-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: Waiting For The Next Cue

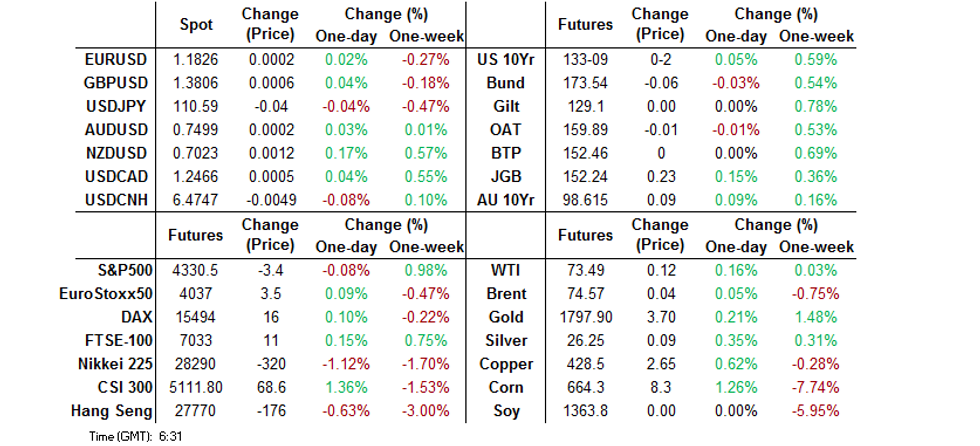

- U.S. Tsys lack follow through in Asia after 10- & 30-Year yield yields hit multi-month lows on Tuesday.

- Macro headline flow was light, leaving the major FX & commodities markets in tight ranges.

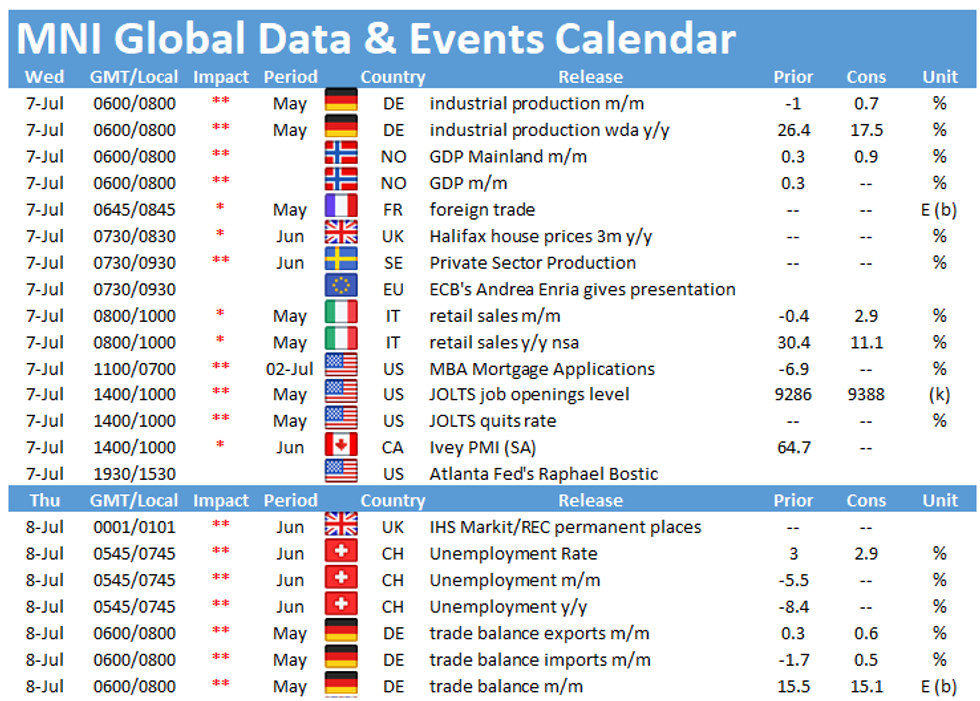

- The minutes from the FOMC's June meeting headline the broader docket on Wednesday.

BOND SUMMARY: U.S. Tsys Fail To Extend Recent Bid, JGBs & ACGBs Firm A Touch

Asia-Pac investors didn't seem particularly keen to drive a fresh bid in the U.S. Tsy space, which is understandable given the lack of fresh macro catalysts evident since the NY close, alongside the multi-month lows registered in both 10- & 30-Year Tsy yields on Tuesday. This has resulted in some modest cheapening in the space, with T-Notes +0-02 at 133-09 as a result, while cash Tsys run little 0.5-1.5bp cheaper, with the 5- to 7-Year zone leading the way. Overnight flow was dominated by a TYU1 block, which saw 2,175 lots lifted (~$176K DV01 equivalent). Looking ahead to NY hours, focus will fall on the aforementioned release of the minutes of the June FOMC meeting, with JOLTS job data and comments from Fed's Bostic also due.

- JGB futures added to their overnight gains during Tokyo trade, with the contract +24 vs. settlement levels at typing. Cash trade saw 7s lead the rally, richening by a little over 2.0bp, indicating that the move may have been futures driven, with the wings of the curve a mere 0.5-1.0bp richer. 30- & 40-Year swap rates dipped a little more than their cash JGB equivalents, narrowing longer dated swap spreads. The offer to cover ratios witnessed at the latest round of BoJ Rinban operations were as follows: 1- to 3-Year: 3.05x (prev. 3.43x), 5- to 10-Year: 3.25x (prev. 2.25x). Note that the 5- to 10-Year operations saw a Y25bn reduction in the purchase size, as prescribed in the Bank's quarterly Rinban plan. The latest Bloomberg survey pointed to expectations that Japanese PM Suga's government will unveil a fiscal support package totalling somewhere between Y20-30tn in the coming months, in order to garner support ahead of the expected election campaign in the autumn. That is inline with previously touted expectations, although some junior officials within the ruling coalition have pushed for a larger package in recent days. 5-Year JGB supply headlines the local docket on Thursday.

- YM +5.0, XM +9.0 at typing, as Sydney participants build on the overnight bid. Cash ACGB trade has seen a similar degree of bull flattening. 3-Year EFPs have tightened by 3.0bp, reversing yesterday's widening, while the 10-Year EFP is 1.5bp wider on the day. A quick look at the open interest data points to fresh shorts driving the YM weakness during Tuesday's session, with that move lower now unwound. The weighted average yield pricing through prevailing mids wasn't particularly strong at today's A$1.0bn round of ACGB Jun '31 supply (0.13bp, per Yieldbroker), with the richening to recent lows in outright yield terms and resultant move in the 3-/10-Year yield spread to multi-month flats likely resulting in a less aggressive bidding stance. Still the cover ratio nudged higher vs. the prev. auction of the line, comfortably topping 3.50x. Local news flow was dominated by the 1-week extension of the Sydney lockdown, although this was widely expected. An address from RBA Governor Lowe and the latest round of scheduled ACGB purchases from the RBA headline locally on Thursday.

FOREX: Broader Caution Remains, NZD Draws Further Support From OCR Hike Bets

The yen garnered some more strength, building on its Tuesday gains, as a degree of risk aversion lingered on. USD/JPY slipped into the Tokyo fix but trimmed losses after a failure to stage a convincing break under Jun 30 low of Y110.42. Looking ahead, there is $1.1bn worth of USD/JPY options with strikes at Y111.00 rolling off today, with a further $1.1bn of USD calls with strikes at Y111.50 also due to expire at the NY cut.

- High-betas underperformed in risk-off trade, as crude oil remained heavy. AUD/JPY extended losses to a two-week low. In Australia, NSW Premier Berejiklian confirmed that Sydney's lockdown will be extended by at least one week.

- NZD bucked the trend and blipped higher in early Asia-Pac hours, as Westpac brought forward their forecast of the first OCR hike to November this year from August 2022.

- ANZ quickly followed suit, which means the whole Big Four now expects the RBNZ to raise the OCR this autumn. The implied odds of a hike by the November meeting ticked higher (per BBG WIRP tool) after yesterday's sizeable post-QSBO jump.

- FOMC Jun MonPol meeting minutes, German & Norwegian industrial output data, Italian retail sales as well as comments from Fed's Bostic & Riksbank's Ohlsson are on the radar today.

FOREX OPTIONS: Expiries for Jul07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1850-70(E822mln), $1.1917-24(E1.5bln), $1.1935-50(E1.1bln)

- USD/JPY: Y109.00($1.1bln), Y109.50-57($738mln), Y111.00($1.1bln), Y111.50($1.1bln-USD calls)

- AUD/USD: $0.7575-80(A$552mln)

- NZD/USD: $0.7140(N$1.1bln-NZD calls), $0.7170-85(N$1.1bln-NZD calls)

- USD/CAD: C$1.2560-70($785mln)

ASIA FX: Won Leads The Way Higher

The greenback continued its move lower, robust appetite for risk supported a bid in most Asia EM FX.

- CNH: Offshore yuan is stronger, adding to gains after trade data showed a wider than expected trade surplus with soaring exports and import growth broadly in line with expectations.

- SGD: Singapore dollar has strengthened, despite an increase in coronavirus infections Singapore is keen to push ahead with plans to open its aviation industry according to Transport Minister Ong Ye Kung. "We hope we can achieve this mutual opening with Hong Kong".

- TWD: Taiwan dollar is higher after dropping yesterday. Yet another Taiwan central banker has joined the chorus touting the futility of intervention in TWD touting the success of Taiwanese companies and foreign inflows.

- KRW: Won has gained and is the best performer today, Vice Finance Minister Lee gave an upbeat assessment of the economic recovery late yesterday, predicting the recovery will be faster than expected.

- MYR: Ringgit is stronger, Finance Ministry said that the gov't will inject MYR440mn into the State Reserve Fund to help regional gov't's in dealing with the consequences of the Covid-19 outbreak.

- IDR: Rupiah has strengthened. The Jakarta Post circulated the results of the 2021 Edelman Trust Barometer, which showed that 89% of Indonesians are concerned about losing their jobs, which is more than the 65% worried about potentially contracting coronavirus.

- PHP: Peso is stronger, Philippine trade deficit narrowed to $2.413bn in March from the revised $2.711 recorded in February, while both imports and exports considerably topped expectations.

- THB: Baht has gained, tourism Min Phiphat addressed concerns about the reopening of Phuket to foreign visitors. The off'l said that the number of Covid-19 cases in the resort island must fall to zero before allowing the entry of tourists, which is scheduled for Jul 1.

EQUITIES: Mixed In Asia

The major Asia-Pac equity indices are mixed after a marginally negative lead from Wall St. The Nikkei 225 is underperforming its major peers, shedding around 1.00%, with the uptick in the JPY since Tuesday's Tokyo close and continued speculation/comments surrounding the prospect of 0 fans being allowed to watch the Tokyo Olympics in person hampering sentiment in Japan. Tuesday's late momentum for the CSI 300 has spilled over into Wednesday's session, with the index adding ~1.0% as of typing, despite the clampdown from authorities surrounding some Chinese companies that have U.S. listings. Elsewhere, policymakers have signalled a clampdown on the broader securities sector to try and weed out fraudulent/unscrupulous activity, which could be a negative for some names in the short-term, but brings the prospect of a better regulated market over the medium term. The major U.S. e-minis trade around neutral levels, with some marginal outperformance for the NASDAQ 100.

GOLD: Back From Tuesday's Peak

The reversal from lows and subsequent rally for the broader USD outweighed the move lower in U.S. real yields on Tuesday, with gold pulling back from its ~$1,815/oz peak before settling around $1,800/oz during Asia-Pac hours. Technically, the 50-day EMA provides the initial resistance point, while initial support is seen at the July 2 low ($1,774.4/oz).

OIL: Stable After Pullback From Cycle Highs

The recovery and subsequent rally in the broader USD, coupled with a softer than expected U.S. ISM services survey and downtick in equity markets saw oil pull away from cycle highs on Tuesday, before a degree of stability kicked in during Asia-Pac trade, with both WTI & Brent hovering around settlement levels at present. The continued OPEC+ impasse (centring on the Saudi-UAE discord) still garners the bulk of the attention in the space, although most of the sell-side expect a deal to be struck at some point (in typical OPEC+ fashion). A reminder that the latest round of weekly API inventory estimates will hit after hours on Wednesday (one day later than usual owing to the elongated U.S. weekend). The backwardation in both the WTI & Brent futures curves continues to indicate tight markets from a supply perspective.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.