-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: Murky Evergrande Coupon Payment Headlines Reverse Early Asia Risk-Off Flow

- News that Evergrande will make a negotiated coupon payment due on an onshore bond aided risk appetite overnight. The details surrounding the matter were somewhat murky and there was no mention of the coupon on the company's US$-denominated bond, which also falls due tomorrow. The lack of clarity tempered the broader risk-positive move.

- The BoJ left its monetary policy settings unchanged as expected, while the latest monthly LPR fixings from the PBoC were unchanged, also matching expectations.

- Today's FOMC meeting will set up a taper start in late 2021, increasingly likely in November. While details of the FOMC's taper plan may not emerge from this meeting, a taper is likely to $15B/meeting pace and optionality to adjust at each meeting, opening up the possibility of an end-2022 rate hike. Consensus expects the median Fed funds rate 'dot plot' path to remain fairly static at this meeting vs the June projections, setting up hawkish risks.

BOND SUMMARY: Evergrande Vol. Evident

Global core FI markets unwound their early Asia-Pac bid and more, before moving back to the middle of their respective daily ranges. Initial worry surrounding all things Evergrande as participants awaited the re-opening of mainland Chinese markets after the elongated holiday weekend subsided. There was some respite for broader risk assets as headlines noted that Evergrande will make a negotiated bond coupon payment for onshore bonds which falls due tomorrow, although no further details were forthcoming. There were no details re: the payment of coupons on a US$-denominated bond also due tomorrow (although there is a 30-day grace period in play there there), nor on the size of the payment that will be made when it comes to the onshore bond coupons. The lack of clarity tempered the broader bounce in risk appetite.

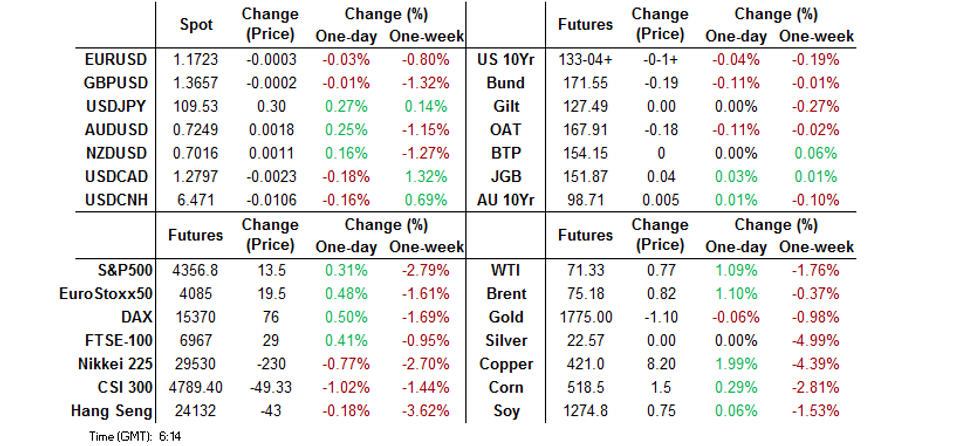

- T-Notes -0-01 at 133-05 as a result, with cash Tsys little changed to 0.5bp cheaper across the curve. The FOMC monetary policy decision headlines the broader docket on Wednesday, with the central bank's commentary surrounding tapering and the particulars within the SEP set to be scrutinised.

- JGB futures last print +4 on the day, after being subjected to the driving forces outlined above. The BoJ's latest monetary policy decision was a bit of a non-event, with the Bank leaving its broader monetary policy settings unchanged, while it lowered its assessment for exports and production. The market will be closed tomorrow as Japan observes a national holiday.

- Over in Sydney, YM unch. & XM +1.0, with longer dated cash ACGBs 1.0bp richer on the day after the space followed the broader gyrations. A$1.0bn of ACGB Apr '26 supply was well received, with the weighted average yield printing 0.97bp through prevailing mids at the time of supply, while the cover ratio printed above 6.00x.

FOREX: Evergrande Coupon Payment Agreement, PBOC Liquidity Boost Soothe Nerves

Headlines outlining an agreement between Evergrande's main onshore unit and holders of its yuan bond on coupon payments due Sep 23 provided relief for risk appetite, in the wake of yesterday's reports noting that the Group missed interest payments to two bank creditors. The PBOC helped boost sentiment as it returned from Chinese holidays with a relatively generous liquidity injection. That said, the initial risk-on market reaction moderated somewhat as the Evergrande story received closer scrutiny.

- The combination of the latest goings-on in the Evergrande saga and PBOC liquidity injection soothed the nerves, allowing the yuan to garner some strength. China's central bank set its central USD/CNY mid-point slightly higher than expected and left LPR rates unchanged, but both fixings were overshadowed by aforementioned developments.

- Risk-on impetus from China swept across G10 FX space, providing a shot in the arm for high-beta currencies. The Antipodeans shook off their initial weakness, which prompted NZD/USD to retest yesterday's low in early Asia-Pac trade.

- The yen retreated as Chinese headlines dented demand for safe haven assets. The BoJ left key monetary policy settings unchanged but USD/JPY overnight implied volatility remained in close proximity to two-month highs.

- FOMC monetary policy decision headlines the global data docket today.

FOREX OPTIONS: Expiries for Sep22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1675-85(E1.2bln), $1.1745-50(E703mln)

- USD/JPY: Y109.00($595mln), Y109.45($685mln), Y109.80-00($1.2bln)

- EUR/JPY: Y128.50(E630mln)

- AUD/USD: $0.7250-65(A$787mln)

- USD/CAD: C$1.2750($1.5bln), C$1.2775($640mln), C$1.2840-55($542mln)

ASIA FX: Evergrande Saga Remains Front & Centre

Some positive headlines re: Evergrande and a fairly sizeable liquidity injection from the PBOC were a boon to the redback, but most other currencies from the Asia EM basket underperformed the greenback. Markets in South Korea and Hong Kong were shuttered in observance of local public holidays.

- CNH: Offshore yuan received a boost amid a round of headlines noting that the embattled Evergrande's main unit has negotiated an agreement with holders of its 5.8% 2025 bond on interest payment due Sep 23, with the PBOC further soothing the nerves with a relatively generous liquidity injection. It is worth noting that the upcoming quarter-end/week-long holidays may have helped nudge the PBOC toward a larger liquidity injection.

- IDR: The rupiah was happy to hug a familiar range after Bank Indonesia left monetary policy settings unchanged on Tuesday.

- MYR: USD/MYR edged higher even as Malaysia reached an important milestone of fully inoculating 80% of its adult population against Covid-19 and thus achieving herd immunity.

- PHP: USD/PHP pushed higher amid little in the way of notable local news flow, with participants awaiting Thursday's BSP MonPol decision.

- THB: The baht went offered, with spot USD/THB trading in close proximity to the key layer of resistance provided by Aug 10 cycle high/round figure of THB33.490/33.500, amid lingering concern over Thailand's decision to raise the official debt cap.

- SGD: USD/SGD took a hit from Evergrande-related headlines but managed to return to neutral levels later in the session.

EQUITIES: Some Respite On Evergrande Headlines, Although Coupon Payment Details Remain Murky

Equities came under some early pressure in Asia-Pac trade, with worry surrounding all things Evergrande remaining evident as participants awaited the re-opening of mainland Chinese markets after the elongated holiday weekend. There was some respite for broader risk assets as headlines noted that Evergrande will make a negotiated bond coupon payment for onshore bonds which falls due tomorrow, although no further details were forthcoming. There were no details re: the payment of coupons on a US$-denominated bond also due tomorrow (although there is a 30-day grace period in play there there), nor on the size of the payment that will be made when it comes to the onshore bond coupons. The lack of clarity tempered the broader bounce in risk appetite.

- Elsewhere, the PBoC upped its liquidity injections to aid the cyclical month-end tightness in money markets, which would have provided some incremental support for equities.

- China's CSI 300 sits a ~1% lower on the day, but is off worst levels, while U.S. e-minis print ~0.3% firmer. Note that Hong Kong observed a market holiday today.

GOLD: Consolidating Into FOMC

Spot bullion deals little changed, just above $1,775/oz, holding onto Tuesday's gains. The technical lines in the sand are well defined. Monday's low ($1,742.5/oz) provides initial technical support ahead of the 76.4% retracement of the Aug 9-Sep 3 rally ($1,724.5/oz). Meanwhile, firm resistance remains located at the Sep 14 high ($1,808.7/oz). Participants await Wednesday's FOMC decision, with a particular focus on the central bank's language surrounding tapering matters.

OIL: API Inventory Estimates & Evergrande News Support Crude

WTI and Brent futures sit ~$0.90 above their respective settlement levels, with the deeper than expected drawdown in the weekly headline crude inventory estimate from API supporting the space. News that Chinese property developer Evergrande will make a negotiated coupon payment on its onshore bond on Thursday also aided the bid, although a lack of clarity surrounding the matter and continued worry re: coupon payments on offshore bonds saw crude off of Asia-Pac highs, before a bid came back in ahead of European hours. The larger than expected drawdown in headline crude stock estimates in the API report was accompanied by a larger than expected drawdown in distillates, a shallower than expected drawdown in gasoline stocks and a drawdown in stocks at the Cushing hub. A quick reminder that Tuesday saw crude nudge higher as U.S. equity markets rebounded from worst levels of the day. We also saw reports pointing to an uptick in OPEC+ production pact compliance during the month of August.

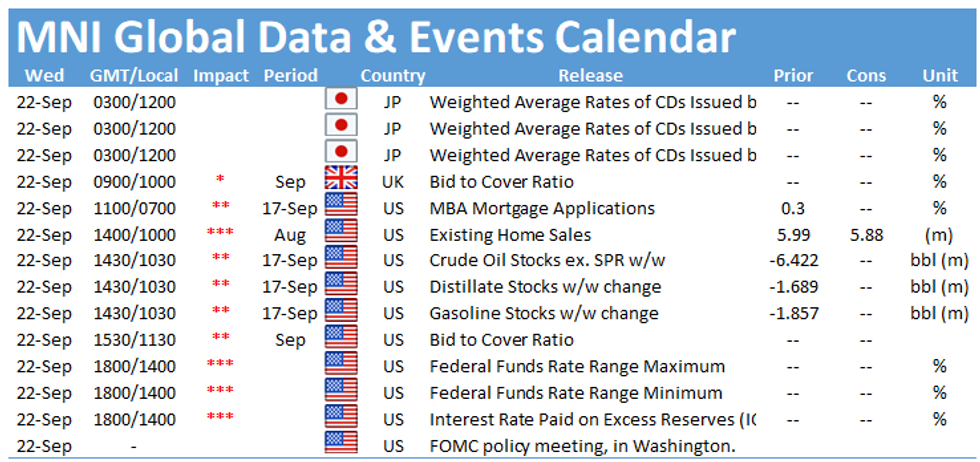

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.