-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Lack Of News Doesn't Halt U.S. Tsy Flattening

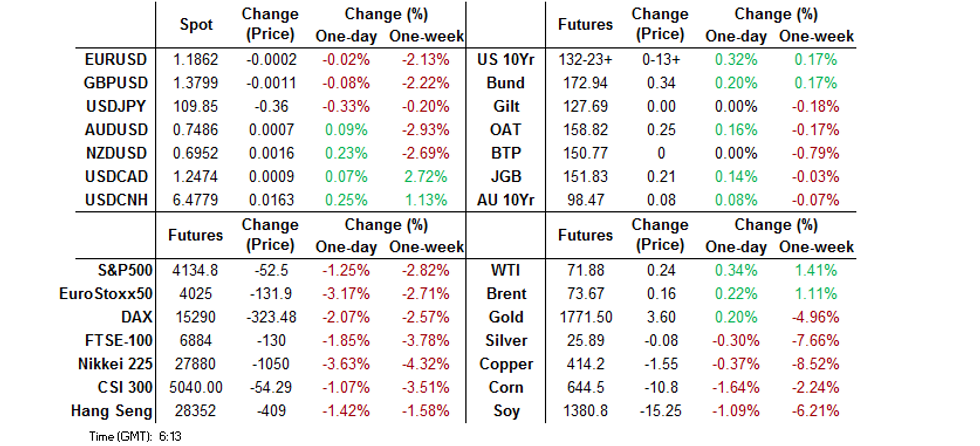

- Another aggressive round of twist flattening was seen on the U.S. Tsy curve during Asia-Pac hours as participants reacted to Friday's move.

- USD mixed amongst the G10 FX space, with JPY the clear outperformer as Japanese equities struggle.

- Fedspeak headlines on Monday.

BOND SUMMARY: Aggressive Tsy Flattening Continues

A lack of notable news flow since Friday's U.S. close didn't sedate activity during Asia-Pac trade, with e-minis trading through their respective Friday lows and the Japanese equity markets trading particularly heavy as the Asia-Pac region reacted to Wall St.'s negative lead. This accentuated the recent round of U.S. Tsy curve flattening, with 2s and 3s seeing some modest cheapening, while the remainder of the major benchmarks richened, led by the long end where 20- & 30-Year Tsy yields sit ~6bp lower on the day (albeit back from extremes). 10- & 30-Year yields printed at levels not witnessed since February, with the latter breaching the 2.00% level. T-Notes last trade +0-13+ at 132-23+, 0-06+ off highs, with volume at a more than healthy 305K. Eurodollar futures trade -0.5 to +2.0 through the reds, twist flattening, with a ~55K buyer of EDU1 with and a ~28K seller of EDH2 dominating on the flow side. There was also a 1,780 block buyer of TYU1 seen into London hours. Fedspeak dominates the local docket on Monday, with Williams, Bullard and Kaplan all due to speak.

- JGB futures sit 21 ticks higher than Friday's settlement at typing, with local equity markets struggling in the wake of Friday's Wall St. sell off (Nikkei 225 last -3.6%, below 28,000) & further downbeat assessments surrounding a lack of spectators at the Tokyo Olympics. The belly of the cash JGB curve led the rally as 7s richened by ~2.0bp, pointing to a bid that was perhaps driven by futures, with the wings of the curve hovering closer to neutral levels. Super-long swap spreads briefly tightened through recent tights. Speculation continues to do the rounds re: the potential for the BoJ to step into the equity market and purchase TOPIX-linked ETFs given the sell off (TOPIX last -2.6%, a little off session lows). 5-Year JGB supply headlines locally on Tuesday.

- Aussie bonds followed the twist flattening theme in the U.S., with YM -2.5 and XM +8.5 at typing. Local focus fell on the (relatively limited) COVID cluster in Sydney, Barnaby Joyce regaining the leadership of the junior party within the government's ruling coalition and a slightly softer than expected round of preliminary retail sales data. The belly of the curve continues to struggle in relative terms, with 5s hitting the cheapest levels witnessed since Apr '18 on the 2-/5-/10-Year butterfly. A reminder that the comparable area of the U.S. curve has exhibited similar patterns in the wake of last week's FOMC decision, while the Aussie market also has to contend with the prospects of the major decisions to be made at the RBA's July decision (whether to roll the 3-Year yield target over to ACGB Nov '24 from ACGB Apr '24 and an announcement surrounding the next round of broader bond purchases), as well as last week's stellar domestic labour market report. The 2-Year sector of the curve is of course influenced by the RBA's current form of yield curve targeting. Weekly payrolls data headlines a relatively limited local docket on Tuesday.

FOREX: Negative Sentiment Boosts JPY, Antipodeans Shielded By Firmer Crude Oil

G10 FX space started the new week by partially reversing last week's moves. The Antipodeans caught a bid, benefitting from an uptick in crude oil prices, linked to the weekend election of a hardline cleric as Iran's president, which may throw sand into the gears of the Iran nuclear talks. Firmer commodity markets shielded the Antipodeans from the potential impact of souring risk sentiment.

- The yen jumped onto the top of the G10 pile, as USD/JPY dipped under the Y110.00 mark on the back of a bout of broader greenback sales. A poor showing from Asia-Pac equity markets and U.S. e-mini contracts lent support to the yen, amid talk of continued trimming of reflation bets. JPY remained buoyant, even as the DXY managed to recoup its initial losses.

- GBP led losses in G10 FX space after the Telegraph reported that the UK would not lift the remaining Covid-19 restrictions at the Jul 5 review. Positioning ahead of this week's monetary policy decision from the BoE may have also affected price action.

- The PBOC left the LPRs unchanged for the 14th month in a row and set its central USD/CNY mid-point at CNY6.4546, 8 pips below sell-side estimate. USD/CNH punched through a pair of its prior daily highs located at CNH6.4645/53 and printed its strongest levels since May 6.

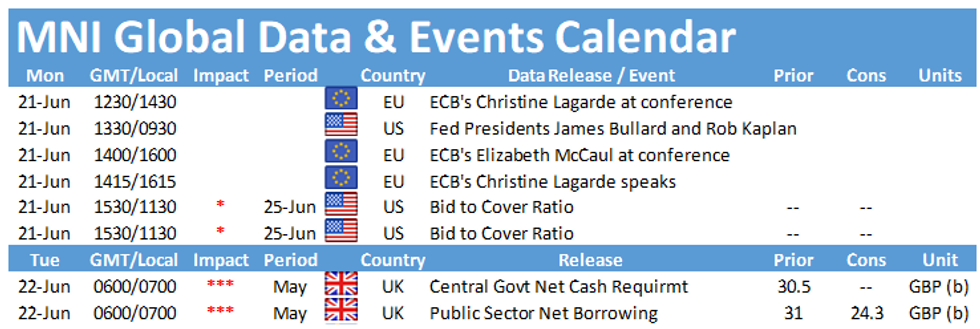

- Speeches from Fed's Williams & Bullard as well as ECB's Lagarde & Centeno take focus from here.

FOREX OPTIONS: Expiries for Jun21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1900(E565mln), $1.1940(E553mln)

- USD/JPY: Y110.00($1.0bln)

EQUITIES: In The Red

A negative day for equity markets in the region with major bourses enduring substantial losses. Markets in Japan lead the way with the Nikkei 225 down around 3.5% at the time of writing and below the 28,000 marker. Markets in mainland China are also lower though selling has been less heavy, in South Korea the KOSPI is lower by around 1.2% despite another set of robust export data. In the US futures are lower, S&P 500 e-minis dropping through Friday's lows while e-mini Dow Jones see the heaviest selling.

GOLD: Unwinding Friday's Losses As U.S. Yields Fall Further

Gold has benefitted from the pull lower in U.S. Tsy yields and pressure on the U.S. & Japanese equity spaces during Asia-Pac hours, adding $10/oz to last print just shy of $1,775/oz, reversing Friday's decline in the process. Bulls still need to retake the Jun 17 high, which is some way away at $1,825.4/oz, to regain some degree of composure.

OIL: WTI Climbs Back Over $72/bbl

Oil is higher in Asia-Pac trade, WTI up $0.58 from settlement levels at $72.22/bbl, Brent is up $0.58 at $74.09/bbl. Oil is getting a boost after the election of conservative cleric Ebrahim Raisi as Iran's president which could be a hurdle for Iran and world powers reaching an agreement on a nuclear deal and complicate the return of Iranian supply to market.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.