-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: 2025 Rate Cut Projections Abate

MNI BRIEF: Canada Says Has Leverage Against Trump Tariffs

MNI EUROPEAN OPEN: Local COVID Headlines Still Dominate In Asia

EXECUTIVE SUMMARY

- FED'S BARKIN: MADE "SUBSTANTIAL FURTHER PROGRESS" ON INFLATION GOAL

- HOUSE PASSES ITS VERSION OF U.S.-CHINA COMPETITIVENESS BILLS (BBG)

- END OF ENGLAND'S COVID RULES STILL SET FOR 19 JULY (BBC)

- BOJ MULLS INCENTIVE FOR LENDERS IN CLIMATE SCHEME (NIKKEI)

- HALF OF AUSTRALIA'S POPULATION IN LOCKDOWN AS DELTA SPREADS (BBG)

- WELLINGTON RETURNS TO ALERT LEVEL 1 AT MIDNIGHT (NZ HERALD)

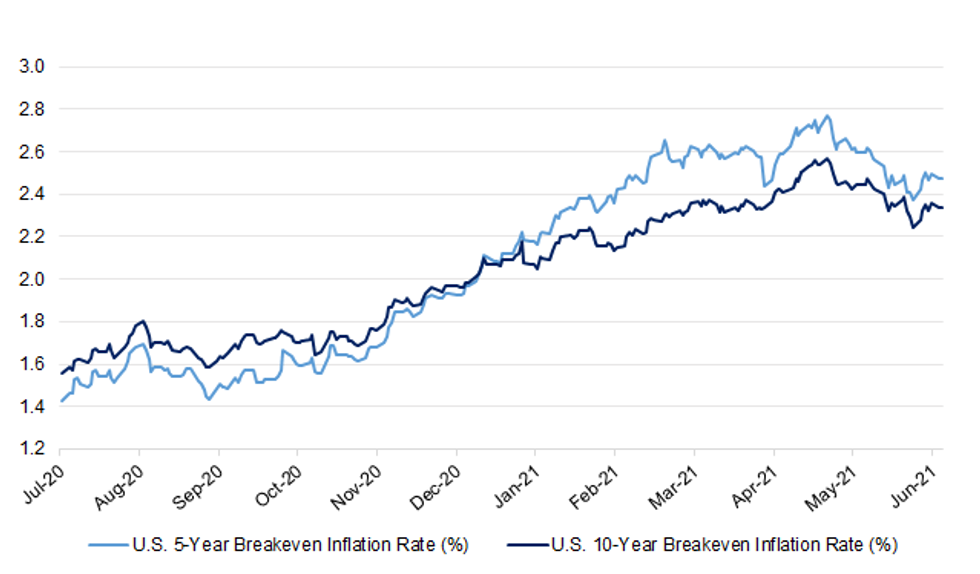

Fig. 1: U.S. 5- & 10-Year Breakeven Inflation Rates (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: The final easing of lockdown measures in England is still set for 19 July, the new health secretary has said. Sajid Javid told MPs that ministers "see no reason to go beyond" that "target date". He said that while cases were rising, the number of deaths "remains mercifully low". In a statement, he said no date for lifting restrictions would come with "zero risk" and that "we have to learn to live with" Covid-19. "We also know that people and businesses need certainty, so we want every step to be irreversible," he said. "The restrictions on our freedoms, they must come to an end." (BBC)

CORONAVIRUS: Ministers are planning to bring an end to school bubbles from September amid mounting concerns over the number of children being forced to self-isolate. Sajid Javid, the health secretary, and Gavin Williamson, the education secretary, are drawing up plans to stop children from having to isolate if a classmate catches Covid-19. A government source said that ministers were concerned that there would be a "two-tier society" with restrictions lifted for most adults but enforced for children. "You cannot have children being put at a disadvantage for the sake of adults," a government source said. "We want to return to a normal environment as soon as possible for children." (The Times)

CORONAVIRUS: Hopes have been raised of summer holidays in Europe for fully vaccinated Britons as a deal with Brussels on Covid passports neared completion and Germany failed to convince popular destinations to pull an "emergency brake" on UK visitors. Restrictions on travel are tightening across the continent for tourists coming from the UK who have not had two jabs, owing to concerns over the highly transmissible Delta variant now dominant in Britain. Portugal announced on Monday that people unable to prove full vaccination status would face 14 days in quarantine. Spain's prime minister, Pedro Sánchez, said Britons travelling to the Balearic islands would need to show either a negative PCR test or proof that they have been fully vaccinated to avoid having to self-isolate. From Wednesday, the Balearics will be on the UK government's green list of countries from which travellers will not need to quarantine when they return home. But for travellers from the UK who have had both doses of an approved vaccine, the prospect of a relatively normal summer break appears brighter, with popular destinations loth to shut the doors on those who are unlikely to be infectious. According to the latest data, 61.9% of UK adults are now fully vaccinated and 84.4% have had at least a first dose. (Guardian)

ECONOMY: The UK government has held emergency talks with retailers, logistics groups and wholesalers as a shortage of lorry drivers threatens to leave gaps on supermarket shelves. Officials from the Department for Environment, Food and Rural Affairs (Defra) are understood to have discussed potential solutions, including relaxing restrictions on drivers' working hours and increasing capacity for HGV driving tests and training to help bring in new local drivers. Defra is also considering putting drivers on the official shortage occupation list to help make it easier to bring in workers from overseas. Sources said the government department was planning to survey related businesses to try to build support for the potential regulatory changes. (Guardian)

ECONOMY: The CBI says the UK must act on the migration advisory committee's advice, which recommended that roles such as bricklayers, butchers and welders be added to the shortage occupation list. The UK's biggest business lobby group has called on the government to relax post-Brexit immigration rules to help companies struggling with staff shortages to hire more workers from overseas. The Confederation of British Industry (CBI) said the government needed to immediately update its "shortage occupations list" to include several areas where employers are finding it difficult to recruit staff, including butchers, bricklayers and welders. (Guardian)

FISCAL: Almost 13,000 investigations of suspected fraud and other breaches in the use of coronavirus support schemes have been opened by HM Revenue & Customs. The number of investigations launched by the tax authority was revealed after a freedom of information request by BLM, the law firm. HMRC reported formal compliance interventions related to the coronavirus job retention scheme, the self-employment income support scheme and Eat Out to Help Out. Compliance interventions are investigations expected to recover funds lost to the exchequer through fraud, tax avoidance, evasion and non-compliance. (The Times)

BREXIT: The EU has said it is confident that a further delay can be agreed to looming restrictions on shipments of meat products across the Irish Sea to Northern Ireland, as Brussels vowed to consider "bold steps" to address some of the problems caused by Brexit in the region. Maros Sefcovic, the EU commissioner in charge of relations with the UK, said he believed a three-month extension could be granted to a grace period before restrictions come into force on exports of chilled meat products from Great Britain to Northern Ireland. Addressing members of the Stormont legislative assembly in Belfast, Sefcovic said the EU wanted to help address barriers to access to medicines in Northern Ireland, signalling the European Commission could introduce legislation to address the matter if necessary. (FT)

BREXIT: Jersey has agreed a last-minute extension to post-Brexit transition arrangements allowing some French vessels to keep fishing in its waters. The Channel island will extend the deal - which had been due to expire on 30 June under an interim agreement - for a further three months. A dispute over fishing rights earlier this year had seen France and Britain send patrol vessels to the seas off Jersey, which is a self-governing crown dependency. (Sky)

BREXIT: Flows of personal data from the EU to the UK will continue, after the European Commission adopted two "data adequacy" decisions. The decisions include a sunset clause, which runs out after four years. They will be renewed only if the UK ensures an adequate level of data protection, the commission said. UK firms had been facing making costly alternative plans with EU counterparts to keep data flowing once a post-Brexit transition period expires this month. The agreement also covers data from countries in the wider European Economic Area. Didier Reynders, Commissioner for Justice, said the adequacy agreement was, "important for smooth trade and the effective fight against crime". Welcoming the decision, the UK government said it "plans to promote the free flow of personal data globally and across borders". "All future decisions will be based on what maximises innovation and keeps up with evolving tech," it added. (BBC)

POLITICS: The departure of Matt Hancock in one sense follows a British political tradition - voters do not always expect ministers to behave well, but the merest sniff of hypocrisy can spell doom. (BBC)

POLITICS: Boris Johnson has defended his actions following Matt Hancock's resignation as health secretary over breaking social distancing guidelines with a colleague. Asked why he hadn't sacked Mr Hancock, the PM replied: "I read the story on Friday and by Saturday we had a new health secretary." The prime minister says the resignation happened at the "right pace". However on Friday, No 10 said the PM had accepted an apology from Mr Hancock and considered the case "closed". (BBC)

POLITICS: The Batley and Spen byelection has descended into allegations of dirty tricks as Labour's campaign was targeted by fake leaflets and the party was accused by one of its own MPs of using "dog-whistle racism" to win votes. Labour was criticised for distributing a flyer to Muslim voters showing Boris Johnson with India's nationalist prime minister, Narendra Modi, in 2019, along with the message: "Don't risk a Tory MP who is not on your side." (Guardian)

WALES: Mark Drakeford has accused Boris Johnson's government of "aggressively" ignoring Wales' government and parliament. The first minister has published a report on reforming the "fragile" union between the four UK nations. It calls for a partnership between governments, but says relations have recently deteriorated. UK ministers said focusing on constitutional issues was an "irresponsible" distraction from Covid. Mr Drakeford said there was an urgent need for change because "the union has never been this fragile". "If matters continue in their current vein the case for the break-up of the UK will only increase," he said. (BBC)

EUROPE

CORONAVIRUS: Groups representing Europe's largest airlines and airports have warned of chaos and hours-long queues unless countries better coordinate the roll-out of the EU's digital COVID-19 certificate and ensure passengers are processed before arriving at airports. The European Union's system of digital COVID-19 travel certificates is due to come into force on Thursday, but airports group ACI and airlines representative bodies A4E, IATA and ERA warned in a letter to EU national leaders of a "worrying patchwork of approaches" across the continent. "As passenger traffic increases in the coming weeks, the risk of chaos at European airports is real," the groups said in the joint letter sent on Monday and seen by Reuters. (RTRS)

GERMANY: German finance minister Olaf Scholz has dismissed calls for reform of German and EU fiscal rules, saying they provide enough flexibility to overcome crises such as the pandemic. But in an interview with the Financial Times, Scholz, who is also the Social Democrat's candidate for chancellor in September's federal election, said Germany must continue its big-spending plans next year to avoid a hard economic landing. "We fared better economically than anyone would have expected in the midst of the crisis because we pursued an expansionary fiscal strategy," he told the FT. "We mustn't abruptly stop the measures we took to ensure the economic recovery." (FT)

ITALY: Italy is preparing a compensation scheme, expected to be approved this week, to help construction firms working in public projects cope with a rise in prices of raw materials, a draft decree seen by Reuters on Monday showed. Strong growth as the global economy recovers from the pandemic with the help of government stimulus has caused supply bottlenecks for some raw materials and raised broader concerns of inflation. The proposed compensation is part of a broader stimulus decree expected to be approved by cabinet on June 30 at the latest, a government source said on condition of anonymity. (RTRS)

ITALY: The Italian government agreed in principle to end the firing ban for manufacturing and construction except for the textile sector, according to a statement. The agreement came in a meeting between Prime Minister Mario Draghi and some ministers. (BBG)

ITALY: Support for Giorgia Meloni's rightist Brothers of Italy party rose, making it the top single Italian party in terms of support, overtaking Matteo Salvini's League for the first time, according to an SWG poll for TG La7. Support for Brothers of Italy rises 0.2 ppt in week to 20.7%. Support for League declines 0.3 ppt to 20.3%. (BBG)

ITALY: The Italian government plans to replace bankrupt Alitalia with a new, state-owned carrier dubbed ITA in October, according to a source close to the matter. A launch in October would mean another delay for ITA, which was expected to start flying in place of Alitalia in August to benefit for the last part of the summer season. Rome is considering to grant another bridge loan for Alitalia to continue operate while its successor gets ready, the source added. (RTRS)

U.S.

FED: MNI BRIEF: Fed's Barkin Suggests QE Taper End Before Liftoff

- Richmond Fed President Tom Barkin Monday said inflation has met the central bank's "substantial further progress" benchmark to begin pulling back on asset purchases and the labor market is "going to get there in relatively short order," adding that he'd prefer to see QE taper end before short-term interest rates are raised - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI: Fed's Quarles Skeptical of Benefits of Digital Dollar

- Federal Reserve Vice Chair for Supervision Randal Quarles Monday expressed doubt about the benefits of a digital dollar, pressing that the Fed is no need to compete against domestic stablecoins or foreign competitors such as China's digital currency. "First, the U.S. dollar payment system is very good, and it is getting better. Second, the potential benefits of a Federal Reserve CBDC are unclear. Third, developing a CBDC could, I believe, pose considerable risks," he said - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: President Joe Biden on Monday pitched the bipartisan infrastructure deal as one "American people can be proud of," while cautioning that there was a lot of work ahead to finish the final product. "This deal is the largest long-term investment in our infrastructure in nearly a century," Biden wrote in an op-ed on Yahoo News. "Economists of all stripes agree that it would create good jobs and dramatically strengthen our economy in the long run." Biden also made clear that he was not satisfied that the bill is missing some "critical initiatives on climate change" — responding to criticism that he'd caved, leaving out ambitious climate goals he promised. But the president said Monday that he intended to go further and pass all of these initiatives in the reconciliation bill, while touting that this initial deal was a "crucial step forward" in clean energy investment. (POLITICO)

FISCAL: President Joe Biden has spoken with Congressional leaders from both parties about the infrastructure deal reached last week, White House press secretary Jen Psaki said on Monday. The White House said it has been in touch with Democratic leaders on a dual-track approach to infrastructure spending, she said. (RTRS)

FISCAL: A bipartisan infrastructure proposal reached by President Joe Biden and a group of senators has regained its footing. Even so, Democrats' plan to push it through Congress in tandem with a broader package to expand the social safety net and fight climate change faces a familiar threat: Senate Minority Leader Mitch McConnell. Biden's suggestion last week that he may veto the bipartisan framework if lawmakers do not also pass other Democratic priorities briefly threatened the deal. The president assuaged some Republicans by clarifying that he would sign the bill if it were passed on its own. But McConnell insisted Monday that Democratic leaders on Capitol Hill also need to separate the two pieces of legislation, raising the risk that the deal could unravel. (CNBC)

CORONAVIRUS: U.S. President Joe Biden and his White House are planning a slate of travel and events this weekend -- including a barbecue for more than a thousand people -- to celebrate his administration's progress combating the pandemic, though the country fell short of his July 4 vaccination goal. (BBG)

CORONAVIRUS: The Los Angeles County Department of Public Health strongly recommended people wear masks indoors in public places -- regardless of vaccination status -- as a precautionary measure against the Delta variant. In the week ending June 12, Delta variants comprised of nearly half of all variants sequenced, L.A. County -- the nation's most populous -- said in a statement. (BBG)

POLITICS: Manhattan District Attorney Cy Vance has indicated he does not currently plan to charge the Trump Organization with crimes related to allegations of "hush money" payments and real estate value manipulations, according to a personal lawyer for Donald Trump. Ronald Fischetti, a New York attorney who represents the former president, said on Monday that in a meeting last week, he asked Vance's team for details on charges they were considering. (POLITICO)

BANKS: Morgan Stanley led big U.S. banks in raising payouts to investors -- by jacking up dividends or announcing plans to buy back shares -- after amassing cash piles that easily met the Federal Reserve's capital requirements. Dividend payouts by the nation's six largest lenders will rise, on average, by almost half -- and that's with Citigroup Inc. abstaining from an increase -- according to statements issued Monday. Morgan Stanley doubled its quarterly payout while also announcing as much as $12 billion in stock buybacks. (BBG)

EQUITIES: Lawsuits brought against Facebook over anti-competitive claims have been dismissed by a federal judge in a major boost for tech firms. The antitrust lawsuit was launched by the Federal Trade Commission (FTC) and a coalition of state attorney generals, but US district judge James Boasberg has dealt a significant blow to regulators attempting to rein in tech giants. In dismissing the claims, Judge Boasberg said they were "legally insufficient" and didn't provide enough evidence to prove Facebook was a monopoly. (Sky)

EQUITIES: Antitrust investigators at the U.S. Justice Department have stepped up scrutiny of Google's digital ad market practices in recent months, according to people familiar with the matter, showing that the Biden administration is actively pursuing a probe that started under former President Donald Trump. Staffers from the antitrust office have interviewed multiple Google competitors about its practices in the advertising technology market, putting a target on the company's second-most important business, according to people familiar with the action, who asked not to be identified discussing the early stage probe. (BBG)

OTHER

GLOBAL TRADE: The Organization for Economic Cooperation and Development aims to impose digital taxes on roughly 100 companies with at least 20 billion euros ($23.9 billion) in revenue and a 10% profit margin, according to a proposal presented to roughly 140 countries and regions. (Nikkei)

U.S./CHINA: The House passed two bills Monday that are expected to form the core of legislation in the chamber designed to boost U.S. research and development in response to China's challenge to U.S. economic supremacy. By wide bipartisan margins, the House authorized more funding for the National Science Foundation and additional money for the Department of Energy, following a similar effort in the Senate that saw the passage of a comprehensive $250 billion measure that included more than $52 billion in incentives and grants for domestic semiconductor manufacturing. "The United States has long been a beacon of excellence in science and engineering," House Science Committee Chair Eddie Bernice Johnson said. "While we should be cognizant of our increasing global competition, we must not be constrained by it. To continue to lead, we must chart our own course." (BBG)

U.S./CHINA/TAIWAN: White House Press Secretary Jen Psaki on Monday said the Biden administration has "rock solid" support for the "leading democracy" Taiwan amid "China's aggressions" — in remarks likely to irk communist-ruled mainland China. US-China relations soured during the COVID-19 pandemic and the Beijing government has repeatedly sent warplanes into Taiwan's airspace amid concern it may one day try to seize the island. "Our support for Taiwan is rock solid. Taiwan is a leading democracy and major economy and a security partner, and we will continue to strengthen our relationship across all areas — all the areas we cooperate, including on economic issues," Psaki said at her daily press briefing. (New York Post)

GEOPOLITICS: Chinese State Councilor and Foreign Minister Wang Yi will attend a summit of G20 foreign ministers via video link on Tuesday at the invitation of Italian Foreign Minister Luigi Di Maio, Chinese Foreign Ministry spokesperson announced on Monday. The spokesperson said that the conference will focus on multilateralism, global governance and other issues. Yet Washington is still highly likely to take advantage of the occasion to create division, continuing gathering its allies to confront Beijing and Moscow. Washington is now clamoring against Beijing on almost all multilateral occasions, lobbying all countries it may convince to keep distance from China. (Global Times)

CORONAVIRUS: Hopes are rapidly fading that the US and UK will agree to open an air corridor before the end of the summer, in the latest sign that a rise in coronavirus cases in Britain is hobbling millions of people's travel plans. Officials involved in talks about a US-UK travel corridor, which started last week, said they thought it was increasingly unlikely they would reach a conclusion by the end of next month, as some had originally expected. Instead they said a combination of the spike in cases of the Delta variant in the UK, the complexities of the US political system, and uncertainty over the status of AstraZeneca's vaccine were set to extend the talks into August and even September. (FT)

BOJ: The Bank of Japan is considering adding interest rates on lenders' deposits according to the size of loans and investments made that contribute to combating climate change in a funding scheme the central bank will introduce this year, Nikkei reports, without attribution. (BBG)

JAPAN: Japan's Financial Services Agency will conduct a survey on ESG-focused investment trusts to eliminate questionable practices, the Yomiuri newspaper reports, without attribution. (BBG)

AUSTRALIA: More than 12 million Australians -- close to half of the population -- are now in lockdown as the nation struggles to contain a spread of the delta coronavirus variant. On Tuesday, Brisbane became Australia's fourth regional capital city to restrict movement outside of homes except for essential reasons such as shopping and exercise for at least three days, less than 24 hours after a similar move in Perth. They followed Sydney and Darwin, which over the weekend announced longer lockdowns of up to two weeks. (BBG)

AUSTRALIA: Tens of thousands of small businesses across NSW will be able to access grants of between $5000 and $10,000 in a new package aimed to help businesses survive the latest COVID-19 lockdown. In addition to the grants, NSW's Dine & Discover voucher program will be extended to August 31 and use of the dining vouchers will now be applied to takeaway orders delivered directly to people's homes by the affected business. NSW Premier Gladys Berejiklian said the centrepiece of the package was the small business support grants which will help businesses by alleviating cashflow constraints while trading is restricted. (9 News)

AUSTRALIA/NEW ZEALAND: New Zealand will reopen its quarantine-free travel bubble with the Australian states of Tasmania, Victoria, ACT and South Australia from July 4, Covid Response Minister Chris Hipkins says at news conference. The pause on travel from New South Wales, Queensland, Northern Territory and Western Australia remains, and will be reviewed on July 6. (BBG)

NEW ZEALAND: Wellington will return to alert level 1 from 11.59pm tonight - eight days after a Covid-infected Sydney tourist flew out of the capital - while the transtasman bubble will reopen to some states from Monday. The virus can incubate for up to 14 days, but director-general of health Dr Ashley Bloomfield told reporters that the likelihood of people in Wellington still incubating the virus was "now very low". Testing centres will remain open in Wellington Central, Porirua, the Kāpiti Coast, Hutt Valley and Wairarapa. But there had been more than 8200 tests in Wellington in the past week, with no positive results, and while there were still about 100 contacts yet to be tested, they will be isolating for a full 14-day period. (NZ Herald)

RBNZ: The Reserve Bank of New Zealand (RBNZ) said on Tuesday economic activity was returning to pre-COVID-19 levels supported by favorable domestic health outcomes and improving global demand and higher prices for New Zealand's goods and exports. A pick-up in consumer spending and construction activity, supported by substantial monetary and fiscal stimulus was also underpinning employment growth, the central bank said in its annual statement of intent. "However, vulnerabilities still remain and the recovery needs continued monetary and fiscal support," Governor Adrian Orr and Deputy Governor Geoff Bascand said in the statement. "We remain prepared to navigate the challenges presented by our economic and financial environment," Orr said. New Zealand enforced tough lockdowns and social distancing measures to virtually eliminate the coronavirus domestically, allowing the economy to bounce back to pre-pandemic levels sooner than expected. The RBNZ last month became one of the first advanced economies to signal a move away from the stimulatory settings adopted during the pandemic after it hinted at an interest rate hike next year. (RTRS)

SOUTH KOREA: South Korea plans to set aside 33 trillion won (US$29.2 billion) for its new round of extra budget aimed at fighting the aftermath of COVID-19, which includes the payment of stimulus checks to individuals in the bottom 80 percent income bracket, ruling party officials said Tuesday. The decision was announced following a consultative meeting between the ruling Democratic Party (DP) and the government, held earlier in the day at the National Assembly. The government plans to finalize drafting the new round of COVID-19 response supplementary budget, the second of its kind so far this year, and submit it to the National Assembly for approval within this week. According to details announced by the DP's policy committee chief Rep. Park Wan-joo, the two sides agreed to pump in a total of about 36 trillion won in a new round of COVID-19 response assistance package. On top of the 33 trillion-won extra budget, to be solely financed by this year's excess tax revenue, the government will reallocate 3 trillion won from this year's existing budget to bankroll the 36 trillion-won extra spending, Park noted. (Yonhap)

SOUTH KOREA: South Korea is looking to open up its economy and work on travel bubble programs given its relative success in controlling the spread of Covid-19, its deputy prime minister told CNBC in an exclusive interview. The government plans to boost consumption and further stimulate the economy in the second half of this year — and policies will be in place to achieve that goal, said Hong Nam-ki, who is also South Korea's minister of economy and finance. "I would say that the current government has been relatively successful in both the infection control and vaccination," he told CNBC's Chery Kang on Friday, according to a CNBC translation of his Korean remarks. "Based on the achievements, the current government now intends to promote economic growth while maintaining such health measures." (CNBC)

ASIA: Export growth is rising in East Asia while new waves of Covid-19 infections are hobbling the economic recoveries of countries in South and Southeast Asia. This means that ratings trends will remain disparate, according to S&P Global Ratings. "The diverging credit conditions between geographies and sectors in Asia-Pacific will widen further given varying Covid-19 containment and vaccination progress," S&P Global Ratings credit analyst Eunice Tan said. S&P projects the tech hardware/semiconductors, homebuilders, and nonessential retail sectors will recover six to 12 months earlier than it anticipated three months ago. (BBG)

ASIA: South Asia's reliance on state-led development is concealing vulnerabilities to growing levels of unsustainable debt that could lead to financial crises, the World Bank warned. Governments in the region, including India and Pakistan, are exposed to the risk of "hidden debt" via funding guarantees by state-owned banks and enterprises, as well as public-private partnerships, the World Bank said in a report Tuesday, which also included policy reforms to help alleviate the risks. "While the government must lead in reform, it takes a concerted effort by society to ensure that the off–balance sheet operations of government serve the right socioeconomic purpose and responsibly leverage public capital," the bank said in the report. "Falling short of this task, South Asian countries face the threat of possible financial crises soon." (BBG)

SOUTH AFRICA: South Africa's official death toll from Covid-19 has passed 60,000, the National Institute of Communicable Diseases said. Over the last 24 hours 138 deaths from the disease were reported, bringing the total to 60,038, the NICD said in a statement on Monday. South Africa's actual number of deaths from the virus could exceed 170,000, according to excess death studies by the South African Medical Research Council, which tracks the number of deaths above the historical norm in weekly reports. (BBG)

IRAN: President Joe Biden on Monday declared that Iran would "never get a nuclear weapon on my watch," after affirming an "iron-clad" relationship between the U.S. and Israel. Biden's comments, in an Oval Office meeting with Israel's outgoing president, Reuven Rivlin, came after the U.S. launched airstrikes against Iranian-linked facilities on the Iraq-Syria border on Sunday evening. Biden said he launched the strikes under the authority of Article II of the Constitution. He also said the U.S. backed recent normalization deals between Israel and countries in the Middle East and Africa. (POLITICO)

MIDDLE EAST: U.S. troops came under rocket fire in Syria on Monday, but escaped injury, in apparent retaliation for weekend U.S. air strikes against Iran-aligned militia in Syria and Iraq. A U.S. military spokesman said U.S. forces were attacked by multiple rockets but did not provide details. "There are no injuries and damage is being assessed. We will provide updates when we have more information," said Colonel Wayne Marotto. Sources in Deir al Zor, in eastern Syria, said that an Iranian-backed militia group had fired a few artillery rounds in the vicinity of al Omar oil field, which is controlled by the U.S.-backed Syrian Democratic Forces. (RTRS)

CHINA

PBOC: People's Bank of China is likely to continue injecting a small amount of liquidity into market via reverse repurchase agreements in coming days by the end of June, Financial News reports, citing Dong Qi, an analyst at Guotai Junan Securities. Market liquidity around the end of second quarter should not be a Concern. The slight increase in the amount of reverse repurchase recently was designed to offset possible larger liquidity fluctuation around the middle of the year. (BBG)

PBOC: The PBOC warned in its latest policy meeting about risks from the Federal Reserve backing out its easing impacting China, the Securities Times said citing analyst Wen Bin of China Merchant Bank, commenting on the Q2 meeting of the monetary policy committee held on Monday, which added "preventing external impact" compared with Q1's statement. The central bank adjusted its outlook on the yuan, calling for "promoting an inner-and-outer balance" after the Chinese currency surged then fell in Q2, the newspaper said. The PBOC may have seen little need to tighten liquidity given the pandemic-hit economy needs to further solidify, and the central bank is likely to continue with targeted adjustments to smoothen out short-term fluctuations, the newspaper said citing analyst Zhang Xun of Everbright Securities. (MNI)

ECONOMY: China's GDP growth is projected to reach 12.3% in the first half of the year and 8.8% for full-year 2021, the Securities Times reported citing Liu Xiaoguang, associate professor at National Academy of Development and Strategy, RUC. Macro policy should focus on stabilizing industrial growth, boosting effective investment and further expanding domestic demand in H2, the newspaper said citing policy meetings of local authorities. H2 recovery driver will swift to domestic consumption from strong exports and production in H1, which needs increased fiscal spending in H2, the newspaper said citing Cheng Shi, chief economist of ICBC International. (MNI)

ECONOMY: Chinese businesses and consumers are not as optimistic on the economy as overall data might indicate, according to an independent study by the China Beige Book released Tuesday. In its latest quarterly survey, the U.S.-based firm found that a measure of Chinese corporate borrowing fell to its lowest in the study's history, and that expectations for loan demand in the next half year dropped - despite low interest rates. Of particular concern, the number of retailers taking out loans fell to a record low, the report said. (CNBC)

LOCAL GOV'T BONDS: Chinese local governments will issue about CNY3 trillion of bonds in H2 to boost infrastructure investment as authorities seek a more proactive policy, Yicai.com reported citing analysts. Fiscal spending, which totaled CNY9.3 trillion in the first five months, was lower than the CNY9.65 trillion revenue, and there needs to be as much as CNY15.7 trillion spending in the rest of the year to meet this year's budgeted expenditure, the newspaper said. Fiscal spending should continue to focus on people's livelihood and social security, so to help boost consumption, the newspaper said citing Luo Zhiheng, deputy dean of Yuekai Securities Research Institute. (MNI)

OVERNIGHT DATA

JAPAN MAY UNEMPLOYMENT RATE 3.0%; MEDIAN 2.9%; APR 2.8%

JAPAN MAY JOB-TO-APPLICANT RATIO 1.09; MEDIAN 1.08; APR 1.09

JAPAN MAY RETAIL SALES +8.2% Y/Y; MEDIAN +8.1%; APR +11.9%

JAPAN MAY RETAIL SALES -0.4% M/M; MEDIAN -0.7%; APR -4.6%

JAPAN MAY DEPT STORE, SUPERMARKET SALES +5.7% Y/Y; MEDIAN +7.0%; APR +15.5%

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 112.2; PREV. 112.4

Headline consumer confidence barely moved last week, dropping only 0.2% from the week before. With new COVID-19 cases rising quite rapidly in NSW over the week, confidence in Sydney fell 4.6%, while in regional NSW it fell 6.6%. The impact of this was largely offset by ongoing recovery in confidence in Melbourne and further gains in confidence elsewhere. Recent experience suggests sentiment will respond to case numbers and lockdown measures in the coming weeks: if case numbers remain high, confidence is likely to deteriorate, but if they come back under control quickly and restrictions look likely to be short-lived sentiment is likely to rebound. (ANZ)

CHINA MARKETS

PBOC INJECTS NET CNY20BN VIA OMOS TUESDAY

The People's Bank of China (PBOC) injected CNY30 billion via 7-day reverse repos with the rate unchanged at 2.2% on Tuesday. The operation resulted in a net injection of CNY20 billion given the maturity of CNY10 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity stable at half-year end, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.2500% at 09:24 am local time from the close of 2.2904% on Monday.

- The CFETS-NEX money-market sentiment index closed at 54 on Monday vs 40 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4567 TUES VS 6.4578

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower for a third trading day at 6.4567 on Tuesday, compared with the 6.4578 set on Monday.

MARKETS

SNAPSHOT: Local COVID Headlines Still Dominate In Asia

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 262.98 points at 28785.34

- ASX 200 down 24.187 points at 7283.1

- Shanghai Comp. down 34.101 points at 3572.271

- JGB 10-Yr future up 6 ticks at 151.71, yield down 0.3bp at 0.055%

- Aussie 10-Yr future up 5.0 ticks at 98.455, yield down 5.5bp at 1.529%

- U.S. 10-Yr future -0-01 at 132-07+, yield up 0.17bp at 1.478%

- WTI crude down $0.36 at $72.56, Gold down $3.55 at $1774.92

- USD/JPY down 6 pips at Y110.57

- FED'S BARKIN: MADE "SUBSTANTIAL FURTHER PROGRESS" ON INFLATION GOAL

- HOUSE PASSES ITS VERSION OF U.S.-CHINA COMPETITIVENESS BILLS (BBG)

- END OF ENGLAND'S COVID RULES STILL SET FOR 19 JULY (BBC)

- BOJ MULLS INCENTIVE FOR LENDERS IN CLIMATE SCHEME (NIKKEI)

- HALF OF AUSTRALIA'S POPULATION IN LOCKDOWN AS DELTA SPREADS (BBG)

- WELLINGTON RETURNS TO ALERT LEVEL 1 AT MIDNIGHT (NZ HERALD)

BOND SUMMARY: ACGBs & JGBs Sit Off Best Levels

There has been nothing in the way of Asia-Pac follow through in the wake of Monday's U.S. Tsy rally/curve flattening, which unwound Friday's cheapening/steepening. T-Notes were seemingly happy to operate within the confines of the range witnessed ahead of the NY close, leaving the contract -0-01 at 132-07+ at typing, on meagre volume of ~35K. Yields are little changed across the cash Tsy curve, with nothing in the way of notable headline flow witnessed overnight.

- Monday's bid in U.S. Tsys meant that the major cash JGB benchmarks were generally flat to 1.0bp richer during Tokyo dealing, with 7s leading the bid, although futures faded from overnight levels to last deal +6 vs. yesterday's settlement, even as domestic equities came under some modest pressure. The latest round of local retail sales data was loosely in line with broader exp., while there was a 0.2 ppt uptick in the unemployment rate vs. 0.1 ppt exp. A decent enough round of 2-Year JGB supply was seen as the cover ratio nudged higher and low price topped dealer expectations (100.235 per the BBG dealer poll), although the tail did see an incremental widening vs. the previous round of 2-Year supply (it was still limited in nature).

- The Aussie bond space looked through the imposition of tighter COVID restrictions in areas of Queensland over the coming days, leaving YM +1.5 and XM +5.0 at typing. There has been little to note outside of the early spill over from U.S. Tsys and developments on the local COVID front.

JGBS AUCTION: Japanese MOF sells Y2.4504tn 2-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.4504tn 2-Year JGBs:- Average Yield -0.116% (prev. -0.125%)

- Average Price 100.243 (prev. 100.262)

- High Yield: -0.114% (prev. -0.124%)

- Low Price 100.240 (prev. 100.260)

- % Allotted At High Yield: 94.4616% (prev. 72.2073%)

- Bid/Cover: 4.291x (prev. 3.968x)

EQUITIES: Negative Day In Asia On Coronavirus Concerns

A broadly negative day for equities in the Asia-Pac region with risk sentiment soured by a resurgence in coronavirus cases and fears over the delta variant, markets in mainland China lead the way lower with losses of over 1% in the CSI 300. The US House passed two bills on Monday that are expected to form the basis of the US-China competitiveness bill. Markets in Japan in the red, the latest round of local retail sales data was loosely in line with broader exp., while there was a 0.2 ppt uptick in the unemployment rate vs. 0.1 ppt expected. Markets in Australia came under pressure with losses in the commodity complex. In the US futures are lower, losses led by the Nasdaq after gains yesterday took US indices to a record highs.

OIL: On Track For Second Day Of Declines

Oil is lower in Asia-Pac trade, on track for a second day of declines. WTI is down $0.33 from settlement levels at $72.57/bbl, Brent is down $0.36 at $74.32/bbl. Markets continues to assess the chances of an output boost at this week's OPEC+ meeting, a global resurgence in coronavirus cases due to the delta variant has also cast some doubt over short term demand. Ahead of the meeting of the technical committee today data indicates that the market will likely remain in deficit this year if output is kept steady.

GOLD: Lines In The Sand Remain Untouched

Bullion has nudged lower over the last 24 hours or so, as the DXY has firmed a little, which seems to have outweighed the downtick in our weighted U.S. real yield measure. Spot last deals a handful of dollars softer on the day, just shy of the $1,775/oz marker. Still, the well-defined technical lines in the sand are untouched. It is also worth noting that known ETF holdings of gold have stabilised in recent weeks, and last print ~9.5% shy of the all-time high registered at the backend of last year.

FOREX: Lingering Caution Keeps Yen Afloat

The yen went bid into the Tokyo fix, as broader coronavirus worry weighed on U.S. e-minis and Asia-Pac equity benchmarks. The defensive feel lent support to the greenback, but the DXY struggled to take out yesterday's high.

- Selling pressure hit AUD as Australia locked down Brisbane, the fourth regional capital to be placed under Covid-19 restrictions. A softer commodity complex provided another headwind for the Aussie, while also wounding the NOK.

- NZD slipped around the time when the RBNZ released their Statement of Intent, even as the document contained little to rock the boat. RBNZ Gov Orr suggested policy settings could normalise over the medium term, provided that the global recovery is sustained.

- The PBOC set its central USD/CNY mid-point at CNY6.4567, just 3 pips below sell-side estimate. Spot USD/CNH blipped higher on the back of general risk aversion.

- Flash German CPI, EZ confidence gauges as well as comments from Fed's Barkin, BoE's Hauser and ECB's Lagarde, Villeroy & Weidmann take focus today.

FOREX OPTIONS: Expiries for Jun29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1900-10(E623mln)

- USD/JPY: Y109.30-45($1.4bln), Y110.00-15($1.1bln-USD puts), Y110.85-90($515mln), Y111.00-10($526mln), Y112.00($1.25bln-USD calls)

- NZD/USD: $0.7260(N$705mln)

- USD/CAD: C$1.2300-10($570mln)

- USD/CNY: Cny6.4000($510mln)

- USD/MXN: Mxn19.88($890mln)

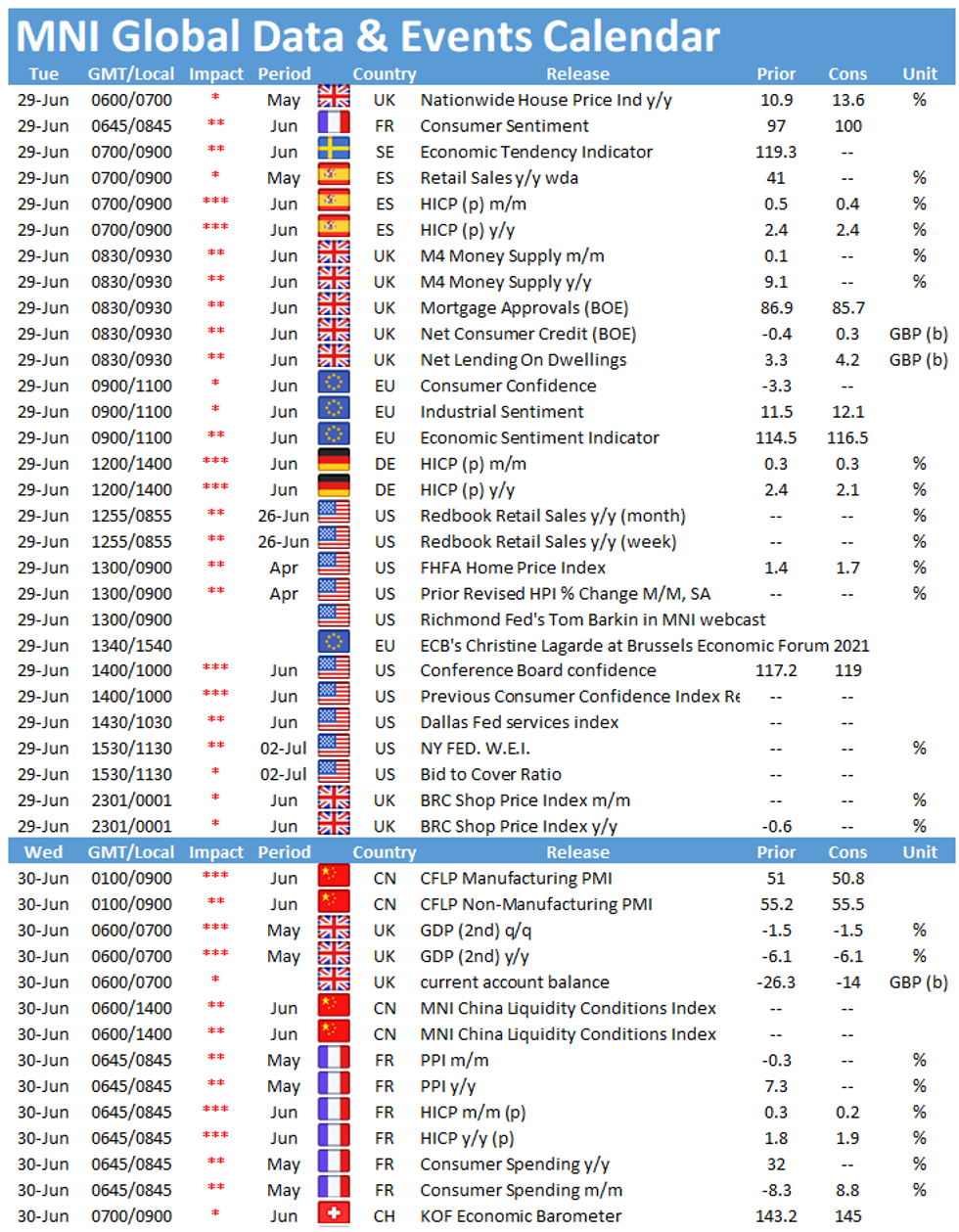

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.