-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Hosts Rutte Amid NATO Uncertainty

MNI US MARKETS ANALYSIS - Front-end Under Pressure Into PPI

MNI EUROPEAN OPEN: DXY Better Bid In Asia, Continuing Theme Against Limited News Flow

EXECUTIVE SUMMARY

- J.&J. VACCINE MAY BE LESS EFFECTIVE AGAINST DELTA, STUDY SUGGESTS (NYT)

- BIDEN TEAM SEES CHIP SUPPLY GAINS, RELIEF SOON FOR CARMAKERS (BBG)

- UK SETS COLLISION COURSE WITH EU UNDER PLANS TO REDRAW BREXIT DEAL (FT)

- LPR HOLD MEANS CHINA MON. POLICY TO BE STABLE IN H221 (SEC. TIMES)

- CHINA NDRC SEEKS ENHANCED MANAGEMENT OF COMMODITIES PRICES (BBG)

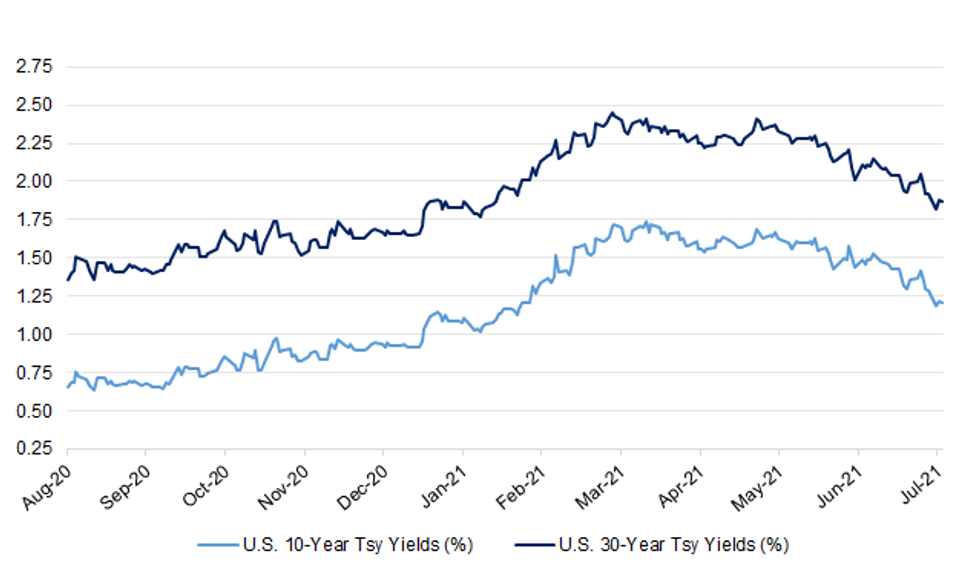

Fig. 1: U.S. 10- & 30-Year Tsy Yields (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: England may have just three weeks to avoid coronavirus restrictions being reimposed after Sage scientists urged ministers to take action if hospital admissions soar above expected levels. Scientific advisers have warned that Boris Johnson should be prepared to act in the first week of August to prevent the NHS becoming overwhelmed by the end of that month. Modelling has suggested that the central case for UK daily hospitalisations at the peak of the third wave – expected at the end of August – could be between 1,000 and 2,000, with deaths predicted to be between 100 and 200 per day. (The i)

CORONAVIRUS: Boris Johnson is being warned by cabinet ministers to exempt more people from the "pingdemic", or face a wave of supermarket, Post Office and restaurant closures. (Telegraph)

CORONAVIRUS: Business urged the UK government to "get control" on Tuesday after ministers clashed over self-isolation advice and Downing Street refused to produce a list of roles in which people could keep going to work even if "pinged" by the NHS app. Prime minister Boris Johnson announced on Monday that critical workers with two jabs would be able to avoid self-isolation if they provided — for example — "food, water, electricity, medicines . . . the defence of the realm". But on Tuesday, Downing Street said employers would have to apply to government departments to ask for specific exemptions from the rules, dashing hopes of an exhaustive list. Only a "very low number of people" would be allowed to circumvent the process, it said. (FT)

CORONAVIRUS: Border officials are no longer required to make basic Covid checks on people arriving in England from green and amber list countries, according to leaked instructions that have prompted claims that the government is turning a blind eye to the risk of importing Covid cases. A change that came into effect on Monday means Border Force officers no longer have to verify whether new arrivals have received a negative Covid test, have booked a test within coming days, or have a passenger locator form showing an address where they will isolate if necessary. (Guardian)

CORONAVIRUS: The Premier League is in talks with clubs over the introduction of compulsory Covid passports for fans from the start of the season — even if it is not required by the government. Rules for supporters to show proof of a double vaccination or a negative lateral flow test to get into sporting events are not expected before the autumn but the league has proposed "going early" with its own policy, to counter any threat of cuts in crowd capacity. Some clubs had discussed introducing their own Covid passport schemes for the new season, which starts on August 13, but Premier League chiefs are understood to have decided that it would be better if all 20 clubs had the same policy. (The Times)

CORONAVIRUS: London office workers want an average pay rise equivalent to the cost of some annual railway season tickets to return to their desks full- time after the pandemic, according to a survey. With Covid-19 restrictions leaving many offices empty, white-collar staff have spent 16 months mostly working from home. Just 17% now say they actively want a full-time return to the office, research for workplace analytics firm Locatee shows. However, cash would convince 43% of employees, according to the research, by YouGov Plc. In London that equates to an average of 5,100 pounds ($6,950) -- virtually the same as an annual railway ticket between London and the commuter town of Tunbridge Wells, in Kent. The U.K. national average was 4,000 pounds, Locatee said. (BBG)

BREXIT: The UK will on Wednesday put itself on a collision course with Brussels by unveiling a new set of demands that would radically overhaul post-Brexit trading arrangements between Great Britain and Northern Ireland. In a move that officials called a "wholesale change of approach", Lord David Frost, Cabinet Office minister, will outline a strategy that seeks to eliminate most of the checks on the Irish Sea trade border that came into force in January. And in a warning that Britain could suspend the Northern Ireland protocol in its Brexit deal with the EU if the bloc does not give way, Frost will claim the UK is already within its rights to activate the Article 16 override clause in the agreement. Boris Johnson on Tuesday discussed the UK strategy with Micheál Martin, his Irish counterpart — including proposals that would transform the way that the protocol currently operates. "Johnson said that all GB-made goods should be able to go into Northern Ireland without checks," said one EU official. (FT)

BREXIT: British Foreign Secretary Dominic Raab lashed out at the European Union's plan for a post-Brexit deal for Gibraltar, accusing the bloc of trying to undermine the U.K.'s "sovereignty" over the territory. Raab said the EU's draft negotiating mandate was no basis for talks over a long-term solution for the small stretch of land adjoining Spain's southern tip. The EU's proposal "directly conflicts" with a temporary agreement struck last year, he said. It "cannot form a basis for negotiations," Raab said in an emailed statement Tuesday. "We have consistently showed pragmatism and flexibility in the search for arrangements that work for all sides, and we are disappointed that this has not been reciprocated. We urge the EU to think again." (BBG)

BREXIT: Former Downing Street aide Dominic Cummings has said he thought it was "good that Brexit happened". But he told the BBC's Laura Kuenssberg says anyone who says they are sure Brexit was a good idea "has got a screw loose", and that "no-one on Earth" knew if Brexit was a good idea right now. (BBC)

BOE: MNI INTERVIEW: BOE Using Implausible Fiscal Assumptions-IFS

- The Bank of England is factoring implausibly low government spending plans into its economic projections, an economist at leading think-tank the Institute for Fiscal Studies told MNI. By convention, to avoid being seen to be passing judgement on fiscal policy, the BOE plugs in the latest fiscal projections as given, and it will use numbers from the government's March budget in its August forecast round. Some economists have argued that this skews its forecasts, by continually underestimating government spending and deficits, and work by IFS suggests the problem is occurring again, Ben Zaranko said in an interview - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

POLITICS: Dominic Cummings has revealed he discussed ousting Boris Johnson within days of the Conservatives winning the December 2019 election by a landslide. The PM's former chief adviser told the BBC it seemed that, by mid-January 2020, Mr Johnson did not "have a plan". Mr Cummings also alleged the PM's wife Carrie Johnson had tried to influence government appointments. But, despite quitting Downing Street last autumn following a power struggle, he denied being motivated by revenge. Asked about Mr Cummings's comments, a government spokesperson said ministers were fully focused on recovery from the pandemic and restoring the economy. (BBC)

EUROPE

ITALY: MNI BRIEF: Italy Covid Pass To Boost Tourism & Leisure Sectors

- Rome is set to approve a new law Wednesday requiring an Italian health pass to allow access to certain social activities or venues in legislation similar to that recently approved by France, an Italian government source close to the matter told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

IRELAND: Time limits will not be included in new guidelines for eating inside bars and restaurants in Ireland. Final guidelines for the reopening of indoor dining are set to be considered by the cabinet on Wednesday. Representatives from the restaurant and bar sectors held meetings with Government officials on Tuesday ahead of the potential reopening of indoor service next week. (Belfast Telegraph)

SWEDEN: Swedish residential property prices fell 0.5% on the month in June, according to the Nasdaq OMX Valueguard-KTH Housing Index, HOX Sweden. HOX Sweden advanced 1.8% in the 3 months through June and rose 16.8% y/y. Adjusted for seasonal effects, the index rose 0.5% m/m in June "It is common for the index to fall in June," according to a Statement. (BBG)

U.S.

INFLATION: MNI INTERVIEW: BLS May Alter CPI Calculation Over Rent Skew

- The U.S. Bureau of Labor Statistics could modify its calculation of CPI to correct an over-reliance on apartment rental data which has tended to push owners' equivalent rent slightly higher since 2013, Cleveland Fed economist Randal Verbrugge told MNI. OER, the implicit cost to rent the home you own, will likely be revised down because apartment rental prices have accelerated much quicker than those of detached units, which account for only about 30% of the BLS' rental sample, he said. The BLS does not distinguish between the two types of housing, using only location to calculate neighborhood rent increases - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: Senate Majority Leader Chuck Schumer's attempt to begin Senate debate Wednesday on a still-unfinished bipartisan infrastructure bill is on track to fail, with Republicans saying that there is no way a deal can be reached by then and that they won't vote to open debate without text spelling out the deal. A bipartisan group of 22 senators announced a deal on a $579 billion infrastructure outline with President Joe Biden nearly one month ago, but have been unable to agree on the details of the package -- particularly how to pay for the new spending. Schumer on Monday scheduled a Wednesday test vote to begin debate and would need 60 votes, including 10 Republicans if all Democrats and independents vote yes. "We're not going to have a product ready tomorrow for consideration," lead GOP negotiator Rob Portman of Ohio said. Portman said that until there is an actual bill to consider he won't support moving forward. Utah Republican Mitt Romney, also a member of the group, urged Schumer to delay the vote until Monday to give the talks more time. "I think all of the issues will be resolved," Romney told reporters, estimating that a deal can be had by the end of this week. He said that over the last two days, 75% of outstanding issues had been resolved. He said there needs to be time to write up the deal and circulate it to members before holding a vote. (BBG)

FISCAL: Senate Republican centrists are calling on Senate Majority Leader Charles Schumer (D-N.Y.) to postpone a key vote on a bipartisan infrastructure package until Monday to give negotiators more time to reach a deal. Schumer has scheduled a procedural vote on a motion to begin debate on the infrastructure package for Wednesday, and Republicans say he will not have the 60 votes needed to proceed. "My hope is that Sen. Schumer will agree to postpone the vote. We're making significant progress," said Sen. Susan Collins (R-Maine). "We just had, a subgroup of us, had a meeting. We met very late last night with the group of 10 and I would hope that Sen. Schumer would recognize the good-faith effort that we're making, that this is extraordinarily complex and that we're working as hard as we can," she added. Collins declined to say whether she would vote "yes" or "no" on the motion to begin debate but reiterated "I want him to delay the vote" and said she would speak to Schumer personally. (The Hill)

FISCAL: West Virginia Senator Joe Manchin is expressing optimism ahead of a procedural vote on the bipartisan infrastructure plan. The senator's office confirmed to Newsweek Tuesday that Manchin said: "We're close. We're getting close." Manchin's remarks were first reported by NBC News' Sahil Kapur. (Newsweek)

FISCAL: Senate Finance Committee Chairman Ron Wyden, D-Ore., on Tuesday released a bill to overhaul a controversial deduction for certain businesses, which was part of Republicans 2017 sweeping tax legislation. Currently, the so-called qualified business income deduction, also known as 199A, allows certain businesses, such as sole proprietors, partnerships and S-corporations, to write off up to 20% of eligible revenue. The bill would phase out the tax break for households making more than $400,000 per year, sticking with President Joe Biden's campaign pledge, Wyden told reporters on a call. (CNBC)

FISCAL: U.S. Senate Minority Leader Mitch McConnell said on Tuesday that efforts to pass a bipartisan infrastructure bill in the Senate would not be slowed down if Democrats lost a procedural vote to begin debate on Wednesday. (RTRS)

FISCAL: Senate Democrats are weighing a Plan B if their infrastructure negotiations fail: adding the nearly $600 billion in spending Republicans have already accepted to the $3.5-trillion plan they want to enact alone — a $4.1 trillion overall price tag. (Axios)

FISCAL: The White House on Tuesday said President Joe Biden expects Congress will vote to raise the U.S. debt limit. The borrowing limit is suspended through July 31, and Treasury Secretary Janet Yellen has warned that so-called extraordinary measures her department uses to keep paying obligations may not last long past the end of July. At Tuesday's regular briefing, White House press secretary Jen Psaki was asked if Biden would unilaterally raise the borrowing limit. "His intention is for Congress to vote to raise the debt limit," she said. (MarketWatch)

CORONAVIRUS: The Delta variant of the coronavirus is the cause of more than 80% of new U.S. COVID-19 cases, but the authorized vaccines remain more than 90% effective in preventing hospitalizations and deaths, said top U.S. infectious disease expert Anthony Fauci during U.S. Senate hearing on Tuesday. (RTRS)

CORONAVIRUS: Press secretary Jen Psaki on Tuesday confirmed that there have been multiple breakthrough coronavirus cases among White House staffers. Her comments come after Axios first reported that a White House official and a staff member for House Speaker Nancy Pelosi (D-Calif.) tested positive for COVID-19 after attending the same reception last week. Psaki said the White House has committed to sharing when a commissioned officer — "the highest level ranking people in the White House," she explained — tests positive for the virus. She did not clarify if that meant that the White House would not announce when a non-commissioned official gets infected. (Axios)

POLITICS: Thomas Barrack, a private equity investor who is a close friend of former President Donald Trump, was arrested Tuesday morning in Los Angeles on federal charges of illegally lobbying Trump on behalf of the United Arab Emirates. Barrack, who was charged with two other men in a seven-count indictment in Brooklyn, New York, federal court, was chairman of Trump's 2017 inaugural fund. The Santa Monica, California, resident is accused with the other defendants of secretly advancing the interests of the UAE at the direction of senior officials of that country by influencing the foreign policy positions of Trump's 2016 campaign, and then the foreign policy positions of the U.S. government during Trump's presidency through April 2018. (CNBC)

BANKING: Top U.S. banking regulators on Tuesday said they would work jointly to modernize rules governing how banks lend hundreds of billions of dollars annually in lower-income communities. Officials also said they would move to scrap a Trump-era overhaul of the rules that had divided regulators and industry officials. At a time when many banking services have moved online, regulators have been trying to forge a consensus for updating rules from a law enacted more than 40 years ago when banking largely took place at physical branches. (WSJ)

OTHER

GLOBAL TRADE: Biden administration officials say they're starting to see signs of relief for the global semiconductor supply shortage, including commitments from manufacturers to make more automotive-grade chips for car companies that have had to idle production. U.S. Commerce Secretary Gina Raimondo, who has led President Joe Biden's efforts on chip supply, has brokered a series of meetings between semiconductor manufacturers, their suppliers, and their customers including automakers. Senior administration officials said the meetings helped ease mistrust between the sides related to the chipmakers' production and allocation and automakers' orders. (BBG)

GLOBAL TRADE: Treasury Deputy Secretary Wally Adeyemo met with the top sanctions officials from the Trump administration on Tuesday as part of a broad review of how the U.S. imposes restrictions to protect national security interests. Adeyemo hosted a virtual meeting with Sigal Mandelker, a former undersecretary for Treasury's Terrorism and Financial Intelligence unit, and Stephen Biegun, who was previously deputy secretary of state, both of who served during the Trump administration. A Treasury spokeswoman said that the meeting also included ex-Obama official Cathy Novelli, who was previously head of global government affairs for Apple Inc., and Ted Kassinger from George W. Bush's administration. (BBG)

U.S./CHINA: U.S. Deputy Secretary of State Wendy Sherman discussed preserving peace in the Taiwan Strait with her Japanese and South Korean counterparts, while sidestepping a question about whether she would visit China. Sherman told reporters Wednesday in Tokyo that she had no updates to the itinerary of her Asian trip, which doesn't so far include a stop in China. The State Department's No. 2 official had been discussing a possible meeting with a senior Chinese diplomat in the northern port of Tianjin as a possible precursor to higher-level U.S.-China exchanges, the South China Morning Post reported last week, citing people it didn't identify. (BBG)

U.S./CHINA: A FOX reporter tweeted the following on Tuesday: "US directly threatens China over "irresponsible" & destabilizing" on-line behavior. A Senior Administration Official tells me this message given "directly" to Chinese government. Message from US to China per SAO: "For as long you continue your pattern of irresponsible malicious cyber activities, we will take action to disrupt threats to our people and there are a range of options we are always considering."" (MNI)

U.S./CHINA: China must cut emissions sooner if the planet is to avoid climate "chaos", US climate envoy John Kerry has warned, telling the Financial Times that he was keen to speak to Beijing about a possible carbon border tax. Limiting global warming to 1.5C will be a "pipe dream" if China waited as late as 2030 for the peak of its emissions, he said in an interview after a major policy speech in London on Tuesday. "We've got to deal with reality here, that is the baseline truth we're talking about," he said. Kerry, who has criss-crossed the world to promote President Joe Biden's climate agenda, in his speech singled out China and said it would be "impossible" to limit warming to 1.5C unless the planet's biggest emitter changed its targets. The 1.5C target is enshrined in the 2015 Paris climate accord. (FT)

GEOPOLITICS: Chinese factories that supply Apple Inc. and Nike Inc. and make other products sold in the U.S. are shunning workers from Xinjiang, as Western countries increase scrutiny of forced labor from the remote northwestern region where Beijing has been accused of committing genocide against local ethnic minorities. Lens Technology Co. Ltd, a Chinese maker of smartphone touch screens and supplier to Apple and other companies, phased out Uyghur factory workers transferred from Xinjiang through a state-backed labor program last year, according to former staff and shop owners near one of its factories. The company has also ceased hiring Uyghur workers, according to current staff. (WSJ)

CORONAVIRUS: Warning that the world is in the early stages of another wave of infections, World Health Organisation (WHO) head Tedros Adhanom Ghebreyesus has said Covid-19 is a test and the world is failing. Speaking to the International Olympic Committee members at their session in the Japanese capital, Tedros said that the Tokyo games should go ahead to demonstrate to the world what can be achieved with the right plan and measures amid the pandemic. Emphasising that profits and patents must come second, the WHO chief criticised the vaccine discrepancies between countries, saying the pandemic could be ended if G20 economies showed collective leadership and there was a fairer distribution of vaccines. (TRT World)

CORONAVIRUS: The coronavirus vaccine made by Johnson & Johnson is much less effective against the Delta and Lambda variants than against the original virus, according to a new study posted online on Tuesday. Although troubling, the findings result from experiments conducted with blood samples in a laboratory, and may not reflect the vaccine's performance in the real world. But the conclusions add to evidence that the 13 million people inoculated with the J.&J. vaccine may need to receive a second dose — ideally of one of the mRNA vaccines made by Pfizer-BioNTech or Moderna, the authors said. The conclusions are at odds with those from smaller studies published by Johnson & Johnson earlier this month suggesting that a single dose of the vaccine is effective against the variant even eight months after inoculation. (New York Times)

HONG KONG: The national security department of Hong Kong police arrests Lam Man-chung, executive editor-in-chief of now-defunct pro-democracy newspaper Apple Daily, Now TV reports, citing unidentified people. A former newspaper editor was arrested Wednesday under the national security law, police say in statement, without identifying him. The 51-year-old man was accused of colluding with foreign forces related to a similar case in June. (BBG)

JAPAN: Japan to extend employment subsidy program to end-Dec. (Nikkei)

BOJ: Sluggish Japanese price growth means no policy normalization from the Bank of Japan, says a key policy architect at the central bank. While inflation has clearly risen in the U.S. and elsewhere, it's still "sluggish in Japan," Deputy Governor Masayoshi Amamiya said in a speech to local business leaders in Niigata prefecture. "Given this, it is necessary for the bank to persistently continue to conduct powerful monetary easing." (BBG)

AUSTRALIA: New cases continued to climb in Australia's two largest cities on Wednesday as strict stay-at-home orders impacting half the nation failed to halt the spread of the delta variant. New South Wales state, home to Sydney, reported 110 new locally transmitted Covid-19 cases. The source of 56 infections is currently unknown. Victoria state, which is home to Melbourne, recorded 22 new local cases. (BBG)

AUSTRALIA: Scott Morrison says returning to JobKeeper is not an option in 2021, and describes the wage assistance program as a solution to problems from last year. "I'm trying to solve the issues and provide the economic supports directly to individuals fast," he says. "You'll recall that when we put JobKeeper in place, it took four to six weeks in order for the system to be rolled out, for businesses to go to their banks to get the loans for their cash flow, to then actually make the payments to those who were working with them and to work through that process. "I don't have six weeks. I need to make sure that we've got $200 million out the door now. (Australian Financial Review)

SOUTH KOREA: South Korea reported a record 1,784 new cases in the past 24 hours, up from 1,278 the previous day, according to the Korea Disease Control and Prevention Agency's website. There were 1,726 local infections, with 599 new cases in Seoul and 450 in Gyeonggi province. About 32% of the population, or 16.4 million people, have received at least one vaccine dose, while 13% are completely vaccinated. (BBG)

CANADA: MNI BRIEF: Trudeau Drops Line About Not Wanting Canada Election

- Canadian Prime Minister Justin Trudeau on Tuesday added to signals around potentially calling an early election to take advantage of the glow from improving vaccination rates and record deficit outlays that are swelling voter pocketbooks. During a funding announcement from Hamilton, an Ontario city whose districts split between Liberal and NDP in the last election, he referenced his "build back better" slogan and attacked what he called the weak record of other parties on the economy and minority rights - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

CANADA: Mark Carney, the former central banker who is now head of impact investing at Brookfield Asset Management Inc., isn't entering Canadian politics just yet. The former governor of both the Bank of Canada and Bank of England won't be a candidate for Justin Trudeau's Liberal Party in an election the prime minister is expected to call in coming weeks, Carney said in a tweet Tuesday. The news was first reported by the Canadian Press. (BBG)

RUSSIA: The U.S. and Germany are close to a deal on the Nord Stream 2 pipeline that would threaten sanctions and other retaliation if Russia tries to use energy as a weapon against Ukraine, according to a draft text obtained by Bloomberg News. Under the agreement, Germany would take unspecified national action if Russia commits such actions, a decision that may mark a concession from Chancellor Angela Merkel, who had previously balked at making independent moves against the Kremlin over the gas pipeline that will run from Russia to Germany. (BBG)

SOUTH AFRICA: A week of deadly riots in South Africa could cost the country about 50 billion rand ($3.4 billion) in lost output, while 150,000 jobs have been placed at risk, the Presidency said, citing estimates from the South African Property Owners Association. About 200 malls were targeted and some 3,000 shops were looted during the protests, while 200 banks and post offices were vandalized, acting Minister in the Presidency Khumbudzo Ntshavheni told reporters in Pretoria, the capital, on Tuesday. (BBG)

SOUTH AFRICA: Cape Town is seeking to secure more than 450 megawatts of power from renewable sources to cut reliance on state power utility Eskom Holdings SOC Ltd. and reduce greenhouse gas emissions. South Africa's second-biggest city is looking at a range of options and expects the bulk of the electricity to be generated from solar plants, Kadri Nassiep, the city's executive director of energy and climate change, said in an interview. On July 14 the city of 4.6 million people released a request for information to seek funding to build its own plants. This month or next it will seek proposals for the provision of as much as 150 megawatts from privately owned plants to be built and operated within the city, he said. As much as 300 megawatts may also be purchased at a later stage from plants outside of Cape Town, according to Nassiep. (BBG)

COMMODITIES: China's top economic planner asks local governments to step up price monitoring and management of expectations, according to a NDRC statement summarizing a meeting held July 15-16. Meeting calls for ensuring supply of goods important for people's livelihood and stabilizing prices. (BBG)

CHINA

PBOC: Chinese banks keeping the loan prime rates unchanged in July puts an end to expectations for further easing policies after the reserve ratio cut, Securities Times said in an article on Wednesday. The decision is seen as a sign to the market that monetary policy will be stable in the second half of the year. A LPR cut would be counter to Beijing's efforts to control inflation, says the People's Daily-backed newspaper. China leads the world in Covid recovery and will be ahead of other countries in normalizing monetary policies in post-pandemic era. (BBG)

PBOC: China is likely to continue pushing for lower financing costs in H2, including rates of bank lending and companies' capital raising, even after it left the LPR unchanged on Monday, the 15th month that the benchmarks stayed at 3.85% for 1-year and 4.65% for 5-year, the Economic Information Daily said citing analyst Wang Qing of Golden Credit Rating. The broad cuts to banks' reserve ratios this month increased available capital, which may still lead to lower corporate loan rates later, Wang was cited saying. Policymakers refrained from cutting rate possibly after June's better-than-expected indicators showing manufacturing investment and consumption both improved, the newspaper said citing Wen Bin, chief economist with Minsheng Bank. The rising expectation of rate hikes by the U.S. Federal Reserve also limits the policy room of China, which seeks a more stable yuan, the newspaper cited Wen as saying. (MNI)

CORONAVIRUS: Nanjing, the capital of eastern Jiangsu province, now requires Covid tests for people leaving the city after Nanjing airport found nine positive samples from workers on Tuesday. The airport has canceled flights, put relevant staff under centralized quarantine and started contact tracing. (BBG)

FISCAL: China may increase fiscal spending in the second half to support the slowing economy by utilizing its policy room after expenditure in H1 was the slowest in recent years even as revenue surged 21.8% y/y, reported Cls.cn, a website owned by Shanghai United Media Group. However, debt-funded government investment will be significantly weaker than in the past and new bond sales could slow so to focus on funding high-quality projects, the newspaper said citing analysts. (MNI)

YUAN: The soon-to-launch offshore yuan trading market in Shanghai's Pudong district will attract more foreign capital's participation in trading yuan products and boost demand for China's currency and its international acceptance, the Shanghai Securities News reported citing industry analysts. More companies in imports and exports have chosen to use yuan for payment settlement, the newspaper said. Choosing Shanghai as the site of offshore yuan trading strengthens the city as a global financial center, the newspaper said. (MNI)

OVERNIGHT DATA

JAPAN JUN TRADE BALANCE +Y383.2BN; MEDIAN +Y460.0BN; MAY -Y189.4BN

JAPAN JUN TRADE BALANCE ADJ -Y90.2BN; MEDIAN +Y22.6BN; MAY +Y19.6BN

JAPAN JUN EXPORTS +48.6% Y/Y; MEDIAN +46.2%; MAY +49.6%

JAPAN JUN IMPORTS +32.7% Y/Y; MEDIAN +28.2%; MAY +27.9%

JAPAN JUN SUPERMARKET SALES +1.7% Y/Y; MAY +2.9%

AUSTRALIA JUN, P RETAIL SALES -1.8% M/M; MEDIAN -0.7%; MAY +0.4%

AUSTRALIA JUN WESTPAC LEADING INDEX -0.07% M/M; MAY +0.05%

NEW ZEALAND JUN CREDIT CARD SPENDING +6.3% Y/Y; MAY +27.2%

NEW ZEALAND JUN CREDIT CARD SPENDING -1.0% M/M; MAY +8.5%

SOUTH KOREA JUL 1-20 EXPORTS +32.8% Y/Y; JUN +29.5%

SOUTH KOREA JUL 1-20 IMPORTS +46.1% Y/Y; JUN +29.1%

SOUTH KOREA JUN PPI +6.4% Y/Y; MAY +6.6%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS WEDS; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Wednesday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2000% at 09:24 am local time from the close of 2.1729% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 48 on Tuesday vs 49 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4835 WEDS VS 6.4855

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4835 on Wednesday, compared with the 6.4855 set on Tuesday.

MARKETS

SNAPSHOT: DXY Better Bid In Asia, Continuing Theme Against Limited News Flow

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 58.63 points at 27438.07

- ASX 200 up 72.669 points at 7324.9

- Shanghai Comp. up 21.314 points at 3558.105

- JGB 10-Yr future down 2 ticks at 152.44, yield unch. at 0.010%

- Aussie 10-Yr future up 0.5 tick at 98.825, yield down 0.9bp at 1.173%

- U.S. 10-Yr future unch. at 134-21+, yield down 1.32bp at 1.209%

- WTI crude down $0.37 at $66.82, Gold down $2.28 at $1808.08

- USD/JPY up 3 pips at Y109.87

- J.&J. VACCINE MAY BE LESS EFFECTIVE AGAINST DELTA, STUDY SUGGESTS (NYT)

- BIDEN TEAM SEES CHIP SUPPLY GAINS, RELIEF SOON FOR CARMAKERS (BBG)

- UK SETS COLLISION COURSE WITH EU UNDER PLANS TO REDRAW BREXIT DEAL (FT)

- LPR HOLD MEANS CHINA MON. POLICY TO BE STABLE IN H221 (SEC. TIMES)

- CHINA NDRC SEEKS ENHANCED MANAGEMENT OF COMMODITIES PRICES (BBG)

BOND SUMMARY: Core FI Little Changed In Asia

T-Notes pared their modest late NY/early Asia losses, last -0-00+ at 134-21. Cash Tsys have seen some bull flattening with the shorter end of the curve little changed, while the longer end has firmed by 1.0-1.5bp. There hasn't been much in the way of news flow to drive the move, with a downtick in e-minis & high beta FX seemingly lending support. In terms of $ supply, Indonesia outlined a tap of their '51 & '71 $ bonds, and a new 10-Year $ bond. The taps and the 10-Year supply will all be of benchmark size, with the potential for pricing in today's NY session (per BBG sources). 20-Year Tsy supply and fiscal matters on the Hill are set to dominate during NY hours on Wednesday.

- Shorter dated JGBs have richened, 10-Year JGBs have failed to break below 0.01% thus far, while some modest cheapening witnessed in the long end of the curve (~1.0bp) has resulted in some twist steepening. JGB futures print 2 ticks below yesterday's settlement level, unwinding the late overnight bid that was witnessed (which seemed a bit out of line vs. the likes of U.S. Tsys). Comments from BoJ Deputy Governor Amamiya failed to introduce any new areas of interest, while the release of the stale minutes from the BoJ's June meeting was never going to be a major market mover. The latest round of BoJ Rinban operations revealed the following offer to cover ratios: 1- to 3-Year: 2.38x (prev. 2.83x), 3- to 5-Year: 2.63x (prev. 2.69x), 5- to 10-Year: 3.07x (prev. 1.82x), JGBis: 3.19x (prev. 5.50x). A reminder that Japanese markets will be closed on Thursday & Friday as the country observes a public holiday.

- The previously flagged and heavily discussed questions surrounding the economic impact of the Australian COVID lockdowns (NSW & Victoria saw an uptick in their new case counts today) & subsequent impact on RBA policy has provided some underlying support for the Aussie bond space, leaving YM & XM +0.5. The cash ACGB has twist steepened on the day, with the long end running ~2.5bp cheaper, albeit off of cheapest levels. The latest round of ACGB Dec '30 supply saw the weighted average yield print 0.32bp through prevailing mids at the time of supply (per Yieldbroker). The cover ratio firmed vs. the prev. auction of the line, even when you account for the decrease in the amount on offer, with the well-defined supportive factors re: ACGB demand outweighing some valuation headwinds.

JGBS AUCTION: Japanese MOF sells Y4.3331tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.3331tn 3-Month Bills:- Average Yield -0.1098% (prev. -0.1070%)

- Average Price 100.0274 (prev. 100.0267)

- High Yield: -0.1042% (prev. -0.1062%)

- Low Price 100.0260 (prev. 100.0265)

- % Allotted At High Yield: 23.7862% (prev. 57.4459%)

- Bid/Cover: 3.541x (prev. 4.882x)

AUSSIE BONDS: The AOFM sells A$800mn of the 1.00% 21 Dec '30 Bond, issue #TB160:

The Australian Office of Financial Management (AOFM) sells A$800mn of the 1.00% 21 December 2030 Bond, issue #TB160:- Average Yield: 1.1233% (prev. 1.5984%)

- High Yield: 1.1250% (prev. 1.6000%)

- Bid/Cover: 5.4125x (prev. 2.4560x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 43.8% (prev. 92.2%)

- bidders 47 (prev. 40), successful 17 (prev. 15), allocated in full 8 (prev. 9)

EQUITIES: Mixed As Delta Variant Worries Linger

A mixed session for equities in the Asia-Pac region with some bourses struggling to shake off delta variant concerns and capitalize on a positive lead from the US. In Japan markets are higher by around 0.5% but have come off session highs seen shortly after the open, markets in mainland China have seen similar gains but the Hang Seng is lower by around 0.5%. Other gainers include markets in Australia and Thailand. Indices in Taiwan, Singapore, South Korea and the Philippines all fell on COVID-19 concerns. In the US futures are lower, pulling back after robust gains yesterday, US yields are lower with the 10-Year dropping back towards 1.2% after claiming the level yesterday. There were reports that the US Senate is to vote on the infrastructure bill later on Wednesday.

OIL: Tepid Recovery Not Sustained In Asia

Crude futures are lower in Asia-Pac trade after staging a tepid bounce on Tuesday; WTI is down $0.60 from settlement at $66.60/bbl, Brent is down $0.69 at $68.76/bbl. Data late yesterday showed US headline crude stockpiles rose 806k bbls according to the API, if confirmed by official figures it would be the first build since May. As such focus Wednesday turns to the weekly DoE crude oil inventories, in which markets see a draw of close to 4mln barrels in crude stocks for the week ending July 16th. For WTI support is seen at $65.56/64.60 - Low Jul 19 / 76.4% of the May 21 - Jul 6 rally, for Brent bears will target $67.43 - 76.4% retracement of the May 21 - Jul 6 rally.

GOLD: Holding

The richening in the U.S. Tsy/real yield space has been countered by USD strength in recent days, with bullion staying in a narrow range as a result, failing to challenge the well-defined technical layover. Spot last deals little changed around the $1,810/oz mark, with nothing in the way of definitive catalysts eyed through the remainder of the week. The U.S. fiscal dynamic will be eyed on Wednesday, but there is a lack of clarity surrounding that particular situation.

FOREX: Aussie Faces Combination Of Headwinds

Cautious mood music returned into G10 FX space, even as dip-buying pushed most Asia-Pac equity benchmarks higher. The AUD led losses as local retail sales shrank more than expected, according to the flash reading for June. Relatively sizeable increase in NSW Covid-19 case count as well as softer crude oil and iron ore prices rubbed some salt into the Aussie's wounds.

- Oil-tied peers CAD and NOK were dragged lower by weaker crude prices, which came under pressure after the latest API report pointed to the first expansion in U.S. stockpiles since May, with the weekly DOE report coming up today.

- The Swiss franc paced gains among safe haven currencies and topped the G10 pile, while the greenback was the runner up.

- USD/CNH retreated after the first half of this week failed to bring a break above the CNH6.5000 mark. The PBOC fix fell virtually in line with sell-side estimate.

- The global economic docket is fairly empty today, with ECB's Visco & Perrazzelli set to speak.

FOREX OPTIONS: Expiries for Jul21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700(E1.3bln), $1.1835-50(E1.1bln), $1.1900(E1.1bln)

- USD/JPY: Y110.00-15($947mln), Y110.50($820mln)

- AUD/USD: $0.7400(A$857mln)

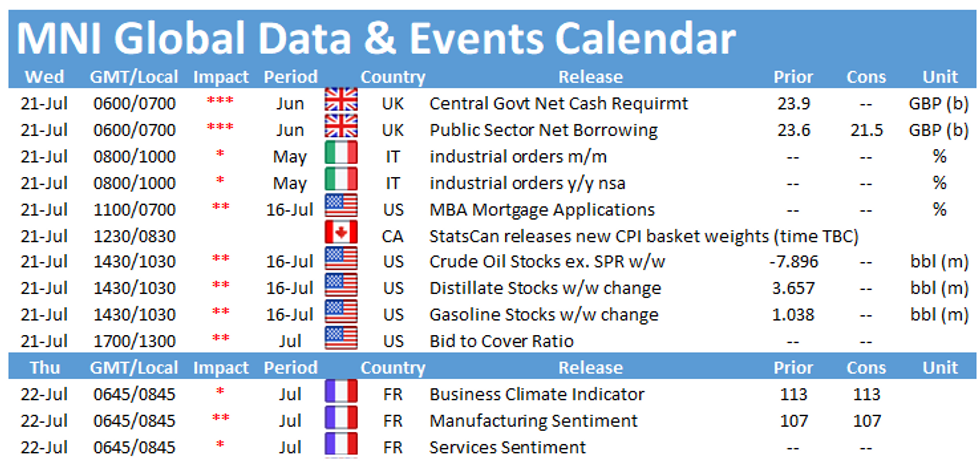

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.