-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: Chinese Growth Questions May Open Path To More Easing

- Softer than expected Chinese m'fing PMI data triggers questions re: Chinese economic growth and speculation surrounding the likelihood of further policy easing.

- Chinese equities recover early losses.

- Most of today's PMI releases represent final readings, with the U.S. ISM m'fing survey set to headline the broader economic docket.

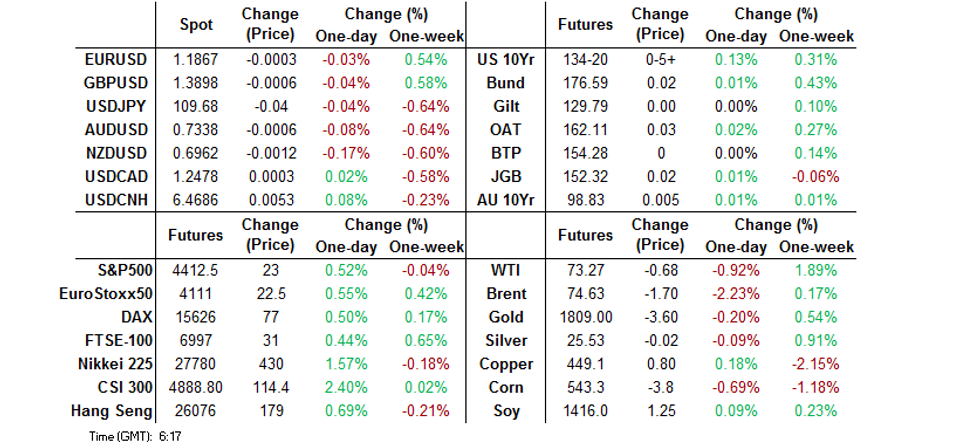

BOND SUMMARY: U.S. Tsys Turn Bid On Chinese Growth Angst, ACGBs & JGBs Limited

After a limited start T-Notes managed to extend to fresh session highs, presumably on some worry surrounding the Chinese growth trajectory in the wake of softer than expected Chinese m'fing PMI releases (and subsequent expectations for the prospect of further policy easing), with softer oil prices also lending a helping hand. The contract last prints +0-05+ at 134-20, 0-01 shy of best levels on volume of ~94K. Technical resistance is not seen until the 20 July high/bull trigger (135-07). Light twist steepening of the curve is evident, with 5s leading the richening (last ~1.0bp firmer), while 20s and 30s now print a little off of their intraday cheaps (~0.5bp cheaper on the day last). There hasn't been much in the way of notable market flow to comment on. The latest ISM m'fing print headlines on the data front during NY hours.

- JGB futures have stuck to a narrow range, after showing below the late overnight lows in early Tokyo trade, before edging away from worst levels to last trade unch. on the day. The major cash JGB benchmarks are little changed out to 7s, with 10+-Year JGBs richening by 0.5-1.0bp as of typing. Idiosyncratic headline flow remains light, with most of the focus falling on the Japanese vaccine scheme. 10-Year JGB supply & Tokyo CPI data headline Tuesday's local docket.

- Thinner market conditions owing to the NSW holiday (cash ACGBs closed) continue to limit broader Aussie bond futures activity, and therefore the willingness/ability of futures to generate a meaningful/lasting bid, even as U.S. Tsys firm. That leaves YM unch. & XM +0.5 at typing. A reminder that NSW COVID cases ticked back from yesterday's joint-record levels, but still printed above the 200 mark. Elsewhere, SE Queensland will see the lockdown in play there extended until 16:00 Sunday. Local lower tier data releases had no impact on the space. Looking ahead, tomorrow's RBA monetary policy decision dominates the local docket, with most looking for the central bank to renege on its tapering move (which wasn't scheduled to get underway until September).

US TSYS: MOVE In Middle Of Range Seen Since Feb Spike

The ICE-Bank of America MOVE Index is currently operating around the middle of the range witnessed since the late February spike, with participants focused on this month's Jackson Hole Symposium as the next potential staging post for Fed policy. Nearer-term, Wednesday's quarterly refunding announcement from the U.S. Tsy and Friday's NFP print provide the two major points of note for market participants this week. Comments from Fed Vice Chair Clarida (Wednesday) will also be eyed.

- While the outright richening in June-July and curve flattening that took place (largely) in June caught most off guard, it would seem that strategists have started to take account of the recent richening when it comes to year-end forecasts, with the latest BBG survey median for 10-Year Tsy Yields looking for 1.80% (prev. 1.88%) yield levels come the end of '21, while the BBG median now looks for 30-Year yields to end the year at 2.42% (prev. 2.55%).

Fig. 1: ICE-Bank of America MOVE Index

Source: Bloomberg

Source: Bloomberg

FOREX: Chinese Data Tip Balance Against Riskier FX

Major crosses hugged tight ranges in Asia, with riskier currencies facing some downward pressure. The yuan took a mild hit in reaction to a miss in China's Caixin M'fing PMI, which is skewed towards smaller firms and exporters. The underwhelming print came on the heels of a miss in the official counterpart released over the weekend. The data suggested that recovery in China's manufacturing sector is plateauing, which weighed on riskier currencies, even as most Asia-Pac equity benchmarks advanced.

- High-beta G10 FX went offered as regional participants digested Chinese data, while the raging Covid-19 outbreak in Southeast Asia helped further dent sentiment. NOK was the worst performer as crude oil turned its tail.

- Softer oil and disappointing Chinese data pressured the Antipodeans, with liquidity limited by a bank holiday in Australia. Domestic risks were eyed on both sides of the Tasman, with RBA monetary policy decision coming up tomorrow, ahead of New Zealand's jobs data due the following day.

- PMI data deluge steals the limelight today, while G20 central bank speaker slate is virtually empty.

FOREX OPTIONS: Expiries for Aug02 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800-15(E1.1bln), $1.1900(E1.3bln), $1.2000-20(E901mln)

- AUD/USD: $0.7360(A$524mln), $0.7400(A$1.1bln)

- USD/CAD: C$1.2550($514mln)

- USD/CNY: Cny6.50($650mln), Cny6.5300($1bln)

ASIA FX: Baht The Worst Performer In Mixed Session For Asia EM FX

A mixed session for Asia EM FX, PMI data showed a general slowdown, but activity remained expansionary and there a was a pace increase for a for countries.

- CNH: Offshore yuan slightly weaker but sticking to a narrow range. Caixin manufacturing PMI misses estimates, the July print comes in at 50.3 below expectations for 51.0, the slowest rate for 16 months.

- SGD: Singapore dollar slightly stronger, on the coronavirus front case numbers have picked up slightly. There is no weekend data available yet, but there were 131 new cases on Friday. PMI data will be released later in the day.

- TWD: Taiwan dollar is stronger, data earlier saw IHS Markit Taiwan July Manufacturing PMI rise to 59.7 from 57.6 in June, there was a sharper increases in both output and new work.

- KRW: Won is weaker, data earlier saw South Korea Markit manufacturing PMI fall to 53.0 in July from 53.9 in June, while the local COVID-19 situation continues to remain a concern to officials.

- MYR: Ringgit is lower, Malaysia's Markit M'fing PMI improved to 40.1 in July from 39.9 prior, pointing to a second back-to-back month of contraction in the sector.

- IDR: Rupiah is flat and in a tight range, Indonesia's Markit M'fing PMI took a strong hit in July, with the index falling to 40.1 from 53.5, showing the fastest pace of contraction since June 2020. CPI rose slightly above expectations at 1.52% Y/Y.

- PHP: Peso is slightly weaker, Bangko Sentral ng Pilipinas Gov Diokno noted that "with cautious optimism, we can say that the worst is over" for domestic economy. His comments were circulated on Friday after the government announced a two-week lockdown in the National Capital Region.

- THB: Baht is lower, Thailand's Covid-19 task force emerged from an emergency meeting Sunday, announcing an extension to lockdown measures in 13 provinces including Bangkok through Aug 31 and their expansion to 16 further regions from Tuesday. Restrictions include bans on dine-in services and inter-provincial travel as well as a night curfew.

ASIA RATES: China Repo Rate Drop, Futures Hit Contract Highs

- INDIA: Yields lower in early trade; a rise in goods and services tax collections for July could provide a boost to Indian assets including bonds, India Gross GST Collections came in at INR 1.16t in July, up from INR 928.5bn in June. Bonds did come under pressure on Friday though after another auction was rescued by primary dealers; of the INR 110bn of the 5.63% 2026 bond dealers took INR 74.7bn. The 5.63% 2026 line also suffered a weak auction on July 2 and INR 104bn of INR 110bn sold was devolved on primary dealers. This has led commentators to speculate that the RBI is targeting the 5-Year and 10-Year sector to anchor the rest of the curve. Later in the session markets await Indian manufacturing data

- SOUTH KOREA: Futures in Korea under some moderate pressure but have recovered early losses, both contracts sticking to last week's well-defined range. Little movement in the cash space so far, 30-Year issuance was well received and saw similar cover to the previous auction despite a 25bps yield concession, the auction was the first sale from a reduced auction slate in August by around KRW 5.5tn compared to July. Elsewhere equity markets are in positive territory after recovering early losses. Data earlier saw South Korea Markit manufacturing PMI fall to 53.0 in July from 53.9 in June, while the local COVID-19 situation continues to remain a concern to officials.

- CHINA: The PBOC matched injections with maturities today following a net injection of CNY 40bn in the last two sessions. Repo rates are lower, the overnight repo rate down some 28bps and the 7-day repo rate down 20bps and back below the PBOC's 2.20% rate. Bonds are sharply higher, futures making fresh contract highs, in the cash space yields are lower across the curve, the 10-Year yield at point touching the lowest since June 2020 at 2.81%. Stocks are in positive territory, recovering earlier losses of up to 1%.

- INDONESIA: Yields slightly lower with IDR also seeing limited movement. Pres Widodo reiterated his opposition to a strict nationwide lockdown, which "won's necessarily end the problem". Widodo said that "people are screaming for a reopening" even as the country is now under a "semi lockdown, not a full lockdown" Indonesia's Markit M'fing PMI took a strong hit in July, with the index falling to 40.1 from 53.5, showing the fastest pace of contraction since June 2020. CPI rose slightly above expectations at 1.52% Y/Y.

EQUITIES: China Recovers Early Losses

Most equity markets in Asia higher, mainland China markets recovering early losses and post gains of around 2.0%. The rise comes despite the latest reports of a crackdown on the tech sector with regulators demanding large tech companies fix a range of issues in the internet industry. Japanese markets were higher from the open, recovering most of Friday's loss, the rise was attributed in part to a decline in US yields with sentiment also boosted by the approach of the US infrastructure package. Other regional equity markets also gained with PMI data showing that while activity mostly slowed it remained expansionary. US futures are higher, coming off the back of a slightly negative close last week. Still, the S&P 500 finished July with gains for the sixth month in a row. Markets will watch another week of earnings as well as the US infrastructure bill.

GOLD: A Touch Weaker In Asia

A slightly firmer USD and uptick in e-minis has kept a lid on gold during Asia-Pac hours, allowing the space to consolidate after spot pulled away from well-defined resistance levels on Friday, unwinding 2/3 of the weekly gains lodged through Thursday in the process. That leaves spot dealing a handful of dollars softer at $1,810/oz at typing, within a now familiar technical layover. Note that known ETF holdings of bullion nudged higher last week. Our weighted U.S. real yield measure hovers just above the all-time lows that were printed in the middle of last week. ISM m'fing data headlines the broader risk docket on Monday, with Friday's NFP print and Wednesday's address from Fed Vice Chair Clarida providing some notable points of reference for participants this week.

OIL: Commodities Under Pressure

Crude futures are lower in Asia; WTI is down $0.70 from settlement, while Brent is down $0.80, after bouncing from worst levels. There is still some way to go to support for WTI at $69.86 the 50-day EMA and $71.62 the 50-day EMA in Brent. Though most equity markets in Asia are in positive territory PMI data has generally showed slowing activity including Caixin manufacturing PMI from China while concerns linger about a pickup in the number of coronavirus cases across the region. A slightly stronger USD could also be keeping a lid on oil. Elsewhere there are tensions between the US and Iran after the US formally blamed Iran for an attack on an oil tanker linked to Israel, warning an appropriate response would be forthcoming.

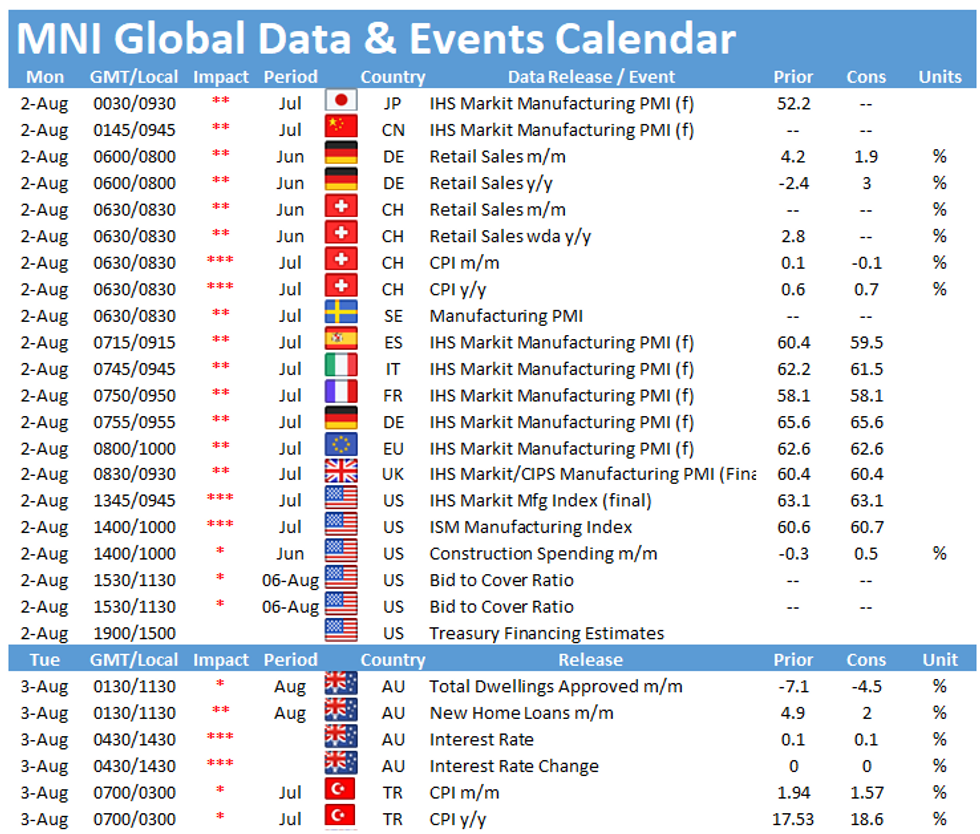

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.