-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Tech Leads E-Minis Lower In Wake Of Amazon Earnings

EXECUTIVE SUMMARY

- ECB'S DE GUINDOS: BACK TO NORMAL MEANS BACK TO PRE-VIRUS GROWTH PATH

- BOJ POLICYMAKER SEES PROSPECTS OF DEEPER DEBATE ON PRICE GOAL THIS YEAR (RTRS)

- U.S. SAYS CONCERNED OVER HARASSMENT OF MEDIA COVERING CHINA FLOODS (BBG)

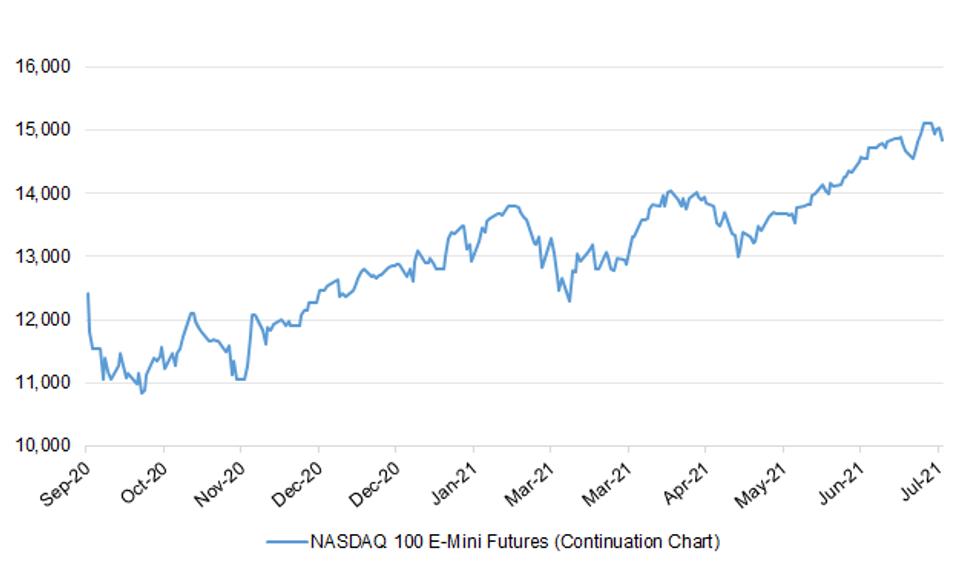

- U.S. EQUITIES STRUGGLE IN WAKE OF AMAZON Q2 EARNINGS REPORT AND GUIDANCE

- CHINESE RESIDENTS SHOW INCREASING INTEREST IN EQUITY ASSETS (CSJ)

Fig. 1: NASDAQ 100 E-Mini Futures (Continuation Chart)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: A number of Conservative MPs have told Sky News they do not think the government will follow through and actually introduce domestic vaccine passports. The prospect of people having to prove their COVID-19 status to access a range of venues has been raised in recent weeks. Boris Johnson has already said that individuals will need to be fully vaccinated to go to nightclubs from the end of September - and proof of a negative COVID test will no longer be sufficient. (Sky)

CORONAVIRUS: Fully vaccinated adults in Wales will no longer have to self-isolate if they are a close contact of someone with coronavirus from 7 August. The Welsh government intends to ease self-isolation rules for those who are double jabbed on the same day the country is expected to move to COVID alert level zero. This is when almost all restrictions will be lifted across Wales. (Sky)

CORONAVIRUS: The dispute between Paris and London over travel restrictions intensified after a French minister hit out at the UK's decision to keep France in its own category, where vaccinated travellers must quarantine for 10 days on arrival in England, while liberalising rules for dozens of other countries. "It is a decision which is not scientifically founded and which is discriminatory," Clément Beaune, France's Europe minister, said on LCI radio on Thursday. "All Europeans, even countries which have more difficult health situations than ours due to the Delta variant . . . no longer have to quarantine." (FT)

CORONAVIRUS: One in four patients classed as a Covid hospitalisation is being treated for other reasons, official data reveal, prompting claims that the public has been misled. (Telegraph)

CORONAVIRUS: British holidaymakers in Spain are poised to escape quarantine next week after ministers received data showing there are no beta variant cases in the country's main tourist areas. (Telegraph)

ECONOMY: The number of empty shops in Britain has continued to rise as retailers struggle with the effects of the Covid pandemic, the British Retail Consortium has said. Shopping centres have been hardest hit, with nearly one in five units empty, the industry group said. The north east of England had the highest vacancy rate, followed by Wales and the north west. The Covid pandemic has accelerated a shift towards online shopping. Many shops were shuttered during lockdowns, although retail sales in June were near pre-lockdown levels, as the reopening of shops released pent-up demand. (BBC)

FISCAL: Speculation that the chancellor will delay his budget until next year is mounting after he instructed the spending watchdog to publish new forecasts without announcing an accompanying fiscal event. In a letter to the Treasury select committee, Rishi Sunak said he had asked the Office for Budget Responsibility to prepare an economic and fiscal forecast to be presented to parliament on October 27. The OBR's document usually accompanies a budget or spending review but in a break from normal protocol, Sunak did not announce either. The OBR is legally required to publish two forecasts a year that can simply be released to parliament. Andrew Goodwin, UK economist at Oxford Economics, said: "It is unusual for the date to be announced like this. (The Times)

EUROPE

ECB: Asked when would the euro-area economy get back to normal, ECB Vice President Luis de Guindos says "some define it as being back to pre-pandemic levels. I would argue that back to normal means back to the pre-pandemic growth path." De Guindos speaks in an interview with Handelsblatt published on the ECB website. "We still have time to decide about the future of PEPP. In September we will set the pace of the purchases for the fourth quarter, in December for the first quarter of 2022." "The PEPP should end when the emergency is over and its dampening effect on inflation disappears." "The main priority is to avoid a cliff effect when the PEPP expires." (BBG)

ITALY: UniCredit has entered exclusive talks to acquire parts of Monte dei Paschi di Siena, the world's oldest bank that was bailed out by the Italian government in 2016. In what would be the first big deal under Andrea Orcel as new chief executive, a takeover of MPS by UniCredit has long been mooted and encouraged by Italian politicians as part of a wave of consolidation among Italy's banks. Earlier this month, the prospect of a deal appeared to be receding as Orcel set a series of conditions on buying the ailing MPS that Italian government officials balked at. But the two sides have since agreed a framework for a possible deal. Terms have not yet been agreed as talks are at such an early stage. (FT)

PORTUGAL: Portugal plans to lift a nighttime curfew and ease other Covid-19 restrictions as the number of vaccinated people increases and the latest surge in coronavirus infections in the country shows signs of slowing. A limit to movement in public spaces between 11 p.m. and 5 a.m. that was imposed in some regions will be lifted on Sunday, Prime Minister Antonio Costa said at a press conference on Thursday. Restaurants and non-food stores can now stay open until 2 a.m. Remote working will no longer be mandatory. "The vaccination campaign has made a very positive contribution," Costa said. (BBG)

SWEDEN: The chief executives of Sweden's biggest construction firms have warned that a local court's surprise ruling could trigger a crippling shortage of key materials in a landmark case that pits environmental concerns against economic interests. Companies exposed to the development, with Skanska AB the most prominent, say the fallout will reverberate throughout the biggest Nordic economy. Sweden's government says it's now "closely following" the process, given how much is at stake. The case revolves around a factory that supplies 75% of Sweden's cement. Earlier this month, a local court denied its application to extend and renew a 20-year mining permit, citing environmental risks. (BBG)

RATINGS: Potential sovereign rating reviews of note scheduled for after-hours on Friday include:

- Fitch on Hungary (current rating: BBB; Outlook Stable) & Ireland (current rating: A+; Outlook Stable)

- Moody's on Germany (current rating: Aaa; Outlook Stable)

- DBRS Morningstar on Austria (current rating: AAA, Stable Trend)

U.S.

ECONOMY: U.S. Treasury Secretary Yellen tweeted the following on Thursday: "Today's GDP numbers are a welcome milestone. The American economy is now above its pre-pandemic level. This was not destined to happen. Our recovery is the result of smart policy choices and a government that can execute them. Beneath these GDP numbers are an effective vaccine rollout & the ambitious relief funding in the American Rescue Plan. Now, our task is to move forward and continue building a fairer, stronger, more resilient economy where American workers can compete and win on the world stage." (MNI)

ECONOMY: Foot traffic at Kimco Realty's shopping centers has returned to pre-pandemic levels, CEO Conor Flynn told CNBC on Thursday. "Traffic is back to 2019 levels, and we have a real playbook now that we can follow thanks to all the lessons learned through the pandemic," Flynn said on "The Exchange." "We launched curbside pickup and ... the last-mile shopping center typically that we own is grocery anchored, and it gives the consumer the way that they want to shop, the optionality that I think is so important to consumers today." (CNBC)

FISCAL/CORONAVIRUS: President Joe Biden on Thursday called on state and local officials to offer residents $100 cash payments as an incentive to receive a Covid-19 vaccine, his administration's latest push to get Americans vaccinated as the highly contagious delta variant spreads. (CNBC)

FISCAL/CORONAVIRUS: The Treasury Department announced Thursday that it will expand tax credits to employers who give workers paid time off to get Covid-19 vaccines, to include time for workers to take family members to get vaccinated. (CNBC)

CORONAVIRUS: New Jersey reported more than 1,000 new cases for the first time since early May, according to state data. Hospitals logged 480 patients, a 35% increase over one week. The sickest patients, those on ventilators, numbered 35. That figure hasn't exceeded 40 since last month. (BBG)

CORONAVIRUS: Almost all of Louisiana's hospitals have canceled or postponed surgeries and other non-emergency care, and many can't accept transfers of critical patients, as a delta-fueled surge in infections grows there, said Joseph Kanter, state health officer of the Louisiana Department of Health, on a call with reporters Thursday. (BBG)

CORONAVIRUS: Los Angeles, which reimposed its mask order about two weeks ago, is seeing a slower increase in the transmission rate for new cases. The number of new infections in the county rose 17% in the past week to 3,248 on Thursday, compared with an 80% jump the week before, according to Barbara Ferrer, director of public health. "The rate of increase may be stabilizing." she said. "The county's case rate would have doubled if not for vaccinations." (BBG)

CORONAVIRUS: Gov. Asa Hutchinson reinstated Arkansas' public health emergency Thursday, and announced he is calling a special session of the legislature to amend the law banning mask mandates. (Axios)

CORONAVIRUS: The District of Columbia will require the wearing of masks indoors as the delta variant causes cases of the coronavirus to surge, Mayor Muriel Bowser announced Thursday. (BBG)

CORONAVIRUS: Texas Gov. Greg Abbott issued an executive order Thursday, reiterating his opposition to mask mandates, Covid-related business restrictions and vaccination requirements and issuing fines of up to $1,000 on those who fail to comply. The governor also called on state hospitals to deliver daily reports on their capacity to the Texas Department of State Health Services to send to the Centers for Disease Control and Prevention. (CNBC)

CORONAVIRUS: President Joe Biden will require federal workers to prove they've been vaccinated against Covid-19 or wear masks and submit to frequent coronavirus testing as the delta variant causes cases to spike. The rules will cover millions of federal workers, including the military and on-site contractors, according to the White House. Biden, who will announce the requirement Thursday, also asked his team to take steps to apply similar standards to all federal contractors and encourage private sector employers to follow the same approach. The requirements come in response to vaccine holdouts, whose refusal to get shots has allowed the delta variant to spread. (BBG)

CORONAVIRUS: Illinois is now requiring face coverings in state facilities regardless of vaccine status given a majority of its counties "are experiencing substantial or high Covid-19 transmission," according to an emailed statement Thursday from the governor's office. (BBG)

CORONAVIRUS: North Carolina Governor Roy Cooper said he would require state employees to get vaccinated or be tested weekly as the state sees an increase in cases driven by people who are unvaccinated, his office said in a statement. (BBG)

CORONAVIRUS: New Mexico Governor Michelle Lujan Grisham on Thursday signed an executive order requiring all state employees to either be fully vaccinated or otherwise submit to regular testing, according to a press release. (BBG)

CORONAVIRUS: Starting Sept. 7, you will have to be vaccinated to eat indoors at some of New York's most famous dining rooms. (BBG)

PROPERTY: House Democratic leadership on Thursday struggled to build support for a five-month extension of the nationwide eviction moratorium that's set to lapse this weekend after running into opposition from more than a dozen Democratic lawmakers, according to two sources familiar with the situation. With the ban set to expire Saturday and millions of Americans at risk of losing their homes, House Majority Leader Steny Hoyer (D-Md.) confirmed that Democrats in favor of extending the moratorium were still working to lock down backing for a possible last-minute vote Friday. The House is set to leave town at the end of this week until September. Asked whether Democrats would consider a shorter extension of the moratorium — such as one through September — Hoyer said: "There's going to be a lot of talk and we'll see. We're talking about it." The scramble came hours after the White House announced plans to allow the ban to expire as scheduled on Saturday because of concerns that another extension would be struck down in court, amid the threat of legal challenges by landlords who warn that it costs them billions of dollars each month. (POLITICO)

EQUITIES: The loosening of lockdown restrictions around the world meant Amazon's customers were increasingly "doing things besides shopping", the ecommerce company said, as it posted weaker than expected sales for the year's second quarter. Dragging Amazon's top line was its core online store business, which grew 15 per cent, the slowest rate since 2019, despite it bringing forward its flagship Prime Day sales event to June. Brian Olsavsky, Amazon's chief financial officer, told reporters the deceleration was "essentially a combination of lapping last year's Covid strength", when demand for online shopping surged to record levels. (FT)

OTHER

GLOBAL TRADE: China's ambassador to the World Trade Organization said there's scope for Beijing to work with the U.S., the European Union and other Western nations on an agreement aimed at curbing the practices at the heart of the still-simmering U.S.-China trade conflict. "China will keep an open mind to that," Li Chenggang said in an interview in Geneva on Wednesday, his first known talk with a Western media outlet since being appointed in February. "If we have a fair and a frank discussion on the issues, I think China will try its best to keep an open mind." Trade ministers from the world's seven largest advanced economies are working on an initiative aimed at reining in Chinese trade abuses such as forced technology transfer, market-changing industrial subsidies and trade-distorting actions by state enterprises. (BBG)

GLOBAL TRADE: Taiwan Semiconductor Manufacturing Co.'s most important plant for supplying Apple processors has been hit by a contamination of gas used in the chipmaking process, the company said on Friday. (Nikkei)

U.S./CHINA: The U.S. expressed concern over harassment and intimidation of foreign journalists in China, highlighting the difficulties they face while covering the world's second largest economy. U.S. State Department spokesman Ned Price said in a statement Thursday that China's actions contradict its professed support of foreign media coverage. "Its harsh rhetoric, promoted through official state media, toward any news it perceives to be critical of PRC policies, has provoked negative public sentiment," Price said, referring to China's formal name. (BBG)

GEOPOLITICS: The US wants to "play a role" in the South China Sea, which shows its hegemony and has made the region a new front line of the contest between great powers. Here in the South China Sea, China will end the struggle between hegemony and anti-hegemony forces with the US. All other countries outside the region are advised to stay away from this confrontation to avoid "accidental injury." (Global Times)

CORONAVIRUS: More than 4.02 billion vaccine doses have been administered across 180 countries, according to data collected by Bloomberg. The latest rate was roughly 39 million doses a day. In the U.S., 344 million doses have been given, with an average of 615,404 per day in the past week. (BBG)

CORONAVIRUS: New research showed that those vaccinated who were infected carry a significant amount of the virus, contradicting earlier observations that inoculated people weren't infectious, the New York Times reported. The research indicated these so-called breakthrough cases have the virus in the nose and throat, the paper said, citing CDC Director Rochelle Walensky. The data, which helped prompt the latest mask U.S. recommendations, showed that even without symptoms, those inoculated may be as contagious with the delta variant as those who haven't received their shots. (BBG)

CORONAVIRUS: Israel will begin offering a third shot of the Pfizer/BioNTech COVID-19 vaccine to people aged over 60, a world first in efforts to slow the spread of the highly contagious Delta variant. (RTRS)

JAPAN: Japan is set to decide later Friday on expanding its COVID-19 state of emergency to Osaka and three prefectures near Tokyo as a recent surge in coronavirus cases has raised fears of straining the country's medical system amid the Tokyo Olympics. Facing pressure to take stronger anti-virus measures, the government of Prime Minister Yoshihide Suga is expected to add Chiba, Kanagawa, Saitama and Osaka prefectures to areas under the emergency, which already covers Tokyo and Okinawa, from next Monday through Aug. 31. (Kyodo News)

BOJ: The Bank of Japan may see conditions fall in place to begin debating a new strategy for hitting its price target around the end of this year, as the economy shakes off the blues from the COVID-19 pandemic, its board member Asahi Noguchi told Reuters. Even so, the central bank can hold off on expanding stimulus unless a shock event derails Japan's economic recovery, Noguchi, known as a vocal advocate of aggressive monetary easing, said in his first interview since joining the board in April. "Once vaccinations proceed and the economy normalises, we'll see pent-up demand emerge quite a bit as households tap savings accumulated during lock-down measures," Noguchi said. (RTRS)

AUSTRALIA: Premier Gladys Berejiklian has warned anyone planning to attend an anti-lockdown protest in Sydney tomorrow could be giving their loved ones a "death sentence" after NSW recorded 170 new COVID-19 cases. (ABC)

AUSTRALIA: Housing groups are calling on the state government to wrap a "financial ring of steel" around residential tenants who are struggling to pay their rent due to lockdowns. It comes as the preliminary results of a Tenants Victoria survey of 400 renters found that 70 per cent had taken a financial hit during the state's latest lockdown, losing an average $1280 in income. About half of these renters said this had affected their ability to pay rent. Jennifer Beveridge, the organisation's chief executive, said no targeted support was provided to residential renters during the state's last two lockdowns. (The Age)

RBNZ: The Reserve Bank of New Zealand (RBNZ) said on Friday it is exploring options to incorporate climate change into its stress testing for banks and insurers. "Our 2021 stress test plan includes drought conditions in a bank stress test scenario and severe weather events in an insurance scenario," the Reserve Bank Assistant Governor Simone Robbers said in a opinion piece published on the bank's website. Robbers said the bank is considering how to incorporate sustainability objectives into its balance sheet operations. (RTRS)

NEW ZEALAND: Fonterra comments in July Global Dairy Update. New Zealand milk production for 12 months to June 2.6% higher than last year. Total New Zealand dairy exports in month of June up 19.6% on June last year. Increase driven by record volumes of whole milk powder, up 45% year-on-year, to China and South East Asia. Exports for the 12 months to June were up 4.5% on the previous comparable period, primarily driven by WMP, fluid milk products and cheese but partially offset by declines in SMP, AMF and infant formula. (BBG)

SOUTH KOREA: Gallup Poll: South Korea President Moon's approval rating unchanged at 40%. (BBG)

BOK: MNI: Analysts: BOK Rate Hike Timing Views Split Amid Covid-19

- A recovery in private consumption could see the Bank of Korea hike its key policy rate as early as October from a historical low of 0.5%, or possibly wait longer for assurance that economic gains are sustainable, according to analysts at two leading Japanese think tanks. "The slowdown in gross domestic product for the second quarter seems to be within forecast. Exports fell 2.0% q/q (in the second quarter) caused by the shortage of semiconductors. But exports are expected to remain solid on the back of firm overseas demand," Hidehiko Mukoyama, the senior analyst in charge of Korean economy and industry at Japan Research, told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

BOC: MNI INTERVIEW: BOC Seen Having Smooth Shift From Taper to Hike

- The Bank of Canada will have a smooth transition out of asset purchases later this year while facing more risks around the timing of an interest-rate rise in 2022, former central bank researcher and CIBC Senior Economist Royce Mendes told MNI. Governor Tiff Macklem will likely taper government bond buying again in October to CAD1 billion a week from the current CAD2 billion, a pace that will simply match maturing assets and may even lead the BOC to drop the QE label, he said. Asset purchases began last year at CAD5 billion and shifting to a net neutral stance would be far ahead of the Fed and ECB, though other peers in the U.K. and New Zealand are also looking to scale back - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

MEXICO: Mexico's Ministry of Finance and Public Credit (SHCP) said Thursday that economic activity is at 99.6 % of the pre-pandemic level and employment at 98.8% after the first half of 2021. "In the second quarter, economic activity continued on its recovery path and approached pre-pandemic levels faster than expected," it said when presenting the reports on the economic situation, public finances, and public debt to the second quarter of 2021. (Rio Times)

MEXICO: Mexico's Finance Ministry will keep working with Pemex to ease its large debt burden, Deputy Finance Minister Gabriel Yorio said Thursday. Aid for Pemex could include plans to help with investment projects, Yorio said in press conference. Finance Ministry expects EM central banks to keep hiking rates going forward. Mexico doesn't expect sovereign rating to be hit after Moody's cut Pemex rating. (BBG)

BRAZIL: Brazil's far-right President Jair Bolsonaro pleaded on Thursday for the replacement of the country's electronic voting system with printed ballots that can be counted, alleging that it is necessary to avoid fraud in next year's election. "I want elections next year, but clean, democratic and sincere elections," he said in his weekly social media webcast to supporters. Bolsonaro showed a series of internet video clips as alleged evidence of past fraud, maintaining that democracy was at risk in Brazil. Critics say that Bolsonaro, like former U.S. President Donald Trump, is sowing election doubts to pave the way for him not to accept defeat in 2022. (RTRS)

BRAZIL: Brazil's central government posted a $14.5 billion budget deficit in June, Treasury figures showed on Thursday, much smaller than a year ago thanks to rising tax revenues and lower crisis-related spending, but still more than economists had expected. The government reported a primary budget deficit, excluding interest payments, of 73.6 billion reais ($14.5 billion) last month, compared with a 194.9 billion reais deficit last June. That marked a 65% decline in real terms, Treasury said. But it was wider than the 63.4 billion shortfall forecast in a Reuters poll of economists. (RTRS)

GOLD: Gold prices will average a little above their current level of $1,830 an ounce for the remainder of 2021 before edging lower next year as the global economy recovers and central banks begin to tighten monetary policy, a Reuters poll showed on Thursday. (RTRS)

COPPER: Workers at the Andina copper mine in central Chile rejected owner Codelco's final wage offer in a vote Thursday, a union leader said. About 97% of members of the two main unions at Andina opted to strike, Manuel Canas, from the SUT union, said in a text message. Chilean labor rules give either party the option to request government mediation, which would avert the strike for five business days. In the unlikely event that neither side requests mediation, a stoppage would start on Aug. 3. (BBG)

CHINA

POLICY: China should properly use this year's "window of low growth pressure," when it is more confident that the economic growth will likely reach or exceed targets set earlier, the People's Daily said in a front-page report, citing government-affiliated advisors. The current macro policy focuses on increasing the resilience of the economic recovery and the quality of growth, the official newspaper said citing Xu Xianchun, a research director at Tsinghua University. Policymakers must focus on boosting domestic spending, Xu was cited saying. While growth is likely to slow in H2 from Q2's 7.9%, the pace should be seen averaged out over the last year and with a long-term view, the daily said. MNI comment: official media have been downplaying the necessity and likelihood of further stimulus this year. Another round of RRR cut seems less likely while fiscal stimulus may also be delayed until next year. (MNI)

PBOC: The People's Bank of China signaled its intention to ensure sufficient liquidity while keeping its prudent stance when it raised the size of Wednesday's OMO reverse repo to CNY30 billion from the usual CNY10 billion but keeping the rate unchanged, the Economic Information Daily said citing analyst Zhang Xu of Everbright Securities. The central bank wants to meet the market's expectations as liquidity demand is expected to rise going into the next month, the daily said. The operation was the second time amounting to CNY30 billion since end-June, it said. The central bank is likely to continue to guide market rates including DR007 around OMO rates, Zhang was cited as saying. (MNI)

CORONAVIRUS: Zhangjiajie, a famous tourist city in central China's Hunan Province, planned to close all its tourist sites on Friday morning after the recent resurgence of COVID-19 case in the city. Zhangjiajie started massive nucleic acid testing in three regions on Wednesday, said Wang Jianghua, director of the municipal health commission, at a press briefing Thursday evening. (Xinhua)

EQUITIES: Chinese residents are likely to continue increasing their investments in equity assets as the nation's economic transformation accelerates and capital market reform deepens, China Securities Journal says in front-page commentary. New mutual funds set up in 1H attracted 1.6t yuan of investment, up 52% from a year earlier, showing people's growing interest in equity assets. China's cross-border capital flow is balanced overall and a longer-term trend of foreign investors increasing investment in yuan assets won't change, China Securities Journal says in a separate article, citing unidentified analyst. (BBG)

PROPERTY: China's Vice Minister of Housing and Urban-Rural Development summoned officials from five Chinese cities with excess gains in home and land prices and ordered them to toughen measures to control the markets and promote healthier development, reported China Construction News owned by the ministry. The published cities, including the western Autonomous Region Ningxia's capital Yinchuan, Huizhou in Guangdong, and Quanzhou in Fujian, will join a list being monitored by all levels of regulatory authorities, the newspaper said. MNI notes that the central government has stepped up measures preventing high property prices from contributing to hidden risks and social discontent, now that growth is likely on target this year. (MNI)

COMMODITIES: Some of China's key fertiliser companies said they would temporarily suspend exports to assure supplies in the domestic market, according to a statement on the website of the National Development and Reform Commission (NDRC) on Friday. The fertilizer firms, which were not named, were summoned by the NDRC for a discussion against hoarding and speculation, the statement said. (RTRS)

OVERNIGHT DATA

JAPAN JUN, P INDUSTRIAL OUTPUT +22.6% Y/Y; MEDIAN +20.7%; MAY +21.1%

JAPAN JUN, P INDUSTRIAL OUTPUT +6.2% M/M; MEDIAN +5.0%; MAY -6.5%

JAPAN JUN UNEMPLOYMENT 2.9%; MEDIAN 3.0%; MAY 3.0%

JAPAN JUN JOB-TO-APPLICANT RATIO 1.13; MEDIAN 1.10; MAY 1.09

JAPAN JUN RETAIL SALES +0.1% Y/Y; MEDIAN +0.2%; MAY +8.3%

JAPAN JUN RETAIL SALES +3.1% M/M; MEDIAN +2.7%; MAY -0.3%

JAPAN JUN DEPT STORE, SUPERMARKET SALES -2.2% Y/Y; MEDIAN +0.5%; MAY +5.7%

AUSTRALIA Q2 PPI +2.2% Y/Y; Q1 +0.2%

AUSTRALIA Q2 PPI +0.7% Q/Q; Q1 +0.4%

AUSTRALIA JUN PRIVATE SECTOR CREDIT +3.1% Y/Y; MEDIAN +2.4%; MAY +1.9%

AUSTRALIA JUN PRIVATE SECTOR CREDIT +0.9% M/M; MEDIAN +0.4%; MAY +0.5%

NEW ZEALAND JUL ANZ CONSUMER CONFIDENCE 113.1; JUN 114.1

NEW ZEALAND JUL ANZ CONSUMER CONFIDENCE -0.9% M/M; JUN +0.1%

Households' confidence about buying major items continues to lift. This likely reflects wealth effects from the housing boom for those lucky enough to own a house, as well as excellent job security in an exceptionally tight labour market. Our confidence composite gauge is a GDP growth indicator created by combining lagged business expectations and intentions with consumer sentiment. The composite is now well above pre-COVID levels. Meanwhile, households continue to expect high inflation. This will make it easier for retailers to raise prices without fear of customer backlash, and can also impact wage demands if the labour market is tight, like it clearly is now. The famously nine-lives New Zealand housing market is also refusing to roll over, with house price expectations ticking higher after four months of falls. Higher mortgage rates are set to provide a stiffer test, but it's fair to say that the notion that the housing market is unstoppable seems to be fairly well ingrained. (ANZ)

NEW ZEALAND JUN BUILDING PERMITS +3.8% M/M; MAY -2.4%

SOUTH KOREA JUN INDUSTRIAL OUTPUT +11.9% Y/Y; MEDIAN +9.6%; MAY +14.9%

SOUTH KOREA JUN INDUSTRIAL OUTPUT +2.2% M/M; MEDIAN +1.5%; MAY -1.0%

SOUTH KOREA JUN CYCLICAL LEADING INDEX CHANGE +0.3; MAY +0.4

SOUTH KOREA AUG BUSINESS SURVEY M'FING 92; JUL 99

SOUTH KOREA AUG BUSINESS SURVEY NON-M'FING 78; JUL 82

CHINA MARKETS

PBOC NET INJECTS CNY20BN VIA OMOS FRI

The People's Bank of China (PBOC) conducted CNY30 billion via 7-day reverse repos with the rate unchanged at 2.2% on Friday. The operation net injected net CNY20 billion into the market as there is CNY10billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep end-month liquidity stable, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.2029% at 09:36 am local time from the close of 2.2900% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 42 on Friday vs 36 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4602 FRI VS 6.4942

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4602 on Friday, compared with the 6.4942 set on Thursday, marking the biggest daily drop since Jan 5, 2021.

MARKETS

SNAPSHOT: Tech Leads E-Minis Lower In Wake Of Amazon Earnings

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 449.42 points at 27333

- ASX 200 up 2.109 points at 7419.5

- Shanghai Comp. down 18.125 points at 3393.599

- JGB 10-Yr future down 5 ticks at 152.27, yield down 0bp at 0.021%

- Aussie 10-Yr future down 3.0 ticks at 98.820, yield up 3.1bp at 1.185%

- U.S. 10-Yr future +0-05 at 134-12, yield down 2.01bp at 1.249%

- WTI crude down $0.43 at $73.19, Gold down $0.41 at $1827.77

- USD/JPY up 3 pips at Y109.51

- ECB'S DE GUINDOS: BACK TO NORMAL MEANS BACK TO PRE-VIRUS GROWTH PATH

- BOJ POLICYMAKER SEES PROSPECTS OF DEEPER DEBATE ON PRICE GOAL THIS YEAR (RTRS)

- U.S. SAYS CONCERNED OVER HARASSMENT OF MEDIA COVERING CHINA FLOODS (BBG)

- U.S. EQUITIES STRUGGLE IN WAKE OF AMAZON Q2 EARNINGS REPORT AND GUIDANCE

- CHINESE RESIDENTS SHOW INCREASING INTEREST IN EQUITY ASSETS (CSJ)

BOND SUMMARY: U.S. Tsys Outperform On Tech-Led E-Mini Weakness

Some weakness in the e-mini space, led by the NASDAQ in the wake of Amazon earnings & guidance, has provided some support for Tsys overnight. A downtick for some of the large Chinese tech equity names also helped the bid. T-Notes last print +0-05 at 134-12, which represents bests levels of the day, on volume of ~120K. The cash Tsy space has bull flattened, with the short-end of the curve ~0.5bp richer on the day, while 5+-Year paper prints ~2.0bp richer, unwinding some of yesterday's bear flattening. 2x 6.0K screen lifts of TYU1 (each equating to $490 DV01 equivalent) headlined on the flow side. Friday's U.S. docket is headlined by PCE data and the latest MNI Chicago PMI reading. Elsewhere, St. Louis Fed President Bullard ('22 voter) will speak on the economy.

- JGB futures gave back their overnight session outperformance, given the cheapening witnessed in U.S. Tsys on Thursday and lack of surprises surrounding the previously flagged COVID state of emergency speculation and subsequent announcements from policymakers. Still, the broader defensive feel evident during Asia-Pac trade likely limited the weakness, with futures -5 at typing. The major cash JGB benchmarks are virtually unchanged across the curve.

- It was a relatively sedate session for Aussie bonds, which struggled to find a bid even with the uptick witnessed in the U.S. Tsy space. YM -1.5, XM -3.5, while cash ACGB trade has seen some steepening, leaving long end paper ~4.0bp cheaper on the day. The A$700mn tap of ACGB 2.75% 21 Nov '27 was smoothly digested, with the weighted average yield printing 0.41bp through prevailing mids at the time of supply (per Yieldbroker), while the cover ratio comfortably topped 5.00x. The previous tap of the line was conducted way back in '18, at a much smaller size and under a different market regime, so any comparisons would be misleading. The pricing through mids may not have been quite as aggressive as some anticipated, but the rarity in terms of taps of the line, market outlook re: the RBA, liquidity dynamic, international appeal and potential demand from dealers identified via AOFM liaison (all of which were flagged ahead of the auction) provided smooth passage despite the recent richening in both outright terms & in the form of belly outperformance. The weekly AOFM issuance slate offered no surprises. Meanwhile, the NSW daily COVID case count ticked back below 200, pulling back from the record high printed earlier this week. Private sector credit data was firmer than expected.

JGBS AUCTION: Japanese MOF sells Y4.3174tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.3174tn 3-Month Bills:

- Average Yield -0.1062% (prev. -0.1098%)

- Average Price 100.0265 (prev. 100.0274)

- High Yield: -0.1022% (prev. -0.1042%)

- Low Price 100.0255 (prev. 100.0260)

- % Allotted At High Yield: 9.0816% (prev. 23.7862%)

- Bid/Cover: 3.896x (prev. 3.541x)

AUSSIE BONDS: The AOFM sells A$700mn of the 2.75% 21 Nov '27 Bond, issue #TB148:

The Australian Office of Financial Management (AOFM) sells A$700mn of the 2.75% 21 November 2027 Bond, issue #TB148:

- Average Yield: 0.7316% (prev. 2.7989%)

- High Yield: 0.7325% (prev. 2.8000%)

- Bid/Cover: 5.5357x (prev. 5.9475x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 77.4% (prev. 76.5%)

- bidders 44 (prev. 39), successful 12 (prev. 12), allocated in full 4 (prev. 5)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance schedule:

- On Wednesday 4 August it plans to sell A$800mn of the 1.75% 21 November 2032 Bond.

- On Thursday 5 August it plans to sell A$1.5bn of the 22 October 2021 Note & A$500mn of the 25 February 2022 Note.

- On Friday 6 August it plans to sell A$700mn of the 0.25% 21 November 2025 Bond.

EQUITIES: Sentiment Switches To Negative

A negative day for equities in the Asia-Pac region, indices paring yesterday's gains after a negative lead from the US. Markets in mainland China are lower the to the tune of ~1%, it seems that pressure on some of the recent "usual suspects" across China & Hong Kong i.e. China Evergrande, Alibaba, Meituan and Tencent, is adding to the downward impetus for risk appetite. Markets in Japan are lower, there were reports that Japan will extend state of emergency declarations to Osaka, Saitama, Chiba and Kanagawa today. US futures are lower with the NASDAQ 100 e-mini contract leading the way lower, currently down around 1.2%. The decline comes on the back of Amazon's quarterly earnings report where revenue slipped and forecasts disappointed.

OIL: Comes Off Highs

Crude futures are slightly lower in Asia-Pac trade amid general risk off sentiment but are holding most of the rally seen over the past two days. WTI is down $0.57 from settlement at $73.06/bbl, Brent is down $0.60 at $75.45/bbl. The move lower comes as the greenback picks up from Thursday's closing lows, USD weakness after Wednesday's Fed decision helped buoy commodities markets across the board. Despite the softness oil is still on track for the second consecutive week of gains with WTI currently up 1.35% for the week. From a technical perspective support is seen at $69.71 the 50- day EMA, Brent also has support at the 50-day EMA of $73.66.

GOLD: Key Resistance In Sight

A downtick for the broader USD has supported bullion over the last 24 hours or so, even as our weighted U.S. real yield measure ticked away from all-time lows. Asia-Pac trade has been relatively limited, with spot printing little changed, just shy of $1,830/oz at typing. Initial resistance is located at the nearby July 15 high/bull trigger ($1,834.1/oz). Any sustained break there would allow bulls to switch focus to the 61.8% retracement of the Jun 1-29 decline ($1,853.3/oz).

FOREX: USD Gains On Lingering Virus Worry, PBOC Signals Discomfort W/Yuan Strength

The greenback outperformed its G10 peers in muted Asia-Pac trade, albeit by very narrow margins. The DXY advanced off a one-month low, after the 50-DMA crossed above the 100-DMA. Familiar themes continued to weigh on broader sentiment, with several deteriorating Covid-19 outbreaks across Asia stealing the limelight.

- USD/JPY eased off in early trade alongside U.S. e-minis, but erased losses ahead of the Tokyo fix. The fact that it was a Gotobi day in Japan may have helped fuel recovery. The yen paid little attention to domestic economic data, which were generally better than expected.

- USD/CNH crept higher as the PBOC set their central USD/CNY mid-point at CNY6.4602, 24 pips above sell-side estimate. Today's fixing represented the biggest positive miss since June 17, which some interpreted as a sign that China's central bank would prefer to see a weaker yuan. That said, USD/CNH failed to cling onto its post-fix gains and erased them later on.

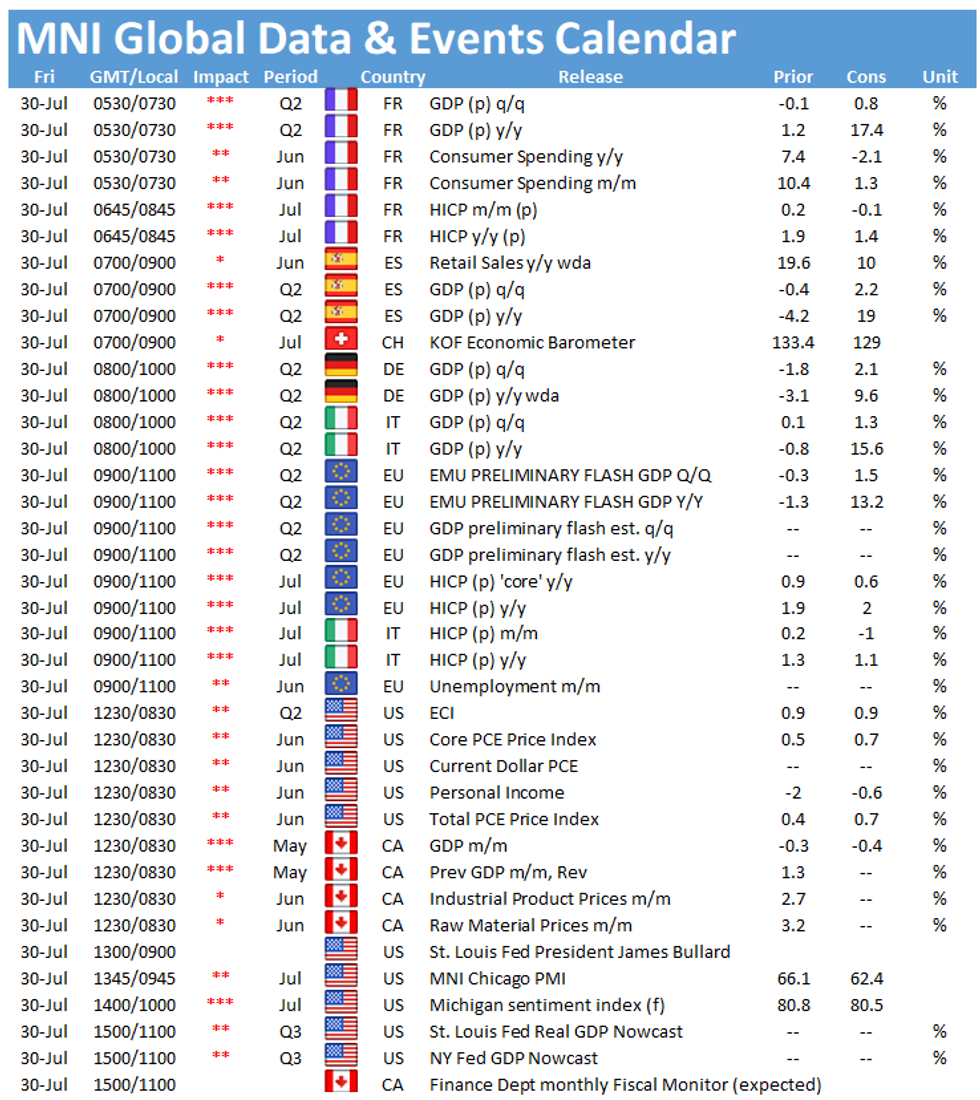

- European flash GDP prints will hit the wires before flash Eurozone CPI. Canada will also provide an update on its GDP, while the U.S. docket is headlined by core PCE, MNI Chicago PMI & final U. of Mich Sentiment. Fed's Bullard is set to speak today.

FOREX OPTIONS: Expiries for Jul30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1650(E1.2bln), $1.1700(E1.2bln), $1.1850-52(E1.6bln), $1.1865-75(E954mln), $1.1900-20(E1.3bln)

- USD/JPY: Y109.00($527mln), Y110.25-40($615mln)

- USD/CAD: C$1.2400($580mln), C$1.2450($615mln), C$1.2500($630mln)

- USD/CNY: Cny6.4650($585mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.