-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Infra Progress In The U.S.? Fed Hawks Continue To Show Their Colours

EXECUTIVE SUMMARY

- FED'S BOSTIC SEES RATE HIKE IN 2022, TWO HIKES IN 2023 (MNI)

- FED'S ROSENGREN PLAYS DOWN RISK OF PERSISTENT HIGH INFLATION (BBG)

- FED'S KAPLAN SEES HIKE IN 2022, TAPER STARTING SOONER (BBG)

- U.S. NEGOTIATORS PREPARE FOR RETURN TO IRAN NUCLEAR TALKS (BBG)

- SENATORS TO BRING BIPARTISAN INFRASTRUCTURE OUTLINE TO BIDEN (BBG)

- PBOC NET INJECTS CNY20BN VIA OMOS

- CBIRC OFFICIAL: CHINA'S PPI LIKELY TO RISE 10% Y/Y IN JUNE (RTRS)

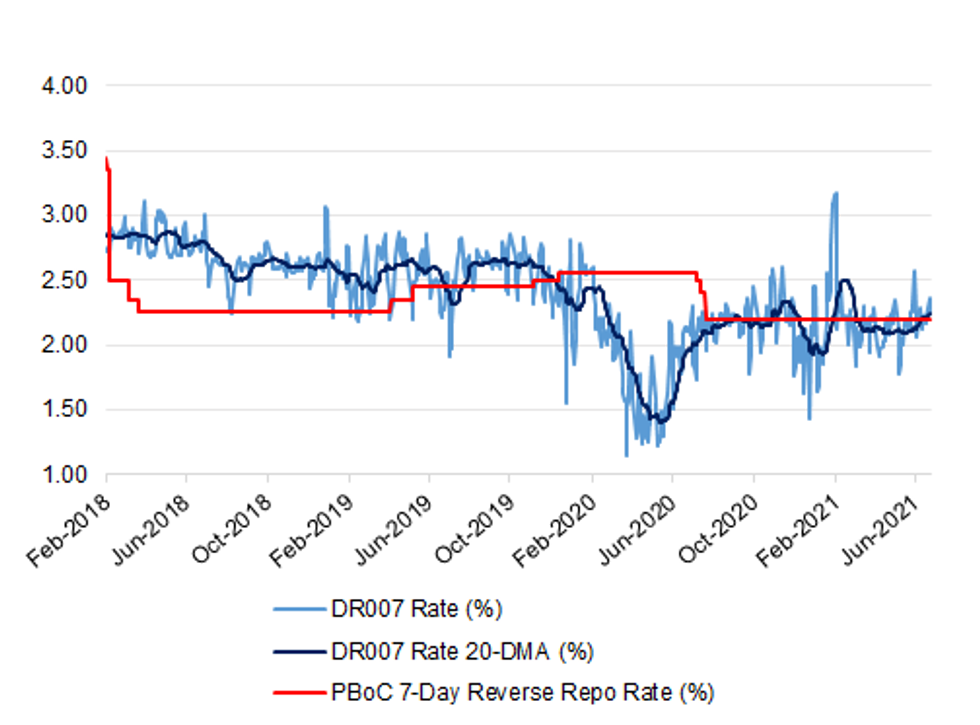

Fig. 1: China Weighted DR007 Repo Rate Vs. 7-Day Reverse Repo Rate (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: A surge in cases of the delta variant continued to push the U.K.'s coronavirus infection numbers to levels not seen since the winter, even with most of the adult population now fully vaccinated. With more than 60 percent of adults in the country having received two shots, there's growing optimism among experts that the vaccine roll-out has broken the link between cases and deaths. Still, the recent surge in cases is threatening plans by Boris Johnson's government to reopen the country, and while vaccines appear to be effective against the latest variant, a rise in cases poses the threat of further mutations. The U.K. reported more than 16,000 new cases on Wednesday, the most since February 6. The surge has in turn led to a steady increase in the number of people hospitalized, at more than 1,500 for the first time since the end of April. (BBG)

CORONAVIRUS: A "big final push" is under way to vaccinate millions more people before coronavirus restrictions are lifted, with walk-in clinics, personal pleas to over-40s to bring forward second doses and a drive to boost low uptake in London. Nadhim Zahawi, the vaccines minister, promised to "strain every sinew" to maximise the numbers having jabs by July 19, saying that uptake was now rising fastest among ethnic minority communities. He praised the "Dunkirk spirit" of the vaccine programme and said that ministers and the NHS were "doubling down our efforts to get more people to come forward" to ensure that at least two thirds of adults have two doses by the time all restrictions are due to be lifted in four weeks. (The Times)

CORONAVIRUS: Wearing face masks and social distancing when ordering at bars are expected to continue to be advised by the Government for months, even if the July 19 reopening goes ahead. The Telegraph understands that laws underpinning both rules are due to be lifted in time for July 19 but advice to Britons to that effect is set to remain in place. Boris Johnson and his ministers are said by well-placed sources to be increasingly optimistic the new "terminus date" for lockdown can be delivered as hoped. (Telegraph)

CORONAVIRUS: Angela Merkel on Wednesday night threatened to scupper hopes of foreign holidays in Europe this summer by demanding that EU countries introduce mandatory quarantine for travelling Britons. The German chancellor urged countries to introduce the quarantine for vaccinated Britons just as the UK Government is finally preparing to relax its rules for returning holidaymakers. Her intervention came ahead of a key meeting on Thursday at which Boris Johnson is expected to approve plans for fully vaccinated people to be able to travel to amber list countries later this summer and not be subject to quarantine when they return home. (Telegraph)

BOE: MNI INSIGHT: Appointments Trim BOE Chief Economist Field

- Internal restructuring and a recent personnel reshuffle at the Bank of England may grant more room for hiring a new chief economist more focussed on research than management, with two possible internal candidates now likely to have been ruled out after taking other senior roles - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

EUROPE

GERMANY: The share of COVID-19 infections caused by the more easily transmitted Delta variant of the coronavirus has doubled in Germany in a week and is likely to gain more traction over other variants, the Robert Koch Institute public health agency said on Wednesday. A whole genome sequencing analysis shows the Delta variant - first identified in India - accounting for 15% of infections, the Institute said, adding that "the proportion of variant B.1.617.2 (Delta) continues to increase and the proportion of this VOC (variant of concern) doubled within one week." "The current distribution of the variants in Germany shows that it can be expected that the VOC B.1.617.2 can be expected to prevail over the other variants," it added in a report. (RTRS)

ITALY/BTPS: Italy to sell the following at the Jun 28 bill auction:

- EUR6.5bn of 6-month Dec 31, 2021 BOT

GREECE: Greece will end the mandatory wearing of face masks outdoors and ease other remaining restrictions imposed to curb the COVID-19 pandemic, authorities said on Wednesday, with infections now clearly on the wane. (RTRS)

U.S.

FED: MNI: Fed's Bostic Sees Rate Hike in 2022, Two Hikes in 2023

- Atlanta Federal Reserve President Raphael Bostic said Wednesday he sees the standard for beginning a slowing of the Fed's asset purchases coming sooner, potentially in the next 3 to 4 months depending on jobs data, and has penciled in a single rate hike in late 2022 and two rate hikes in 2023. "Given the upside surprises and recent data points, I pulled forward my projection for our first move to late 2022," Bostic said in remarks to reporters after speaking at the Russell Innovation Center for Entrepreneurs. "The economy is well on its way to recovering from the pandemic, and much of the data, recently has come in stronger than expected" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: The U.S. economy will likely meet the Federal Reserve's threshold for tapering its asset purchases sooner than people think, said Dallas Fed President Robert Kaplan, who has penciled in an interest-rate increase next year. "As we make substantial further progress, which I think will happen sooner than people expect -- sooner rather than later -- and we're weathering the pandemic, I think we'd be far better off, from a risk-management point of view, beginning to adjust these purchases of Treasuries and mortgage-backed securities," Kaplan said Wednesday in an interview with Bloomberg News. Kaplan says he's forecasting rate liftoff in 2022 from its current setting near zero, as inflation surpasses the central bank's 2% goal this year and next and unemployment dips below 4%. He declined to elaborate on his 2023 rate projection. (BBG)

FED: Federal Reserve Bank of Boston President Eric Rosengren expects inflation to ease next year and return close to the central bank's 2% target as supply shortages resolve. "The likelihood that we see persistent inflation at 3% -- as a modal forecast, "I think it is not a particularly good forecast," Rosengren said Wednesday during a virtual event hosted by the New England chapter of the National Association of Corporate Directors. "My expectation is that most of the price increases we are seeing this year will be reversed as we get into next year." Rosengren, who does not vote in the rate-setting Federal Open Market Committee this year, said he expects inflation to be slightly above 2% in 2022, though he stressed that risks and uncertainty are high and policy makers have to remain vigilant. The Fed targets 2% inflation over the longer run. (BBG)

FED: MNI: Ex-Fed Officials See Rate Liftoff Before Taper Ends

- The Federal Reserve is likely to raise interest rates before its bond-purchasing program is phased out completely if faced with uncomfortable levels of inflation, though its communication task will be simplified if it can finish tapering first, former top Fed officials told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: San Francisco Fed President Daly tweeted the following on Wednesday: "Grateful to @PIIE for the discussion on climate risk. While the future is uncertain, here are 3 things we know:1. A changing climate poses a significant risk to the economy2. Economic transitions are inevitable3. Preparation makes all the difference." (MNI)

INFLATION: MNI BRIEF: Yellen Says Inflation to Return to Normal in 2022

- U.S. Treasury Secretary Janet Yellen told a Congressional panel Wednesday that inflation will return back to 2% in 2022 and inflation expectations are well contained. "I do continue to believe that" higher inflation will only be temporary, the former Fed chair said. "Now that the economy's opening back up again, some of those prices are reverting towards more normal levels" and "after the year is over inflation rates will go back to normal" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY/FISCAL: Job hunting has been muted in 12 states that opted out of federal unemployment programs in recent weeks, suggesting the policy may not be working as planned, according to a new analysis. The states have ended the pandemic-era benefits — including an extra $300 a week — since June 12, about three months ahead of their Sept. 6 expiration. (CNBC)

FISCAL: Senators negotiating a bipartisan infrastructure plan with the White House will meet Thursday with President Joe Biden to present an outline for a roughly $559 billion compromise package of spending on roads, bridges and other projects. "We have a framework," Republican Bill Cassidy of Louisiana, one of the 10 senators involved in the negotiations, said Wednesday after another round of talks with Biden's aides. "We are going to the White House tomorrow." The meeting with Biden marks a significant step forward in the effort to put together a package of infrastructure spending that can draw enough votes from both parties to get through Congress. The Senate group was striving to reach an agreement before the chamber leaves Washington for a two-week break that begins Friday. (BBG)

FISCAL: Democrats in the U.S. Congress and at the White House nudged Republicans on Wednesday to join them in forging an agreement on a $1.2 trillion infrastructure plan by the end of business on Thursday. "My goal is that we have a deal by the end of the day, and hopefully by early afternoon," Democratic Senator Jon Tester told Reuters. A second Democratic negotiator, Senator Joe Manchin, told reporters they hoped to have a deal before the Senate breaks on Thursday for the July 4 Independence Day holiday. The two are part of the "G-21," a group of 21 senators working on an eight-year bipartisan framework to rebuild roads, bridges and other traditional infrastructure sought by President Joe Biden, a Democrat. Republican negotiators were not immediately available for comment. (RTRS)

FISCAL: Senate Republicans are questioning President Joe Biden's willingness to reach a bipartisan deal on infrastructure, a new and potentially troubling sign as talks threaten to drag into July. A bipartisan group of negotiators met again Wednesday afternoon with White House officials to discuss a possible $1 trillion infrastructure package. But a growing number of GOP senators say the Biden administration isn't showing enough flexibility when it comes to how to pay for any agreement, rejecting their proposals to raise user fees on drivers and resisting their push to raid coronavirus relief accounts for infrastructure. (POLITICO)

FISCAL: Treasury Secretary Janet Yellen implored lawmakers Wednesday to suspend the legal limit on how much debt the U.S. can owe before it kicks back in on Aug. 1, warning that failure to do so "would have absolutely catastrophic economic consequences." In testimony before a Senate subcommittee, Yellen urged Congress to make sure the U.S. does not default on its debt by raising and suspending the so-called debt ceiling. A two-year deal to suspend the debt limit expires after July 31, at which point the Treasury Department would have to take "extraordinary measures" to prevent the U.S. from defaulting. (The Hill)

CORONAVIRUS: U.S. public-health leaders sought to reassure Americans that Covid-19 shots are safe and to get vaccinated after reports that a relatively small number of mostly young men had suffered a heart problem after being immunized. About 1,200 cases of heart inflammation have been reported in people who received messenger RNA Covid-19 vaccines, according to the Centers for Disease Control and Prevention. The numbers were reported at a Wednesday meeting of the CDC's Advisory Committee on Immunization Practices. After the numbers were made public, top U.S. health officials, regulators and doctors said that the risk potentially posed by shots developed by the Pfizer Inc.-BioNTech SE partnership and Moderna Inc. is extremely low, and that it is much more likely that the coronavirus itself would pose a serious threat to people's health. (BBG)

CORONAVIRUS: A group of CDC scientists said Wednesday that there isn't enough data to support recommending Covid-19 booster shots to the general population — at this time — but more vulnerable people like the elderly or transplant recipients may need an extra dose. The Covid-19 working group of the CDC's Advisory Committee on Immunization Practices didn't rule out the possibility that the general population eventually may need booster shots if immunity from the vaccines wanes or a variant reduces the effectiveness of current shots. "Boosters may be required for a broad population. However, it could also be that the need for boosters of Covid vaccine may only be demonstrated in some populations," Dr. Sarah Oliver, co-lead of the working group and a medical epidemiologist with CDC's National Center for Immunization and Respiratory Diseases. (CNBC)

CORONAVIRUS: New York Governor Andrew Cuomo said Wednesday the COVID-19 State of Emergency, originally declared in March of 2020, will expire Thursday. (Voice Of America)

CORONAVIRUS: JPMorgan Chase & Co. said it may require employees to be vaccinated against the Covid-19 virus, as Wall Street's biggest banks ramp up efforts to keep thousands of personnel safe while reopening U.S. workplaces. The nation's largest bank is ordering workers to fill out a questionnaire on their vaccination status by the end of this month, Chief Executive Officer Jamie Dimon and other members of the operating committee wrote in a memo to staff Wednesday. Employees who don't respond will be contacted by managers until they do. (BBG)

HOUSING: The White House on Wednesday removed Mark Calabria as the regulator of U.S. mortgage giants Fannie Mae and Freddie Mac, hours after the Supreme Court gave President Joe Biden more power to fire him. Federal Housing Finance Agency spokesperson Raffi Williams confirmed that Calabria, the agency's director, was removed. Earlier Wednesday, a White House official said Biden is "moving forward today to replace the current director with an appointee who reflects the administration's values." (POLITICO)

POLITICS: Gov. Gavin Newsom (D) will face a recall election later this year, California's Secretary of State confirmed Wednesday. (Axios)

MARKETS: A FOX reporter tweeted the following on Wednesday: "Payment for order flow leaders @citsecurities @VirtuFinancial preparing for SEC crackdown on the controversial market practice that lets investors trade for free but may also give them an info advantage. Chair Gary Gensler eyeing new regs."

OTHER

GLOBAL TRADE: TSMC plans to raise price for some 8-inch and 12-inch wafers by 10% to 20% next year due to strong demand, Taipei-based Economic Daily News reports, citing unidentified people in integrated circuit design industry. Price increase in 12-inch process will be more than 8-inch. TSMC declines to comment on prices. (BBG)

GLOBAL TRADE: Ship congestion outside the busiest U.S. gateway for trade held steady over the past week, as ports from China to Germany battle with Covid-19 outbreaks and other constraints on their capacity to keep containers moving across the global economy. A total of 13 container ships were anchored awaiting entry into the adjacent ports of L.A.-Long Beach as of Tuesday, compared with 12 a week earlier, according to officials who monitor marine traffic in San Pedro Bay. The bottleneck has persisted since late last year, peaking around 40 vessels in early February. (BBG)

GLOBAL TRADE: U.S. and EU share the same democratic values, are equally committed to privacy protections and have mutual interest in finding ground on common issues including technology, U.S. Commerce Secretary Gina Raimondo says in a virtual event hosted by the Coalition of Services Industries. "If we together don't write the rules of the road, if you will, with respect to technology, then other countries that don't share our values, particularly China, will write the rules of the road." U.S. and EU have differences of opinion on digital-privacy protections that need to be resolved and worked through. U.S. needs to stay at the table with the EU to negotiate a Privacy Shield Framework successor. Raimondo sees big opportunity for U.S. to grow services exports; health care, tourism, travel are areas with potential. (BBG)

GLOBAL TRADE: U.S. Treasury Secretary Janet Yellen on Wednesday said the Biden administration is hoping to gain endorsement at next month's G20 finance ministers meeting for a global minimum tax. Yellen's remarks came to lawmakers during a hearing on the administration's budget proposal and followed a Reuters report on Tuesday that a draft communique being circulated ahead of the July 9-10 gathering indicated the finance leaders would endorse a global minimum tax, although it made no reference to a specific rate. The Biden administration is seeking a global minimum tax of at least 15%. (RTRS)

GLOBAL TRADE: The United States International Trade Commission (ITC) said on Wednesday that U.S. manufacturers are "materially injured" by imports of passenger vehicle and light truck tires from Korea, Taiwan and Thailand. (RTRS)

U.S./CHINA: The U.S. is poised to bar some solar products made in China's Xinjiang region, according to several people familiar with the matter, marking one of the Biden administration's biggest steps yet to counter alleged human rights abuses against China's ethnic Uyghur Muslim minority. Factories in Xinjiang -- where advocacy groups and a panel of United Nations experts say Uyghurs and other Muslim minorities have been subjected to human-rights abuses and forced to work against their will -- produce roughly half of global supply of polysilicon, a material critical for solar panels and semiconductors. China has denied the allegations, saying they're an attempt to undermine successful businesses. (BBG)

U.S./CHINA/TAIWAN: U.S. and Taiwan trade officials will resume Trade and Investment Framework Agreement, or TIFA, meetings by June 30 via video conference, Taipei-based Economic Daily News reports, without saying where it got the information. The 11th TIFA talk is expected to be held by end-June, the report says, citing American Chamber of Commerce in Taiwan President Andrew Wylegala. Topics may include intellectual property rights protection, agricultural products, and strengthening supply chain tenacity. Top negotiators will be acting deputy U.S. trade representative and Taiwan's deputy trade representative Yang Jen-ni. (BBG)

CORONAVIRUS: The European Union's top diplomat in Washington said the United States should safely ease COVID-19 travel restrictions on Europeans, calling it a mistake to prevent European business executives from overseeing their U.S. investments. (RTRS)

JAPAN: AstraZeneca's Covid-19 vaccine for those aged 18 and older for public use, though recommending it to only those aged 60 and above, Kyodo reports, citing an unidentified person. The government doesn't have immediate plans to use the vaccine but will be prepared to use when needed. (BBG)

AUSTRALIA: NSW's daily coronavirus numbers are in. The state has recorded 11 new cases of COVID-19 in the community. Five new, locally acquired cases of COVID-19 were detected in the 24 hours to 8pm yesterday. In addition, six new cases were detected overnight. (Sydney Morning Herald)

AUSTRALIA: Another case of COVID-19 has been detected in Melbourne, after a man in his 60s flew into the city from Sydney. Acting Premier James Merlino said the man was tested and returned a positive result this morning. All of Greater Sydney and Wollongong will be classified by the Victorian Government as a red zone. (Sydney Morning Herald)

AUSTRALIA: New variants of Covid-19 emerging in poor countries are 'unpredictable' and could evade vaccines, Scott Morrison has warned. The Prime Minister backed his policy to keep international borders closed as other countries relax restrictions, saying he won't 'recklessly' trade places with nations that still have high numbers of cases and deaths. 'Once you let it in you can't get it out,' he said of the virus in an interview with Sunrise. (Daily Mail)

NEW ZEALAND: Covid-19 Response Minister Chris Hipkins says there are no positive cases in the community or MIQ to report as Wellington adjusts to life in alert level 2 after an infected Australian tourist visited last weekend. The Wellington region moved into alert level 2 at 6pm on Wednesday - after a Covid-19 positive man from Sydney visited 13 locations in the capital, unaware he had the virus, last weekend. (Otago Daily Times)

BOK: Bank of Korea Governor Lee Ju-yeol gave his clearest signal yet that interest rate hikes are in the pipeline, calling for a policy normalization this year that he said shouldn't be characterized as a tightening of monetary conditions. Speaking at a briefing Thursday following the release of a semi-annual report on inflation, Lee said the current record low interest rate of 0.5% was "significantly accommodative" and that it would remain so even after one or two increases. Government fiscal policy could support businesses affected by monetary policy normalization, he added. (BBG)

CANADA: MNI: Canada Finance Dept Cautioned on Big Long-Term Bond Sales

- Canadian finance department staff late last year cautioned against outsized sales of long-term debt, a strategy the government backs as a way of making record deficits to tackle the pandemic more affordable, according to a briefing document obtained by MNI on Wednesday - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

MEXICO: Mexican President Andres Manuel Lopez Obrador's ambitious reform agenda, which includes three major constitutional amendments, faces a difficult path through a divided congress where parties have little appetite to reach consensus, Senate majority leader Ricardo Monreal said. "It will be complicated," Monreal said about pushing the government's legislative priorities in the second part of Lopez Obrador's six-year term. "I'm not overflowing with optimism, I am cautious," he said in an interview with Bloomberg News on Tuesday. (BBG)

MEXICO: Vice President Kamala Harris is heading to the U.S.-Mexico border this week, amid an unrelenting chorus of criticism from Republicans over her failure to visit there. Harris, who was tasked by President Joe Biden to lead diplomatic efforts to stem the flow of migrants arriving on the southern border, will visit El Paso, Texas, on Friday, according to sources familiar with the trip. She will be accompanied by Homeland Security Secretary Alejandro Mayorkas. (POLITICO)

BRAZIL: Brazil's controversial Environment Minister Ricardo Salles, who's been targeted by the federal police in a probe of alleged irregularities in timber exports, has quit his post. Salles said on Wednesday that President Jair Bolsonaro accepted his resignation letter and that he will be replaced by Joaquim Alvaro Pereira Leite, a former member of an agricultural lobbying group who has worked at the environment ministry since 2019. Bolsonaro's choice was celebrated by the agricultural caucus in congress and lamented by environmentalists. (BBG)

RUSSIA: BRIEF: Late Franco-German Bid To Put Russia On Summit Agenda

- A bid by France and Germany to put the idea of a 'Biden-style' summit with Russian leader Vladimir Putin on the agenda of the June 24-25 EU summit has run into resistance from other EU member states. Berlin and Paris are reported to be pushing for "new formats" for future EU-Russia dialogue. Referring to the recent US-Russia summit in Geneva, one EU diplomat told MNI there were "elements in there we could have a look at" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

SOUTH AFRICA: South Africa's daily Covid-19 infections rose to 17,493, the highest number recorded in the country's third resurgence of the virus. The number of infections, announced by the National Institute of Communicable Diseases on Wednesday, is the highest since Jan. 14. Of those tested 24.9% were positive for Covid-19 and 62% of the new infections were in the commercial hub of Gauteng, the NICD said. The number excess deaths, thought to be a more accurate representation of mortality from Covid-19 than official statistics, in the week to Jun. 13 was also the highest since the last week of January, according to a separate report released on Wednesday by the South African Medical Research Council. (BBG)

IRAN: Iran said on Wednesday the United States had agreed to remove all sanctions on Iran's oil and shipping, although Germany cautioned that major issues remained at talks between Tehran and world powers to revive a 2015 nuclear deal. (RTRS)

IRAN: U.S. negotiators are prepared to return to a seventh round of indirect talks with Iran on re-entering on 2015 nuclear deal once the leadership in Tehran is ready, a senior administration official said. President Joe Biden's negotiating team, led by Iran envoy Robert Malley, could return to talks in Vienna as early as next week, though that date might be pushed back, according to the official, who asked not to be identified discussing private deliberations. (BBG)

IRAN: A sabotage operation against one of the buildings of Iran's Atomic Energy Organization (IAEO) caused major damage – despite Iranian denials, The Jerusalem Post learned on Wednesday night. Although Iran has claimed throughout the day that the sabotage failed and caused no damage or casualties, the Post has been given strong indications otherwise, though it has no way to independently confirm. The incident is said to be under investigation by Iranian authorities. It is as of yet unclear how the attack was carried out. (Jerusalem Post)

OIL: Saudi Arabia's Energy Minister said the OPEC+ alliance has a role in "taming and containing" inflationary pressures, just hours after Brent crude surged back above $75 a barrel. The comments come as OPEC+ countries weigh whether to increase production further in the coming months. The oil cartel is scheduled to meet online next week to decide its production policy for August and beyond, after boosting output from May to July. "We have also a role in taming and containing inflation, by making sure that this market doesn't get out of hand," Prince Abdulaziz bin Salman said Wednesday at a conference organized by Bank of America Corp., according to a recording of his remarks obtained by Bloomberg News. (BBG)

CHINA

YUAN: The yuan faces increased risks of a steeper correction in the short term as the Federal Reserve's recent policy direction sustains a dollar rebound, the Shanghai Securities News said citing analyst Li Liuyang with China Merchant Bank. A rise in the short-term rate of the dollar will have a significant impact on inflation and global capital flow, even as the yuan is supported by China's strong exports, Li was cited as saying. However, the yuan has been more stable trading against other major currencies as indicated by the weekly CFETS yuan index, the newspaper said. While the yuan may be pressured by the dollar in the near term, it will remain strong relative to other currencies given China's medium-to-high growth, surpluses in the international balance of payments, and its stable monetary policy, the newspaper said. (MNI)

INFLATION: China's monthly producer price index (PPI) is likely to rise 10% in June, adding pressure on downstream consumers, senior official of banking and insurance watchdog Yu Xuejun told a forum in Beijing on Thursday. The PPI, a benchmark gauge of a country's industrial profitability, rose 9% from a year earlier in May, the fastest pace since September 2008 as China's economy recovers. (RTRS)

PROPERTY: China's housing authorities should extend property market controls to smaller cities as property prices in many county-level municipalities, mostly in the developed eastern regions such as Zhejiang, Jiangsu and Hainan provinces, have rapidly gained, the 21st Century Business Herald said in a commentary. Land prices have also surged, partly because some property developers have been forced out of larger cities and begun to compete for land in some economically more developed county-level cities, the newspaper said. High home prices in county-level cities, where most urbanizing farmers migrate to settle, will place large debt burdens on them and reduce their spending, something that policymakers had counted on for spurring future consumption, the newspaper said. (MNI)

OVERNIGHT DATA

JAPAN MAY PPI SERVICES +1.5% Y/Y; MEDIAN +1.5%; APR +1.1%

JAPAN MAY SUPERMARKET SALES +2.9% Y/Y; APR +6.0%

SOUTH KOREA JUN CONSUMER CONFIDENCE 110.3; MAY 105.2

CHINA MARKETS

PBOC INJECTS NET CNY20BN VIA OMOS THURS

The People's Bank of China (PBOC) conducted CNY30 billion via 7-day reverse repos with the rate unchanged at 2.2% on Thursday, marking the biggest injection since Feb 5, 2021. The operation left a net injection of CNY20billion given there is CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity stable at half-year end, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.2359% at 09:40 am local time from the close of 2.2696% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 36 on Wednesday vs 40 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4824 THURS VS 6.4621

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher for an eighth day at 6.4824 on Thursday, compared with the 6.4621 set on Wednesday.

MARKETS

SNAPSHOT: Infra Progress In The U.S.? Fed Hawks Continue To Show Their Colours

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 5.46 points at 28869.61

- ASX 200 down 6.554 points at 7291.9

- Shanghai Comp. down 5.212 points at 3561.008

- JGB 10-Yr future down 5 ticks at 151.63, yield down 0.1bp at 0.055%

- Aussie 10-Yr future up 0.5 tick at 98.430, yield down 0.3bp at 1.557%

- U.S. 10-Yr future -0-01 at 132-05, yield up 0.34bp at 1.489%

- WTI crude up $0.06 at $73.14, Gold down $4.1 at $1774.54

- USD/JPY up 1 pip at Y110.97

- FED'S BOSTIC SEES RATE HIKE IN 2022, TWO HIKES IN 2023 (MNI)

- FED'S ROSENGREN PLAYS DOWN RISK OF PERSISTENT HIGH INFLATION (BBG)

- FED'S KAPLAN SEES HIKE IN 2022, TAPER STARTING SOONER (BBG)

- U.S. NEGOTIATORS PREPARE FOR RETURN TO IRAN NUCLEAR TALKS (BBG)

- SENATORS TO BRING BIPARTISAN INFRASTRUCTURE OUTLINE TO BIDEN (BBG)

- PBOC NET INJECTS CNY20BN VIA OMOS

- CBIRC OFFICIAL: CHINA'S PPI LIKELY TO RISE 10% Y/Y IN JUNE (RTRS)

BOND SUMMARY: Core FI Little Changed In Asia On Thursday

A very modest, early U.S. Tsy bid faded during Asia-Pac trade, T-Notes last -0-01 at 132-05, with the contract sticking within the confines of a 0-04 range. The contract had a brief and very shallow look below Wednesday's low. The major cash Tsy benchmarks sit unchanged to 0.5bp cheaper on the day. U.S. infrastructure matters dominated headline flow overnight. The bipartisan group of Senators meeting on the Hill negotiated a ~$559bn compromise framework re: the matter and will visit the White House to discuss the issue on Thursday. Note that Dem. Party leadership hasn't formally backed the deal and need to give it the once over. On the flow side, TYQ1 129.00 puts were sold on block (-13,125) at 0-01.

- A lukewarm round of 20-Year JGB supply saw the cover ratio tick higher vs. prev. auction, tail narrow a little vs. prev. auction, while the low price matched broader dealer expectations (proxied by the BBG poll). 20-Year cash JGBs have richened by ~1.0bp in the wake of the auction after some modest concession during the morning, while JGB futures haven't shown anything in the way of a tangible reaction. JGB futures print -3 at typing, while the major cash JGB benchmarks run little changed to ~1.0bp richer on the day. There has been a lack of notable domestic news flow on Thursday.

- Australian focus fell on another uptick in COVID cases in NSW (although there were no fresh restrictions imposed today) and further receiving pressure in AUD 1Y/1Y & 2Y/1Y swaps as RBA pricing fades from the recent extremes (likely aided by matters in NSW). YM last +2.0, XM unch. at typing as a result. The 5- to 10-Year zone of the curve lags, despite the presence of RBA purchases in the Nov '28 to Nov '31 area of the curve, with the major benchmarks running unchanged to 1.5bp firmer across the cash ACGB space. EFPs have widened by a little over 1.0bp on the day.

JGBS AUCTION: Japanese MOF sells Y980.4bn 20-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y980.4bn 20-Year JGBs:- Average Yield 0.433% (prev. 0.445%)

- Average Price 101.21 (prev. 101.00)

- High Yield: 0.436% (prev. 0.450%)

- Low Price 101.15 (prev. 100.90)

- % Allotted At High Yield: 31.0507% (prev. 37.4530%)

- Bid/Cover: 3.618x (prev. 3.478x)

JAPAN: Another Round Of Net Weekly Buying Of Foreign Bonds

The latest round of weekly international security flow data revealed the third straight week of net purchases of foreign bonds by Japanese investors, pushing the 4-week rolling sum of the measure into positive territory for the first time since late April. Elsewhere, Japanese investors ended a 3-week run of net purchases of foreign equities, although that particular round of net flows was relatively light.

- Foreign investors lodged a third straight week of net purchases of Japanese bonds, although the weekly net sum moderated in w/w terms. Foreigners shed Japanese equities in net terms for a second consecutive week, although that particular round of weekly net flows remained limited in the grander scheme of things.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 979.7 | 410.6 | 967.7 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -208.9 | 105.3 | 93.3 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 291.0 | 1309.8 | 2061.1 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | -191.5 | -35.7 | 48.9 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

EQUITIES: Mixed

A mixed day for equity markets in the Asia time zone on Thursday after US stocks lacked decisive direction; bourses in Japan have squeezed out some small gains alongside indices in Taiwan and South Korea. Markets in mainland China and Australia are lower, with losses also seen in EM indices. In China the PBOC injected liquidity for the first time since March. In the US futures are higher, markets digest comments from Fed speakers late yesterday; Fed's Kaplan said tapering could be on the cards sooner than markets expect, while Fed's Bostic said asset purchases could be slowed in the coming months. Fed's Rosengren said the recovery was robust but highlighting the progress needs to be made on the labour market and noting risks around inflation.

OIL: Crude Futures Tread Water

Oil is flat in Asia-Pac trade, struggling for direction in a quiet session. WTI is down $0.01 from settlement levels at $73.07/bbl while Brent is down $0.03 at $75.16/bbl. At these levels both benchmarks are hovering around cycle highs. Ata yesterday showed headline crude stocks fell more than expected at 7.614m bbls, while gasoline stocks also saw a draw. Focus now shifts to the upcoming OPEC+ meeting in Vienna next week. The group's delegates meet on July 1st, with recent reports suggesting the group could up daily output by a further 500,000bpd - still a relatively small move given the IEA's forecast that Q4 oil demand will hit multi-year highs of 100mln bpd in Q4. Saudi Arabia's Energy Minister Prince Abdulaziz bin Salman said yesterday that OPEC has a role in taming inflation, which could indicate further supply will hit the market.

GOLD: Playing The Range

Gold has stuck to a narrow range in Asia-Pac trade, last printing a handful of dollars lower vs. closing levels at $1,775/oz after backing off from best levels on Wednesday as the DXY recovered from the worst levels of the day. Bulls still haven't managed to force a real challenge of $1,800/oz, with the technical picture remaining unchanged. Focus during the remainder of the week will likely fall on the raft of Fedspeak that is due, as well as the latest U.S. PCE reading.

FOREX: USD/JPY Pulls Back From Multi-Month High Into Tokyo Fix

The kiwi edged higher in quiet Asia-Pac trade, with broader G10 FX space looking for fresh catalysts. Some may have found it reassuring, when NZ off'ls said that they haven't found any new Covid-19 cases in the community, after an infected person from Australia visited Wellington over the weekend.

- A bout of JPY sales pushed USD/JPY to a fresh 13-month high of Y111.12, but pulled back into the Tokyo fix.

- The PBOC set its central USD/CNY mid-point at CNY6.4824, virtually in line with sell-side estimate. USD/CNH inched higher, trapped within the confines of yesterday's range.

- The European docket is headlined by BoE MonPol decision, German Ifo survey as well as comments from ECB's Schnabel & Panetta.

- In the U.S., focus moves to initial jobless claims, third GDP reading, flash durable goods orders and Fedspeak from Williams, Kaplan, Barkin, Bostic & Bullard.

FOREX OPTIONS: Expiries for Jun24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800(E1.8bln), $1.1840-50(E1.0bln), $1.1900-10(E1.1bln), $1.1920-25(E1.8bln), $1.1945-50(E713mln), $1.1975(E640mln), $1.2000-20(E1.1bln)

- USD/JPY: Y109.50($658mln), Y109.95-110.00($2.1bln), Y110.25-30($663mln), Y110.50($602mln), Y110.65-75($1.3bln-USD puts), Y111.20-30($1.8bln), Y111.75($1.4bln)

- GBP/USD: $1.3895-00(Gbp798mln), $1.4000(Gbp686mln)

- EUR/JPY: Y132.00(E556mln)

- AUD/USD: $0.7750-70(A$1.25bln)

- USD/CAD: C$1.2900($1.4bln)

- USD/CNY: Cny6.40($1bln)

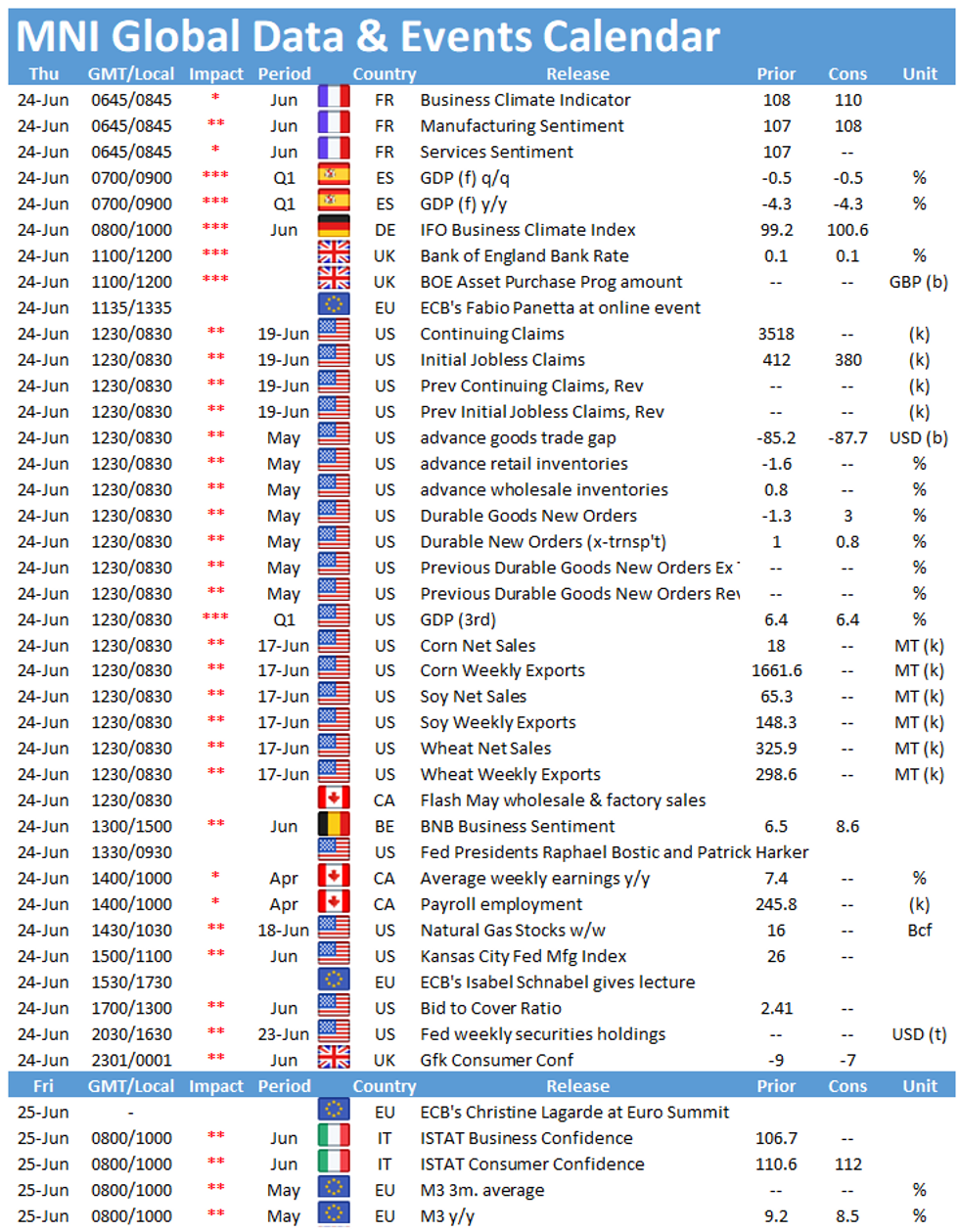

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.