-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Hawks Swirling In New Zealand

- Another round of hawkish RBNZ repricing seen in the wake of NZ labour market data, more than 25bp of tightening is now priced for this month's RBNZ meeting.

- Chinese Caixin Services PMI comfortably tops expectations.

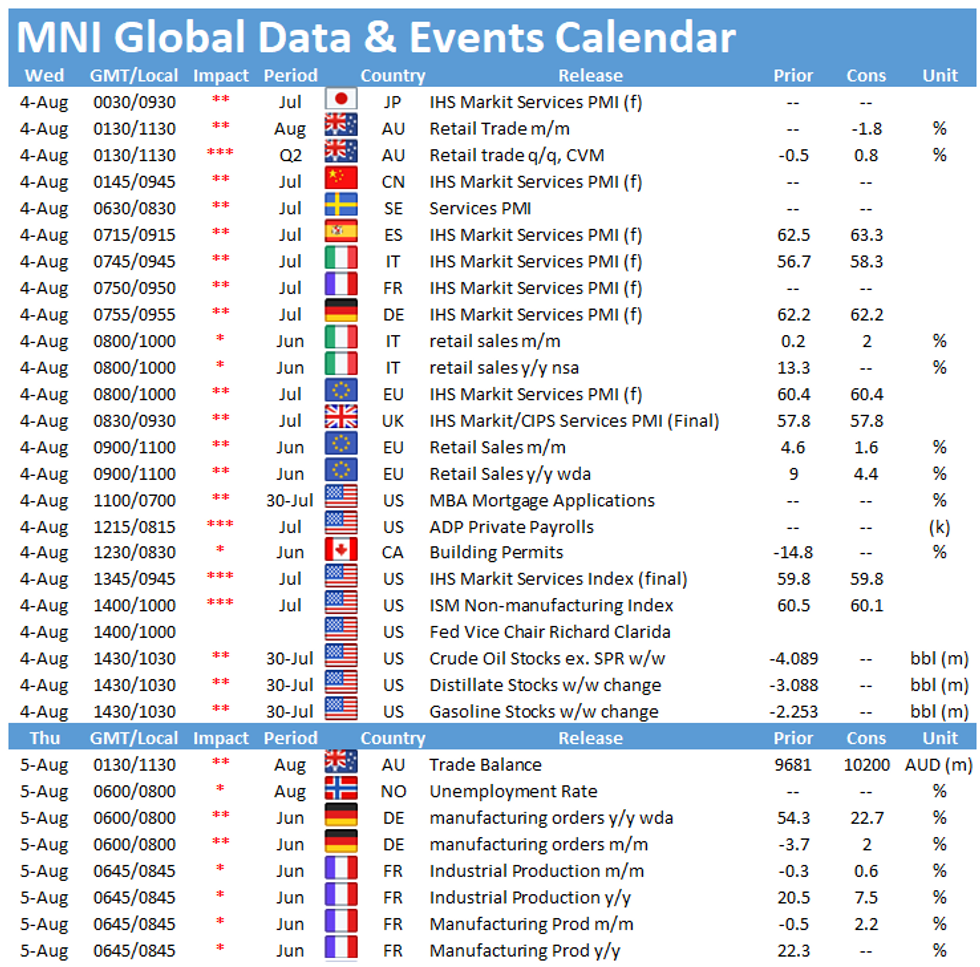

- U.S. ADP employment data, the latest U.S. ISM survey and an address from Fed Vice Chair Clarida headline the broader docket on Wednesday.

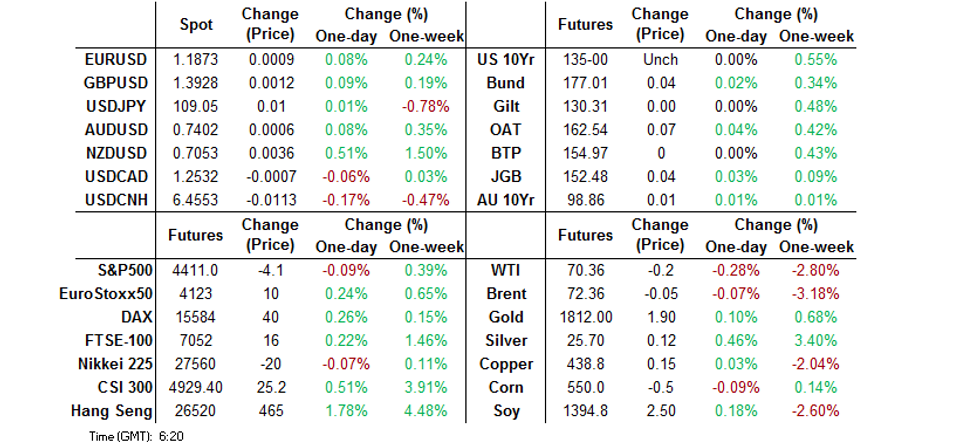

BOND SUMMARY: JGBs See Light Bid, U.S. Tsys & ACGBs Limited

Some screen selling of T-Notes helped the contract to fresh session lows on the back of the stronger than expected Caixin services PMI print, although the contract stuck to the confines of a narrow 0-03+ range in Asia-Pac hours. A bounce in the Hang Seng, reportedly on the back of Chinese state media toning down its rhetoric against the online gaming industry, also applied some modest pressure to the space at the same time that the Chinese data hit. T-Notes last trade -0-01+ at 134-30+ on volume paltry volume of ~52K. Cash Tsys trade little changed to 1.0bp cheaper across the curve, with very modest bear steepening in play. Focus on Wednesday moves to an address from Fed Vice Chair Clarida, ADP employment data and the quarterly refunding announcement from the U.S. Tsy. We will also hear from St. Louis Fed President Bullard ('22 voter)

- JGB futures last print +7, with cash JGBs little changed to 1.0bp richer as 10s have a look below the 0.01% yield level and flirt with 0% (although most do not expect a sustained break into negative territory under the current dynamics). The domestic COVID situation continues to dominate headline flow, with Japan's top medical advisor noting that the authorities are considering placing the entire country under a state of emergency. The latest round of BoJ Rinban operations (covering 1- to 5- and 10- to 25-Year JGBs) revealed slightly lower to steady cover ratios. Both of these matters may have helped the bid in the Tokyo afternoon.

- The ACGB curve has seen some modest twist flattening, with YM -1.0 and XM +0.5 at typing. The front-end may have seen some very modest trans-Tasman pressure on the hawkish RBNZ repricing which came in the wake of the latest NZ labour market report. We also saw comments from S&P, with the ratings agency noting that the COVID-related lockdowns that have been implemented in Australia are unlikely to slow the country's fiscal repair. S&P also suggest that it does not see the lockdowns weighing heavily on Australia's AAA rating.

FOREX: Kiwi Flies On Jobs Report, Upbeat Caixin Services PMI Supports Risk

New Zealand's labour market data beat expectations across the board and another round of hawkish RBNZ repricing ensued, while some major sell-side desks released hawkish updates of their RBNZ calls. The OIS strip fully prices a 25bp OCR hike in August, while all "Big 4" banks now expect the Reserve Bank to raise the OCR by 25bp at each of their three remaining monetary policy meetings this year. The kiwi comfortably outperformed all of its G10 peers, while NZD/USD punched through its 50-DMA for the first time in two months.

- AUD/NZD sank through the NZ$1.0500 figure, which had been intact since early December, as hawkish RBNZ repricing added fresh tightening pressure to the Australia/New Zealand 2-Year swap spread, resulting in yet another multi-year low for that differential.

- Major NZD crosses saw notable spikes in their 2-week implied volatilities, as the RBNZ's next gathering is slated for August 18.

- Risk appetite got a boost as China's Caixin Services PMI turned out considerably firmer than expected, in contrast to the factory gauge released earlier this week. USD/CNH faltered to fresh weekly lows, while traditional safe haven currencies took a hit.

- U.S. monthly ADP and a number of PMI reports from across the globe take focus today, while central bank speaker slate is headlined by Fed's Clarida & Bullard.

FOREX OPTIONS: Expiries for Aug04 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800-05(E598mln), $1.1830-35(E591mln), $1.1845-55($1.8bln), $1.1920-25(E601mln)

- USD/JPY: Y110.50($1.3bln)

- GBP/USD: $1.3750(Gbp502mln)

- EUR/GBP: Gbp0.8550(E841mln)

- EUR/JPY: Y129.25(E710mln)

ASIA FX: Mixed Performance; TWD & IDR Top Table, THB Lags

The greenback dropped in Asia on Wednesday but risk sentiment was mixed with regional dynamics in play. The rupiah continues to outperform.

- CNH: Offshore yuan is stronger, USD/CNH broke out of yesterday's range as the yuan gained. Chinese equity markets gained today, there was no updated commentary on the regulatory crackdown. Data earlier showed China July Caixin services PMI rose to 54.9 from 50.3.

- SGD: Singapore dollar is stronger, on the coronavirus front new cases fell to 98 on Tuesday, dropping below 100 for the first time in two weeks while Singapore July whole economy PMI rose to 56.7 from 50.1 in June.

- TWD: Taiwan dollar is stronger, on track for a third day of gains. USD/TWD has retreated further underneath the 28.00 handle, the recent decline in coronavirus case numbers has led to a slight relaxation of restrictions in Taipei.

- KRW: Won is stronger, managing to gain after a shaky start. Coronavirus cases jumped but focus has been on a hawkish set of BoK minutes with the August meeting now seen as live by several banks.

- MYR: Ringgit is lower. Political turmoil rumbles on; UMNO Pres Zahid said that 11 UMNO MPs have retracted support for PM Muhyiddin and submitted their declaration to the King, while Energy Minister from UMNO stepped down.

- IDR: Rupiah gained and is on track for a sixth higher finish. Some of the gain is attributed to bond inflows after a strong sukuk auction yesterday. Indonesian Q2 GDP report will be published on Thursday.

- PHP: Peso fell, Bangko Sentral ng Pilipinas released a statement based on Gov Diokno's recent speech, noting that the central bank will maintain its accommodative policy stance for "as long as necessary" amid risks stemming from the spread of the Delta variant.

- THB: Baht is lower, Thailand's Covid-19 case count topped 20,000 for the first time today, while daily deaths reached a new record high of 188 while the Cabinet agreed yesterday to double its Covid-19 relief budget to THB60bn.

ASIA RATES: China Futures Lower For Second Day; Indonesia Boosted By Strong Auction

- INDIA: Yields lower in early trade. Bonds held steady yesterday, entering a holding period ahead of the RBI's rate announcement on Friday. The RBI is expected to maintain policy settings and acknowledge headwinds to growth, while expressing a preference to wait for more data points on the inflation. The RBI has maintained that higher inflation is transitory but inflation prints remain stubbornly higher. Kotak Asset Management noted that Friday could see "some steps towards normalization of liquidity via increased tenor or quantum of VRRR (variable rate reverse repo) – something which bond markets seem to be anticipating". Equity markets seem to be anticipating a dovish outlook from the RBI, indexes closed at record highs yesterday.

- SOUTH KOREA: Futures are higher again today, rallying for a second day, but are within the well defined range seen since mid-July. Coronavirus cases jumped again, after hovering in the 1,200's for two days there were 1,725 new cases in the past 24 hours. The minutes from the July BoK meeting were widely seen as hawkish, though there were indications of concern around the fourth wave of coronavirus, several banks have bought forward rate hike calls to August. The BoK sold KRW 2.3tn of 2-Year bonds at a yield of 1.27%, the sale was covered 1.39x.

- CHINA: The PBOC matched injections with maturities today, repo rates are within recent ranges. The overnight rate is up 14bps at 1.6971% after plunging into the close yesterday, 7-day repo rate up 1.6bps at 1.9667%. Futures are lower, on track for a second straight decline against a backdrop of an extended rally. Chinese equity markets are higher today after finishing flat yesterday. Data earlier showed China July Caixin services PMI rose to 54.9 from 50.3 in previous month. The positive survey helps offset a slowdown in the official and Caixin manufacturing PMI releases.

- INDONESIA: Yields lower across the curve, on track for a fifth day of declines. Yesterday's auction was strong, the government sold IDR 13.5tn against a target of IDR 12tn and received the strongest bids of 2021 so far. Indonesian Foreign Min Marsudi travelled to DC to meet with her U.S. counterpart Blinken. Both chief diplomats launched a "strategic dialogue" on issues including freedom of navigation in the South China Sea. Indonesian Q2 GDP report will be published on Thursday. The Indonesian economy is expected to have grown 6.72% Y/Y, according to Bloomberg consensus forecast.

EQUITIES: Hang Seng Rebounds, Japanese Bourses Soft

Another day and another session of mixed performance for equity markets in the Asia-Pac region. Markets in mainland China are up after a flat finish yesterday, late Tuesday earnings from Alibaba showed the firm's revenue missed estimates for the first time in more than two years. The Hang Seng leads the way higher, Tencent is recovering from a sharp drop yesterday stoked by renewed regulatory concerns. Most other markets in EM Asia seeing gains. Markets in Japan are lower but off session lows, pressured by COVID-19 concerns and weighed by SoftBank who sold off after reports that the sale of one its units to Nvidia could be blocked. In the US futures are hovering around neutral levels, markets await US ADP employment data as a precursor to US NFP data later in the week, as well as further PMI survey data and another busy day of earnings.

GOLD: Some Points Of Note Through The Backend Of This Week

Spot remains comfortably within the confines of the recent range, last dealing little changed just above $1,810/oz after the DXY & U.S. real yields struggled to make any notable moves on Tuesday. This leaves the well-defined technical picture intact.

- Focus now moves to today's address from Fed Vice-Chair Clarida & Friday's U.S. NFP print.

OIL: Crude Futures On Track For Third Day Of Decline

Oil is slightly lower in Asia-Pac trade on Wednesday, struggling for gains after falling on Tuesday. WTI is down $0.15 from settlement, while Brent is flat. Crude futures were heavy yesterday despite reports that Iranian-backed forces were believed to be behind the seizure of the tanker the Asphalt Princess in the Gulf of Oman, with an armed group in control of the vessel. With the situation remaining unstable, markets will likely keep watch of the situation, which may be arresting any downside pressure on energy products. Elsewhere data late Tuesday from API showed US crude stocks fell 879k bbls while gasoline stocks fell 5.75m bbls, official DOE numbers are due later today.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.