-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI INTERVIEW2: Poland To Push For EU Defence Fund

MNI EUROPEAN MARKETS ANALYSIS: ECB Day

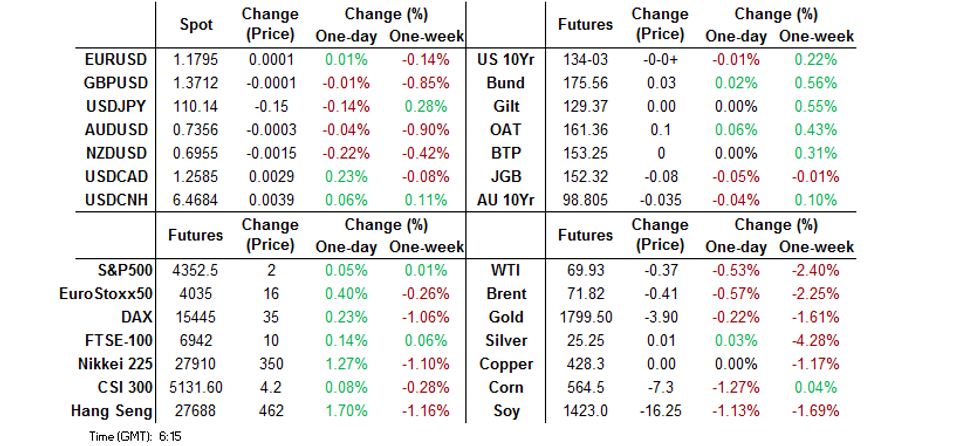

- A Japanese market holiday and lack of tier 1 news flow made for a fairly limited round of Asia-PAc trade.

- The major Asia-Pac equity indices benefitted from the positive Wall St. lead.

- The earlier-than-expected publication of the strategy review has transformed today's ECB meeting from a placeholder to a live event. Any material changes in policy are still likely to be on hold for September (or possibly December), but changes to the forward guidance and additional communication around the strategy review implications could be market moving. Clarification of the new buzzwords "forceful" and "persistent", as well as the extent to which inflation deviations from target will be tolerated, are likely to be a focus during the press conference.

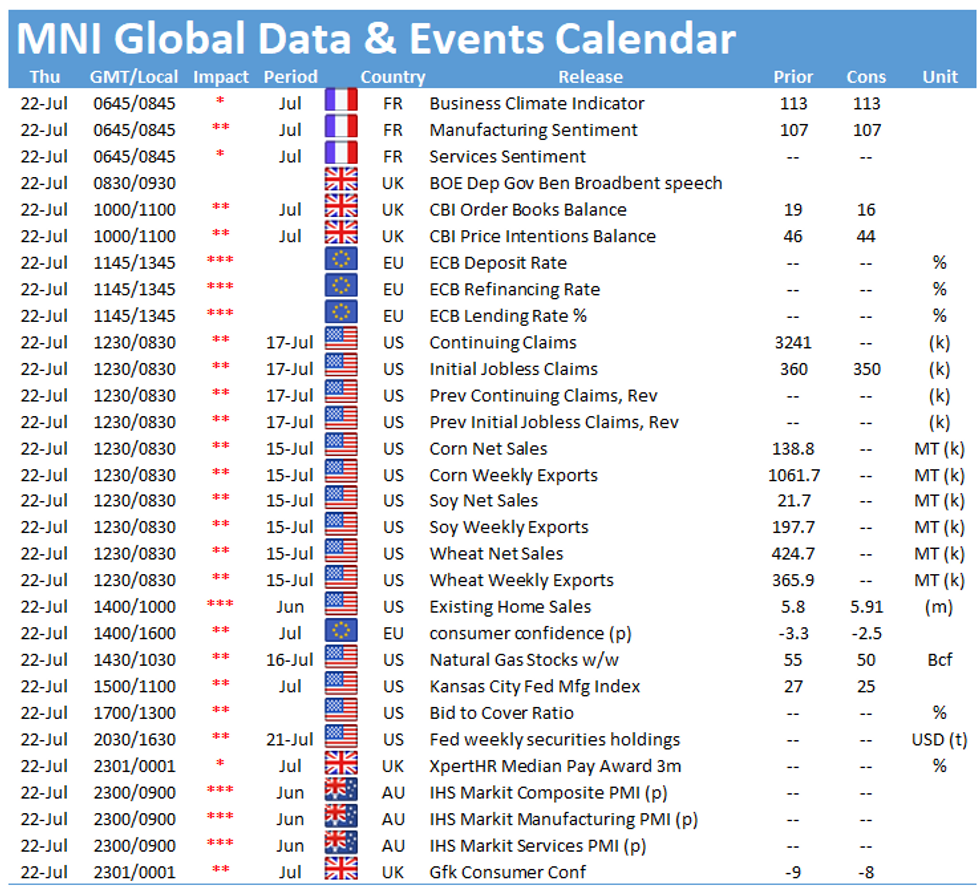

BOND SUMMARY: Asia-Pac Core FI Activity Limited By Japanese Holiday

T-Notes have stuck to a narrow 0-04 range in Asia-Pac hours, last dealing -0-00+ at 134-03. A quick reminder that cash Tsys are closed until London hours owing to a Japanese holiday (the same will hold true on Friday). The Japanese holiday has also limited broader volume, with ~50K T-Notes changing hands thus far. There hasn't been much in the way of notable headline flow, although U.S. President Biden flagged the potential for COVID vaccinations for children under 12 in the coming weeks/months. Elsewhere, the Washington Post has suggested that White House officials "are debating whether they should urge vaccinated Americans to wear masks in more settings as the delta variant causes spikes in coronavirus infections across the country." We also saw Biden reaffirm his views on inflation & the labour market. The latest ECB decision and press conference will provide some interest early in the NY session (given Lagarde's recent comments on forward guidance). Domestic focus will fall on the weekly jobless claims data, some of the regional Fed activity indices & 10-Year TIPS supply.

- The local COVID situation continues to underpin the ACGB space during Sydney hours, allowing futures to work away from their overnight lows. We saw a marginal uptick in Victoria's daily case count (up to 26 from 22), with the state's health body noting that "the 26 new locally-acquired are all linked to the current outbreaks. 24 of the 26 cases were in quarantine throughout their entire infectious period." Elsewhere, the NSW daily case count being pressed above 120, with less encouraging isolation statistics than Victoria. YM and XM both comfortably off of overnight lows, with YM -3.0 and XM -3,5 The latest ABS payrolls data revealed a 1.0% fall in the fortnight to July 3, with the ABS highlighting that "the latest fortnight of data overlapped with increased COVID-19 restrictions in most states & territories, including lockdowns in 4/8 capital cities. It also coincided with school holidays in most states & territories." The deeper/wider spread lockdowns are set to result in further dips in this metric in the coming weeks. A$700mn of ACGB 4.25% 21 April 2026 supply, the release of the AOFM's weekly issuance slate and flash PMI data are set to headline the local docket on Friday.

FOREX: Driven By Caution

A defensive feel crept into G10 FX space in Asia, even as regional equity benchmarks rose on a positive lead from Wall Street. Major crosses unwound some of yesterday's moves, with liquidity thinned out by a market closure in Japan. The yen was the best G10 performer amid renewed demand for safe haven currencies, likely supported by familiar angst surrounding several Covid-19 flare-ups across the globe.

- NZD, AUD and CAD lost ground, but NOK bucked the trend and held up well, despite weaker crude oil prices.

- The PBOC fix fell virtually in line with sell-side expectations. USD/CNH ground higher through the session, partly retracing its deepest downswing in eight weeks seen on Wednesday.

- Sterling went offered as the UK was on a collision course with the EU on the so called Northern Ireland Protocol, in what may generate further bilateral tensions.

- The ECB will announce their latest monetary policy decision today. Elsewhere, U.S. weekly jobless claims and comments from BoE's Broadbent are set to take focus.

FOREX OPTIONS: Expiries for Jul22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1650-60(E562mln), $1.1710(E1.1bln), $1.1800-15(E1.1bln), $1.1900(E589mln), $1.1935(E1.1bln)

- EUR/GBP: 0.8650(E815mln)

- AUD/USD: $0.7375(A$1.1bln)

- USD/CAD: $1.2750($1.4bln)

- USD/CNY: Cny6.4300($1.6bln), Cny6.4400($645mln), Cny6.4370($520mln), Cny6.4900-10($666mln)

ASIA FX: Higher As Risk On Extends

Most EM Asia currencies gained after the greenback snapped a four-day rally on Wednesday, a holiday in Japan sapped some liquidity from the region.

- CNH: Offshore yuan is slightly weaker, giving back some of Wednesday's gains which was the best day for offshore yuan in eight weeks.

- SGD: Singapore dollar is stronger, Singapore announced earlier this week will tighten restrictions again from today as new cases hit a record daily high. Markets await CPI data tomorrow.

- TWD: Taiwan dollar gained, retreating from a three-month low. Markets await an announcement from officials that lockdown measures will be relaxed.

- KRW: Won is higher, shaking off another record day of coronavirus case numbers. There were over 1,800 new cases and authorities are said to be considering extending movement restrictions.

- MYR: Ringgit gained, Dep PM Ismail Sabri said that the gov't is considering permitting factories where more than 80% of staff have been fully vaccinated against Covid-19 to resume operations. Markets await CPI tomorrow.

- IDR: Rupiah strengthened, Markets await the BI's interest rate announcement later in the session. Bloomberg published a source story shedding some light on the decision-making process behind Indonesia's handling of Covid-19 outbreak. The article suggested that Pres Widodo ignored advice from his health advisors, who warned against dramatic spike in both caseload and death toll, when he chose not to impose a a full-scale lockdown.

- PHP: Peso is higher, The Presidential Palace said officials are considering a travel ban on Malaysia and other neighbouring countries, after denying entry to travellers from Indonesia.

- THB: Baht hovers around neutral levels, the laggard in Asia EM. There were reports that the coronavirus Thai outbreak could take up to 2ppts off 2021 GDP.

ASIA RATES: Broad Sell-Off Seen

- INDIA: Yields higher in early trade. Indian markets return today after a public holiday yesterday, bonds are playing catch up with a decline in US tsys during the market closure. Markets will focus on the RBI's GSAP operation, the Central Bank will purchase INR 200bn of bonds from the market, the RBI has included less liquid issues in its purchase operation which could support the market later in the session. Issues included are 6.18% 2024, 6.7% 2026, 8.60% 2028 and 6.79% 2029.

- SOUTH KOREA: Futures in South Korea are lower for the first time in four days, falling out of favour as equity markets rise even in the face record COVID-19 numbers. South Korea reported record daily COVID-19 cases for the second day, there were 1,842 new cases with authorities noting mass infections from a virus-hit Naval unit, while it seems increasingly likely officials will extend the toughest virus restrictions in the wider Seoul area. Concerns are also rising over the delta variant, which has fast become the nation's dominant strain constituting 76% the past week. Elsewhere Fitch affirmed South Korea at AA- with a stable outlook and gave a positive assessment.

- CHINA: The PBOC matched maturities with injections at OMOs today, repo rates are off yesterday's highs though the overnight rate is higher on the session after plunging into the close yesterday. The 7-day repo rate retreats from opening highs of 2.25%, 5bps above the PBOC's rate. Futures are lower after a four day rally, even as equity market struggle to make upward progress. Elsewhere recent premiums for local bonds over central government issues continue to shrink, while banks in Hong Kong suspended new mortgages for Evergrande's unfinished projects.

- INDONESIA: Yields mixed, the wings higher while the belly is lower. Markets await the BI's interest rate announcement later in the session. Policymakers are expected to hold their benchmark policy rate unchanged by virtually all analysts. Elsewhere, FinMin Indrawti said late Wednesday that the government will utilise IDR 186.67tn of surplus from last year's budget to help finance the 2021 spending plans. Yesterday's bond auction saw the highest bids since January.

EQUITIES: Chinese Markets Struggle For Upside On Positive Day

Most markets in Asia higher after taking a positive lead from the US, though moves are more subdued than markets in Europe and the US with a Japanese holiday sapping liquidity and impetus from markets while coronavirus concerns in the region still weigh. Markets in mainland China are hovering around neutral levels while the Hang Seng is higher, driven by the energy sector after the rally in crude yesterday. Markets in South Korea are higher, shrugging off another day of record COVID-19 case numbers. Markets in Australia are higher by 1%, helped by the NAB business conditions confidence index rising to a record high. In the US futures are higher again, building on the S&P 500's biggest back to back gain in two months and taking the index to within touching distance of record highs.

GOLD: Looking Below $1,800/oz, Initial Support Not Tested Yet

Spot is (just) back below $1,800/oz in Asia-Pac dealing. This comes after bullion printed as low as $1,794.8/oz on Wednesday as a more risk-positive backdrop and uptick in U.S. real yields weighed. Still the initial line of key near-term support (the July 12 low at $1,791.7/oz) remains intact. A break there would expose the July 2 low ($1,774.4/oz). Conversely, initial resistance/the bull trigger is located at the July 15 high ($1,834.1/oz).

OIL: Crude Futures Dip Slightly After Rally

WTI & Brent futures sit $0.45 below settlement levels into European hours. Crude is weighed on by reports that China has been dipping into its strategic reserve to supply its refiners in an attempt to stem price appreciation amid warnings of elevated commodity prices stoking inflation. The bounce yesterday accelerated on a bullish set of numbers from the Weekly DoE Report. Markets focused on the far larger than expected draw in distillates inventories, which saw stockpiles drop around 1.3mln bbls - the fastest pace of decline in months. Analysts had expected a build of 1.1mln bbls over the period. Traders also shrugged off the bigger-than-expected build in headline reserves, with isolated West Coast supply being largely responsible a bullish candle pattern on from Monday/Tuesday is still in place, which could target first resistance at $71.40 (weekly high) and $72.48.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.