-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Chinese Economic Data & Regulatory Worry Provide Familiar Risks

- The Hang Seng led the way lower overnight, aided by increased regulatory oversight for casinos in Macau.

- Softer than expected Chinese economic activity data fed into the defensive tone seen in regional equity benchmarks.

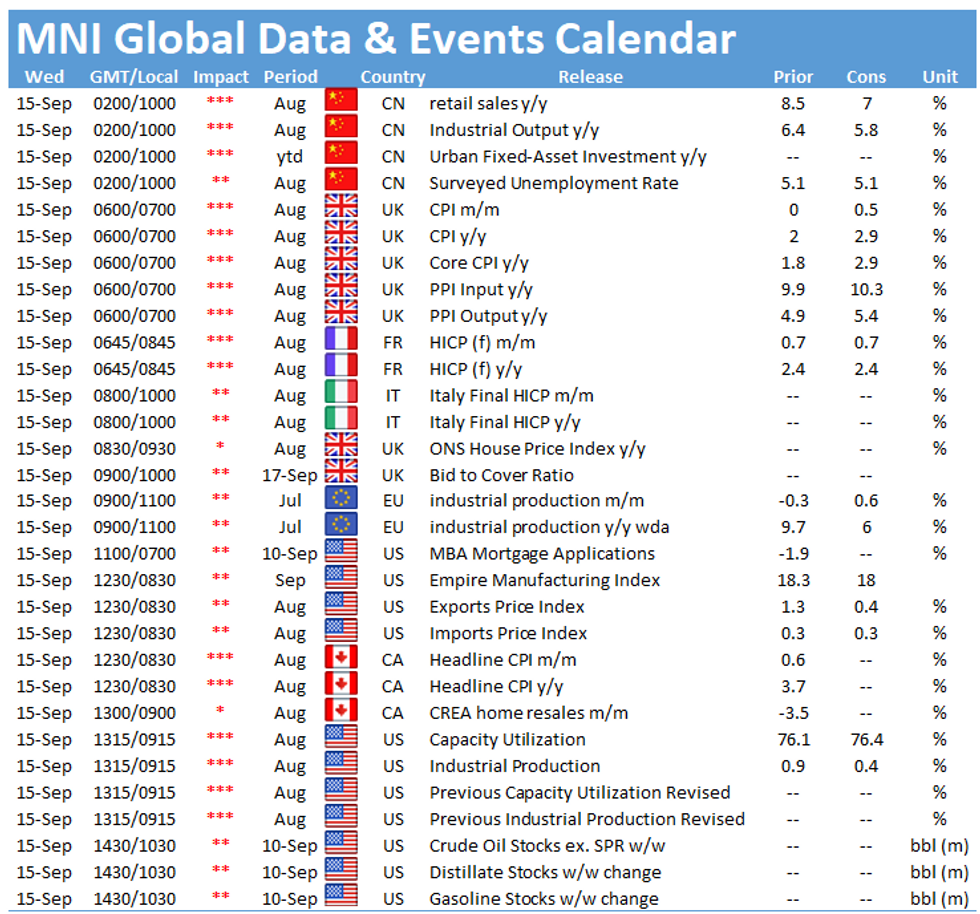

- Inflation data from the UK and Canada, as well as ECB speak from Lane & Schnabel headline the broader docket on Wednesday.

BOND SUMMARY: Mixed Performance For Core FI In Asia, Tsys Lagged

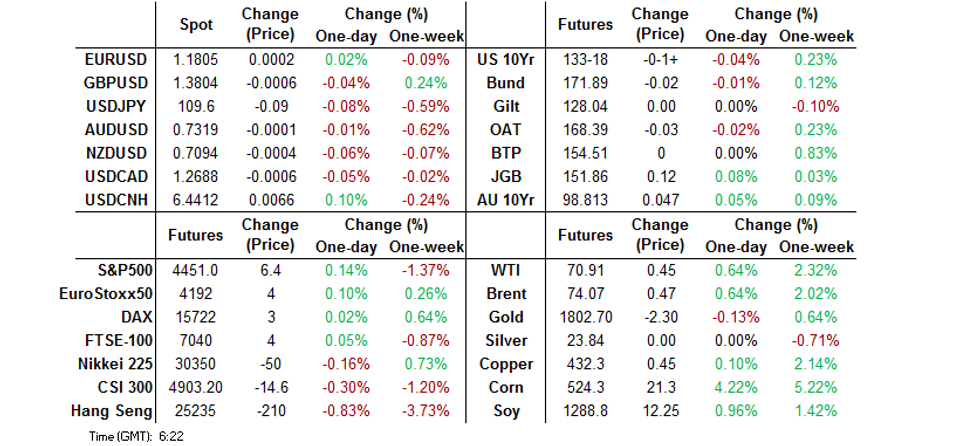

Tsys looked through an FT report which noted that U.S. President "Biden suggested he hold a face-to-face summit with Chinese president Xi Jinping during a 90-minute call last week but failed to secure an agreement from his counterpart, leading some US officials to conclude that Beijing is continuing to play hardball with Washington." Meanwhile, softer than expected Chinese economic activity data provided a very modest bid which didn't last. That left T-Notes within the confines of a narrow 0-03 range overnight, last -0-02+ at 133-17, while cash Tsys are virtually unchanged across the curve. An FV/WN block flattener (-9,409 FV vs. +1,362 WN) headlined on the flow side in Asia. NY trade will see the release of lower tier data, headlined by the Empire manufacturing and industrial production readings.

- JGB futures sit 10 ticks higher on the day, aided by softer offer/cover ratios in the latest round of BoJ Rinban operations covering 1- to 10-Year JGBs. Cash JGBs sit little changed to ~1.5bp richer across the curve, with the 3- to 10-Year zone outperforming, aided by the Rinban ops, while the longer end was a little more subdued ahead of tomorrow's 20-Year JGB supply. Local news flow remains centred on the political space. Elsewhere, headlines pointed to the potential for a multi-tranche round of corporate supply from Softbank.

- Most of the early bid in the ACGB space held with little in the way of outright explanations offered/observed re: the move higher. YM +2.2, XM +4.0, while the longer end of the cash ACGB curve has firmed by ~4.5bp. On the re-opening front, a Yahoo Finance interview has confirmed that "Qantas has scheduled flights to London, Los Angeles, Vancouver, and Singapore to commence from 18 December." This is in line with rough timelines that had been outlined previously, resulting in no tangible market impact. We also saw Treasurer Frydenberg point to the potential for an RBA review post-election after such suggestions were made by the OECD.

FOREX: Chinese Data Spoil Mood, Spark Limited Risk-Off Reaction

Risk appetite took a modest hit after the release of China's underwhelming economic activity indicators, with slowdown in retail sales growth proving particularly pronounced. USD/CNH extended gains to fresh session highs but in the grand scheme of things the price reaction was very limited. The pair had earlier crept higher, with the PBOC fixing slightly softer than estimated.

- Below-forecast Chinese data sent the Antipodeans to session lows but then recouped the bulk of losses.

- The yen registered some gains into the Tokyo fix and remained among the best G10 performers, along its safe haven peer CHF.

- AUD/JPY attacked the psychological Y80.00 barrier and printed its worst levels since Aug 30, before retracing most of its downswing.

- Participants look ahead to inflation data from the UK and Canada, U.S. Empire M'fing and industrial output, as well as comments from ECB's Lane and Schnabel.

FOREX OPTIONS: Expiries for Sep15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800(E647mln), $1.1820-30(E1.0bln), $1.2000(E1.1bln)

- USD/JPY: Y109.60-80($1.5bln), Y110.00($686mln)

- USD/CAD: C$1.2750($660mln), C$1.2795-00($988mln)

ASIA FX: Yuan Lags Behind

The yuan underperformed after the release of disappointing activity data out of China.

- CNH: USD/CNH extended gains after China's monthly economic activity indicators missed expectations, with consumption growth proving considerably slower than expected. The PBOC earlier set their central USD/CNY mid-point slightly above sell-side estimate and rolled over all of the MLF loans maturing today.

- KRW: The won started on a softer footing after Statistics Korea released monthly jobs data, which showed that while the unemployment rate plunged to a record low, participation shrank and annual employment growth slowed.

- PHP: The peso garnered some strength in the wake of BSP Gov Diokno's comments delivered yesterday. The official said that the peso remains "relatively stable" and noted that policymakers will "move in a pre-emptive fashion" to address price stability risks. As a reminder, Philippine CPI inflation accelerated to the fastest pace since 2018 in August.

- IDR: USD/IDR gave away its initial gains, holding a familiar range in the process, as domestic headline flow lacked notable catalysts. Indonesia's trade surplus surged to $4.740bn in August from $2.589bn recorded in July, defying expectations of a slight narrowing.

- MYR: USD/MYR struggled to make headway beyond its 100-DMA, which has kept a lid on gains this month.

- THB: USD/THB reversed its initial gains after initially approaching the THB33.000 figure for the first time in three weeks.

- SGD: The Singdollar firmer at the margin, ignoring domestic Q2 Labour Market Report, which showed an uptick in the unemployment rate.

EQUITIES: Major Regional Indices Tick Lower In Asia, E-Minis Little Changed

The Hang Seng provided the focal point of Asia-Pac trade yet again, with Macau's increased supervision over gambling companies weighing on the casino sector, deflecting some of the focus from the headwinds that the tech space is currently facing. Softer than expected Chinese economic activity data for the month of August didn't help broader risk sentiment, with e-minis giving back the bulk of their early gains, while the major Asia-Pac indices trade up to 1% softer on the day, with the Hang Seng leading the way lower. Note that U.S. tech giant Microsoft announced a stock buyback plan which could reach $60bn in size. The company also increased the size of its regular dividend at the same time.

GOLD: Back Above $1,800/oz

The softer than expected U.S. CPI print (and related perceptions surrounding the knock-on impact for Fed monetary policy settings) allowed gold to recover from worst levels of the day on Tuesday, with our weighted U.S. real yield monitor ultimately finishing little changed on the day. The same held true for the broader USD (as measured by the DXY), despite a brief round of USD weakness post-CPI, which was subsequently unwound. The technical overlay remains as it was, with spot last dealing at virtually unchanged levels just shy of $1,805/oz.

OIL: API Aids The Bid In Asia, Outweighing Soft Chinese Economic Data

WTI & Brent have added ~$0.45 vs. settlement levels, aided by the larger than expected drawdowns in headline crude, gasoline & distillate inventories in the latest round of weekly API estimates, which were supplemented by a drawdown in stocks at the Cushing hub. A softer than expected round of Chinese economic data provided some headwinds for crude in Asia-Pac hours, resulting in fresh sessions lows, before a relatively swift bounce played out.

- This comes after crude finished at virtually unchanged levels on Tuesday. The size of China's sale of crude from its strategic reserves, slated for September 24, was smaller than many had feared (7.38mn bbl), although the spectre of further potential sales looms large.

- Elsewhere, restart issues surrounding crude production in the U.S. Gulf remain evident.

- Tuesday also saw confirmation that Russia's plan to lift crude production in September had gone into play, with output levels witnessed in the first couple of weeks of the month nudging higher vs. August's levels.

- The weekly DoE crude inventory data headlines on Wednesday.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.