. Iranian President Rouhani spoke with Chinese President Xi yesterday with talks centering around deeper trade ties and energy. Markets look ahead to the API US stockpile report later in the day.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.