-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: More Woes For China Evergrande, NZ GDP Beats

EXECUTIVE SUMMARY

- WHITE HOUSE: ONGOING DISCUSSION WITH CHINA ON BIDEN-XI ENGAGEMENT (RTRS)

- ECB'S LANE TO INVESTORS: DON'T FOCUS ON BOND-BUYING VOLUMES (BBG)

- ANALYSTS: CHINA LPRS LIKELY TO REMAIN UNCH. IN SEP (SEC. DAILY)

- EVERGRANDE'S ONSHORE REAL ESTATE UNIT SUSPENDS ALL BOND TRADING (BBG)

- WHITE HOUSE TO CONVENE COMPANIES ON CHIPS AMID DELTA DISRUPTIONS (BBG)

- NZ Q2 GDP PROVIDES BETTER PRE-COVID START POINT, RBNZ HIKE ODDS FIRM

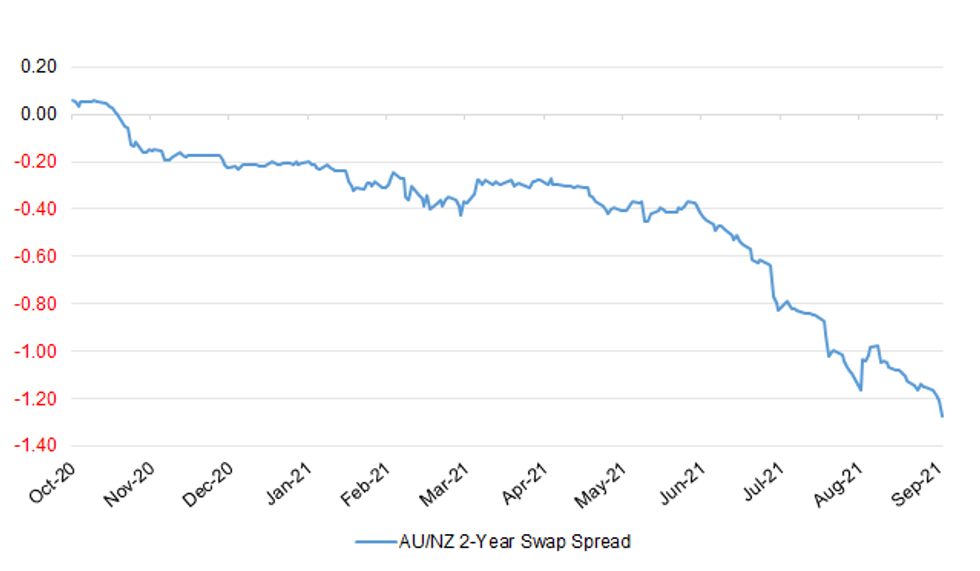

Fig. 1: Australia/New Zealand 2-Year Swap Spread

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

ECONOMY: MNI REALITY CHECK: UK Aug Sales Could Miss Modest Expectations

- UK August retail sales could fall short of already-modest expectations, with consumers able to expand spending on services last month -- not least, in the form of staycations – with further bottlenecks reducing the already tight supply of a range of goods. Food sales are the biggest wildcard in forecasting the August outcome, with industry leaders noting a slowing in annual growth, as consumers return to pubs and restaurants following months of imposed home cooking - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

CORONAVIRUS: Vaccinated travellers entering England will be subjected to lighter testing requirements as the UK government seeks to boost the struggling travel industry ahead of state support ending this month. In a major overhaul of the UK's current "traffic light" system of travel restrictions, ministers will announce later this week that people who have had two jabs will no longer need to take a Covid test before entering England, according to a government insider. Under the new proposals, the current system will be simplified by merging the green and amber groups to form one category of countries deemed safe to travel to. A separate "no go" list of countries will require travellers to enter hotel quarantine upon arrival in England. (FT)

CORONAVIRUS: Vaccine passports may be required in pubs if the spread of Covid-19 worsens seriously, the health secretary suggested yesterday. Although the government's winter plan talks about the passports only for large events, Sajid Javid said that he could not rule them out for pubs "if something happens". Ministers are considering whether to set out a list of factors to be taken into account when deciding if compulsory face coverings, working from home and vaccine passports need to be introduced. Hospital admissions and NHS pressure will be at the centre of a series of indicators being drawn up to decide if fresh restrictions are needed. (The Times)

POLITICS: Conservative party staff were told by Oliver Dowden, the new co-chairman, on Wednesday night to start preparing for a general election which could be in as little as 20 months' time. Oliver Dowden, who was moved from Culture Secretary in the reshuffle, walked into Tory HQ on Matthew Parker Street in Westminster shortly after leaving Downing Street, and addressed party staff. "You can't fatten a pig on market day," he said, days after MPs started debating a law to scrap a requirement to hold elections every five years. "It's time to go to our offices and prepare for the next election." (Telegraph)

EUROPE

ECB: European Central Bank Chief Economist Philip Lane said investors should look beyond the sheer volume of asset purchases in assessing the institution's monetary policy, just days after officials decided to slow down buying in the fourth quarter. Asked whether the subdued medium-term inflation outlook wouldn't warrant an increase rather than a withdrawal of stimulus, Lane said that "it's not a good idea to identify the monetary policy stance with the volume of asset purchases." "The efficient approach is to emphasize persistence," he said in a webinar on Wednesday. "We're happy that our monetary accommodation is strengthening the underlying inflation dynamic and over time -- this will continue to build. We have a coherent policy setting." (BBG)

FISCAL: MNI: EU's Officials Plan Debt Pact Review As Hawks Soften

- European Economy Commissioner Paolo Gentiloni will visit Dublin on Monday for a meeting with Eurogroup President and Irish Finance Minister Paschal Donohoe as early signs emerge that fiscal hawks are open to possible compromise in an upcoming review of the bloc's borrowing rules, officials told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FRANCE: France will hand out about 580 million euros ($685 million) to help poor households cope with soaring energy bills. Prime Minister Jean Castex will make the announcement Thursday. An aide, in a briefing to journalists, gave details: A special subsidy of 100 euros will be granted in December to 5.8 million households that already get an annual voucher of 150 euros toward their energy costs. The special relief comes as gas prices in Europe continued their record- breaking run. With winter fast approaching, governments are being forced to intervene and offer relief to pandemic-hit consumers still struggling to get on their feet. The political need to step in is acute in France, with President Emmanuel Macron campaigning for re-election next April. (BBG)

U.S.

FED: Federal Reserve Chairman Jerome Powell has picked up a handful of fresh endorsements from U.S. senators this week for another four-year term, but several key Democrats aren't yet sold. Powell's term as chair of the U.S. central bank ends in February and President Joe Biden is expected to name a replacement for at least that seat this fall. Biden also has a chance to fill the positions of vice chair, vice chair for supervision and a vacant board seat. Powell enjoys broad bipartisan support for confirmation but interviews by Bloomberg with more than a dozen senators this week suggest he still has some work to do to gain the backing of Senator Joe Manchin of West Virginia and leading progressives who could be influential in Biden's decision-making. (BBG)

ECONOMY: MNI REALITY CHECK: US August Sales Fall on Storms, Covid Surge

- The pace of retail sales slipped again in August as the spread of the Delta variant of Covid-19 eroded consumer confidence and severe storms capped mobility in parts of the country, industry experts told MNI. "It will be an important release," to determine the impact that surging Covid cases and things like school reopenings will have on spending in the near term, said Jack Kleinhenz, chief economist at the National Retail Federation. "We are all wondering about the degree to which the Delta variant has affected household behavior," he added. "That's probably on the forefront of everybody's mind" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: The biggest set of U.S. tax increases in a generation took a major step forward on Wednesday with approval by the House Ways and Means Committee of $2.1 trillion in new levies mostly focused on corporations and the wealthy. The vote largely along party lines -- there were no Republican votes in favor -- brings President Joe Biden's $4 trillion longer-term economic agenda one step closer to enactment. The tax package will help pay for the biggest expansion in social spending in decades, in a budget bill currently penciled in at $3.5 trillion. While the committee agreed to key elements, including tax increases on businesses and the wealthy, an extension of refundable child tax credits along with a bevy of incentives for clean energy, differences remain. (BBG)

CORONAVIRUS: The White House maintains its plan to start the booster program for some covid vaccines the week of Sept. 20, if the boosters get the necessary approvals, White House Press Secretary Jen Psaki says during a press briefing. (BBG)

CORONAVIRUS: The staff of the Food and Drug Administration on Wednesday declined to take a stance on whether to back booster shots of Pfizer's Covid-19 vaccine, saying U.S. regulators haven't verified all the available data. "There are many potentially relevant studies, but FDA has not independently reviewed or verified the underlying data or their conclusions," they wrote in a 23-page document published on the agency's website. "Some of these studies, including data from the vaccination program in Israel, will be summarized during the September 17, 2021 VRBPAC meeting." The staff said some observational studies have suggested declining efficacy of the Pfizer vaccine over time against symptomatic infection or against the delta variant, while others have not. (CNBC)

CORONAVIRUS: Advisers to the Centers for Disease Control and Prevention will hold a two-day meeting next week to discuss booster shots for Covid-19 vaccines. The Advisory Committee on Immunization Practices posted notice of the meeting, which will be held Sept. 22-23, on its website on Wednesday. The panel of outside experts advises the CDC on how best to administer new vaccines. (BBG)

CORONAVIRUS: Proof of COVID-19 vaccination will be required at indoor bars, wineries, breweries, nightclubs and lounges in Los Angeles County under a forthcoming health order aimed at further armoring the region against the pandemic. The mandate, which will be issued by Friday, will require both patrons and employees to have at least one vaccine dose by Oct. 7 and be fully vaccinated by Nov. 4, according to Public Health Director Barbara Ferrer. L.A. County, like the rest of the state and nation, has for months been battling the latest wave of the coronavirus, which has been fueled by the highly infectious Delta variant. Though there are indications that the latest surge is losing some steam, officials are already turning a wary eye to the fall and winter, when the busy holiday season will bring people together from all over the map and colder weather will increasingly push gatherings and recreation indoors. (LA Times)

OTHER

GLOBAL TRADE: The Biden administration plans to convene another meeting with companies in the semiconductor supply chain next week as the worldwide spread of the Covid-19 delta variant increasingly causes disruptions and production delays. Commerce Secretary Gina Raimondo, who has been President Joe Biden's point person on the effort, and National Economic Council Director Brian Deese will be leading the Sept. 23 discussion at the White House, according to a senior administration official. The attendee list hasn't been finalized but companies invited will include chipmakers as well as companies that use them to manufacture products including autos, consumer electronics and medical devices. (BBG)

GLOBAL TRADE: Chinese importers bought four to six bulk cargoes of Brazilian soybeans early this week for shipment in October and November, an unusual purchase during the peak export period for rival supplier the United States, two traders with knowledge of the deals said on Wednesday. The deals were inked as export terminals along the U.S. Gulf Coast in Louisiana, the country's busiest crop shipping outlet, have struggled to recover from damage, flooding and power outages caused by Hurricane Ida on Aug. 29. The pivot to costly Brazilian soybeans underscored concerns among global importers that U.S. shipping delays could linger well into the peak season for exports from the United States. (RTRS)

U.S./CHINA: The White House on Wednesday said there was an ongoing discussion with Chinese leaders about future engagement by President Joe Biden and Chinese President Xi Jinping. Biden on Tuesday denied a media report that his Chinese counterpart had turned down an offer from Biden for a face-to-face meeting during their phone call last week. White House press secretary Jen Psaki said the two leaders had discussed how to continue their communications, but the initial report was not accurate. "What's accurate is there is an ongoing discussion with the Chinese leaders about what the next step should be about engagement on a leader-to-leader level." (RTRS)

GEOPOLITICS: Washington has launched a new trilateral security partnership with London and Canberra which will support Australia's plan to build a fleet of nuclear-powered submarines, a move that will strengthen the allies' ability to counter China. The move is US president Joe Biden's latest effort to bolster alliances amid increasing tensions with China over disputes ranging from the South China Sea to Taiwan. Biden was preparing to announce the deal in a virtual event with Boris Johnson, UK prime minister, and his Australian counterpart Scott Morrison on Thursday evening in Washington. (FT)

GEOPOLITICS: President Biden plans to host British Prime Minister Boris Johnson at the White House next week, according to people familiar with the preparations. Rewarding Johnson with a White House visit is another indication that the two leaders plan to work collaboratively on COVID-19, China and climate change. (Axios)

UK/CHINA: China should take reciprocal actions against the British ambassador to China, and bar the British envoy from entering the Great Hall of the People in Beijing in the future, the officially run Global Times said in an editorial, referring to the site of China's legislative assembly. The editorial came after the Chinese ambassador to Britain was barred by the British parliament. China should not hesitate to strike back against "anti-China shows" staged at parliaments of western countries, often by radical members, but it needs not to respond to get entangled with them, said the newspaper. MNI noted that while the official newspaper used harsh language to denounce the UK, it also reminded readers not to overreact and further worsen China's fraught relations with the West. (MNI)

CORONAVIRUS: Pfizer Inc. said that data from the U.S. and Israel suggest that the efficacy of its Covid-19 vaccine wanes over time, and that a booster dose was safe and effective at warding off the virus and new variants. The company detailed the data in a presentation it will deliver to a meeting of outside advisers to the Food and Drug Administration on Friday. The panel is expected to make recommendations for whether more Americans should receive booster shots. "Real-world data from Israel and the United States suggest that rates of breakthrough infections are rising faster in individuals who were vaccinated earlier," Pfizer said in its presentation, which was posted on the FDA website. The drug giant is partnering with Germany's BioNTech SE to make the shots. (BBG)

CORONAVIRUS: Moderna on Wednesday released more data on so-called breakthrough cases it says supports the push for wide use of Covid-19 vaccine booster shots. The U.S. drugmaker shared a new analysis from its phase three study that showed the incidence of breakthrough Covid cases, which occur in fully vaccinated people, was less frequent in a group of trial participants who were more recently inoculated, suggesting immunity for earlier groups had started to wane. There were 88 identified breakthrough cases out of 11,431 people vaccinated between December and March, the company said in a release, compared with 162 breakthrough cases out of 14,746 trial participants vaccinated in July through October of last year. There were also fewer severe cases of Covid-19 cases in the group that received the vaccine more recently, according to a manuscript of the results shared by the company. Three Covid-19 related hospitalizations occurred in the group that got the shots early on, resulting in two deaths, according to the data. There were no hospitalizations or deaths in the group that recently received the vaccine, although the finding on severe cases was not statistically significant. (CNBC)

CORONAVIRUS: A third dose of the Pfizer Inc.-BioNTech SE Covid vaccine can dramatically reduce rates of Covid-related illness in people 60 and older, according to data from a short-term study in Israel. Starting 12 days after the extra dose, confirmed infection rates were 11 times lower in the booster group compared with a group that got the standard two doses, the analysis released Wednesday by the New England Journal of Medicine found. Rates of severe illness were almost 20 times lower in the booster group. Early versions of the highly anticipated analysis have been cited by Biden administration officials, including the president's Covid medical adviser, Anthony Fauci, as they push for a booster program scheduled to start Monday. The Israeli analysis is expected to be highlighted at a meeting of Food and Drug Administration advisers reviewing Pfizer's application for clearance of the booster shots. (BBG)

JAPAN: Taro Kono, one of three candidates for leadership of Japan's ruling Liberal Democratic Party, said monetary policy couldn't be changed immediately during the virus crisis. Speaking to reporters in Tokyo, Kono said debate was needed on how to fill the 22 trillion yen GDP gap. Must continue the current administration's climate and digitalization policies. In favor of same-sex marriage and allowing married couples to keep separate names. Cooperation with the U.S., U.K. and Australia is very important for Japan. (BBG)

JAPAN: Jiji runs a headline noting that Deputy Prime Minister and Finance Minister Taro Aso has said that he will basically support Taro Kono and Fumio Kishida in LDP leadership election, while allowing members of his faction to vote as they please. The news come as no surprise, a number of earlier press reports suggested that the Aso faction was divided even as Taro Kono is a member. Kono succeeded in winning the support of Shigeru Ishiba, a former potential candidate and an outspoken critic of former Prime Minister Shinzo Abe and his key ally Taro Aso. Kyodo reported that the Nikai faction will also allow a free vote in the election of LDP President, confirming earlier rumours. Chief Cabinet Secretary Katsunobu Kato said at a press conference that the government considers a special Diet session on October 4 to elect the next Prime Minister. The winner of LDP leadership contest is virtually certain to become the next Premier. (MNI)

JAPAN: A majority of Japanese firms say the world's third-largest economy will recover to pre-pandemic levels in fiscal 2022, a Reuters poll showed, with many anticipating they will continue to face COVID pains until next year or later. (RTRS)

BOJ: A new Japanese prime minister due to be installed later this month is unlikely to change fiscal or other policies sufficiently to force the central bank to amend its monetary settings, a Bloomberg survey showed. All-but one of 47 economists expect the Bank of Japan will keep its yield-curve control and asset-purchase programs unchanged at a two-day meeting ending Sept. 22. That's one week before the ruling Liberal Democratic Party holds a leadership ballot that basically determines the next prime minister. (BBG)

AUSTRALIA: Lockdown restrictions in Australia's second most populous city Melbourne will be slightly eased this weekend after more than 70% of Victoria state's adult population had their first vaccination, Premier Daniel Andrews told reporters. Among the changes, residents will be allowed to travel up to 10 kilometers from their home for up to four hours of exercise a day and be allowed to meet a friend in a park for a picnic, he said. Health authorities in Victoria continue to struggle to bring the delta varient under control. The state recorded 514 more daily infections, and its outbreak has doubled in seven days, according to Bloomberg calculations of Victorian health department data. Meanwhile, the delta surge in Australia's most populous state is steadying after New South Wales found 1,351 new infections overnight. The state's seven-day moving average has fallen to its lowest level in more than a week, according to Bloomberg calculations on New South Wales health department data. (BBG)

NEW ZEALAND: The Government is allocating more money towards paying for the Covid-19 response. It is topping up its Covid-19 Response and Recovery Fund by $7 billion, having already put aside $62 billion for the response since the start of the pandemic. Finance Minister Grant Robertson said: "The extra funding will be targeted at further economic support as well as building resilience in our health system, supporting the vaccination rollout and border and MIQ provision." As at Monday, $2.3 billion had been paid to businesses in Wage Subsidies and Covid-19 Resurgence Support Payments for this outbreak. Robertson said the Government is using its "greater fiscal headroom" to top up the Covid-19 fund, implying that at this stage he believes it's unlikely the Government will need to borrow more than it already is to fund the additional expenditure. (Interest NZ)

CANADA: Alberta Premier Jason Kenney introduced a wide array of sweeping restrictions to public life Wednesday and placed the province under a state of public health emergency as hospitals strain under the pressure of a fourth wave of COVID-19 infection. Many of the new restrictions will only apply to businesses not signed onto a vaccine passport system the government is calling the "restrictions exemption program," which will allow vaccinated Albertans, as well as those who can present a negative COVID-19 test, to access participating businesses without facing restrictions, other than masking. (Calgary Herald)

NORTH KOREA: The missiles fired by North Korea on Wednesday were a test of a new "railway-borne missile system" designed as a potential counter-strike to any forces that threaten the country, state news agency KCNA reported on Thursday. The missiles flew 800km (497 miles) before striking a target in the sea off North Korea's east coast, KCNA said. (SCMP)

NORTH KOREA: One of the top-ranked conservatives seeking to be South Korea's next president said the U.S. was "reckless" in its diplomacy with North Korea and questioned if the American ally's nuclear shield offered real protection. "America is approaching North Korea in a naive way," Hong Joon-pyo, a leading candidate from the People Power Party said in an interview with Bloomberg on Wednesday, where he criticized the Biden administration for trying to prod Pyongyang back to stalled nuclear talks. "If you look at the way the U.S. approaches North Korea with diplomacy, they've gotten dragged into their ways," he said, adding that Pyongyang "will never back down, they'll just pretend to back down." (BBG)

BRAZIL: Brazil needs political tranquility for the BRL/USD rate to fall, said Economy Minister Paulo Guedes told in an interview with Jovem Pan radio. 2022 growth prospects still undefined, he said. Political interests interfere with the economy. Govt wants court-ordered payments known as 'precatorios' to be predictable, doable. Goal is to have a moderate 'Bolsa Familia' social program, he added, but that would not be possible without solving issue with court-ordered payments. Inflation is at its worst now, Guedes said, noting it is expected to return to 4% by the end of 2022. (BBG)

BRAZIL: Brazil's federal electoral court (TSE) is set to probe the funding of last week's rallies in support of President Jair Bolsonaro, as well as alleged election campaigning outside the allotted legal time frame. (RTRS)

BRAZIL: Brazil shows a decline in severe respiratory syndrome cases over the last 6 weeks, as well as an stabilization trend in the past 3 weeks, health foundation Fiocruz says in a bulletin from Sept. 5-11. Only Espirito Santo and Pernambuco states show a rising long-term trend. Significant reduction in the number of cases reflects vaccination campaign efforts, Fiocruz researcher Marcelo Gomes says. (BBG)

MIDDLE EAST: French President Emmanuel Macron said on Wednesday that French military forces had killed Islamic militant Adnan Abu Walid al-Sahrawi, the leader of Islamic State in the Greater Sahara. (RTRS)

IRAN: Iran, emboldened by the messy U.S. withdrawal from Afghanistan, is betting that its new hardline cabinet -- including Deputy Foreign Minister Ali Bagheri Kani -- can force concessions in talks on Tehran's 2015 nuclear deal with world powers. (RTRS)

IRAN: Iran's new president is flying to Tajikistan for his first foreign trip where he's expecting to gain membership of a growing Eurasian club led by China and Russia, whose economic muscle has helped Tehran blunt American sanctions. The Shanghai Cooperation Organisation, or SCO, was founded two decades ago in St. Petersburg and currently has eight members representing half the world's population and a quarter of its economic output. Iran's been angling to join the bloc that also includes India and Pakistan since 2005, with membership a key goal of conservatives who after the June election of President Ebrahim Raisi control all the levers of power. They want tighter economic integration with Beijing and Moscow to help replace some of the sanctioned trade with western economies. (BBG)

METALS: China to sell more copper, aluminum & zinc From reserves. China will continue to sell state reserves to ease imbalances between supply and demand, and guide the price return to normal, NDRC official Li Hui says at a press conference. (BBG)

OIL: Energy companies on Wednesday kept 30% of U.S. Gulf of Mexico crude oil production shut, or 537,193 barrels, according to regulator Bureau of Safety and Environmental Enforcement (BSEE), more than two weeks after Hurricane Ida hit platforms in the region. Oil and gas companies still had 36 offshore facilities evacuated and 39% of their usual natural gas offshore production shut-in following the storm. U.S. Gulf energy companies have been able to quickly restore pipeline service and electricity after another hurricane, Nicholas, passed through Texas this week, allowing them to resume efforts to repair the significant damage Ida had previously caused. (RTRS)

OIL: Libya's Hariga oil terminal will immediately return to normal operations, the National Oil Corporation (NOC) media office said on Wednesday, and the port manager said protesters were withdrawing. Exports at Hariga had been blocked by a group that said it was protesting for jobs. (RTRS)

CHINA

PBOC: China's loan prime rates are most likely to remain unchanged as PBOC kept MLF loan rate at 2.95%, Securities Daily reports, citing analysts. It's unlikely for China to cut both reserve requirement ratio and policy rate, report cites Wang Qing, chief macroeconomic analyst of Golden Credit Rating, as saying, adding that he expects MLF rate to remain unchanged. (BBG)

PBOC: The PBOC may intend to ensure sufficient liquidity to fully meet the demand of financial institutions, as it rolled out the matured medium-term lending facility yesterday with the same amount, higher than market expectation, the 21st Century Business Herald reported citing Zhang Xu, chief analyst of Everbright Securities. The probabilities of cutting RRRs or MLF rate may however be low, the newspaper cited Zhang as saying. PBOC's officil comment of "no big gap in the base money" last week has dispelled the market's expectation of a RRR or rate cut by the end of the year, the newspaper said. The MLF operation yesterday further dampened rate cut expectations, though it indicates the PBOC supports moderately loose liquidity in the medium and long term, which will help to further reduce the financial cost of the real economy, the newspaper said citing Wang Qing, chief analyst with Golden Credit Rating. (MNI)

ECONOMY: National Development and Reform Commission approved 11 fixed-asset investment projects with total investment of 100.6b yuan, NDRC's spokeswoman Meng Wei says at a press conference. China has "confidence, ability and conditions" to achieve the full-year economic and social development targets, NDRC official Li Hui says. (BBG)

ECONOMY: China will remove some administrative restrictions on consumption in orderly manner, NDRC official Chang Tiewei says at a presser conference, without giving details. China's consumption will recover when virus is brought under control. (BBG)

INFLATION: China has started second-round purchase of hog reserves, which will have a larger scale and last longer than the first round, National Development and Reform Commission official Peng Shaozong says at a press conference. Hog price will likely rebound gradually on reserves purchase and rising demand in autumn and winter. NDRC advised slaughter houses and food processing businesses to replenish stocks. (BBG)

CREDIT: Evergrande Real Estate Group's onshore bonds will suspend trading Thursday, according to a statement from the unit of developer China Evergrande Group. The suspension was prompted by a credit rating downgrade by domestic risk assessor China Chengxin International Credit Rating Co. to A from AA, the firm said. Trading in the notes will resume Friday, said Evergrande Real Estate. (BBG)

PROPERTY: Sales reported by China's property developers plunged in August as regional governments toughened restrictions to prevent property bubbles, the China Securities Journal said citing company disclosures. China Merchants Shekou said its volume sold last month dropped 26% y/y while revenues declined 24%, the newspaper said. China Vanke, one of the largest developers, reported a 48% reduction in August realized contract sales volume and a 37% decline in revenue, the journal said. The last week saw new home sales in the largest cities such as Shanghai, Guangzhou and Shenzhen declining by 30%, while sales in 80% of second-tier cities fell, said the journal. Many city authorities summoned developers to meetings and ordered them not to cut prices that could lead to market disorder, said the newspaper. (MNI)

CORONAVIRUS: An outbreak in the eastern Chinese province of Fujian continued to grow, with 48 new cases. A prefecture bordering Myanmar also reported one local infection, though it's unknown whether that case bears any link to those in Fujian. At Putian, where the Fujian outbreak was detected about a week ago, 49 kids under 12 at kindergartens and primary schools have been infected, though none of them have developed severe disease, state news agency Xinhua reported. Covid vaccines have yet to be rolled out to children under the age of 12 in China. As many as four rounds of Covid testing have been done in some of the jurisdictions that have detected clusters and officials have warned of more cases in the coming days. Overnight in Beijing, a positive result from a Covid test sample prompted local health officials to seal off some residential compounds for a few hours, only to find it was false after another test was ran. Beijing has been on high alert for any potential spread of the virus ahead of major holidays, and have taken preemptive measures such as cutting transport from regions with cases in an previous outbreak spreading widely across China in August. (BBG)

OVERNIGHT DATA

JAPAN AUG TRADE BALANCE -Y635.4BN; MEDIAN +Y2.9BN; JUL +Y439.4BN

JAPAN AUG TRADE BALANCE ADJUSTED -Y271.8BN; MEDIAN +Y108.7BN; JUL -Y5.9BN

JAPAN AUG EXPORTS +26.2% Y/Y; MEDIAN +34.1%; JUL +37.0%

JAPAN AUG IMPORTS +44.7% Y/Y; MEDIAN +40.0%; JUL +28.5%

JAPAN AUG TOKYO CONDOMINIUMS FOR SALE +16.2% Y/Y; JUL -6.3%

AUSTRALIA AUG UNEMPLOYMENT 4.5%; MEDIAN 5.0%; JUL 4.6%

AUSTRALIA AUG EMPLOYMENT CHANGE -146.3K; MEDIAN -80.0K; JUL +3.1K

AUSTRALIA AUG FULL-TIME EMPLOYMENT CHANGE -68.0K; JUL -5.0K

AUSTRALIA AUG PART-TIME EMPLOYMENT CHANGE -78.2K; JUL +8.1K

AUSTRALIA AUG PARTICIPATION RATE 65.2%; MEDIAN 65.7%; JUL 66.0%

AUSTRALIA SEP CONSUMER INFLATION EXPECTATION +4.4% Y/Y; AUG +3.3%

AUSTRALIA AUG RBA FX TRANSACTIONS GOV'T -A$962MN; JUL -A$1.121BN

AUSTRALIA AUG RBA FX TRANSACTIONS MARKET +A$914MN; JUL +A$1.099BN

AUSTRALIA AUG RBA FX TRANSACTIONS OTHER +A$11.994BN; JUL -A$2.371BN

NEW ZEALAND Q2 GDP +17.4% Y/Y; MEDIAN +16.1%; Q1 +2.9%

NEW ZEALAND Q2 GDP +2.8% Q/Q; MEDIAN +1.1%; Q1 +1.4%

NEW ZEALAND AUG NON-RESIDENT BOND HOLDINGS 53.3%; JUL 53.0%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS THURS; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Thursday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.2038% at 09:30 am local time from the close of 2.2212% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 58 on Wednesday vs 39 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4330 THURS VS 6.4492

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4330 on Thursday, compared with the 6.4492 set on Wednesday.

MARKETS

SNAPSHOT: More Woes For China Evergrande, NZ GDP Beats

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 192.31 points at 30312.8

- ASX 200 up 54.468 points at 7471.8

- Shanghai Comp. down 24.772 points at 3631.451

- JGB 10-Yr future down 5 ticks at 151.82, yield up 0.5bp at 0.041%

- Aussie 10-Yr future down 4.4 ticks at 98.720, yield up 4.8bp at 1.255%

- U.S. 10-Yr future +0-00+ at 133-13, yield down 0.33bp at 1.296%

- WTI crude up $0.16 at $72.77, Gold down $2.42 at $1791.74

- USD/JPY down 11 pips at Y109.27

- WHITE HOUSE: ONGOING DISCUSSION WITH CHINA ON BIDEN-XI ENGAGEMENT (RTRS)

- ECB'S LANE TO INVESTORS: DON'T FOCUS ON BOND-BUYING VOLUMES (BBG)

- ANALYSTS: CHINA LPRS LIKELY TO REMAIN UNCH. IN SEP (SEC. DAILY)

- EVERGRANDE'S ONSHORE REAL ESTATE UNIT SUSPENDS ALL BOND TRADING (BBG)

- WHITE HOUSE TO CONVENE COMPANIES ON CHIPS AMID DELTA DISRUPTIONS (BBG)

- NZ Q2 GDP PROVIDES BETTER PRE-COVID START POINT, RBNZ HIKE ODDS FIRM

BOND SUMMARY: U.S. Tsys Flat, JGBs & ACGBs A Little Softer

T-Notes held to a narrow 0-03+ range in Asia-Pac hours, shaking off continued regional worry surrounding trouble property developer China Evergrande/pressure on the Hang Seng & equity indices in mainland China. TYZ1 +0-01 at 133-13+, with cash Tsys virtually unchanged across the curve. A 5.0K block buyer of the TYV1 132.75/132.25 put spread dominated flow in the Tsy space, while the short end saw a 5.0K screen lift of the EDM2/U2 spread. Thursday's NY session is set to bring retail sales data for August, the latest round of weekly jobless claims figures and the monthly regional m'fing survey from the Philadelphia Fed.

- Cheapening pressures crept into the JGB space in the wake of the latest round of 20-Year JGB supply. The auction saw the low price meet broader dealer expectations (as proxied by the BBG dealer poll), although the remaining metrics surrounding the auction were nowhere near as firm. The length of the tail widened a little vs. the prev. round of 20-Year supply, while the cover ratio eased (moving back below the 6-auction average of 3.50x), printing at the lowest level witnessed at a 20-Year auction since February in the process. It looks like supply worry and the lack of outright yield on offer may have outweighed the carry and roll proposition/recent, modest cheapening. That left futures -9, while 7+-Year paper cheapened by ~0.5bp in cash trade, with shorter dated paper little changed on the day. 30- & 40-Year swap spreads widened, aiding the pressure. Domestic political headlines continue to be observed but had little impact on the space.

- In Sydney, a quick but contained tick lower for XM saw the contract show below its early Sydney lows, with no news flow apparent at the time. The move may have been related to hedging surrounding the pricing of TCV's new Sep '35 sustainability bond (A$2.5bn in size), with details crossing the wires a little while after. This paper headlined the continued steady round of A$ issuance witnessed in recent sessions. Elsewhere, the larger than expected fall in headline employment in Australia during the month of August provided very little market impact, as hours worked fell, while the drop in the participation rate outweighed the headline fall, resulting in a surprise downtick in the unemployment rate. The market could look through the release given the fact that policymakers expect a swift, sharp bounce back for the economy once COVID restrictions are unwound. YM -2.8 & XM -4.4.

JGBS AUCTION: Japanese MOF sells Y982.6bn 20-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y982.6bn 20-Year JGBs:

- Average Yield 0.412% (prev. 0.405%)

- Average Price 99.77 (prev. 99.89)

- High Yield: 0.416% (prev. 0.408%)

- Low Price 99.70 (prev. 99.85)

- % Allotted At High Yield: 64.0878% (prev. 72.6958%)

- Bid/Cover: 3.203x (prev. 3.653x)

JGBS AUCTION: Japanese MOF sells Y2.8841tn 1-Year Bills:

The Japanese Ministry of Finance (MOF) sells Y2.8841tn 1-Year Bills:

- Average Yield -0.1161% (prev. -0.1320%)

- Average Price 100.116 (prev. 100.133)

- High Yield: -0.1101% (prev. -0.1271%)

- Low Price 100.110 (prev. 100.128)

- % Allotted At High Yield: 0.8469% (prev. 86.2370%)

- Bid/Cover: 3.293x (prev. 4.214x)

JAPAN: Japan Bought Largest Net Round Of Foreign Bonds Since Nov ‘20 Last Week

Bond flows continue to dominate Japan's weekly international security flow data.

- Japanese investors lodged the largest net round of weekly bond purchases seen since November '20 last week (Y1.7614tn), as most of the major benchmark core global FI metrics cheapened a little.

- Elsewhere, foreign investors registered the third consecutive week of net purchases of Japanese bonds, with an uptick in purchase sizes vs. the previous week, although the level of net purchases didn't reach levels witnessed two weeks ago.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 1761.4 | 1043.2 | 2075.3 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -139.0 | -455.7 | -581.4 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 951.9 | 432.9 | 2640.3 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 128.7 | 422.8 | 25.4 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

EQUITIES: Most Major Asia-Pac Equity Indices Struggle, Familiar Risks Weigh

The major regional equity indices were mostly lower on Thursday. The Nikkei 225 continued its pullback from the multi-decade highs registered earlier this week. Elsewhere, troubled developer China Evergrande suspended trading of all of its onshore bonds on Thursday, although dealing is set to resume tomorrow. Regulatory headwinds also continued to blight the sectors that Chinese policymakers have targeted in recent months. This allowed the Hang Seng to lead the way lower, shedding ~2% on the day. Australia's ASX 200 was the exception to the broader rule, with the energy sector providing the largest sectoral gain on the energy price dynamics witnessed over the last 24 hours. U.S. e-mini futures traded either side of unchanged during the overnight session, in what was relatively limited, directionless dealing.

OIL: An Uptick In Asia

WTI & Brent crude futures have added ~$0.20 to settlement levels. A reminder that a deeper than expected drawdown in headline crude stocks in the latest DoE inventory report added to the post-API impetus on Wednesday, with the DoE release also providing a drawdown in stocks at the Cushing hub. The distillate and gasoline DoE readings also witnessed drawdowns, although they weren't as deep as broader exp. Several supply side headlines were more negative, although inventory data outweighed those matters, with U.S. Gulf crude production slowly coming back online, the Colonial pipeline pointing to normal operation, while exports from the Libyan oil terminal of Hariga are set to resume.

GOLD: Lack Of Conviction

Gold continues to meander, dealing either side of $1,800/oz over the last few days, with the eventual modest uptick in U.S. Tsy yields unwinding a portion of Tuesday's U.S. CPI-inspired gains during Wednesday's NY session. Participants look for more clarity come the end of next week's FOMC decision, with the familiar, well-trodden technical overlay for gold remaining in place for now, as spot deals essentially unchanged at $1,795/oz.

FOREX: Kiwi Gains On Strong GDP Data, Leaving Antipodean Cousin Behind

The Antipodean cross AUD/NZD pierced the psychological NZ$1.0300 barrier and retreated to its worst levels since Apr 2020, after New Zealand's upbeat Q2 GDP report inspired participants to add hawkish RBNZ bets. Quarterly growth not only topped BBG median estimate but was faster than projected by any of the economists taking part in the survey. NZD landed atop the G10 pile in the immediate aftermath of the release and remained the best performer in the space, despite the backward-looking nature of the data.

- Trans-Tasman spillover prompted AUD to blip higher against most G10 peers after the publication of Kiwi GDP figures, but the currency reversed gains later in the session. Domestic labour market report proved noisy, with the data was affected by Australia's lockdown dynamics. The Aussie retreated as employment shrank more than forecast and the decline in participation was deeper than anticipated, even as headline unemployment rate unexpectedly dipped.

- The Australia/New Zealand 2-Year swap spread continued to tighten as the Antipodean data poured fuel on existing central bank outlook divergence. NZ OIS strip prices ~36bp worth of tightening at the next RBNZ meeting, up from ~27bp seen yesterday. In contrast, RBA Gov Lowe earlier this week underscored the cautious approach of Australia's central bank.

- The yen garnered some strength on the back of waning risk appetite, which saw U.S. e-mini futures turn red. Japanese political headlines continued to do the rounds, with Chief Cabinet Sec Kato noting that the gov't considers calling a special parliament session for Oct 4 to pick the new PM.

- Looking ahead, U.S. retail sales & jobless claims as well as Canadian housing starts & trade balance will hit the wires later in the day. Speeches are due from ECB's Lagarde & Rehn.

FOREX OPTIONS: Expiries for Sep16 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1720-25(E1.3bln), $1.1750(E635mln), $1.1850(E574mln)

- USD/JPY: Y109.30-40($673mln), Y109.70-80($1.3bln), Y110.50-65($1.7bln)

- EUR/GBP: Gbp0.8525-45(E580mln)

- AUD/USD: $0.7360(A$514mln)

- USD/CAD: C$1.2550-75($1.9bln)

- USD/CNY: Cny6.40($1bln), Cny6.45($995mln)

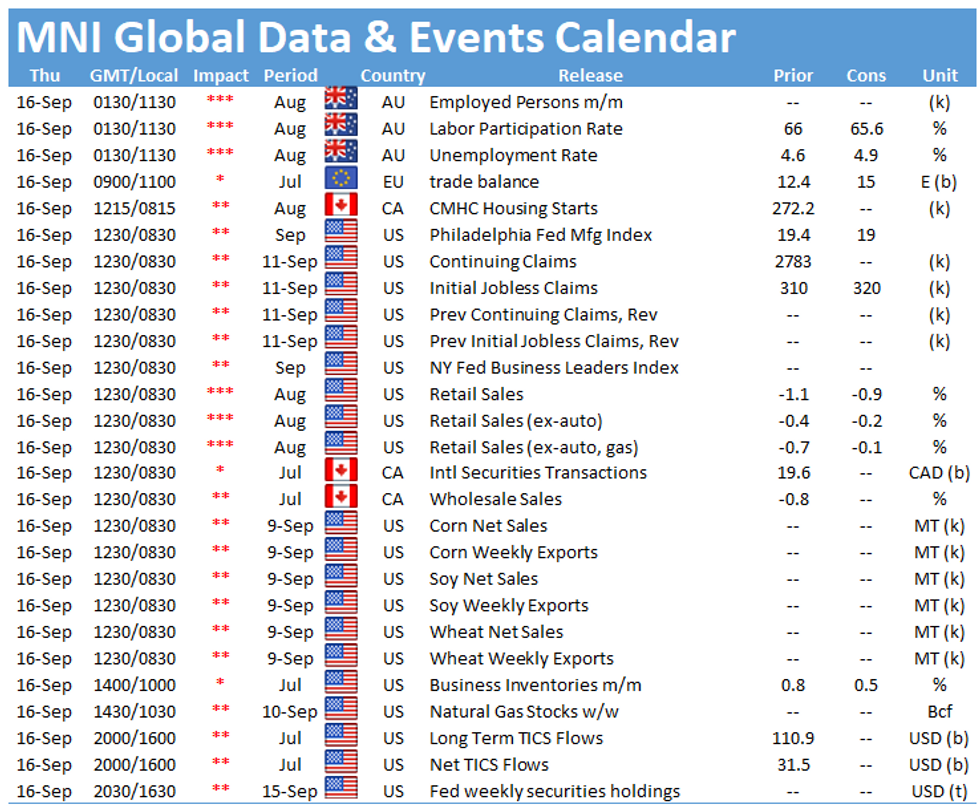

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.