-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Evergrande Uncertainty Limit Markets, Fedspeak Eyed

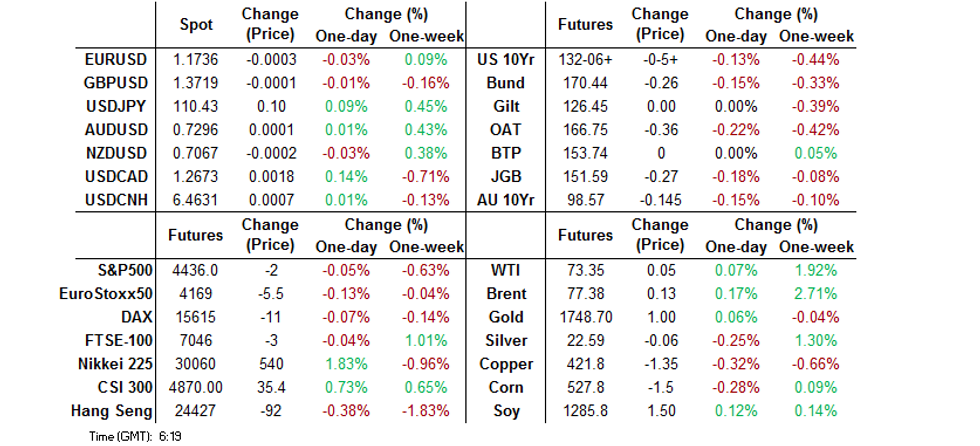

- Markets lacked a firm sense of direction during Asia-Pac hours, with the DXY little changed, Nikkei 225 well bid after Thursday's Tokyo holiday, while JGBs and Aussie bonds were dragged lower by Thursday's U.S. Tsy move.

- There is a lack of fresh news flow surrounding the missed Evergrande coupon payment on on its its US$-denominated bonds.

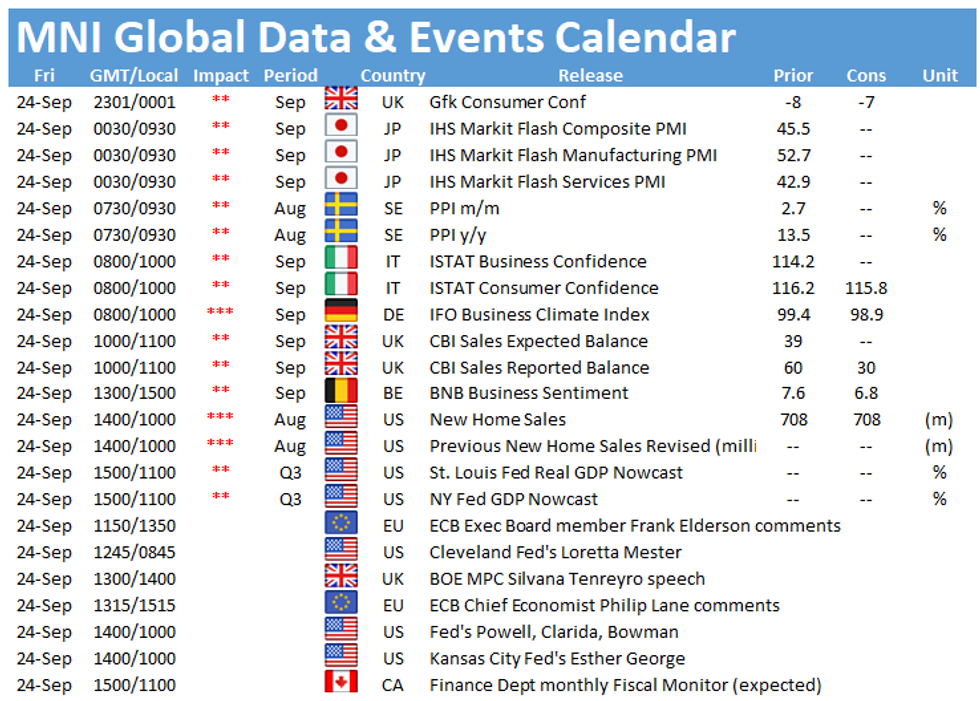

- A raft of Fedspeak, including comments from Powell, Clarida, Bowman, Mester, George & Bostic, headlines the broader docket on Friday. We will also hear from policymakers at the ECB, BoE & Norges Bank.

BOND SUMMARY: Core FI Weaker In Asia

T-Notes -0-06 at 132-06, 0-03 off worst levels after sliding through Thursday's low. A brief bid was seen on headlines pointing to the apparent continued non-payment of a coupon on one of China Evergrande's US$-denominated bonds that was due Thursday (a reminder there is a 30-day grace period on the coupon payment before a default would be triggered), before the cheapening resumed and fresh session lows were seen. Cash Tsys are little changed to 2.0bp cheaper on the day, with 20s leading the weakness. Fedspeak from Powell, Clarida, Bowman, Mester, George & Bostic is due during NY hours.

- It has been a heavy return to trade for JGBs, with futures last dealing 29 ticks lower on the day, just above session lows, as the pressure witnessed in the U.S. Tsy space on Thursday spilled over, pushing the contract through initial technical support in the process. 7s represent the weak point on the cash JGB curve, cheapening by ~2.5bp, with shorter dated paper 0.5-1.0bp softer and longer dated paper running ~1.5-2.0bp cheaper. The fact that 7s are leading the cheapening may point to futures driven activity. Meanwhile, 5+-Year swap spreads are generally wider on the day (7s are the exception to rule, given the move in the cash JGB space), suggesting that payside swap flow is aiding the broader cheapening in the cash JGB space. The latest BoJ Rinban ops saw the following cover ratios, which may be adding some light pressure in afternoon dealing: 1- to 3-Year 2.75x (prev. 1.97x), 3- to 5-Year 3.11x (prev. 2.25x), 5- to 10-Year 2.58x (prev. 2.04x), 25+-Year 5.40x (prev. 2.85x).

- The steepening extended in Aussie Bond trade, with nothing in the way of a fresh, overt catalyst observed. Perhaps lower liquidity owing to the holiday in play in the state of Victoria played a role here, allowing the overnight/early Sydney move to extend. YM -6.0, XM -14.5. There may also be some correlation in play with U.S. Tsys, as T-Notes slipped through Thursday's session low. A quick dive into today's A$1.0bn ACGB Jun '31 auction revealed that the weighted average yield printed 0.47bp through prevailing mids at the time of supply (per Yieldbroker). The cover ratio was comfortably above 4.00x. This represented a solid auction, even in the face of aggressive U.S. Tsy-driven cheapening, with a better entry point building on the support provided by the previously outlined (and well defined) supportive factors that have been in play in recent times.

FOREX: Evergrande Jitters Dampen Risk Recovery

Some degree of broader optimism carried over into the Asia-Pac session but dissipated amid lingering uncertainty surrounding the Evergrande situation. Bloomberg reported that three holders of the developer's dollar bond with a coupon that was due Thursday had not received their payments as of Friday morning.

- This amounted to a mixed picture for G10 FX space, with AUD still narrowly outperforming despite giving away almost all of its initial gains, which allowed AUD/USD to retest yesterday's high.

- NOK and CAD sit at the bottom of the G10 pile, even as crude oil prices are little changed, with major crosses generally holding narrow ranges.

- German IFO Survey, U.S. new home sales will take focus later in the day. Central bank speaker slate is quite tightly packed and features no less than six Fed members in addition to policymakers from ECB, BoE & Norges Bank.

FOREX OPTIONS: Expiries for Sep24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1650(E664mln), $1.1675(E663mln), $1.1700(E1.3bln), $1.1765-85(E879mln)

- AUD/USD: $0.7275(A$685mln)

- USD/CAD: C$1.2585-00($1.2bln), C$1.2620-40($1.0bln), C$1.2650-55($1.2bln), C$1.2680-00($1.3bln), C$1.2800($1.6bln)

ASIA FX: Most Asia FX Rebounds

Broad risk on sentiment has seen Asia FX bid as the greenback recedes. Volumes remain fairly thin with US participants slow to return after the Martin Luther King Jr holiday on Monday, while key risk events will likely keep traders on the sidelines. Yellen will testify to congress at 1000ET/1500GMT, while China report prime rates tomorrow, Malaysia and Indonesia announce rates later this week.

- The PBOC fixed USD/CNY at 6.4883, in line with sell side estimates and around 38 pips higher than yesterday. The bank also injected CNY 75bn, well above the CNY 5bn injections seen over the past week. However a weaker fixing for the yuan and a liquidity injection were not enough to dampen risk sentiment evident in the region, USD/CNH is last down 29 pips at 6.4940, but off worst levels of the day.

- USD/IDR has traded sideways, holding near neutral levels thus far. The pair last trades little changed at IDR14,065 & participants remain on the lookout for fresh catalysts.

- USD/THB has slipped and last deals down modestly at THB30.02, trading through yesterday's trough

- USD/SGD managed to break yesterday's low, down around 22 pips at 1.3291 having taken out the 1.33 handle which was challenged but not broken yesterday.

- USD/MYR has edged lower, but remains within yesterday's range amid lack of catalysts. Last 4.0490.

- USD/TWD has bucked the trend and ticked higher through the session, though the rate is still down on the day due to wild swings into the close on rumoured CB intervention. Last 27.992.

- USD/HKD last at 7.7525. HKD bid in Asia, hitting the highest levels in a week against the greenback as the Hang Seng soars and amid 19 consecutive sessions of inflows.

- USD/KRW heads into the close near session lows, down 2.35 at 1101.65 as the won rebounds from the lowest levels in 4 weeks, but still has some way to go to close the gap from Friday's close (close at 1099.75)

EQUITIES: Nikkei 225 Outperforms In Asia

Asia-Pac trade saw e-minis move away from best levels as BBG headlines pointed to a lack of coupon payment on a US$-denominated bond issued by China Evergrande, but the contracts have recovered from worst levels of the day to trade little changed. A reminder that the coupon payment was due yesterday, but there is a 30-day grace period before a default is triggered. There are also reports/chatter of the company's electric vehicle arm failing to pay salaries to some of its employees, in addition to a failure when it came to the timely payment covering factory equipment. There is an air of confusion re: the ultimate end game when it comes to Evergrande, although worries about contagion have receded.

- The Nikkei 225 managed to benefit from the uptick in USD/JPY evident over the last 24 hours, while playing catch up to 2 days of gains on Wall St after Thursday's Tokyo holiday.

- Elsewhere, performance was a little more mixed, with the remaining major regional indices lacking any sustained deviation from unchanged levels.

GOLD: Away From Thursday's Lows

Bullion has ticked away from Thursday's lows during Asia-Pac dealing to last deal $10/oz or so better off, just above $1,750/oz. This comes after the move higher in our weighted U.S. real yield monitor applied pressure on Thursday, with a softer USD providing little notable counter. Thursday's move saw a breach of Monday's low ($1,742.5/oz), before bottoming out at $1,738.0/oz. Bears now look to the 76.4% retracement of the Aug 9-Sep 3 rally ($1,724.5/oz). A plethora of Fedspeak headlines the broader docket on Friday.

OIL: Oil On Track For Another Weekly Gain

The broader DXY consolidated Thursday's losses during Asia-Pac trade, while mixed equity market performance did little for crude futures over the session. This left WTI & Brent futures just a handful of cents higher on the day after the benchmarks added a little over $1.00 apiece come yesterday's settlement. Oil is on track to lodge a fifth consecutive weekly gain, supported by a tightening supply-demand backdrop, which has intensified on the back of the well-documented northern hemisphere gas shortage.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.