-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Calmer Tides In Asia

- Equities generally ticked higher in Asia-Pac hours while U.S. Tsys stabilised.

- The USD recovered from Monday's lows.

- Fed Chair Powell & NY Fed President Williams didn't add much to the monetary policy debate.

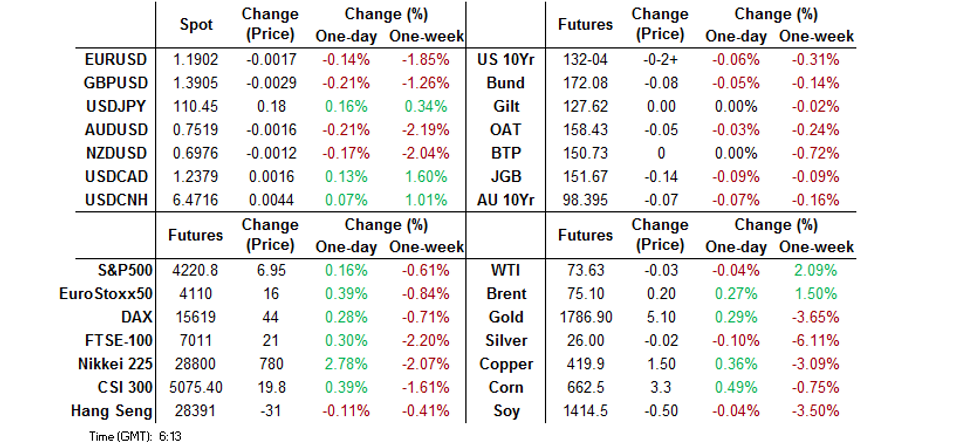

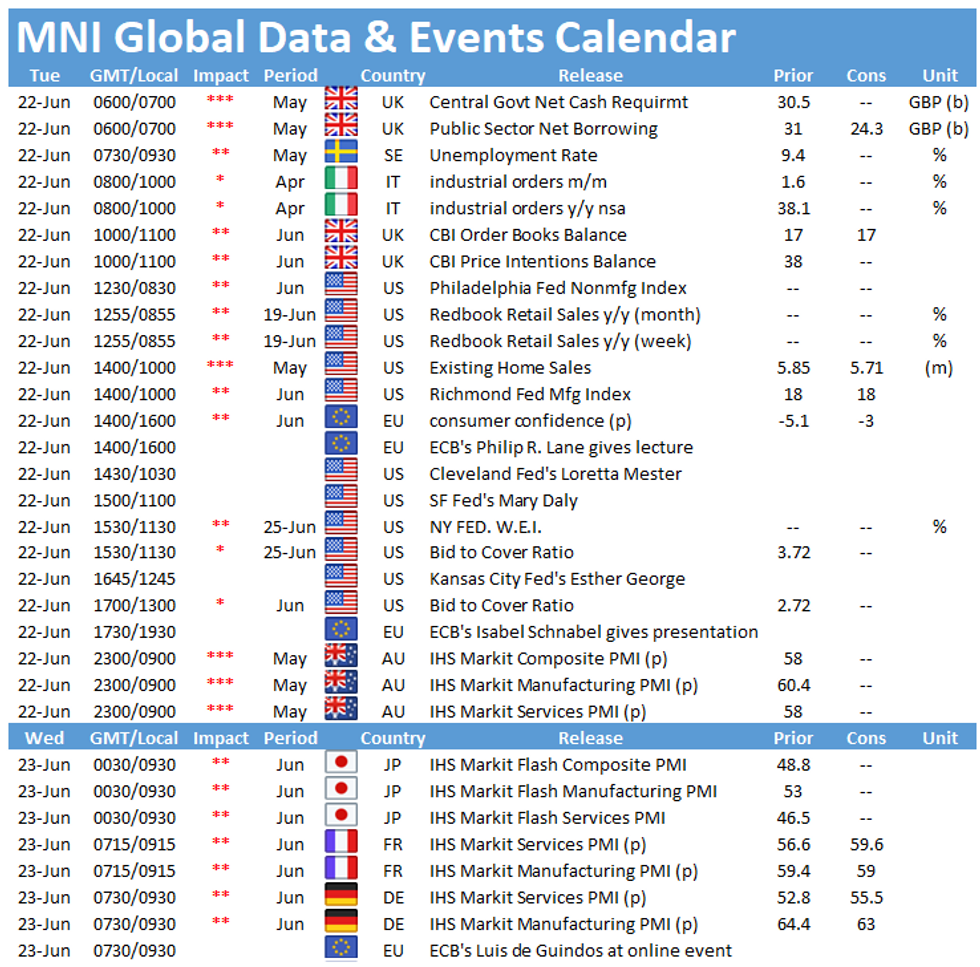

BOND SUMMARY: A Calmer Asia Session

A much more sedate round of Asia-Pac trade for the global core FI markets on Tuesday, with an uptick/rally for most of the major regional equity indices applying light pressure to the U.S. Tsy space after some modest early richening. T-Notes last -0-02 at 132-04+, holding to a 0-06+ range, while the major cash Tsys run little changed to 1.0bp cheaper across the curve. Existing home sales data and the release of the latest Richmond Fed m'fing index are due to be released later today, while Fedspeak will come from Powell, Daly & Mester. 2-Year Tsy supply is also slated.

- The latest round of 5-Year JGB supply wasn't the firmest, at least on the pricing side, with the average price printing in line with broader expectations for the low price (per the BBG dealer poll). The cover ratio was a touch firmer than prev., while the price tail saw an incremental widening. The soft pricing of the auction and uptick in the domestic equity indices (TOPIX last +~3.0%) applied some pressure to futures, which pushed below their overnight/morning lows before regaining some composure, last -15 on the day. 5-Year JGB yields haven't shown much of a reaction to the auction, with some modest underperformance in the belly of the curve seen on the day (5- to 10-Year paper is ~0.5bp cheaper on the day). There were no other notable catalysts evident during Tokyo trade. Flash PMI data and the latest round of BoJ Rinban ops headline locally on Wednesday.

- Aussie bonds moved in a similar manner to U.S. Tsys with a widening and elongation of Sydney's indoor mask-wearing order implemented as the latest COVID cluster grew providing the major headlines on the local front. Futures sit shy of best levels, with YM last printing unch. and XM -7.0 on the day. Elsewhere, a recommendation from RBC re: receiving AU 1Y/1Y Swap rates vs. the U.S. equivalent garnered some interest. Wednesday will bring the release of the flash IHS Markit PMIs, preliminary trade balance data, an address from RBA's Ellis & A$1.0bn of ACGB 1.25% 21 May 2032 supply.

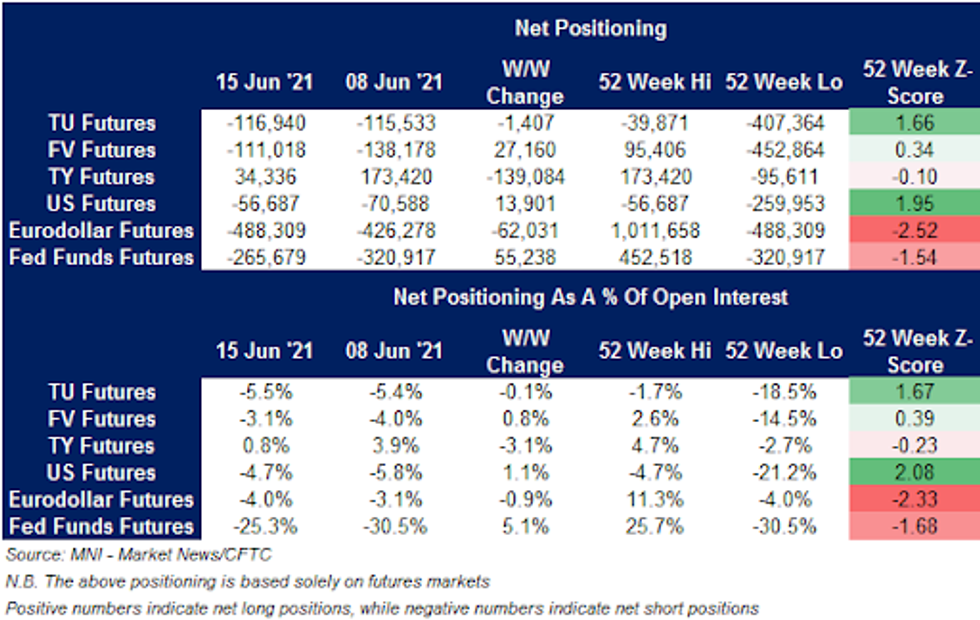

US TSY FUTURES: Tsy Net Positioning Generally Pared Back Into FOMC

Pre-FOMC positioning adjustments across the major U.S. Tsy futures contracts generally revealed a paring of the broader net exposures.

- TY futures saw a relatively notable trimming of net long exposure (from multi-year highs) in the week ending 15 Jun, while net short positioning in TU, FV & US futures was essentially flat to a little less pronounced.

- Eurodollar futures saw an extension of net shorts, while net short positioning in Fed Funds Futures edged away from the all-time extreme (in headline terms) registered in the previous week.

ASIA FX: Positive Risk Sentiment Offset By USD Bounce

The greenback rose slightly in Asia after declining on Monday, the move came even as equity markets in the region made gains.

- CNH: Offshore yuan heads into the European close slightly weaker, USD/CNH oscillated around neutral levels, reversing initial weakness after the PBOC fixed the yuan stronger than expected.

- SGD: Singapore dollar is weaker, retracing its move on Monday. participants will look ahead to CPI data tomorrow. CPI hit the highest level since 2014 last month, though a low base effect and transitory factors were cited as drivers.

- TWD: Taiwan dollar is weaker, reversing earlier strength. Taiwan reported 75 new local COVID-19 cases yesterday, marking the first time the country has recorded less than 100 cases in one day since May 14.

- KRW: The won is stronger, USD/KRW set for a lower finish for the first time in seven sessions. The BoK warned that deepening fiscal imbalances caused by excessive borrowing and potential asset bubbles are a threat to the economy.

- MYR: Ringgit fell, PM Muhyiddin's powerful coalition partner UMNO called for reopening the parliament within 14 days, with UMNO leader Zahid warning that a failure to act would be tantamount to treason. Tensions between Muhyiddin's Bersatu and UMNO have been simmering for months, with the gov't's survival hinging on their continued cooperation.

- IDR: Rupiah is stronger, the daily nationwide count of new Covid-19 infections rose to a record. The 14,536 cases detected on Monday pushed the total case count above 2mn. Econ Min Hartarto announced new restrictions in areas mostly affected by the virus, despite calls by exports to implement a wider lockdown.

- PHP: Peso is lower. The Philippines May budget deficit printed PHP 200.3bn from a deficit of PHP 44bn last time out. May expenditures rose 29.15% Y/Y, revenues rose 69.26%.

- THB: Baht declined. A Bangkok Post source said that the BoT will hold a meeting with financial institutions this week to discuss proposed reduction to ceiling rates applied to targeted consumer products. Ceiling rates for some products with rates above 20% per year are expected to be trimmed by at least 1-2%.

ASIA RATES: BoK To Reduce 2-Year MSB Issuance

- INDIA: Yields higher in early trade. Bonds are expected to come under pressure again today as oil prices continue to rise with Brent claiming the $75/bbl handle. Yesterday the RBI converted INR 67bn of short dated bonds to longer maturities under its switch operation, less than the INR 100bn announced. On the coronavirus front India administered 8.62 million vaccine doses in the last 24 hours, a daily record. There were 42,640 cases in the past 24 hours

- SOUTH KOREA: 10-Year future is lower but the 3-year future proving more resilient and just keeping in positive territory. There were reports earlier that the BoK plans to reduce 2-Year MSB (monetary stabilization bond) issuance by around KRW 2tn to KRW 3.5tn, and will instead adopt a 3-Year MSB for around KRW 1.3tn a month. Cash curve twist steepens, 20-year yield some 1.7bps higher post auction. The sale saw bid/cover soften slightly from the previous sale of the line.

- CHINA: The PBOC matched maturities with injections, repo rates crept higher for the fourth session in a row. China is likely to keep liquidity level appropriate and policies stable, and the market needs not to be concerned even as the pace of credit expansion has slowed, the Securities Times reported citing analysts. Monetary policies will emphasize two structural aspects of extending the terms for small business loans and green finance, the newspaper said adding that regulators may also judge the soaring commodity-driven PPI to be unsustained, which means that MLF isn't likely to be raised due to inflation.

- INDONESIA: Yields higher across the curve. The daily nationwide count of new Covid-19 infections rose to a record. The 14,536 cases detected on Monday pushed the total case count above 2mn. Econ Min Hartarto announced new restrictions in areas mostly affected by the virus, despite calls by exports to implement a wider lockdown. Elsewhere FinMin Indrawati said the Indonesian government has gradually reduced its financing dependency on the central bank due to a more stable and improving situation in the bond market.

EQUITIES: Bouncing Back

Equity markets are in the green on Tuesday, Asia-Pac markets shaking off Monday's malaise after a positive lead from the US. Markets in Japan lead the way higher with gains of around 3%, Japan officially capped the number of spectators at the Olympic events at 10,000 or 50% of venue capacity (whichever is smaller). In Australia the ASX 200 is up around 1.6% while bourses in mainland China have seen gains of around 0.5%. In the US futures are higher with e-mini Dow Jones leading the way. Late on Monday Fed's Williams spoke and was optimistic on the economy, he warned it was still too early to cut back on QE bond purchases did confirm the FOMC is approaching a discussion about tapering asset purchases.

GOLD: Little Changed

Spot gold last deals little changed around the $1,787/oz mark after bullion managed to shrug off the eventual uptick in longer dated U.S. real yields on Monday, benefitting from a softer DXY. This came after gold initially turned bid on the Asia-Pac richening witnessed in the U.S. Tsy space, before some sharp cheapening kicked into that space during European & NY hours. Little has changed from a technical perspective, with the initial lines in the sand now well-defined.

OIL: Brent Above $75/bbl

WTI last deals around unchanged levels while Brent is above $75.00/bbl for the first time in two years, printing ~$0.20 better off at typing. WTI's key resistance and the bull trigger remains $72.99, Jun 16. A break of this level would confirm a resumption of the underlying uptrend. Elsewhere China has reduced its crude oil import quota for private oil refiners by about 35% compared to last year, amid a government crackdown on the sector. Markets look ahead to API inventory data later today.

FOREX: Greenback Edges Higher, Antipodeans Sag

Major USD crosses retraced some of yesterday's moves, albeit to a limited degree. The greenback outperformed its G10 peers at the margin, with participants awaiting a congressional testimony from Fed Chair Powell. The Asia-Pac session saw little in the way of fresh headline flow to stir the pot.

- The Antipodeans faced a modicum of selling pressure, even as consumer confidence improved on both sides of the Tasman.

- The PBOC set its central USD/CNY mid-point at CNY6.4613, 13 pips shy of sell-side estimate. Spot USD/CNH oscillated within a tight range around neutral levels.

- U.S. existing home sales, advance EZ consumer confidence take focus on the data front today. Speeches are due from ECB's Lane, Rehn & Schnabel as well as Fed's Powell, Mester & Daly.

FOREX OPTIONS: Expiries for Jun22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2175(E536mln), $1.2220-25(E1.4bln-EUR puts)

- USD/CNY: Cny6.28($600mln), Cny6.35($600mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.