-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

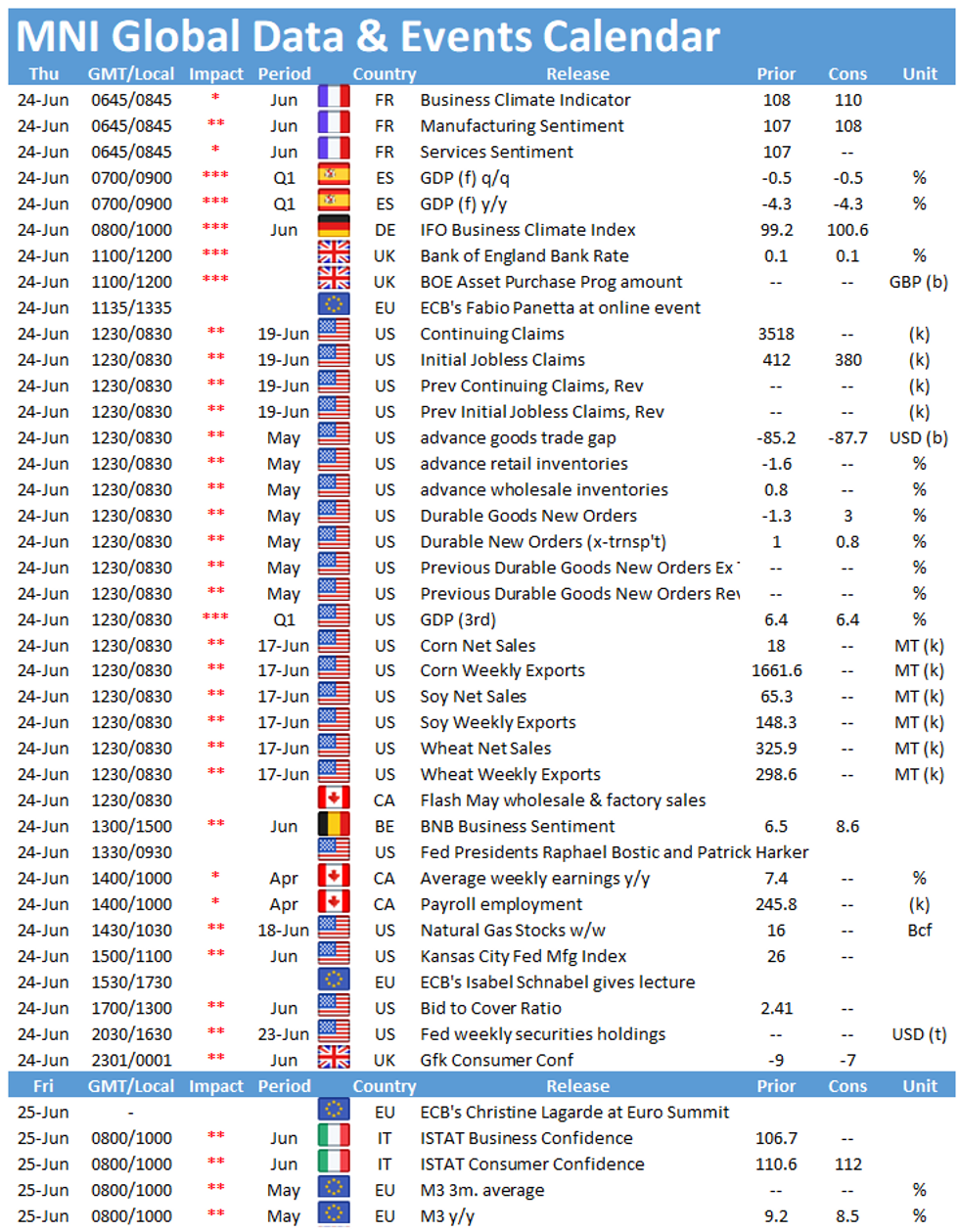

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Markets Tight In Asia, BoE, Fedspeak & U.S. Infra Eyed

- Markets were generally contained in Asia-Pac hours with the latest round of U.S. infrastructure headlines doing little for participants.

- 6 Fed speakers are slated for Thursday, with the hawks dominating on Wednesday after measured to dovish tones from Powell & Williams earlier in the week.

- The latest BoE monetary policy decision headlines the UK docket on Thursday. No changes are foreseen re: the Bank's broader policy settings. We think it is unlikely, but the most significant event for the market would be if another MPC member joined the outgoing Haldane in voting for a reduction to the QE target. We think that the extra COVID-related uncertainty evident at present will be enough to stop any such move, however. The elephant in the room will be questions surrounding the impact on the labour market when the furlough scheme begins to wind down.

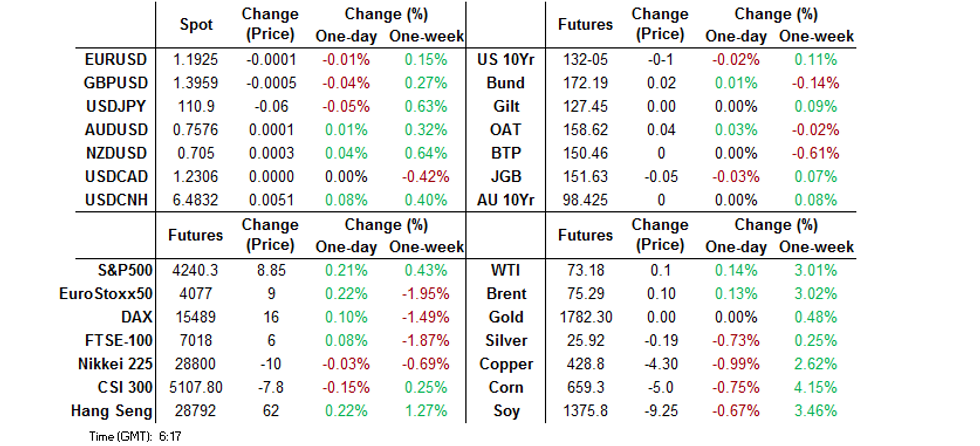

BOND SUMMARY: Core FI Little Changed In Asia On Thursday

A very modest, early U.S. Tsy bid faded during Asia-Pac trade, T-Notes last -0-01 at 132-05, with the contract sticking within the confines of a 0-04 range. The contract had a brief and very shallow look below Wednesday's low overnight. The major cash Tsy benchmarks sit unchanged to ~0.5bp cheaper on the day. U.S. infrastructure matters dominated headline flow overnight. The bipartisan group of Senators meeting on the Hill negotiated a ~$559bn compromise framework re: the matter and will visit the White House to discuss the issue on Thursday. Note that the Dem. Party leadership hasn't formally backed the deal and need to give it the once over. On the flow side, TYQ1 129.00 puts were sold on block (-13,125) at 0-01. The German IFO survey & BoE monetary policy decision headline in Europe. Thursday's local docket sees the latest raft of Fedspeak (Williams, Bostic, Barkin, Harker, Bullard & Kaplan), the Fed stress test results, several data releases of note (headlined by the latest durable goods and weekly jobless claims data) and 7-Year Tsy supply.

- JGB futures print -5 at typing, while the major cash JGB benchmarks run little changed to ~1.0bp richer on the day. There has been a lack of notable domestic news flow on Thursday. A lukewarm round of 20-Year JGB supply saw the cover ratio tick higher vs. prev. auction, tail narrow a little vs. prev. auction, while the low price matched broader dealer expectations (proxied by the BBG poll). 20-Year cash JGBs have richened by ~1.0bp in the wake of the auction after some modest concession during the morning, while JGB futures haven't shown anything in the way of a tangible reaction. Looking ahead, Tokyo CPI data headlines the local docket on Friday.

- Australian focus fell on another uptick in COVID cases in NSW (although there were no fresh restrictions imposed today) and further receiving pressure in AUD 1Y/1Y & 2Y/1Y swaps as RBA pricing fades from the recent extremes (likely aided by matters in NSW). YM last +2.0, XM -0.5 at typing as a result. The 5- to 10-Year zone of the curve lags, despite the presence of RBA purchases in the Nov '28 to Nov '31 area, with the major benchmarks running unchanged to 1.5bp firmer across the cash ACGB space. EFPs have widened by 1.5-2.0bp on the day. The release of the weekly AOFM issuance slate will headline on Friday.

FOREX: USD/JPY Pulls Back From Multi-Month High Into Tokyo Fix

The kiwi edged higher in quiet Asia-Pac trade, with broader G10 FX space looking for fresh catalysts. Some may have found it reassuring, when NZ off'ls said that they haven't found any new Covid-19 cases in the community, after an infected person from Australia visited Wellington over the weekend.

- A bout of JPY sales pushed USD/JPY to a fresh 13-month high of Y111.12, but pulled back into the Tokyo fix.

- The PBOC set its central USD/CNY mid-point at CNY6.4824, virtually in line with sell-side estimate. USD/CNH inched higher, trapped within the confines of yesterday's range.

- The European docket is headlined by BoE MonPol decision, German Ifo survey as well as comments from ECB's Schnabel & Panetta.

- In the U.S., focus moves to initial jobless claims, third GDP reading, flash durable goods orders and Fedspeak from Williams, Kaplan, Barkin, Bostic & Bullard.

FOREX OPTIONS: Expiries for Jun24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800(E1.8bln), $1.1840-50(E1.0bln), $1.1900-10(E1.1bln), $1.1920-25(E1.8bln), $1.1945-50(E713mln), $1.1975(E640mln), $1.2000-20(E1.1bln)

- USD/JPY: Y109.50($658mln), Y109.95-110.00($2.1bln), Y110.25-30($663mln), Y110.50($602mln), Y110.65-75($1.3bln-USD puts), Y111.20-30($1.8bln), Y111.75($1.4bln)

- GBP/USD: $1.3895-00(Gbp798mln), $1.4000(Gbp686mln)

- EUR/JPY: Y132.00(E556mln)

- AUD/USD: $0.7750-70(A$1.25bln)

- USD/CAD: C$1.2900($1.4bln)

- USD/CNY: Cny6.40($1bln)

ASIA FX: Most EM Asia FX Weaker

The dollar index crept higher on Thursday after a flat finish Wednesday. Risk tone was mixed with most asset classes struggling for direction.

- CNH: Offshore yuan is slightly weaker, USD/CNH higher but sticking to yesterday's range. The PBOC injected funds into the system for the first time since March. The Bank set its central USD/CNY mid-point at CNY6.4824, virtually in line with sell-side estimate.

- SGD: Singapore dollar weakened again, on the coronavirus front there were reports in the Straits Times that Singapore is preparing a road map for emerging from lockdowns and life going forward.

- TWD: Taiwan dollar is weaker, hovering around the 28.00 handle after breaching the level for the first time since mid-May yesterday. There were reports earlier that the US and Taiwan would resume trade talks by June 30.

- KRW: The won is stronger, reversing early losses seen at the open after hawkish comments from BoK Gov Lee, he said that it would be appropriate to start normalising policy this year. Elsewhere consumer confidence rose again.

- MYR: Ringgit fell, the World Bank downgraded Malaysia's GDP growth forecast to +4.5% Y/Y from +6.0% Y/Y, owing to the rise in new Covid-19 cases and high hospital bed occupancy rate. Separately, Malaysia's Econ Min Mohamed said that the gov't expects a strong economic recovery in 4Q2021.

- IDR: Rupiah is lower, it has been among the worst performers in Asia, as Wednesday's record increase in Indonesia's Covid-19 case count has weighed on sentiment.

- PHP: Peso declined, Bangko Sentral ng Pilipinas will deliver their latest monetary policy decision today and are widely expected to leave the benchmark Overnight Borrowing Rate unchanged.

- THB: Baht is weaker, markets continue to digest the BoT decision. The Bank left its benchmark policy rate on hold, in line with consensus, while slashing economic forecasts for this year. The Bank now expects domestic GDP to grow 1.8% Y/Y in 2021, after earlier projecting a 3.0% rise, while the 2022 growth forecast was trimmed to +3.9% from 4.7%.

ASIA RATES: China Adds Liquidity First Time Since March

- INDIA: Yields mixed in early trade with focus on the RBI's INR 260bn bonds sale tomorrow. Bonds rose for the second day yesterday after the RBI's sale of bills was taken down smoothly, the INR 360bn sale saw cut off yields in line with expectations. The bill sale last week was weak, with cut offs hitting the highest in over a year after higher inflation data.

- SOUTH KOREA: Futures were hit back to neutral levels after hawkish comments from BoK Governor Lee who said that policy normalisation would begin this year. Lee noted that given the extraordinary levels of monetary accommodation a rate hike should not be seen as tightening, but normalising. Lee also noted it was necessary for fiscal and monetary policy to compliment each other. Data earlier in the session showed consumer confidence rose for the sixth straight month.

- CHINA: The PBOC injected a net CNY 20bn into the financial system today, the first injection since March. Repo rates are lower with the overnight repo rate dropping below 2%, the decline helped support futures. There had been several commentary pieces from state media suggesting there could be liquidity injections in June but markets had to wait a long time for those to come to fruition. While the injection is small in standalone terms it indicates that the PBOC stands ready to adjust liquidity conditions if needed. While repo rates had been creeping higher they weren't at levels high enough to give the central bank concern, unlike the spike in January heading into LNY. The 20 day rolling average of DR007 has hovered just above the PBOC's 7-day repo rate (2.20%) for the past 11 days.

- INDONESIA: Curve twist steepens, Pres Widodo decided to stick to the plan of implementing partial restrictions, shrugging off calls for stricter measures, even as Indonesia declared a record increase in new Covid-19 cases on Wednesday. Worth noting that the latest Insight piece from our Policy Team noted that "Bank Indonesia's concerns are beginning to focus on the danger that direct government financing under its QE programme could undermine international investor confidence and cause a run on the rupiah".

JAPAN: Another Round Of Net Weekly Buying Of Foreign Bonds

The latest round of weekly international security flow data revealed the third straight week of net purchases of foreign bonds by Japanese investors, pushing the 4-week rolling sum of the measure into positive territory for the first time since late April. Elsewhere, Japanese investors ended a 3-week run of net purchases of foreign equities, although that particular round of net flows was relatively light.

- Foreign investors lodged a third straight week of net purchases of Japanese bonds, although the weekly net sum moderated in w/w terms. Foreigners shed Japanese equities in net terms for a second consecutive week, although that particular round of weekly net flows remained limited in the grander scheme of things.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 979.7 | 410.6 | 967.7 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -208.9 | 105.3 | 93.3 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 291.0 | 1309.8 | 2061.1 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | -191.5 | -35.7 | 48.9 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

EQUITIES: Mixed

A mixed day for equity markets in the Asia time zone on Thursday after US stocks lacked decisive direction; bourses in Japan have squeezed out some small gains alongside indices in Taiwan and South Korea. Markets in mainland China and Australia are lower, with losses also seen in EM indices. In China the PBOC injected liquidity for the first time since March. In the US futures are higher, markets digest comments from Fed speakers late yesterday; Fed's Kaplan said tapering could be on the cards sooner than markets expect, while Fed's Bostic said asset purchases could be slowed in the coming months. Fed's Rosengren said the recovery was robust but highlighting the progress needs to be made on the labour market and noting risks around inflation.

GOLD: Playing The Range

Gold has stuck to a narrow range in Asia-Pac trade, last printing a handful of dollars lower vs. closing levels at $1,775/oz after backing off from best levels on Wednesday as the DXY recovered from the worst levels of the day. Bulls still haven't managed to force a real challenge of $1,800/oz, with the technical picture remaining unchanged. Focus during the remainder of the week will likely fall on the raft of Fedspeak that is due, as well as the latest U.S. PCE reading.

OIL: Crude Futures Tread Water

Oil is flat in Asia-Pac trade, struggling for direction in a quiet session, with WTI & Brent both ~$0.10 above their respective settlement levels. At these levels both benchmarks are hovering around cycle highs. Data yesterday showed headline crude stocks fell more than expected at 7.614m bbls, while gasoline stocks also saw a draw. Focus now shifts to the upcoming OPEC+ meeting in Vienna next week. The group's delegates meet on July 1st, with recent reports suggesting the group could up daily output by a further 500,000bpd - still a relatively small move given the IEA's forecast that Q4 oil demand will hit multi-year highs of 100mln bpd in Q4. Saudi Arabia's Energy Minister Prince Abdulaziz bin Salman said yesterday that OPEC has a role in taming inflation, which could indicate further supply will hit the market.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.