-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Fed Day

- Core markets generally meandered through overnight trade, with a distinct pre-FOMC evident during Asia-Pac hours.

- The FOMC is likely to begin "talking about talking" about tapering at its June meeting. But Chair Powell will make clear that the FOMC is not yet ready to move any further than that on reducing asset purchases, with the recent jump in inflation being only "transitory", and weaker-than-expected job growth leaving the Fed far away from achieving its "substantial further progress" criteria.

- Chinese policymakers enact latest move vs. commodity price rally.

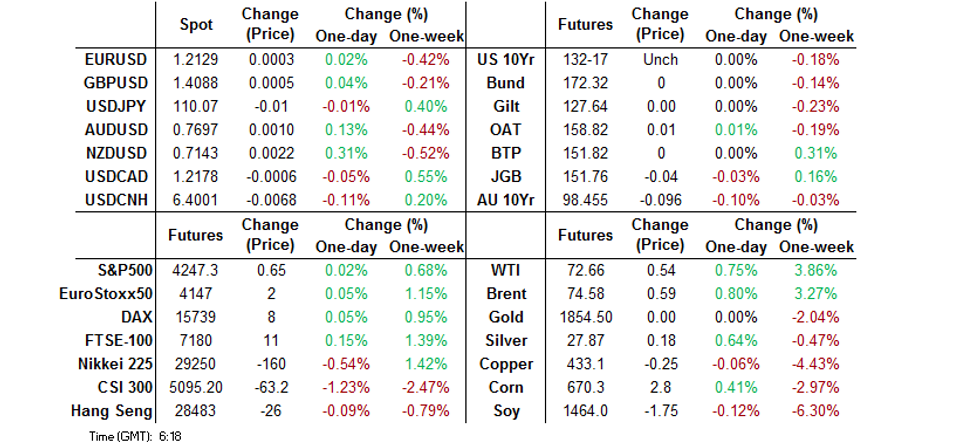

BOND SUMMARY: FOMC Awaits

T-Notes deal unchanged at 132-17 at typing with the contract holding to a narrow 0-03 range overnight. Cash Tsys print unchanged to 1.0bp cheaper across the curve. Participants remain focused on today's FOMC decision, while the release of the monthly Chinese economic activity datapoints will provide some interest in the interim. There was nothing in the way of tangible reaction to the latest moves by Chinese policymakers re: stemming the rally in commodity prices. Building permits, housing starts & MBA mortgage apps pad out the domestic docket ahead of FOMC.

- The Tokyo morning saw some weakness in the longer end of the JGB curve, which was perhaps linked to growing speculation surrounding a snap election and a fresh fiscal support package, with local press reports pointing to such matters perhaps playing out in September. The long end has now retraced some of the early weakness. Futures stuck to the confines of the overnight session's range, last -4 on the day. The latest round of BoJ Rinban operations revealed a moderation in the offer to cover ratios for the 1- to 3- and 3- to 5-Year buckets (vs. prev. operations), while the 5- to 10-Year bucket saw an uptick in the cover ratio. There is little of note on the local docket on Thursday, outside of the BoJ's 2-day policy meeting getting underway.

- Aussie bond futures struggled for any fresh traction, consolidating above their respective overnight lows within tight ranges, leaving YM -1.4 & XM -3.9. The cash ACGB curve has steepened, playing catch up to the overnight moves in futures, with longer end bonds running as much as ~4.0bp cheaper at typing. Headline flow remains light, leaving participants somewhat sidelined ahead of the latest FOMC decision out of the U.S. and RBA Governor Lowe's latest address, which is scheduled for Thursday and titled "From Recovery to Expansion" Thursday will also bring the release of the latest monthly labour market report and a scheduled round of ACGB purchases from the RBA.

FOREX: Antipodeans Gain, Markets In Waiting Mode

Most major USD crosses tread water in Asia-Pac hours, as participants were preparing for the upcoming monetary policy decision from the FOMC & China's monthly economic activity data. The DXY was happy to hold its yesterday's range.

- The Antipodeans were slightly firmer, despite light regional news flow. A BBG trader source flagged demand for the Aussie from local exporters.

- The PBOC set its central USD/CNY mid-point at CNY6.4078, 7 pips above the sell-side estimate. Spot USD/CNH held a very tight range, close to neutral levels.

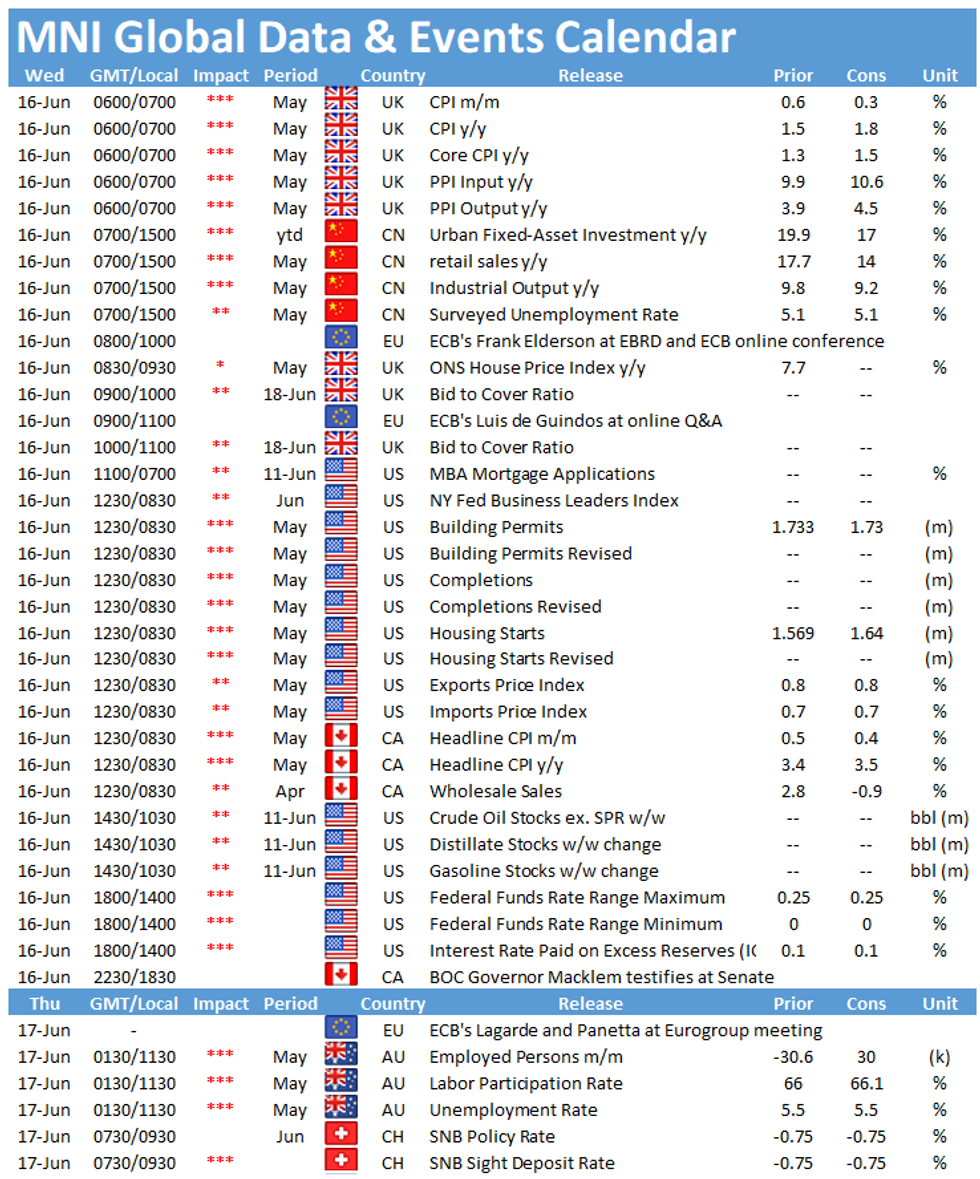

- Apart from the aforementioned FOMC decision & Chinese data, focus turns to inflation figures from the UK & Canada, U.S. housing starts/building permits, as well as ECB & BoC speak.

FOREX OPTIONS: Expiries for Jun16 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2115-20(E1.2bln-EUR puts), $1.2130(E428mln-EUR puts), $1.2200(E551mln)

- USD/JPY: Y109.15-25($660mln), Y109.70-75($965mln-USD puts), Y110.00-05($775mln-USD puts),Y110.25-31($656mln-USD puts)

- AUD/USD: $0.7740-45(A$589mln-AUD puts)

- USD/CNY: Cny6.40($726mln-USD puts)

ASIA FX: Mostly Weaker; China Data Eyed

Another quiet session ahead of the FOMC rate announcement later today, while impending China data also kept activity subdued.

- CNH: Offshore yuan strengthened slightly. Markets focused on a whole host of Chinese data later in the session; retail sales, industrial production, asset investment and the jobless rate. Consensus is for the pace of increase so slow for most data points on fading base effects.

- SGD: Singapore dollar is flat having barely budged through the session. Markets look ahead to export data tomorrow which is expected to show another month of gains. An MAS survey released yesterday predicted the economy would grow 6.5% with gains expected to be driven by exports.

- TWD: Taiwan dollar strengthened. Markets await the CBC rate announcement tomorrow, the bank are expected to keep rates on hold at a record low but be positive on the recovery and upgrade growth forecasts.

- KRW: The won is weaker, but has come off worst levels and resisted Tuesday's USD strength. The market is focusing on yesterday's BoK minutes which were more hawkish than expected and has seen analysts bring forward rate hike estimates.

- MYR: Ringgit is weaker, PM Muhyiddin unveiled Malaysia's reopening plan in a special televised address on Tuesday, pointing at end-Oct as the earliest possible date when restrictions could be fully lifted and life could return to normalcy.

- IDR: Rupiah declined, Indonesian Econ Min Hartarto said that national economy is expected to rebound this year and the gov't remains confident that the GDP growth target of +4.5%-5.3% will be met. Hartarto added that the gov't has used 31.4% (or IDR219.65tn) of its 2021 pandemic stimulus budget.

- PHP: Peso is lower, data late yesterday showed overseas remittances rose 12.7% Y/Y to +$2.305bn in April, missing expectations of a 19.3% annual growth. Elsewhere the IMF said GDP could frow 5.4% this year and 7% in 2022.

- THB: Baht dropped, PM Prayuth said Tuesday that relevant state agencies, including the Bank of Thailand, have been ordered to put more effort into finding ways to address the rising household debt burden.

ASIA RATES: China Repo Rates Drop

- INDIA: Yields higher in early trade, markets look ahead to an INR 360bn bill sale later today. Data yesterday showed India's trade deficit narrowed more than expected in May, exports rose 69.4% while imports rose 73.6%. Imports took a bigger hit which was attributed to lower imports of gold. On the coronavirus front recoveries continue to outnumber daily new cases for the 34th consecutive day.

- SOUTH KOREA: Futures ground lower after the release of a hawkish set of BoK minutes yesterday. Following the release many sell side analysts have bought forward hike calls. The minutes showed four out of the six monetary policy board members said it was appropriate to think about potential timing to adjust the degree of monetary easing. Timings of rate hikes have now been bought forward to Q4 2021 from Q1 2022, Citi expects a hike as soon as October 2021.

- CHINA: Repo rates are lower today after rising for three consecutive sessions. The overnight repo rate is down 9bps at 2.0079%, while the 7-day repo rate is down 4bps at 2.1895% - back below the PBOC's 2.20% rate. The PBOC refrained from injecting liquidity again after rolling over the MLF and draining CNY 10bn via OMO's, speculation is rising that the central bank will soon inject liquidity, but the bank is expected to position these as a tool to smooth repo rate volatility rather than an easing signal. Futures are higher today, benefitting from lower repo rates and a decline in stocks with equity markets negative for the third straight session.

- INDONESIA: Yields higher across the curve. Indonesian Econ Min Hartarto said that national economy is expected to rebound this year and the gov't remains confident that the GDP growth target of +4.5%-5.3% will be met. Hartarto added that the gov't has used 31.4% (or IDR219.65tn) of its 2021 pandemic stimulus budget. Bank Indonesia will deliver their latest MonPol decision tomorrow. Virtually all analysts expect them to leave their benchmark policy rate unchanged.

EQUITIES: China Stocks Struggle Again

Another mixed day for equity markets in the Asia time zone; markets in China are lower again, on track for the third straight day of declines. The PBOC refrained from injecting liquidity again but repo rates dropped after rising for three straight days. In Japan the Nikkei 225 is has lost some ground, data showed the trade deficit widened more than expected, exports rose below consensus while imports beat forecasts. Core machinery orders rose below consensus and a sharp drop in the pace of increase from last month. In South Korea markets are slightly higher as the won weakened, markets digest a hawkish set of BoK minutes. Futures in the US are mostly lower, though the Nasdaq is just keeping above water after a heavy sell off yesterday, markets await the FOMC rate announcement later today.

GOLD: Respecting The Range

Bullion finished lower again on Tuesday but failed to challenge the extremes of Monday's ranges as participants looked ahead to the latest FOMC decision (please see our full preview for more colour on that specific matter). Spot has settled into a narrow range during Asia-Pac hours given the impending event risk, last trading a handful of dollars softer, just above $1,855/oz. The previously outlined technical picture remains intact.

OIL: Rally Rolls On

Oil continues its march higher; WTI & Brent last print ~$0.60 above their respective settlement levels. Data after market yesterday from the US API showed headline crude stocks fell 8.54m bbls last week, markets will look to US DOE inventory figures later today to confirm the draw which would be the biggest since January. Demand cues from the US remain positive, California opened up its economy yesterday while New York has now lifted all remaining restrictions.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.