-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY68.6 Bln via OMO Thursday

POSCO (POHANG, Baa1/A-/NR) S.Korea to respond to U.S. tariffs

MNI EUROPEAN MARKETS ANALYSIS: Equities Continue To Tick Higher Overnight

- A lack of fresh headline drivers allowed e-minis and the major regional equity indices to tick higher during Tuesday's Asia-Pac hours, building on recent gains.

- Comments from ECB's Schnabel headline a relatively limited docket on Tuesday.

BOND SUMMARY: Tight Ranges In Asia, Very Modest Pressure For Core FI

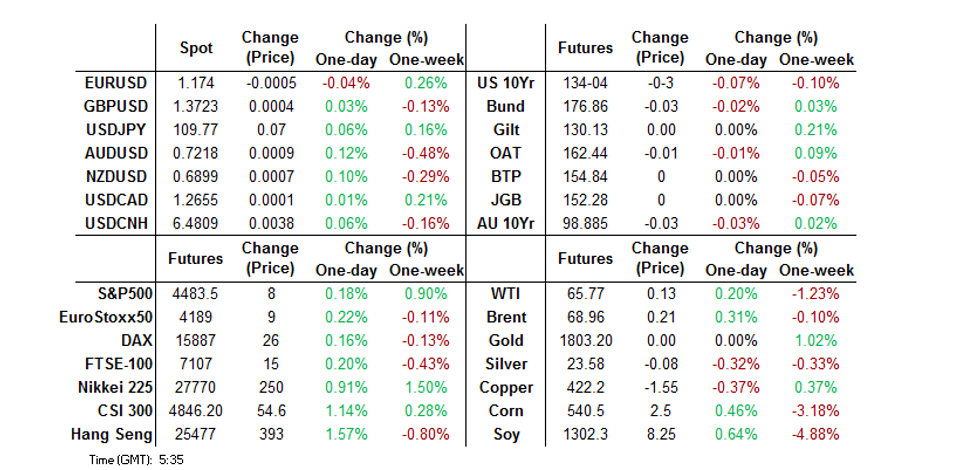

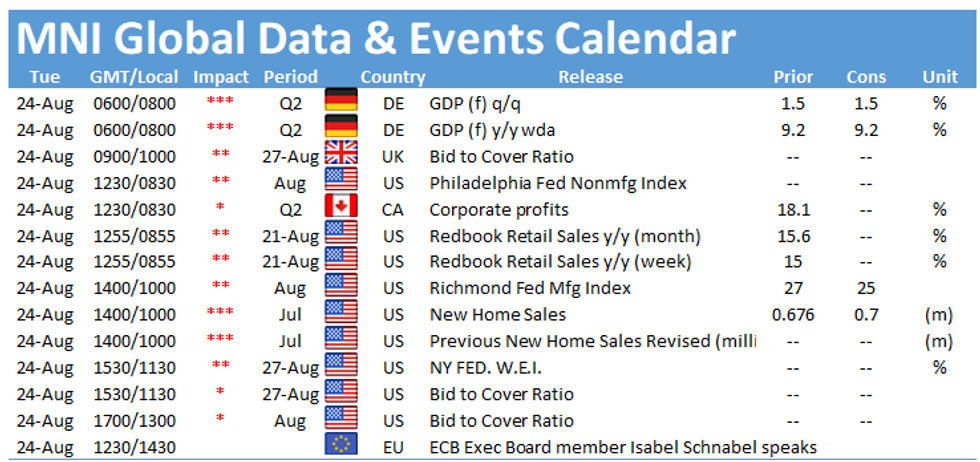

Cash Tsys sit 0.5-1.5bp cheaper across the curve, while T-Notes print -0-02+ at 134-04+, operating within a 0-03 range in Asia. Headline and market flow remain light, with a couple of pockets of TY futures sales witnessed since the re-open. The uptick in e-minis and the major Asia-Pac equity indices is applying some modest pressure to the space. Looking ahead to the NY docket, we will see the latest round of new home sales data, the Richmond Fed manufacturing index reading & 2-Year Tsy supply.

- JGB futures last +1, back from overnight session highs, with similar moves witnessed in the respective U.S. & Australian bond futures contracts. Cash JGB trade sees the major benchmarks running unchanged to ~0.5bp richer across the curve. News flow remains sparse, with the local COVID and political situations still dominating there. The latest round of 5-Year supply wasn't the firmest, with the pricing side disappointing. A lack of outright and relative value attraction at present likely hampered the auction. The average price seen at the auction only just met the broader expectations for the low price (as proxied by the BBG dealer poll), although the cover ratio nudged incrementally higher.

- Over in Australia YM & XM held to tight ranges albeit with a steepening bias, with the former -1.5 and the latter -3.0. Cash ACGB trade sees the longer end of the curve running ~4.0bp cheaper on the day at typing. The latest round of daily COVID case counts out of NSW & Victoria saw a slight moderation, but the numbers remain elevated (the NSW Premier has pointed to some form of additional freedom for those that are double vaccinated, with an announcement on the matter set to come towards the end of this week). Some of the pressure on the space may have originated from hedging surrounding the A$3.25bn syndication of the new 0.25% 21 November 2032 Treasury Indexed Bond.

FOREX: Risk Rally Extends

Another constructive session for risk assets and commodity currencies in the Asia-Pac session Tuesday, oil and equity markets built on Monday's gains. Major pairs observed narrow ranges amid a lack of catalysts; headline flow has been light while the economic docket had a distinct lack of major releases.

- Both AUD and NZD trade a handful of pips higher heading into Europe, AUD/USD breaking out of yesterday's range. The local COVID dynamic remains in focus, Both NSW and Victoria reported a lower case count than the previous day while New Zealand FinMin Robertson said that New Zealand was in a strong fiscal position to weather the lockdown. Elsewhere New Zealand retail sales excluding inflation rose 3.3% in Q2, above the 2.5% expected.

- USD/JPY is marginally higher on the session, the local COVID and political situation in Japan had little impact through the session.

- Offshore yuan has weakened slightly with USD/CNH creeping slightly higher, reversing some of Monday's decline. Markets digested comments from PBOC Governor Yang late on Monday, he said the Central Bank would increase credit support to the economy and SME's in particular. There were a few pieces doing the rounds from China dailies, including one from Minister of Commerce Wang that China could consider a smaller negative list to attract foreign capital.

- Looking ahead German GDP data is due later in the session while broader focus for the week remains on the Fed's annual Jackson Hole Economic Symposium, with commentary from FOMC Chair Powell on Friday headlining that (now virtual) event.

ASIA FX: COVID-19 Fears Abate For Now

Supportive risk sentiment helped Asia EM currencies higher at the open, the greenback did rise slightly which saw most USD/Asia crosses come off best levels.

- CNH: Offshore yuan has weakened slightly with USD/CNH creeping slightly higher, reversing some of Monday's decline. Markets digested comments from PBOC Governor Yang late on Monday, he said the Central Bank would increase credit support to the economy and SME's in particular.

- SGD: Singapore dollar is flat, on the coronavirus front Singapore reported 94 new cases yesterday, the highest case count since August 5 after a cluster of infections was discovered at a foreign worker dormitory

- TWD: Taiwan dollar is stronger, pausing a two day decline thanks to equity inflows as the Taiex posts robust gains. As a reminder late yesterday industrial production rose less than expected at 13.93% while the unemployment rate beat expectations.

- KRW: Won is stronger, there were reports that the national budget for 2022 should be bigger than the KRW 604 trillion earmarked for this year to finance the country's efforts to tackle the COVID-19 crisis. Late Monday the Fin Min said it would take action in the case of excessive volatility.

- MYR: Ringgit gained, hitting its highest in two weeks, new Covid infections dropped to 17,672 on Monday, the lowest in two weeks. New PM Ismail said his cabinet choices will be announced this week.

- IDR: Rupiah is higher, BI announced it would extend its bond buying programme.

- THB: Baht is higher, officials said late yesterday that the latest COVID-19 outbreak has peaked, the infectious disease panel has approved a shift to learning to live with COVID-19 including total vaccination coverage for vulnerable groups and active-case searches.

- PHP: Peso gained, data showed a budget deficit of PHP 121.2 billion in July, revenues rose 9.21%.

ASIA RATES: Indonesia To Extend Bond Purchases & Reduce Debt Issuance

- INDIA: Yields slightly higher in early trade. Crude futures rose over 5% yesterday which is expected to weigh on Indian bonds as the prospect of an inflation overshoot returns to the fore. Markets await a state debt sale today with a total target amount of INR 112bn. Elsewhere Indian FinMin Sitharaman said yesterday that the government has plans to raise INR 6tn through a scheme of leasing out state-owned infrastructure assets over the next four years with the aim of funding capex without putting further pressure on government finances. This initiative has long been expected. On the coronavirus front India's vaccine panel Chief Arora said that India should have up to 1.2bn vaccine doses by the end of 2021 and is set to approve six domestic inoculations by the end of this year

- SOUTH KOREA: Moves muted in the space, future slightly lower. Risk environment is generally supportive, equity markets in the region in the green. 20-Year auction was smoothly taken down despite a slightly larger sale size. There were reports that the national budget for 2022 should be bigger than the KRW 604 trillion earmarked for this year to finance the country's efforts to tackle the COVID-19 crisis. The leader of the ruling Democratic Party said the 2022 budget should include compensation for small merchants and small business owners affected by the pandemic, noting the current budget measures did not go far enough. On the coronavirus front there were 1,509 new cases in the past 24 hours, back above 1,500 after reporting 1,418 on Monday.

- CHINA: Futures slightly higher in China and hugging a narrow range. Equity markets in the region have seen muted moves compared to peers, but have managed to sustain positive territory. The PBOC matched maturities with injections, the overnight repo rate is higher, up 2.2808%, the 7-day repo rate is lower by around 1.8bps at 2.2121%, the second time in the past two weeks the rates have inverted. Markets digest comments from PBOC Governor Yang late on Monday, he said the Central Bank would increase credit support to the economy and SME's in particular. There were a few pieces doing the rounds from China dailies, including one from Minister of Commerce Wang that China could consider a smaller negative list to attract foreign capital. There was a piece in China's People Daily which said that China should adopt a more proactive macroeconomic policy to support the economy and maintain the sustainability and stability of its policies.

- INDONESIA: Yields lower, some curve steepening seen. Bank of Indonesia plans to extend its bond purchases through 2022 according to reports, the plan is said to have the backing of majority of lawmakers in parliament. The "burden sharing" programme, as it is known, between the Central Bank and the government will be expanded by IDR 215tn this year and IDR 224tn in 2022. Last year almost IDR 400tn of debt was purchases via private placements. FinMin Indrawati said the plan would allow Indonesia "to be able to respond to this extraordinary situation and challenge with an extraordinary policy." It was also announced that Indonesia would reduce government bond issuance via auctions. The government aims to bring the budget deficit under the legal limit of 3% of GDP by 2023. Indonesia will reduce its bond sale target per auction for the rest of 2021 to IDR 30t - IDR 35tn.

EQUITIES: Higher For A Second Day

Equity markets in the Asia-Pac region have posted gains on Tuesday, taking a positive lead from the US where major indices hit fresh record highs. Technology stocks were the drivers of gains in Asia which helped bourses in Hong Kong, Japan, China, South Korea and Taiwan higher. In China comments from the PBOC yesterday that the Central Bank would increase credit support to the economy and SME's in particular also helped engender a positive risk environment. In the US futures are higher, markets continue to assess full approval for the Pfizer-BioNTech vaccine while awaiting the Fed's annual Jackson Hole Economic Symposium, with commentary from FOMC Chair Powell on Friday headlining that (now virtual) event.

GOLD: Spot Back Above $1,800/oz

The combination of a pullback from the recent highs in the DXY and our weighted U.S. real yield monitor supported bullion on Monday, allowing spot gold to trade back above $1,800/oz, where it has consolidated overnight. The overarching technical picture remains little changed, with key resistance still located at the July 15 high ($1,834.1/oz). Fed Chair Powell's (virtual) address at the annual Jackson Hole symposium provides the key immediate event for participants later this week.

OIL: Crude Futures Continue Rally

WTI & Brent sit $0.10-0.20 above Monday's settlement levels. Markets continue to digest yesterday's reports from the US Energy Department that it intends to sell up to 20 million barrels of crude oil from the nation's Strategic Petroleum Reserve. The next hurdle for WTI bulls is the 20-day EMA while Brent bulls target $71.90 the high Aug 12 and a key resistance. Participants look ahead to US API inventory data later in the session.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.