-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Sino-U.S. Headlines At The Fore

EXECUTIVE SUMMARY

- U.S. CLIMATE ENVOY KERRY EXPECTED TO TRAVEL TO CHINA IN SEPTEMBER (RTRS)

- WALL STREET, CHINA TO REVIVE TALKS IN HUNT FOR COMMON GROUND (BBG)

- SEC TO DEMAND ALL CHINA FIRMS SAY MORE ABOUT INVESTOR RISKS (BBG)

- BIDEN RECEIVES INCONCLUSIVE INTELLIGENCE REPORT ON COVID ORIGINS (WASHINGTON POST)

- PBOC NET INJECTS CNY40BN VIA OMOS TO MANAGE MONTH-END LIQUIDITY

- U.S. HOUSE DEMS CLEAR PATH TOWARD PASSING BUDGET BILL & INFRASTRUCTURE PLAN (CNBC)

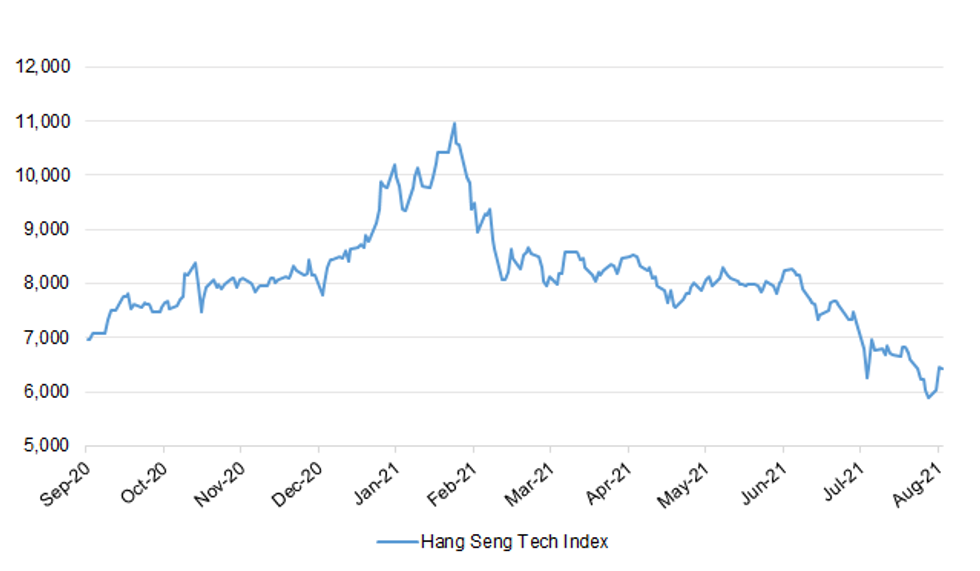

Fig. 1: Hang Seng Tech Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

ECONOMY: Employers' desire to hire new workers is close to record highs in a sign that staff shortages will persist into the autumn, a survey suggests A net balance of 29 per cent of businesses told the Recruitment & Employment Confederation that they plan to expand their workforce and invest in their operations, down only four percentage points from the previous rolling quarter's record high. Demand for workers has risen considerably as the economy has emerged from lockdown, with businesses in certain sectors now struggling to fill key positions. The figures suggest that recruitment challenges will persist for some time. yet. (The Times)

EUROPE

GERMANY: Outgoing Chancellor Angela Merkel vowed Tuesday that her party will fight for a good result in Germany's election next month and won't be distracted by polls showing its support at worryingly low levels. Merkel's Union bloc has been sagging in polls for weeks as Armin Laschet, the leader of her Christian Democratic Union party and the center-right candidate to succeed her as chancellor, so far has failed to impress voters. Laschet is the governor of Germany's most populous state, North Rhine-Westphalia. This week, a clutch of surveys showed it level with or even marginally behind the center-left Social Democrats, whose experienced candidate — Olaf Scholz, the vice chancellor and finance minister in Merkel's coalition government — has gained in popularity as the Sept. 26 election nears. Others have given it only a skimpy lead. That's a shock for the Union, which until recent months was used to healthy poll leads, because the Social Democrats have long been mired in a poll slump. Current surveys show the environmentalist Greens, who are making their first run for the chancellery with Annalena Baerbock, a few points behind the pair. "We are fighting, or the party is fighting — I personally am not up for election," Merkel said when asked about the polls at a news conference in Berlin. She pointed to a "good opening" to its official campaign on Saturday. "We will work every day to get a good election result and not look every day at the polls," Merkel added. "Ultimately it is the ballots of voters in the ballot box that count." (AP)

GERMANY: Bavarian Premier Markus Soeder, who heads a key faction in Chancellor Angela Merkel's conservative bloc, conceded that the alliance may fail to hit a goal of comfortably winning next month's election as a poll put the Social Democrats in the lead for the first time. The Forsa survey showed SPD support climbing to 23%, inching ahead of Merkel's CDU/CSU bloc, which is on 22%, down from more than 30% as recently as March. The SPD hasn't led in that poll since October 2006, and it suggests Merkel's alliance may be in danger of losing its grip on power for the first time since she won her debut election in 2005. (BBG)

U.S.

FISCAL: House Democrats forged ahead with President Joe Biden's economic plans Tuesday after they broke a stalemate that threatened to unravel the party's sprawling agenda. In a 220-212 party line vote, the chamber passed a $3.5 trillion budget resolution and advanced a $1 trillion bipartisan infrastructure bill. The vote allows Democrats to write and approve a massive spending package without Republicans and puts the Senate-passed infrastructure plan on a path to final passage in the House. The measure includes a nonbinding commitment to vote on the infrastructure bill by Sept. 27, which aims to appease nine centrist Democrats who pushed the House to consider the bipartisan plan before it took up the Democratic budget resolution. The vote also advances a sweeping voting rights bill, which Democrats aim to pass as soon as Tuesday.

CORONAVIRUS: The effectiveness of Covid-19 vaccines among front-line workers declined to 66% after the delta variant became dominant, compared with 91% before it arose, according to a report from the Centers for Disease Control and Prevention. The vaccines are still protective, the CDC said. The finding must be interpreted with caution, as vaccine effectiveness might wane over time and the estimates of efficacy were imprecise. (BBG)

CORONAVIRUS: The U.S. will increase payments for health-care providers to deliver Covid-19 vaccines at home. Medicare will pay $75 per dose, up from $40, for at-home vaccinations, the agency said Tuesday. The policy is intended to boost vaccinations "including second and third doses" for homebound Medicare beneficiaries, including those in group homes, assisted living and other settings. (BBG)

CORONAVIRUS: There are no more intensive care unit beds available for coronavirus patients due to a surge in cases driven by the Delta variant, Arkansas Gov. Asa Hutchinson (R) said during a press conference on Tuesday. It is the first time since the beginning of the pandemic that ICU beds are full in the state, AP reports. The state reached a new record on Monday for the number of coronavirus patients currently on ventilators, according to government data. (Axios)

CORONAVIRUS: Idaho's hospitals are "at or over capacity" and could soon be granted state authorization to turn away patients and reduce services as Covid-19 cases rise, a top official said Tuesday. "We are dangerously close to crisis standards of care," said Dave Jeppesen, director of the Idaho Department of Health and Welfare. The number of intensive care patients across the state is the highest since the pandemic started, Jeppesen said during a online briefing. (BBG)

CORONAVIRUS: New York Governor Kathy Hochul said Monday she would institute a mask mandate for students at schools in the state and require staff to be vaccinated against Covid or tested weekly. Hochul, in her first address after being sworn in, said she would make her first priority the safety of New Yorkers, especially children. The 62-year-old Democrat said she would issue updated guidelines for Covid-19, particularly for schools, expedite aid to New Yorkers in need of rental assistance and work to reform ethics in Albany. (BBG)

CORONAVIRUS: Massachusetts is set to mandate masks at its public schools as early as Wednesday, the New York Times reported, after its state education board voted to give the education commissioner the power to require masks. Governor Charlie Baker, a Republican, has been criticized for not backing a mask mandate, the newspaper said. (BBG)

CORONAVIRUS: Top White House Covid officials called for private employers to mandate vaccines at a briefing Tuesday, one day after the Food and Drug Administration granted full approval to Pfizer for its coronavirus vaccine. Many companies have responded to this summer's surge in Covid cases by rolling out vaccine requirements for all or part of their U.S. staff, including Google, Facebook and United Airlines. But others have avoided vaccine mandates, both to give the FDA time to approve a full license and to keep vaccine hesitant workers from leaving. "If you're a business, a nonprofit, a state or local leader who has been waiting for full and final FDA approval before you put vaccination requirements in place, now is the time," White House Coronavirus Response Coordinator Jeffrey Zients said at the briefing. "You have the power to protect your communities and help end the pandemic through vaccination requirements." (CNBC)

OTHER

GLOBAL TRADE: The Meishan terminal at China's second-busiest port is reopening following a two-week shutdown that further snarled already stressed shipping routes in Asia. The terminal was about a quarter of the Ningbo-Zhoushan port's capacity and was shut from Aug. 11 after a worker was found to be infected with Covid-19. (BBG)

GLOBAL TRADE: U.S. officials have approved license applications worth hundreds of millions of dollars for China's blacklisted telecom company Huawei to buy chips for its growing auto component business, two people familiar with the matter said.Huawei, the world's largest telecommunications equipment maker, has been hobbled by trade restrictions imposed by the Trump administration on the sale of chips and other components used in its network gear and smartphones businesses. The Biden administration has been reinforcing the hard line on exports to Huawei, denying licenses to sell chips to Huawei for use in or with 5g devices. But in recent weeks and months, people familiar with the application process told Reuters the U.S. has granted licenses authorizing suppliers to sell chips to Huawei for such vehicle components as video screens and sensors. The approvals come as Huawei pivots its business toward items that are less susceptible to U.S. trade bans. Auto chips are generally not considered sophisticated, lowering the bar for approval. One person close to the license approvals said the government is granting licenses for chips in vehicles that may have other components with 5g capability. Asked about the automotive licenses, a U.S. Department of Commerce spokesperson said the government continues to consistently apply licensing policies "to restrict Huawei's access to commodities, software, or technology for activities that could harm U.S. national security and foreign policy interests." The Commerce Department is prohibited from disclosing license approvals or denials, the person added. (RTRS)

GLOBAL TRADE: Mazda will extend an output halt at two factories in Japan through Friday after being unable to determine when an awaited parts shipment will arrive from China. (BBG)

U.S./CHINA: A contingent of Wall Street veterans and high-level Chinese government officials are seeking to open up talks again, as business leaders work outside of the Biden administration for greater access to the world's most populous country. An influential group conceived during escalating strains between the U.S. and China in 2018 is preparing a new round of meetings before the end of the year, according to a person with knowledge of the matter. The talks, featuring emissaries from U.S. finance as well as senior Chinese regulatory officials, had taken a backseat amid the raging pandemic. (BBG)

U.S./CHINA: U.S. climate envoy John F. Kerry is expected to travel to China next month to continue his efforts to carve out climate change as an area of closer collaboration amid deepening tensions between the two countries, according to two people familiar with the plans. The visit would mark the second for the former secretary of state, who has led U.S. efforts to convince the global community of the threat of climate change and urge them to accelerate efforts to curb carbon emissions. (RTRS)

U.S./CHINA: Securities and Exchange Commission will demand that the more than 250 Chinese companies trading in U.S. markets better inform investors about political and regulatory risks, expanding a dictate that it recently imposed for firms seeking initial public offerings. SEC Chair Gary Gensler said in a Tuesday interview that he envisions the enhanced disclosures being included in corporations' annual reports beginning early next year. The new details would likely include information about the businesses' shell-company structures, he added.

U.S./CHINA/CORONAVIRUS: President Biden on Tuesday received a classified report from the intelligence community that was inconclusive about the origins of the novel coronavirus, including whether the pathogen jumped from an animal to a human in a natural process, or escaped from a laboratory in central China, according to two U.S. officials familiar with the matter. The intelligence community will seek within days to declassify elements of the report for potential public release, officials said. (Washington Post)

GEOPOLITICS: The ruling parties of Japan and Taiwan will hold their first bilateral security talks on Friday as the two nations seek to strengthen ties to counter an increasingly belligerent China. In an interview with the Financial Times on Tuesday, Masahisa Sato, a parliamentarian who runs foreign affairs for the ruling Liberal Democratic party, said deeper dialogue was needed because Taiwan's future would have "a serious impact" on both Japan's security and economy. "That is how important we feel the situation in Taiwan is at the moment," Sato said. (FT)

GEOPOLITICS: The drastic change in Afghanistan provides a renewed opportunity for cooperation between China and the EU as both sides have economic interests in the region, the Global Times said in an editorial. What has happened in Afghanistan proves that the U.S. is an unreliable partner that will always sacrifice others to protect its own interests, the state-owned newspaper said. European leaders should see that the best course of action is to strengthen cooperation with China, and if the U.S. uses its dollar to sanction Afghanistan, financial cooperation between China and the EU with the rising status of the euro and the yuan may help the country out, Global Times said. (MNI)

CORONAVIRUS: A top World Health Organization official said that misinformation about Covid-19 and vaccines appears to have gotten worse in recent weeks and is keeping people from getting the shots and driving an increase in cases around the world. Public health leaders have blamed conspiracy theories and misinformation for growing distrust of the vaccines around the world — so much so that U.S. Surgeon General Vivek Murthy declared Covid misinformation a "serious public threat" in the U.S. last month. "In the last four weeks or so, the amount of misinformation that is out there seems to be getting worse, and I think that's really confusing for the general public," Maria Van Kerkhove, WHO's technical lead on Covid-19, said during a Q&A livestreamed on the organization's social media channels Tuesday. That's become another risk factor that is "really allowing the virus to thrive," she said. (CNBC)

JAPAN: Japanese Prime Minister Yoshihide Suga plans to hold a news conference at 9 p.m. local time to discuss the expansion of a state of emergency to include eight more prefectures as the country battles record infection numbers. The formal decision is expected to come a few hours before the news conference. Kyodo News reported the prefectures to be added are Hokkaido, Miyagi, Gifu, Aichi, Mie, Shiga, Okayama and Hiroshima, which will be under a state of emergency from Friday that runs until Sept. 12. When the expansion takes effect, more than 20 areas in Japan will be under a state of emergency. (BBG)

JAPAN: The Japanese government will tap ~1.4t yen in reserves that it earmarked in fiscal 2021 budget for its coronavirus response, Nikkei reports, without attribution. The government will spend more than 1t yen on additional vaccine purchases and on securing Covid drugs. The cabinet will approve the spending as soon as Friday. With the additional expenditures, the government will have tapped nearly half of the ~5t yen reserves set aside for virus responses. (BBG)

BOJ: MNI BRIEF: BOJ Nakamura Warns On Downside Risk On Covid Spread

- Bank of Japan board member Toyoaki Nakamura said on Wednesday that attention must be paid to downside risks to the economy amid a state of emergency to curb the spread of Covid-19 - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

AUSTRALIA: The delta-variant outbreak that's placed Sydney into lockdown for more than two months shows no sign of slowing, with a new daily case record posted in New South Wales. Australia's most populous state recorded 919 new infections on Wednesday, more than the previous high of 830 cases on Sunday. Even as infections surge, Prime Minister Scott Morrison is seeking to ease Covid-19 precautions when vaccination rates hit certain thresholds. Depending on whether state and territory leaders agree, that could see lockdowns removed when 70% of adult Australians have both jabs -- a rate expected to be reached by the end of the year. (BBG)

AUSTRALIA: The Queensland Premier tweets: "We're announcing a pause on arrivals from New South Wales, Victoria and the ACT into Queensland from noon. Queensland has been overwhelmed by new arrivals relocating to escape interstate lockdowns, placing huge pressure on our hotel quarantine system. No one currently in a declared hotspot will be permitted to enter Queensland's hotel quarantine for two weeks, except for those with exemptions such as compassionate reasons. New arrivals and Queensland residents will have to reapply for a border pass." (MNI)

NEW ZEALAND: New Zealand recorded 62 new coronavirus cases in the community on Wednesday, bringing the total outbreak to 210. Of the 210 cases, 105 have been linked to the Assembly of God Church in Mangere - the biggest sub-cluster in the country so far. The second sub-cluster with around 36 cases is the Birkdale Social Cluster associated with Case A. There are 12 people currently in hospital but none in ICU. (Sky)

MEXICO: The Supreme Court ruled on Tuesday that the Biden administration must reinstate former President Trump's "Remain-in-Mexico" policy. The Court voted 6-3 to reject Biden's plea to block the reinstatement of the program, which requires immigrants seeking asylum at the southern border to wait in Mexico while their applications are pending. (Axios)

BRAZIL: Brazil's central bank chief Roberto Campos Neto said on Tuesday that worsening inflation expectations were "obviously a concern," with global trends and a local drought likely to keep pressuring prices over the coming months. Speaking at the Expert XP event, he said the market's rise in inflation expectations for 2022 was not in line with the bank's projections, and it was a concern that analyst's views on 2022 prices were less bullish than the bank's. (RTRS)

BRAZIL: President Jair Bolsonaro is growing uneasy about Brazil's inflation in the run-up to general elections next year, but his complaints about rising prices don't mean he plans to interfere with the central bank, according to five people close to him including cabinet members. Central bank chief Roberto Campos Neto remains highly regarded within the Bolsonaro administration and also has the backing of key congressional allies, including lower house Speaker Arthur Lira, said the people, who requested anonymity to speak about internal government matters. (BBG)

BRAZIL: Brazil Economy Minister Paulo Guedes will work to achieve a consensus with lawmakers on the tax reform bill, President Jair Bolsonaro said in a pre-recorded interview for Canal Rural network. If govt insists on the previous tax reform proposal, which remains the best version, there will be no consensus and govt will be back to square one. Bolsonaro said that he and Guedes agree on a minimum of 300 reais for Auxilio Brasil program, which will replace Bolsa Familia. Bolsonaro said that the program will be paid within the spending cap. Bolsonaro said that international environmental policies aim to reduce Brazilian influence in the global agribusiness market. (BBG)

BRAZIL: There is no possibility that a Constitutional Amendment to change court-ordered payment rules known as "precatorios" will lead to defaults or to having to exceed the spending cap, Lower House Speaker Arthur Lira told reporters in Brasilia. Lira said he will hold meetings with the government this week to make changes to the amendment. (BBG)

BRAZIL: Arrival of another shipment of Covid-19 vaccine's input is scheduled for this Wednesday, Fiocruz foundation said on its Twitter account. Arrival of raw-material for Covid-19 vaccines is scheduled to take place at 5:40am at Galeao airport, in Rio de Janeiro state. (BBG)

AFGHANISTAN: Joe Biden is sticking by his plan to withdraw US troops from Afghanistan by the end of the month, defying international pressure, including from key European allies, to allow more time for evacuations. The US president's decision caps days of uncertainty about the fate of the August 31 deadline for the final pullout of American military from Afghanistan. It comes despite growing concerns about the security situation around Kabul airport and the chaotic effort to evacuate thousands of foreign nationals and Afghans out of the country. Jen Psaki, the White House press secretary, said Biden had confirmed during a virtual meeting of G7 leaders on Tuesday that the US was "currently on pace to finish" by August 31, and "made clear that with each day of operations on the ground, we have added risk to our troops with increasing threats from Isis-K". Biden did note "that completion of the mission by August 31 depends on continued co-ordination with the Taliban, including continued access for evacuees to the airport", Psaki added, and "asked the Pentagon and the state department for contingency plans to adjust the timeline should that become necessary". (FT)

AFGHANISTAN: U.S. Secretary of State Blinken tweeted the following on Tuesday: "I'll be speaking tomorrow at 12:15pm EDT about our efforts to bring Americans home and how we're supporting the broader evacuation from Afghanistan." (MNI)

AFGHANISTAN: Democratic Rep. Seth Moulton and Republican Rep. Peter Meijer fly to Kabul to "conduct oversight" on the ongoing evacuation operations for American citizens and U.S. allies in Afghanistan, the lawmakers say in a joint statement. "We came into this visit wanting, like most veterans, to push the president to extend the August 31st deadline," the lawmakers say. (BBG)

AFGHANISTAN: MNI BRIEF: US-EU In G7 Split On Aug 31 Afghanistan Exit Date

- Several EU voices had "expressed concern" over the August 31 deadline for evacuations from Afghanistan, European Council President Charles Michel said Tuesday following a G7 video summit on Afghanistan. Michel said that those expressing concerns had included Commission President Ursula von der Leyen and himself, despite the fact that US President Biden has insisted he will abide by the deadline agreed with the Taliban government - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

AFGHANISTAN: German Chancellor Angela Merkel on Tuesday said evacuation efforts in Afghanistan will not be able to continue without the support of the United States government. Addressing reporters in Berlin following a virtual meeting of G7 leaders, she said G7 leaders must continue to work together on evacuation operations. I have to emphasize that the US has the lead here. Without the US, we can't continue with the evacuations, this must be made clear," Merkel said. (CNN)

AFGHANISTAN: The Taliban must guarantee a safe passage for those who want to leave Afghanistan beyond the 31 August deadline, PM Boris Johnson has said. Following an emergency virtual meeting of G7 leaders, Mr Johnson said the UK would continue evacuating people from the country "until the last moment". He added he was confident thousands more could be airlifted out. (BBC)

AFGHANISTAN: Britain's evacuation from Kabul is expected to end within "24 to 36 hours", potentially abandoning thousands of Afghans, defence sources said as the increasingly bullish Taliban moved to prevent them travelling to the airport to flee. (Guardian)

OIL: Mexican state oil firm Petroleos Mexicanos (Pemex) expects to resume by August 30 all oil production hit by a deadly fire on an offshore platform, the firm's chief executive said on Tuesday. Sunday's accident in the southern Gulf of Mexico put 125 wells offline. So far 35 wells, which produce 71,000 barrels a day, have been brought back online, Chief Executive Octavio Romero said in a video posted on Youtube. (RTRS)

CHINA

POLICY: China has this month intensified signals for a pro-growth focus in the next four months, with increased cross-cycle adjustment measures to ensure a prelude to next year's reasonable growth, the Securities Times said in a front-page report. The PBOC has disclosed that it has made expanding credit the primary objective for the next four months, the official securities newspaper said. The cost of capital is expected to be low given ample monetary supply, the newspaper said. Credit expansion will stabilize after a slowdown in July, and aggregate financing is expected to rebound, it said. (MNI)

PBOC: The PBOC may time another RRR cut when the liquidity is pressured by CNY3.05 trillion of MLFs maturing before the yearend, as simply rolling over MLFs will see more funds going to large banks instead of smaller banks supporting SMEs, the 21st Century Business Herald reported citing analyst Luo Yunfeng with China Merchants Securities. The RRR cut in July lifted the currency multiplier of creating money to a record high of 7.41, compared with the previous peak of 7.16 in August 2020, the newspaper said. The possible RRR cut will not affect the size of the central bank's balance sheet, as the contraction by about CNY1 trillion in July is mainly due to the decline in the balance of structural monetary instruments such as MLFs, the newspaper said. (MNI)

OVERNIGHT DATA

JAPAN JUN, F LEADING INDEX 104.1; FLASH 104.1

JAPAN JUN, F COINCIDENT INDEX 94.5; FLASH 94.0

AUSTRALIA Q2 CONSTRUCTION WORK DONE +0.8% Q/Q; MEDIAN +2.8%; Q1 +2.4%

NEW ZEALAND JUL TRADE BALANCE -NZ$402MN; JUN +NZ$245MN

NEW ZEALAND JUL TRADE BALANCE 12 MTH YTD -NZ$1.104BN; JUN -NZ$277MN

NEW ZEALAND JUL EXPORTS NZ$5.75BN; JUN NZ$5.96BN

NEW ZEALAND JUL IMPORTS NZ$6.16BN; JUN NZ$5.71BN

SOUTH KOREA SEP BUSINESS SURVEY M'FING 96; AUG 92

SOUTH KOREA SEP BUSINESS SURVEY NON-M'FING 81; AUG 78

CHINA MARKETS

PBOC NET INJECTS CNY40BN VIA OMOS WEDS

The People's Bank of China (PBOC) conducted CNY50 billion via 7-day reverse repos with the rate unchanged at 2.2% on Wednesday. The operation injected net CNY40 billion into the market as there is CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep month-end liquidity stable, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2275% at 09:29 am local time from the close of 2.2205% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 40 on Tuesday vs 58 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4728 WEDS VS 6.4805

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4728 on Wednesday, compared with the 6.4805 set on Tuesday.

MARKETS

SNAPSHOT: Sino-U.S. Headlines At The Fore

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 3.79 points at 27726.97

- ASX 200 up 10.12 points at 7513.3

- Shanghai Comp. up 12.019 points at 3526.49

- JGB 10-Yr future down 5 ticks at 152.21, yield up 0.5bp at 0.023%

- Aussie 10-Yr future down 0.5 tick at 98.855, yield up 0.7bp at 1.158%

- U.S. 10-Yr future -0-00+ at 133-31, yield down 0.16bp at 1.292%

- WTI crude down $0.39 at $67.14, Gold down $7.86 at $1794.79

- USD/JPY up 10 pips at Y109.74

- U.S. CLIMATE ENVOY KERRY EXPECTED TO TRAVEL TO CHINA IN SEPTEMBER (RTRS)

- WALL STREET, CHINA TO REVIVE TALKS IN HUNT FOR COMMON GROUND (BBG)

- SEC TO DEMAND ALL CHINA FIRMS SAY MORE ABOUT INVESTOR RISKS (BBG)

- BIDEN RECEIVES INCONCLUSIVE INTELLIGENCE REPORT ON COVID ORIGINS (WASHINGTON POST)

- PBOC NET INJECTS CNY40BN VIA OMOS TO MANAGE MONTH-END LIQUIDITY

- U.S. HOUSE DEMS CLEAR PATH TOWARD PASSING BUDGET BILL & INFRASTRUCTURE PLAN (CNBC)

BOND SUMMARY: Steady As She Goes In Asia

T-Notes held to a 0-03 range overnight, last dealing -0-00+ at 133-31, while cash Tsys trade at virtually unchanged levels across the curve. There was a lack of meaningful news headlines during Asia hours. Roll flow bolstered futures volumes, while the options space saw block buys of the USU1 169.50 (+2.0K) and USV1 166.00 (+2.5K) calls. We also saw a small screen buyer of the TYV1 132.00 puts. Looking ahead to NY hours, we will see prelim durable goods data and the latest round of 5-Year supply.

- JGBs futures nudged lower during Tokyo dealing given the impetus from Tuesday's U.S. Tsy trade, last printing 4 ticks below yesterday's settlement levels, while the major cash JGB benchmarks were little changed. The latest round of BoJ Rinban operations saw mixed variations re: the movement in the cover ratios vs. prev. ops, but nothing in the way of sizeable swings. BoJ board member Nakamura didn't bring anything new to the table in his latest address.

- YM -2.0 & XM -1.0 at typing, with early supply-related pressure waning. The daily state COVID case counts saw a new record for NSW (919), while new cases in Victoria pulled back below the 50 level. As a reminder, commentary from Australian PM Morrison and NSW Premier Berejiklian has started to focus on hospitalisation/serious cases in recent days, as opposed to the outright case count. On the supply front the A$1.0bn ACGB May '32 round of supply saw the average price print 0.36bp through prevailing mids at the time of supply (per Yieldbroker), with the cover ratio holding above 5.0x. On the local data front completed construction work for Q2 got the Australia GDP partials off to a soft start.

AUSSIE BONDS: The AOFM sells A$1.0bn of the 1.25% 21 May '32 Bond, issue #TB158:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 1.25% 21 May 2032 Bond, issue #TB158:

- Average Yield: 1.2041% (prev. 1.3878%)

- High Yield: 1.2050% (prev. 1.3900%)

- Bid/Cover: 5.2350x (prev. 5.3213x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 53.6% (prev. 14.2%)

- bidders 50 (prev. 42), successful 16 (prev. 15), allocated in full 6 (prev. 6)

EQUITIES: Treading Water After Rally

Equity markets in Asia struggled to find decisive direction, major markets hovering between minor losses and gains after a strong start to the week. In mainland China major markets are broadly flat, the PBOC injected a net CNY 40bn of liquidity into the system via OMO's to maintain liquidity into month end. Markets in Japan also hovering around neutral, Japan's Covid-19 task force may formalise the declaration of emergency for another eight prefectures today. In the US futures are slightly lower, giving back some of the rally this week. German Ifo survey, flash U.S. durable goods as well as comments from Fed's Daly & ECB's de Guindos take focus from here, while participants await Fedspeak out of this week's Jackson Hole meetings looking further ahead.

OIL: Oil Dips In Asia After Two Day Rally

Crude futures dipped slightly in Asia-Pac trade on Wednesday, benchmarks slipping after closing near session highs after a two day rally. The greenback rose for the first time in two sessions which weighed on oil, while the prospect of the Delta variant also looms over markets. Data yesterday showed headline crude stocks dipped 1.622m bbls, while gasoline and distillate stocks also fell. Markets look ahead to US DoE inventory figures. Our tech analyst says the short-term outlook appears bullish with Monday's price pattern representing a bullish engulfing candle, with gains to the 20day EMA next up at $67.35, support is seen at $61.74 the Aug 23 low. For Brent support is seen at the Aug 23 low of $64.60, resistance at the 20-day EMA $69.98.

GOLD: Looking Below $1,800/oz

The broader USD (DXY) has managed to tick further away from yesterday's session low during Asia-Pac hours, which has put some modest pressure on bullion, pushing spot back below $1,800/oz after a brief look above the recent intraday highs on Tuesday. Spot gold last deals the best part of $10/oz softer, just below $1,795/oz. Participants continue to look to Fed Chair Powell's Friday address, with the usual USD & real yield dynamics taking turns to drive matters in the interim.

FOREX: Greenback Takes Lead

The greenback caught a light bid in today's quiet Asia-Pac session, which failed to provide any meaningful catalysts, with participants awaiting Fedspeak out of this week's Jackson Hole meetings.

- NZD slipped after data showed that New Zealand's trade balance flipped to a deficit of NZ$402mn in July from a surplus of NZ$245mn in June, with annual deficit widening to NZ$1.104bn as a result.

- The kiwi trimmed losses later in the session, but the broader commodity-tied FX space continued to trade on the back foot, as crude oil prices faltered.

- Greenback strength drove spot USD/CNH higher, with a softer than expected PBOC fix helping the move. China's central bank set their USD/CNY midpoint at CNY6.4728, 13 pips above sell-sde estimate.

- German Ifo survey, flash U.S. durable goods as well as comments from Fed's Daly & ECB's de Guindos take focus from here.

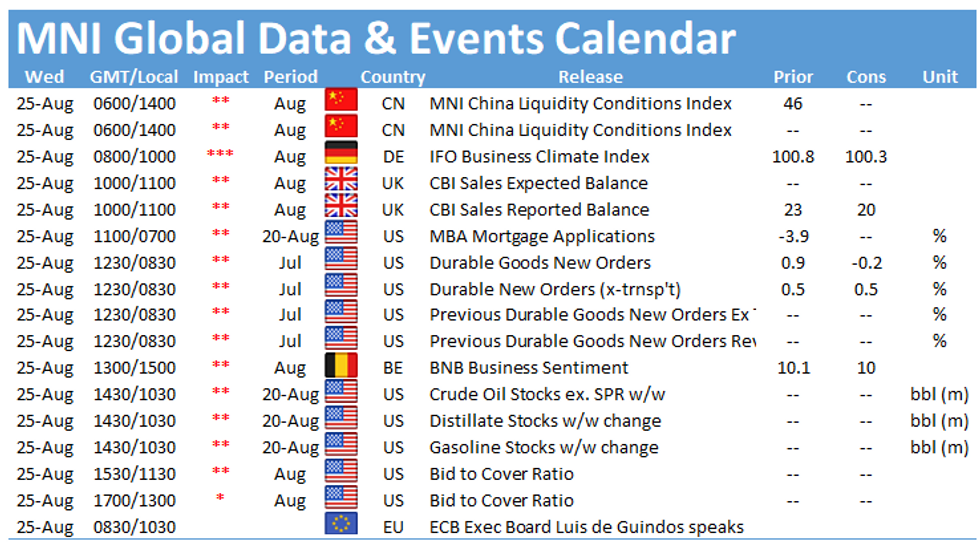

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.